Presentation- Hardik Batra.pptx

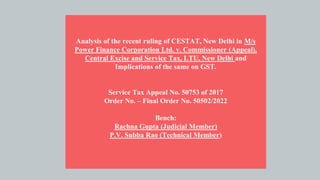

- 1. Analysis of the recent ruling of CESTAT, New Delhi in M/s Power Finance Corporation Ltd. v. Commissioner (Appeal), Central Excise and Service Tax, LTU, New Delhi and Implications of the same on GST. Service Tax Appeal No. 50753 of 2017 Order No. – Final Order No. 50502/2022 Bench: Rachna Gupta (Judicial Member) P.V. Subba Rao (Technical Member)

- 2. Facts of the case: - The Appellant - a Non-Banking Financial Company - financing projects. - Pays service tax on banking and other financial services that it provides. - Appellant took Cenvat Credit on service tax - paid on services relating to CSR for period 01.04.2011 to 31.12.2015. - Show-cause notice issued on 12.04.2016 to the Appellant - denying cenvat credit. - Ground for SCN being - CSR expenses do not constitute input service for output service - ‘banking and other financial services’. - Order-in-original (impugned order) passed by the Commissioner of Central Excise and Service Tax, LTU, Delhi on 01.12.2016, - Denied credit on service tax of Rs. 78,68,936 taken by the Appellant in the relevant period.

- 3. Submissions made in the Appeal: 1. Expenditure on CSR - discharge of statutory liability u/s 135 of the Companies Act, 2013. 2. Services availed in respect of CSR activities - constitutes input service under Rule 2(I) of CENVAT Credit Rules 2004. 3. Appellant relies on the cases of Essel Propack Ltd. and Millipore India Pvt. to further their stance. 4. Appellant - taken Cenvat Credit under bonafide belief of being entitled to it - therefore, extended period of limitation must not be invoked. 5. Penalty u/s 76 of the Finance Act, 1994 - concerns default in payment of service tax - the present dispute is in respect of Cenvat Credit. Thus, Penalty - not imposable.

- 4. Submissions, on behalf of the Revenue: 1. Revenue - supports impugned order - submits that to check if service qualifies as an ‘input service’, definition of input service under Rule 2(I) of Cenvat Credit Rules, 2004 to be referred. 2. Relevant portion of the definition reads as: “Any service used by a provider of taxable service for providing an output service”. 3. In case of service providers, only thing required to be checked - whether there is a nexus between output services and the services on which credit is claimed. 4. CSR - even though, an obligation under Companies Act - no nexus to the services provided.

- 5. Issues involved: 1. Whether expenditure incurred by the Appellant in discharging CSR can be construed as Input Service for the output services rendered by it? 2. Whether extended period of limitation can be invoked in the present case? 3. Whether penalty is imposable under section 76 of Finance Act, 1994.

- 6. Decision of the Hon’ble CESTAT, New Delhi: 1. CSR - LEGAL OBLIGATION AND NOT INPUT SERVICE FOR OUPUT SERVICE - ”BANKING AND OTHER FINANCIAL SERVICES” 2. LANGUAGE OF RULE 2(I) CCR, 2004 – ABSENCE OF LEGISLATIVE INTENT The definition reads as: “for providing output services”. Expenses towards CSR are not used for providing output services, thus, they are not to be construed as input services, for providing ‘banking and other financial services’. 3. CSR- NOT MENTIONED EVEN IN THE INCLUSION CLAUSE OF DEFINITION 4. DEMAND FOR PENALTY: NO EVIDENCE OF FRAUD OR COLLUSION

- 7. . Coming to the examination of case laws, cited by the Appellant, Hon’ble CESTAT observed as following: 1. In respect of Millipore India Pvt. Ltd case, the Hon’ble Karnataka High Court had made just a passing reference to CSR in para 7 but that did not form an issue in dispute, nor any decision was taken on whether CSR qualifies as an input service. 2. In respect of Essel Propack Ltd. case, the order of CESTAT Mumbai does not lay down correct law as Rule 2(I) does not include ‘activities relating to business’ as input service. And, it is not in the hands of tribunal to modify or enlarge scope of this Rule with the same being a legislative or quasi- legislative function.

