IMPORTANT CIRCULARS & NOTIFICATIONS related to CENTRAL EXCISE

•Download as ODT, PDF•

1 like•147 views

IMPORTANT CIRCULARS & NOTIFICATIONS related to CENTRAL EXCISE

Report

Share

Report

Share

Recommended

Recommended

More Related Content

What's hot

What's hot (17)

RBI SEBI MCA & Taxation Updates - 14th December 2016

RBI SEBI MCA & Taxation Updates - 14th December 2016

XBRL OUTSOURCING SERVICES FORM 23AC/23ACA/COST AUDIT IN XBRL FORMATE CONVERSI...

XBRL OUTSOURCING SERVICES FORM 23AC/23ACA/COST AUDIT IN XBRL FORMATE CONVERSI...

Export and Import of Goods, Services and Currencies - Procedural Aspects

Export and Import of Goods, Services and Currencies - Procedural Aspects

Similar to IMPORTANT CIRCULARS & NOTIFICATIONS related to CENTRAL EXCISE

This article offers valuable insights into the potential challenges and pitfalls during the GST refund process and highlights reasons why the tax department might not process Input Tax Credit (ITC) refund applications.Navigating the Complexities of GST Refunds for Exports

Navigating the Complexities of GST Refunds for ExportsManish Anil Gupta & Co. - A CA firm in Delhi, India

Similar to IMPORTANT CIRCULARS & NOTIFICATIONS related to CENTRAL EXCISE (20)

Study Circle Reference Material-CA Payal (Prerana) Shah-10 02 2015

Study Circle Reference Material-CA Payal (Prerana) Shah-10 02 2015

Be Prepared for scrutiny of your returns by Taxmen

Be Prepared for scrutiny of your returns by Taxmen

Importers and customs broker’s accreditation in the Philippines

Importers and customs broker’s accreditation in the Philippines

Navigating the Complexities of GST Refunds for Exports

Navigating the Complexities of GST Refunds for Exports

Revised ICDS ppt - CIRC Noida Branch by CA Parul Mittal

Revised ICDS ppt - CIRC Noida Branch by CA Parul Mittal

Service Tax (including CENVAT) Amendments 2016 & Recent issues & Judgments

Service Tax (including CENVAT) Amendments 2016 & Recent issues & Judgments

More from IamSMEofIndia

More from IamSMEofIndia (8)

IFC-NIESBUD PROGRAM FOR ADVANCING CAPACITY OF TRAINERS

IFC-NIESBUD PROGRAM FOR ADVANCING CAPACITY OF TRAINERS

IMPORTANT CIRCULARS & NOTIFICATIONS related to DHBVNL

IMPORTANT CIRCULARS & NOTIFICATIONS related to DHBVNL

Recently uploaded

Recently uploaded (20)

CAFC Chronicles: Costly Tales of Claim Construction Fails

CAFC Chronicles: Costly Tales of Claim Construction Fails

Philippine FIRE CODE REVIEWER for Architecture Board Exam Takers

Philippine FIRE CODE REVIEWER for Architecture Board Exam Takers

The doctrine of harmonious construction under Interpretation of statute

The doctrine of harmonious construction under Interpretation of statute

589308994-interpretation-of-statutes-notes-law-college.pdf

589308994-interpretation-of-statutes-notes-law-college.pdf

8. SECURITY GUARD CREED, CODE OF CONDUCT, COPE.pptx

8. SECURITY GUARD CREED, CODE OF CONDUCT, COPE.pptx

WhatsApp 📞 8448380779 ✅Call Girls In Nangli Wazidpur Sector 135 ( Noida)

WhatsApp 📞 8448380779 ✅Call Girls In Nangli Wazidpur Sector 135 ( Noida)

