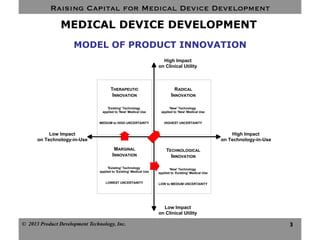

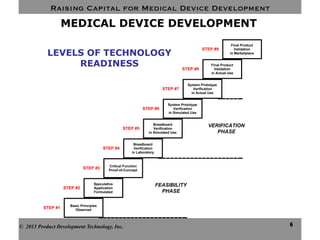

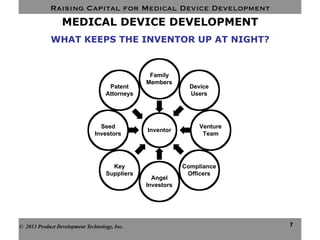

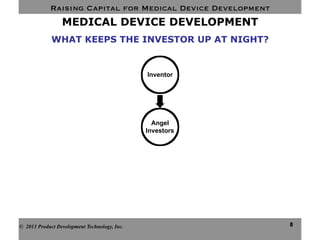

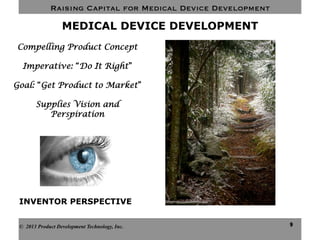

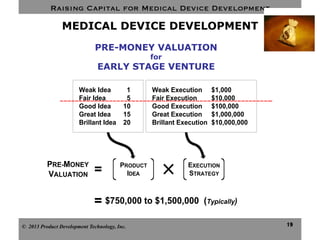

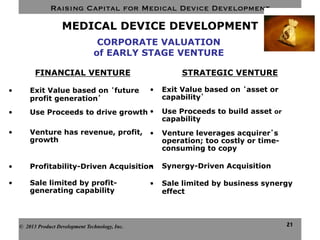

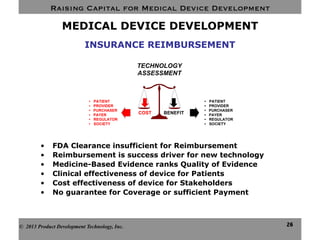

This document discusses challenges for inventors and investors in raising capital for medical device development. It outlines four levels of innovation risk from lowest to highest - marginal, technological, therapeutic, and radical. Radical innovation involving new technology and new clinical uses poses the highest uncertainty. The document also compares perspectives of inventors, who focus on developing products, and investors, who seek returns. Their differing goals can cause challenges in collaborating on ventures. Additional hurdles include regulatory requirements and changing markets and technologies.