80g

•Download as PPT, PDF•

0 likes•739 views

This document provides information about tax deductions available under Section 80G of the Indian Income Tax Act for donations made to eligible charitable organizations and funds. It lists the types of organizations that qualify for 100% or 50% tax deductions without any limits, as well as those eligible for 100% or 50% deductions subject to specified qualifying limits. Contact details and website information are also provided for the 80G certification services offered.

Report

Share

Report

Share

Recommended

Recommended

More Related Content

Similar to 80g

Similar to 80g (20)

Online 12A Registration and Online 80G Registration - We Legalize

Online 12A Registration and Online 80G Registration - We Legalize

Your One Click Can Change A Child’s Life & Give Tax Benefits

Your One Click Can Change A Child’s Life & Give Tax Benefits

Receipt of donation vs. FCRA Namrata Dedhia 20150110

Receipt of donation vs. FCRA Namrata Dedhia 20150110

Recently uploaded

""wsp;+971581248768 "/BUY%$ AbORTION PILLS ORIGNAL%In DUBAI ))%3 ((+971_58*124*8768((#Abortion Pills in Dubai#)Abu Dhabi#. #UAE# DUBAI #| SHARJAH#UAE💉💊+971581248768>> SAFE AND ORIGINAL ABORTION PILLS FOR SALE IN DUBAI AND ABUDHABI}}+971581248768

+971581248768 Mtp-Kit (500MG) Prices » Dubai [(+971581248768**)] Abortion Pills For Sale In Dubai, UAE, Mifepristone and Misoprostol Tablets Available In Dubai, UAE CONTACT DR.Maya Whatsapp +971581248768 We Have Abortion Pills / Cytotec Tablets /Mifegest Kit Available in Dubai, Sharjah, Abudhabi, Ajman, Alain, Fujairah, Ras Al Khaimah, Umm Al Quwain, UAE, Buy cytotec in Dubai +971581248768''''Abortion Pills near me DUBAI | ABU DHABI|UAE. Price of Misoprostol, Cytotec” +971581248768' Dr.DEEM ''BUY ABORTION PILLS MIFEGEST KIT, MISOPROTONE, CYTOTEC PILLS IN DUBAI, ABU DHABI,UAE'' Contact me now via What's App…… abortion Pills Cytotec also available Oman Qatar Doha Saudi Arabia Bahrain Above all, Cytotec Abortion Pills are Available In Dubai / UAE, you will be very happy to do abortion in Dubai we are providing cytotec 200mg abortion pill in Dubai, UAE. Medication abortion offers an alternative to Surgical Abortion for women in the early weeks of pregnancy. We only offer abortion pills from 1 week-6 Months. We then advise you to use surgery if its beyond 6 months. Our Abu Dhabi, Ajman, Al Ain, Dubai, Fujairah, Ras Al Khaimah (RAK), Sharjah, Umm Al Quwain (UAQ) United Arab Emirates Abortion Clinic provides the safest and most advanced techniques for providing non-surgical, medical and surgical abortion methods for early through late second trimester, including the Abortion By Pill Procedure (RU 486, Mifeprex, Mifepristone, early options French Abortion Pill), Tamoxifen, Methotrexate and Cytotec (Misoprostol). The Abu Dhabi, United Arab Emirates Abortion Clinic performs Same Day Abortion Procedure using medications that are taken on the first day of the office visit and will cause the abortion to occur generally within 4 to 6 hours (as early as 30 minutes) for patients who are 3 to 12 weeks pregnant. When Mifepristone and Misoprostol are used, 50% of patients complete in 4 to 6 hours; 75% to 80% in 12 hours; and 90% in 24 hours. We use a regimen that allows for completion without the need for surgery 99% of the time. All advanced second trimester and late term pregnancies at our Tampa clinic (17 to 24 weeks or greater) can be completed within 24 hours or less 99% of the time without the need surgery. The procedure is completed with minimal to no complications. Our Women's Health Center located in Abu Dhabi, United Arab Emirates, uses the latest medications for medical abortions (RU-486, Mifeprex, Mifegyne, Mifepristone, early options French abortion pill), Methotrexate and Cytotec (Misoprostol). The safety standards of our Abu Dhabi, United Arab Emirates Abortion Doctors remain unparalleled. They consistently maintain the lowest complication rates throughout the nation.Contact +971581248768 for 100% original and safe abortion pills available for...