- 8. Summary of the ruling of Hon’ble CESTAT: ● CSR obligation is consequent to the rendering of output services. ● Only such services which are used for providing output service qualify as input service. There could be services which are used not for providing output service but for some other business purpose. ● Some services which may not be used for providing output service have been mentioned in the inclusion part of the definition of input service. However, CSR was not mentioned therein. ● Mumbai Tribunal ruling in case of Essel Propack Ltd., which allowed CENVAT credit on CSR activities, does not lay down the correct law. ● Tribunal held that the taxpayer was not entitled to CENVAT credit on services used for undertaking CSR activities. However, demand for extended period of limitation was set aside.

- 9. Input Tax Credit on GST paid towards CSR Expenses: Provisions under the CGST Act, 2017: ● While the earlier legislations imposed numerous restrictions on credits, such conditions are now a lot relaxed with Section 17(5) of the CGST Act mentioning a list of supplies for which credit is not available. ● According to Section 16(1) of the CGST Act, every registered person is entitled to take input tax credit on supplies of goods or services or both used in the course or furtherance of business. This is unlike the erstwhile Cenvat credit regime credit was available only if the goods/ services were covered by the definition of inputs, input services or capital goods. ● Therefore, based on the above-mentioned provisions it can be said that input tax credit is available for any inward supply which is used in the course or furtherance of business, unless it is covered by the negative list mentioned under Section 17(5) of the CGST Act

- 10. Contrary Rulings over the subject: ● In the case of Polycab Wires Pvt Ltd reported at 2019-VIL-100-AAR, the applicant had distributed electrical goods to people affected by flood in Kerala against discharge of its CSR obligations. The Kerala AAR held that the applicant distributed electrical items on free basis without collecting any money and for these transactions input tax credit would not be available as per Section17(5)(h) of the KSGST Act and CGST Act. Therefore, it can be seen that the provisions of Section 17(5)(h) of the CGST Act are invoked to deny ITC of goods distributed free of cost for meeting CSR obligations. Section 17(5)(h) of the CGST Act - according to this sub-section, ITC is not available for “goods lost, stolen, destroyed, written off or disposed of by way of gift or free samples”. It is to be seen that the said sub-section merely places ITC restriction on free distribution of goods and does not restrict ITC on provision of services for free. ● In the case of CIT v. Ajax products Ltd reported at (1965) 55 ITR 741, the Supreme Court had held that there was no scope for intendment where the words used by the legislature were clear and unambiguous. Therefore, the restriction under Section 17(5)(h) cannot be made applicable on free provision of services.

- 11. . ● Uttar Pradesh Authority for Advance Ruling (‘AAR’) in the matter of Dwarikesh Sugar Industries Ltd (2021) held that a company is mandatorily required to undertake CSR activities and the same thus, forms a core part of its business process. Hence, the CSR activities are to be treated as incurred in “the course of business”. ● Thus, Uttar Pradesh AAR held that the expenses incurred by the Company in order to comply with requirements of CSR under the Act qualify as being incurred in the course of business and are eligible for ITC in terms of the Section 16 of the CGST Act, 2017. ● Gujarat Authority for Advance Ruling (‘AAR’) in the matter of Adama India Pvt. Ltd (2021) held that “CSR activities, as per Companies (CSR Policy) Rules, 2014 are those activities excluded from normal course of business of the applicant and therefore not eligible for ITC, as per section 16(1) of the CGST Act.”

- 12. Presenter’s comments on whether ITC can be availed on GST paid towards CSR Expenses, incurred in the course or furtherance of business? ● It is relevant to note that the scope of input service under GST is wider and covers all services used in the course or furtherance of business (unless the service comes under ‘blocked credit’). ● However, in case of service tax, as already explained earlier in the presentation, in order to claim CENVAT credit, an input service must have a nexus with the output service. Then only can the credit be availed. So, there exists a clear difference in scope, when the two definitions are viewed. ● In my opinion, therefore, the ruling in M/s Power Finance Corporation should not be considered to be applicable when it comes to availing credit on GST paid towards CSR Expenses, in the course of business.

- 13. . ● However, a clarification is still required because the CESTAT in Power Finance Corporation Ltd. also held that CSR is consequent to the rendering of output services. If that logic is applied to GST, question of availing ITC should not even arise, because CSR expenses will not satisfy the definition under CGST Act which includes goods or services used or intended to be used in the course or furtherance of his business. ● AAR of Uttar Pradesh, on the other hand, in the context of GST, has held that a company is mandatorily required to undertake CSR activities and the same forms a core part of its business process. CSR activities, therefore, are to be treated as incurred in “the course of business”. The expenses, thus, incurred by the Company in order to comply with requirements of CSR under the Act qualify as being incurred in the course of business and are eligible for ITC in terms of the Section 16 of the CGST Act, 2017. ● I think that there is a need for another ruling, either from a larger bench of CESTAT or from a High Court or the Supreme Court, overturning what has been laid down in M/s Power Finance Corporation case. The 2 member bench, instead of clearing the ambiguities, has contributed to further confusion when it comes to the status of CSR activities, being part of a business.

