Nomura Property Report (May 2011)

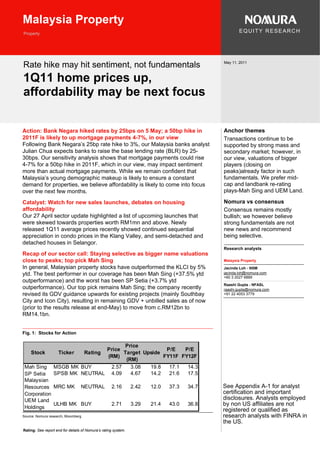

- 1. Malaysia Property Property EQUITY RESEARCH May 11, 2011 Rate hike may hit sentiment, not fundamentals 1Q11 home prices up, affordability may be next focus Action: Bank Negara hiked rates by 25bps on 5 May; a 50bp hike in Anchor themes 2011F is likely to up mortgage payments 4-7%, in our view Transactions continue to be Following Bank Negara’s 25bp rate hike to 3%, our Malaysia banks analyst supported by strong mass and Julian Chua expects banks to raise the base lending rate (BLR) by 25- secondary market; however, in 30bps. Our sensitivity analysis shows that mortgage payments could rise our view, valuations of bigger 4-7% for a 50bp hike in 2011F, which in our view, may impact sentiment players (closing on more than actual mortgage payments. While we remain confident that peaks)already factor in such Malaysia’s young demographic makeup is likely to ensure a constant fundamentals. We prefer mid- demand for properties, we believe affordability is likely to come into focus cap and landbank re-rating over the next few months. plays-Mah Sing and UEM Land. Catalyst: Watch for new sales launches, debates on housing Nomura vs consensus affordability Consensus remains mostly Our 27 April sector update highlighted a list of upcoming launches that bullish; we however believe were skewed towards properties worth RM1mn and above. Newly strong fundamentals are not released 1Q11 average prices recently showed continued sequential new news and recommend appreciation in condo prices in the Klang Valley, and semi-detached and being selective. detached houses in Selangor. Research analysts Recap of our sector call: Staying selective as bigger name valuations close to peaks; top pick Mah Sing Malaysia Property In general, Malaysian property stocks have outperformed the KLCI by 5% Jacinda Loh - NSM ytd. The best performer in our coverage has been Mah Sing (+37.5% ytd jacinda.loh@nomura.com +60 3 2027 6889 outperformance) and the worst has been SP Setia (+3.7% ytd Raashi Gupta - NFASL outperformance). Our top pick remains Mah Sing; the company recently raashi.gupta@nomura.com revised its GDV guidance upwards for existing projects (mainly Southbay +91 22 4053 3779 City and Icon City), resulting in remaining GDV + unbilled sales as of now (prior to the results release at end-May) to move from c.RM12bn to RM14.1bn. Fig. 1: Stocks for Action Price Price P/E P/E Stock Ticker Rating Target Upside (RM) FY11F FY12F (RM) Mah Sing MSGB MK BUY 2.57 3.08 19.8 17.1 14.3 SP Setia SPSB MK NEUTRAL 4.09 4.67 14.2 21.6 17.5 Malaysian Resources MRC MK NEUTRAL 2.16 2.42 12.0 37.3 34.7 See Appendix A-1 for analyst Corporation certification and important UEM Land disclosures. Analysts employed ULHB MK BUY 2.71 3.29 21.4 43.0 36.8 by non US affiliates are not Holdings registered or qualified as Source: Nomura research, Bloomberg research analysts with FINRA in the US. Rating: See report end for details of Nomura’s rating system.

- 2. Nomura | AEJ Malaysia Property May 11, 2011 Overall view of 50bp hike for 2011 = 4-7% impact on mortgage payments Based on pre-hike financing rates of 4% on average (BLR – 2.3%), monthly mortgage payments are likely to rise by 4-7% for a further 50bp increase in the OPR (as per our in- house forecasts – the first 25bp hike occurred on May 5; we expect another 25bp hike in 3Q11). Our Malaysia banks analyst Julian Chua however also believes that what remains to be seen is whether banks will try to pass through additional costs arising from the 100bp increase in the SRR to consumers. At a property launch last weekend, we noticed banks offering BLR minus 2.4-2.45% with reduced lock-in periods of three years (from BLR minus 2.3% and five-year lock-in periods a few months back), implying greater competition among banks for the consumer loans business. Exhibits 1 and 2 provide a sensitivity chart and table of mortgage payments to lending rate hikes. As such, even if the actual impact of the recent OPR hike may only cause a minor impact on mortgage payments, overall sentiment or the inclination to upgrade homes may be affected. Fig. 2: Sensitivity chart: Mortgage payment to rate hikes Fig. 3: Sensitivity table: Mortgage payments to rate hike 15 20 25 30 35 220 20 years 25 years 30 years 35 years 4.0% - - - - - 200 4.5% 3% 4% 5% 6% 7% 180 5.0% 7% 9% 11% 12% 14% 160 5.5% 10% 14% 16% 19% 21% 140 6.0% 14% 18% 22% 26% 29% 6.5% 18% 23% 28% 32% 36% 120 7.0% 22% 28% 34% 39% 44% 100 7.5% 25% 33% 40% 46% 52% 80 8.0% 29% 38% 46% 54% 60% 4.0% 4.5% 5.0% 5.5% 6.0% 6.5% 7.0% 7.5% 8.0% 8.5% 9.0% 9.5% 10.0% 8.5% 33% 43% 53% 61% 69% 9.0% 37% 48% 59% 69% 77% Source: Nomura Research Source: Nomura Research Industry sources (namely, the Malaysian Real Estate and Housing Developers Association (REHDA) generally expect double-digit price appreciation (c. 13%) in residential properties for 2011, and while we continue to expect transaction volumes and values this year to be supported by a strong secondary market and mass market transactions (just like it was last year) due to a young underlying Malaysian demographic profile, we believe the key focus in the sector over the coming months will likely be affordability for the larger part of the middle-income Malaysian population (and incidentally, a key voter pool in urban areas). While there will always be a cash-rich older generation to help its young buy homes, we believe that a stronger upside to support a structural long-term residential property boom is continued affordability levels, when every working person is able to afford a house. For more details on our affordability analyses, please see our 8 April 2011 report, “Mass Market or Million Dollars, Dear?” at http://www.nomura.com/research/getpub.aspx?pid=428887 Our analysis of upcoming launches points to a higher number of launches priced over RM1mn (as detailed in our 27 April sector update here at http://www.nomura.com/research/getpub.aspx?pid=432869). 2