Contact +971581248768 for 100% original and safe abortion pills available for...DUBAI (+971)581248768 BUY ABORTION PILLS IN ABU dhabi...Qatar

Recently uploaded (20)

Challenges and Opportunities: A Qualitative Study on Tax Compliance in Pakistan

Challenges and Opportunities: A Qualitative Study on Tax Compliance in Pakistan

Pre Engineered Building Manufacturers Hyderabad.pptx

Pre Engineered Building Manufacturers Hyderabad.pptx

Falcon Invoice Discounting: Unlock Your Business Potential

Falcon Invoice Discounting: Unlock Your Business Potential

Getting Real with AI - Columbus DAW - May 2024 - Nick Woo from AlignAI

Getting Real with AI - Columbus DAW - May 2024 - Nick Woo from AlignAI

Contact +971581248768 for 100% original and safe abortion pills available for...

Contact +971581248768 for 100% original and safe abortion pills available for...

Top Quality adbb 5cl-a-d-b Best precursor raw material

Top Quality adbb 5cl-a-d-b Best precursor raw material

Jual obat aborsi Hongkong ( 085657271886 ) Cytote pil telat bulan penggugur k...

Jual obat aborsi Hongkong ( 085657271886 ) Cytote pil telat bulan penggugur k...

GURGAON CALL GIRL ❤ 8272964427❤ CALL GIRLS IN GURGAON ESCORTS SERVICE PROVIDE

GURGAON CALL GIRL ❤ 8272964427❤ CALL GIRLS IN GURGAON ESCORTS SERVICE PROVIDE

HomeRoots Pitch Deck | Investor Insights | April 2024

HomeRoots Pitch Deck | Investor Insights | April 2024

SEO Case Study: How I Increased SEO Traffic & Ranking by 50-60% in 6 Months

SEO Case Study: How I Increased SEO Traffic & Ranking by 50-60% in 6 Months

Abortion pills in Jeddah ! +27737758557, cytotec pill riyadh. Saudi Arabia" A...

Abortion pills in Jeddah ! +27737758557, cytotec pill riyadh. Saudi Arabia" A...

Falcon Invoice Discounting: Empowering Your Business Growth

Falcon Invoice Discounting: Empowering Your Business Growth

2024 May - Clearbit Integration with Hubspot - Greenville HUG.pptx

2024 May - Clearbit Integration with Hubspot - Greenville HUG.pptx

Falcon Invoice Discounting: Aviate Your Cash Flow Challenges

Falcon Invoice Discounting: Aviate Your Cash Flow Challenges

QSM Chap 10 Service Culture in Tourism and Hospitality Industry.pptx

QSM Chap 10 Service Culture in Tourism and Hospitality Industry.pptx

JIND CALL GIRL ❤ 8272964427❤ CALL GIRLS IN JIND ESCORTS SERVICE PROVIDE

JIND CALL GIRL ❤ 8272964427❤ CALL GIRLS IN JIND ESCORTS SERVICE PROVIDE

The Art of Decision-Making: Navigating Complexity and Uncertainty

The Art of Decision-Making: Navigating Complexity and Uncertainty

80g

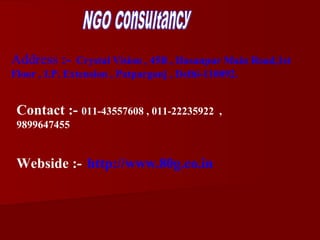

- 1. Address :- Crystal Vision , 45B , Hasanpur Main Road,1st Floor , I.P. Extension , Patparganj , Delhi-110092. Contact :- 011-43557608 , 011-22235922 , 9899647455 Webside :- http://www.80g.co.in

- 2. What is 80g? • Section 80g offers a tax deduction for donations to certain prescribed funds and charitable institutions.