- 14. . ● In my view, considering the mandatory requirement of CSR under Companies Act, 2013 and other direct & indirect advantages which the Corporate derives by discharging CSR, such activities should well be considered a part of business, because of their assistance in smooth running of a business. ● MOREOVER, as already pointed out, while discussing Polycab Wires Pvt Ltd case, there exist doubts over the rationale in respect of the distinction created when it is about availability of ITC on free distribution of goods (and services) under section 17(5) of the CGST Act. It is high time that the government brings in amendment to ensure that ITC is allowed for distribution of goods and services alike for CSR. This will encourage the industry to come forward for taking up similar projects of CSR which otherwise requires government support.

- 15. THANK YOU

Editor's Notes

- Cenvat Credit- Service providers, who collect and remit tax from their customers are also service receivers who pay tax to other service providers themselves. For instance, a software development company which collects and remits service tax on its billing also pays service tax on services availed by the company like telephone charges, security charges, consultation charges and more. If a mechanism for CENVAT credit is not available, then the tax on tax has a cascading effect – ultimately increasing the final charge of the service too high. To avoid this effect, the Government allows service providers to take credit of tax paid for the services availed in providing output service. Corporate social responsibility, or CSR, activities reflect a business’s accountability and commitment to contributing to the well-being of communities and society through various environmental and social measures. CSR activities may include environmental initiatives, charity work, ethical labour practices and volunteer projects.

- 135 (5)- The Board of every company referred to in sub-section (1), shall ensure that the company spends, in every financial year, at least two per cent. of the average net profits of the company made during the three immediately preceding financial years, 5[or where the company has not completed the period of three financial years since its incorporation, during such immediately preceding financial years] in pursuance of its Corporate Social Responsibility Policy: (Section 135 of the Act, mandates companies to spend 2% of their average net profits towards CSR expenses. If not complied with, action is taken extending to fine and imprisonment) In terms of section 73 of Finance Act, 1994, the demand of service tax can be raised within five years by invoking the extended period of limitation.(otherwise, it’s one year) (Maharaja Crane Services Vs Commissioner of CGST (CESTAT Chandigarh) ALSO, even when as assessee has suppressed facts, the extended period of limitation can be invoked only when ”suppression” or “collusion” is wilful with an intent to evade payment of duty- CESTAT Delhi in SOTC Travels Services v. Principal Commr. Of CE. SECTION 76 Finance Act- Penalty for Failure to pay service tax – Chapter V of Finance Act, 1994 Rule 2(l) CCR- "input service" means any service, used by a provider of taxable service for providing an output service; or used by the manufacturer, whether directly or indirectly, in or in relation to the manufacture of final products and clearance of final products upto the place of removal and includes services used in relation to setting up, modernization, renovation or repairs of a factory, premises of provider of output service or an office relating to such factory or premises, advertisement or sales promotion, market research, storage upto the place of removal, procurement of inputs, activities relating to business, such as accounting, auditing, financing, recruitment and quality control, coaching and training, computer networking, credit rating, share registry, and security, inward transportation of inputs or capital goods and outward transportation upto the place of removal;

- Rule 2 (l) "input service" means any service, (i) used by a provider of taxable service for providing an output service; or (ii) used by the manufacturer, whether directly or indirectly, in or in relation to the manufacture of final products and clearance of final products upto the place of removal and includes services used in relation to setting up, modernization, renovation or repairs of a factory, premises of provider of output service or an office relating to such factory or premises, advertisement or sales promotion, market research, storage upto the place of removal, procurement of inputs, activities relating to business, such as accounting, auditing, financing, recruitment and quality control, coaching and training, computer networking, credit rating, share registry, and security, inward transportation of inputs or capital goods and outward transportation upto the place of removal;

