1. The exercise price on one of Flanagan Companys options is .docx

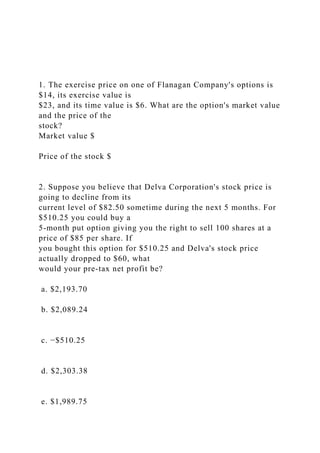

- 1. 1. The exercise price on one of Flanagan Company's options is $14, its exercise value is $23, and its time value is $6. What are the option's market value and the price of the stock? Market value $ Price of the stock $ 2. Suppose you believe that Delva Corporation's stock price is going to decline from its current level of $82.50 sometime during the next 5 months. For $510.25 you could buy a 5-month put option giving you the right to sell 100 shares at a price of $85 per share. If you bought this option for $510.25 and Delva's stock price actually dropped to $60, what would your pre-tax net profit be? a. $2,193.70 b. $2,089.24 c. −$510.25 d. $2,303.38 e. $1,989.75

- 2. 3. The current price of a stock is $50, the annual risk-free rate is 6%, and a 1-year call option with a strike price of $55 sells for $7.20. What is the value of a put option, assuming the same strike price and expiration date as for the call option? a. $7.71 b. $7.33 c. $8.55 d. $9.00 e. $8.12 4. A call option on the stock of Bedrock Boulders has a market price of $7. The stock sells for $29 a share, and the option has an exercise price of $25 a share.What is the exercise value of the call option? $ What is the option's time value? $

- 3. 5. Deeble Construction Co.'s stock is trading at $30 a share. Call options on the company's stock are also available, some with a strike price of $25 and some with a strike price of $35. Both options expire in three months. Which of the following best describes the value of these options? a. The options with the $25 strike price will sell for $5. b. The options with the $25 strike price have an exercise value greater than $5. c. If Deeble's stock price rose by $5, the exercise value of the options with the $25 strike price would also increase by $5. d. The options with the $35 strike price have an exercise value greater than $0. e. The options with the $25 strike price will sell for less than the options with the $35 strike price. Ch08 P08 Build a Model Spring 1, 20137/22/12Chapter 8. Ch 08 P08 Build a ModelExcept for charts and answers that must be written, only Excel formulas that use cell references or functions will be accepted for credit. Numeric answers in cells will not be accepted.You have been given the following information on a call option on the stock of Puckett Industries:P

- 4. =$65X =$70t =0.5rRF =4%s =50.00%a. Using the Black- Scholes Option Pricing Model, what is the value of the call option?First, we will use formulas from the text to solve for d1 and d2.Hint: use the NORMSDIST function.(d1)=N(d1) =(d2)=N(d2) =Using the formula for option value and the values of N(d) from above, we can find the call option value.VC=b. Suppose there is a put option on Puckett's stock with exactly the same inputs as the call option. What is the value of the put?Put option using Black-Scholes modified formula =Put option using put-call parity = Sheet27/22/12 Chapter8/13/10Chapter 8. Tool Kit for Financial Options and Applications in Corporate FinanceFINANCIAL OPTIONS (Section 8.1)An option is a contract which gives its holder the right to buy (or sell) an asset at a predetermined price within a specified period of time. Option contracts, though often quoted in terms of single shares, usually are contracts for a 100 shares. A call option describes a situation in which one investor may sell to someone the right to buy his/her shares of a stock over some interval of time. In this scenario, the writer of the call option (the party that surrenders the right to exercise) is said to hold a short position on the option. Meanwhile, the party that has purchased this right to buy is said to hold a long position on the option. The predetermined price that the stock may be purchased for is called the strike, or exercise, price. When an investor "writes" call options against stock held in his/her portfolio, this is called a "covered call". When the call options are written without the stock to back them up, they are they are called "naked calls". When the strike price is below the current market price, the call option is said to be "in-the-money". Likewise, when the strike price exceeds the current market price, the call option is said to be "out-of-the-money". For instance, if you believed that the price of stock was primed to rise, a call option would allow you to capture a profit off of the rise in price.A put option allows you to buy the right to sell a

