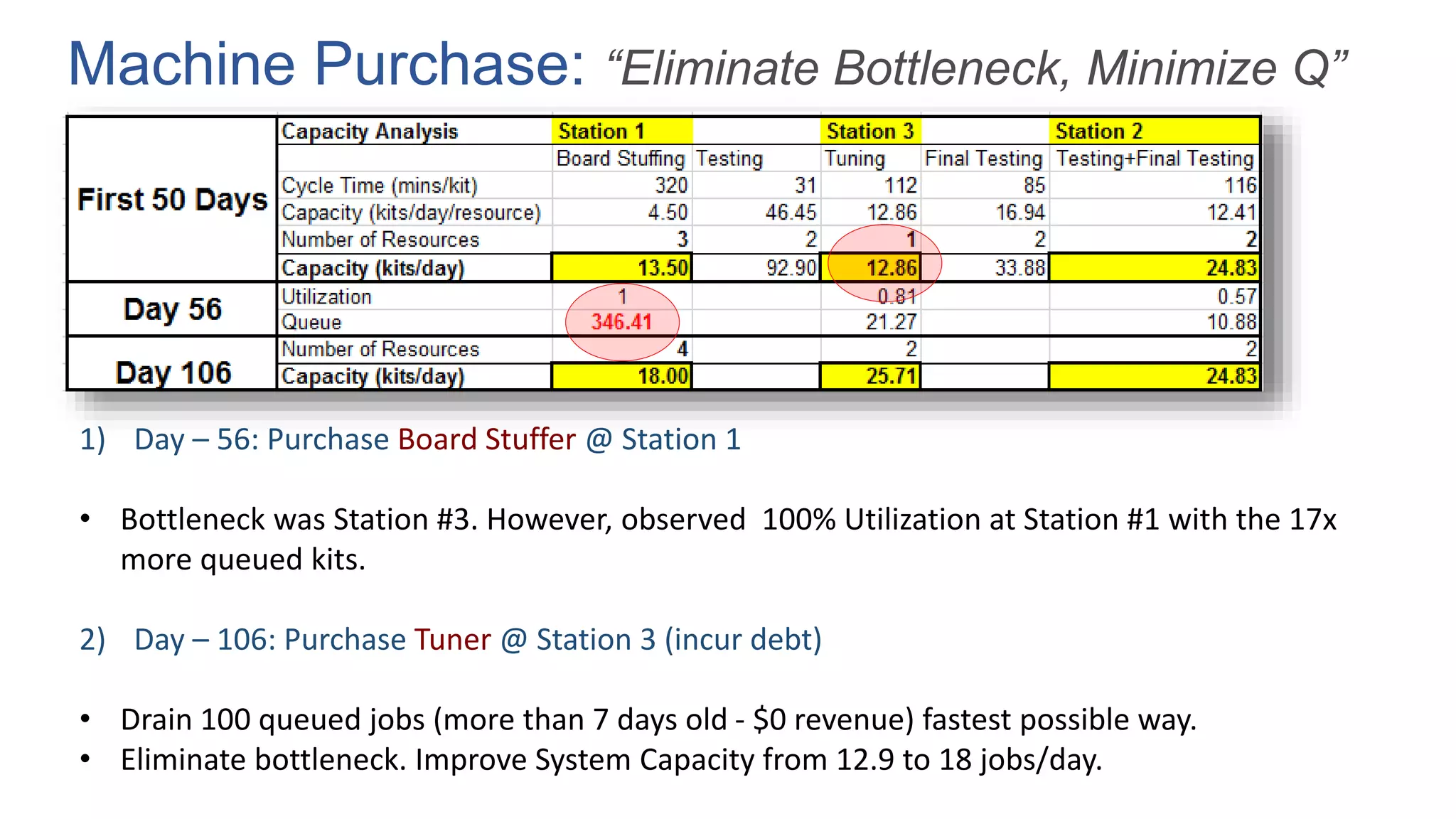

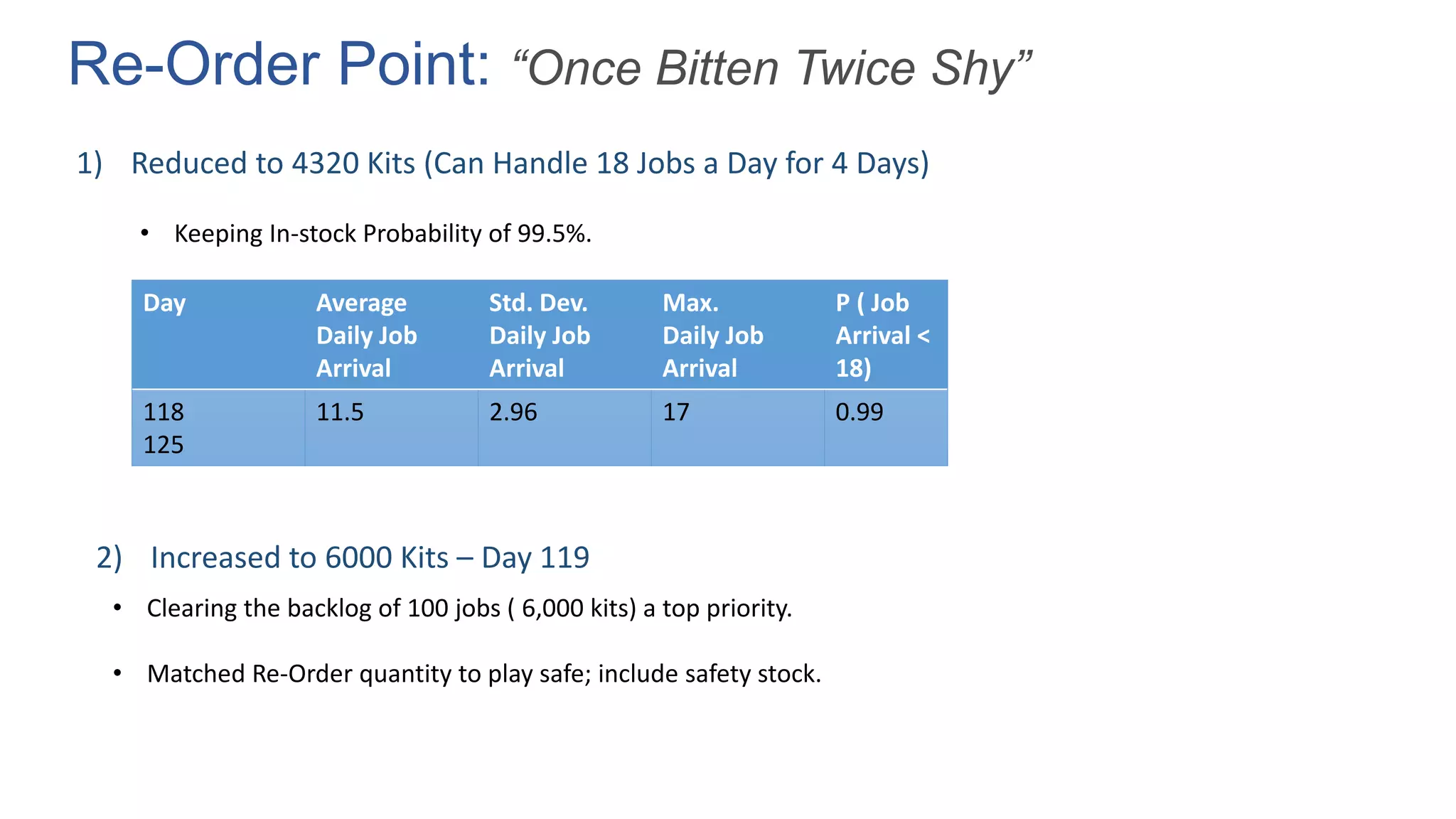

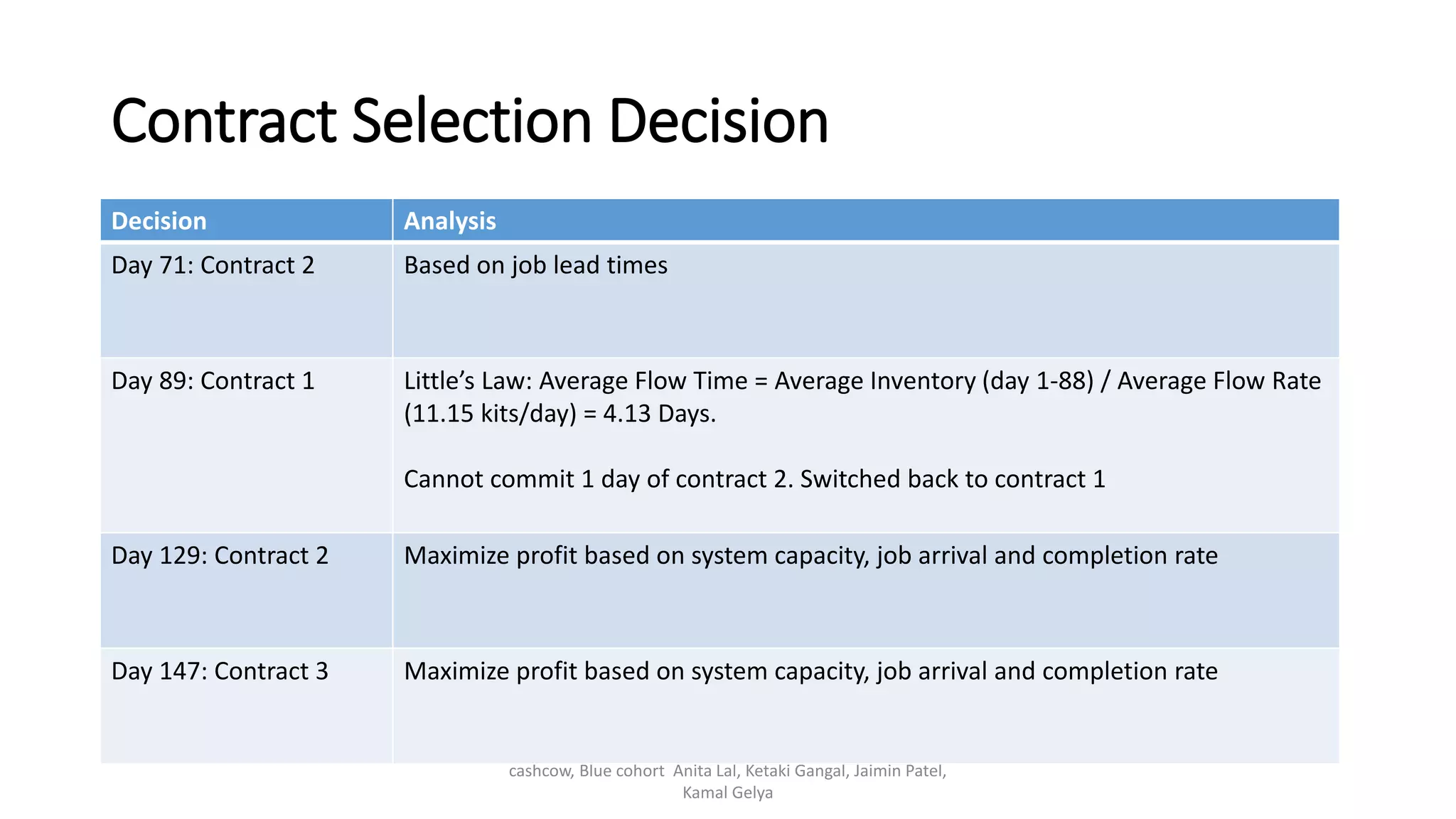

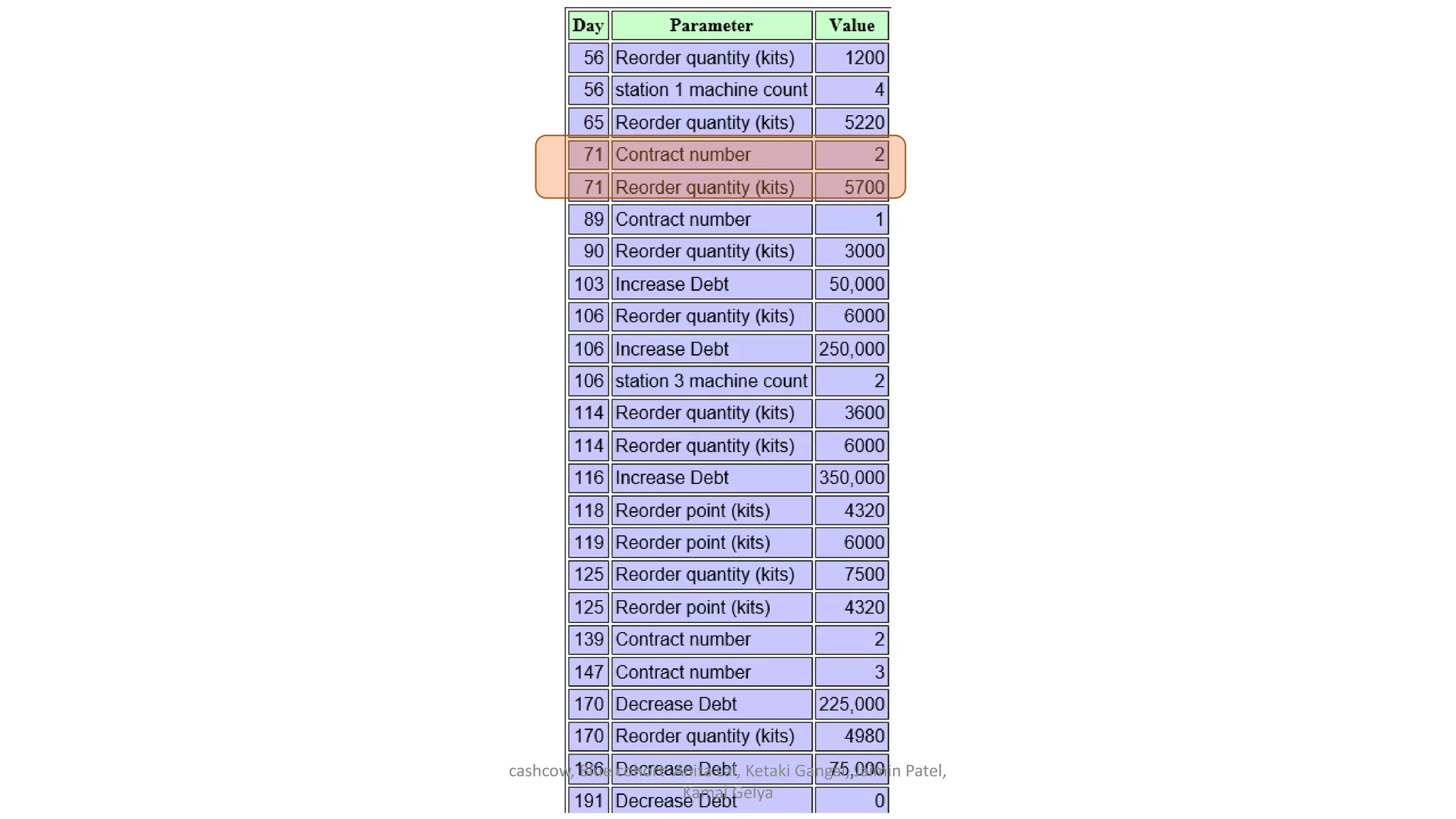

