De Agostini 2020 english

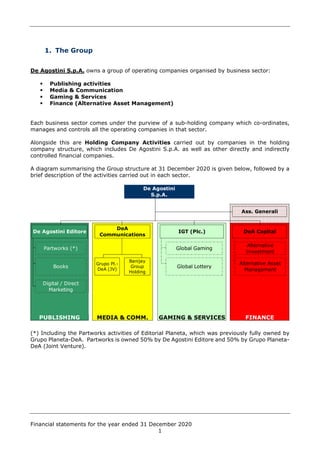

- 1. Financial statements for the year ended 31 December 2020 1 1. The Group De Agostini S.p.A. owns a group of operating companies organised by business sector: Publishing activities Media & Communication Gaming & Services Finance (Alternative Asset Management) Each business sector comes under the purview of a sub-holding company which co-ordinates, manages and controls all the operating companies in that sector. Alongside this are Holding Company Activities carried out by companies in the holding company structure, which includes De Agostini S.p.A. as well as other directly and indirectly controlled financial companies. A diagram summarising the Group structure at 31 December 2020 is given below, followed by a brief description of the activities carried out in each sector. (*) Including the Partworks activities of Editorial Planeta, which was previously fully owned by Grupo Planeta-DeA. Partworks is owned 50% by De Agostini Editore and 50% by Grupo Planeta- DeA (Joint Venture). De Agostini S.p.A. Ass. Generali De Agostini Editore DeA Communications IGT (Plc.) DeA Capital Partworks (*) Global Gaming Alternative Investment Books Grupo Pl.- DeA (JV) Banijay Group Holding Global Lottery Alternative Asset Management PUBLISHING MEDIA & COMM. GAMING & SERVICES FINANCE Digital / Direct Marketing

- 2. Financial statements for the year ended 31 December 2020 2 PUBLISHING This sector is organised by business unit, based on the nature of products provided and the sales channels used: Partworks, which includes Italian and international activities managed by the subsidiary De Agostini Publishing. With regard to this business unit, the Group supplies collectable products aimed at various target markets, ranging from hobbies to cinema, products for children to and courses of various kinds, through news-stands, the Internet and subscriptions. Various corporate actions were undertaken during the year to optimise and accelerate growth; these led to the establishment of a Joint Venture with the Planeta De Agostini Group, which brought together all the Partworks activities, as set out in greater detail in the “Significant events during the year” section of this Report on Operations; Books, which includes traditional publishing activities in Italy, in the school texts and bookshop business areas. In the school texts business, the Group mainly operates in the Italian market through De Agostini Scuola, under a number of brands, in the primary and secondary school, university and dictionary sectors. In the bookshop business, the Group operates through the affiliate DeA Planeta Libri, with a presence primarily in “Children’s books”, “General reference” and “Non-fiction”; Digital, which includes activities relating to the management of thematic TV channels, the creation/acquisition, management and marketing of audiovisual content, the management of properties through its digital platforms and website, operated directly by De Agostini Editore or by its associated companies. Direct Marketing, for which a progressive phase-out process has been under way since 2017, includes the mail-order channel activities of the Group aimed at consumers in many European countries. The sub-holding company for Publishing activities is De Agostini Editore S.p.A. (“De Agostini Editore”), which is fully owned directly by De Agostini S.p.A.

- 3. Financial statements for the year ended 31 December 2020 3 MEDIA & COMMUNICATION The sector includes the Group's interests in media & communication; the relevant sub-holding company is DeA Communications S.A. (DeA Communications), which is fully-owned directly by De Agostini S.p.A. At 31 December 2020, the business included the following companies: Banijay Group Holding (parent company of the Banijay Group), which is approximately 13.31% held on a fully diluted basis through LDH, a holding company that is 19.82% owned by DeA Communications which, in turn, is the holder of a 67.1% controlling stake in Banijay Group Holding. With the acquisition of Endemol Shine Group in 2020, Banijay Group Holding is now the largest independent producer and distributor of TV and multi- media content in the world, and is present in 22 countries (with fiction, factual, reality entertainment and docu-drama entertainment productions, and children’s and cartoon programmes) and 120 brands (with a catalogue of over 100,000 hours of content distributed worldwide); Grupo Planeta-De Agostini, a 50-50 joint venture with Planeta Corporación, is in the Training and Media business sectors, the latter through the following subsidiaries: - Atresmedia, a Spanish national radio/TV broadcaster listed on the Madrid stock exchange; - DeA Planeta, active in cinema and content distribution in Spain. It should be noted that, based on the IAS/IFRS international accounting standards adopted by the Group in preparing the consolidated financial statements, the activities in question are recorded under "Investments in associates and joint ventures" and measured at equity.

- 4. Financial statements for the year ended 31 December 2020 4 GAMING & SERVICES The sector includes the Group’s activities in Gaming & Services. The sub-holding company for these activities is IGT Plc, with its registered office in the UK and listed on the New York Stock Exchange (NYSE), this company being 50.49% controlled by De Agostini S.p.A. (at 31 December 2020). On 1 July 2020, IGT finalised it proposal to reorganisation its activities in two segments, namely: - Global Gaming; - Global Lottery. Accordingly, IGT operates with the following structure: Global Gaming. This area is responsible for the entire gaming business around the world, including iGaming, sports betting, sales, product management, research, global production and technology. The area produces gaming products and services, including gaming software and content, casino games management systems, video lottery terminals (“VLTs”), Amusement With Prizes games machines (“AWPs”), VLT central systems, sports betting, iGaming and other equipment and support services for casino operators. More specifically, the business offers: - a complete suite of casino products and solutions through the development and delivery of games, systems and solutions for traditional casinos and interactive online betting systems, and develops, sells and licenses casino management systems that help casinos to improve their operational efficiency and to provide customised services and promotional offerings. The business's revenues are generated both by the sale and rental of gaming machines, systems and software to casinos and by services relating to the maintenance of machines and systems; - AWP gaming machines and VLT terminals that are installed in various retail outlets and connected to a central system. The company also sells and rents systems, machines and games to other concession holders; - interactive games authorised on the Italian market, such as online poker, casino, bingo, roulette, blackjack and other skill-based games, sports and horse race betting, as well as betting on car and motorcycle races. - As a concession holder, it manages an extensive network of agencies and “corners” under the "Better" brand for the collection of sports and other betting linked to a proprietary platform; it also provides call centre solutions and services, Internet betting technology and other services related to sports betting. Global Lottery This area is responsible for the entire traditional gaming business around the world and iLottery business, including sales, operations, product development, technology and support as well as for commercial services. Specifically: - IGT has been the concession holder for Gioco del Lotto in Italy since 1998, that concession having been renewed for a further nine years in 2016. This has allowed to capitalise on its significant experience in managing all activities throughout the entire lottery value chain (collection of bets through high-security processing systems, management of electronically connected terminals at retail outlets, advertising and promotion, staff training, assistance for license holders and management of back office activities). In addition, Lottomatica has acted as the sole concession holder for Gratta & Vinci (scratch cards) since 2004, acting in a consortium with other Italian and foreign operators. In 2016, IGT was awarded a new nine-year concession for Lotto, through its subsidiary Lottomatica, acting in a consortium with other Italian and foreign operators; - This business area develops and provides innovative solutions for lotteries to some 90 customers around the world and performs research and development for all lottery-related products in the regions in which it operates. These solutions