- Section- 76 With regards to the penalty levied in the event of failure of service tax payment or deference of service tax payment, Section 76 has been amended to determine whether the failure or deference was done with no unscrupulous intention to avoid the payment of service tax. The main aim of the amendment of penal provisions under Section 76 of the Finance Act, was to take into consideration penalties levied on those assessees who have failed to make service tax payments for reasons that are deemed to be without any intent of malice. This means that the penalties levied will not be in accordance with penalties levied on those assessees who actively avoid service tax payments due to unscrupulous activities such as fraud, concealment of information, violation of the provisions and rules of the Act etc. SECTION 76 Finance Act- Penalty for Failure to pay service tax – Chapter V of Finance Act, 1994 In terms of section 73 of Finance Act, 1994, the demand of service tax can be raised within five years by invoking the extended period of limitation.(otherwise, it’s one year) (Maharaja Crane Services Vs Commissioner of CGST (CESTAT Chandigarh) ALSO, even when as assessee has suppressed facts, the extended period of limitation can be invoked only when ”suppression” or “collusion” is wilful with an intent to evade payment of duty- CESTAT Delhi in SOTC Travels Services v. Principal Commr. Of CE.

- CCR, 2004- Rule 2 (l) "input service" means any service, (i) used by a provider of taxable service for providing an output service; or (ii) used by the manufacturer, whether directly or indirectly, in or in relation to the manufacture of final products and clearance of final products upto the place of removal and includes services used in relation to setting up, modernization, renovation or repairs of a factory, premises of provider of output service or an office relating to such factory or premises, advertisement or sales promotion, market research, storage upto the place of removal, procurement of inputs, activities relating to business, such as accounting, auditing, financing, recruitment and quality control, coaching and training, computer networking, credit rating, share registry, and security, inward transportation of inputs or capital goods and outward transportation upto the place of removal; SECTION 76. Penalty for failure to pay service tax.— (1) Where service tax has not been levied or paid, or has been short-levied or short-paid, or erroneously refunded, for any reason, other than the reason of fraud or collusion or wilful mis-statement or suppression of facts or contravention of any of the provisions of this Chapter or of the rules made thereunder with the intent to evade payment of service tax, the person who has been served notice under sub-section (1) of section 73 shall, in addition to the service tax and interest specified in the notice, be also liable to pay a penalty not exceeding ten per cent. of the amount of such service tax : Provided that where service tax and interest is paid within a period of thirty days of — (i) the date of service of notice under sub-section (1) of section 73, no penalty shall be payable and proceedings in respect of such service tax and interest shall be deemed to be concluded; (ii) the date of receipt of the order of the Central Excise Officer determining the amount of service tax under sub-section (2) of section 73, the penalty payable shall be twenty-five per cent. of the penalty imposed in that order, only if such reduced penalty is also paid within such period. (2) Where the amount of penalty is increased by the Commissioner (Appeals), the Appellate Tribunal or the court, as the case may be, over the above the amount as determined under sub- section (2) of section 73, the time within which the reduced penalty is payable under clause (ii) of the proviso to sub-section (1) in relation to such increased amount of penalty shall be counted from the date of the order of the Commissioner (Appeals), the Appellate Tribunal or the court, as the case may be. CSR- LEGAL OBLIGATION AND NOT INPUT SERVICE Hon’ble CESTAT observed that output Services rendered by the Appellant were “banking and other financial services” and after rendering these services, since the Appellant earns profit or meets criteria under Section 135 of the Companies Act, 2013, it results in a legal obligation on them to spend on activities of CSR. Input Services are those which are used for providing output services. CSR arises only after output services are provided and the Appellant earns some profit. LANGUAGE OF RULE 2(I) CCR, 2004 Reading Rule 2(I) of CCR, 2004 shows that not any service used by the provider of output services in running its business qualifies as ‘input service’ but only the ones which are used for providing output services are termed as ‘input services’. Had legislative intent been to allow an output service provider to avail Cenvat Credit on all the services they use during business, then, then rule would have read as ‘any service used by the provider of output service’. However, the definition reads as: “for providing output services”. Expenses towards CSR are not used for providing output services, thus, they are not to be construed as input services, for providing ‘banking and other financial services’. CSR- NOT MENTIONED EVEN IN THE INCLUSION CLAUSE FURTHER, Hon’ble CESTAT observed the definition of input services is followed by an inclusion clause and an exclusion clause. Inclusion part of the definition includes some of those services which may not be used for providing output service but are still to be construed as input services. These include the services used for modernisation, renovation, repairs of factory premises, advertisement etc. (Legislative intent to include them, even though, they do not have a nexus with output services. CSR is not included in the inclusion clause. DEMAND FOR PENALTY: On the question of extended period of limitation and imposition of penalties, there is no evidence of fraud or collusion or wilful statement or suppression of the facts in the present matter. Therefore, the demand can be raised only within the normal period of limitation. The denial of Cenvat Credit on expenses incurred on CSR within normal period of limitation is upheld and the demand for extended period of limitation and penalty is set aside.

