SEC Whistleblower Program Analysis

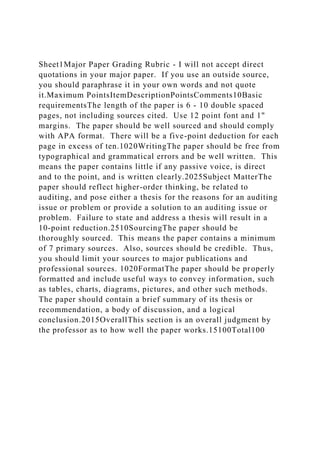

- 1. Sheet1Major Paper Grading Rubric - I will not accept direct quotations in your major paper. If you use an outside source, you should paraphrase it in your own words and not quote it.Maximum PointsItemDescriptionPointsComments10Basic requirementsThe length of the paper is 6 - 10 double spaced pages, not including sources cited. Use 12 point font and 1" margins. The paper should be well sourced and should comply with APA format. There will be a five-point deduction for each page in excess of ten.1020WritingThe paper should be free from typographical and grammatical errors and be well written. This means the paper contains little if any passive voice, is direct and to the point, and is written clearly.2025Subject MatterThe paper should reflect higher-order thinking, be related to auditing, and pose either a thesis for the reasons for an auditing issue or problem or provide a solution to an auditing issue or problem. Failure to state and address a thesis will result in a 10-point reduction.2510SourcingThe paper should be thoroughly sourced. This means the paper contains a minimum of 7 primary sources. Also, sources should be credible. Thus, you should limit your sources to major publications and professional sources. 1020FormatThe paper should be properly formatted and include useful ways to convey information, such as tables, charts, diagrams, pictures, and other such methods. The paper should contain a brief summary of its thesis or recommendation, a body of discussion, and a logical conclusion.2015OverallThis section is an overall judgment by the professor as to how well the paper works.15100Total100

- 2. S.E.C. Whistleblower Program: Overview and Analysis University of Maryland University College ACCT 630 – Fall 2015 April 26, 2015 Abstract Amidst the corporate scandals, fraud, and securities laws violations that have made headlines, Congress passed laws to change corporate practices and increase accountability with the intent of protecting investors and regaining investor confidence. Two of such laws enacted were the Sarbanes-Oxley Act of 2002 and the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010. While each law has different emphasis, both have whistleblower protection and anti-retaliation provisions. They are similar in context but the Dodd-Frank Act provides additional rules and it is also responsible for the creation of the U.S. SEC Whistleblower Program. The establishment of the program, however, did not happen without debate. The SEC received many letters and comments concerning the program rules. Some provided support while others, opposition. This paper seeks to examine the laws from which the program is derived as well as to dissect and analyze the primary concerns that were debated prior to the SEC

- 3. producing the final rules. Comment by JP: This isn't an abstract, it is an introduction. You are talking only about what you will do, not what you concluded as well. Comment by JP: I don't require that the abstract be on a separate page to allow you more space to write. Introduction In light of the highly publicized corporate scandals and financial crisis, such as the massive fraud cases of Enron and WorldCom and the 2008 financial crisis, Congress enacted laws to protect investors through changes in the corporate setting and the financial industry. On July 30, 2002, the Sarbanes-Oxley Act of 2002 (“SOX”) was passed. Through its strict reforms, this law intended to protect investors, particularly with respect to corporate governance and changes to financial practices (Sarbanes-Oxley Act of 2002, 2002). The next major reform happened eight years later. On July 21, 2010, the Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank Act”) was signed into law (Sweet, 2010). With an emphasis on the financial industry, this law intended to restore confidence in the financial system through increased regulations that are meant to prevent financial crisis by detection of any financial bubbles (Sweet, 2010). Of the various provisions of SOX and the Dodd-Frank Act, the ones in focus are Section 806 of SOX – Protection for employees of publicly traded companies who provide evidence of fraud – which is under Title VIII – Corporate and Criminal Fraud Accountability – and Section 922 of the Dodd-Frank Act