- 3. Nomura | AEJ Malaysia Property May 11, 2011 Next 6 months in Malaysia property – trying to look ahead We continue to expect that property transactions will likely remain supported into 2011 on the back of continued favourable demographics which have driven up the volume of secondary mass market transactions. Analysing the correlation of residential sales and GDP growth, we find that GDP growth tends to lead residential property values at the major economic turns by about 1-2 quarters. 1Q and 2Q numbers tend to be weaker with transactions picking up throughout the year. As such, unless the market sees strong and surprising sales numbers even in 1Q and 2Q breaking away from seasonal trends, we think the current premium valuations for names like SP Setia have priced in most good news. Recent anecdotal evidence suggests better performance for mass market launches (while most developers are positioned in mid- to high end), while the official Property Market Report 2010 released by the Valuation and Property two weeks ago highlighted a moderation in overall primary sales performance y-y (47% in 2010 from 59% in 2009). Fig. 4: GDP Growth tends to lead residential property sales values at recent economic turns 10.0% 10,000.0 8.0% 8,500.0 6.0% 7,000.0 4.0% 5,500.0 2.0% 4,000.0 0.0% 2,500.0 1Q02 3Q02 1Q03 3Q03 1Q04 3Q04 1Q05 3Q05 1Q06 3Q06 1Q07 3Q07 1Q08 3Q08 1Q09 3Q09 1Q10 3Q10 -2.0% 1,000.0 -4.0% -500.0 -6.0% -2,000.0 -8.0% -3,500.0 Residential sales value of 4 key states Real GDP Growth Source: Department of Statistics, Valuation and Property Services Department; residential values used are for the 4 key Malaysian states 3

- 4. Nomura | AEJ Malaysia Property May 11, 2011 Fig. 5: Average prices in KL, Selangor and Johor Sequential 4Q10 Sequential 3Q10 From trough to Average transaction price (RM) 1Q11 4Q10 3Q10 1Q10 1Q09 1Q08 1Q07 to 1Q11 (%) to 4Q10 (%) current (%) KL 1-1 1/2 Storey Terraced 338,191 326,207 321,981 328,215 258,359 254,222 249,360 4 1 31 2-3 Storey Terraced 554,550 413,160 444,644 395,805 2-2 1/2 Storey Semi Detach 1,957,390 2,012,829 1,719,709 2,053,312 1,423,750 1,206,000 1,130,332 (3) 17 37 Detached 2,082,840 2,247,765 2,345,980 2,309,043 1,466,333 1,970,125 1,818,131 (7) (4) 42 Cluster 114,250 118,200 122,500 99,500 104,714 96,000 (3) (4) 9 Low Cost House 195,125 181,138 157,463 147,667 130,750 131,200 8 15 Flat 134,272 128,297 114,899 119,007 109,671 100,955 96,292 5 12 22 Condominium 478,709 431,094 406,320 454,295 395,281 383,305 323,221 11 6 21 Low Cost Flat 72,890 71,763 72,449 68,120 69,955 72,556 67,037 2 (1) 4 Selangor 1-1 1/2 Storey Terraced 181,771 189,208 174,834 179,467 168,040 159,191 161,028 (4) 8 8 2-3 Storey Terraced 277,050 287,146 270,922 1-1 1/2 Storey Semi 301,835 204,333 368,243 312,905 217,917 231,100 341,000 48 (45) 39 2-3 Storey Semi Detached 874,006 927,831 810,094 786,179 672,775 598,385 627,522 (6) 15 30 Detached 1,041,392 819,902 744,182 826,806 644,850 794,229 564,625 27 10 61 Cluster 242,071 160,600 188,917 Low Cost House 99,453 106,568 96,434 97,997 90,774 90,300 84,479 (7) 11 10 Flat 102,180 95,294 98,208 100,706 92,258 98,388 79,945 7 (3) 11 Condominium 226,816 211,490 210,326 216,173 172,876 177,370 163,312 7 1 31 Low Cost Flat 65,854 62,811 62,724 62,828 60,412 60,125 60,550 5 0 9 Johor 1-1 1/2 Storey Terraced 152,990 149,052 146,530 138,358 137,233 130,612 137,432 3 2 11 2-3 Storey Terraced 188,140 177,542 176,888 1-1 1/2 Storey Semi 212,827 206,548 207,119 195,951 209,215 200,227 188,755 3 (0) 2 2-3 Storey Semi Detached 411,527 411,650 411,953 408,113 404,452 380,286 312,004 (0) (0) 2 Detached 346,682 271,375 375,431 186,176 248,168 254,656 263,359 28 (28) 40 Cluster 420,257 373,797 267,114 414,712 323,706 12 40 30 Low Cost House 56,302 53,878 59,196 43,832 57,607 48,598 51,241 4 (9) (2) Flat 63,657 74,929 60,143 51,769 78,306 65,600 (15) 25 (19) Condominium 198,681 198,444 220,586 237,564 175,567 248,632 211,431 0 (10) 13 Low Cost Flat 35,666 33,335 36,000 33,636 34,031 26,290 33,778 7 (7) 5 Note: Trough is 1Q11 vs 1Q09 (ie, over past two years) Source: CEIC, Valuation and Property Services Department Meanwhile, recently released 1Q11 average prices (by Valuation and Property Services Department) showed prices continued to climb for condos in Klang Valley, and certain landed properties. The high-end landed properties in KL (between RM1-2mn) saw a slight slowdown in price performance. Recapping our sector call – stay selective We continue to recommend staying selective and focusing on names with re-rating stories as news of sales launches, and good profit performance have been baked into valuations of leading names like SP Setia (NEUTRAL). Our top pick remains Mah Sing given its lower P/Es, supported by above-average ROEs and the high dividend yields. It recently revised its RNAV guidance for a few projects post its annual review of projects, the main ones being Southbay City (from RM911mn to RM2,091mn), Icon City (upwards by about RM200mn) and Kinrara Residence (upwards by about RM136m) largely due to higher pricing from project GDVs that have not been revised for more than a year. 4

- 5. Nomura | AEJ Malaysia Property May 11, 2011 Fig. 6: Mah Sing Projects breakup, FY10 vs 1QFY11 FY 2010 1Q11 Residential 7214 7279 Commercial 3851 6173.7 Industrial 919 610 Total 11984 14062.7 Source: Company data Fig. 7: Performance over KLCI index (ytd) Stock Outperform ance over KLCI index ytd SP Setia 1.9% Mah Sing 38.4% UEM Land 6.7% MRCB 9.2% Note: Pricing as of 9 May 2011 Source: Bloomberg Fig. 8: Valuation comparison: P/E ratio Nom ura Curr Price FY11F EPS FY12F EPS Ticker FY11F P/E Grow th (%) FY12F PE Rating (RM) (RM) (RM) Mah Sing MSGB MK Buy 2.57 0.18 14.3 0.22 22% 11.7 SP Setia Berhad SPSB MK Neutral 4.09 0.19 21.6 0.23 24% 17.5 Malaysian Resources Corporation Berhad MRC MK Neutral 2.16 0.06 37.3 0.06 8% 34.7 UEM Land Holdings Berhad ULHB MK Buy 2.71 0.06 43.0 0.07 17% 36.8 IGB Corporation Berhad IGB MK Not rated 2.13 0.13 16.8 0.14 9% 15.3 IJM Land Berhad IJMLD MK Not rated 2.77 0.16 17.6 0.18 15% 15.4 KLCC Properties KLCC MK Not rated 3.27 0.24 13.5 0.26 9% 12.4 Sunw ay City Berhad SCITY MK Not rated 4.69 0.42 11.2 0.48 15% 9.7 Sunw ay Holdings Berhad SGW MK Not rated 2.38 0.27 8.7 0.31 13% 7.7 Total/Wtd avg 0.15 26.20 0.18 22.62 Note: Pricing as of 9 May 2011 Source: