Management of financial services

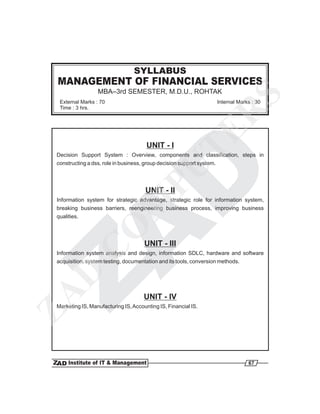

- 1. UNIT - I Decision Support System : Overview, components and classification, steps in constructing a dss, role in business, group decision support system. UNIT - II Information system for strategic advantage, strategic role for information system, breaking business barriers, reengineering business process, improving business qualities. UNIT - III Information system analysis and design, information SDLC, hardware and software acquisition, system testing, documentation and its tools, conversion methods. UNIT - IV Marketing IS, Manufacturing IS,Accounting IS, Financial IS. MBA–3rd SEMESTER, M.D.U., ROHTAK SYLLABUS External Marks : 70 Time : 3 hrs. Internal Marks : 30 67 MANAGEMENT OF FINANCIAL SERVICES ZA D C O M PU TER S

- 2. UNIT – I 68 MANAGEMENT OF FINANCIAL SERVICES FINANCE : SPECIALIZATION PAPERS Q. Define Financial Services. Explain its nature and scope. Ans. Introduction : Financial services are an important component of the financial system. There are four components of financial system. Diagram : Financial System Meaning of Financial Services : The term financial services is broadly understood to include banking, insurance, housing finance, stock broking and investment services. The services include fund-based as well as fee-based services. Financial services cater to the needs of financial institutions, financial markets and financial instruments geared to serve individual and institutional investors. Financial institutions and financial markets facilitate functioning of the financial system through financial instruments. In order to fulfil the tasks assigned, they required a number of services of financial nature. Financial services are, therefore regarded as the fourth element of the financial system.An orderly functioning of the financial system depends to a great deal on the range of financial services extended by the provider, and their efficiency and effectiveness. Financial services not only to help to raise the required funds but also ensure their efficient deployment. They assist in deciding the financial mix and extend their services up to the stage of servicing of lenders. In order to ensure an efficient management of funds, services such as: Financial Services Financial Institutions Financial System Financial Market Financial Instruments ZA D C O M PU TER S

- 3. 69 MANAGEMENT OF FINANCIAL SERVICES ØBill Discounting ØFactoring of Debtors ØParking of short term funds in the money market ØSecuritisation of debts Sources of Financial Services : (i) Stock Exchanges (ii) Specialised and General Institutions (iii) Non-Banking Finance Companies (iv) Subsidiaries of financial Institutions (v) Bank Insurance Companies. Nature of Financial Services : Financial services differ in nature from other services. Some of the salient features of financial services are discussed as follows: (1) Customer-Oriented : Financial services are customer-oriented. The providers of such services study the needs on the customers in detail to suggest financial strategies which give due regard to costs, liquidity and maturity considerations. The providers of financial services remain in constant touch with the market. They design both universal and firm-specific projects. This is due to the fact that the present day firms happen to be different in terms of: ØSize ØLevel of Output ØProfits and Labour force. (2) Intangibility : Financial services are intangible in nature. Unless the institutions supplying them have a good image and confidence of the clients, they may not succeed. Thus, they have to focus on quality and innovativeness of their services to build their credibility and gain the trust of clients. (3) Inseparability : the functions of producing and supplying financial services have to be performed simultaneously. This needs a perfect understanding between the financial services firms and their clients. (4) Perishability : Financial services like any other services cannot be stored. They have to be supplied as required by customers. The providers of financial services have to ensure a match between demand and supply. (5) People Based Service : Marketing of financial services is people-intensive and therefore subject to variability of performance or quality of service. The personnel in financial services organizations need to be selected on the basis of their suitability. ZA D C O M PU TER S

- 4. 70 (6) Dynamism : Financial services have to be constantly redefined on the basis of socio- economic changes such as disposable income, standard of living and educational changes related to the various classes of customers. Financial services institutions while evolving new services could be proactive in visualizing in advance what the markets want, or reactive to the needs and wants of customers. Scope or Constituents of Financial Services : Financial services comprise four major constituents: (1) Instruments :These includes: (i) Equity Instruments (ii) Debt Instruments (iii) Hybrid Instruments (iv) Exotic Instruments. (2) Market Players :These includes: (i) Banks (ii) Financing Institutions (iii) Mutual Funds (iv) Merchant Bankers (v) Stock Brokers (vi) Consultants (vii) Underwriters (viii) Market Makers etc. (3) Specialised Institutions :These include: (i) Discount Houses (ii) Credit RatingAgencies (iii) Venture Capital Institutions etc. (4) Regulatory Bodies :These includes (i) Department of Banking and Insurance of the Central Government. (ii) Reserve Bank of India (iii) Securities and the Exchange Board of India (SEBI) (iv) Board for Industrial and Financial Reconstruction (BIFR) Q. Explain the Regulatory Framework for Financial Services. Ans. Meaning of Financial Services : Financial services cater to the needs of financial institutions, financial markets and financial instruments geared to serve individual and institutional investors. ZA D C O M PU TER S

- 5. 69 MANAGEMENT OF FINANCIAL SERVICES Financial institutions and financial markets facilitate functioning of the financial system through financial instruments. In order to fulfil the tasks assigned, they required a number of services of financial nature. Financial services are, therefore regarded as the fourth element of the financial system.An orderly functioning of the financial system depends to a great deal on the range of financial services extended by the provider, and their efficiency and effectiveness. Different Level of Regulation on Financial Services : Level I Government of India AppellateAuthority and Regulator in Certain Cases Level II Legislation Passed in the Parliament Banking RegulationAct, InsuranceAct, IndianTrustAct, etc. Level III Institutions Under anAct of Parliament UTIAct, LICAct, GICAct, etc. Level IV Regulators RBI SEBI IRA Level V Regulations Given by the Regulators RBI Directions to Commercial Banks NBFC's Directions issued by the RBI SEBI Regulations, Guidelines, Notifications, etc. Level VI Self - Regulation By-laws, Rules and Regulation and Code of Conduct Issued by the various Financial Service Industry Associations. Regulatory Framework : For the purpose of studying regulatory framework which govern the financial services, we can divide the financial services in four different categories: (A) Banking and Financing Services (B) Insurance Services (C) Investment Services (D) Merchant Banking and other services ZA D C O M PU TER S

- 6. 70 Regulations on all these services are : (A) Regulations on BankingAnd Financing Services : (1) Banking Institutions : In order to develop a sound banking system in the country, the RBI regulates the commercial banking institutions in the following ways: (i) It is the licensing authority to sanction the establishment of new bank or new branch. (ii) It prescribe the ØMinimum capital, ØReserves and use of profits and reserves ØDistribution of dividends ØMaintenance of minimum cash reserve ØOther liquid assets (iii) It has the authority to inspect or conduct investigation on the working of the banks; and (iv) It has the power to control the appointment of Chairman and Chief Executive Officer of the private Banks and nominate members in the Board of Directors. (2) Non-Banking Financial Companies (NBFCs) : The Banking Laws Act, 1963 was introduced to regulate the NBFCs.The RBI which derives powers under this Act regulates the NBFCs as follows: (i) It requires the NBFCs of certain categories to register with it and provide periodical statements on their working. (ii) It prescribes the types of companies which are eligible to raise funds from public and its members. (iii) It also prescribes the extent to which the funds could be raised and the terms and condition thereof. (iv) NBFCs are also required to invest certain percentage of the deposits in the approved securities and maintain reserve fund. (v) It also collects periodic reports and has the powers to collect information on any aspect relating to the functioning of the NBFCs , conduct inspection of the books of NBFCs and investigate on any aspects relating to the activities of the NBFCs. (vi) Finally, it has the powers to imposing penalties or suspending or canceling the license or registration. ZA D C O M PU TER S