- 5. stock at a specified price within some future period. If you happened to believe that the price of a stock was ready to fall, a put option would allow you the opportunity to turn a profit out of that decline. In the cases of both call and put options, the profit or loss made on an options transaction is determined by the value of the underlying asset, the strike price of the option, and the price of the option.FOR A CALL, AT EXPIRATIONIf the value of the underlying asset exceeds that of the strike price, the profit/loss from the call transaction would be equal to the difference between the value of the asset and the strike price less the price of the call. In this case there could be either a net profit or loss depending upon the exercise value and the price of the call.If the value of the underlying asset equals that of the strike price, the profit/loss from the call transaction would be equal to the price of the call, because whether exercised or unexercised the call value would be zero. In this case there is a loss equal to the price of the call.If the value of the underlying asset is less than that of the strike price, the profit/loss from the call transaction would be equal to the price of the call, because the option would not be exercised if the strike price was greater than the market price. In this case there is a loss equal to the price of the call.FOR A PUT, AT EXPIRATIONIf the value of the underlying asset is less than that of the strike price, the profit/loss from the put transaction would be equal to the difference between the strike price and value of the asset less the price of the put. In this case there could be either a profit or loss depending upon the exercise value and the price of the put.If the value of the underlying asset equals that of the strike price, the profit/loss from the put transaction would be equal to the price of the call, because whether exercised or unexercised the put value would be zero. In this case there is a loss equal to the price of the put.If the value of the underlying asset exceeds that of the strike price, the profit/loss from the put transaction would be equal to the price of the put, because the option would not be exercised if the market price was greater than the strike price. In this case there is a loss equal to the price of the

- 6. put.Table 8-1January 8, 2010, Listed Options QuotationsCALLS—LAST QUOTEPUTS—LAST QUOTEClosing PriceStrike PriceFebruaryMarchMayFebruaryMarchMayGeneral Computer Corporation (GCC)53.50504.254.755.500.651.402.2053.50551.302.053.152. 65r4.5053.50600.300.701.506.65r8.00U.S. Biotec56.65555.256.108.002.253.75rFood World56.65553.504.10r0.70rrNote: r means not traded.Suppose you purchase GCC's May call option with a strike price of $50 and the stock price goes to $60. What is the rate of return on the stock? What is the rate of return on the option?Stock ReturnIntital stock price$53.50Final stock price$60.00Rate of return on stock12.1%Call Option ReturnIntital cost of opiotn$5.50Market price of stock$60.00Strike price$50.00Profit from exercise$10.00Rate of Return81.8%Suppose you purchase GCC's May put option with a strike price of $50 and the stock price goes to $45. What is the rate of return on the stock? What is the rate of return on the option?Stock ReturnIntital stock price$53.50Final stock price$45.00Rate of return on stock- 15.9%Put Option ReturnIntital cost of option$2.20Market price of stock$45.00Strike price$50.00Profit from exercise$5.00Rate of Return127.3%What is the exercise value of GCC's May call option with a strike price of $50? What is the exercise value of GCC's May call option with a strike price of $55?Exercise ValueStock price$53.50Strike price$50.00Exercise value$3.50Stock price$53.50Strike price$55.00Exercise value$0.00THE SINGLE-PERIOD BINOMIAL OPTION PRICING MODEL (Section 8.2)Consider a call option on a stock. The stock's current price, denoted by P, is $40 and the strike price, denoted by X, is $35. The option expires in 6 months. The nominal annual risk-free rate is 8%.PAYOFFS IN A SINGLE-PERIOD BINOMIAL MODELAt expiration, the stock can take on only one of two possible values. It can either go up in price by a factor of 1.25, or down in price by a factor of 0.80.Inputs:Key output:Current stock price, P =$40.00VC