- 4. – Whistleblower Protection. The SOX whistleblower provisions were the first to provide relief to whistleblowers while the Dodd-Frank Act further refined such relief to include an expanded definition of covered employees as well as an extended filing date for violation complaints. Together, these sections of the Acts provide protection for covered employees that are considered whistleblowers. The Dodd-Frank Act, in particular, provide the basis for the Securities and Exchange Commission’s (“SEC”) highly debated and recently established Whistleblower Program (Sarbanes-Oxley Act of 2002, 2002). SOX – Section 806 Overview SOX, particularly the Section 806 provisions, addresses the protection for employees who divulge information as to the fraud activities of a firm. It is the building block for whistleblower protection against anti-retaliation from which Section 922 Dodd-Frank Act addressed and enhanced in its whistleblower protection provisions. Overall, this section of SOX addresses the role of a whistleblower in providing information about company violations as well as the damages that can be sought if it can be proven that a whistleblower was discriminated against in the process of providing such information (Sarbanes-Oxley Act of 2002, 2002). Section 806 of SOX offers protection to employees of publicly traded firms or firms that have securities registered under the Securities Exchange Act of 1934 against company retaliation when they “blow the whistle” on fraud or fraudulent reporting committed by the company (Sarbanes-Oxley Act of 2002, 2002). According to this section, an employee is covered under the protection of SOX if he or she is or was employed at the time by a public company and when such person discloses information about violations of SEC rules and regulations or other types of Federal law, particularly regarding “fraud against shareholders.” Information Provided The type of information provided by an employee that is

- 5. covered under this section of SOX is any information on the conduct of the company where the employee “reasonably believes” that anti-fraud laws and regulations were violated (Sarbanes-Oxley Act of 2002, 2002). Such information offered could be as straightforward as the employee providing an initial tip, providing assistance in an investigation, or could be by providing testimony for or participation in a proceeding filed or to be filed. In addition, the information covered is one given to a Federal regulatory agency, law enforcement agencies, members or committees of Congress, or any official with “supervisory authority over the employee” (Sarbanes-Oxley Act of 2002, 2002). In a nutshell, information relating to a firm’s activities meant to defraud shareholders that are shared with government officials or authorities at any stage by an employee of the firm – initial disclosure of knowledge, disclosure throughout investigations, or disclosure at final stages such as court proceedings – are protected from discrimination and retaliation. According to this section, a firm may not discriminate against the employee for any lawful act of protecting shareholders. Discrimination in this case includes “discharge, demotion, suspension, threat, harassment, or any other manner…in the terms and conditions of employment” (Sarbanes-Oxley Act of 2002, 2002). Remedies If an employee of a firm was discriminated against by the firm, an officer of the firm, another employee, a contractor, subcontractor, or an agent of the firm because he or she presented information to agencies and officials mentioned above relating to fraud, that employee is afforded remedies under this section of SOX. Remedies include compensatory damages and retained rights (Sarbanes-Oxley Act of 2002, 2002). Compensatory damages that could be awarded under this section include the following: · Reinstatement of position held with the firm – the employee would be given back the same job status as before the discrimination occurred and would not be given a reduced job

- 6. status or demotion of any kind. · Retro-pay with interest tacked on – the employee would be given back pay for the period when the discrimination occurred, if it involved some sort of loss of income. In addition, interest would be assessed on the income withheld. · Additional monetary compensation for special damages – the employee would be reimbursed for costs incurred to defend against the discrimination. Such special damages would include litigation costs, attorney fees, or any other fees incurred as a result of the discrimination (Sarbanes-Oxley Act of 2002, 2002). An employee who has been discriminated against, as it applies to this section, can seek these remedies within ninety days of the violation by first filing a formal complaint with the Secretary of Labor and if no decision was made within 180 days as to the action to be taken, then the employee can bring about a lawsuit with the relevant district court (Sarbanes-Oxley Act of 2002, 2002). In the latter case, the district court would have full jurisdiction to preside over the discrimination case “without regard to the amount in controversy.” As can be conceived, Section 806 of SOX is aimed at providing protection so that whistleblowers, if in the event of discrimination, can be made whole as if the discrimination did not occur. Although the primary emphasis on SOX was to encourage investor confidence through changes to practices primarily in financial reporting and corporate governance, it also included provisions relating to the welfare of employees. With this section of the Act in place, whistleblowers should be able to speak up about the corporate wrongdoing on behalf of shareholders sans fear of retaliation. Dodd-Frank Act – Section 922 Overview As an enhancement to the SOX whistleblower provisions that were enacted eight years prior, the Dodd-Frank Act of 2010 took the SOX a few steps further by providing expanded protection to whistleblowers. In addition, it was the law that established the SEC. Office of the Whistleblower, and in the

