TAXATIONJoan Fung, age 67, is married to Alan, age 56, who ha.docx

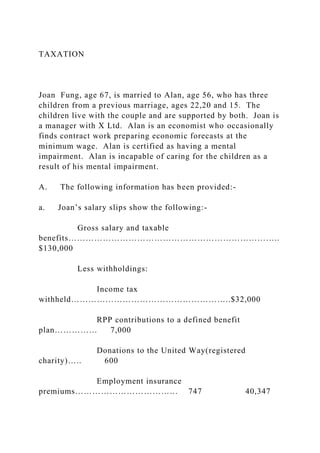

- 1. TAXATION Joan Fung, age 67, is married to Alan, age 56, who has three children from a previous marriage, ages 22,20 and 15. The children live with the couple and are supported by both. Joan is a manager with X Ltd. Alan is an economist who occasionally finds contract work preparing economic forecasts at the minimum wage. Alan is certified as having a mental impairment. Alan is incapable of caring for the children as a result of his mental impairment. A. The following information has been provided:- a. Joan’s salary slips show the following:- Gross salary and taxable benefits……………………………………………………………….. $130,000 Less withholdings: Income tax withheld………………………………………………..$32,000 RPP contributions to a defined benefit plan…………… 7,000 Donations to the United Way(registered charity)….. 600 Employment insurance premiums……………………………… 747 40,347

- 2. Net salary and taxable benefits……………………………………………………………… …… .$89,653 b. Joan has the following other sources of income:- Dividends from Y Ltd.,(CCPC) ……………………………………………………………………….. 3,600 Dividends from Bell Canada………………………………………………………………… ………… 5,000 Interest on Canada Savings Bonds…………………………………………………………………. 4,000 Canadian sourced interest income………………………………………………………………… 2,000 Interest on loan to her sister………………………………………………………………… ………. 875 Taxable capital gains(allowable capital losses):- Tax Trivia Canada Ltd., common shares………………………………………………………..29,000 Painting by a Canadian artist………………………………………………………………… …….. 2,500 Growth Potential, common

- 3. shares………………………………………………………………..( 1,100) Loss on common shares of X Ltd., a small business corporation……………………..(40,000) Monthly pension of $4,500 from previous employer…………………………………………54,000 Old Age Security Pension received……………………………………………………………… ……. 6,400 At the beginning of 2011, Joan had two rental properties. These properties are expected to have the following operating cash flows associated with them:- Property #1 Property #2 Gross rents received……………………………………………$ 60,000……………………………………$36,000 EXPENSES:- Advertising for tenants………………………………….1,200……………………… ……………………0………. Property taxes……………………………………………….5,400…………… …………………………..3,000….. Utilities(Landlord provided)………………………… 6,200………………………………………..3,800…..

- 4. TOTAL EXPENSES……………………………………………………12,800 ………………………………………. 6,800….. Property #1 was purchased in 1985 at a cost of $120,000 for both land and building. The cost of the land was $50,000. Property #2 was purchased in 1999 at a total cost of $210,000. The cost of the land was $80,000. The UCC balance in Class#3(5%) was $20,780 and Class #1(4%) was $67,280 at January 1,2011. During 2011, new bylaws on safety requirements of rental properties were enacted. To upgrade the two properties would require $80,000 for Property #1 and $90,000 for Property #2. As a result, Joan decided to improve Property #1 and paid the $80,000 for the upgrade. She decided to sell Property #2 and did so for $248,000. The fair market value of the land was appraised to be $120,000 and the building $128,00. c. Joan’s disbursements included the following: Interest on funds borrowed to purchase the investment portfolio……………………...$ 1,700 RRSP contributions(fully deductible and based on last year’s earned income)……… 9,000 d. Alan has the following income: Income(for tax purposes) from part-time employment…………………………………………$8,000 e. Dot , the 22 year old, attended the University of Toronto

- 5. for eight months during 2011 as a full-time student. She has income for tax purposes of $4,500 and paid tuition fees of $3,100. f. Duncan, age 20, attends high school and Duggan, age 15, attends a special school for the hearing impaired, since he has no hearing. Child care expenses for Duggan were incurred of $4,000. Joan paid $6,500 in expenses for rehabilitative therapy fees to Duggan’s special school in 2011. g. The following additional disbursements were made by Joan in 2011:- Donations to the University of Toronto………………………………………..$1,300 London Life extended health care premiums……………………………….. 875 Donations to federal political parties……………………………………………. 1250 g. Joan has a net capital loss balance of $1,350 and a non- capital loss of $5,500 at the end of 2011. Both are available for carry over. Joan and her brother have a manufacturing business,Y Ltd., inherited from her deceased parents. Joan’s brother,Matthew, manages the business on a day-to-day basis. Joan and Matthew have an agreement that any profits or losses from the business are to be shared 40% to Joan and 60% to Matthew. B. The following income statement and miscellaneous financial information for the year ended December 31,2011,for