Bloomberg consensus estimates for not rated companies, Nomura estimates Fig. 9: Valuation comparison: P/B ratio Nom ura Curr Price FY11F FY12F Ticker FY11F P/BV Grow th (%) FY12F P/BV Rating (RM) BVPS (RM) BVPS (RM) Mah Sing MSGB MK Buy 2.57 1.19 2.2 1.32 11% 1.9 SP Setia Berhad SPSB MK Neutral 4.09 3.50 1.2 3.63 4% 1.1 Malaysian Resources Corporation Berhad MRC MK Neutral 2.16 0.88 2.5 0.92 5% 2.3 UEM Land Holdings Berhad ULHB MK Buy 2.71 1.13 2.4 1.23 9% 2.2 IGB Corporation Berhad IGB MK Not rated 2.13 2.13 1.0 2.22 4% 1.0 IJM Land Berhad IJMLD MK Not rated 2.77 1.61 1.7 1.774 10% 1.6 KLCC Properties KLCC MK Not rated 3.27 4.48 0.7 4.688 5% 0.7 Sunw ay City Berhad SCITY MK Not rated 4.69 5.64 0.8 6.12 8% 0.8 Sunw ay Holdings Berhad SGW MK Not rated 2.38 1.65 1.4 1.96 18% 1.2 Total/Wtd avg 2.28 1.69 2.42 1.57 Note: Pricing as of 9 May 2011 Source: Bloomberg consensus estimates for not rated companies, Nomura estimates 5

- 6. Nomura | AEJ Malaysia Property May 11, 2011 Fig. 10: Valuation comparison: Dividend yield Nom ura Curr Price FY11F DPS FY11F Yield FY12F DPS FY12F Yield Ticker Grow th (%) Rating (RM) (RM) (%) (RM) (%) Mah Sing MSGB MK Buy 2.57 0.07 3.0 0.09 29% 3.7 SP Setia Berhad SPSB MK Neutral 4.09 0.13 2.1 0.16 23% 2.6 Malaysian Resources Corporation Berhad MRC MK Neutral 2.16 0.01 0.5 0.01 5% 0.5 UEM Land Holdings Berhad ULHB MK Buy 2.71 0.00 0.0 0.00 0% 0.0 IGB Corporation Berhad IGB MK Not rated 2.13 0.04 1.6 0.04 6% 1.7 IJM Land Berhad IJMLD MK Not rated 2.77 0.026 1.0 0.031 19% 1.1 KLCC Properties KLCC MK Not rated 3.27 0.11 3.3 0.12 7% 3.6 Sunw ay City Berhad SCITY MK Not rated 4.69 0.10 2.5 0.12 14% 2.8 Sunw ay Holdings Berhad SGW MK Not rated 2.38 0.03 1.5 0.04 12% 1.6 Total/Wtd avg 0.05 1.34 0.06 1.56 Note: Pricing as of 9 May 2011 Source: Bloomberg consensus estimates for not rated companies, Nomura estimates Fig. 11: Valuation comparison: ROE (%) Ticker Nom ura Rating Curr Price (RM) FY11F ROE (%) FY12F ROE (%) Mah Sing MSGB MK Buy 2.57 15.5 17.2 SP Setia Berhad SPSB MK Neutral 4.09 8.0 7.5 Malaysian Resources Corporation Berhad MRC MK Neutral 2.16 6.7 6.9 UEM Land Holdings Berhad ULHB MK Buy 2.71 8.8 8.1 IGB Corporation Berhad IGB MK Not rated 2.13 5.8 5.9 IJM Land Berhad IJMLD MK Not rated 2.77 11.2 11.4 KLCC Properties KLCC MK Not rated 3.27 5.4 4.8 Sunw ay City Berhad SCITY MK Not rated 4.69 7.5 7.9 Sunw ay Holdings Berhad SGW MK Not rated 2.38 14.8 14.5 Total/Wtd avg 8.72 8.53 Note: Pricing as of 9 May 2011 Source: Bloomberg consensus estimates for not rated companies, Nomura estimates Valuation Methodology and Risks Mah Sing Valuation Methodology - We peg Mah Sing’s price target at RM3.08, at parity to our RNAV-based and diluted fair value (after accounting for the proposed convertibles) derived from net present value of profits from on-going and future projects at a discount rate of 9%. Investment Risks: 1) Project delays. Any project delays or disappointing take-up rates could dent our earnings forecasts. Profit margin could also vary at different stages of billing — a slower actual schedule might result in a difference between actual reported net profit and our estimates. Project delays could arise from longer-than-expected approval/completion on land acquisition and building designs. Delays to key projects such as Icon City, Garden Plaza or Southbay could affect our projections to a greater 6

- 7. Nomura | AEJ Malaysia Property May 11, 2011 degree compared to the rest of its projects. 2) General economic conditions. The company’s operational as well as stock performance is closely tied to general economic conditions and consumer sentiment. Any contractions in GDP growth or unexpected government policy measures to curb sentiment in the property sector are downside risks to our call. SP Setia Valuation Methodology - We peg SPSB’s price target at RM4.67, at parity to our RNAV-based and diluted fair value (after accounting for any warrants conversion), derived from a combination of a net present value of profits from ongoing projects at a discount rate of 9% and revaluation surplus of land values above their book value. Investment Risks: 1) Any project delays or disappointing take-up rates could dent our earnings forecasts. Profit margin could also vary at different stages of billing – a slower actual schedule might result in a difference between actual reported net profit and our estimates. Project delays could arise from longer-than-expected approval/completion on land acquisition and building designs. 2) Project concentration in Johor / Klang Valley - While the company has stepped up its diversification efforts in recent years by securing projects in Vietnam and China, the bulk of its portfolio still consists of projects in Malaysia, and in particular, residential projects in Johor and Klang Valley. Its operational as well as stock performance is therefore closely tied to the Johor and Klang Valley residential markets. 3) Double dip or recessionary scenario occurring moving forward. Upside risks include further RNAV-enhancing landbanking acquisitions and higher than expected sales and take-up rates. Malaysian Resources Valuation Methodology – We peg MRCB’s price target at RM2.42, at parity to our RNAV-based fair value, derived from 1) the net present value of profits from its property segment at 10% discount rate, 2) valuing the construction profits at 15x PE FY12F (FY12F earnings of RM45.4mn) based on the multiples used for other construction stocks in our rating universe, 3) valuing the two toll concessions using a 10% discount rate. Investment Risks: Downside risks exist should: 1) project billings be delayed; 2) land bank / order book replenishment remain weak; or 3) slowdown in the economy, double dip or recessionary scenario moving forward. Upside risks include faster-than-expected order book wins and faster progress billing pace. UEM Land Valuation Methodology – We peg ULHB’s price target at RM3.29, at parity to our RNAV-based fair value, derived from a combination of a net present value of profits from on-going projects at a discount rate of 10% and revaluation surplus of its landbank above its book value. Investment Risks: Downside risks to our call include developments that could jeopardise progress in developing Nusajaya, which comprises 99% of the landbank: 1) advent of a recession could derail the development in Nusajaya; 2) negative newsflow on land sales / deal progress; 3) any reversal in the positive tone and progress in Malaysia- Singapore relations as negotiations continue; 4) political events, eg, election upsets that could encroach on UEM Land’s position as a strategic Khazanah holding and change the regulatory environment; 5) delayed launches / project delays which could lead to earnings downside as Nusajaya is less concentrated than the markets of Selangor and KL; 6) immediate conversion of the RCPS which could present near-term dilution; and 7) any restrictive moves to curb the Malaysian property market. 7

