Presenter _______________________________ Section __________.docx

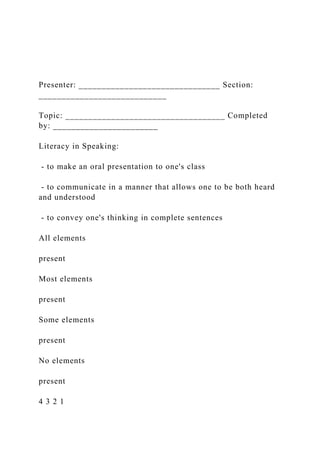

- 1. Presenter: _______________________________ Section: ____________________________ Topic: ___________________________________ Completed by: _______________________ Literacy in Speaking: - to make an oral presentation to one's class - to communicate in a manner that allows one to be both heard and understood - to convey one's thinking in complete sentences All elements present Most elements present Some elements present No elements present 4 3 2 1

- 2. 4 3 2 1 4 3 2 1 4 3 2 1 All elements present Most elements present Some elements present No elements present 4 3 2 1 4 3 2 1 4 3 2 1 4 3 2 1 4 3 2 1 4 3 2 1 TOTAL NUMBER OF POINTS:

- 3. 35 - 40 = A 29 - 34 = B 23 - 28 = C 17 - 22 = D 10 - 16 = F Total Score __________ Volume (Presenter can be easily heard by all. No gum, etc.) CONTENT Introduction (Presentation begins with a clear focus/thesis.) Topic Development PPT Slides a. Presentation highlights key ideas and concludes with a strong final statement. a. Presentation includes all elements necessary to fully cover the topic. b. Presentation is clearly organized. (Material is logical sequenced, related to thesis, and not repetitive.) c. Presentation shows full grasp and understanding of the material a. Strong design including use of pictures,

- 4. avoids complete sentences, meaningful connection to topic. Conclusion Delivery (Presenter doesn't rush, shows enthusiasm, avoids likes, ums, kind ofs, you knows, etc. Uses complete sentences.) SPEAKING SKILLS Eye Contact (Presenter keeps head up, does not read, and speaks to whole audience.) Posture (Presenter stands up straight, faces audience, and doesn't fidget.) ACCTG. 390W - PRESENTATION RUBRIC 6/9/2015 From "write-up" to right profitable http://journalofaccountancy.com/issues/2013/apr/20127002.html 1/12 Journal of Accountancy From "write-up" to right profitable For CPAs, the silver lining in the cloud could be a gold mine in client accounting services.

- 5. BY JEFF DREW March 31, 2013 CPA firms for decades saw little upside to providing basic acco unting services to business clients. Bookkeeping and other “writeup” activities required extensive data entry and document transfer that chewed up man-hours but did not require much specialized kno wledge. Client accounting services (CAS) were seen as commodities that brought with them depress ed hourly rates and a risk of costly errors. It simply made more sense, not to mention money, for C PA firms to focus on higher-margin tax and audit work. It is a testament then to the transformative power of technologic al and market forces that CAS is now being touted in some circles as the future of public accounting. The digitization of financial data and the evolution of cloud computing, broadband connectivity, and mob ile devices have made it possible for accounting firms and their clients to access critical information and applications from virtually anywhere at any time. This has set the stage for the development of cloud- based software packages that allow CPAs and clients to work from a shared database of the client’s essential financial data. Cloud-based software automates or otherwise greatly reduces the manual lab or associated with transactional accounting functions, opening the door for CPA firms to offer o utsourced CAS in a scalable model capable of serving many clients and generating a steady stream of revenue and profits (see Exhibit 1 for a list of services commonly included in CAS offerings).