Analysis of R V Kelkar's Criminal Procedure Code ppt- chapter 1 .pptx

Analysis of R V Kelkar's Criminal Procedure Code ppt- chapter 1 .pptx

IMPORTANT CIRCULARS & NOTIFICATIONS related to CENTRAL EXCISE

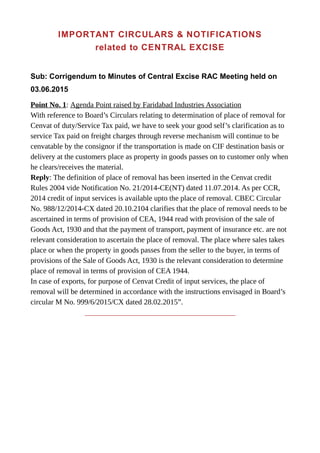

- 1. IMPORTANT CIRCULARS & NOTIFICATIONS related to CENTRAL EXCISE Sub: Corrigendum to Minutes of Central Excise RAC Meeting held on 03.06.2015 Point No. 1: Agenda Point raised by Faridabad Industries Association With reference to Board’s Circulars relating to determination of place of removal for Cenvat of duty/Service Tax paid, we have to seek your good self’s clarification as to service Tax paid on freight charges through reverse mechanism will continue to be cenvatable by the consignor if the transportation is made on CIF destination basis or delivery at the customers place as property in goods passes on to customer only when he clears/receives the material. Reply: The definition of place of removal has been inserted in the Cenvat credit Rules 2004 vide Notification No. 21/2014-CE(NT) dated 11.07.2014. As per CCR, 2014 credit of input services is available upto the place of removal. CBEC Circular No. 988/12/2014-CX dated 20.10.2104 clarifies that the place of removal needs to be ascertained in terms of provision of CEA, 1944 read with provision of the sale of Goods Act, 1930 and that the payment of transport, payment of insurance etc. are not relevant consideration to ascertain the place of removal. The place where sales takes place or when the property in goods passes from the seller to the buyer, in terms of provisions of the Sale of Goods Act, 1930 is the relevant consideration to determine place of removal in terms of provision of CEA 1944. In case of exports, for purpose of Cenvat Credit of input services, the place of removal will be determined in accordance with the instructions envisaged in Board’s circular M No. 999/6/2015/CX dated 28.02.2015”. ________________________________________

- 2. Subject: Standard Operating Procedure to be followed while Seeking permission under the provisions of Central Excise Rules, 2002/ Cenvat Credit Rules, 2004 OFFICE OF THE COMMISSIONER OF CENTRAL EXCISE, FARIDABAD 1 C.No. iv (16) CE/FBD-1/Tech/01/2015-16/ 3065 dated 7th September 2015 Trade Notice No. 03/2015-16 With a view to minimize the time taken in granting permission in cases where it is mandatory on part of the assesses to obtain permissions from the Commissioner Central Excise under certain provisions of Central Excise Rules, 2002/ Cenvat Credit. Rules, 2004, the following procedure is prescribed: The applicant assessee, in addition to the application filed with the office of Commissioner, Central Excise, Faridabad-1, will also send a copy of application to the jurisdictional Divisional Deputy/ Assistant Commissioner and Range Superintendent. On receipt of the said application, the Range Superintendent shall within maximum 2 working days verify and send his comments regarding admissibility or otherwise to the jurisdictional Deputy/ Assistant Commissioner. The deputy/ Assistant Commissioner will further examine the report of the Range Superintendent and send his/her comments/ recommendation to the Headquarters Technical Session, within 3 days of the receipt of application in Divisional Office. The headquarters Technical Section shall ensure that the application along with the Range and Division reports is submitted for consideration of the Commissioner within 2 days of receipt of report from the Division. All such cases where the permission or otherwise cannot be communicated to the applicant within 10 working days shall be submitted to the Addl. Commissioner Concerned who shall then take necessary action for resolution. ___________________________________________

- 3. Subject: Initiative towards good governance. Trade Notice No. 01/2015-16 dated 11th September, 2015 received from Commissioner, Central Excise Faridabad Attention of the trade & industry is invited to the Central Government’s emphasis on reform oriented non adversarial tax administration. The Central Board of Excise & Customs has taken several initiatives over the years to facilitate trade and simply procedures to reduce interface between tax officials and the taxpayers. It is CBEC’s mission to achieve excellence in the formulation and implementation of customs, Central Excise and Service Tax policies and enforcement of cross border control for the benefit of trade, industry and other stake holders. It is reiterated that the CBEC considers all taxpayers as the cornerstone of our economical independence and prosperity. Therefore, it is important to further simplify and modernize our working to expand the tax base and improve compliance. This is in tandem with the Central Government’s overall objective to ensure good governance. Thus is has been decided to designate one day of the week, viz., Wednesday (9.30 am to 1.30 pm) as Taxpayer’s Day wherein the Heads of all offices falling under the jurisdiction of Central Excise & Service Tax commissionerate, Faridabad-II will be available for meeting the taxpayer without any prior appointment to address their grievances expeditiously.