- 7. 69 MANAGEMENT OF FINANCIAL SERVICES Major Directions: The RBI has issued three major directions to regulate different forms of Non-Banking Financial Companies and other financial institutions.They are: (i) Non-Banking Financial Companies Directions, 1977 (ii) Miscellaneous Non-Banking Financial Companies Directions, 1977 (iii) Residuary Non-Banking Financial Companies Directions, 1977 (B) Regulations on Insurance Services : With an objective of reforming the insurance sector and allowing private entrants, the Government of India had set up an interim Insurance Regulation Authority (IRA) in January, 1996 and introduced the Insurance RegulatoryAuthority Bill, 1996 in December, 1996 to give statutory status. The duties, powers and functions of the IRAas per theAct are: (i) To regulate, promote and ensure orderly growth of the insurance business. (ii) To protect the interest of the policyholders in matter concerning assigning of policy nomination by policyholders, insurance interest, settlement of insurance claims, surrender value of the policy and other terms and conditions of contract insurance. (iii) To promote efficiency in the conduct of insurance business (iv) To call for information from, undertake inspection and conduct enquires and investigation including audit of the insurers, insurance intermediaries and other organization connected with the insurance business. (v) To regulate investment of funds by insurance companies. (vi) To adjudicate disputes between insurers and intermediaries. (C) Regulations on Investment Services : Investment services are primarily fund based activities. The mutual funds and venture capital funds are directly fall under the investment services. SEBI is emerging as a powerful regulator of various financial services. Securities and Exchange Board of India (SEBI) : The SEBI Act, 1992 entrusts the responsibility of protecting the interest of investors in securities.They are: (i) Regulating the business of stock exchange and any other securities markets. (ii) Registering and regulating the working of stock brokers. (iii) Registering and regulating the working of collective investment schemes including mutual funds. (iv) Promoting investors education and training of intermediaries of securities markets. ZA D C O M PU TER S

- 8. 70 (v) Calling for information from, undertaking inspection, conducting inquires and audit of stock exchanges. (vi) Conducting research for the above purpose (vii) Performing some other functions as may be required. (D) Merchant Banking and Other Services : There are several intermediaries associated with management of public and rights issue of capital. While the merchant bankers is the main intermediary others associated with the issue management are Underwriters, Brokers, Advisors and Credit Rating Agencies. The SEBI has issued a detailed guideline/regulation on many of these intermediaries.They are: (i) SEBI ( Merchant Banker) Regulation, 1992 (ii) SEBI Rules for Underwriters (iii) SEBI ( Brokers and Sub-brokers) Regulation 1992 (iv) SEBI Rules for Registrar to an Issue and ShareTransferAgents, 1993 (v) SEBI (DebenturesTrustees ) Regulations, 1993 Graphic Presentation of Regulation on Financial Services : Regulation on Financial Services Financial Services Banking and Insurance Investment and Merchant Bankers Financing Services Fee-based Services and Other Services Services Banking Insurance Securities Contracts SEBI Regulations, Regulation Act, 1938 Act, 1956 1992 Act, 1949 CompaniesAct, 1956 IndianTrustAct, 1882 Reserve Bank Insurance SEBI SEBI Rules for of India Regulatory Registrar Authority And Share TransferAgents Notification, Regulations, SEBI Regulations, Rules, Guildelines etc. 1994 Directions, etc. ZA D C O M PU TER S

- 9. 69 MANAGEMENT OF FINANCIAL SERVICES Q. Explain the risk involved in Financial Services. Ans. Meaning of Financial Services : The term financial services is broadly understood to include banking, insurance, housing finance, stock broking and investment services. Classification of Financial Services:- Financial services include fund-based as well as fee- based services. (i) Fund-based Services: In fund based services, the firm raises equity, debt and deposits and invests in securities or lends to those who are in need of capital. (ii) Fee-based Services: In fee-based services, the financial service firms enable other to raise capital from the market. The financial sector is also known for its dynamic character and within a short period, it has introduced several new products and services. Though the sector is growing rapidly all over the world, the financial markets have seen a number of bank and insurance companies failure and market crashes. The industry is operating in an environment where the risk is very high. Trading in Risk :There are two types of risk involved in financial services: (1) External Risk (2) Internal Risk. (1) External Risk : It could be due to changes in interest rate in the market that reduces the value of existing financial claims.As these are events arising outside the company, they can be grouped under external sources. The following are few external sources of risk: (i) Institutions Providing Direct Finance : There are different types of institutions available in the financial market providing finance for various requirements. There are many examples: ØCommercial Banks normally provide finance for short term needs of the firms. ØTerm-lending institutions meet the long term funding needs of industries which are commonly known as project financing. ØHousing finance companies provide funds to individuals and some times house-construction companies for acquisition of house property. ØVenture capital provides funds in the form of equity to new projects which involve some innovative ideas. External Risk : ØA bank may fail to honour the deposit claims of the deposit holders if the non-performing assets of the bank are above its net worth. ZA D C O M PU TER S

- 10. 70 ØAnother important external reason for the failure of these institutions in the business of lending is the quality of other assets in their total assets. If the investment is made in high-risk debt or equity securities, any adverse development in the capital market or the issuing company or agency will reduce the value of the investments and in this process it may affect the bank's ability to meet the liability. (ii) Insurance Services : Insurance services take the risk associated with the assets of their clients. The premium collected for this service in turn is either invested in securities or led to outsiders who are in need of money. External Risk : ØAn insurance company may fail to honour its obligation if the investments they have been made poor. ØSimilarly, the quality of assets they have insured may also turn bad. ØThere are two common problems in insurance services namely : (a) Moral Hazard : Moral hazard is the tendency of an insured to take greater risk because she/he is insured. For example, a machine owner may run the machine continuously ignoring the normal shut-down requirement to complete an order in less time. Without insurance, the owner may not turn the unit ignoring the normal shut-down requirement. (b) Adverse Selection : The adverse selection is the tendency of insuring the low quality asset and not insuring high quality assets. (iii) Stock Broking Services : Stock Brokers but and sell on behalf of their clients. They collect the securities from the sellers and collect money from the buyer and hand over the funds to seller after deducting the brokerage for the service rendered. External Risk : Though the activity looks relatively simple, the risk from external sources are very high: ØFirst, in situation where the trades are not guaranteed by the stock exchanges. ØThere is always a possibility that the client may fail to honour the commitment but the broker has to make good the loss. (iv) Leasing and Hire Purchase : Leasing and Hire Purchase service is very close to the banking service. These companies also raise money from the market through deposits and other means and lend to industries. Of course, the lending is done not in the form of term loan or working capital loan, but in the form of assets. ZA D C O M PU TER S

- 11. 69 MANAGEMENT OF FINANCIAL SERVICES External Risk : Leasing and hire purchase companies are also affected by the frequent changes in the regulations. The recent Reserve Bank of India regulation is expected to wipe out many of these companies from the market as RBI has put rigid norms in raising deposits from the public. (v) Institutions Offering Fee Based Services : Merchant Banking, Mutual Funds, Credit Rating , Merger and Acquisition are few examples of fee based services offered by the financial services companies. External Risk : ØThere are major changes in the regulation of merchant banking and mutual funds which will effectively reduce the number of players in their respective industry. (2) Internal Risk : Financial Services Company often fails due to their own mistakes. There are several internal factors that contribute to the failure of the firms in the financial services industry. Some of these internal sources of risk for different financial services companies are discussed below: (i) Institutions Providing Direct Finance : Banks, term lending institutions and other companies providing direct finance are exposed to several internal source of risk. Internal Risks : ØFirst and foremost among them is the quality of evaluation of the loan proposals. Often, the appraising officers fail to consider vital issues that affect the outcome of the project. ØThey are also affected by the asset-liability mismatch and excessive dealing in the security market. ØAnother important source of internal risk is the policy of the institution in using derivatives in managing their risk. If the bank fails to use the derivatives products in hedging the risk, its performance may be affected if the market moves against the position the bank is holding. (ii) Insurance Services : As in case of financial services companies which are in the business of direct lending, insurance companies are also affected by the efficiency in assessing the insurance proposal. Internal Risk : Unless, the internal system of evaluating the insurance proposal is efficient, the company will end up in insuring bad assets. (iii) Stock Broking Service : Though the stock broking is a fee based service, there are many sources of risk attributable to internal factors. Stock broking activity typically involves ØReceipt of the order from the clients ØExecution of the order in the exchange ZA D C O M PU TER S