- 6. “CAS clients are like an annuity for a firm,” said Michael Smith , CPA/CITP, a McGladrey partner who helped build an outsourced accounting business for the firm. The business potential of CAS is bolstered by increased demand from small companies and nonprofits for outside help with accounting functions. In addition, manage ment teams are seeking higher levels of industry-specific knowledge to navigate increasingly complex c ompetitive and regulatory environments. These factors have sown the seeds for a fertile CAS market that some CPA firms already are harvesting. Steve Chaney, CPA, has leveraged cloud computing and market specialization to build a California-based accounting firm that serves 300 churches and f aith-based nonprofits. Chaney & Associates enjoys what its founder calls an “endless” supply of work and high profit margins thanks to monthly fees that range from $1,000 to $8,000. https://googleads.g.doubleclick.net/aclk?sa=L&ai=B3qey5DF3V Y__DO6olALz6oJAoKzd1AcAAAAQASCQqeodOABY- ODpmoUCYMne-IbIo- gZsgEYam91cm5hbG9mYWNjb3VudGFuY3kuY29tugEJZ2ZwX 2ltYWdlyAEC2gE9aHR0cDovL2pvdXJuYWxvZmFjY291bnRhb mN5LmNvbS9pc3N1ZXMvMjAxMy9hcHIvMjAxMjcwMDIuaH RtbMACAuACAOoCEC83NTYxL2pvZmF3ZWJyZXP4AoTSHo ADAZADrAKYA- ADqAMByAOZBOAEAZAGAaAGFNgHAQ&num=0&cid=5Gia ROj7wK- 5pnbuA22MZ28Y&sig=AOD64_3hUuY23zOyAk3w7bdfzCGdq Cgp3w&client=ca-pub- 5812885488916435&adurl=http://sps.northwestern.edu/info/acc ounting.php%3Futm_source%3DAICPA%26utm_medium%3Dba nner300x250%26utm_term%3Dfebmar%26utm_content%3DAcc

- 8. 6/9/2015 From "write-up" to right profitable http://journalofaccountancy.com/issues/2013/apr/20127002.html 2/12 Other practitioners, including several who participated in panel discussions at CPA2Biz’s inaugural Digital CPA Conference in December, report monthly fees as hi gh as $15,000 per client and hourly rates of as much as $800 for advisory and project work. How can CPA firms launch a cloud-based outsourced accountin g practice and develop it into a profitable line of business, either as the main focus of a firm or as a complement to tax or other services? This article provides direction drawn from a road map developed by technology author and business consultant Geoffrey Moore and also offers insights fro m practitioners who have blazed the trail in this area. THE FOUNDATION FOR CAS A trio of mega-trends has laid the groundwork for the growth of CAS, said Moore, who interviewed dozens of CPAs while researching Accounting Services: Harnes s the Power of Cloud Computing, a white paper he developed for CPA2Biz, the AICPA’s technolog y and marketing services subsidiary. Moore describes the three forces as follows: Digitization. For accounting firms, this refers to the move from paper to paperless. The availability of financial information in digital form makes it possible to run cl

- 9. oud-based applications that swiftly process business data and identify, analyze, and report key process indic ators for management. In this and other ways, the cloud breaks down barriers to productivity and r educes the limitations of size, granting small companies and firms access to computing power previousl y reserved only for large enterprises. Virtualization. The connectivity enabled by cloud computing an d mobile devices has removed geographic barriers, meaning that CPAs no longer have to be ph ysically present to connect with clients. Technologies that allow for real-time communication and collab oration over the internet have made it possible for accountants to work with people they have never m et in person. Along the same lines, technologies such as Skype, WebEx, smartphones, instant messa ging, email, and a host of internet- based applications make it possible to have virtual workforces who can work from virtually anywhere provided they have an internet connection. Transformation. This refers to a shift from generalization to spe cialization that has been taking place among small businesses for the past two decades, Moore said. B usiness has become so complex and specialized that business owners and management need advisers who understand the unique characteristics of their industry. Cloud and business intelligence applications make it possible for CPAs to provide advice based on real-time information streams. “The ability to provide business intelligence from a quick analysis of data is a miracle,” Moore said. NOT RIGHT FOR EVERY FIRM

- 10. Not every accounting firm is suited to offer cloud-powered CAS . Firms that audit publicly traded companies can run into problems with SEC and PCAOB regulati ons related to the offering of consulting services. Firms that perform audits only on private organization s must be careful to offer CAS only to 6/9/2015 From "write-up" to right profitable http://journalofaccountancy.com/issues/2013/apr/20127002.html 3/12 non-attest-level clients or risk impairing their independence. Fo r more information, see the AICPA Code of Professional Conduct, Section 100, Independence, Integrity, and Objectivity, and Interpretation No. 101-3, Nonattest Services. Jennifer Katrulya, CPA/CITP, CGMA, provides CPAs with train ing on how to develop a cloud-enabled CAS business line, both through her firm, the Connecticut-based Business Management Resource Group (BMRG), and through her role as the founding writer and lead facilitator of CPA2Biz’s two-day CAS training workshop. Katrulya recommends to her students th at they assess the profitability of their audit and attest engagements and consider whether it would mak e their firms more money to drop audit and convert their attest clients to CAS clients. For firms with s mall to midsize clients, CAS can be “a lot more profitable” than audit engagements, Katrulya said, though that’s not the case for firms with large audit engagements.