- 8. Nomura | AEJ Malaysia Property May 11, 2011 Appendix A-1 Analyst Certification I, Jacinda Ee Wenn Loh, hereby certify (1) that the views expressed in this Research report accurately reflect my personal views about any or all of the subject securities or issuers referred to in this Research report, (2) no part of my compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report and (3) no part of my compensation is tied to any specific investment banking transactions performed by Nomura Securities International, Inc., Nomura International plc or any other Nomura Group company. Issuer Specific Regulatory Disclosures Mentioned companies Issuer name Ticker Price Price date Stock rating Sector rating Disclosures Mah Sing Group MSGB MK 2.57 MYR 09-May-2011 Buy Not rated SP Setia SPSB MK 4.09 MYR 09-May-2011 Neutral Not rated Malaysian Resources MRC MK 2.16 MYR 09-May-2011 Neutral Not rated Uem Land Holdings Bhd ULHB MK 2.71 MYR 09-May-2011 Buy Not rated Previous Rating Issuer name Previous Rating Date of change Mah Sing Group Not Rated 08-Feb-2011 SP Setia Buy 17-Jan-2011 Malaysian Resources Not Rated 27-Oct-2010 Uem Land Holdings Bhd Not Rated 27-Oct-2010 Mah Sing Group (MSGB MK) 2.57 (09-May-2011) Buy (Sector rating: Not rated) Rating and target price chart (three year history) Date Rating Target price Closing price 08-Feb-2011 3.08 2.63 For explanation of ratings refer to the stock rating keys located after chart(s) Valuation Methodology We peg Mah Sing’s price target at RM3.08 at parity to our RNAV-based and diluted fair value (after accounting for the proposed convertibles) derived from net present value of profits from on-going and future projects at a discount rate of 9%. Risks that may impede the achievement of the target price 1) Project delays. Any project delays or disappointing take-up rates could dent our earnings forecasts. Profit margin could also vary at different stages of billing — a slower actual schedule might result in a difference between actual reported net profit and our estimates. Project delays could arise from longer-than- expected approval/completion on land acquisition and building designs. Delays to key projects such as Icon City, Garden Plaza or Southbay could affect our projections to a greater degree compared to the rest of its projects. 2)General economic conditions. The company’s operational as well as stock performance is closely tied to general economic conditions and consumer sentiment. Any contractions in GDP growth or unexpected government policy measures to curb sentiment in the property sector are downside risks to our call. 8

- 9. Nomura | AEJ Malaysia Property May 11, 2011 SP Setia (SPSB MK) 4.09 (09-May-2011) Neutral (Sector rating: Not rated) Rating and target price chart (three year history) Date Rating Target price Closing price 22-Mar-2011 4.67 4.10 17-Jan-2011 4.59 4.47 17-Jan-2011 Neutral 4.47 27-Oct-2010 4.07 3.51 19-May-2010 3.37 2.65 19-May-2010 Buy 2.65 20-Mar-2009 1.76 2.00 02-Oct-2008 1.77 2.07 01-Sep-2008 1.84 2.25 01-Sep-2008 Reduce 2.25 For explanation of ratings refer to the stock rating keys located after chart(s) Valuation Methodology We peg SPSB’s price target at RM4.67 at parity to our RNAV-based and diluted fair value (after accounting for any warrants conversion), derived from a combination of a net present value of profits from ongoing projects at a discount rate of 9% and revaluation surplus of land values above their book value. Risks that may impede the achievement of the target price 1) Any project delays or disappointing take-up rates could dent our earnings forecasts. Profit margin could also vary at different stages of billing – a slower actual schedule might result in a difference between actual reported net profit and our estimates. Project delays could arise from longer-than-expected approval/completion on land acquisition and building designs. 2)Project concentration in Johor / Klang Valley - While the company has stepped up its diversification efforts in recent years by securing projects in Vietnam and China, the bulk of its portfolio still consists of projects in Malaysia, and in particular, residential projects in Johor and Klang Valley. Its operational as well as stock performance is therefore closely tied to the Johor and Klang Valley residential markets. 3)Double dip or recessionary scenario occurring moving forward. Upside risks include further RNAV-enhancing landbanking acquisitions and higher than expected sales and takeup rates. Malaysian Resources (MRC MK) 2.16 (09-May-2011) Neutral (Sector rating: Not rated) Rating and target price chart (three year history) Date Rating Target price Closing price 08-Apr-2011 2.42 2.31 27-Oct-2010 2.13 2.05 27-Oct-2010 Neutral 2.05 04-May-2010 Not Rated 1.51 19-Aug-2008 0.60 0.71 19-Aug-2008 Sell 0.71 For explanation of ratings refer to the stock rating keys located after chart(s) Valuation Methodology We peg MRCB’s price target at RM2.42 at parity to our RNAV-based fair value, derived from 1) The net present value of profits from its property segment at 10% discount rate 2) Valuing the construction profits at 15x PE FY12F 9