- 12. 70 ØReceipt of documents or cash from the clients and delivery of cash or documents to the clients. Internal Risk : ØThere are many fake documents in the market ØEven if the stocks delivered are good and genuine, there is no guarantee that they are good for delivery. ØMany Indian stock brokers have also trade on their account and their proximity with the trading system does not guarantee profit. On several occasions, many big brokers have incurred huge losses on their trading. (iv) Leasing and Hire Purchase : The business of leasing and hire purchase is highly competitive with too many players in the market. Internal Risk : ØFirst the credit rating information in India is relatively weak and published accounts are not reliable to assess the credit worthiness of the borrowers. ØSecondly, the competition in the industry allows very little time to take decision on sanctioning the proposals, otherwise, the competitors will take away your clients. ØAnother internal problem is on the asset-liability mismatch. (v) Institutions Offering Fee Based Services : Institutions offering specialized services are exposed to several internal risks. Internal Risk : ØThe performance of mutual funds directly depends on the ability of the fund managers in reading the market and making investments accordingly. ØOn the other hands, if they freely use the information to their own benefit, it hurts the performance of the funds. Types of Risk : In the previous section, the different source of risk for various financial services firms have discussed. They could now broadly be classified under the following six heads: 1. Credit Risk : Many of the financial services firms like banking, credit cards, lease and hire purchase are also involved in fund based business. The credit risk affects the fund based activities of the financial services. The risk arises in evaluating the proposals for lending. While credit rating, either by credit rating institutions or internally helps to quantify the risk, the percentage of non-performing assets measurers the impact of credit risks in the firms. 2. Asset-Liability Gap Risk : This risk also applies to firms doing fund based services. Since funds raised from external sources play a major role in the fund based activities, ZA D C O M PU TER S

- 13. 69 MANAGEMENT OF FINANCIAL SERVICES the duration of the liability is an important variable which needs to be considered while lending. For example, if a firm gives a five year loan against a deposit for two years, there is a mismatch between the liability and asset. 3. Due-Diligence Risk : Merchant banking companies and other financial services firms which are offering fee based services like merger and acquisition have to exercise due diligence in their operations. This due diligence may have to be provided to the regulatory agencies or to their clients. For example, the SEBI regulation on Merchant Banking requires the lead manager to provide a due diligence certificate in the prescribed form before the public or rights issue opens for subscriptions. In the event of any lapse or mistake noticed in the due diligence subsequently, it will affect the financial services firm which has provided the due-diligence certificate in different ways. 4. Interest Rate Risk : This risk affects the firms which are in fund based activities. The interest rate risk arises when there are frequent changes in the interest rates in the market. 5. Market Risk : Financial services firms which are in the investment business or investing a part of the funds in securities are exposed to the market risk. This risk arises on account of changes in the economy and all securities are affected. 6. Currency Risk : Firms which are dealing in foreign exchange currencies are exposed to this source of risk. Bank, financial institutions and money changers are few financial services firms which are normally affected by this source of risk. This risk arises because of changes in the currency values which in turn was determined by the fundamental economic strength of the two countries and short run demand and supply gap. These firms are affected by currency risk when they hold currencies or liabilities in the form of either forward contract or interest/principal payment. (i) When the Rupee depreciates, it affects those who are holding foreign currency liabilities. (ii) When the Rupee appreciates, if affects those who are holding foreign currency. Q. Explain how you can manage the risk involved in Financial Services. Ans. Introduction : It may not be feasible to start any venture without taking risk. Risk is an integral part of any business and the reward or profit is directly proportional to the risk undertaken. In the case of financial services industry, the firms deals with financial claims which are by nature risk products. We will now discuss different strategies available to manage these risks: Management of Risk : (1) Managing Credit Risk : The first step in the process of managing the credit risk is the quantification of credit risk the firm is exposed. The quantification is done through credit rating. The firm can adopt the following strategy in managing the credit risk. The steps involved in this strategy are: ZA D C O M PU TER S

- 14. 70 (i) Desirable Loan Portfolio : The starting point could be to develop a desirable loan mix which consists of different categories of the borrowers. (ii) Continuous Monitoring : This is more important in managing the credit risk. This continuous monitoring requires flow of information from the borrowers and also from the market and the firm has to develop necessary mechanism to collect such information from the borrowers and the market intelligence system. Since the performance of the borrowers deteriorate over a period, the monitoring system in force should give early warning and thus assumes a crucial role in the credit risk management. (iii) Action on Doubtful and Bad Debts : The moment the monitoring system raises some doubts about the loan account, action need to be initiated to recover the loans.The steps are: ØFirst things that need to be done is to check the assets, movable or immovable, that are given as a security to avail the loan. ØIf the asset value is found is to be inadequate, then demand is to be made for additional security. Along with this process, it is also useful to offer a good discount to motivate the borrowers to prepay the loan. (2) Managing Asset-Liability Gap Risk : This risk also applies to firms doing fund based services. Since funds raised from external sources play a major role in the fund based activities, the duration of the liability is an important variable which needs to be considered while lending. For example, if a firm gives a five year loan against a deposit for two years, there is a mismatch between the liability and asset. The techniques of management are: Gap Management: The first job in the ALM is to measure gap. There are two ways in which the gap can be measured. If the gap is measured at a macro level, it has limited use. It given an idea about the level of risk involved in the firm. The second method which is useful in ALM is to get a detailed break up of 'Gap'. The gap has to be necessarily closed or managed. (3) Managing Due-Diligence Risk : The professional efficiency and ethics followed by the firm determine this source of risk. Since the financial services firm is giving a certification to either the regulating agencies or its client on the completion of required formalities, they are expected to perform efficiently with thigh ethical standards. This risk could be managed by bringing in more professional an creating right environment within the organization. (4) Managing Interest Rate Risk : Interest rates in the economy play a major role in the financial markets. For managing interest rate risk interest rate swap is adopted. Interest Rate Swap : Interest rate swap involves the exchange of interest payments. It usually occurs when a person or a firm needs fixed rate funds but is only able to get ZA D C O M PU TER S

- 15. 69 MANAGEMENT OF FINANCIAL SERVICES floating rate funds. It finds another party who needs any floating rate loan but is able to get fixed rate funds. The two, known as counter parties, exchange the interest payments and the loans according to their own choice. It is the swap dealer, usually a bank, that brings together the two counter-parties for the swap. (5) Managing Market Risk : This is the minimum risk that investors in the market are exposed. Firms which are investing in the securities have to manage the market risk. There are several ways through which the market risk is managed. Some firms take a view on the market and switch over the funds from one market to another in order to minimize the risk. (6) Managing Currency Risk : Firms dealing in foreign exchange are exposed to currency risk. Non-banking entities, such as traders, that use the foreign exchange market for the purpose of hedging their foreign exchange exposure on account of changes in the exchange rate.They are known as hedgers. ZA D C O M PU TER S

- 16. 70 UNIT – II MANAGEMENT OF FINANCIAL SERVICES FINANCE : SPECIALIZATION PAPERS Q. Explain the Operations of Indian Stock Market. Ans. Meaning of Stock Exchange : Stock exchange means an organized market where securities issued by companies, government organizations and semi-organizations are sold and purchased. Securities include: (i) Shares (ii) Debentures (iii) Bonds etc. Definition of Stock Exchange : According to Pyle : “Stock Exchange are market places where securities that have been listed thereon, may be bought and sold for either investment or speculation.” Features of Stock Exchange : The main features of stock exchange are as follows: (1) Organised Market : Stock Exchange is an organized market. Every stock exchange has a management committee, which has all the rights related to management and control of exchange. All the transactions taking place in the stock exchange are done as per the prescribed procedure under the guidance of management committee. (2) Dealing in Securities issued by various concerns : Only those securities are traded in the stock exchanges which are listed there. After fulfilling certain terms and conditions, a company gets it security listed on stock exchange. (3) Dealing only through Authorized Members : Investors can sale and purchase securities in stock exchange only through authorized members. Stock exchange is a specified market place where only the authorized members can go. Investor has to take their help to sale and purchase. (4) Necessary to obey the Rules and Bye-Laws : While transacting in stock exchange, it is necessary to obey the rules and bye-laws determined by stock exchange. Functions of Stock Exchange : The main functions performed b stock exchange are as follows: ZA D C O M PU TER S