- 11. CPA firms considering a foray into CAS also need to consider w hether such a move makes sense for their clients and for their firm’s culture. Some firms are better o ff sticking with core tax and audit offerings or operating in a niche that caters to clients who don’t want to deal with the hassles of converting to a paperless tax system. “There will be some small set of firms that will succeed by saying, ‘We’re never going to use digital, ever,’ ” Moore said. “But the growth of the market will be in the digital domain.” SELLING CAS TO STAFF AND CLIENTS: CHALLENGES AN D BENEFITS Firms that want to launch a cloud-based CAS business must obt ain staff and client buy-in. With staff, firms may emphasize the work/life benefits that can come when a firm moves to an all-digital, cloud- based platform, Smith said. “Some of our staff have family responsibilities that interfere wit h work hours,” he said. With cloud-based applications and data, “it’s much easier to work remotely,” he s aid. With clients, firms can speak to the increased efficiencies and r educed errors associated with the automated financial reporting and data transfer possible in a pap erless, cloud-connected setup. Other benefits to the client include: Lower costs. Small companies can outsource their accounting fu nctions for less money than it would cost to staff a full-time accounting department.

- 12. More time to focus on running their core business. With the CP A firm handling the accounting recordkeeping, business owners can devote their attention to im proving operations and pursuing new market opportunities. Instant access to key performance indicators. Many firms provid e KPI dashboards giving management a real-time view of the company’s essential financi al metrics. 6/9/2015 From "write-up" to right profitable http://journalofaccountancy.com/issues/2013/apr/20127002.html 4/12 Access to expert advice. Outsourced accounting departments oft en provide experienced CPAs, many with industry-specific expertise and management-accounting kn owledge, to supply financial and strategic advice in a consulting role. Many firms term these type s of services as virtual or outsourced CFO, but those names can be misleading because the “virtual C FO” provided by the accounting firm usually does not work full-time hours with the client or perform all of the duties associated with the CFO position (for more, see the sidebar, “The Reality of Virtual CFO ”). THE ROAD MAP TO CAS In his white paper, Moore lays out a four-stage process to devel oping a high-value CAS business. Following is a tour of the plan’s key parts.

- 13. Stage One: A Necessary Evil Even with technological advances, there’s only so much efficien cy CPA firms can provide in write-up, an area Moore terms “a necessary evil.” To maximize the value they can offer clients, CPAs should specialize in an industry or business segment, as Chaney has wit h faith-based nonprofits and Katrulya has with venture capital firms. Firm leaders should pick a business segment they and their staff are passionate about, but they also must be careful to pick a niche that can provide enough business for the firm to survive. The target segment, or industry vertical, Moore writes in his white paper, s hould be “big enough to matter” but “small enough to lead” and also should fit well with the firm’s r eservoir of skills and expertise. Firms can add other niches at a later date. Katrulya’s BMRG serves medic al, legal, and nonprofit clients in addition to venture capital firms, but the firm limits its CAS offerings to those four “verticals.” “Industrybased expertise is critical,” Katrulya said. “Expertise is what we sell.” Along with selecting a niche, firms must have some baseline tec hnology in place before venturing into CAS. Most important is having an online system of record that i s available 24 hours a day, seven days a week to both clients and CPAs working from any location. “T here are two reasons to want to have a common system of record,” Moore said in an interview. “One is to have the bookkeeping happen in a single place so that you never have to copy an entry from one sy stem to another system, particularly a