- 10. Nomura | AEJ Malaysia Property May 11, 2011 (FY12F earnings of RM45.4 mn) based on the multiples used for other construction stocks in our rating universe 3) Valuing the two toll concessions using a 10% discount rate. Risks that may impede the achievement of the target price Downside risks exist should: 1) project billings be delayed;2)land bank / order book replenishment remain weak; or 3) slowdown in the economy, double dip or recessionary scenario moving forward. Upside risks include faster-than-expected order book wins and faster progress billing pace. Uem Land Holdings Bhd (ULHB MK) 2.71 (09-May-2011) Buy (Sector rating: Not rated) Rating and target price chart (three year history) Date Rating Target price Closing price 28-Feb-2011 3.29 2.70 27-Oct-2010 2.88 2.29 27-Oct-2010 Buy 2.29 For explanation of ratings refer to the stock rating keys located after chart(s) Valuation Methodology We peg ULHB’s price target at RM3.29 at parity to our RNAV-based fair value, derived from a combination of a net present value of profits from on-going projects at a discount rate of 10% and revaluation surplus of its landbank above its book value. Risks that may impede the achievement of the target price Downside risks to our call include developments that could jeopardise progress in developing Nusajaya, which comprises 99% of the landbank: 1) advent of a recession could derail the development in Nusajaya; 2) negative newsflow on land sales/dealprogress; 3)any reversal in the positive tone and progress in Malaysia-Singapore relations as negotiations continue; 4) political events, eg, election upsets that could encroach on UEM Land’s position as a strategic Khazanah holding and change the regulatory environment;5)delayed launches/project delays which could lead to earnings downside as Nusajaya is less concentrated than the markets of Selangor and KL;6)immediate conversion of the RCPS which could present near-term dilution; and 7)any restrictive moves to curb the Malaysian property market. 10

- 11. Nomura | AEJ Malaysia Property May 11, 2011 Important Disclosures Online availability of research and additional conflict-of-interest disclosures Nomura Japanese Equity Research is available electronically for clients in the US on NOMURA.COM, REUTERS, BLOOMBERG and THOMSON ONE ANALYTICS. For clients in Europe, Japan and elsewhere in Asia it is available on NOMURA.COM, REUTERS and BLOOMBERG. Important disclosures may be accessed through the left hand side of the Nomura Disclosure web page http://www.nomura.com/research or requested from Nomura Securities International, Inc., on 1-877-865-5752. If you have any difficulties with the website, please email grpsupport- eu@nomura.com for technical assistance. The analysts responsible for preparing this report have received compensation based upon various factors including the firm's total revenues, a portion of which is generated by Investment Banking activities. Industry Specialists identified in some Nomura International plc research reports are employees within the Firm who are responsible for the sales and trading effort in the sector for which they have coverage. Industry Specialists do not contribute in any manner to the content of research reports in which their names appear. Marketing Analysts identified in some Nomura research reports are research analysts employed by Nomura International plc who are primarily responsible for marketing Nomura’s Equity Research product in the sector for which they have coverage. Marketing Analysts may also contribute to research reports in which their names appear and publish research on their sector. Distribution of ratings (US) The distribution of all ratings published by Nomura US Equity Research is as follows: 38% have been assigned a Buy rating which, for purposes of mandatory disclosures, are classified as a Buy rating; 4% of companies with this rating are investment banking clients of the Nomura Group*. 55% have been assigned a Neutral rating which, for purposes of mandatory disclosures, is classified as a Hold rating; 1% of companies with this rating are investment banking clients of the Nomura Group*. 7% have been assigned a Reduce rating which, for purposes of mandatory disclosures, are classified as a Sell rating; 0% of companies with this rating are investment banking clients of the Nomura Group*. As at 31 March 2011. *The Nomura Group as defined in the Disclaimer section at the end of this report. Distribution of ratings (Global) The distribution of all ratings published by Nomura Global Equity Research is as follows: 49% have been assigned a Buy rating which, for purposes of mandatory disclosures, are classified as a Buy rating; 37% of companies with this rating are investment banking clients of the Nomura Group*. 40% have been assigned a Neutral rating which, for purposes of mandatory disclosures, is classified as a Hold rating; 46% of companies with this rating are investment banking clients of the Nomura Group*. 11% have been assigned a Reduce rating which, for purposes of mandatory disclosures, are classified as a Sell rating; 16% of companies with this rating are investment banking clients of the Nomura Group*. As at 31 March 2011. *The Nomura Group as defined in the Disclaimer section at the end of this report. Explanation of Nomura's equity research rating system in Europe, Middle East and Africa, US and Latin America for ratings published from 27 October 2008 The rating system is a relative system indicating expected performance against a specific benchmark identified for each individual stock. Analysts may also indicate absolute upside to target price defined as (fair value - current price)/current price, subject to limited management discretion. In most cases, the fair value will equal the analyst's assessment of the current intrinsic fair value of the stock using an appropriate valuation methodology such as discounted cash flow or multiple analysis, etc. STOCKS A rating of 'Buy', indicates that the analyst expects the stock to outperform the Benchmark over the next 12 months. A rating of 'Neutral', indicates that the analyst expects the stock to perform in line with the Benchmark over the next 12 months. A rating of 'Reduce', indicates that the analyst expects the stock to underperform the Benchmark over the next 12 months. A rating of 'Suspended', indicates that the rating