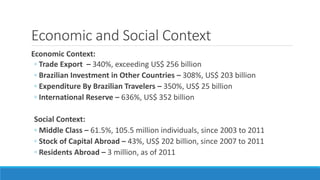

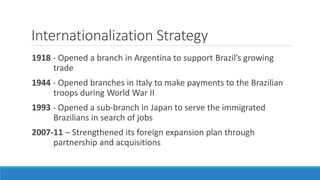

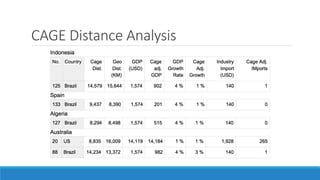

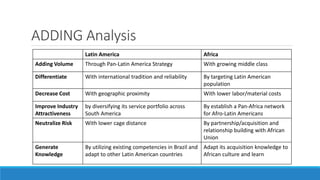

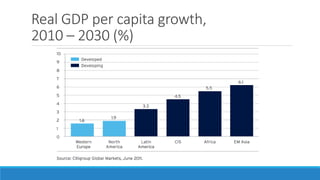

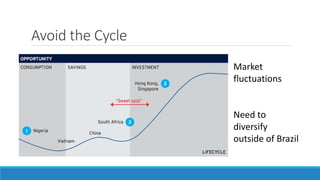

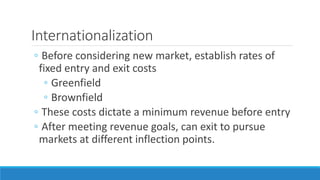

The document details Banco do Brasil's internationalization strategy and economic context, highlighting significant growth in Brazilian trade, investment, and tourism. It emphasizes the need for expansion driven by client retention, market learnings, and the growing Brazilian presence abroad. Additionally, it discusses opportunities for growth in Africa and Latin America through partnerships and leveraging existing communities.