- 17. 69 MANAGEMENT OF FINANCIAL SERVICES (1) Providing Liquidity and Marketability to existing securities : Stock exchange is a market place where previously issued securities are traded. Various types of securities are traded here on regular basis. Whenever required, investor can invest his money through this market into securities and can reconvert this investment into cash. (2) Pricing of Securities : A stock exchange provides platform to deal in securities. The forces of demand and supply work freely in the stock exchange. In this way, prices of securities are determined. (3) Safety of Transactions : Stock exchanges are organized markets. The fully protect the interest of investors. Each stock exchange has its own laws and be-laws. Each member of stock exchange has to follow them and any member found violating them, his membership is cancelled. (4) Contributes to Economic Growth : Stock exchange provides liquidity to securities. This gives the investor a double benefit-first, the benefit of the change in the market price of securities and secondly, n case of need for money they can be sold at the existing market price at any time. (5) Spreading Equity Cult : Share market collects every types of information in respect of the listed companies. Generally this information is published or otherwise n case of need anybody can get it from the stock exchange free of any cost. In this way, the stock exchange guides the investors by providing various types of information.] (6) Providing Scope for Speculation : When securities are purchased with a view to getting profit as a result of change in their market price, it s called speculation. It is allowed or permitted under the provisions of the relevant Act. It is accepted that in order to provide liquidity to securities, some scope for speculation must be allowed. The share market provides this facility. Stock Exchange in India : There are 24 stock exchanges functioning currently in India. The names are given below: 1. Mumbai Stock Exchange OR 12. Bhubaneswar Stock Exchange Bombay Stock Exchange-BSE 13. Cochin Stock Exchange 2 National Stock Exchange (NSE) 14. Coimbatore Stock Exchange 3. Over the Counter Exchange o 15. Guwahati Stock Exchange India (OTCEI) 16. Jaipur Stock Exchange 4. Calcutta Stock Exchange(CSE) 17. Kanpur Stock Exchange 5. Delhi Stock Exchange (DSE) 18. Ludhiana Stock Exchange 6. Chennai Stock Exchange 19. Mangalore Stock Exchange 7. Ahmedabad Stock Exchange 20. Meerut Stock Exchange 8. Hyderabad Stock Exchange 21. Patna Stock Exchange 9. Bangalore Stock Exchange 22. Pune Stock Exchange 10. Indore Stock Exchange 23. Rajkot Stock Exchange 11. Baroda Stock Exchange 24. Capital Stock Exchange Kerala Ltd. ZA D C O M PU TER S

- 18. 70 Q. What are the main features of NSEI? Explain the trading process of NSEI Ans. National Stock Exchange of India (NSEI) : The NSEI has been established in the form of a traditional competitor stock exchange. It is an exchange where business is carried on in the securities of the medium & large-sized companies & the government securities. This stock exchange is fully computerized. The NSEI was established in the form of a public limited company in Nov., 1992. Its promoters are like this: (i) The Industrial Development Bank of India (IDBI). (ii) The Industrial Finance Corporation of India (IFCI). (iii) The Industrial Credit & Investment Corporation of India (ICICI). (iv) The Life Insurance Corporation of India (LIC). (v) The General Insurance Corporation of India (GIC). (vi) The SBI Capital Market Limited. (vii) The Stock Holding Corporation of India Ltd. (viii) The Infrastructure Leasing & Financial Services Ltd. Features or Nature of NSEI : The Chief features of the NSEI are following: 1) Model Exchange : The NSEI is the first stock exchange of its kind. The system of transaction of securities is very efficient and transparent. It is, therefore called a model exchange. 2) Floorless : In the NSEI there is no special importance of trading. The terminals of the NSEI have been established almost throughout the country. 3) Two Segments : On the basis of the transactions of securities done on the NSEI, it can be divided into two parts: (i) Wholesale Debt Market (WDM): This can be called money market segment. It mai9nly concerns the government securities, bonds of public sector undertakings, treasury bills, commercial papers, certificates of deposits, etc. (ii) Capital Market Segment: Its concern is with the shares and debentures of companies. 4) Easy Access : It being a special floorless stock exchange, every big and small investor can easily approach it. 5) Transparency in Transactions : Anybody can visit the local terminal of the NSEI and have a look at various transactions of the securities. Therefore is no possibility of any fraud in transactions. 6) Competition : The NSEI has removed the shortcomings of the traditional share markets and it has attempted to provide better facilities to the investors. That’s why the remaining share markets are nervous at its success. Now, they are also trying to provide good facilitate to the investors. In this way, there is a competition between two kinds of share markets.The investors are getting the benefits of this competition. ZA D C O M PU TER S

- 19. 69 MANAGEMENT OF FINANCIAL SERVICES 7) Same Price : Under the traditional system, the shares of a company could have different rates in different share markets but at the NSEI all the shares have the same value in all the towns. 8) Listing of other Stock Exchange : The securities of those companies which have not been listed on other share markets can be traded on the NSEI. 9) Undisclosed Identity of Participants : Information about any individual trading on any terminal of the NSEI cannot be passed on to any other person. In this way, the secrecy about the identity of the investors is maintained. 10) Order Driven System : The NSEI is a stock exchange based on the order driven system. It means that the sellers and buyers first place the order about the type of security, its number, rate and time when they are ready to buy or sell them. On the receipt of this order on the computer, the process of order matching starts. The moment a good matching takes place, its information appears on the computer screen. Purposes of NSEI : The chief aims of the establishment of the NSEI are the following: 1) Single Stock Exchange at National Level : It was decided by a Shri M.J. Pherwani that there should be a single stock exchange at the National level so that the confidence of the investors in the capital market increases. 2) Increasing Numbers of Transactions : For the last few decades, there has been an increase in the numbers of investors while the stock exchange system continues to be old. In such a situation the transactions cannot be settled easily. The purpose of the establishment of the NSEI is to solve this problem. 3) Increasing Transaction Costs : The transaction costs increase because of the distance between the stock exchange and the investors. Through the medium of NSEI, an effort bas been made to reduce these costs. 4) Decreasing Liquidity : There is a decline in the liquidity of the securities under the system of local stock exchange because the people doing transaction on a single stock exchange are limited in number. On the contrary, through the medium of NSEI the investors from the entire country can trade simultaneously at a single stock exchange. This increase the liquidity of securities. Therefore, the purpose of the NSEI is to check the decreasing liquidity of securities. 5) Developing a Debt Market : The purpose of the NSEI is to develop a debt Market. In the traditional share market, transactions are mostly in shares and no attention is paid to Debentures. Now the NSEI has divided the market in two parts-Debt market and capital Market.Therefore, this division is helpful in the development of debt market. ZA D C O M PU TER S