and target price have been suspended temporarily to comply with applicable regulations and/or firm policies in certain circumstances including when Nomura is acting in an advisory capacity in a merger or strategic transaction involving the company. Benchmarks are as follows: United States/Europe: Please see valuation methodologies for explanations of relevant benchmarks for stocks (accessible through the left hand side of the Nomura Disclosure web page: http://www.nomura.com/research);Global Emerging Markets (ex- Asia): MSCI Emerging Markets ex-Asia, unless otherwise stated in the valuation methodology. SECTORS A 'Bullish' stance, indicates that the analyst expects the sector to outperform the Benchmark during the next 12 months. A 'Neutral' stance, indicates that the analyst expects the sector to perform in line with the Benchmark during the next 12 months. A 'Bearish' stance, indicates that the analyst expects the sector to underperform the Benchmark during the next 12 months. Benchmarks are as follows: United States: S&P 500; Europe: Dow Jones STOXX 600; Global Emerging Markets (ex-Asia): MSCI Emerging Markets ex-Asia. Explanation of Nomura's equity research rating system for Asian companies under coverage ex Japan published from 30 October 2008 and in Japan from 6 January 2009 STOCKS Stock recommendations are based on absolute valuation upside (downside), which is defined as (Target Price - Current Price) / Current Price, subject to limited management discretion. In most cases, the Target Price will equal the analyst's 12-month intrinsic valuation of the stock, based on an appropriate valuation methodology such as discounted cash flow, multiple analysis, etc. A 'Buy' recommendation indicates that potential upside is 15% or more. 11

- 12. Nomura | AEJ Malaysia Property May 11, 2011 A 'Neutral' recommendation indicates that potential upside is less than 15% or downside is less than 5%. A 'Reduce' recommendation indicates that potential downside is 5% or more. A rating of 'Suspended' indicates that the rating and target price have been suspended temporarily to comply with applicable regulations and/or firm policies in certain circumstances including when Nomura is acting in an advisory capacity in a merger or strategic transaction involving the subject company. Securities and/or companies that are labelled as 'Not rated' or shown as 'No rating' are not in regular research coverage of the Nomura entity identified in the top banner. Investors should not expect continuing or additional information from Nomura relating to such securities and/or companies. SECTORS A 'Bullish' rating means most stocks in the sector have (or the weighted average recommendation of the stocks under coverage is) a positive absolute recommendation. A 'Neutral' rating means most stocks in the sector have (or the weighted average recommendation of the stocks under coverage is) a neutral absolute recommendation. A 'Bearish' rating means most stocks in the sector have (or the weighted average recommendation of the stocks under coverage is) a negative absolute recommendation. Explanation of Nomura's equity research rating system in Japan published prior to 6 January 2009 (and ratings in Europe, Middle East and Africa, US and Latin America published prior to 27 October 2008) STOCKS A rating of '1' or 'Strong buy', indicates that the analyst expects the stock to outperform the Benchmark by 15% or more over the next six months. A rating of '2' or 'Buy', indicates that the analyst expects the stock to outperform the Benchmark by 5% or more but less than 15% over the next six months. A rating of '3' or 'Neutral', indicates that the analyst expects the stock to either outperform or underperform the Benchmark by less than 5% over the next six months. A rating of '4' or 'Reduce', indicates that the analyst expects the stock to underperform the Benchmark by 5% or more but less than 15% over the next six months. A rating of '5' or 'Sell', indicates that the analyst expects the stock to underperform the Benchmark by 15% or more over the next six months. Stocks labeled 'Not rated' or shown as 'No rating' are not in Nomura's regular research coverage. Nomura might not publish additional research reports concerning this company, and it undertakes no obligation to update the analysis, estimates, projections, conclusions or other information contained herein. SECTORS A 'Bullish' stance, indicates that the analyst expects the sector to outperform the Benchmark during the next six months. A 'Neutral' stance, indicates that the analyst expects the sector to perform in line with the Benchmark during the next six months. A 'Bearish' stance, indicates that the analyst expects the sector to underperform the Benchmark during the next six months. Benchmarks are as follows: Japan: TOPIX; United States: S&P 500, MSCI World Technology Hardware & Equipment; Europe, by sector - Hardware/Semiconductors: FTSE W Europe IT Hardware; Telecoms: FTSE W Europe Business Services; Business Services: FTSE W Europe; Auto & Components: FTSE W Europe Auto & Parts; Communications equipment: FTSE W Europe IT Hardware; Ecology Focus: Bloomberg World Energy Alternate Sources; Global Emerging Markets: MSCI Emerging Markets ex-Asia. Explanation of Nomura's equity research rating system for Asian companies under coverage ex Japan published prior to 30 October 2008 STOCKS Stock recommendations are based on absolute valuation upside (downside), which is defined as (Fair Value - Current Price)/Current Price, subject to limited management discretion. In most cases, the Fair Value will equal the analyst's assessment of the current intrinsic fair value of the stock using an appropriate valuation methodology such as Discounted Cash Flow or Multiple analysis etc. However, if the analyst doesn't think the market will revalue the stock over the specified time horizon due to a lack of events or catalysts, then the fair value may differ from the intrinsic fair value. In most cases, therefore, our recommendation is an assessment of the difference between current market price and our estimate of current intrinsic fair value. Recommendations are set with a 