AC1220 ACCOUNTING ILab 4.2AC1220 Lab 4.2Intro.docx

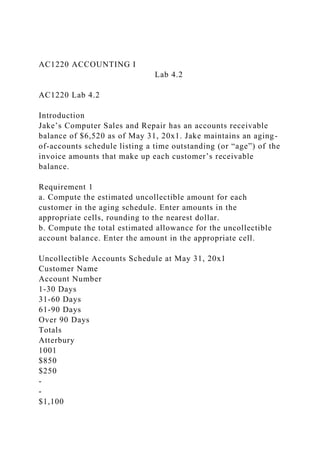

- 1. AC1220 ACCOUNTING I Lab 4.2 AC1220 Lab 4.2 Introduction Jake’s Computer Sales and Repair has an accounts receivable balance of $6,520 as of May 31, 20x1. Jake maintains an aging- of-accounts schedule listing a time outstanding (or “age”) of the invoice amounts that make up each customer’s receivable balance. Requirement 1 a. Compute the estimated uncollectible amount for each customer in the aging schedule. Enter amounts in the appropriate cells, rounding to the nearest dollar. b. Compute the total estimated allowance for the uncollectible account balance. Enter the amount in the appropriate cell. Uncollectible Accounts Schedule at May 31, 20x1 Customer Name Account Number 1-30 Days 31-60 Days 61-90 Days Over 90 Days Totals Atterbury 1001 $850 $250 - - $1,100

- 2. Smith 1002 1,320 2,900 $480 - $4,700 Walten 1003 - - 50 40 $90 Total $2,170 $3,150 $530 $40 $6,520 Estimated percent uncollectible x 2% x 5% x 10% x 90% Estimated allowance for uncollectible accounts Requirement 2 a. Make the necessary journal entry to establish an allowance

- 3. for the uncollectible accounts account. Use the target allowance for the uncollectible accounts balance computed in Requirement 1. DATE DETAILS DEBIT CREDIT 5/31/x1 b. Post the entry from Requirement 2a and account receivable balance to the following T-Accounts: Uncollectible Account Expense Allowance for Uncollectible Accounts Accounts Receivable

- 4. c. Show the disclosure of net accounts receivable in the following partial balance sheet: In the current assets section of the balance sheet: Accounts Receivable, Net Requirement 3 Jake is informed in writing that a customer, Walten, has filed for bankruptcy and will be unable to settle an account receivable of $90. Make the journal entry necessary to write off this amount. DATE DETAILS DEBIT CREDIT 5/31/x1

- 5. Requirement 4 Jake receives notice from Walten’s attorney that Jake’s Computer Sales and Repair will receive $0.50 on the dollar of the $90 account receivable previously written off. A check for that amount is included. Journalize the partial reinstatement and recovery of Walten’s account receivable. DATE DETAILS DEBIT CREDIT 5/31/x1

- 6. Requirement 5 Customer Smith’s account receivable balance of $480 is more than 60 days old. Jake and Smith agree to reclassify this amount as a note payable with a six-month maturity and a 15 percent annual interest rate. Jake makes the following journal entry: DATE DETAILS DEBIT CREDIT 5/31/x1 Note Receivable $480 Accounts Receivable $480 To record 15% note receivable

- 7. Compute the interest and principle components of the payment that Smith will make on June 30, 20x1, on the note payable. Hint: Principal x Interest Rate x Days/365 = Amount of Interest Requirement 6 Requirement 6 Jake considers using the direct write-off method to account for uncollectible accounts. He would debit the uncollectible account expense and credit the accounts receivable account only when an account receivable is deemed uncollectible. The allowance method seems tedious because it involves first estimating uncollectible accounts in the current period and then debiting an allowance for the uncollectible accounts account. Furthermore, Jake reasons that the direct wrote-off method is better because an allowance for uncollectible accounts is only an estimate, whereas the direct-write off method is based on a known amount. Should Jake continue using the allowance method to account for uncollectible accounts? Provide two reasons why the direct write-off method might be unacceptable, according to generally accepted accounting principles (GAAP). 1

