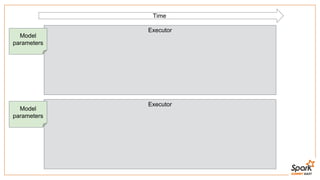

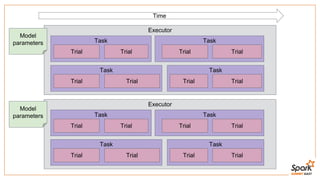

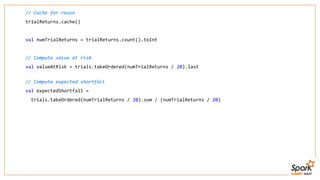

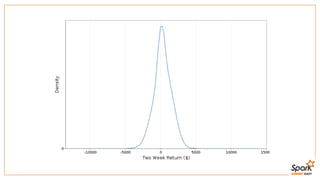

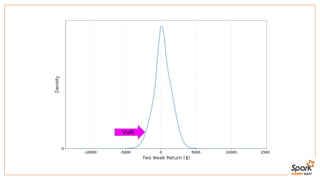

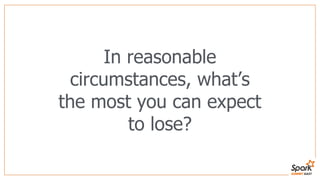

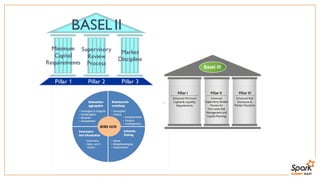

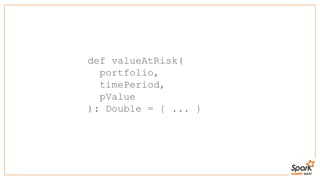

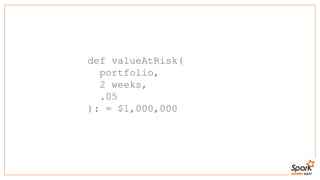

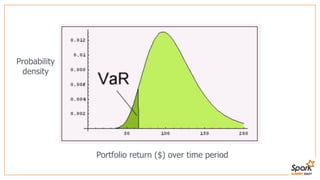

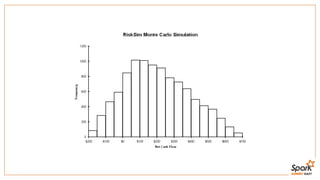

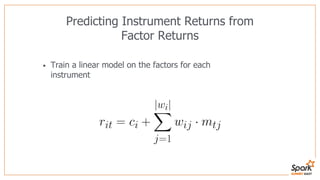

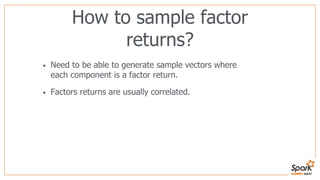

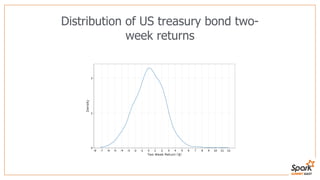

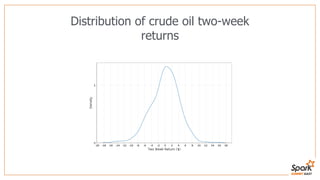

This document discusses estimating financial risk using Apache Spark. It introduces the value-at-risk (VaR) metric, which estimates the maximum potential loss of a portfolio over a given time period and probability. It describes approaches for VaR estimation including variance-covariance, historical simulation, and Monte Carlo simulation. It then explains how to predict instrument returns from market risk factors using linear regression models in Spark. The document outlines sampling factor returns from a multivariate normal distribution and running simulations across a Spark cluster to estimate VaR and expected shortfall. It argues that Spark enables easier, more powerful financial risk analysis by allowing joint processing, simulation matrices to be saved in memory, and calling GPUs for matrix operations.

![import org.apache.commons.math3.stat.regression.OLSMultipleLinearRegression

// Load the instruments and factors

val factorReturns: Array[Array[Double]] = ...

val instrumentReturns: RDD[Array[Double]] = ...

// Fit a model to each instrument

val models: Array[Array[Double]] =

instrumentReturns.map { instrument =>

val regression = new OLSMultipleLinearRegression()

regression.newSampleData(instrument, factorReturns)

regression.estimateRegressionParameters()

}.collect()](https://image.slidesharecdn.com/slidesharerisktalk-150911155504-lva1-app6891/85/Estimating-Financial-Risk-with-Apache-Spark-15-320.jpg)

![import org.apache.commons.math3.stat.correlation.Covariance

// Compute means

val factorMeans: Array[Double] = transpose(factorReturns)

.map(factor => factor.sum / factor.size)

// Compute covariances

val factorCovs: Array[Array[Double]] = new Covariance(factorReturns)

.getCovarianceMatrix().getData()](https://image.slidesharecdn.com/slidesharerisktalk-150911155504-lva1-app6891/85/Estimating-Financial-Risk-with-Apache-Spark-21-320.jpg)

![def trialReturn(factorDist: MultivariateNormalDistribution, models: Seq[Array[Double]]): Double = {

val trialFactorReturns = factorDist.sample()

var totalReturn = 0.0

for (model <- models) {

// Add the returns from the instrument to the total trial return

for (i <- until trialFactorsReturns.length) {

totalReturn += trialFactorReturns(i) * model(i)

}

}

totalReturn

}](https://image.slidesharecdn.com/slidesharerisktalk-150911155504-lva1-app6891/85/Estimating-Financial-Risk-with-Apache-Spark-24-320.jpg)

![// Broadcast the factor return -> instrument return models

val bModels = sc.broadcast(models)

// Generate a seed for each task

val seeds = (baseSeed until baseSeed + parallelism)

val seedRdd = sc.parallelize(seeds, parallelism)

// Create an RDD of trials

val trialReturns: RDD[Double] = seedRdd.flatMap { seed =>

trialReturns(seed, trialsPerTask, bModels.value, factorMeans, factorCovs)

}](https://image.slidesharecdn.com/slidesharerisktalk-150911155504-lva1-app6891/85/Estimating-Financial-Risk-with-Apache-Spark-25-320.jpg)