RMPG Learning Series CRM Workshop Day 4

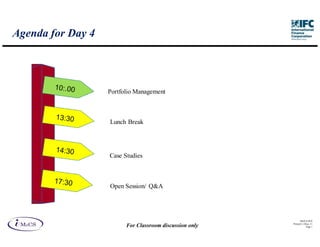

- 1. Agenda for Day 4 Portfolio Management Lunch Break Case Studies Open Session/ Q&A IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 1

- 2. Portfolio management essential to evaluate whether results aligned with strategy Components of Strategy Performance and portfolio composition Profits Capital Budgeting Interest Expenses Product Mix Interest Income Interest on Deposits Customer Mix Interest on other Borrowings Delivery Channels Fee Income Operating Expenses Risk Appetite Organisation structure Treasury Income Losses due to defaults, liquidity mismatches IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 2

- 3. Measures that describe a portfolio (Retail) Salaried vs. self employed Seasonin Geography g Demogr NPAs aphics Age Original and LTVs residual tenure Loan Portfolio Delinque Loan ncies / Amount Overdues NIM FOIR IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 3

- 4. Summary of Approach - Modeling Approach : Dataset – Sample borrowers 1.Construction of Indices on Grading Scale HL1 - HL10 qualitative parameters – 1.Model Training Sample: XX accounts Objective parameters 2.Discriminant Analysis 2.Model Validation Sample: on quantitative & qualitative XX accounts parameters Subjective parameters 3.Calibration to grading scale IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 4

- 5. Explanatory Variables in the Home Loan Model Type of Age + Organisation Quality of Borrower Index Educational Designation Qualification (salaried) Length of Years of Banking Qualitative Service /Business + No. of Residence Cost of Living Index Marital Status dependents type - to Cost - Loan Fixed Obligation / Income Quantitative EMI/NW Loan Amount Income - + + IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 5

- 6. Qualitative Indicators Age of Applicant Based on the Life Cycle Hypothesis where the investment/saving life cycle of an individual has four phases: 1. Expenditure Phase: High on Debt 2. Accumulation Phase: Low debt, Investment 3. Sustenance Phase: No Debt, Investment 4. Rundown Phase: Use of wealth for livelihood Applicant is likely to have higher surpluses in the Accumulation and Sustenance Phases IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 6

- 7. Qualitative Indicators Educational Qualification Higher educational qualification implies 1. Higher job security 2. Higher future earning potential 3. Alternative employment opportunities Hence, higher educational qualification of the applicant indicates better continuing payment ability IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 7

- 8. Quantitative Indicators Illustration: Fixed Obligation to Income Ratio (FOIR) Median 33% Higher the FOIR, lower is the 25% Median 33% 20% capacity of the applicant to absorb Frequency 15% the negative shock in net income. 10% Hence, higher the FOIR, lower is the 5% ability of the applicant to meet 0% 10% 15% 20% 25% 30% 35% 40% 45% 50% 55% 60% 65% 70% 75% FOIR unforeseen expenses. FOIR = (Monthly Instalments on 1. From the data it is observed that if FOIR exceeds 47%, about 50% of the cases all loans* + Monthly Rent) / Net default. Annual Income 2. The optimum range for lending in terms Note: Consider net annual income, of most favorable default experience is the 25%-40% FOIR zone. loan EMI , rent of applicant & co- obligant, while calculating the FOIR * Includes the estimated instalment for the proposed loan also in the calculation IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 8

- 9. Quantitative Indicators Illustration: Loan to Cost Ratio (LCR) Loan to Value Ratio 20% Importance of this indicator 18% 16% 14% Median -53% Lower the LCR, greater is the 12% 10% 8% applicants contribution towards the 6% 4% asset i.e. loss in event of default 2% 0% Below 10%- 20%- 30%- 40%- 50%- 60%- 70%- 80%- Above increases for the applicant. 10% 20% 30% 40% 50% 60% 70% 80% 90% 90% Hence, if LCR is low, in case of The optimum range in terms of most default by the applicant, the Loss favorable default experience is the 45- 65% LCR zone. Given Default for the bank will be lower Default rates are around 35% higher for LCR= Loan Amount/ Cost of the LCR being in the above 75% zone Asset to be acquired IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 9