- 5. Financial statements for the year ended 31 December 2020 5 have enabled IGT to become the benchmark leader for most WLA (World Lottery Association) customers in North America by providing support to 37 of the 46 lotteries in the USA. Business revenues are derived from both the sale and rental of hardware, software and terminals for lotteries, and from the direct management of two lotteries in Indiana and New Jersey through Lottery Management Agreements (LMAs). The current Lottery portfolio also includes the digital channel (iLottery) through the provision of a wide range of content in the form of e-instant tickets (i.e. '10 e Lotto', 'MillionDay', 'Eurojackpot' and 'Gratta e Vinci on-line’). This business area also generates income from covering the entire process from development to the printing and selling of instant lottery tickets to 31 customers in North America and 21 customers in other regions around the world. - The business offers processing services for high volumes of commercial transactions not connected with lotteries, including top-up services for mobile phones, payments for utilities and taxes and stamp duties, reloading prepaid cards, and transport ticketing services. - Finally, the business offers instant lottery tickets and provides ancillary printing services that offer graphic design and the printing of those designs.

- 6. Financial statements for the year ended 31 December 2020 6 FINANCE The sector includes the Group’s activities in Alternative Asset Management - in particular promotion, management and value creation for investment funds in real-estate, credit and private equity, as well as multi-asset/multi-manager investment solutions provided via a platform for operating companies. To support the activities of this platform and by making use of available capital, DeA Capital has also built up over time an Alternative Investment portfolio mainly consisting funds managed by the platform’s asset management company. The sub-holding company for the Finance business is DeA Capital S.p.A. (“DeA Capital”), which is listed on the FTSE Italia STAR segment of the Milan stock exchange and is directly controlled by De Agostini S.p.A., which had a stake of around 67.1% at 31 December 2020. With Combined Assets Under Management of some 23,800 million euros, DeA Capital is the principal Italian independent alternative asset management operator (in terms of assets under management), the aim being, to also grow at the pan-European level and then to extend the range of investment products and solutions offered. DeA Capital’s main shareholdings are: • full ownership of DeA Capital Real Estate SGR (100%), Italy’s largest independent real-estate asset management company, with assets under management of about 10.4 billion euros and 54 managed funds (including two listed funds); • full ownership of DeA Capital Alternative Funds SGR (100%), which manages alternative investment fund assets under management (private equity and credit funds), with over 5.5 billion euros in assets under management and 16 managed funds; • a majority stake in Quaestio SGR (38.8%, held indirectly through Quaestio Holding), primarily providing investment solutions for institutional investors, with Assets Under Management of around 7.9 billion euros; • a controlling holding in DeA Capital Real Estate France (70.0%), DeACapital Real Estate Iberia (73.0%) and DeACapital Real Estate Germany (70.0%), together with a joint controlling interest in DeA Capital Real Estate Poland (50.0%), a company constituted between the end of 2018 and the end of 2020 to develop real- estate advisory business for raising funds and for real-estate consultancy and management in the French, Spanish, German, Austrian, Swiss and Polish markets. In this sector, it also has a minority stake, of about 1.45% at 31 December 2020, in Assicurazioni Generali, one of the largest insurance companies in Europe and listed on the Milan Stock Exchange. In this regard, it should be pointed out that a 1.28% stake in Assicurazioni Generali is held directly by De Agostini S.p.A., while a further 0.17% is held through DeA Communications, which is fully controlled by De Agostini S.p.A. itself. Holding Company activities Holding Company activities include the activities carried out by the companies within the holding company structure, which encompasses De Agostini S.p.A. as well as other directly or indirectly controlled financial companies. Specifically, these activities relate to the management of shareholdings in the sub-holding companies of the Group’s individual businesses, as well as its interests in non-strategic shareholdings and activities.

- 7. Financial statements for the year ended 31 December 2020 7 2. Significant events during the year Publishing activities Disposal of m-dis Distribuzione Media shares On 8 June 2020, De Agostini Editore accepted the binding offer by a third-party operator to acquire the shares it held in m-dis Distribuzione Media. On 17 February 2021, RCS Mediagroup (the other m-dis Distribuzione Media shareholder) exercised its pre-emptive right and acquired 2,353,685 m-dis Distribuzione Medi shares, equating to 81.8% of the shares held in this company by De Agostini Editore, for a total amount of 1.5 million euros. At the same time, De Agostini Editore exercised its option to sell its remaining 523,041 shares in m-dis Distribuzione Media to RCS Mediagroup. Merger by reverse acquisition of De Agostini Publishing With legal effect from 1 August 2020 and effective for accounting and tax purposes from 1 January 2020, De Agostini Publishing was merged by incorporation with De Agostini Publishing Italia, taking the company name De Agostini Publishing. Partial and proportional demerger of De Agostini Publishing With effect from 1 August 2020, De Agostini Publishing spun off part of its business to Betterly, a company wholly-owned by De Agostini Editore, by transferring to it the “Betterly” business division for a total amount of 0.4 million euros. Transfer of the Spanish Partworks business With effect from 1 November 2020, De Agostini Publishing undertook a capital increase for a total of 28 million and 56 euros, of which 56 euros were subscribed to by De Agostini Editore and paid up in full in cash and 28 million euros subscribed to by Grupo Planeta-De Agostini, paid up on the basis of a contribution in kind of the fully owned company Editorial Planeta De Agostini, operating in the partworks business. As a result of this operation, De Agostini Editore now holds De Agostini Publishing at 50.0001% with the remaining 49.9999% being held by Grupo Planeta-De Agostini. Gaming & Services Disposal of the IGT Italian Gaming business On 7 December 2020, IGT concluded an agreement for the transfer of all of the share capital of Lottomatica Videolot Rete and Lottomatica Scommese, that is to say IGT’s Italian Gaming business, to Gamenet/Apollo Global Management (the IOTA project). This disposal was concluded after the close of the 2020 financial year on 10 May 2021, the total price being 950 million euros, of which 725 million euros already received on that date. The remainder will be received by IGT in two instalments (without interest): 100 million euros to be paid by December 2021; 125 million euros to be paid by September 2022. IGT will use this money, net of the cash of the company disposed of, equating to 94 million euros, to pay for the costs of the transaction and to reduce its own debt.