- 20. 70 6) Conforming to International Standard : Many modern share markets are being established at the International Level. In India also, there is a dire need of establishing a stock exchange of international level. The NSEI is a modern stock exchange based on the international standards. 7) Outdated Settlement System : In the traditional share markets, the system of settlement of transactions had become old. It was getting difficult to control the ever increasing number of transactions under this system. Under the NSEI, provision has been made to settle the transaction very quickly. Trading Process on NSEI : The selling and buying process of securities on the NSEI is as under: 1) Placing the Order : First of all the person buying or selling securities places an order. In this order, he tells the name of the company whose security he is ready to buy or sell at what price, in what quantity and for what period of time. 2) Conveying the Message to Computer : The moment the terminal operator receives the order from the customer, he feeds it in the computer. 3) Starting of Matching Process : The moment the computer receives orders, it starts the process of matching. During the process of matching orders, the best matching of the selling or buying order is sought to be found out. 4) Accepting the Order : As soon as the best matching of the buying and selling orders is established during the process of matching orders, its list is immediately obtained on the computer screen. This information tells us at what rate, time.All the terminals of the NSEI established throughout the country go on feeding their computers continent with what party your order has been transacted. 5) Delivery and Payment : After the transaction has been settled, the delivery and payment are made according to the rules of the NSEI. Q. What are the main features of OTCEI? Explain the trading process of OTCEI. Ans. Over the Counter Exchange of India (OTCEI) : The OTCEI is a completely computerized and special ringless stock exchange which is different from the traditional stock exchange and on which the buying and selling of securities is absolutely transparent and moves at a great speed. Its counters are spread all over the country where transactions are made with the help of telephone. The OTCEI was established under section 25 of the CompaniesAct, 1956 in October, 1990. The promoters of the OTCEI are the following financial and other institutions: (i) The UnitTrust of India (ii) The Industrial Credit and Investment Corporation of India. (iii) The Industrial Development Bank of India ZA D C O M PU TER S

- 21. 69 MANAGEMENT OF FINANCIAL SERVICES (iv) The Industrial Finance Corporation of India (v) The Life Insurance Corporation of India (vi) The General Insurance Corporation of India (vii) The SBI Capital Market Limited (viii) The Canbank Financial Services Limited. Features or Nature of OTCEI :The main features of the OTCEI are the following: (1) Ringless Trading : There s no particular place for transacting business in securities under the OTCEI. This exchange has its counters/offices throughout the country. Any buyer or seller of securities can go the counter/officer and have transaction through the medium of the operator. (2) Nation Network : The OTCEI has its network all over the country.All the counters are linked with the central terminal through the medium of computers. Therefore, the facility of nationwide listing is available here. In other words by listing on one exchange, one can have transactions with all the counters in the whole country. (3) Exclusive List of Companies : On the OTCEI only those companies are listed whose issued capital is 30 lakhs or more. In the old share markets this amount used to be ten crores on the BSE and three crores on the other exchanges and hence, listing was not possible in case the issued capital was less than three crores. Those companies which have been listed on the old share markets cannot be listed on the OTCEI. (4) Fully Computerized : This exchange is fully computerized. It means that all the transactions done on this exchange are done through the medium of computers. (5) Sponsorship : In order to get listed on the OTCEI, a company has to find a member to sponsor it. The main job of a sponsor is market making. T means a sponsor has to be read to buy or sell the shares of that company at least for a period of 18 months. In this way, a sponsor creates liquidity in securities. (6) Investor’s Registration : All the investors doing transactions on the OTCEI have got to register themselves compulsorily. Registration can be got done b giving an application at an counter. The registration is called the INVESTOTC CARD. On the basis of this card, one can do transactions of securities at any counter throughout the country. (7) Greater Liquidity : There is greater liquidity in securities because of the sponsor’s job of market making. (8) Transparency in Transactions : All the transactions are done in the presence of the investor. The rates of buying and selling can be seen on the computer screen. The operator cannot do any fraud or mischief with the transactions. (9) Faster Delivery and Payment : On the OTCEI, delivery in case of buying and payment in case of selling are both very fast. The work of delivery and payment in case of listed securities and permitted securities is completed within seven days and 15 days respectively. ZA D C O M PU TER S

- 22. 70 (10) Two ways of Public Offer : A company listed on the OTCEI can issue security in two ways. Firstly, the company can go directly to the public. This is called Direct Offer System. Secondly, the company sells its securities to the sponsor at a particular price. Then the sponsor sells them to the public.This is called Indirect Offer System. (11) Easy Access : In the big cities the counters of the OTCEI can be seen like ordinary shops.Any body can go the counter and do buying and selling of securities. Trading Process : One can trade in securities b going to any counter of the OTCEI. All the counters are linked with the central computer at the OTCEI headquarter. This office is in Mumbai.There can be three types of trading on the OTCEI: (1) Initial Allotment : When an investor is allotted shares through the medium of OTCEI, he is given a receipt which is called counter receipt-CR. This receipt is just like the share certificate. Selling and buying can be done through the medium of this receipt. (2) Buying in the Secondary Market : For the purpose of buying shares listed on the OTCEI, a person has to get himself registered (if he is not already registered). After this, he informs the counter operator about the number of the shares to be purchased. The counter operator displays the rates on the screen. After getting himself satisfied with the rate, the investor hands over the cheque to the operator. On the encashment of the cheque, the CR is handed over to the investor. This procedure takes about a week. (3) Selling in the Secondary Market : An investor who has purchased shares from the OTCEI can sell his shares at any counter of the OTCEI. After getting himself satisfied with the rate displayed on the screen, the investor hands over the Counter Receipt and the Transfer Deed to the Operator. The operator prepares the Sales Confirmation Slip (SCS) and a copy of it is handed over to the seller. The operator sends the CR, TD and SCS to the Registrar for confirmation.After confirming every detail the Registrar sends them back to the counter operator. In the end the operator issues a cheque to the seller and receives back the SCS from the seller. Purposes of OTCEI : The objects of the establishment of the OTCEI may be described as under: (1) Liquidity : The first object for the establishment of the OTCEI is o maintain liquidity in the securities of the small companies. The sponsor has got to do the job of market making. (2) Transparency : The second aim of this share market is to maintain transparency of transactions. Here all the transactions are made on the computer screen. This eliminates any chance of fraud. (3) Investor’s Grievances : An important aim of the establishment of the OTCEI is the speed solution of the problems of the investors. ZA D C O M PU TER S

- 23. 69 MANAGEMENT OF FINANCIAL SERVICES (4) Quick Settlement : In the traditional share markets both the delivery and payment take time.This problem has been overcome with the help of the OTCEI. (5) Listing of Small Companies : Small companies remain deprived of being listed because they are unable to fulfil the conditions laid down by the old share markets. (6) Access : This stock exchange is of the ringless type and therefore, has its counters all over the country. Q. Write brief notes on the concept of mutual funds. Also explain the organizational functions of mutual funds. Ans. Meaning of Mutual Fund : A mutual fund is essentially a mechanism of pooling together the savings of a large number of small investors for collective investment, with an avowed objective of attractive yields and capital appreciation, holding the safety and liquidity as prime parameters. Amutual fund is a trust that pools the savings of a number of investors who share a common financial goal.The money, thus, collected is then invested in capital market instruments such as shares, debentures and other securities. The income earned through these investments and the capital appreciation realized are share by its unit holders in proportion to the number of units owned by them. Working of a Mutual Fund : The flow chart below describes broadly the working of a mutual fund : Returns Passed back to Generates Investors Pool their money with Fund Manager Invest in Securities ZA D C O M PU TER S

- 24. 70 Mutual Fund – Organisation : There are many entities involved and the diagram below illustrates the organization set up of a mutual fund: Organisation of a Mutual Fund A mutual fund can be constituted either as a corporate entity or as a trust. In India, UTI was set up as a corporation under an Act of parliament in 1964. Indian banks when permitted to operate mutual funds, were asked to create trusts to run these funds. A trust has to work on behalf of its trustees. Indian banks operating mutual funds had made a convincing plea before the government to allow their mutual funds to constitute them as ‘Asset Management Companies’. The department of Company Affairs, Ministry of Law, Justice and Company Affairs has issued guidelines in respect of registration of Assets Management Companies (AMCs) in consultation with SEBI, as follows: (1) Approval of AMC by SEBI : As per guidelines, AMC shall be authorized for business by SEBI on the basis of certain criteria and the Memorandum and Articles of Association of theAMC would have to be approved by SEBI. (2) Authorised Capital of AMC : The primary objective of setting up of an AMC is to manage the assets of the mutual funds and other activities, which it can carry out, such as, financial services consultancy, which do not conflict with the fund management activity and are only secondary and incidental. Many players who help in running a mutual fund are as follows: SEBI Unit Holders Sponsors Trustees The Mutual Fund Custodian AMC Transer Agent ZA D C O M PU TER S