- 10. Other important factors which should be considered for appraisal Credit Track Record Past credit record depicts the attitude of the person in honouring his credit obligation. “Wilful default” are one of the causes for a number of defaults. A bank could analyse credit track record based on: 1. Number of Cheques returned in last six month (Bank Statements) 2. Number of Credit Roll Overs in last six months (Credit Card Statements) IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 10

- 11. Other important factors which should be considered for appraisal Nature of Asset In Housing Segment, assets gradually appreciate with time unlike many other assets [Cars, white goods, etc.]. The chance of negative equity* will be lesser and Loan to cost ratio will improve over the period of time. * Negative equity: When the outstanding loan amount is lesser than the value of the asset, chance of default is lesser. Hence, chance of default is lesser in housing loan than other retail segments. IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 11

- 12. Other important factors which should be considered for appraisal Collateral Security Additional collateral security lowers the net exposure of the bank. It increases the applicants contribution in the asset thus effectively reducing loan to cost ratio. Hence, if the Collateral Security is high, in case of default by the applicant, the Loss Given Default for the bank will be lower IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 12

- 13. Balance Business flexibility with Asset quality improvement Trade-off between acceptance and NPA generation 100% 90% 62.2%, 79.3% 80% % NPAs reduced 70% 60% 50% 40% 30% 20% 10% ICRA recommendation 0% 0% 20% 40% 60% 80% 100% % proposals accepted The objective is to strike a balance between business objectives (so that not too many cases are rejected) and potential NPA reduction. IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 13

- 14. Portfolio analytics: Formation of Pools – cost effective way of managing risks Pool 1 Pool 2 Pool 3 Pool 4 Source of Income Salaried Salaried Self Emp Self Emp LTV >70% >70% 50% - 70% >70% FOIR <40% 40%-60% 40%- 60% >60% NIM 2% 3% 3% 4% Seasoning 18 18 12 18 Performance Delinquency 10% 20% 15% 25% NPAs 1% 2.5% 2% 3% IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 14

- 15. Understand how pool are formed by the bank Maturity Loan Product FOIR EAD • Size :3-5 % of total LGD portfolio (e.g. of Loan/ Land Value Loan/Value housing loans) PD Calculate PD, •Each obligor :not of Borrower Risk Characteristics Risk Characteristics LGD, EAD Mortgage Loan Home Loan LoanPersonal Loan Against Property Loans for home repairs Revolving Credit more than 0.2% Geographic Zone •Technique generally used to segment: Type of Borrower CHAID or expert judgement FOIR/ Income Income Networth 1. A pool is formed on risk and transaction characteristics 2. A pool is assumed to have homogenous PD and LGD and reduces the task of individually rating obligors 2. IMaCS assume that bank will provide the Mortgage pools based on some of the above described borrower or transaction characteristics IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 15

- 16. Understand Portfolio Characteristics of a bank’s Mortgage pool IMaCS Preliminary analysis of portfolio data to assess Pool characteristics risk assessment Portfolio size Loan Schemes Weighted loan tenure Amount weighted portfolio default rate – 90+dpd, 180+dpd Number weighted portfolio default rate – 90+dpd, 180+dpd Delinquency Flow rates of difference buckets Average tenure of the loans Average ticket size Average month on books Weighted IRR Location Customer categories/Borrower type(Salaried-Govt. /reputed company/Others, Professional, Self employed) FOIR Ratio(Fixed Income to obligation ratio), Income of the borrower LTV ratio Recovery /Security Information The portfolio is further segmented based on the above described parameters IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 16