- 14. manual copy. That’s kind of the kiss of death in this system.” The second reason to have a common system of record is that it provides a place where the CPA firm can use online business intelligence tools to analyze company d ata and provide actionable intelligence to the client. This can lead to more strategic discussions betwee n the firm and the client. “That’s a very high return on having a common system of record,” Moore said. The other baseline technology to have in place is a single, cloud -based point of exchange for all documents between the CPA firm and the client, Moore said. Stage Two: Establishing the Practice Establishing a CAS practice requires the development of a clien t roster. Many practitioners presenting 6/9/2015 From "write-up" to right profitable http://journalofaccountancy.com/issues/2013/apr/20127002.html 5/12 at the Digital CPA Conference emphasized the importance of sta ndardization in client development. CPA firms that standardize software and processes can build or use templates to set up clients in a fast, repeatable process. Blue Bell, Pa.-based Fesnak and Associ ates requires all of its new clients to use the Intacct web-based accounting and financial platform, sai d Nicole Ksiazek, CPA, a senior manager and cloud accounting practice leader at Fesnak. ( Edito r’s note: Intacct is one of a handful of cloud-based applications offered through the CPA2Biz Trusted

- 15. Business Advisor program, and Chaney and Ksiazek have served as facilitators for CPA2Biz’s two-day CAS training workshop.) A CAS client roster is composed of two types of clients, existin g and new. With existing clients, it’s essential to select the right ones to transition. Not all clients are suited for a digital, CAS setup. In those cases, firms can either transition the client to another CPA firm or maintain the current relationship parameters with the client— a viable option at firms that offer other services in addition to C AS. As for the clients that firms decide to move to the cloud, there a re a number of approaches practitioners can take. Some at Digital CPA recommended starting with a lar ger client, which is less likely to push back on pricing issues. Others suggested that there are fewer he adaches when transitioning smaller clients. Chaney recommends starting with the clients with whom you ha ve the best relationship. He employed that approach and didn’t lose any clients. “I launched our digital journey with 75 clients,” Chaney said. “The goal was to have 200 clients in five years. We hit it in one year.” For new clients, practitioners at Digital CPA recommended a thr ee-phase process. First phase. Conduct a client needs assessment. Firms charge be tween $2,000 and $5,000 for this. Christine Triantos, CFO and virtual business solution consultant with Colorado-based accounting firm

- 16. Anton Collins Mitchell, said she uses her first meeting with clie nts to ask them about the pain points in their companies. This information is essential in determining wh ether and how to proceed with a client. Second phase. This consists of client on-boarding and migration . Firms generally charge double the first-phase costs for this part of the process. Third phase. Once clients are set up and running, firms generall y charge $1,000 to $5,000 per month for CAS, though advisory and project work can push the fee sig nificantly higher. Upfront costs with new clients can vary based on firm philosoph y and individual situations. McGladrey’s Smith advises firms to use judgment on upfront costs. “We want clients to have skin in the game, but don’t charge too much,” he said. Fesnak and Associates has gon e back and forth on what to charge, according to Ksiazek, who said firms can absorb costs upfront a nd make up the difference later. Other options include spreading upfront costs over the course of the fi rst year and offering credit. Stage Three: Expanding the Practice Accounting firms must leverage the power of virtualization to g row their client and talent base. CPAs need to use cloud-based business intelligence and data analytics to detect patterns in their clients’ 6/9/2015 From "write-up" to right profitable http://journalofaccountancy.com/issues/2013/apr/20127002.html

- 17. 6/12 companies that the clients have not yet discovered. For instance, a CPA might develop a continually updating chart visualizing the change in certain business metric s over a period of time. When updated in real time, the chart might identify an investment opportunity or illuminate a cash flow problem that requires quick action. In either case, the CPA should bring the i nformation to the client’s attention. “As a trusted adviser, you need to provoke the conversation,” M oore said. In addition, firms can turn CAS into a growth business by using virtualization to be digitally present in other cities and interact with clients without having to actually be there. “That turns out to work very well in vertical markets,” Moore said. Moore lists four key principles for Stage Three: 1. Streamline your work flow processes to be location independ ent. 2. Re-engineer your internal communications and collaboration processes to support a virtual organization. 3. Engage your clients through digital channels and migrate you r interactions online. This involves the use of mobile devices, social media sites such as Twitter an d YouTube, video services such as FaceTime and Skype, and instant messaging services includin g texting. 4. Extend your target market’s geographical boundaries while m aintaining your focus on target industry and core differentiation. This is where industry experti