- 6. Y Inc. has been provided to you. Y Incorporated Condensed Income Statement For the Year Ended December 31st,2011 Sales…………………………………………………………… ……………………………………..$1,832 ,000 Cost of goods sold…………………………………………………………………… …………. 1,439,000 Gross Profit………………………………………………………………… ………………………$ 393,000 General and administrative expenses………………………………$ 79,000 Depreciation and amortization……………………………………………54,000 Interest………………………………………………………… …………………. 20,000 ……….153,000 $240,000 Gain on disposal of fixed assets…………………………………………………………….. 85,000 Net Income before taxes…………………………………………………………………

- 7. ………$325,000 Income taxes:- Current……………………………………………………….$6 0,000 Deferred……………………………………………………… 40,000 (100,000) Net Income………………………………………………………………… ………………………….$ 225,000 During your review of the working paper file and last year’s tax return, you have made the following notes to yourself, because you think that there might be tax implications associated with these items. i. Included in cost of sales is a reserve for a possible decline in the market value of finished goods inventory of $50,000. There is also an obsolescence reserve of $50,000 for some raw materials that were purchased from a supplier and were later found to be defective and worthless. So far, the supplier has refused to allow X to return the materials for a refund. ii. The gain on disposal of fixed assets consists of the accounting gain on the sale of some land for $415,000 on May 30th, 2011, and the sale of a limited life license for $16,000 on July 15th, 2011. X purchased the land on January 15th, 2011, for $325,000. The land was purchased with the intention of it being used to expand the manufacturing operation. After

- 8. purchasing the property, X received some bad publicity and complaints regarding the expansion plans, as the land was relatively close to a new subdivision. The management group at X decided to sell the land and expand its operations at the current location instead. Real estate commissions of $15,000 were paid in relation to the sale. X expanded its manufacturing space by constructing a new building adjacent to its current manufacturing plant. The construction of the new building started March 1st, 2011 and was completed June 30th, 2011. The CCA on new residential buildings is 6%. The license was purchased in 2008 for $6,000. It was the only asset left in the CCA class when it was disposed in July,2011.(Class #14) iii. General and administrative expenses include: a. Donations of $63,000 to registered charities and $1,000 to registered political parties………………………………………………………………… …………$64,000 b. Accrued bonuses-fully paid June 28th,2012……………………………………..44,000 c. Accrual for a potential settlement to a former employee for an injury received on the job; X was notified of the pending lawsuit on December 18th,2011……………………………………………………………

- 9. …… 60,000 d. Utility connection costs for the new building………………………………………..5,000 e. Insurance costs:- $400 per month for the existing property………………………………….4,800 $200 per month for the new building(Starting March 1st,2011)…2,000 f. New software purchased November 1st,2011($3,000 for applications..Cl#12 and $10,000 for new systems-Cl#52- 100%)………………………………………….13,000 g. Application to the State of Michigan for an unlimited life license to sell in the State…………………………………………………………………… ………………… 6,000 4. Interest includes the following:- a. Interest on 9%-$215,000 Mortgage for land purchased. The mortgage was repaid on May 30th,2011, on the sale of the property (see 2 above)…………………………………………………………………

- 10. ………………… 7,210 b. Interest on 5%-$340,000 mortgage for the construction of the new building taken out on April 15th, 2011. Interest is payable semi-annually starting October 15th, 2011. No principal payments were made in 2011…………………………………………………………………… ………12,156 5. The undepreciated capital cost balances at December 31,2010, were as follows:- Class #3(5%)……………………………………………………………….$ 550,000 Class #8(20%)…………………………………………………………….. 35,000 Class #10.1(30%)………………………………………………………… 9,200 Class #14…………………………………………………………………… … 5,000 Class#43(30%)…………………………………………………

- 11. ………….. 313,750 Class #44(25%)……………………………………………………………. 15,000 6. The cumulative eligible capital balance at December 31,2010, was $10,000. The Company has claimed CECA in prior years of $4,000, none of which has been recaptured for tax purposes. 7. Purchases and sales made during 2011 were as follows:- a. The cost of constructing the new building was $340,000. b. The Company purchased a new facsimile machine for $1,200. c. Some outdated desks used by the finance department with a cost of $5,000 were sold for proceeds of $3,500. 8. A 20-year patent to use a manufacturing process was purchased on July 1,2011 for $120,000. 9. A company car for use by the president of the company was purchased for $40,000 before HST. This car replaced the only other existing company car, which was purchased in 2004 for $35,000. The old car was sold for $12,000. 10. Dies and moulds for manufacturing equipment were purchased for $85,000 in January, 2011. 11. A customer list was sold for $40,000 to a former sales

- 12. agent of the company located in Vancouver. C. In 2011 Joan had two properties. Details of the properties are listed below. She sold the City Home in September 2011 for $1,170,000. Residence…………………………………………Date of Purchase…………………….Selling Price…………………Cost……… City Home……………………………………………2002……………… ………………………..$1,170,000………………$1,000,000 Cottage………………………………………………..2007………… ……………………………..$ 900,000………………... 400,000 =============================================== ====================================== Required:-Complete the following Federal T1 forms for 2011:- a. T1-1 b. T1-2 c. T1-3 d. T1-4 e. Federal Tax Schedules with the non-refundable credits