0 20150421 1.digital-transformation_banking_platform_präsentation

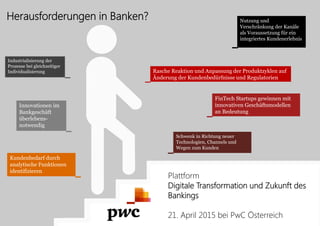

- 1. Kundenbedarf durch analytische Funktionen identifizieren Schwenk in Richtung neuer Technologien, Channels und Wegen zum Kunden Industrialisierung der Prozesse bei gleichzeitiger Individualisierung Innovationen im Bankgeschäft überlebens- notwendig Nutzung und Verschränkung der Kanäle als Voraussetzung für ein integriertes Kundenerlebnis FinTech Startups gewinnen mit innovativen Geschäftsmodellen an Bedeutung Plattform Digitale Transformation und Zukunft des Bankings 21. April 2015 bei PwC Österreich Herausforderungen in Banken? Rasche Reaktion und Anpassung der Produktzyklen auf Änderung der Kundenbedürfnisse und Regulatorien

- 3. >600m accounts Market cap: 389.9bn 1,4bn users Market cap: 226.5bn 244m users Market cap: 177.7bn 155m users Market cap: 72.4bn 332m users Market cap: 33.2bn 800m iTunes Acc. Market cap: 737.4bn 500m users Sold for USD22bn 117m users Sold for USD1.5bn 1bn users Sold for USD1.7bn 618m users Market cap: $231bn 427k FTE Market cap: 186bn 200m user Market cap: 17.6bn 500m users Market cap: $73bn >13m users Market cap: 808.1m Yandex 95m users Market cap: $4.8bn >300m users (Skype) Market cap: 353.1bn 141K FTE Market cap: $32.4bn Selection of leading technology companies worldwide 3 Global digital ecosystems are on the rise

- 4. Termine • ca. 1 Event / Quartal im PwC Office • 23. Juni, 22. September, 1. Dezember • Zeitrahmen von 8:30-10:30 Uhr Agenda • Diskussion der jüngsten Trends / Schwerpunktthemen • Offene Diskussion durch Teilnehmer (Chancen, Risiken, Entwicklung möglicher Strategien) Ziele • Diskussion von Fokusthemen • Informeller / bankenübergreifender Erfahrungsaustausch & Meinungsbildung Teilnehmer • Bereich Strategie, (Digitaler) Vertrieb und (Segment-)Steuerung, Channel Management, Innovationsmanagement • Nach Schwerpunkthema: Servicedienstleister, Gastsprecher,…. Plattform Digitale Transformation und Zukunft des Bankings

- 5. Vorstellungsrunde Name Firma, Funktion Bezug zu Digital Transformation

- 6. The breakthrough of new technologies and its impact on existing business models is still to come 1999-2007: Increasing digitalization S Social Media Mobile Solutions Analytics Cloud Computing • New partnering-models • Flexible value chain networks • Service-orientation • Convergence of industries (Consolidation) • Internet as sales channel • New digital market places • Digitalization of products • Digitalization of processes From 2007: Establishment of disruptive technologies Tomorrow: New digital ecosystems Change of Business Models &

- 7. Three Top Tech Players are leading the Top 5001 10 9 8 7 6 5 4 3 2 1 Apple 737,4bn Google 389,9bn Exxon Mobil 359,2bn Berkshire Hathaway 350,1bn Microsoft 347,5bn Wells Fargo 281,3bn Johnson & Johnson 278,4bn Wal-Mart 266,8bn China Mobile 261,5bn General Electric 255,5bn Market Cap. The Rise of Digital Ecosystems: Global technology companies creating digital ecosystems and preparing the disruption of other industries

- 8. Four important drivers will change banking in Europe Important drivers affecting product and service distribution Increasing competition Stricter investor protection rules Changing customer behaviour Ongoing digitization How are customers behaving and what are they demanding? How do new digital business models increase market share and why are they successful? How do banks use cooperations, partnerships and insights to transform their business into digital? Banks operate in a regulated market, what are key points to be considered for digital? Banking Industry

- 9. Digitisation New business opportunities New user experience • Business and user insights: Real time insights inform about what, when, and how we interact with users and how we operate • New value pools and value shifts: Opportunities for major shifts in value occur as market structures and competitive dynamics are permanently changed • Productivity: Efficiency and effectiveness gains from innovation and automation: processes, tools, and work routines • Personalisation and customisation • Interactive, immersive experiences • Real-time data and analytics • Online- and offline integration • Content as advertising • Leveraging the crowd On the innovation curve digitisation triggers new business opportunities and enables new user experience in digital channels