- 25. 69 MANAGEMENT OF FINANCIAL SERVICES (i) Registers and TransferAgents :The major responsibilities are: ØReceiving and processing the application form of a mutual fund ØIssuing of unit/share certificate on behalf of mutual fund ØMaintain detailed records of unit holders transactions ØPurchasing, selling, transferring and redeeming the Unit/Share certificate ØIssuing of income /dividend, broker cheques etc. (ii) Advertiser : Major responsibilities of an adviser include: ØHelping mutual funds organizers to prepare a media plan for marketing the fund. ØIssuing/buying the space in newspapers and other electronic media for advertising the various features of a fund. ØArranging or hoardings at public places. (iii) Advisor/ Manager : It is generally a corporate entity that does the following jobs: ØProfessional advice on the fund’s investments ØAdvice on asset management services. (iv) Trustees : Trustees provide the overall management services and charge management fee. (v) Custodian : A custodian is again a corporate body that carries out the following functions: ØHolds Securities ØReceives and delivers securities ØCollects income/interest/dividends on the securities ØHolds and processes cash (vi) Other Players : Besides the above, other players are as under: ØFundAdministrator ØFundAccounting Services ØLegalAdvisors. ØFund Officers ØUnderwriters/Distributors Q. What are the advantages of investing in mutual funds? Also explain the drawbacks of mutual funds. Ans. Meaning of Mutual Fund : A mutual fund is essentially a mechanism of pooling together the savings of a large number of small investors for collective investment, with an avowed objective of attractive yields and capital appreciation, holding the safety and liquidity as prime parameters. ZA D C O M PU TER S

- 26. 70 Advantages of Investing in Mutual Funds : The advantages of investing in mutual funds are: (1) Professional Management : Most mutual funds pay top-flight professionals to manage their investments. These managers decide what securities the fund will buy and sell. (2) Regulatory Oversight : Mutual funds are subject to many government regulations that protect investors from fraud. (3) Liquidity : It’s easy to get your money out of a mutual fund. Write a cheques, make a call and you’ve got the cash. (4) Convenience : You can usually buy mutual fund shares by mail, phone or over the Internet. (5) Low Cost : Mutual fund expenses are often no more 1.5 % of your investment. (6) Investment variety and spread in different industries. (7) CapitalAppreciation (8) No impulsive decision-making regarding purchase or sale of share/securities, since the funds are managed by expert, professional fund managers who have access to the latest detailed information regarding the stock market. (9) Even the smallest dividend or capital gain gets reinvested, thus enhancing the effective return. (10) Freedom from paperwork. (11) Transparency (12) Flexibility (13) Choice of Schemes (14) Tax benefits on invested amounts/returns/capital gains (15) Well regulated Drawbacks of Mutual Fund : Mutual funds have their drawbacks: (1) No Guarantees : No investment is risk-free. If the entire stock market declines in value, the value of mutual fund shares will go down as well. (2) Fees and Commissions : All funds charge administrative fees to cover their day-to- day expenses. Some funds also charge sales commissions or ‘loads’ to compensate brokers, financial consultants, or financial planners. (3) Taxes : During a typical year, most actively managed mutual funds sell anywhere from 20 to 70% of the securities in their portfolios. If your fund makes a profit on its sales, you will pay taxes on the income you receive, even if you reinvest the money you made. ZA D C O M PU TER S

- 27. 69 MANAGEMENT OF FINANCIAL SERVICES (4) Management Risk : When you invest in a mutual fund, you depend on the fund’s manager to make the right decisions regarding the fund’s portfolio. If the manager does not perform as well as you had hoped, you might not make as much money on your investment as you expected. Q. What are the different types of mutual funds schemes?Also explain the types of mutual fund schemes in India. Ans. Meaning of Mutual Fund : A mutual fund is essentially a mechanism of pooling together the savings of a large number of small investors for collective investment, with an avowed objective of attractive yields and capital appreciation, holding the safety and liquidity as prime parameters. Types of Mutual Fund Schemes : A wide variety of mutual fund schemes exists to cater to the needs such as financial position, risk tolerance and return expectations etc. Types of Mutual Fund Schemes By Structure By Investment Other Schemes Objectives Open-ended Funds Growth Funds Tax Saving Funds Close-ended Funds Income Funds Special Funds Balanced Funds Area Funds (A) By Structure : On the basis of structure, there are two types of mutual fund schemes: (1) Open-ended Funds : In open-ended funds, there is not limit to the size of funds. Investors can invest as and when they like. (2) Close-ended funds : These funds are fixed in size as regards the corpus of the fund and the number of shares. In close-ended funds, no fresh units are created after the original officer of the scheme expires. (B) By Investment Objectives : On the basis of investment objectives there are four types of mutual funds schemes: (1) Growth Funds : These funds do not offer fixed regular returns but provide substantial capital appreciation in the long run. The pattern of investment in general is oriented towards shares of high growth companies. ZA D C O M PU TER S

- 28. 70 (2) Income Funds : These funds offer a return much higher than the bank deposits but with less capital appreciation. The emphasis being on regular returns, the pattern of investment in general is oriented towards fixed income-yielding securities like non-convertible debentures of consistently good dividend paying companies etc. (3) Balance Schemes or Income and Growth-Oriented Funds : These offer a blend of immediate average returns and reasonable capital appreciation in the long run. (4) Area Funds : These are funds that are raised on other countries for providing access to foreign investors. The India Growth Fund and the India Fund raised in the US and UK respectively are examples of area funds. (C) Other Schemes : (1) Tax Saving Funds : These funds are raised for providing tax relief to those investors whose income comes under taxable limits. (2) Special Funds : These funds are invested in a particular industry like cement, steel, jute, power or textile etc. These funds carry high risks with them as the entire fund is exposed to a particular industry. Types of Mutual Fund Schemes in India : (1) Growth Funds :There are the following features: (i) Objective : Generating substantial capital appreciation (ii) Investment Pattern : Nearly all in equity shares (iii) Duration : SevenYears (iv) Investment Risk : High risk in reinvestment schemes (v) Returns : No assured return but high returns are expected (vi) Liquidity : No repurchase facility except at the end of the scheme (vii) Transfer of units is allowed Some Examples of Growth Schemes : Schemes issued by (a) Master Share, Master share plus, Master Gain, UGS-200 UnitTrust of India (b) Magnum Express, Magnum Multiplier SBI Mutual Fund (C) Canshare, Canstar Cap, Cangrowth, Canbonus Canbank Mutual Fund (d) Ind Ratna, Ind Sagar, Ind Moti Indbank Mutual Fund (2) Income Funds :The Income funds are the following features: (i) Objective :Assured minimum income and safety of capital (ii) Duration : 5-7 years (iii) Investment Pattern : Bulk of funds invested in fixed income securities like government bonds, company debentures, etc. and rest in equity shares. ZA D C O M PU TER S

- 29. 69 MANAGEMENT OF FINANCIAL SERVICES (iv) Investment Risk :Absolute Safety (v) Return : 14.75% p.a. upwards-payable monthly or quarterly plus mid scheme bonus and end of the scheme appreciation. (vi) Liquidity : No listing on stock exchange and units are not transferable. Some examples of Income Funds: (a) Units Scheme of 1964, Growing Income Unit Scheme of 1987 Unit trust of India (b) Magnum Monthly Income Schemes SBI Mutual Fund (c) Rising Monthly Income Schemes BOI Mutual Fund (3) Balance Funds :The main features are: (i) Objective : Income and growth with reasonable safety (ii) Duration : SevenYears (iii) Investment pattern :About 50% in equity and the rest in debenture etc. (iv) Returns : No assured returns, but steady income due to annual contribution of minimum of 80% of theTrust’income by way of dividends, interest etc. (v) Liquidity : Repurchase facility after initial lock-in period of three years (vi) No listing of stock exchange (vii) Transfer of units permitted (viii) Units can be pledged to banks for loans (4) Tax Planning Schemes : The investment made under these schemes are deductible from the taxable income up to certain limits, thus providing substantial tax relief to the investors. Examples of tax planning schemes: (a) Can 80CC and Canstar 80Lof Canbank Mutual Fund (b) Ind 88Aof Indbank Mutual Fund (5) Other Schemes : These include schemes of 10-15 years duration, which offer multiple benefits. For example: Sr. No. Scheme Benefits 1. Unit Linked Insurance (i) Contribution eligible for tax deduction of Plan of UTI ITAct (ii) Insurance cover up to target amount (iii) Reasonable income by way of dividend (iv) Liquidity (v) Safety Of Capital 2. Dhanaraksha, These offer some or all of the following Dhansahyog, benefits : ZA D C O M PU TER S