- 8. AC1220 ACCOUNTING I Lab 4.1 AC1220 Lab 4.1 Introduction On May 31, 20x1, Jake obtains a bank statement from Ninth- Bank. According to the bank statement, the business bank account of Jake’s Computer Sale and Repair has an ending balance of $33,895 on May 31, 20x1. The cash account in the books of Jake’s Computer Sale and Repair shows an ending balance of $44,640. Jake notes the following items: · Jake deposited $11,600 in Ninth-Bank on May 30. The bank has not yet credited this amount to the business bank account. · The following checks written by Jake have not yet been presented to Ninth-Bank for payment: · Check #125: $350 · Check #131: $1,100 · Check #138: $90 · Jake’s Computer Sale and Repair presently has $800 in prepaid advertising on its books. The advertising agency had overcharged Jake’s Computer Sale and Repair by $150. The advertising agency corrects the error and deposits the amount directly into the business bank account. · Bank service charges per the bank statement are $35. · Interest earned on the bank balance is $10. · A check for $250, previously recorded as a payment by a customer on an account receivable, was returned marked “nonsufficient funds” (NSF). · The bank incorrectly debited the bank account of Jake’s Computer Sale and Repair for $560. This amount in fact relates to a check drawn on the account of a different business, Jack’s Car Sales and Repairs.

- 9. Requirement 1 Prepare the bank reconciliation of Jake’s Computer Sale and Repair as of May 31, 20x1. Complete the following: Jake’s Computer Sale and Repair Bank Reconciliation May 31, 20x1 Bank Statement: Balance, May 31, 20x1 Add: Less: Adjusted Bank Balance at May 31, 20x1

- 10. Books of Jake’s Computer Sale and Repair: Balance, May 31,20x1 Add: Less: Adjusted Book Balance at May 31, 20x1 Requirement 2 Make the journal entries necessary to reconcile the cash account with the bank statement. DATE DETAILS

- 11. DEBIT CREDIT 5/31/x1 Account receivable collected by bank 5/31/x1 To record interest received on bank balance 5/31/x1

- 12. To record bank service charge Requirement 1, continued DATE DETAILS DEBIT CREDIT 5/31/x1 Account receivable collected by bank

- 13. Requirement 3 Dave is presently a part-time employee at Jake’s Computer Sale and Repair. Dave’s responsibilities include receiving and handling inventory and serving as the cashier when Jake is unavailable. Jake presently makes all the entries into the accounting records for the business and prepares the financial statements. Jake is impressed with Dave’s work ethic and apparent trustworthiness, and offered Dave a full-time position. The volume of transactions is increasing significantly as the business grows, and Jake is having trouble keeping up with all the day to day accounting work. Jake considers expanding Dave’s responsibilities to include journalizing all sales and inventory-related transactions. Identify the internal control issues that could arise if Dave’s duties were to include making journal entries for transactions, in addition to his current duties. Provide one examples of an internal control problem that could arise and suggest a solution to that problem. 1 Project Part 1: The Accounting Cycle Karen Harris starts her own scooter retail business, City Rides, on December 1, 20x2. The business operates as a proprietorship from a rented space near a busy downtown area. Harris hires Jim Waters as the sales associate and assistant manager of the

- 14. business. The following transactions take place during December 20x2. Transactions Dec. 1 Harris deposits $45,000 into the business bank account. In exchange, she receives capital in the proprietorship. |X| 1 Harris writes and mails check #001 for $2,400 for rent. The rent payment covers rent for the three months ended February 28, 20x2. |X| 2 Harris purchases office equipment for $1,800 by check #002. |_| 2 Harris purchases office supplies for $420 by check #003. |_| 2 Harris purchases 20 Model X mopeds at $500 each and 15 Model L mopeds at $800 each, costing a total of $22,000, on account from a supplier, Fun Brands: · Harris elects to use the first-in-first-out (FIFO) method to account for inventory. · Fun Brands provides an invoice with the following terms: 2/10 net 30. |_| 9 In the first week of operation, City Rides sells 16 Model X mopeds at $750 each: 10 are sold on account, and the rest are sold for cash. |_| 12 City Rides makes payment to Fun Brands in full settlement of accounts payable by check #004. Payment is net of the purchase

- 15. discount. Hint: The terms are 2/10 net 30, and any purchase discount received reduces the cost of inventory. |_| 13 City Rides purchases 10 Model X mopeds from Fun Brands on account at a cost of $520 each. |_| 16 The sales for the week are as follows: 6 Model X mopeds sold on account for $750 each—inventory cost accounted using the FIFO method. |_| 18 Cash receipts from customers on accounts receivable are $7,100. |_| 30 Sales for the rest of December are as follows: 2 Model L mopeds sold for cash for $1,100 each. |_| 30 Harris receives the utilities bill for December 20X2 for $650, still payable at month end. |_| 30 Harris pays wages amounting to $1,800 by check #005. |_| 30 Harris withdraws $2,500 in cash. |_|