- 7. =$7.71Risk-free rate, rRF =8%Strike price, X =$35.00Up factor for stock price, u =1.25Down factor for stock price, d =0.80Years to expiration, t =0.50Number of periods until expiration, n =1 Mike Ehrhardt: Do not change this input.Consider the value of the stock and the payoff of the option.Figure 8-1: Binomial PayoffsStrike price: X =$35.00Current stock price: P =$40.00Up factor for stock price: u =1.25Down factor for stock price: d =0.80Cu,Ending up ending upstock priceoption payoffP (u) =Max[P(u) − X, 0] ==A146*D135 =$50.00=MAX(D141- D133,0) =$15.00P,VC,currentcurrentstock priceoption price$40?Cd,Ending down ending downstock priceoption payoffP (d) =Max[P(d) − X, 0] ==A146*D136 =$32.00=MAX(D151-D133,0) =$0.00THE HEDGE PORTFOLIO APPROACHWe can form a portfolio by writing 1 call option and purchasing Ns shares of stock. We want to choose Ns such that the payoff of the portfolio if the stock price goes up is the same as if the stock price goes down. This is a hedge portfolio because it has a riskless payoff. Step 1. Find the number of shares of stock in the hedge portfolio.Ns =Cu - Cd=0.83333P(u - d)Step 2. Find the hedge portfolio’s payoff.If the stock price goes up:Portoflio payoff =Ns (P)(u) - Cu=$26.6667If the stock price goes down:Portoflio payoff =Ns (P)(d) - Cd=$26.6667Figure 8-2: The Hedge Portfolio with Riskless PayoffsStrike price: X =$35.00Current stock price: P =$40.00Up factor for stock price: u =1.25Down factor for stock price: d =0.80Up option payoff: Cu = MAX[0,P(u)-X] =$15.00Down option payoff: Cd =MAX[0,P(d)-X] =$0.00Number of shares of stock in portfolio: Ns = (Cu - Cd) / P(u-d) =0.83333Stock price = P (u) =$50.00P,Portoflio's stock payoff: = P(u)(Ns) =$41.67currentSubtract option's payoff: Cu =$15.00stock pricePortoflio's net payoff = P(u)Ns - Cu =$26.67$40Stock price = P (d) =$32.00Portoflio's stock payoff: = P(d)(Ns) =$26.67Subtract option's payoff: Cd =$0.00Portoflio's net payoff = P(d)Ns - Cd =$26.67Step 3. Find

- 8. the present value of the hedge portfolio's riskless payoff.The present value of the riskless payoff disounted at the risk-free rate (we assume daily compounding) is:Pv of payoff =Payoff=$26.6667=$25.6212(1 + rRF/365)365*(t/n)1.04081Step 4. Find the option's current value.The current value of the hedge portolio is the the stock value (Ns x P) less the call value (VC). But the hedge portfolio has a riskless payoff, so the hedge portfolio's value must also be equal to the present value of the riskless payoff disounted at the risk-free rate (we assume daily compounding). With a little algebra, we get: VC =Ns (P) - Present value of riskless payoffVC =$7.71THE REPLICATING PORTFOLIOIf a portfolio can be formed such that is has the same cash flows as an option, the the option value must equal the value of this replicating portfolio. It is possible to replicate an option's cash flows with a portfolio of stock and risk-free bonds, as we show in the next section.Suppose we form a portfolio with Ns shares of stock (as determined by the formula for the number of shares of stock in the hedge portfolio). How much could we borrow so that the net payoff from the stock and the repayment of the loan (and its interest) has the same payoff as the option?Inputs:Current stock price, P =$40.00Risk-free rate, rRF =8%Strike price, X =$35.00Up factor for stock price, u =1.25Down factor for stock price, d =0.80Years to expiration, t =0.50Number of periods until expiration, n =1 Mike Ehrhardt: Do not change this input.Intermediate calculations:Up payoff for stock, Pu =$50.00Down payoff for stock, Pd =$32.00Cu =$15.00Cd =$0.00Ns =Cu - Cd=0.8333P(u - d)If we form a portfolio with Ns shares of stock, how much can we afford to borrow so that the portfolio's net payoff is equal to the option's payoff?Value of stock in portfolio if up =Ns P u=$41.67Cu =$15.00Amount of borrowing (plus interest) that can be repaid =$26.6667Value of stock in portfolio if down =Ns P d=$26.67Cd =$0.00Amount of borrowing (plus interest) that can be repaid =$26.6667Notice that the amount of borrowing (plus interest) that we can afford to repay is the same