- 30. 70 Dhanavridhi (i) Life Insurance cover (ii) Accident Insurance Cover Schemes of LIC (iii) Reinvestment of annual dividends of Mutual Fund reasonable dividend (iv) Safety of capital (v) Reasonable capital appreciation (vi) Liquidity (vii) Units are not transferable, but bank loan facility is available (viii) Tax exemption on dividend Q. Explain the Merchant Banking Services. Ans. Merchant Bankers : Amerchant banker is any person who is engaged in the business of issue management either by making arrangements regarding selling, buying or subscribing to securities or acting as manager/consultant/advisors or rendering corporate advisory service in relation to such issue management. Issues mean an offer for sale/purchase of securities by any body corporate/other person or group of persons through a merchant banker. The importance of merchant bankers as sponsors of capital issues is reflected in their major services such as, determining the composition of capital structure, draft of prospects and application forms, listing of securities and so on. In view of the importance of merchant bankers in the process of capital issues, it is now mandatory that all public issues should be managed by merchant bankers functioning as the lead managers. In the case of right issues not exceeding Rs. 50 lakh, such as appointments may not be necessary. Services provided by the Merchant Bankers : (1) Project Management : Right from planning to commissioning of project, project counseling and preparation of project reports, feasibility reports, preparation of loan application form, government clearances for the project from various agencies, foreign collaboration, etc. (2) Issue Management : (i) The evaluation of the client’s fund requirements and evolution of a suitable finance package. (ii) The design of instrument such as equity, convertible debentures, non- convertible debentures etc. (iii) Applications covering consents from institutions/banks and audited certificates, etc. (iv) Appointment of agencies such as printers, advertising agencies, registrars, underwriters, and brokers to the issue. (v) Preparation of prospectus ZA D C O M PU TER S

- 31. 69 MANAGEMENT OF FINANCIAL SERVICES (3) Portfolio Management Services : Portfolio management schemes are promoted by merchant bankers and other finance companies to handle funds of investors at a fee. (4) Counselling : Corporate counseling basically means the advice a merchant banker gives to a corporate unit to ensure better performance in terms of growth and survival. (5) Loan Syndication : Loan syndication refers to the services rendered by merchant banker in arranging and procuring credit from financial institutions, banks and other lending institutions. Q. What is Issue Management. Explain various types of issues. Ans. Issue Management : Issue management refers to management of securities offerings of the corporate sector to public and existing shareholders on rights basis. Issue managers in capital market are known as Merchant Banker or Lead Managers.Although the term merchant banking, in generic terms, covers a wide range of services, but issue management constitutes perhaps the most important function within it. Under SEBI Guidelines, each public issue and rights issue of more than Rs. 50 lacs is required to be managed by merchant banker, registered with SEBI. Types of Issues : Existing as well as new companies raise funds through various sources for implementing projects: (1) Public Issue : The most common method of raising funds through issues is through prospectus. Public issue is made by a company through prospectus for a fixed number of shares at a stated price which may be at par or premium and any person can apply for the shares of the company. (2) Rights Issue : Right issues are issues of new shares in which existing shareholders are given preemptive rights to subscribe to new issue of shares. Such further shares are offered in proportion to the capital paid-up on the shares help by them at the date of such offer. The shareholders to whom the offer is made are not under any legal obligation to accept the offer. (3) Private Placement : The direct sale of securities by a company to investors is called private placement. In private placement, no prospectus is issued. Private placement covers shares, preference, shares and debentures. Q. Discuss briefly the pre-issue and post-issue obligations of merchant bankers. Ans. Introduction : raising money from the capital market needs planning the activities and chalking out a marketing strategy. It is, therefore, essential to make an nalaytical study of various sources, the quantum, the appropriate time, the cost of raising capital and the possible impact of such resources on the overall capital structure besides the low governing the issue. There are various activities required for raising funds from the capital markets. These can be broadly divided into pre-issue and post-issue activities. ZA D C O M PU TER S

- 32. 70 (A) Pre-issueActivities : (1) Signing of MoU : Issue management activities begin with the signing of Memorandum of Understanding between the client company and the Merchant banker. The MoU clearly specifies the role and responsibility of the Merchant banker, vis-à-vis, that of the Issuing Company. (2) Obtaining Appraisal Note : After the contract is awarded, an appraisal note is prepared either-in-house or is obtained from outside appraising agencies viz., financial institutions/banks etc. The appraisal not thus prepared throws light on the proposed capital outlay on the project and the sources of funding it. (3) Determination of Optimum Capital Structure : Optimum capital structure is determined considering the nature and size of the project. If the project is capital intensive, funding is generally biased in favour of equity funding. (4) Appointment of Underwriters, Registrars etc. : For ensuring subscription to the offer, underwriting arrangement are also made with various functionaries. This is followed by appointment of registrars to an issue for handling share allotment related work, appointment of Bankers to an issue for handling collection of application at various centres, printers for bulk printing of issue related stationery, legal advisors and advertising agency. (5) Preparation of Documents : Thereafter, initial application are submitted to those stock exchange where the listing company intends to get its securities listed. Lead managers also prepares the list of material documents viz., MoU with Registrar, with bankers to an issue, with advisor to the issue, co-managers to issue, agreement for purchase of properties, etc., to be sent for inclusion of prospectus. (6) Due Diligence : The lead manager while preparing the offer document is required to exercise utmost due diligence and to ensure that the disclosures made in the draft offer document are true, fair and adequate. (7) Submission of Offer Document to SEBI : The draft document thus prepared is filed with SEBI along with a due diligence certificate to obtain their observations. SEBI is required to give its observations on the offer document within 21 days from the receipt of the offer document. (8) Finalisation of Collection Centres : Lead Manager finalises collection centres at various places for collection of issue application from the prospective investors. (9) Filing with RoC : After incorporating SEBI observations in the offer document, the complete document is filed with Registrar of Companies to obtain their acknowledgment. (10) Launching of a Public Issue : The observation letter issued by SEBI is valid for a period of 365 days from the date of its issuance within which the issue can open for ZA D C O M PU TER S

- 33. 69 MANAGEMENT OF FINANCIAL SERVICES subscription. Once the legal formalities and statutory permission for issue of capital are complete, the process of marketing the issue starts. Lead manager has to arrange for distribution of public issue stationery to various collecting banks, brokers, investor , etc. The announcement regarding opening of issue in the newspapers is alos required to be made by advertising in newspapers 10 days before of the issue opens. (11) Promoter’s Contribution : A certificate to this effect that the required contribution of the promoter’s has been raised before opening of the issue obtained from a chartered accountant is also required to be filed with SEBI. (12) Closing of the Issue : During the currency of the issue, collection figures are also obtained on daily basis from Bankers to the issue. These figures are to be filed in a 3 days report with SEBI. Another announcement through the newspapers is also made regarding the closure of the issue. (B) Post-Issue Activities : After the closures of the issue, lead manager has to manage the post-issue activities pertaining to the issue. Certificate of 90% subscription from Registrar as well as final collection certificate from Bankers are obtained. (1) Finalisation of Basis of Allotment : In case of a public offering, if the issue is subscribed more than five times, association of SEBI nominated public representative is required to participate in the finalization of Basis of allotment (BoA). (2) Despatch of Share Certificate : Then follows dispatch of share certificates to the successful allotees and refund order to unsuccessful applicants. (3) Issue of Advertisement in Newspapers : An announcement in the newspaper is also made regarding BoA, no. of applications received and the date of despatch of share certificates and refund orders etc. ZA D C O M PU TER S