- 8. Financial statements for the year ended 31 December 2020 8 IGT refinancing operations In: March 2020, IGT repaid its 4.75% Senior Secured Notes that were due to expire in 2020; this amounted to a total of 387.9 million euros; May 2020, it signed agreements amending the Senior Facility Agreement in respect of the Revolving Credit Facilities maturing in July 2024 and the Senior Facility Agreement in respect of the Term Loan Facilities maturing in January 2023; this will give the company greater flexibility, particularly given: i) the suspension of the financial covenants until the end of the quarter ending 30 June 2021; ii) the obligation on the part of the company to maintain a minimum liquidity of 500 million US dollars in every quarter until 30 June 2021; iii) amendments to certain financial covenants in the quarters subsequent to 30 June 2021; iv) a prohibition on the distribution of dividends and on share buy-backs until 30 June 2021 and subsequently, although solely in the event that the net debt to Ebitda ratio were to fall below a given threshold; June 2020, it • fully repaid its 5.5% Senior Secured Notes that were due to expire in 2020, this amounting to a total of 27.3 million US dollars; • issued 5.25% Senior Secured US Dollar Notes maturing in 2029, for a total nominal value of 750 million US dollars, of which 500 million US dollars will be used to repay early part of the 6.25% Senior Secured US Dollar Notes of which 1,500 million US dollars are due to mature in 2022. Finance activities Acquisition of Quaestio Holding/Quaestio Capital SGR – Payment of the earn- out for the Non-performing Loans Servicing business and receipt of the proceeds of divestment of the Non-performing Loans Servicing and Non-performing Loans Management activities In February 2020, following the disposal by Quaestio Holding of its holding in Quaestio Cerved Credit Management (Non-performing Loans Servicing business) and on the basis of the agreements concluded when Quaestio Holding became a shareholder, DeA Capital paid 16.5 million euros in earn-out fees (that amount already having been posted to financial liabilities at 31 December 2019). In May 2020, on the basis of those agreements, Quaestio Holding distributed amounts deriving primarily from the disposal of the Non-performing Loans business (Management and Servicing) for a cash-in by DeA Capital amounting to 22.3 million euros (that amount having already been recognised in the net financial position at 31 December 2019). Next step in the Alternative Asset Management platform’s internationalisation process The incorporation under German law of DeA Capital Real Estate Germany, was completed in October 2020, with 70% of the company’s equity being held by the DeA Capital Group and the remainder by a local key manager. The company's objective is to develop real-estate advisory business to attract funds and expand its real-estate consultancy and management businesses in the German, Austrian and Swiss markets, with a particular focus on the core+, value-added and opportunistic sectors. The company also intends to offers products and services in the real-estate sector through Real- Estate Investment Trusts (REITS); to this end, a specialised team has been acquired to handle investments in listed companies in the real-estate sector.

- 9. Financial statements for the year ended 31 December 2020 9 Distribution by IDeaMI In 2020, DeA Capital received 22.2 million euros from the balance of the liquidation surplus for ordinary shareholders and from the residual amount due on the special shares held by IDeaMI (SPAC). Holding Company activities Corporate reorganisation project for De Agostini S.p.A., B&D Holding S.p.A. and B&D Finance, a fully owned subsidiary of B&D Holding S.p.A. In 2020, the project to reorganise De Agostini S.p.A., B&D Holding and the latter’s wholly owned subsidiary B&D Finance was completed. It was aimed at: merging the cooperative management and investment activities of B&D Holding and B&D Finance into those of De Agostini S.p.A.; structuring the B&D Holding and De Agostini S.p.A. shareholder bases in the most appropriate way, with the unanimous agreement of their members. In concrete terms, the reorganisation included: a partial non-proportional reverse split of B&D Holding in favour of De Agostini S.p.A., with the transfer to the latter of the holding in B&D Finance; the simultaneous merger of B&D Finance into De Agostini S.p.A. In addition, with the completion of these transactions on 1 January 2020, new texts of the Articles of Association were adopted by De Agostini S.p.A. and B&D Holding. As a result of this reorganisation, which came into effect on 1 January 2020, B&D Holding's shareholding in De Agostini S.p.A. now stands at 61.77% of the latter's (fully diluted) share capital. Disposal of a proportion of the shares held in LDH (parent company for Banijay Group Holding) In July 2020, Banijay announced completion of the acquisition of the Endemol Shine Group (ESG), previously jointly owned by The Walt Disney Company and funds managed by Apollo Global Management, Inc. This acquisition, completed on 2 July 2020, was funded through a mix of new equity (subscribed to by Financiere LOV, Vivendi and Fimalac, a new shareholder) and new debt. De Agostini did not take part in the capital increase and its holding in LDH was therefore diluted. This transaction has given the Banijay Group some 200 operating entities in 22 countries (with entertainment, fiction, factual, reality entertainment and docu-drama productions, and children’s and animation programs) and 120 brands (with a catalogue of over 100,000 hours of content distributed worldwide). With regard to the acquisition of Endemol Shine Group, DeA Communication disposed of half of its holdings in LDH (49.9%), the parent company for Banijay Group Holding, between July and October 2020, generating a total of 113.8 million euros, of which 54.8 million euros were paid in cash and 59 million euros through a convertible bond issue by LDH, with a total capital gain of some 45 million euros being recognised in the consolidated accounts.

- 10. Financial statements for the year ended 31 December 2020 10 As a result of these operations, DeA Communications has a fully diluted holding in Banijay Group Holding of around 13.31% (as compared with 34.23% previously). Prepayment relating to the Dauphine Project On 20 April 2020, the formalities were completed for a floating charge to be granted in favour of Credit Suisse on the 18 million IGT shares underlying the Dauphine Project (“the IGT Shares). Immediately after this floating charge was activated, De Agostini S.p.A. issued a request to Credit Suisse for funding equating to the current countervalue of the IGT Shares, valued at the Put Option Strike Price, i.e. the “Pre-payment Amount”, for a cash-in of some 439.8 million US dollars, net of total interest on this loan. In granting this loan, Credit Suisse retained a (discounted) amount of 7.7 million US dollars to cover the Stamp Duty for which De Agostini S.p.A. would be liable in the event of physical settlement of the Collar derivative. In the event of physical settlement of all four tranches of the Dauphine Project - which mature on a six-monthly basis from May 2022 through to November 2023 - the Credit Suisse loan would “self-liquidate” from the proceeds of the sale of IGT shares, as would the interest that has already been discounted for. Early repayment and new loans to De Agostini S.p.A. On 24 April 2020, De Agostini S.p.A. repaid in full the 2013 Club Deal to coincide with the loan instalment of 26.2 million euros that had fall due, thereby paying back early the last two instalments that were due to mature on 24 October 2020 and 23 April 2021; the total repaid amounted to 52.5 million euros. Subsequently, on 1 July 2020, De Agostini S.p.A. repaid part of the 2014 Club Deal in advance of the remaining instalments (for total of 355 million euros) scheduled to fall due on 29 October 2020 (50 million euros), 29 April 2021 (50 million euros) and 29 October 2021 (255 million euros) respectively, leaving a residual amount, scheduled to fall due on 29 October 2021 that was repaid early and in full on 2 November 2020. Dividends received/paid In June 2020, the General Meeting of shareholders of De Agostini S.p.A. approved the annual financial statements at 31 December 2019 that showed a net profit of 55.3 million euros, of which 0.1 million was allocated to the reserve for foreign exchange-rate gains and 55.2 million to the Extraordinary reserve. In 2020, De Agostini S.p.A. recorded dividends from associated companies amounting to a total of 88.0 million euros, of which 15.9 million euros related to IGT, 21.5 million euros to DeA Capital, 10.1 million euros to Assicurazioni Generali and 40.0 million euros to DeA Communications.