- 16. The Chart of Accounts The ledger of City Rides is composed of the following accounts. Classify each account by account type. Choose from among the following items: Asset Contra-asset Liability Owner’s equity Account Name Account Type Cash Accounts Receivable Supplies Prepaid Rent Inventory Office Equipment Accumulated Depreciation—Office Equipment Accounts Payable Capital—Harris

- 17. Withdrawals—Harris Income Summary Sales Revenue Cost of Goods Sold Wages Expense Rent Expense Depreciation Expense—Office Equipment Supplies Expense Complete the following schedule to track the purchase and sale of inventory items during December 20x2. Use the FIFO method to account for the cost of goods sold. The first inventory purchase and sale are included as an example. MODEL X MODEL L Date Purchase (sale) Quantity Cost per unit Total Date Purchase (sale) Quantity Cost per unit Total Dec. 2 Purchase

- 19. 16 Task 1: Making Journal Entries Journalize the transactions for December 20x2. The first three transactions are journalized already. Use the following template to make journal entries and check off transactions as they are entered, using the check boxes. Double-click each check box and select “checked” in the dialog box. Click the OK button to check. Date Account and Explanation Debit Credit Dec 1 Cash

- 20. $45,000 Capital $45,000 To record owner contribution 1 Prepaid Rent $2,400 Cash $2,400 To record prepaid expense

- 23. Date

- 27. AC1220 ACCOUNTING I Project Part 1 Page 1 Task 2: Using the Accounting Worksheet Adjustments Dec. 31 Depreciation on office equipment, $360 |_| 31 Supplies used, $300 |_| 31 Recognized rent expense—prepaid rent account |_| Complete the worksheet provided on the next page by making the adjustments described. Compute adjusted trial balance amounts and enter account balances into the income statement and balance sheet columns, where necessary. City Rides

- 28. Accounting Worksheet For the Month Ended Dec. 31 20x2 Account Trial Balance Adjustments Adjusted Trial Balance Income Statement Balance Sheet Debit Credit Debit Credit Debit Credit Debit Credit Debit Credit Cash $19,020 Accounts Receivable 12,000

- 30. Office Equipment 1,800 Accumulated Depreciation—Office Equipment - Accounts Payable $5,850 Capital—Harris

- 31. 45,000 Withdrawals—Harris 2,500 Sales Revenue 16,500 Cost of Goods Sold 11,040

- 32. Wages Expense 1,800 Rent Expense - Depreciation Expense—Office Equipment -

- 34. Net Income TOTAL Task 3: Preparing Financial Statements and Closing the Accounts Using the following adjusted trial balance amounts, prepare the income statement, the statement of owner’s equity, and the balance sheet of City Rides for the month ended December 31, 20x2. City Rides Trial Balance December 31, 20x2 Account Debit

- 35. Credit Cash $19,020 Accounts Receivable 12,000 Prepaid Rent 1,600 Supplies 120 Inventory 15,720 Office Equipment 1,800 Accumulated Depreciation—Office Equipment 360 Accounts Payable 5,850 Capital—Harris 45,000 Withdrawals—Harris 2,500 Sales Revenue 16,500 Cost of Goods Sold 11,040

- 36. Wages Expense 1,800 Rent Expense 800 Depreciation Expense—Office Equipment 360 Utilities Expense 650 Supplies Expense 300 $67,710 $67,710 City Rides Income Statement For the Year Ended December 20x2 Sales Revenue Less Expenses:

- 37. Net Income Preparing Financial Statements City Rides Statement of Owner’s Equity For the Year Ended December 20x2 Beginning Capital Ending Capital, Harris City Rides Balance Sheet December 31, 20x2 Assets

- 39. Total Assets Total Liabilities and Owner’s Equity Closing Temporary Accounts Using the journal template given, make the following closing entries. Use the revenue, expense, and withdrawals balances given before. Closing Entries 31 Closed Sales Revenues to Income Summary Account |_| 31 Closed Expense Accounts to Income Summary Account |_| 31 Closed Income Summary Account to Capital—Harris, Account |_| 31 Closed Withdrawals—Harris Account to Capital Account |_| Date Account and Explanation Debit

- 40. Credit Dec 31 To close sales revenue to income summary 31

- 41. To close expenses to income summary 31 To close income summary 30

- 42. To close withdrawals account ---End of Project Part 1---