- 18. se becomes more important than location. As Moore writes in his white paper: “A faith-based ins titution in Birmingham has more in common with a sister organization in Boston than with a restaur ant franchisee just down the street.” Stage Four: Deepening the Practice As accounting firms spend more time working in client business es and in specific industry verticals, their CPAs will gain crucial experience and expertise in the issu es of most importance to their clients. In addition, firms should enable CPAs to attend industry conferenc es and access other learning opportunities to become experts in their field, Katrulya said. On ce they achieve expert status, CPAs can take on a trusted adviser role, one in which the CPA becomes m ore of a strategic partner than a technician, Moore writes in the white paper. As a strategic partner, the CPA becomes an essential resource to the business owner, acting as a consultant and taking on special projects that address client-spe cific issues and command high margins because of the expertise required. One such project could involv e a CPA helping to develop a five-year financial model that forecasts the cash flow and tax implications of an acquisition a client is considering, said Smith, the McGladrey partner. Other examples of project work CPAs can take on include: Analyzing critical processes in the client’s business and potenti ally re-engineering them to make them more efficient or produce more timely and accurate financi al information.

- 19. 6/9/2015 From "write-up" to right profitable http://journalofaccountancy.com/issues/2013/apr/20127002.html 7/12 Assisting a client with an international expansion. This could in volve helping the client understand international tax matters and develop policies and procedures to deal with tax compliance issues. Part of this process could include developing new accounting pr ocesses to support currency conversion and value-added-tax (VAT) reporting. Doing projects for individual clients is “very valuable” work wi th strong margins, Smith said, but it’s difficult to scale up because it is so customized. Thus, Smith sai d, firms cannot expect these types of advisory and project services to make up more than a third of a CAS business. “There needs to be a mix,” he said. From Katrulya’s perspective, the greatest long-term value of clo ud-enabled CAS comes from the development of turnkey accounting services that leverage the fir m’s industry-specific expertise but are standardized so that the process of delivering them is repeatable across many clients. “The key is the growth of the scalable portion,” she said. “What we are being paid for is being a firm with a plan.”

- 20. CONCLUSION Barry Melancon, CPA, CGMA, president and CEO of the AICP A, points to swiftly increasing complexity as “the No. 1 opportunity and No. 1 threat” for accounting firms . In the small business sector, radical and rapid change in the business and regulatory landscape has s pawned increased demand for outsourced accounting departments and advisory services. This, in turn, has created a significant opportunity for CPAs willing to become experts in client industr ies and to invest in technologies that facilitate cloud-based communication and collaboration with cli ents. Long-term, profitable relationships beckon for CPAs who can le verage digitization and virtualization to provide timely, transformative business intelligence to small bu siness owners. Does this mean that CAS is the real deal for the future of public accounting? No one can s ay for sure, but for several firms already operating in the CAS space, their leaders already are seeing the upside. To view Geoffrey Moore talking about his road map to CAS, cli ck here (/videos/technology-client- services.html). Exhibit 1: CAS: An Overview A multitude of services can fall under the client accounting serv ices (CAS) umbrella. Here is a quick look at some of the major types of services. http://journalofaccountancy.com/videos/technology-client- services.html

- 21. 6/9/2015 From "write-up" to right profitable http://journalofaccountancy.com/issues/2013/apr/20127002.html 8/12 General accounting. This includes the monthly close process an d general ledger maintenance. Budgeting and forecasting. This can be customized as needed to specific departments or projects. Reporting and analytics. This often calls for the development of dashboards displaying key performance metrics that the client’s management team can see. Tax administration. Planning and return preparation. Technology services. Helping clients choose the right software and tweaking the applications so that they integrate well with one another. Training clients and st aff on how to use the applications. Payroll. This process makes sure the client pays its employees. Accounts payable. This function ensures the client is paying its bills. Accounts receivable. This covers everything related to the client getting paid by its customers. Source: Michael Smith, McGladrey. The Reality of Virtual CFO