- 9. whether the stock goes up or down. To find the amount we can borrow, we find the present value fo the amount we can repay. Option pricing assumes that interest rates are compounded very frequently. We will assume daily compounding (which is a good approximation for continuous compounding).Amount borrowed =Amount repaid=25.6212(1 + rRF/365)365*(t/n)A summary of the replicating portfolio value and payoff's is shown below:Replicating Portfolio PayoffsNumber of shares of stock: Ns =0.8333Current stock price: P =$40.00Up factor for stock price: u =1.2500Up stock price: P(u) =$50.00Down factor for stock price: d =0.8000Down stock price: P(d) =$32.00Risk-free rate: rRF =8.00%Years to expiration: t =0.50Number of periods until expiration: n =1Amount of principal and interest repaid =$26.67Amount borrowed =$25.62(Ns) x (Pu) =$41.67Loan repayment =$26.67Net portfolio payoff =$15.00Current value of portfolio:(Ns) x (P) =$33.33Amount borrowed =$25.62Total portfolio net cost =$7.71(Ns) x (Pd) =$26.67Loan repayment =$26.67Net portfolio payoff =$0.00The call option has the same cash flows as the replicating portfolio, so the call's price must be equal to the value of the replicating portfolio:VC = Total portfolio value =$7.71THE SINGLE-PERIOD BINOMIAL OPTION PRICING FORMULA (Section 8.3)The step-by-step hedge portfolio approach works fine, but for problems in which you want to change the inputs, it is easier to use the binomial option pricing formula shown below. Inputs:P =$40.00X =$35.00u =1.25d =0.80Cu =$15.00Cd =$0.00Risk-free rate, rRF =8%Years to expiration, t =0.50Number of periods until expiration, n =1 Mike Ehrhardt: Do not change this input.VC =$7.71The Simplified Binomial Option Pricing FormulaP =$40.00X =$35.00u =1.25d =0.80Cu =$15.00Cd =$0.00Risk-free rate, rRF =8%Years to expiration, t =0.50Number of periods until expiration, n =1 Mike Ehrhardt: Do not change this input.We can simplify the

- 10. model by define pu and pd as:The binomial option pricing model then simplifies to:VC = Cu pu + Cd pd For Western's 6- month options, we have: pu =0.5141 pd =0.4466We can find the value of Western's 6-month call with a $35 strike price:VC =Cu x pu +Cd x pd VC =$15.00x0.5141+$0.00x0.4466VC =$7.71Find the value of a 6-month call option with a $30 strike price:x =$30.00Cu =MAX[0,Pu-X] =$20.00Cd =MAX[0,Pd-X] =$2.00VC =Cu x pu +Cd x pd VC =$20.00x0.5141+$2.00x0.4466VC =$11.18In fact, we can use the p's to find the value of any security with payoffs that depend on Western's 6-month stock price. THE MULTI-PERIOD BINOMIAL OPTION PRICING MODEL (Section 8.4)Suppose we divide the year into two 6-month periods. We will allow the stock to only go up or down each period, but because there are more periods there will be more possible stock prices. The key is to keep the standard deviation of the stock's return the same as we divide the year into smaller periods. If we know the standard deviation of the stock's return and the number of periods, there is a formula that will show us what u and d must be.s is the standard deviation of stock return. Here are the formulas relating s to to u and d:The standard deviation of Western's stock return is shown below. Notice that this provides the values for u and d that we used in the single-period model.Multi-periodSingle-periodAnnual standard deviation of stock return, s =31.5573%31.5573%Years to expiration, t =0.50.5Number of periods prior to expiration, n =2 Mike Ehrhardt: The number of periods per year may not be changed by the user. Mike Ehrhardt: Do not change this input.1 Mike Ehrhardt: The number of periods per year may not be changed by the user. Mike Ehrhardt: Do not change this input.u =1.17091.250d