- - MILLIPORE- “That apart, the definition of input services is too broad. It is an inclusive definition. What is contained in the definition is only illustrative in nature. Activities relating to business and any services rendered in connection there- with, would form part of the input services. The medical benefit extended to the employees, insurance policy to cover the risk al accidents to the vehicle as well as the person, certainly would be a part of the salary paid to the employees. Landscaping of factory or garden certainly would fall within the concept of modernization, renovation, repair, etc., of the office premises. A any rate, the credit rating of an industry is depended upon how the factory is maintained inside and outside the premises The Environmental law expects the employer to keep the factory without contravening any of those laws. That apart, now the concept of corporate social responsibility is also relevant. It is to discharge a statutory obligation, when the employer spends money to maintain their factory premises in an eco- friendly, manner, certainly, the tax paid on such services would form part of the costs of the final products. In those circumstances, the Tribunal was right in holding that the service tax paid in all these cases would fall within the input services and the assessee is entitled to the benefit thereof.” ESSEL- To pin point the dispute, it is now to be looked into as to if CSR can be considered as input service and be included within the definition of "activities relating to business" and if in so doing, a company's image before corporate world is enhanced so as to increase its credit rating as found from the handbook of CSR activities discussed above. The answer is in the affirmative since to win the confidence of the stakeholders and shareholders including the people affected by the supply of raw material from their locality, say natural resources like mines and minerals etc., the hazardous emission that may result in production activities.” ESSEL IN BRIEF- Corporate Social Responsibility (CSR) can be considered as Input service and be included within definition of 'activities relating to business' for availing CenvatCredit

- Input Tax Credit or ITC is the tax that a business pays on a purchase and that it can use to reduce its tax liability when it makes a sale. In other words, businesses can reduce their tax liability by claiming credit to the extent of GST paid on purchases. Goods and Services Tax (GST) is an integrated tax system where every purchase by a business should be matched with a sale by another business. This makes flow of credit across an entire supply chain a seamless process.

- 16 (1) Eligibility and conditions for taking input tax credit.— (1) Every registered person shall, subject to such conditions and restrictions as may be prescribed and in the manner specified in section 49, be entitled to take credit of input tax charged on any supply of goods or services or both to him which are used or intended to be used in the course or furtherance of his business and the said amount shall be credited to the electronic credit ledger of such person. Business is defined under CGST Act, 2017 as (a) any trade, commerce, manufacture, profession, vocation, adventure, wager or any other similar activity, whether or not it is for a pecuniary benefit;(b) any activity or transaction in connection with or incidental or ancillary to sub-clause (a); the phrase “in course or furtherance of business” has not been defined in the law. Dictionary meaning of the term “furtherance” implies advancement, promotion of scheme, etc. Therefore, furtherance of business would imply advancement or promotion of business. Any activity carried on with a purpose to achieve business objectives, business continuity and stability would per se amount to an activity in course or furtherance of business. BLOCKED CREDIT: 17 (5) Notwithstanding anything contained in sub-section (1) of section 16 and sub- section (1) of section 18, input tax credit shall not be available in respect of the following, namely:— (h) goods lost, stolen, destroyed, written off or disposed of by way of gift or free samples; and

- BLOCKED CREDIT: 17 (5) Notwithstanding anything contained in sub-section (1) of section 16 and sub- section (1) of section 18, input tax credit shall not be available in respect of the following, namely:— (h) goods lost, stolen, destroyed, written off or disposed of by way of gift or free samples; and

- Section 135(7) is a penal provision under the Act which deals with penalty on non-compliance of section 135(5) and (6). It was observed by the UP AAR that a Company fulfilling eligibility criteria under section 135(1) of the Act is required to mandatorily spend towards CSR and thus, must comply with these provisions to ensure smooth run of business. As per Companies (CSR Policy) Rules, 2014, (d) "Corporate Social Responsibility (CSR)" means the activities undertaken by a Company in pursuance of its statutory obligation laid down in section 135 of the Act in accordance with the provisions contained in these rules, but shall not include the following, namely:- (i) activities undertaken in pursuance of normal course of business of the company:

- Section 135(7) is a penal provision under the Act which deals with penalty on non-compliance of section 135(5) and (6). It was observed by the UP AAR that a Company fulfilling eligibility criteria under section 135(1) of the Act is required to mandatorily spend towards CSR and thus, must comply with these provisions to ensure smooth run of business.