- 22. Many accounting firms offer virtual CFO and virtual controllers hip services, but those names often don’t reflect the true nature of the CFO and controller positions. For instance, some firms use the terms virtual CFO and virtual c ontrollership interchangeably despite the fact that the two roles are “very different,” points out Jennif er Katrulya, CPA/CITP, CGMA, the CEO of Connecticut-based Business Management Resource Group (B MRG) and the developer of training programs for CPAs interested in adding cloud-based client acco unting services (CAS) to their firms’ product menus. Controllership services, by Katrulya’s definition, include most o f the client accounting services mentioned in the main article “From ‘WriteUp’ to Right Profita ble.” At the higher end, these services include preparing and sending out reports that provide clients w ith the essential financial metrics of their companies, as well as the development of key performance indic ator dashboards. Virtual CFO services can refer to controllership services in addi tion to advisory or project work for individual clients. Accounting firms sometimes allocate top-lev el CPAs, usually partners or others with management experience, to serve as a part-time CFO for a client . These CPAs can offer clients value by doing budgets, reviewing insurance policies, interfacing with bankers, and managing and predicting cash flow, but part-time CFOs lack the bandwidth to perform th e full range of CFO duties, including treasury, strategic, and day-to-day management; staff evaluation ; investor relations; oversight of

- 23. information technology initiatives; and deep collaboration with, or direct oversight of, the human resources department. 6/9/2015 From "write-up" to right profitable http://journalofaccountancy.com/issues/2013/apr/20127002.html 9/12 “I believe a CPA firm's risk exposure will grow by holding out t hese advisers to be CFOs, controllers, etc., or de facto client management or executives when in fact t hey are not performing the full range of functions for such an executive position,” said Ed Schultz, CPA , MBA, a partner at executive services firm Tatum LLC who also serves as a JofA editorial adviser. In his role at Tatum, which provides executives who work on a contract basis with clients, Schultz ha s held interim CFO and other senior management positions for more than a dozen companies. “There is a big difference between a real CFO and other senior f inancial managers and one who kind of ‘gets it,’ and not every firm has the resources to have practicing CFOs do this work,” he said. Part-time CFOs also aren’t as available as full-time CFOs to ad dress day-to-day executive leadership and big-picture questions brought up in real time by senior man agement, such as major expenditures and merger-and-acquisition opportunities. “There definitely comes a point where we recommend a full-tim e CFO for our clients,” Katrulya said. “If a

- 24. client needs 20 to 25 hours or more per week from us … the nee ds become such that it can’t be standardized.” In those situations, firms providing standardized CAS can partn er with other firms that specialize in supplying contract CFOs who have management accounting exp erience and can focus on meeting the client’s needs. BMRG has entered into such arrangements, whic h Katrulya recommends as a good option for firms just getting started with CAS. EXECUTIVE SUMMARY Technological advances, most notably cloud computing, have m ade it possible for accounting firms to profitably provide outsourced accounting services. Clo ud-based software applications and shared databases have automated most of the manual data entry and transfer that made “writeup” a low-margin business. Rapid change and increasing complexity in the marketplace are driving up demand for outsourced accounting services. Upper management teams at sm all and medium-size companies want to devote more resources to improving business and less to handling bookkeeping. A white paper written by technology guru Geoffrey Moore for A ICPA subsidiary CPA2Biz lays out a road map for CPA firms to launch and grow a cloud-based outsourced accounting practice. Moore credits three mega-trends— digitization, virtualization, and transformation—for fertilizing the field for client accounting services (CAS), a field that has pr

- 25. oved lucrative for a number of accounting firms. Cloud-based CAS is not right for every firm or every client. Fir ms that perform audits could run into regulatory and independence concerns. Firms considering a fora y into CAS may continue to offer other services, such as tax, but they should specialize their CAS pract ice in an industry vertical. 6/9/2015 From "write-up" to right profitable http://journalofaccountancy.com/issues/2013/apr/20127002.html 10/12 Firms that embrace cloud-based CAS must obtain staff and clien t buy-in and make the necessary technology investments. At a minimum, firms need a shared online system of record that is available to clients and CPAs at any time from any location w ith an internet connection. Moore’s road map consists of four stages. The journey starts wit h recognizing that client accounting services are necessary. The next stages cover how to establish, e xpand, and deepen the practice. CPAs who develop deep expertise in their industry vertical shou ld look for opportunities to provide strategic advice and business intelligence to their client s. The goal is to move from a compliance adviser to a strategic adviser trusted to execute high -margin, customized projects for clients.