6-12 month horizon unless specified otherwise. Accordingly, within this horizon, price volatility may cause the actual upside or downside based on the prevailing market price to differ from the upside or downside implied by the recommendation. A 'Strong buy' recommendation indicates that upside is more than 20%. A 'Buy' recommendation indicates that upside is between 10% and 20%. A 'Neutral' recommendation indicates that upside or downside is less than 10%. A 'Reduce' recommendation indicates that downside is between 10% and 20%. A 'Sell' recommendation indicates that downside is more than 20%. SECTORS A 'Bullish' rating means most stocks in the sector have (or the weighted average recommendation of the stocks under coverage is) a positive absolute recommendation. A 'Neutral' rating means most stocks in the sector have (or the weighted average recommendation of the stocks under coverage is) a neutral absolute recommendation. A 'Bearish' rating means most stocks in the sector have (or the weighted average recommendation of the stocks under coverage is) a negative absolute recommendation. Target Price A Target Price, if discussed, reflect in part the analyst's estimates for the company's earnings. The achievement of any target price may be impeded by general market and macroeconomic trends, and by other risks related to the company or the market, and may not occur if the company's earnings differ from estimates. 12

- 13. Nomura | AEJ Malaysia Property May 11, 2011 Disclaimers This publication contains material that has been prepared by the Nomura entity identified at the top or bottom of page 1 herein, if any, and/or, with the sole or joint contributions of one or more Nomura entities whose employees and their respective affiliations are specified on page 1 herein or elsewhere identified in the publication. Affiliates and subsidiaries of Nomura Holdings, Inc. (collectively, the 'Nomura Group'), include: Nomura Securities Co., Ltd. ('NSC') Tokyo, Japan; Nomura International plc ('NIplc'), United Kingdom; Nomura Securities International, Inc. ('NSI'), New York, NY; Nomura International (Hong Kong) Ltd. (‘NIHK’), Hong Kong; Nomura Financial Investment (Korea) Co., Ltd. (‘NFIK’), Korea (Information on Nomura analysts registered with the Korea Financial Investment Association ('KOFIA') can be found on the KOFIA Intranet at http://dis.kofia.or.kr ); Nomura Singapore Ltd. (‘NSL’), Singapore (Registration number 197201440E, regulated by the Monetary Authority of Singapore); Capital Nomura Securities Public Company Limited (‘CNS’), Thailand; Nomura Australia Ltd. (‘NAL’), Australia (ABN 48 003 032 513), regulated by the Australian Securities and Investment Commission ('ASIC') and holder of an Australian financial services licence number 246412; P.T. Nomura Indonesia (‘PTNI’), Indonesia; Nomura Securities Malaysia Sdn. Bhd. (‘NSM’), Malaysia; Nomura International (Hong Kong) Ltd., Taipei Branch (‘NITB’), Taiwan; Nomura Financial Advisory and Securities (India) Private Limited (‘NFASL’), Mumbai, India (Registered Address: Ceejay House, Level 11, Plot F, Shivsagar Estate, Dr. Annie Besant Road, Worli, Mumbai- 400 018, India; SEBI Registration No: BSE INB011299030, NSE INB231299034, INF231299034, INE 231299034). THIS MATERIAL IS: (I) FOR YOUR PRIVATE INFORMATION, AND WE ARE NOT SOLICITING ANY ACTION BASED UPON IT; (II) NOT TO BE CONSTRUED AS AN OFFER TO SELL OR A SOLICITATION OF AN OFFER TO BUY ANY SECURITY IN ANY JURISDICTION WHERE SUCH OFFER OR SOLICITATION WOULD BE ILLEGAL; AND (III) BASED UPON INFORMATION THAT WE CONSIDER RELIABLE. NOMURA GROUP DOES NOT WARRANT OR REPRESENT THAT THE PUBLICATION IS ACCURATE, COMPLETE, RELIABLE, FIT FOR ANY PARTICULAR PURPOSE OR MERCHANTABLE AND DOES NOT ACCEPT LIABILITY FOR ANY ACT (OR DECISION NOT TO ACT) RESULTING FROM USE OF THIS PUBLICATION AND RELATED DATA. TO THE MAXIMUM EXTENT PERMISSIBLE ALL WARRANTIES AND OTHER ASSURANCES BY NOMURA GROUP ARE HEREBY EXCLUDED AND NOMURA GROUP SHALL HAVE NO LIABILITY FOR THE USE, MISUSE, OR DISTRIBUTION OF THIS INFORMATION. Opinions expressed are current opinions as of the original publication date appearing on this material only and the information, including the opinions contained herein, are subject to change without notice. Nomura is under no duty to update this publication. If and as applicable, NSI's investment banking relationships, investment banking and non-investment banking compensation and securities ownership (identified in this report as 'Disclosures Required in the United States'), if any, are specified in disclaimers and related disclosures in this report. In addition, other members of the Nomura Group may from time to time perform investment banking or other services (including acting as advisor, manager or lender) for, or solicit investment banking or other business from, companies mentioned herein. Furthermore, the Nomura Group, and/or its officers, directors and employees, including persons, without limitation, involved in the preparation or issuance of this material may, to the extent permitted by applicable law and/or regulation, have long or short positions in, and buy or sell, the securities (including ownership by NSI, referenced above), or derivatives (including options) thereof, of companies mentioned herein, or related securities or derivatives. For financial instruments admitted to trading on an EU regulated market, Nomura Holdings Inc's affiliate or its subsidiary companies may act as market maker or liquidity provider (in accordance with the interpretation of these definitions under FSA rules in the UK) in the financial instruments of the issuer. Where the activity of liquidity provider is carried out in accordance with the definition given to it by specific laws and regulations of other EU jurisdictions, this will be separately disclosed within this report. Furthermore, the Nomura Group may buy and sell certain of the securities of companies mentioned herein, as agent for its clients. Investors should consider this report as only a single factor in making their investment decision and, as such, the report should not be viewed as identifying or suggesting all risks, direct