- 11. Financial statements for the year ended 31 December 2020 11 3. Analysis of the Group’s operating performance and financial position 3.1 Introduction Legislative framework for preparation of the financial statements The consolidated financial statements for the year ended 31 December 2020 were prepared on the basis of the international accounting and reporting standards (IAS/IFRS) approved by the European Union. All the interpretations issued by the International Financial Reporting Interpretations Committee (IFRIC), including those previously issued by the Standing Interpretations Committee (SIC), approved by the European Union, were also applied in preparing the Consolidated Financial Statements. The Consolidated Financial Statements at 31 December 2020 were prepared under the same accounting standards as those used in the previous year. It should be noted that following the agreement on the disposal of the IGT Italian Gaming business to Gamenet/Apollo Global Management (as set out in the previous section on “Significant events during the year”), the financial statements at 31 December 2019 were restated to comply with IFRS 5 accounting standard, the effects thereof all being reclassified in the Income Statement under “Net profit from operations sold or discontinued”. No restatement was, however, necessary for the Statement of Financial Position. The "Restated consolidated financial position" included in the financial statements for the year ended 31 December 2019 are given below. These statements were revised in the light of the provisions of IFRS 5 to ensure that they were comparable with the statements for 2020: Figures in EUR million 2019 "As Reported" IOTA Project 2019 "Restated" REVENUES 4,627 (671) 3,956 EBITDA 1,641 (237) 1,404 Deprec., amort. and other non-cash items (909) 95 (814) Income (loss) from equity investments 26 - 26 ORDINARY EBIT 758 (142) 616 Financial income/(charges) (420) 1 (419) ORDINARY EBT (A) 338 (141) 197 Impairment (54) - (54) Other non-recurring income/(charges) (61) 4 (57) NO - ORDINARY EBT (B) (115) 4 (111) EBT (A+B) 223 (137) 86 Taxes (155) 37 (118) Net profit (loss) from assets sold/discontinued operations - 100 100 Consolidated net profit (loss) 68 - 68 Of which: Net profit (loss) pertaining to minorities 49 - 49 Net profit (loss) pertaining to group 19 - 19

- 12. Financial statements for the year ended 31 December 2020 12 The provisions of Legislative Decree 38/2005 and of the IAS/IFRS constituted the legislative framework for the Company in preparing the Consolidated Financial Statements. As laid down in the provisions of Legislative Decree 38/2005, the Company prepares its financial statements in accordance with arts. 2423 et seq. of the Italian Civil Code. Restated Consolidated Financial Statements The Consolidated Financial Statements and explanatory notes thereto have been supplemented with a number of performance indicators that enable the management to provide information on the performance of the Group’s businesses, in line with analysis and control parameters. For this reason, a set of restated Consolidated Financial Statements was prepared showing performance indicators more commonly used by the management than those shown in the aforementioned Consolidated Financial Statements and explanatory notes. These are: Net revenues This represents the turnover of individual businesses and the Group as a whole, calculated as the income from sales and services. EBITDA This represents operating profit/(loss) before tax, financial income/charges, one-off items, profits/losses of shareholdings valued at equity, depreciation and amortisation, and other non-cash items (e.g. impairment losses and gains/losses on the sale of tangible and intangible assets). Given the nature of the business carried out by the companies in the Finance business and the holding company structure, the net financial income relating to these activities is included in EBITDA (Earnings before interest, tax, depreciation and amortisation). ORDINARY EBIT This is calculated using the EBITDA figure plus the profits/losses from shareholdings valued at equity, depreciation and amortisation and other ordinary non- cash items. ORDINARY EBT This is calculated by subtracting the figure for net financial income/expenses from ORDINARY EBIT. This figure – like ORDINARY EBIT – does not include the effects of any impairment or other non-recurring items included in the NON-ORDINARY EBT figure, which is shown separately. NET FINANCIAL POSITION (NFP) This represents the difference between: (+) cash and cash equivalents, as well as loans, receivables and certain financial assets with changes in fair value recognised in Comprehensive Income (under other comprehensive income) or in the Income Statement; (-) financial liabilities. Net revenues, EBITDA, ORDINARY EBIT/EBT and net financial position are alternative performance indicators not determined according to IAS/IFRS; they are reported to help show performance trends, as well as to provide useful information on the Group’s ability to manage debt, and to assist in estimating the value of group assets. The restated Consolidated Financial Statements show the same net profit/(loss) and shareholders’ equity as the Consolidated Financial Statements and are used below to comment on both the consolidated results and those of the individual business areas.

- 13. Financial statements for the year ended 31 December 2020 13 3.2 Restated Consolidated Financial Statements A summary is given below of the Group’s key financial and operating performance indicators, based on the restated Consolidated Financial Statements, prepared in line with the above explanations. (*) Restated in accordance with the provisions of IFRS 5. Figures in EUR million 2020 2019 Restated Absolute % 2019 As Reported REVENUES 3,026 3,956 (930) -24% 4,627 EBITDA 974 1,404 (430) -31% 1,641 Deprec., amort. and other non-cash items (754) (814) 60 (909) Income (loss) from equity investments (17) 26 (43) 26 ORDINARY EBIT 203 616 (413) -67% 758 Financial income/(charges) (403) (419) 16 (420) ORDINARY EBT (A) (200) 197 (397) -202% 338 Impairment (272) (54) (218) (54) Other non-recurring income/(charges) (331) (57) (274) (61) NO - ORDINARY EBT (B) (603) (111) (492) n.a. (115) EBT (A+B) (803) 86 (889) n.a. 223 Taxes 3 (118) 121 (155) Net profit (loss) from assets sold/discontinued operations 27 100 (73) - Consolidated net profit (loss) (773) 68 (841) n.a. 68 Of which: Net profit (loss) pertaining to minorities (395) 49 (444) n.a. 49 Net profit (loss) pertaining to group (378) 19 (397) n.a. 19 Net Financial Position (6,861) (7,521) 660 n.a. (7,521) Of which: Gaming and Services (6,553) (7,144) 591 n.a. (7,144) Change (*)

- 14. Financial statements for the year ended 31 December 2020 14 3.3 Operating performance Net revenues Consolidated net revenues in 2020 were 3,026 million euros, a decrease of around 24% as compared with 2019 (3,956 million euros). These figures break down as follows: Net revenues from Publishing activities were 249 million euros, down -39 million euros as compared with 2019 Restated (-14.0%) and attributable to Partworks (-24 million euros, primarily due to the effects of COVID-19, despite the positive effect of +18 million euros from line-by-line consolidation in November 2020 of Editorial Planeta De Agostini), as well as Digital (-6 million euros, principally from the effects linked to disposal of JV Super! Broadcast and of LCN 59 in 2019) and Direct Marketing (-6 million euros, in the wake of the corresponding business phase-out process). The Gaming & Services business posted net revenues of 2,708 million euros, a decline of -895 million euros as compared with 2019 Restated, reflecting in particular: a fall of some 6% in Global Lottery, which, however, showed considerable resilience, with Global same-store sales unchanged and a significant recovery in the second quarter of 2020 in same-store sales in North America, due to the lottery sales, above all in Instants, saw an increase as compared to 2019; a 45% fall in Global Gaming following the prolonged closure of casinos and gaming venues and major restrictions around the world following the spread of the COVID-19 health emergency. The Finance business posted net revenues of 71 million euros, slightly higher than the 2019 Restated. These revenues were primarily attributable to fees generated by Alternative Asset Management. EBITDA (Earnings before interest, tax, depreciation and amortisation) The Group recorded EBITDA of 974 million euros for the year ended 31 December 2020, a decrease as compared with the previous year. This breaks down as follows: The EBITDA for Publishing Activities was 27 million euros, an improvement of +9 million euros as compared with 2019 Restated, primarily due to the recovery of +4 million euros in Partworks Net Revenues Figures in EUR million 2020 % 2019 Restated % Change 2019 As Reported Publishing 249 8.2% 288 7.3% (39) 288 Gaming & Services 2,708 89.5% 3,603 91.1% (895) 4,274 Finance 71 2.3% 66 1.7% 5 66 Holding Companies / Eliminations (2) -0.1% (1) 0.0% (1) (1) Consolidated Total 3,026 100.0% 3,956 100.0% (930) 4,627 EBITDA Figures in EUR million 2020 % 2019 Restated % Change 2019 As Reported Publishing 27 2.8% 18 1.3% 9 18 Gaming & Services 939 96.4% 1,366 97.3% (427) 1,603 Finance 14 1.4% 42 3.0% (28) 42 Holding Companies / Eliminations (6) -0.6% (22) -1.6% 16 (22) Consolidated Total 974 100.0% 1,404 100.0% (430) 1,641