- 3. Benefits of 80g • Those organizations who donate to ngo under section 80g, they get deduction of 50% in their tax.

- 4. Eligible Assesses for 80g This section is applicable to all Ngo, who make an eligible donation, whether an individual, HUF, NRI or a company.

- 5. Applying for 12a certification • shall ensure the acceptance of the organization by Income Tax department. After getting the 12a certification the ngo organization gets the perfect legal entity. The entire tax of ngo is exempted.

- 6. Appl y for 80g cer tification By showing their record of achievements in social welfare activities and by proving their service to the public. By getting this 80g certification, organization are privileged to provide tax exemption to the donors who donates their organization. That is when an organization receives donation from public, individual or from a group it shall issue 80g tax exemption to the donor, where donors are entitled to donate from their 10% of gross total annual income. In that 10% of their donation, donors shall receive 10% tax exemption for their donation. So this type of certification, gives the power to the organization to encourage their donation to donate more .

- 7. W hat is the validity period of the re gistr ation under section 12A and 80G of Income Tax Act? 12A registration : Lifetime validity 80G registration : 1 to 3 years validity

- 8. W hen you apply for 80 g you shall check your self for the fitness of 80g approval under the following factor s. 1. If nonprofit Ngo organization is under going with any business, then they have to maintain a separate account and should not mix the donations they receive for social cause. 2. Other than charitable cause the organization or its byelaw should not represent any other causes towards spending of such donation amounts or the assets and incomes of the nonprofit Ngo organization. 3. The nonprofit Ngo organization shall not be able to apply for 80 g if it support religion based, caste and creeds based activity. 4. The nonprofit Ngo organization should have the qualification of registration which might have been registered under Societies registration act 1860 or registered under section 25 of Companies act 1956. 5. Proper annual returns, accounting, book keeping should be in manner before applying for 80 g. 6. If you have already received the 80 g certificate, then proper renewal is must to hold such tax benefits. Income tax department has the power to approve or reject such approval upon disqualification of the nonprofit organization or dissatisfaction found by the department towards the nonprofit Ngo organization activities.

- 9. Donations with 100% deduction without any qualifying limit . Prime Minister’s National Relief Fund National Defence Fund Prime Minister’s Armenia Earthquake Relief Fund The Africa (Public Contribution - India) Fund The National Foundation for Communal Harmony Approved university or educational institution of national eminence The Chief Minister’s Earthquake Relief Fund, Maharashtra Donations made to Zila Saksharta Samitis. The National Blood Transfusion Council or a State Blood Transfusion Council. The Army Central Welfare Fund or the Indian Naval Benevolent Fund or The Air Force Central Welfare Fund.

- 10. Donations with 50% deduction without any qualifying limit. Jawaharlal Nehru Memorial Fund Prime Minister’s Drought Relief Fund National Children’s Fund Indira Gandhi Memorial Trust The Rajiv Gandhi Foundation

- 11. Deduction amount u/s. 80g. Donations paid to specified institutions qualify for tax deductionunder section 80G but is subject to certain ceiling limits. Based on limits, we can broadly divide alleligible donations under section 80G into four categories: a) 100% deduction without any qualifying limit (e.g., Prime Minister’s National Relief Fund). b) 50% deduction without any qualifying limit (e.g., Indira Gandhi Memorial Trust). c) 100% deduction subject to qualifying limit (e.g., an approved institution for promoting family planning). d) 50% deduction subject to qualifying limit (e.g., an approved institution for charitable purpose other than promoting family planning).

Editor's Notes

- 12a registration-?