- 7. process, it was also the law responsible for the creation of the SEC Whistleblower Program (U.S. Securities and Exchange Commission, n.d.). Section 922 of the Dodd-Frank Act amended the Securities and Exchange Act of 1934’s Section 21F – Securities Whistleblowers Incentives and Protection – by addressing the whistleblower’s protection under the Act (Dodd-Frank Wall Street Reform and Consumer Protection Act, 2010). It expands beyond the whistleblower scope of SOX provisions by broadening the definition of an “employee” and including stipulations for the (1) payment of awards, (2) denial of awards, (3) Investor Protection Fund establishment, and (4) the various means of whistleblower protection that both supplement and enhance the provisions covered under SOX – those which are mentioned above (Dodd-Frank Wall Street Reform and Consumer Protection Act, 2010). Payment of Awards to Employee Under Section 922, the definition of a covered employee is expounded to include not only an employee of those mentioned under “Remedies” above, but also to include an employee of affiliates and subsidiaries of the firm in question. This enhanced the SOX’s definition of an employee as it allows for more people to be eligible for protection under the Dodd-Frank Act and it reduces the doubt as who to may qualify as a covered employee. In addition to adding to the categories of covered employees, Section 922 also enhances SOX by explicitly stating the range of monetary awards that can be given to whistleblowers. Under this section, whistleblowers can be awarded monetary compensation for original information provided to the SEC in a value range from 10 percent to no more than 30 percent of what is collected from the firm in question (Dodd-Frank Wall Street Reform and Consumer Protection Act, 2010). Such payment to a whistleblower would be derived from monetary sanctions credited to the SEC Investor Protection Fund (“Fund”) which was set up with the

- 8. Treasury of the United States, as required by the Act. The amount to be determined as award to the whistleblower is at the discretion of the SEC and is based on due consideration for the following: · Value of the information in relation to the success of the actions taken against the firm in question · Degree of participation in relation to the judicial and administrative processes · Extent to which the award to the whistleblower would serve as a deterrence for other securities laws violations · Other factors that the SEC may deem relevant such as when established by new rules or regulations (Dodd-Frank Wall Street Reform and Consumer Protection Act, 2010). In addition, since the payment of awards would come from the Fund exclusively, the Dodd-Frank Act explicitly states that the amount of award determined for payout should not be affected by the balance of the Fund (Dodd-Frank Wall Street Reform and Consumer Protection Act, 2010). In other words, irrespective of the amount of monies in the Fund at the time of award, the SEC should calculate a payout amount and “make good” on its promise to pay. Any payout in excess of the balance of the Fund would be covered by the sanctions from which the award is derived. Denial of Awards On the other hand, as equally as it is important to stipulate the payment of awards, the denial of awards was also addressed in this section of the Dodd-Frank Act. Whistleblowers could be denied an award if the following applies to the individual(s): · Employed by related agencies – the SEC other regulatory agencies, Department of Justice, the Public Company Accounting Oversight Board, a self-regulating organization, or any law enforcement agencies. · Convicted of criminal violations related to the judicial and administrative action in question · Obtained the information through financial statement audits that are required under the securities laws