- 15. Financial statements for the year ended 31 December 2020 15 margins as well as the positive effect of line-by-line consolidation in November 2020 of Editorial Planeta De Agostini, and to the positive contribution of school texts, which more than offset the decline in Direct Marketing during its phase-out period and the effects linked to the disposal of JV Super! Broadcast in 2019. The EBITDA for Gaming and Services business was 939 million euros, a steep fall as compared with 2019, primarily due to lower net revenues in the wake of the COVID-19 health crisis, as previously indicated. The EBITDA for the Finance business was 14 million euros (42 million euros in 2019 Restated), reflecting the contribution made by DeA Capital’s activities and the dividend received from Assicurazioni Generali (of 11 million euros, as compared with 21 million euros in 2019). The investment income and expenses of DeA Capital in 2020 were negative overall (-9 million euros) as compared with a positive contribution in 2019 (+7 million euros), primarily due to the reduction in fair value of the portfolio assets of Opportunity Fund I (-11 million euros). The EBITDA for Holding Company Activities/Other business was down by -6 million, a distinct improvement as compared with 2019 due to lower costs for services and significant improvements in the fair value of the investments made by the Connect fund. ORDINARY EBIT The Group’s ORDINARY EBIT for the year ended 31 December 2020 was 203 million euros, after deduction of depreciation/amortisation charges and other ordinary non-cash items totalling EUR 754 million euros and a negative income of -17 million euros from shareholdings measured at equity. Amortisation, depreciation and other ordinary non-cash items break down as follows: 65 million euros for amortisation and write-downs of right-of-use assets recorded following the adoption of the IFRS 16 accounting standard on 1 January 2019 (67 million euros in 2019 Restated); 376 million euros for amortisation and write-downs of intangible assets (397 million euros in 2019 Restated), especially for customer relationships; 313 million euros relating to depreciation and write-downs of tangible assets (350 million euros in 2019 Restated). In 2020, the Group posted negative income from shareholdings measured at equity of -17 million euros, as compared with a profit of 26 million euros in 2019 Restated; in particular, the figure reported in 2020 included the income of the Planeta-De Agostini Group of -11 million euros (+29 million in 2019 Restated), primarily reflecting the worsening trend for Altresmedia, due to the contraction of the adversing market in Spain in the wake of COVID-19, for LDH, the parent company for Banijay Group Holding of -5 million euros (close to zero in 2019) and for DeA Planeta Libri of -1 million euros (-3 million euros in 2019 Restated). ORDINARY EBIT Figures in EUR million 2020 2019 Restated Change 2019 As Reported EBITDA 974 1,404 (430) 1,641 Deprec., amort. and other non-cash items (754) (814) 60 (909) Income (loss) from equity investments (17) 26 (43) 26 ORDINARY EBIT 203 616 (413) 758

- 16. Financial statements for the year ended 31 December 2020 16 Net profit (loss) The table below shows the relationship between ORDINARY EBIT and consolidated net profit/loss: ORDINARY EBT for 2020 was negative at -200 million euros, after deducting a negative financial management balance of -403 million euros. With regard to financial management, the balance in 2020 (as compared with the corresponding values for 2019 Restated) breaks down as follows: -2 million euros relating to the Publishing Activities business (-3 million euros in 2019 Restated); -373 million euros relating to the Gaming and Services business (-389 million euros in 2019 Restated); -28 million euros relating to Holding Company activities (-27 million euros in 2019 Restated). Non-ordinary charges totalling -603 million euros in 2020 (versus non-ordinary charges of -111 million euros in 2019 Restated) were included in the NON-ORDINARY EBT figure. Particular note should be taken of the following items recorded in 2020: Impairment of -272 million euros, of which -271 million euros related to the Gaming and Services business, primarily goodwill on international activities and on North America Gaming & Interactive. This alignment in value, which has no monetary impact and therefore no bearing on the company's net financial position, was based on the outcome of an impairment test conducted following the 2020 results (lower than expected, in particular due to the effect of COVID-19); Other non-recurring income/expenses of -331 million euros (-57 million euros in 2019 Restated), of which -258 million euros relating to the USD/EUR exchange rate effect for IGT due to the weak US dollar as compared with the euro (principally from the conversion Net profit (loss) Figures in EUR million 2020 2019 Restated Change ORDINARY EBIT 203 616 (413) 758 Financial income/(charges) (403) (419) 16 (420) ORDINARY EBT (A) (200) 197 (397) 338 Impairment (272) (54) (218) (54) Other non-recurring income/(charges) (331) (57) (274) (61) NO - ORDINARY EBT (B) (603) (111) (492) (115) EBT (A+B) (803) 86 (889) 223 Taxes 3 (118) 121 (155) Net profit (loss) from assets sold/discontinued operations 27 100 (73) 0 Consolidated net profit (loss) (773) 68 (841) 68 Of which: Net profit (loss) pertaining to minorities (395) 49 (444) 49 Net profit (loss) pertaining to group (378) 19 (397) 19 2019 As Reported