- 34. 70 UNIT – III MANAGEMENT OF FINANCIAL SERVICES FINANCE : SPECIALIZATION PAPERS Q. Define Leasing. What are its essential elements? Discuss briefly the significance and limitations of leasing. Ans. Meaning of Leasing : Conceptually, a lease may be defined as a contractual arrangement in which a party owing an asset (lessor) provides the asset for use to another (lessee) over a certain/for an agreed period of time for consideration in form of periodic payment. At the end of the period of contract, the asset reverts back to the lessor unless there is a provision for the renewal of the contract. Leasing is a process by which a firm obtain the use of a certain fixed asset for which it must make a series of contractual periodic tax-deductible payments (lease rentals). Essential Elements :The essential elements of leasing are: (1) Parties to the Contract : There are essentially two parties to a contract of lease financing, namely: (i) The Owner called the lessor (ii) The User called the lessee Lessors as well as lessees may be individuals, partnerships, joint stock companies, corporations or financial institutions. Sometime there may be jointly lessors or joint lessees. Besides, there may be a lease-broker who acts as an intermediary in arranging lease deals. They charge certain percentage of fees for their services, ranging between 0.5 to 1 percent. (2) Asset : The asset, property or equipment to be leased is the subject matter of a contract of lease financing. The asset may be an automobile, plant & machinery equipment, land & building and so on. The asset must, however, be of the lessee's choice suitable for his business needs. (3) Ownership separated from User : The essence of a lease financing contract is that during the lease-tenure, ownership of the asset vests with the lessor and its use is allowed to the lessee. On the expiry of the lease tenure, the asset reverts to the lessor. (4) Term of Lease : the term of lease is the period for which the agreement of lease remains in operation. Each lease should have a definite period otherwise it will be legally inoperative. ZA D C O M PU TER S

- 35. 69 MANAGEMENT OF FINANCIAL SERVICES (5) Lease Rentals : The consideration which the lessee pays to the lessor for the lease transaction is the lease rental. (6) Modes of Terminating Lease : The lease is terminated at the end of the lease period and various courses are possible, namely, (i) The lease is renewed on a perpetual basis for a definite period, or (ii) The asset reverts to the lessor, or (iii) The asset reverts to the lessor and the lessor sells it to a third party, or (iv) The lessor sells the asset to the lessee. Advantage/Significance of Leasing :The advantages are: (A) Advantage to the Lessee : Lease financing has following advantage to the lessee: (1) Financing of Capital Goods : Lease financing enables the lessee to have finance for huge investments in land, building, plant, machinery, heavy equipments and so on, upto 100 percent, without requiring any immediate down payment. (2) Additional Source of Finance : leasing facilitates the acquisition of equipment, plant & machinery without necessary capital outlay, and thus, has a competitive advantage of mobilizing the scare financial resources of the business enterprise. (3) Less Costly : Leasing, as a method of financing, is less costly than other alternatives available. (4) Ownership Preserved : Leasing provides finance without diluting the ownership or control of the promoters. (5) Flexibility in Structuring of Rentals : The lease rentals can be structured to accommodate the cash flow position of the lessee, making the payment of rentals convenient to him. (6) Simplicity : A lease finance arrangement is simple to negotiate and free from cumbersome procedure with faster and simple documentation. (7) Tax Benefits : By suitable structuring of lease rentals, a lot of tax advantage can be derived. If the lessee is in a tax paying position, the rental may be increased to lower his taxable income. If the lessor is in tax paying position, the rentals may be lowered to pass on a part of the tax benefit to the lessee. Thus, the rentals can be adjusted suitably for postponement of taxes. (8) Obsolescence Risk is averted : In a lease arrangement, the lessor being the owner bears the risk of obsolescence and the lessee is always free to replace the asset with latest technology. (B) Advantage to the Lessor :Alessor has the following advantage: (1) Full Security : The lessor's interest is fully secured since he is always the owner of the leased asset and can take repossession of the asset if the lessee defaults. ZA D C O M PU TER S

- 36. 70 (2) Tax Benefit : The greatest advantage for the lessor is the tax relief by way of depreciation. If the lessor is in high tax bracket, he can assets high depreciation rates and , thus reduce his tax liability substantially. (3) High Profitability : The leasing business is highly profitable since the rate of return is more than what the lessor pays on his borrowings. (4) High Growth Potential : The leasing industry has a high growth potential. Lease financing enables the lessees to acquire equipment and machinery even during a period of depression, since they do not have to invest any capital. Leasing, thus, maintains the economic growth even during recessionary period. Limitations of Leasing : Lease financing suffers from certain limitations too: (1) Restrictions on Use of Equipment : A lease arrangement may impose certain restrictions on use of the equipment, or require compulsory insurance, and so on. Besides, the lessee is not free to make additions or alterations t the leased asset to suit his requirement. (2) Loss of Residual Value : The lessee never becomes the owner of the leased asset. Thus, he is deprived of the residual value of the asset and is not even entitled to any improvement done by the lessee or caused by inflation or otherwise, such as appreciation in value of leasehold land. (3) Consequences of Default : If the lessee defaults are complying with any terms and conditions of the lease contract, the lessor may terminate the lease and take over the possession of the leased asset. (4) Understatement of Lessee's Asset : Since the leased assets do not form part of lessee's assets, there is an effective understatement of his assets. (5) Double Sales-tax : With the amendment of sale-tax law of various states, a lease financing transaction may be charged to sales-tax twice- once when the lessor purchases the equipment and again when it is leaded to the lessee. Q. Define Lease. Give the Classification of Lease. Ans : Meaning of Leasing : Conceptually, a lease may be defined as a contractual arrangement in which a party owing an asset (lessor) provides the asset for use to another (lessee) over a certain/for an agreed period of time for consideration in form of periodic payment. At the end of the period of contract, the asset reverts back to the lessor unless there is a provision for the renewal of the contract. Leasing is a process by which a firm obtain the use of a certain fixed asset for which it must make a series of contractual periodic tax-deductible payments (lease rentals). Classification of Lease : Leasing can be classified into the following types: ZA D C O M PU TER S

- 37. 69 MANAGEMENT OF FINANCIAL SERVICES (A) Finance Lease and Operating Lease : (1) Finance Lease :According to InternationalAccounting Standards (IAS-17), in finance lease the lessor transfers to the lessee, substantially all the risks and rewards incidental to the ownership of the asset. It involves payment of rentals over an obligatory non-cancellable lease period, sufficient in total to amortise the capital outlay of the lessor and leave some profit. In such leases, the lessor is only a financier and is usually not interested in the assets. Types of assets included, under such lease, are ships, lands, buildings, heavy machinery diesel generating sets and so on. (2) Operating Lease : According to the IAS-17, an operating lease is one which is not a finance lease. In an operating lease, the lessor does not transfer all the risks and rewards incidental to the ownership of the asset and the cost of the asset is not fully amortised during primary lease period. The lessor provides services attached to the leased asset, such as maintenance, repair and technical advice. Operating lease is generally used for computers, office equipments, automobiles, trucks, some other equipments, and so on. (B) Sale and Lease Back and Direct Lease : (1) Sale and Lease Back : In a way, it is an indirect form of leasing. The owner of an asset sells it to a leasing company (lessor) which leases it back to the owner (lessee). (2) Direct Lease : In direct lease, the lessee, and the owner of the asset are two different entities.Adirect lease can be of two types: ØBipartite Lease :There are two parties in the lease transaction, namely (i)Asset Supplier-cum-lessor and (ii) Lessee ØTripartite Lease : Such type of lease involves three different parties in the lease agreement: supplier, lessor and lessee. (C) Single Investor Lease and Leveraged Lease : (1) Single Investor Lease : There are only two parties to the lease transaction- the lessor and the lessee. The leasing company (lessor) funds the entire investment by an appropriate mix of debt and equity funds. (2) Leveraged Lease : There are three parties to the transaction- (i) Lessor, (ii) Lender (iii) Lessee. In such type of lease, the leasing company buys the asset through substantial borrowing. (D) Domestic Lease and International Lease : (1) Domestic Lease : A lease transaction is classified as domestic if all parties to the agreement, namely, equipment supplier, lessor and the lessee, are domiciled in the same country. ZA D C O M PU TER S