- 9. · Failed to provide information to the SEC as deemed by the SEC through its rules and regulations. If any of the above applies to the whistleblower, he or she cannot receive awards for the information provided. In addition, the information that leads to successful prosecution can only be granted consideration for award if it is new and original information or that which was not already known to the SEC (Dodd-Frank Wall Street Reform and Consumer Protection Act, 2010). Whistleblower Protection Apart from the monetary awards that can be given to whistleblowers, the Dodd-Frank Act also defines the areas of protection afforded to whistleblowers that extend beyond the scope of the SOX provisions. The protection provisions stipulated in the Dodd-Frank Act are similar to that stipulated in SOX except that it adds to the amount of compensatory damages that can be collected and it extends the statute of limitations on the whistleblowing coverage period. As it relates to the changes to compensatory damages, if an employee was terminated for whistleblowing reasons, under Section 922 of the Dodd- Frank Act, such employee can be awarded double the amount of back pay, including interest (Dodd-Frank Wall Street Reform and Consumer Protection Act, 2010). The other forms of compensatory damages remain the same as named in the SOX provisions. As it relates to the changes to the statute of limitations, an employee has 180 days to file a complaint under the Dodd- Frank Act, as opposed to the 90 days under SOX (Dodd-Frank Wall Street Reform and Consumer Protection Act, 2010). The lengthened statute of limitations for complaints provides for more protection under the Act as well as allows for more time for the objectives under the Act to be effective. In other words, fewer whistleblowers would be denied protection as there would be additional time to file a complaint. As can be envisioned, the provisions under the Dodd-Frank Act provide enhanced reforms from the precursor Act – SOX.

- 10. While SOX laid the foundation for many reforms for overall corporate accountability, certain elements of the Dodd-Frank Act improved SOX, particularly with respect to its whistleblowing provisions. Also, in additional to the major elements stated above, the Dodd-Frank Act provisions also include other elements not included in SOX such as confidentiality, a study on the effectiveness of the whistleblower protection program, description of award payouts and Fund balances, and the requirement for audited financial statements of the Fund (Dodd-Frank Wall Street Reform and Consumer Protection Act, 2010). SEC Whistleblower Program Overview Prior to the enactment of the Dodd-Frank Act, in particular, the SEC had limited authority to take action against corporate wrongdoers. The agency’s “bounty program” could only be used for insider trading and the monetary awards it was allowed to pay out had a ceiling of only 10 percent of the monetary sanctions collected (U.S. SEC, 2011). This means that the SEC now has expanded authority, through the SEC Whistleblower Program set up by the Dodd-Frank Act, to compensate whistleblowers for information provided, not only for insider trading, but now for other federal securities laws violations. In addition, the payout amount increased from a maximum of 10 percent to a range from 10 percent to 30 percent. As explained in the preceding paragraphs on the SOX and the Dodd-Frank Act overview, SOX provided the foundational elements for anti-retaliation provisions of whistleblowers that provide information leading to judicial action and the Dodd- Frank Act further enhanced such provisions by expanding the scope of what is covered under federal law primarily through the creation of the SEC Office of the Whistleblower and the SEC Whistleblower Program. (Other significant improvements include a broader definition of covered employees and the amplified consequences for retaliation against such employees). Program Objectives