- 17. Financial statements for the year ended 31 December 2020 17 of IGT loans in foreign currencies), -35 million euros relating to IGT liability management costs,-41 million euros relating to restructuring costs, -63 million euros relating to the minority interests in the Lottoitalia profit, reported in the consolidated financial statements as remuneration for the financial debt recorded and not as income attributable to minority interests (by virtue of the specific contractual clauses existing between Lottomatica and third-party shareholders), +45 million euros from capital gains on the disposal of shares in LDH, the parent company for Banijay Group Holding, and +24 million euros due to the mark to market of the Dauphine Project, after deduction of the exchange-rate effect of the corresponding Prepayment. In terms of taxes, a gain of +3 million euros was posted in 2020, as compared with a charge of -118 million euros in 2019 Restated, which breaks down as follows: -3 million euros relating to the Publishing Activities business (-1 million euros in 2019 Restated); -16 million euros relating to the Gaming and Services business (-118 million euros in 2019 Restated) reflecting the loss posted by IGT in 2020 resulting in a significant tax benefit, completely eroded by the reversal of deferred tax posted previously and not recoverable by IGT and by the irrelevance for tax purposes of the impairment of goodwill; +15 million euros relating to Finance activities (-5 million euros in 2019 Restated), principally from recognition of total net income for DeA Capital of +16 million euros following the fiscal realignment by DeA Capital Real Estate of its goodwill by applying the option granted under the 2021 Budget Act and paying a substitute tax of 3%; +7 million euros relating to Holding Company activities (+6 million euros in 2019 Restated). The net profit in 2020 from operations sold or discontinued comes from the sale of IGT’s Italian Gaming business to Gamenet/Apollo Global Management in 2021 for a total of 30 million euros (+100 million euros in 2019 Restated). To summarise, the Consolidated Net Income was negative at -773 million euros in 2020, as compared with the positive figure of +68 million euros in 2019 Restated; the negative Net Income attributable to the Group was -378 million euros, as compared with a positive net income of +19 million in 2019 Restated. The Net Income attributable to minority interests, which was negative at -395 million euros (as compared with the positive figure of +49 million euros in 2019 Restated), mainly reflected the - 403 million euros relating to IGT’s pro-rata share of the Group Net Income (+ 46 million euros in 2019 Restated) and the +6 million euros relating to the pro-rata share of the Group Net Income accruing to Connect (close to zero in 2019 Restated) and +2 million euros relating to the pro-rata share of the Group Net Income accruing to the DeA Capital Group/IDeA OPI I (+3 million euros in 2019 Restated). The Net Income attributable to the Group was negative at -378 million euros (as compared with the positive figure of +19 million euros in 2019 Restated) and primarily reflected: + 2 million euros in net income from the DeA Editore Group (+4 million euros in 2019 Restated); -413 million euros relating to the pro-rata share of the Group Net Income accruing to the IGT Group (-1 million euros in 2019 Restated); - 11 million euros relating to the pro-rata share of the Group Net Income accruing to the Planeta-De Agostini Group (+29 million in 2019 Restated) and -5 million euros relating to the pro-rata share of the Group Net Income accruing to LDH, the parent company of Banijay Group Holding (close to zero in 2019 Restated); +7 million euros relating to the pro-rata share of the Group Net Income accruing to the Connect (+2 million euros in 2019 Restated);

- 18. Financial statements for the year ended 31 December 2020 18 +11 million euros relating to the pro-rata share of the Group Net Income accruing to the DeA Capital/IDeA OPI I Group (+8 million euros in 2019 Restated); +11 million euros in dividends from Assicurazioni Generali (+21 million euros in 2019 Restated); +20 million euros in net income from the holding company structure (-44 million euros in 2019 Restated). Statement of Performance – IAS 1 A summary version of the Comprehensive Income or Statement of Performance – IAS 1, is shown below. It reports the net profit/(loss) for the year as the sum of the portion recorded in the Income Statement and that posted directly to shareholders' equity: Gains/(losses) on financial activities measured at fair value amounted to a negative balance of -94 million euros in 2020 (a positive balance of 83 million euros in 2019, which included a positive variation in the fair value for Assicurazioni Generali of +87 million euros), attributable in particular to negative variations in fair value for Assicurazioni Generali (-94 million euros). Exchange-rate gains and losses largely reflected the effects of the conversion into euro of the financial statements of the Group’s companies that are prepared in different currencies. This related in particular to the Gaming & Services business (-7 million euros as compared with +32 million euros in 2019 and was due mainly to the devaluation of the US dollar against the euro). To summarise, comprehensive income was negative at -884 million euros in 2020, as compared with the positive figure of +183 million euros in 2019; the portion attributable to the Group was negative, amounting to -484 million euros, as compared with the figure of +121 million euros in 2019. Statement of Performance - IAS 1 Figures in EUR million 2020 2019 Net Profit/(Loss) (A) (773) 68 Items that could be subsequently reclassified within the profit (loss) for the period Profit / (loss) on traslating foreign operations (12) 35 Profit / (loss) on cash flow hedge (1) (2) Profit / (loss) on investments valued at equity (4) 1 Tax effect - - Items that could be subsequently reclassified within the profit (loss) for the period Profit / (loss) on financial assets at Fair Value (94) 83 Profit/(loss) on remeasurement of defined benefit plans (1) (1) Tax effect 1 (1) Other comprehensive income/(loss) (B) (111) 115 Total comprehensive income/(loss) (A+B) (884) 183 Of which: Net profit (loss) pertaining to minorities (400) 62 Net profit (loss) pertaining to group (484) 121

- 19. Financial statements for the year ended 31 December 2020 19 3.4 Statement of financial position The table below provides a summary of the Group’s key figures from the statement of financial position. Goodwill At 31 December 2020, goodwill was 4,063 million euros (5,072 million euros at 31 December 2019), which breaks down as follows: 59 million euros relating to Publishing activities (34 million euros at 31 December 2019, entirely attributable to school texts); this difference as compared with 31 December 2019, amounting to a total of +25 million euros, is attributable to the Spanish partworks business transferred to De Agostini Publishing by the Spanish Planeta De Agostini joint venture on 1 November 2020; 3,904 million euros relating to the Gaming and Services business (4,933 million euros at 31 December 2019); the difference as compared with 31 December 2019, amounting to a total of -1,029 million euros, is due to foreign exchange differences from the conversion of goodwill (-312 million euros), the impairment posted for the International and North American Gaming & Interactive businesses (of -176 million euros and -94 million euros respectively) and the reclassification under Net balance of non-current or disposal group assets and liabilities held for resale of the pro rata share of goodwill relating to the IGT Italian Gaming business, namely Lottomatica Videolot Rete and Lottomatica Scommesse, the disposal of which was concluded on 7 December 2020 (-447 million euros). 100 million euros for the Financial Activities business (105 million euros at 31 December 2019) relating to DeA Capital Alternative Funds SGR (38 million euros, also including the Non-performing Loans Management branch acquired from Quaestio SGR from 2019) and DeA Capital Real Estate SGR (62 million euros). Other intangible assets Other intangible assets include intellectual property rights, concessions, licenses and trademarks, as well as other intangibles. At 31 December 2020, Other intangible assets totalled 1,339 million euros (1,702 million euros at 31 December 2019), comprising: Figures in EUR million Goodwill 4,063 5,072 (1,009) Other intangible assets 1,339 1,702 (363) Tangible assets 996 1,313 (317) Right of use assets (IFRS 16) 267 350 (83) Investments 1,594 1,858 (264) Cash and cash equivalents 1,040 876 164 Other net assets 1,173 880 293 TOTAL 10,472 12,051 (1,579) for hedging: Financial liabilities 8,216 8,815 (599) Shareholders' equity 2,256 3,236 (980) 31.12.2020 31.12.2019 Change