or indirect, that may be associated with any investment decision. Please see the further disclaimers in the disclosure information on companies covered by Nomura analysts available at www.nomura.com/research under the 'Disclosure' tab. Nomura Group produces a number of different types of research product including, among others, fundamental analysis, quantitative analysis and short term trading ideas; recommendations contained in one type of research product may differ from recommendations contained in other types of research product, whether as a result of differing time horizons, methodologies or otherwise; it is possible that individual employees of Nomura may have different perspectives to this publication. NSC and other non-US members of the Nomura Group (i.e. excluding NSI), their officers, directors and employees may, to the extent it relates to non-US issuers and is permitted by applicable law, have acted upon or used this material prior to, or immediately following, its publication. Foreign-currency-denominated securities are subject to fluctuations in exchange rates that could have an adverse effect on the value or price of, or income derived from, the investment. In addition, investors in securities such as ADRs, the values of which are influenced by foreign currencies, effectively assume currency risk. The securities described herein may not have been registered under the US Securities Act of 1933, and, in such case, may not be offered or sold in the United States or to US persons unless they have been registered under such Act, or except in compliance with an exemption from the registration requirements of such Act. Unless governing law permits otherwise, you must contact a Nomura entity in your home jurisdiction if you want to use our services in effecting a transaction in the securities mentioned in this material. This publication has been approved for distribution in the United Kingdom and European Union as investment research by NIplc, which is authorized and regulated by the UK Financial Services Authority ('FSA') and is a member of the London Stock Exchange. It does not constitute a personal recommendation, as defined by the FSA, or take into account the particular investment objectives, financial situations, or needs of individual investors. It is intended only for investors who are 'eligible counterparties' or 'professional clients' as defined by the FSA, and may not, therefore, be redistributed to retail clients as defined by the FSA. This publication may be distributed in Germany via Nomura Bank (Deutschland) GmbH, which is authorized and regulated in Germany by the Federal Financial Supervisory Authority ('BaFin'). This publication has been approved by NIHK, which is regulated by the Hong Kong Securities and Futures Commission, for distribution in Hong Kong by NIHK. This publication has been approved for distribution in Australia by NAL, which is authorized and regulated in Australia by the ASIC. This publication has also been approved for distribution in Malaysia by NSM. In Singapore, this publication has been distributed by NSL. NSL accepts legal responsibility for the content of this publication, where it concerns securities, futures and foreign exchange, issued by their foreign affiliates in respect of recipients who are not accredited, expert or institutional investors as defined by the Securities and Futures Act (Chapter 289). Recipients of this publication should contact NSL in respect of matters arising from, or in connection with, this publication. Unless prohibited by the provisions of Regulation S of the U.S. Securities Act of 1933, this material is distributed in the United States, by NSI, a US-registered broker-dealer, which accepts responsibility for its contents in accordance with the provisions of Rule 15a-6, under the US Securities Exchange Act of 1934. This publication has not been approved for distribution in the Kingdom of Saudi Arabia or to clients other than 'professional clients' in the United Arab Emirates by Nomura Saudi Arabia, NIplc or any other member of the Nomura Group, as the case may be. Neither this publication nor any copy thereof may be taken or transmitted or distributed, directly or indirectly, by any person other than those authorised to do so into the Kingdom of Saudi Arabia or in the United Arab Emirates or to any person located in the Kingdom of Saudi Arabia or to clients other than 'professional clients' in the United Arab Emirates. By accepting to receive this publication, you represent that you are not located in the Kingdom of Saudi Arabia or that you are a 'professional client' in the United Arab Emirates and agree to comply with these restrictions. Any failure to comply with these restrictions may constitute a violation of the laws of the Kingdom of Saudi Arabia or the United Arab Emirates. No part of this material may be (i) copied, photocopied, or duplicated in any form, by any means; or (ii) redistributed without the prior written consent of the Nomura Group member identified in the banner on page 1 of this report. Further information on any of the securities mentioned herein may be obtained upon request. If this publication has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error-free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses. The sender therefore does not accept liability for any errors or omissions in the contents of this publication, which may arise as a result of electronic transmission. If verification is required, please request a hard-copy version. Additional information available upon request NIPlc and other Nomura Group entities manage conflicts identified through the following: their Chinese Wall, confidentiality and independence policies, maintenance of a Restricted List and a Watch List, personal account dealing rules, policies and procedures for managing conflicts of interest arising from the allocation and pricing of securities and impartial investment research and disclosure to clients via client documentation. Disclosure information is available at the Nomura Disclosure web page: http://www.nomura.com/research/pages/disclosures/disclosures.aspx 13