- 11. =0.85400.8000Here are the other data for Western, taken from the original problem:Current stock price, P =$40.00Risk-free rate, rRF =8%Strike price, X =$35.00Because we are going to solve a binomial problem repeatedly, it will be easier if we go ahead and calculate the p's now.(1 + rRF/365)365(T/n) =1.0202 pu =0.5140 pd =0.4662Applying these values of u and d to the intital stock price gives the possible stock prices after 3 months. We can then apply u and d to these 3-month values to get the stock values at the end of 6 months, as shown below. Notice that because d = 1/u, the "middle" stock value at the end of the year is the same whether the stock initially went up and then went down, or whether it went down and then went up.Notice that the range of final outcomes at 6 months is wider than the previous problem. However, the standard deviation of stock returns is the same as before, because most of the time the stock price will end up at the middle outcome rather than at the top or bottom outcomes.Figure 8-3: The 2-Period Binomial Lattice and Option ValuationStandard deviation of stock return: s =31.557%Current stock price: P =$40.00Up factor for stock price: u =1.1709Down factor for stock price: d =0.8540Strike price: X =$35.00Risk-free rate: rRF =8.00%Years to expiration: t =0.50Number of periods until expiration: n =2Price of $1 payoff if stock goes up: pu =0.51400Price of $1 payoff if stock goes down: pd =0.46621Now3 months6 monthsStock = P (u) (u) =$54.84Cuu = Max[P(u)(u) − X, 0] =$19.84Stock = P (u) =$46.84Cu = Cuupu + Cudpd =$12.53 P =$40.00Stock = P (u) (d) = P (d) (u) =$40.00VC=Cupu+Cdp =$7.64Cud = Cdu = Max[P(u)(d) − X, 0] =$5.00Stock = P (d) =$34.16Cd = Cudpu + Cddpd =$2.57Stock = P (d) (d) =$29.17Cdd = Max[P(d)(d) − X, 0] =$0.00To find the current value of the option, we can break the binomial lattice into three problems. Problem #1 is to find the option value at the end of six months, given that the stock moved upward from its initial value. Problem #2 is to find the option value at the end of six months, given that the stock moved downward from its intitial value. Finally, problem #3 is to find the current value of the option, given its two

- 12. possible values at the end of six months.In this example, we divided time into two periods. If we were to divide time into more periods, we would get a distribution of stock prices in the last period that would be very realistic, which would give a very accurate option price. It is true that dividing time into more periods would create more binominal problems to solve, but each problem is very easy and computers can solve them very quickly.BLACK-SCHOLES OPTION PRICING MODEL (Section 8.5)In deriving this option pricing model, Black and Scholes made the following assumptions:1. The stock underlying the call option provides no dividends or other distributions during the life of the option.2. There are no transaction costs for buying or selling either the stock or the option.3. The short-term, risk-free interest rate is known and is constant during the life of the option.4. Any purchaser of a security may borrow any fraction of the purchase price at the short-term, risk-free interest rate.5. Short selling is permitted, and the short seller will receive immediately the full cash proceeds of today's price for a security sold short.6. The call option can be exercised only on its expiration date.7. Trading in all securities takes place continuously, and the stock price moves randomly.The derivation of the Black-Scholes model rests on the concept of a riskless hedge. By buying shares of a stock and simultaneously selling call options on that stock, an investor can create a risk-free investment position, where gains on the stock are exactly offset by losses on the option. Ultimately, the Black-Scholes model utilizes these three formulas:VC =P[ N (d1) ] - X e-r t [ N (d2) ]Note: r is the risk free rate, rRF.d1 ={ ln (P/X) + [rRF + s2 /2) ] t } / (s t1/2)d2 =d1 - s (t 1 / 2)In these equations, V is the value of the option. P is the current price of the stock. N(d1) is the area beneath the standard normal distribution corresponding to (d1). X is the strike price. rRF is the risk-free rate. t is the time to maturity. N(d2) is the area beneath the standard normal distribution corresponding to (d2). s is the volatility of the stock price, as measured by the standard deviation. Looking at

