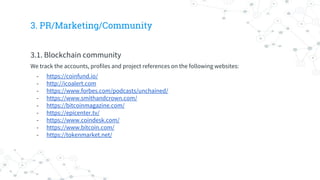

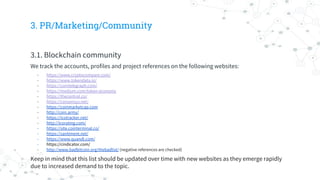

The document provides a framework for conducting in-house due diligence on pre-ICO startup projects. It outlines a multi-step process to analyze various aspects of a project team and startup, including: verifying the identities and backgrounds of founders, advisers, and executives; evaluating the market viability and technical feasibility of the project; assessing the project's marketing strategy and community engagement; and checking for any criminal or fraudulent connections among team members. The goal is to recognize scam features, assess risks, and compare ICO goals to actual project capabilities, in order to make informed investment decisions.