- 11. The SEC Whistleblower Program is directed by the Dodd- Frank Act to enforce the provisions under Section 922 (U.S. SEC, n.d.). According to the official SEC website, the primary intent for the creation of the SEC Whistleblower Program is to “reward individuals who act early to expose violations and who provide significant evidence that helps the SEC bring successful cases” (U.S. SEC, 2011). This goes in line with one of the primary missions of the SEC – to protect investors. The SEC is focused on exposing fraud against shareholders; however, not at the expense of those providing the information that exposed the fraud. If an employee blows the whistle on fraudulent acts, under SOX and the Dodd-Frank Act provisions, the SEC must protect the individual from retaliation. In addition, it is instructed to also provide awards for successful actions, as required by the Dodd-Frank Act and through the SEC Whistleblower Program (U.S. SEC, 2011). Debate and Controversy Comment by JP: Sorry, but finally we get beyond summary. The creation and implementation of the SEC Whistleblower Program, however, did not arise without debate and controversy. Prior to creating the final rules of the program, the SEC received more than 240 comment letters and about 1,300 “form letters” specifically addressing concerns and support for the proposal (U.S. SEC, 2011). The letters received were from commenters that range from individuals to lawyers and law firms, public entities, professional organizations, audit firms, compliance personnel, whistleblower advocacy groups, academics, and not-for-profit organizations who all chimed in on what they feel would be the impact of the proposal (U.S. SEC, 2011). The following were the primary controversial topics that were discussed in great detail throughout the comment letters: · The impact of the Act on internal compliance processes · Definition of whistleblower and other key elements that would

- 12. make certain claims eligible for awards · Relationship between eligible whistleblowers and anti- retaliation provisions Comment by JP: Cite for this? Internal Compliance Among these listed, the most controversial topic is the impact on a firm’s internal compliance processes. Some feared that an employee’s bypass to the SEC would undermine a firm’s internal compliance program and the firm’s ability to take remedial action and participate with the SEC. These commenters suggested that the proposal would defeat the purpose of a firm having an internal compliance department if its employees were allowed to go directly to the SEC without first reporting the issues to the firm (U.S. SEC, 2011). In other words, the impact would be such that a firm would not have the ability to implement its internal compliance or make any form of corrective action prior to an employee tipping off the SEC. On the flipside of this concern is the support for employees to go to the SEC with information that can bring to an end one more firm engaged in corporate wrongdoing. Advocates suggest that to state a firm and its management team could be completely unaware of fraud and its securities violations is foolish (Havian & Kelton, 2010). It is likely that the management team would know that their firm is violating securities laws. Additionally, advocates support the direct link to the SEC on the basis that employees may fear retaliation if they bring concerns to the internal compliance department (Havian & Kelton, 2010). If the environment of a firm is one where retaliation is a possibility, employees may not be persuaded to divulge pertinent information. The direct link to the SEC opens an avenue to bring to light corporate fraud. With the support for and the concerns against the whistleblower link to the SEC either before or after it is addressed with a firm’s internal compliance department, the SEC ruled against the business community and stated in its final rules that a whistleblower need not initially report the issue with the firm (U.S. SEC, 2011). The SEC’s position is that a whistleblower

- 13. may decide to channel the information through the internal compliance department, but the individual is not required to do so. However, for common ground, the SEC does incentivize whistleblower to first use the internal compliance department. As mentioned above in the Dodd-Frank Act – Section 922 Overview, the award amount is based on a number of factors and included as a factor is the degree of participation. The SEC ruled that participation in the judicial and administrative process, including participation and cooperation with the whistleblower firm’s own internal compliance and reporting systems, would increase the likely payout amount (U.S. SEC, 2011). This is meant to encourage whistleblowers to first report with the firm in question. Definition of Whistleblower Another highly debated topic was the definition of “whistleblower” as this could impact eligibility of awards and protection under the law, particularly with regards to the anti- retaliation provisions. With respect to the debate about the definition of a “whistleblower,” it is two-fold: (1) the types of informers that would fall under the definition of a “whistleblower” and (2) the phrasing of other related words that would qualify a whistleblower and impact anti-retaliation provisions (U.S. SEC, 2011). Regarding the former, some shared concerns as to whom or what may constitute as a whistleblower. For instance, some stated that a whistleblower should not be limited to a natural person, but rather, it should also include un-naturalized institutions such as non-governmental organizations (“NGO”), e.g., labor unions. Support for this is on the basis that NGO’s and other institutions are in the best position to analyze corporate wrongdoing. By limiting the classes of “whistleblowers” to strictly natural persons, this may be going against the objective of the Act, which is to seek information of violations of securities laws and to reward and protect those who provide such information (Voices for Corporate Responsibility, 2010).