- 13. these equations we see that you must first solve d1 and d2 before you can proceed to value the option.First, we will lay out the input data given earlier for Western Cellular's call option.Inputs:Key Output:P =$40VC =$7.39X =$35rRF =8.00%t =0.5s =31.557%Now, we will use the formula from above to solve for d1.d1=0.8892Having solved for d1, we will now use this value to find d2.d2=0.6661At this point, we have all of the necessary inputs for solving for the value of the call option. We will use the formula for V from above to find the value. The only complication arises when entering N(d1) and N(d2). Remember, these are the areas under the normal distribution. Luckily, Excel is equipped with a function that can determine cumulative probabilities of the standard normal distribution. This function is located in the list of statistical functions, as "NORMSDIST". For both N(d1) and N(d2), we will follow the same procedure of using this function in the value formula. The data entries for N(d1) are shown below.N(d1)=0.8131N(d2)=0.7473By applying this method for cumulative distributions, we can solve for the option value using the formula above.VC=$7.39EFFECTS OF OPM FACTORS ON THE VALUE OF A CALL OPTIONThe figure below shows 3 of Westerns's call options, each with a $35 strike price. One option has 1 yearsuntil expiration, 1 has 6 months (0.5 years), and 1 has 3 months (0.25 years).Figure 8-5. Western Cellular’s Call Options with a Strike Price of $35Data for the figure.Time until expiration10.50.25Stock Price$5$9.37$7.39$6.20$0.00$0.00$0.00$0.00$0.00$2.50$0.00$ 0.00$0.00$0.00$5.00$0.00$0.00$0.00$0.00$7.50$0.00$0.00$0.0 0$0.00$10.00$0.00$0.00$0.00$0.00$12.50$0.00$0.00$0.00$0.0 0$15.00$0.00$0.02$0.00$0.00$17.50$0.00$0.07$0.00$0.00$20. 00$0.00$0.22$0.02$0.00$22.50$0.00$0.53$0.09$0.01$25.00$0. 00$1.05$0.28$0.04$27.50$0.00$1.82$0.68$0.18$30.00$0.00$2. 86$1.37$0.56$32.50$0.00$4.16$2.41$1.32$35.00$0.00$5.70$3. 78$2.54$37.50$2.50$7.45$5.46$4.20$40.00$5.00$9.37$7.39$6. 20$42.50$7.50$11.42$9.51$8.44$45.00$10.00$13.59$11.76$10. 80$47.50$12.50$15.85$14.11$13.24$50.00$15.00$18.17$16.51$

- 14. 15.71$52.50$17.50$20.54$18.95$18.20$55.00$20.00$22.94$21. 42$20.70$57.50$22.50$25.37$23.90$23.19The figure shows that:1.Option prices increase as the stock price increases relative to the strike price.2.Option prices increase as time to expiration increases.3.Obviousy, an increase in the strike price will cause the option price to fall.The impact of changes in sWe keep all inputs constant except the standard deviation:Standard deviationCall option price0.001%$6.3710.000%$6.3831.557%$7.3940.000%$8.0760. 000%$9.8790.000%$12.70The impact of changes in the risk- free rateWe keep all inputs constant except the risk-free rate:Risk-free rate (rRF)Call option price0%$6.414%$6.898%$7.3912%$7.9020%$8.93THE VALUATION OF PUT OPTIONS (Section 8.6)Consider two portfolios. The first has a put option and a share of stock. The second has a call option and cash equal to the present value of the strike price (discounted with continuous compounding; see Chapter 4 Web Extension 4C). What are the payoffs at expiration date T of the two portfolios if the stock price is less than the strike price at expiration? If it is above the strike price at expiration?PT<XPT>=XPutX-PT0StockPTPTPortfolio 1:XPTCall0PT - XCashXXPortfolio 2:XPTAs the table shows, the two porfolios have the same payoffs. Therefore, they must have the same value today. This is called put-call parity.Put + Stock = Call + PV of strike priceVP = VC - P + X exp(-rRF t)Suppose you have the following information. What is the value of the put?P =$40X =$35rRF =8%t =0.50V (call price) =$7.39Put =VC-P+X exp(-rRF t)=$7.39-$40+33.63=$1.02If you do not already have the value of the call option, you can use the following formula to directly calculate the value fo the put.Put =P[ N (d1) - 1 ] - X e-r t [ N (d2) -1 ]Note: r is the risk free rate, rRF.The formulas for d1 and d2 are the same as for the Black-Scholes call option model. In fact, the only differences between the two models is that the formula for puts subtracts 1 from N(d1) and N(d2).Put =$1.02 0.0049 2.5 5.0 7.5 10.0 12.5 15.0 17.5 20.0 22.5 25.0