- 10. Generally, there are two different business model approaches and players in the banking industry "I already have an established digital platform and a strong online DNA that I would like use in order to move into new industries and to generate new revenues." "I solve a very specific customer problem in the financial world by profound technological or procedural changes that offer added value to customers." Self-image Self-image Digital Banking Player Solution-oriented business model approach • Pace and flexibility in the implementation of online business models & security due to existing structures • Being able to set up new products and services quickly • Established market position & online DNA (employees) • Co-dependencies to scale products faster (iPhone with Apple Pay) • Deep know-how about the digital customers, their needs, and digital distribution channels Capabilities Pure Digital Player Platform-driven business model approach • Know-how and expertise in the financial industry and the challenges • Specific procedural and technological solutions • Pace in the implementation of ideas and disruptive innovations • Agile approach and fast adaptability • Strong expertise on digital target groups and their needs Capabilities Banking Industry

- 11. PersonalFinanceManagement Asset&WealthManagement LendingOperations PaymentTransactions Fintechs acting in silosTraditional bank as full service provider Traditional bank Personal Finance Management Asset & Wealth Management Payment Transactions Crowd Funding & P2P Lending Bank Loan Platform Crowd Investing Online Broker Investment Platforms Mobile Bank Mobile Payment Online Payment E-Wallet Financial Management Savings Management P2P Lending with Bank Lending Operations Digital disruption will hit banks bit by bit – FinTechs are leading the way

- 12. A wide range of banks are already partnering, collaborating, or prototyping with FinTechs

- 13. Screening of startups & investors Matchmaking between startups & investors Consulting for Intern. Growth & Scaling Assistance in Fundraising & Exits Build up of infrastructures for growth through resources and access For investors PwC Accelerator PwC Accelerator PwC’s Accelerator International Network

- 15. Zukunft des Private Banking? • Diskussion Herausforderungen im Private Banking • Digitaler Generationswechsel • Übergreifende Plattform-Lösungen (live Prototyp) Compliance im Digitalen Zeitalter? • Diskussion regulatorischer Herausforderungen • Sicherstellung der Erfüllung der Compliance-Anforderungen in digitalen Geschäftsmodellen? Prozessautomatisierung • Automatisierungspotenziale im digitalen Zeitalter • Plattform- und Architekturvoraussetzungen • Demo Workflow-Systeme Zukunft der Filiale? • Anpassung des Filalnetzes an Kundenbedürfnisse • Filialnetzwerkoptimierung und Filialtypologien • Integration mit digitalen Vertriebskanälen Mögliche Fokusthemen für die kommende Plattform am 23. Juni

- 16. Do you know PwC? • We have more than 180,000 employees • Thereof more than 2,000 experts in the fields of digital transformation including customer strategy, multi-access and analytics/big-data • We supported many similar projects with international HVB peers but also outside financial services • We know how to establish trust as we are the Nr.1 in IT security and analytics/forensics • We safeguard the realization of any digital transformation through our integrated and agile approach • We have strong partnerships in the digital ecosystem • 150 Experts • CoE: Digital Transformati on UK • 1,100 Experts • Technology Institute • Mobile Lab US • 90 Experts • CoE: Retail Banking • CoE: Mobile • CoE: CRM Germany / Austria PwC’s global network: > 2,000 “digital” experts PwC global Digital Transformation Hub Our team’s expertise Strategists Information Architects Engineers Creative Designers Technologists Data Scientists Researchers Ethnographers • 75 Experts • CoE: Digital Transformati on Australia • 650 Experts • Delivery & Innovation Lab India, China • 80 Experts EU others PwC is one of the largest consulting firms in the field of digital transformation

- 17. Programme Management EvolveStrategize & Assess Design Construct Implement Operate Review Günther Seyer Technology Consulting T: +43 676 833 77 5118 M: guenther.seyer@at.pwc.com Julia Tanasic Digital Transformation T: +49 170 1575846 M: julia.tanasic@de.pwc.com Enrico Reiche PwC’s Accelerator T: +49 151 16781604 M: enrico.reiche@de.pwc.com Johannes Wolfslehner Strategy & Operations T: +43 699 16305315 M: johannes.wolfslehner@at.pwc.com Ihr Umsetzungspartner im Bereich Digital Transformation