How Do Private Equity Funds in India Work?

•Download as DOCX, PDF•

1 like•241 views

Several private equity firms in India have proved very beneficial for early stage funding for startup businesses, especially in agriculture sector.

Report

Share

Report

Share

Recommended

More Related Content

Recently uploaded

Recently uploaded (8)

Collective Mining | Corporate Presentation - May 2024

Collective Mining | Corporate Presentation - May 2024

Binance crypto market report Q1 2024 You should read to understand the trend

Binance crypto market report Q1 2024 You should read to understand the trend

Featured

Featured (20)

Product Design Trends in 2024 | Teenage Engineerings

Product Design Trends in 2024 | Teenage Engineerings

How Race, Age and Gender Shape Attitudes Towards Mental Health

How Race, Age and Gender Shape Attitudes Towards Mental Health

AI Trends in Creative Operations 2024 by Artwork Flow.pdf

AI Trends in Creative Operations 2024 by Artwork Flow.pdf

Content Methodology: A Best Practices Report (Webinar)

Content Methodology: A Best Practices Report (Webinar)

How to Prepare For a Successful Job Search for 2024

How to Prepare For a Successful Job Search for 2024

Social Media Marketing Trends 2024 // The Global Indie Insights

Social Media Marketing Trends 2024 // The Global Indie Insights

Trends In Paid Search: Navigating The Digital Landscape In 2024

Trends In Paid Search: Navigating The Digital Landscape In 2024

5 Public speaking tips from TED - Visualized summary

5 Public speaking tips from TED - Visualized summary

Google's Just Not That Into You: Understanding Core Updates & Search Intent

Google's Just Not That Into You: Understanding Core Updates & Search Intent

The six step guide to practical project management

The six step guide to practical project management

Beginners Guide to TikTok for Search - Rachel Pearson - We are Tilt __ Bright...

Beginners Guide to TikTok for Search - Rachel Pearson - We are Tilt __ Bright...

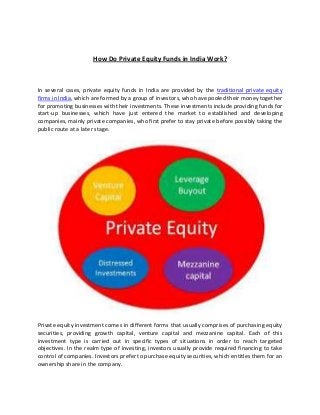

How Do Private Equity Funds in India Work?

- 1. How Do Private Equity Funds in India Work? In several cases, private equity funds in India are provided by the traditional private equity firms in India, which are formed by a group of investors, who have pooled their money together for promoting businesses with their investments. These investments include providing funds for start-up businesses, which have just entered the market to established and developing companies, mainly private companies, who first prefer to stay private before possibly taking the public route at a later stage. Private equity investment comes in different forms that usually comprises of purchasing equity securities, providing growth capital, venture capital and mezzanine capital. Each of this investment type is carried out in specific types of situations in order to reach targeted objectives. In the realm type of investing, investors usually provide required financing to take control of companies. Investors prefer to purchase equity securities, which entitles them for an ownership share in the company.

- 2. Private equity firms in India sometimes purchase businesses, which are normally called as leveraged buyouts (LBOs). This type of businesses is generally funded by large debt amount. These transactions carried out simply means those assets of the businesses being bought together with the firms doing the procedure of buying will be used as collateral. As startup businesses are at their initial stage and just have entered the market, they don’t possess that capital as required at initial stage to run the business smoothly, but later can prefer to raise capital by issuing bonds or stocks to the public. For such startup or new ventures, even banks don’t provide financing options, so the owners of such businesses usually choose to opt for investing in private equity funds in India. The other reason is that start-up companies usually don’t have substantial earnings and are extremely risky to be provided funding, but for agencies, the companies might look very promising. Private equity investing can be made through investments done on the secondary market. Typically, it has been seen that private equity transactions require investors to stay committed to oversee their investments for a specified time limit, which can be pretty long. Thus, secondary market allows investors to come out of their commitments, before the end of the particular period, which in turn allows other investors to enter.