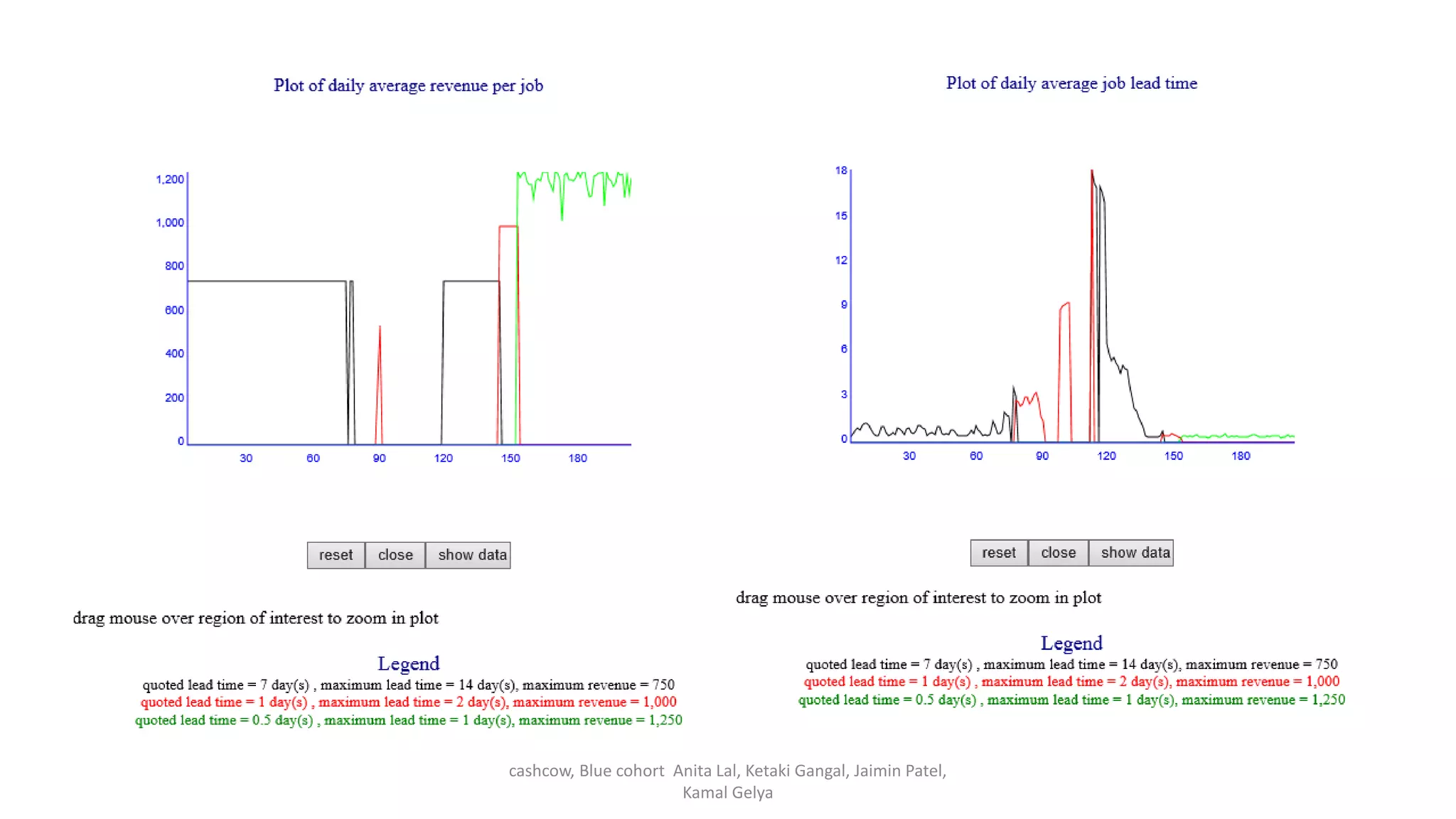

The Blue team purchased additional machines to eliminate bottlenecks and increase production capacity. They took on debt to quickly process a backlog of over 100 jobs. The team determined re-order quantities based on cash on hand, historical demand, and minimizing inventory levels while maintaining high probability of meeting demand. Re-order points were set using statistical analysis of demand and a goal of 99% probability of meeting an arrival rate of 18 jobs per day. The end strategy focused on being risk averse while maximizing profit by experimenting with lower inventory levels that reduced shipment costs and inventory holding losses.