- 15. 27.5 30.0 32.5 35.0 37.5 40.0 42.5 45.0 47.5 50.0 52.5 55.0 57.5 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 2.5 5.0 7.5 10.0 12.5 15.0 17.5 20.0 22.5 0.0049 2.5 5.0 7.5 10.0 12.5 15.0 17.5 20.0 22.5 25.0 27.5 30.0 32.5 35.0 37.5 40.0 42.5 45.0 47.5 50.0 52.5 55.0 57.5 1.51506222467964E- 173 8.551037404862E-17 1.0707398540399E-9 1.78882936371088E-6 0.000135852498602879 0.00232090633119555 0.0170078188603651 0.0734174602902471 0.222652674121347 0.527670943536376 1.046402594016459 1.818079352219861 2.857848945107179 4.158883709038092 5.698556991630983 7.445448529226486 9.365239188459078 11.4247939402102 13.59450307065918 15.84928390461534 18.16870054198051 20.53658479836515 22.94043090090215 25.37073506523161 0.0049 2.5 5.0 7.5 10.0 12.5 15.0 17.5 20.0 22.5 25.0 27.5 30.0 32.5 35.0 37.5 40.0 42.5 45.0 47.5 50.0 52.5 55.0 57.5 0.0 2.03437166585549E-32 2.1793900216619E-18 4.44229145562589E-12 1.93203845722943E-8 4.33424982656166E-6 0.000181250982217191 0.00265642188932642 0.0193802973823096 0.0870366929662917 0.275893968805316 0.677053621542877 1.372389235035076 2.407580349095648 3.783161253339091 5.463147158467155 7.391742525158513 9.509039115814772 11.76129127512468 14.10548320216353 16.50986325103071 18.95237496450883 21.41840110800933 23.89860854715915 0.0049 2.5 5.0 7.5 10.0 12.5 15.0 17.5 20.0 22.5 25.0 27.5 30.0 32.5 35.0 37.5 40.0 42.5 45.0 47.5 50.0 52.5 55.0 57.5 0.0 3.10068157347839E-63 2.41111671358491E-35 7.21930486657584E-23 1.01084729435005E-15

- 16. 3.81606506301323E-11 5.03845361193844E-8 8.19395127732203E-6 0.000330518959587531 0.0050541777747499 0.0385454872591215 0.17667576564412 0.555431161175346 1.319031421495138 2.54306417 2982212 4.203078489765005 6.204557603445071 8.43508293014844 10.8008922565077 13.23864514390552 15.71147265743971 18.20020902528756 20.69574019842843 23.19403160206953 Stock Price ($) $ Exercise Value T = 1 T = 0.5 T = 0.25 8.1SECTION 8.1SOLUTIONS TO SELF-TEST Brighton Memory's stock is currently trading at $50 a share. A call option on the stock with a $35 strike price currently sells for $21. What is the exercise value of the call option? What is the time value?Stock price$50Strike price$35Market price of option$21Exercise value of option$15.00Time value of option$6.00 8.2SECTION 8.2SOLUTIONS TO SELF-TEST Lett Incorporated's stock price is now $50 but it is expected to either go up by a factor of 1.5 or down by a factor of 0.7by the end of the year. There is a call option on Lett's stock with a strike price of $55 and an expiration date one year from now. What are the stock's possible prices at the end of the year? What are the call option's payoffs if the stock price goes up? If the stock price goes down? If we sell one call option, how many shares of Lett's stock must we buy to create a riskless hedged portfolio consisting of the option position and the stock? What is the

