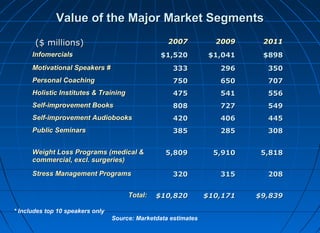

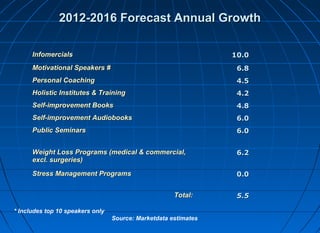

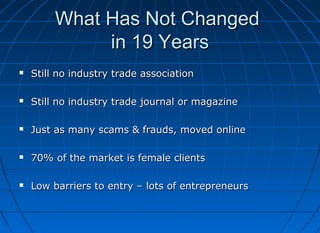

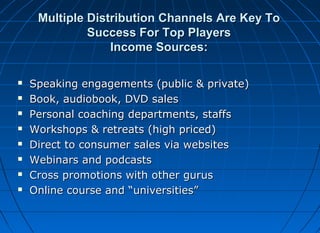

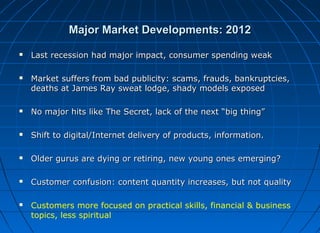

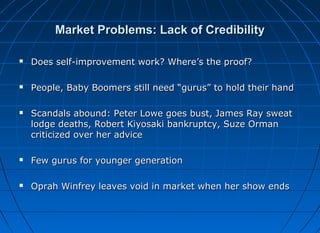

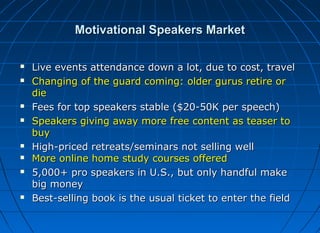

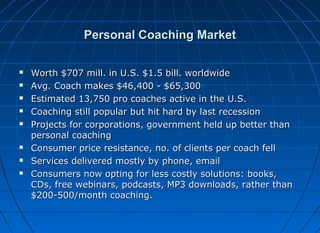

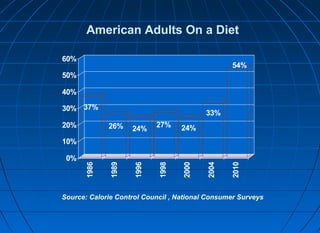

The document provides an overview and analysis of the U.S. self-improvement market as of November 2013, detailing its size, segments, emerging trends, and forecasts. It highlights the market's fragmentation, the predominance of female customers, and the impact of online platforms on product delivery. Additionally, it notes ongoing challenges such as credibility issues, customer confusion, and emerging competition from younger gurus in the industry.