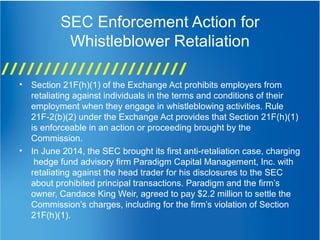

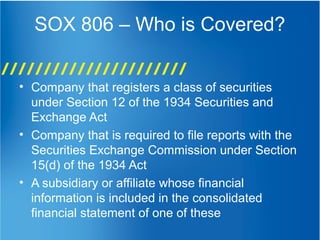

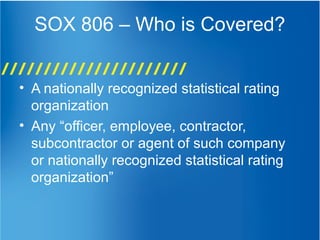

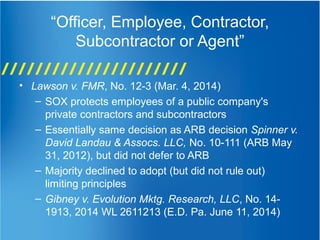

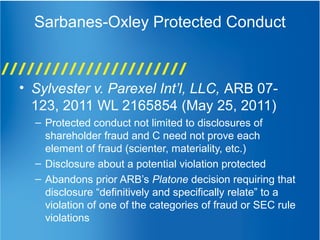

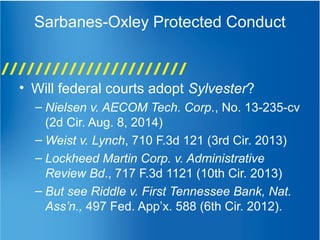

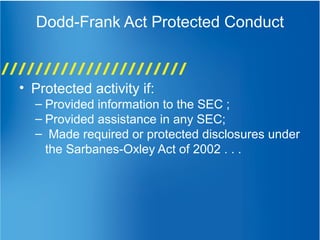

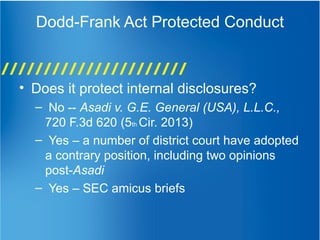

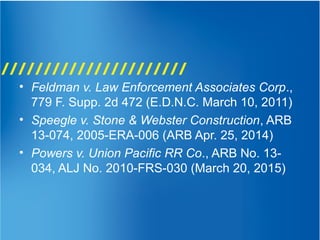

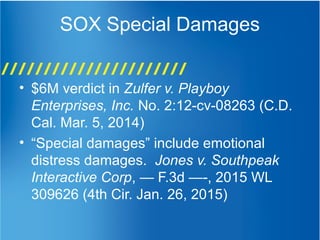

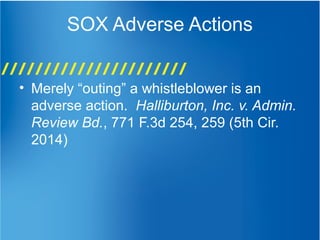

The document discusses recent developments in whistleblower rewards and retaliation claims, including the impact of SEC whistleblower awards and the implications of gag clauses in settlement agreements. It highlights enforcement actions against retaliation, the coverage of the Sarbanes-Oxley Act and Dodd-Frank Act protections, and relevant case law influencing whistleblower protections. The document emphasizes the legal framework for whistleblowing and anti-retaliation measures, detailing recent Supreme Court rulings and their effects on various industries.

![Gag Clauses

From OWB Annual Report:

•OWB has been working to identify employee confidentiality,

severance, and other kinds of agreements that may interfere with an

employee’s ability to report potential wrongdoing to the SEC.

•Rule 21F-17(a) under the Exchange Act provides that “[n]o person

may take any action to impede an individual from communicating

directly with the Commission staff about a possible securities law

violation, including enforcing, or threatening to enforce, a confidentiality

agreement…with respect to such communications.”

•The Office is actively working with Enforcement staff to identify and

investigate practices in the use of confidentiality and other kinds of

agreements that may violate this Commission rule.](https://image.slidesharecdn.com/whistleblowerrewardandretaliationclaims-currentdevelopments-150406095022-conversion-gate01/85/Whistleblower-Reward-and-Retaliation-Claims-5-320.jpg)