- 17. payoff of this portfolio? If the annual risk free rate is 6 percent, how much is the riskless portfolio worth today (assuming daily compounding)? What is the current value of the call option?Inputs:Current stock price$50Strike price$55u1.50d0.70Risk-free rate6%Time to exercise1.00Stock price if u$75.00Stock price if d$35.00Option payoff if u$20.00Option payoff if d$0.00N0.50Hedge portfolio payoff if u$17.50Hedge portfolio payoff if d$17.50Portfolio value today (PV of payoff)$16.48Current option value$8.52 8.3SECTION 8.3SOLUTIONS TO SELF-TEST Yegi's Fine Phones has a current stock price of $30. You need to find the value of a call option with a strike price of $32 that expires in 3 months. Use the binomial model with 1 period until expiration. The factor for an increase in stock price is u = 1.15; the factor for a downward movement is d = 0.85. What are the possible stock prices at expiration? What are the option's possible payoffs at expiration? What are pu and pd? What is the current value of the option (assume each month is 1/12 of a year)? Inputs for ProblemCurrent stock price$30.00Strike price$32.00u =1.15d =0.85Time in years to expiration0.25Number of periods until expiration1 Mike Ehrhardt: The number of periods per year may not be changed by the user.Risk-free rate, rRF =6%Binomial lattice of stock prices:P(u) =$34.50P =$30.00P(d) =$25.50Cu =$2.50Cd =$0.00 pu =0.5422 pd =0.4429Current value of option:VC =$1.36 8.4SECTION 8.4SOLUTIONS TO SELF-TEST Ringling Cycle’s stock price is now $20. You need to find the value of a call option with an strike price of $22 that expires in 2 months. You want to use the binomial model with 2 periods (each period is a month). Your assistant has calculated that u = 1.1553, d = 0.8656, pu = 0.4838, and pd = 0.5095. Draw the binomial lattice for stock prices. What are the possible prices after 1 month? After 2 months? What are the option's possible payoffs at expiration? What will the option's value be in 1 month if the

- 18. stock goes up? What will the option's value be in 1 month if the stock price goes down? What is the current value of the option (assume each month is 1/12 of a year)? Previous work done by your assistant:Annual standard deviation of stock return, s =50.000%Years to expiration, T =0.1667Number of periods per year, n =2 Mike Ehrhardt: The number of periods per year may not be changed by the user.u =1.1553d =0.8656Risk-free rate, rRF =8%(1 + rRF/365)365(T/n) =1.0067 pu =0.4838 pd =0.5095Inputs for ProblemCurrent stock price$20.00Strike price$22.00u =1.1553d =0.8656Time in years to expiration0.1667Number of periods until expiration2pu =0.4838pd =0.5095Binomial lattice of stock prices:P(u)(u) =$26.69P(u) =$23.11P =$20.00P(u)(d) = P(d)(u) =$20.00P(d) =$17.31P(d)(d) =$14.99Option payoffs at expirationCuu =$4.69Cud =$0.00Cdd =$0.00Value of option in 1 month if stock goes up:Cu =$2.27Value of option in 1 month if stock goes up:Cd =$0.00Current value of option:VC =$1.10 8.5SECTION 8.5SOLUTIONS TO SELF-TEST What is the value of a call option with these data: P = $35, X = $25, rRF = 6%, t = 0.5 (6 months), and s = 0.6? P$35X$25rRF6.0%t0.50s0.6(d1)1.076(d2)0.652N(d1)0.8590N(d 2)0.7427V =$12.05 8.6SECTION 8.6SOLUTIONS TO SELF-TEST A put option written on the stock of Taylor Enterprises (TE) has an exercise price of $25 and six months remaining until expiration. The risk-free rate is 6 percent. A call option written on TE has the same exercise price and expiration date as the put option. TE's stock price is $35. If the call option has a price of $12.05, what is the price (i.e., value) of the put option? P =$35.00X =$25.00rRF =6.00%t =0.50V (call price) =$12.05Put =$1.31 n / t e