- 17. Static Pool Analysis(SPA) to estimate weighted delinquency rates of unseasoned portfolio The delinquency rates estimated in first portfolio analytics give us standalone delinquency rates, which doesn’t give correct picture of the portfolio delinquency rates as it seasons. Thus SPA tool is used to - compute and compare delinquency cum loss rates across the different seasonings points ( for net loan originations in different years) - approximate loss rates for partially (un) seasoned portfolio tranches - assesses loss rates for the overall portfolio and portfolio segmented by tenure Data requirement : Quarterly/Yearly Snapshot of the pool for at least two years to perform the static pool analysis and to project the delinquency rates for unseasoned portfolio tranches Loss cum delinquency rate= ((90+dpd outstanding using the YoB Band)* POS)/ Net quarter disbursements Pool tenure 5-10year Years on Book(Seasoning points) In Crores Sanctioned FY 0-1 1-2 2-3 3-4 4-5 5-6 6-7 7-8 8-9 9-10 Net Disbursement Year Estimated <=2001 3.60% 4.00% 3.70% 40.9 2002 2.80% 3.00% 2.60% 4.10% 87.9 Unseason 2003 3.50% 3.60% 4.10% 4.50% 4.50% 125.1 ed 2004 4.30% 5.00% 4.90% 4.50% 3.80% 3.80% 136.3 2005 3.90% 4.10% 3.40% 4.50% 3.80% 4.40% 4.00% 181.5 portfolio 2006 4.70% 5.20% 4.10% 4.20% 4.30% 4.00% 4.20% 4.20% 189.4 delinquen 2007 2.00% 3.80% 4.10% 4.15% 4.00% 4.00% 4.20% 3.80% 3.00% 214.5 2008 0.6% 1.90% 3.20% 4.00% 4.20% 3.50% 4.70% 3.00% 3.00% 3.00% 266.8 cy rates Current 2009 0.3% 2.20% 4.5% 4.20% 4.25% 4.00% 3.00% 3.00% 3.50% 3.50% 231.5 2010 0.1% 2.30% 3.90% 4.30% 4.15% 4.50% 4.40% 3.50% 4.00% 4.00% 440.8 Snapshot deliquency 2.7 with product of highlighted delinquency % Weighted Delinquency Rate of Mortgage pool for current sum of various seasoning point their respective net disbursements rates snapshot = % Estimated delinquency rates for unseasoned portfolio(IMaCS Method) - Delinquency cum loss rates for remainder tenure computed using a semi-log fn. IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 17 - Weighted year wise delinquencies adjusted for coefficient of variation

- 18. Estimating Expected Loss The SPA helps in assessing Probability of default, where as Expected loss helps in assessing the actual loss after liquidating the collateral . Expected Loss is computed as a product of =EAD* PD * LGD Where EAD can be seen as an estimation of the extent to which bank may be exposed to counterparty in the event of and at the time of counterparty’s default. EAD= Balance outstanding Default cases + Interest accrued from NPAdate to cutoff date PD is computed from SPA analysis weighted delinquency rates (As shown is previous slide) LGD Computations : (1-p(Cure))*Economic loss+ Recovery Cost EAD Where P is Cure rates of NPA account after performance period Economic losses= EAD-Discounted recoveries Discounted recoveries= Min(∑RR x Vi x Discount factor, EAD) i i Annual interest rate =Opportunity cost of bank Discount period=The period for which the recoveries are discounted Recovery cost= Legal Cost + Recover department Cost Sample EL and EL as a % of POS Computations Case 1: Home loan default cases with POS 90 Cr and interest accrued till cutoff date is10 Cr with 2.7% Weighted delinquency and LGD % of 55% Expected Loss = (90+10)Cr*2.7% *55%= 1.48 Cr EL as percentage of POS = 1.48 = 1.48% 100 Cr IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 18

- 19. Capital adequacy Economic capital Higher capital for higher LTV and FOIR loans Higher capital for loans provided to self employed borrowers Higher capital for longer tenure loans Greater capital required in case of higher concentration in a demographic segment Should be at least equal to the regulatory capital required Regulatory capital As prescribed by Bangladesh Bank from time to time IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 19

- 20. Risk Adjusted Return on Capital Employed Risk Adjusted Return Risk Income Expenses Adjustment Fee and other Origination Provisions / Interest Interest non interest and servicing Expected Income income Expense costs Loss Capital Required (regulatory) / Employed (economic) IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 20

- 21. Benefits of portfolio management Enables proactive identification of problem pools and take decisions related to portfolio rebalancing Enables Decisions related to increased efforts for Marketing for the best performing pool Monitoring or collection for delinquent pools Policy changes maybe required due to the result of analysis Risk adjusted returns High spreads but high defaults in a particular segment could mean lower risk adjusted returns with respect to a lower spread and lower default segments IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 21

- 22. DISCUSSIONS IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 22

- 23. All the contents of the presentation are confidential and should not be published, reproduced or circulated without the written consent of IFC, Bangladesh Bank and IMaCS. IM aCS 2010 Printed 11-M ay-11 For Classroom discussion only Page 23