- 20. Financial statements for the year ended 31 December 2020 20 32 million euros relating to the Publishing Activities business (30 million euros at 31 December 2019), mainly in respect of investments in the publishing of school texts, digital investments, intellectual property rights and basic software and applications; 1,281 million euros relating to the Gaming & Services business (1,629 million euros at 31 December 2019), primarily for customer agreements, concessions, licenses and capitalised software. The decrease in 2020, amounting to a total of -348 million euros was primarily due to depreciation for the period (-176 million euros), as well as foreign exchange differences from the conversion (-113 million euros) and at other intangible assets relating to the IOTA Project (-77 million euros) reclassified under “Net balance of non-current or disposal group assets and liabilities held for resale”; 26 million euros relating to the Finance Activities business (43 million euros at 31 December 2019), chiefly due to customer contracts and performance fees. The decrease in 2020 is due to the receipt by DeA Capital S.p.A. of contractual rights acquired pursuant to specific commitments made by Quaestio Holding shareholders under the agreement for the purchase of shares by DeA Capital (-22 million euros). Tangible assets At 31 December 2020, tangible assets totalled 996 million euros (1,313 million euros at 31 December 2019), which broke down as follows: Real estate equating to 27 million euros (62 million euros at 31 December 2019); Other tangible assets amounting to 969 million euros (1,251 million euros at 31 December 2019). Real estate, amounting to a total of 27 million euros, included: 11 million euros relating to Publishing Activities business (12 million euros at 31 December 2019); 16 million euros relating to the Gaming & Services business (50 million euros at 31 December 2019). This decrease is chiefly due to the reclassification of real-estate relating to the IOTA Project (-29 million euros) under Net balance of non-current or disposal group assets and liabilities held for resale. Other tangible assets totalled 969 million euros, including: 2 million euros relating to Publishing Activities business (2 million euros at 31 December 2019); 963 million euros relating to the Gaming & Services business (1,245 million euros at 31 December 2019), mainly for terminals and contract-related systems. This decrease is chiefly due to the reclassification of Other tangible assets relating to the IOTA Project (- 62 million euros) under Net balance of non-current or disposal group assets and liabilities held for resale. 4 million euros relating to Holding Company Activities (4 million at 31 December 2019). Investments At 31 December 2020, the Group’s investments totalled 1,594 million euros. A breakdown of this item is given below: Investments Figures in EUR million 31.12.2020 31.12.2019 Change Investment properties 26 33 (7) Equity Investments 439 540 (101) Loans and receivables 287 346 (59) Financial assets at fair value through OCI 345 441 (96) Financial assets at fair value through profit or loss 497 498 (1) Total group 1,594 1,858 (264)

- 21. Financial statements for the year ended 31 December 2020 21 At 31 December 2020, investment property totalled 26 million euros (33 million euros at 31 December 2019) attributable to the Venere Fund (managed by DeA Capital Real Estate SGR), De Agostini S.p.A. and Immobiliare San Rocco; the decrease from 31 December 2019 was due to sales of real-estate units held by the Venere Fund. Depreciation and write-downs of 2 million euros were charged for the period. Shareholdings measured at equity included Grupo Planeta-De Agostini at 333 million euros (357 million euros at 31 December 2019) and LDH/Banijay Group at 67 million euros (128 million euros at 31 December 2019). With regard to the acquisition of Endemol Shine Group, DeA Communication disposed of half of its holdings in LDH, the parent company for Banijay Group Holding, between July and October 2020, generating a total sum of 113.8 million euros, of which 54.8 million euros were paid in cash and 59 million euros through a convertible bond issue by LDH. Loans and receivables amounted to 287 million euros, down by 59 million euros as compared with the balance at 31 December 2019 (346 million euros) and primarily includes IGT customer financing receivables and loans from the transfer of shares in EAE-EDP Ediformacion S.L. and EAE-OSTELEA FORMACION ONLINE, S.L. by DeA Communications to Planeta Corporation and lending on real-estate co-investment vehicles in France concluded in 2020 by the DeA Capital Group. Financial assets valued at fair value with changes recognised in the other components of the Comprehensive Income Statement (OCI) amounted to 345 million euros (441 million euros at 31 December 2019); these mainly reflected the investment, recognised under Financial assets, in Assicurazioni Generali, recorded for a value of 326 million euros on the basis of the closing price on 31 December 2020 (14.260 euros/share, as compared with 18.395 euros/share on 31 December 2019). At 31 December 2020, the Group held 1.45% of the share capital of Assicurazioni Generali, i.e. 22,830,815 shares (unchanged as compared with 31 December 2019). Financial assets valued at fair value with changes recognised in the Income Statement amounted to 497 million euros (498 million euros at 31 December 2019); this includes: derivatives for 153 million euros (174 million euros at 31 December 2019), mainly attributable to the positive mark-to-market of the Dauphine Project; investments in funds for 163 million euros (177 million euros at 31 December 2019), of which 123 million euros related to the Financial Activities business, 34 million euros to Holding Company Activities and 6 million euros to the Gaming and Services business; Other investments/activities for 181 million euros (147 million euros at 31 December 2019), of which 45 million euros related to the Finance Activities business, 136 million euros to Holding Company Activities, including the convertible bond issued by LDH referred to above; Other net current assets At 31 December 2020, other net current assets totalled 1,173 million euros. The table below shows the items included in this balance:

- 22. Financial statements for the year ended 31 December 2020 22 The net balance of trade receivables and payables comprised trade receivables of 758 million euros (956 million euros at 31 December 2019) and trade payables of 937 million euros (985 million euros at 31 December 2019). The Net balance of non-current or disposal group assets and liabilities held for resale relates to the IGT Italian Gaming business, amounting to a total of 496 million euros (sold to Gamenet/Apollo Global Management in 2021). The net balance of tax assets and liabilities amounting to -274 million euros (-358 million euros at 31 December 2019) included deferred tax assets of 71 million euros (47 million euros at 31 December 2019) and deferred tax liabilities of 273 million euros (332 million at 31 December 2019). The net balance of Other assets and liabilities includes Other assets amounting to a total of 1,743 million euros (2,040 million euros at 31 December 2019) and Other liabilities for a total of 574 million euros (712 million euros at 31 December 2019). At 31 December 2020, provisions amounting to 45 million euros (61 million euros at 31 December 2019), mainly consisting of provisions for employee severance indemnities of 18 million euros (21 million euros at 31 December 2019), other provisions relating to personnel for 4 million euros (6 million euros at 31 December 2019), the agent severance fund for 4 million euros (4 million euros at 31 December 2019) and provisions for future risks and charges for 19 million euros (30 million euros at 31 December 2019). Shareholders' equity At 31 December 2020, consolidated shareholders’ equity (Group and minority interests) totalled 2,256 million euros (3,236 million euros at 31 December 2019); Group shareholders’ equity was 1,384 million euros (1,864 million euros at 31 December 2019), while minority interests accounted for 872 million euros (1,372 million euros at 31 December 2019). The decrease in shareholder’s equity attributable to the Group - amounting to a total of -480 million euros - is mainly reflected by the following: a net loss of -378 million euros for 2020; other changes for a total of -102 million euros, related in particular to the devaluation of the investment in Assicurazioni Generali totalling -94 million euros. The decrease in shareholder’s equity attributable to minority interests - amounting to -500 million euros - was due to the following: a net loss of -395 million euros for 2020; the payment of dividends totalling -82 million euros (to minority shareholders of IGT and DeA Capital); other changes totalling -23 million euros. Other net assets Figures in EUR million 31.12.2020 31.12.2019 Change Trade receivables/payables: net balance (179) (29) (150) Net balance of non-current assets/liabilities or of discontinued operations held for sale 502 - 502 Net balance of tax assets/liabilities (274) (358) 84 Net balance of other assets/liabilities 1,169 1,328 (159) Provisions (45) (61) 16 Total group 1,173 880 293