- 14. Regarding the latter, the wording within the definition of a “whistleblower” was deliberated upon as the phrasing could potentially disqualify some people that may otherwise qualify to be a whistleblower. In addition, some commenters addressed the significant effects the definition would have on anti-retaliation provisions against firms in question. Concerning the disqualification of whistleblowers in the context of the definition, some people recommended that the definition should be broadened to state “potential violations,” “likely violations”, “possible violations,” “probable violations,” etc., that “has occurred, is ongoing, or is about to occur” when describing the lawful act of an individual providing information about the violations or future violations (U.S. SEC, 2011). Advocates for this also suggested that “reasonable belief” or “good faith belief” should be inserted in the definition. The basis for this broadened definition is for a wider coverage and qualification as to who can be considered a whistleblower (U.S. SEC, 2011). Contrary to this perspective, opponents felt strongly that broadening the definition of a whistleblower to include “potential” violations could provide opportunities for people to exploit the law and make puerile claims under the anti- retaliation provisions (Rubin, 2011; U.S. SEC, 2011). They assert that if an employee had adverse action against himself or herself and he or she made frivolous claims as to “potential” violations of the firm, they may qualify as a whistleblower and therefore seek damages under the anti-retaliation provisions (Rubin, 2011). In this case there would be concern for abuse of the law in that the employee would make meritless claims solely for the anti-retaliation benefits. Other commenters claiming abuse also suggested that the relationship between the eligible whistleblowers and the anti- retaliation provisions should be “categorically” divided (U.S. SEC, 2011). They stated that if a company decides to make an adverse action against an employee for other reasons not relating to whistleblowing, the company should be exempt from

- 15. the anti-retaliation provisions, even if the employee qualifies as a whistleblower (U.S. SEC, 2011). SEC Rule on Definition and Exemption Upon review and deliberation, the SEC decided on the final definition of “whistleblower” and addressed the relationship between whistleblower and the anti-retaliation provisions. In terms of who or what may constitute as a whistleblower, the SEC ruled that only natural persons can be a qualified whistleblower. They did not agree that the definition should include institutions or NGO’s and cited the meaning of “individual” under statutory text and legislative history. In terms of a broadened definition to include wording such as “potential violation,” “probably violation,” etc., the SEC agreed with those commenters stating the language of the definition should be changed to “possible violation” as it is more refined and less imprecise (U.S. SEC, 2011). The SEC ruled against narrowing the definition of a whistleblower; however, they decided to modify the proposed rule by adding to who can be afforded protection under the anti-retaliation provisions. (This was meant to strike a balance between opposing views). As a means of addressing abuse of the anti-retaliation provisions, the SEC ruled that a whistleblower can qualify for protection if he or she had “reasonable belief” as to the possible violation. The language of “reasonable belief,” then, is belief that another individual may possess if he or she was place in the same situation. In addition, the SEC included “lawful act” in the definition so as to distinguish between actions taken in connection with the Act with any other action (U.S. SEC, 2011). Essentially, only adverse action against the employee for the “lawful act” to provide information applies. Any other reason for the adverse action would not be covered under the anti- retaliation provisions. The SEC asserts that this would still encourage people to provide quality information while also discouraging those who would use the law for abuse or retaliation against the firm (U.S. SEC, 2011). Analysis