- 26. While consulting services are valuable with a lot of margin, the y are not easily scalable. As a result, firms in the CAS space should aim for a mix of consultin g and turnkey CAS engagements. Jeff Drew is a JofA senior editor. To comment on this article or to suggest an idea for another article, contact him at [email protected] (mailto:[email protected]) or 91 9-402-4056. AICPA RESOURCES JofA articles “Cloud Security Alliance Endorses AICPA SOC Report (http://ti nyurl.com/bd5pvy5)” “Cloud Adoption Brings Unexpected Costs, KPMG Survey Says (http://tinyurl.com/aeq9lhq)” “Most CPAs See Role in Helping Clients Adopt Technology, AI CPA Survey Finds (http://tinyurl.com/bxlhq4c)” “Accounting Profession at Tech Tipping Point, Wolters Kluwer Exec Says (http://tinyurl.com/au2v34b)” “Heads in the Cloud: Part 1 (/issues/2012/feb/20114580.html),” Feb. 2012, page 20, and “Heads in the Cloud: Part 2 (/issues/2012/mar/20114818.html),” March 20 12, page 34 JofA videos

- 27. “ ‘WriteUp’ Is Now All Right (/videos/technology-client-servic es.html)” “Managing Controls, Risk in the Cloud (/videos/managingcontro lsrisk.html)” “The Cloud: Security and Opportunities (/videos/cloudsecuritya ndopportunities.html)” Publications http://tinyurl.com/au2v34b http://journalofaccountancy.com/videos/technology-client- services.html http://journalofaccountancy.com/issues/2012/mar/20114818.htm l mailto:[email protected] http://tinyurl.com/bxlhq4c http://journalofaccountancy.com/issues/2012/feb/20114580.html http://journalofaccountancy.com/videos/managingcontrolsrisk.ht ml http://journalofaccountancy.com/videos/cloudsecurityandopport unities.html http://tinyurl.com/aeq9lhq http://tinyurl.com/bd5pvy5 6/9/2015 From "write-up" to right profitable http://journalofaccountancy.com/issues/2013/apr/20127002.html 11/12 Geoffrey Moore white paper (http://tinyurl.com/by7kt6y), Acco unting Services: Harness the Power of the Cloud (free PDF)

- 28. “Leverage Advanced Technologies, Achieve Business Goals (htt p://tinyurl.com/bg2tw9o),” AICPA IT Section editorial brief, August 2012 (free) CPE self-study IT: Risks and Controls in Traditional and Emerging Environmen ts (#733520) Service Organization Control Reports: What Companies and Cus tomers Need to Know (#780279, on demand) Write-Up, Payroll and Other Accounting Services: Managing th e Risks (#733763) Conference Practitioners Symposium and Tech+ Conference in partnership with the Association for Accounting Marketing Summit, June 10–12, Las Vegas For more information or to make a purchase or register, go to cp a2biz.com (http://cpa2biz.com/) or call the Institute at 888-777-7077. Website Trusted Business Advisor 2.0 Resource Center (http://tinyurl.co m/7y3sv84) Private Companies Practice Section and Succession Planning Re source Center The Private Companies Practice Section (PCPS) is a voluntary f irm membership section for CPAs that

- 29. provides member firms with targeted practice management tools and resources, including the Succession Planning Resource Center, as well as a strong, colle ctive voice within the CPA profession. Visit the PCPS Firm Practice Center at aicpa.org/PCPS (http://ai cpa.org/PCPS). Information Management and Technology Assurance (IMTA) Se ction and CITP credential In an effort to better recognize and support the breadth of its me mbers’ professional duties and responsibilities, the AICPA has changed the name of the Inform ation Technology Section to the Information Management and Technology Assurance (IMTA) Se ction. The IMTA division serves members of the IMTA Membership Section, CPAs who hold the Certified Information Technology Professional (CITP) credential, other AICPA members, and acco unting professionals who want to http://cpa2biz.com/ http://tinyurl.com/by7kt6y http://aicpa.org/PCPS http://tinyurl.com/7y3sv84 http://tinyurl.com/bg2tw9o 6/9/2015 From "write-up" to right profitable http://journalofaccountancy.com/issues/2013/apr/20127002.html 12/12 maximize information technology to provide information manag ement and/or technology assurance services to meet their clients’ or organization’s operational, co

- 30. mpliance, and assurance needs. To learn about the IMTA division, visit aicpa.org/IMTA (http://aicpa.org /IMTA). © 2015 American Institute of CPAs - All Rights Reserved http://aicpa.org/IMTA