- 23. Financial statements for the year ended 31 December 2020 23 Net Financial Position (NFP) The table below shows the Group’s net financial position (NFP) broken down by business area: With specific reference to Holding Company Activities, the net financial position at 31 December 2020 was a negative figure of -360 million euros, including payables to banks of -67 million euros, the prepayment debt relating to the Dauphine Project of -362 million euros, the De Agostini S.p.A. convertible bond with a nominal value of -80 million euros, cash and cash equivalents of +135 million euros and other assets/liabilities of +14 million euros; the net financial position at 31 December 2020 improved by +82 million euros as compared with the balance at 31 December 2019 attributable to the combined effect of dividends received from investee companies of +48 million, cash received from the disposal of part of the holding in LDH, the parent company of Banijay Group Holdings amounting to +55 million euros, after deduction of structural and financial/other charges totalling -21 million euros. Intra-segment eliminations relates entirely to the elimination of half of the Publishing Activities put options loan for the shares held by the Planeta-De Agostini Group in De Agostini Publishing. As mentioned earlier, the net financial position is calculated using the figures reported in the financial statements and is the difference between: (+) cash and cash equivalents, as well as loans, receivables and certain financial assets with changes in fair value recognised in Comprehensive Income (under other comprehensive income) or in the Income Statement; (-) financial liabilities. The reconciliation statement below shows the key figures in the Consolidated Statement of Financial Position at 31 December 2020 as compared with the amounts included in the Net Financial Position. The differences seen, in particular between Financial Activities with variations in fair value recognised in Comprehensive Income (under other comprehensive income) or in the Income Net Financial Position Figures in EUR million 31.12.2020 31.12.2019 Change Publishing (98) (45) (53) Gaming & Services (6,553) (7,144) 591 Finance 129 110 19 Holding (360) (442) 82 Eliminations intrasegment 21 - 21 Total group (6,861) (7,521) 660 Figures in EUR million Carrying amount at 31.12.2020 of which in Net Financial Position INVESTMENTS - NON-CURRENT ASSETS 811 11 Financial assets at fair value through OCI 331 5 Financial assets at fair value through profit or loss 480 6 LOANS AND RECEIVABLES - NON-CURRENT ASSET 89 74 INVESTMENTS - CURRENT ASSETS 31 31 Financial assets at fair value through OCI 14 14 Financial assets at fair value through profit or loss 17 17 LOANS AND RECEIVABLES - CURRENT ASSETS 198 198 CASH AND CASH EQUIVALENTS 1,040 1,040 NON-CURRENT FINANCIAL LIABILITIES (7,379) (7,379) CURRENT FINANCIAL LIABILITIES (836) (836) Net Financial Position - Group (6,046) (6,861)

- 24. Financial statements for the year ended 31 December 2020 24 Statement, are essentially related to the classification within these items of activities that qualify for inclusion in the Net Financial Positions management indicator in accordance with the Group Accounting Principles; in particular, at 31 December 2020, as was the case at 31 December 2019, the most significant differences related to the value of investments in Assicurazione Generali, in funds and in other financial investments. For information on the use of financial instruments, pursuant to art. 2428(2)(6-bis) of the Italian Civil Code, please refer to the Notes to the consolidated financial statements for the year ending 31 December 2020. * * * In addition to the commentary on the consolidated results, with the related breakdown by business, see the following websites for details of the financial information for the Group’s main businesses, which mainly consist of companies whose shares are traded on regulated markets: www.atresmedia.com www.igt.com www.deacapital.it www.generali.com

- 25. Financial statements for the year ended 31 December 2020 25 3.5 Main risks and uncertainties to which the Parent Company and consolidated Group companies are exposed As mentioned in the first section of the Report on Operations, the Group operates in a number of business sectors and is organised accordingly; each business activity comes under a sub- holding company, which is responsible for the coordination, management and control of all the companies that pertain to it. In addition, companies in the Holding Company structure – including the Parent Company and other directly and indirectly-controlled financial companies – carry out holding company activities in tandem with the above-mentioned businesses. Given its structure and the international arena in which it operates, the Group is exposed to a number of risks and uncertainties, which can be categorised as either systemic risks or specific risks. Such risks may significantly affect the operating performance and financial position of the Parent Company and the other companies included in the Group's Consolidated Financial Statements. Systemic risks relate to trends in macroeconomic variables in the different countries in which the Group operates, and at global level, including GDP, interest rates, inflation, exchange rates and unemployment, as well as the state of the financial markets – which particularly affects access to capital and return on investment (especially financial investment). In terms of the macroeconomic scenario in particular, note should be taken of the global spread of COVID-19 in 2020, which was a material factor underlying the stability of the macroeconomy itself and, in general, impacting on a whole range of risk factors, making it essential to rapidly adopt measures to preserve the operational continuity of companies within the Group. Operational integrity was ensured without interruption, firstly through the timely and generalised adoption of a smart-working policy and, subsequently, in conjunction with the relaxation from time to time of the regulatory constraints on the mobility of people, through the implementation of a regulatory protocol to combat and contain the spread of the virus in the workplace (supported by the adoption of all technical or organisational measures necessary to ensure a rotating return to the operational headquarters of all workforce professionals). This meant that the Group was able to oversee the governance of its activities in a period of extraordinary uncertainty with its response capacities substantially unchanged as compared to its business-as-usual scenario. Specific risks can be analysed according to individual business areas, and include: for the Publishing Activities business, risks connected with the demand for published products (i.e. partworks, school texts and others), the costs of producing these items, legislative changes and the efficiency and effectiveness of logistics systems; for the Media & Communications business, risks associated with the performance of TV broadcasters (in turn affected by trends in advertising revenues) and the creative abilities required to launch new program formats on the market; for the Gaming & Services business, risks connected with maintaining/renewing existing contracts or licenses, the innovation required to launch new gaming and services products, production capacity for new gaming/lottery management systems, the possibility of a technological malfunction (system and/or terminals) that prevents collection of receipts, and fixed-odds sports betting, where the operator bears the bookmaking risk; for Finance Activities, risks connected with typical alternative investment and alternative asset management activities (undertaken by DeA Capital Real Estate SGR, DeA Capital Alternative Funds, DeA Capital Real Estate France, DeA Real Estate Iberia and DeA Capital Real Estate Germany), and the performance of the investments made.

- 26. Financial statements for the year ended 31 December 2020 26 Risks for each business, common to all business areas in which the Group is highly diversified, are also associated with the attitude of management, relationships with employees and suppliers, integration policies and debt management. The specific risks relating to the Holding Company Activities business – in addition to those connected with the management of operations in the aforementioned business sectors and the associated effects on cash flow or dividends – include exposure to specific sectors or investments and the difficulties of identifying opportunities for investments or disposals. Although we stress the significance of the aforementioned risks for the Group’s economic and operating performance and financial position, we have put in place appropriate measures to limit the impact of any serious negative developments. With regard to systemic risks, in early 2000 the Group started to diversify its investments – both by sector and by geographical area. It now has a widely diversified portfolio of activities combining resilient businesses (such as lotteries and asset management) with others that have good long-term growth prospects (such as media and content production), all with a strong international footprint. With regard to specific risks, the Group believes it has adopted a modern system of governance for its businesses, facilitating the effective management of complexity and the achievement of the strategic goals of the sub-holding companies and the Group. Specifically, this governance system has set out the procedures for managing relationships between the Parent Company and sub-holding companies, and the responsibilities of the latter concerning the coordination, management and control of all operating companies under their responsibility.