- 16. Based on the above rationalizations for or against certain facets of the program rules, it is safe to say that both sides have merits. Some prefer that the definition of a whistleblower be comprehensive and rightfully so. The SEC operates on the tips they receive so if a tip leads to a successful judicial action against a firm, they should rightfully protect those who provided the tip and they should not hinder award and protection because of language in the rules that may be disputed and may lead to disqualification. However, on the flipside of this, narrowing the definition could be seen as a way to reduce any abuse of the law. From the perspective of the employer, it can be appreciated that they do not want to fear repercussions for any adverse action done to an employee who makes a frivolous claim. In addition, the debate as to whether or not the whistleblower should be required to report issues to the internal compliance department was also warranted. Some say that if the employee is not required to report internally first, then it defeats the purpose of having a dedicated compliance department in the first place. The firm should have a chance to correct any issues before going to the SEC. However, such a requirement for the employee may mean that the information may not be provided at all. Overall, the SEC has done an adequate job of addressing most concerns and striking the balance between both sides. The SEC changed the verbiage of the definition of a whistleblower to accommodate those who feel strongly about a broadened scope but also worded the definition is such a way that limits abuse and explicitly states the authority of the SEC to decide on the applicability of the provisions to specific cases, i.e., “lawful act” and “reasonable belief.” In addition, for the concerns that the SEC sided against, e.g. institutions included in whistleblower definition, the SEC provided an adequate explanation in the final rules. Taken as a whole, the program rules appear fair and in line with the objectives of the Dodd- Frank Act.

- 17. Conclusion The final rules and the implementation of the SEC Whistleblower Program incited debate with many individuals and organizations supporting the program and program rules and many others disagreeing with the position. Some wanted a broader definition of a whistleblower to widen the scope of covered individuals while some wanted a narrower definition to limit the amount of potential abuse on the use of the anti- retaliation provisions. The SEC deliberated and ruled on what it believed to be a proper middle ground between the opposing sides while keeping the objectives of the Act intact. The SEC modified the language of who may qualify as a whistleblower and who may be afforded protection under the anti-retaliation provisions. To date, the SEC Whistleblower Program has shown success as it has paid out more than $50 million in awards to more than 16 whistleblowers since the establishment of the program in 2011 (U.S. SEC, 2015). In addition, the amount of tips received each year continues to grow (U.S. SEC, n.d.). We can expect that despite opposition, particularly from the business community, the SEC Whistleblower Program will be around for a while and will continue to successfully take action against fraud and securities violations while simultaneously protecting those who provided the necessary information.

- 18. References Dodd-Frank Wall Street Reform and Consumer Protection Act, H.R. 4173, 111th Cong. (2010). Havian, E. R. & Kelton, E. A. (2010, December 13). SEC whistle-blower program worth protecting. The Washington Post. Retrieved from http://www.washingtonpost.com/wp- dyn/content/article/2010/12/10/AR2010121006066.html Rubin, J. W. (2011, January 4) Re: file no. S7-33-10 release no. 34-63237 proposed rules for implementing the whistleblower provisions of section 21F of the securities exchange act of 1934. Retrieved from http://www.sec.gov/comments/s7-33-10/s73310- 253.pdf Sarbanes-Oxley Act of 2002, H.R. 3763, 107th Cong. (2002). Sweet, W. (2010, July 21). Dodd-Frank act becomes law [Harvard Law School Forum on Corporate Governance and Financial Regulation]. Retrieved from http://corpgov.law.harvard.edu/2010/07/21/dodd-frank-act- becomes-law/#comments U.S. Securities and Exchange Commission. (n.d.). 2014 annual report to congress on the Dodd-Frank whistleblower program. Retrieved from http://www.sec.gov/about/offices/owb/annual- report-2014.pdf U.S. Securities and Exchange Commission. (n.d.). Implementation of the whistleblower provisions of section 21F of the securities exchange act of 1934. Retrieved from http://www.sec.gov/rules/final/2011/34-64545.pdf U.S. Securities and Exchange Commission. (2011, May 25). SEC adopts rules to establish Whistleblower Program. Retrieved from http://www.sec.gov/news/press/2011/2011-116.htm U.S. Securities and Exchange Commission (2015, April 22). SEC announces million-dollar whistleblower award to compliance officer. Retrieved from http://www.sec.gov/news/pressrelease/2015-73.html U.S. Securities and Exchange Commission. (n.d.) Whistleblower program. Retrieved from http://www.sec.gov/spotlight/dodd- frank/whistleblower.shtml

- 19. Voices for Corporate Responsibility. (2010, December 17). Retrieved from http://www.sec.gov/comments/s7-33-10/s73310- 162.pdf