6.2 Types of Sales PromotionsThere are many types of promotional.docx

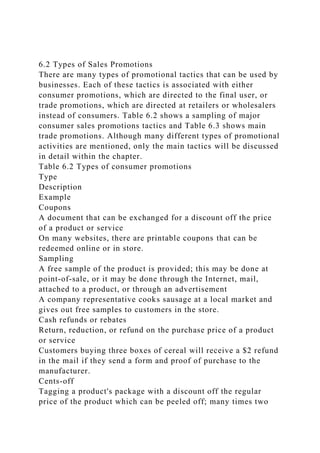

- 1. 6.2 Types of Sales Promotions There are many types of promotional tactics that can be used by businesses. Each of these tactics is associated with either consumer promotions, which are directed to the final user, or trade promotions, which are directed at retailers or wholesalers instead of consumers. Table 6.2 shows a sampling of major consumer sales promotions tactics and Table 6.3 shows main trade promotions. Although many different types of promotional activities are mentioned, only the main tactics will be discussed in detail within the chapter. Table 6.2 Types of consumer promotions Type Description Example Coupons A document that can be exchanged for a discount off the price of a product or service On many websites, there are printable coupons that can be redeemed online or in store. Sampling A free sample of the product is provided; this may be done at point-of-sale, or it may be done through the Internet, mail, attached to a product, or through an advertisement A company representative cooks sausage at a local market and gives out free samples to customers in the store. Cash refunds or rebates Return, reduction, or refund on the purchase price of a product or service Customers buying three boxes of cereal will receive a $2 refund in the mail if they send a form and proof of purchase to the manufacturer. Cents-off Tagging a product's package with a discount off the regular price of the product which can be peeled off; many times two

- 2. products may be packaged together for the same effect A person buying a razor may find an attached peel-off coupon that gives 50 cents off the product. Premiums When consumers purchase a set amount of products, they receive a gift. Customers receive a free purse if they purchase branded perfume. Sweepstakes, games or contests Sweepstakes are drawings of chance and are free to enter (no purchase required); contests or games may not be free and require skill or are based on both chance and skill. Companies often hold sweepstakes to increase brand recognition and sales. Point-of-purchase (POP) display or point-of-sale (POS) display Specialized sales promotions located in a retail store; they often hold products and are found near the check-out location. A store may set up POP display that holds batteries for a specific brand. Frequency or loyalty programs Consumers are rewarded for frequently making purchases of a business's products. The airlines often use frequency programs, commonly referred to as frequent flyer programs. Free trials Provides an opportunity for a customer to try a product before buying. A customer may receive a free subscription to a magazine for a short period with the hope that the customer will become a paying customer. Warranties and guarantees Warranties are assurances about a product or service and guarantees are a promise that the product or service will perform. Some Craftsman hand tools (Sears) will be repaired or replaced free of charge for the lifetime of the tool.

- 3. Tie-in promotions A type of cross promotion in which two or more brands (or companies) join to develop coupons, refunds, contests, rebates, etc. A video game and movie join forces to increase sales of both. Cross promotions One brand is used to advertise or promote another noncompeting product, brand, or service. A fast food chain promotes a children's movie by providing toys from the movie in a kid's meal. Business Outline For Smuggling Tobacco Where (what states to smuggle from and to) First we need to determine what states we should potentially smuggle from and to. The top five states with lowest taxes on cigarettes are Missouri, Virgina,Georgia, North Dakota, and South Carolina (in that order). The top five states with highest taxes rates are New York, Connecticut, Rhode Island, Massachusetts, and Hawaii. If you include state, county and local taxes the real price of cigarettes in chicago illinois and its surrounding areas is the highest, followed by new york city. Our business proposes that we smuggle cigarettes from St Patrick, MO to Chicago, IL. This is a 5 hour drive and has a $5.99 tax difference between the two areas (effective 2018). When compared to a 4.5 hour drive from virginia to NYC and only having a $5.55 tax difference. This is and 8% difference in profit margin between the two areas and we believe would justify the extra drive time that smuggling from Missouri warrants.

- 4. How (Strategy/ Business model) We believe that there are two possible methods when scaling our smuggling business. The first would be working directly with producers we do not believe that it is feasible to buy from farmers and process our own raw tobacco and turn them into cigarettes to to the high entry barriers (Capital Intensity) in the industry. This would leave attempting to purchase the finished product “under the table” from Major companies that are highly regulated and dominated by 3 firms (Altria, reynolds, and Imperial Brands). With Cigarettes being a highly inelastic product the majority of the tax incidence falls on consumers, and each company's net income has been growing. With the combination of high regulation, increasing income, and the fact that the tax burden is likely being passed onto consumers; we see little incentive for any major cigarette companies to cooperate with us in any sort of illegal activities. This leaves the second method, buying from retailers in low taxes states and selling in the underground market in high tax states. This method requires no bribery or corruption of business officials to implement. The entire risk falls solely on ourselves as well. There will be minimal overhead cost relative to other models, only requiring transportation and a means of distribution. In order to execute our retail to distribution plan we would first need to purchase a way to transport our inventory preferably a utility van or some other inconspicuous vehicle to transport large volumes of cigarettes. We plan to buy a reasonable amount of cigarettes ( as to not raise suspicions) at multiple retailers in missouri.After we transport our cargo to chicago we will need to form a distribution network in order to our get reach consumer. We propose either working with “shady” convenient stores or developing a network of individuals who are willing to sell directly to consumers in areas with a high density of smokers (similar to narcotics distribution). If we

- 5. believe that tobacco users are price takers then we should theoretically be able to sell at close to market value of an individual pack (discounting for the increased risk and opportunity cost that consumers might bear when purchasing in the underground economy). Risk ( potential risks and how we would avoid them) Illegal/arrest both durring transportation and distribution Gaining a coustomer base laundering Liquor( comparative analysis of difficulty and profitability) WWW.IBISWORLD.COM Cigarette & Tobacco Manufacturing in the US August 2016 1 IBISWorld Industry Report 31222 Cigarette & Tobacco Manufacturing in the US August 2016 Ibrahim Yucel Smoke free: Declining cigarette use will shift industry’s focus to smokeless products 2 About this Industry 2 Industry Definition 2 Main Activities

- 6. 2 Similar Industries 2 Additional Resources 4 Industry at a Glance 5 Industry Performance 5 Executive Summary 5 Key External Drivers 7 Current Performance 10 Industry Outlook 13 Industry Life Cycle 15 Products & Markets 15 Supply Chains 15 Products & Services 18 Demand Determinants 19 Major Markets 21 International Trade 23 Business Locations 25 Competitive Landscape 25 Market Share Concentration 25 Key Success Factors

- 7. 26 Cost Structure Benchmarks 29 Basis of Competition 30 Barriers to Entry 31 Industry Globalization 33 Major Companies 33 Altria Group Inc. 35 Reynolds American Inc. 36 Imperial Brands plc 39 Operating Conditions 39 Capital Intensity 40 Technology & Systems 40 Revenue Volatility 41 Regulation & Policy 43 Industry Assistance 45 Key Statistics 45 Industry Data 45 Annual Change 45 Key Ratios 46 Jargon & Glossary www.ibisworld.com | 1-800-330-3772 | [email protected]

- 8. This report was provided to Ohio State University - Columbus Campus (OhioNet) (211852729) by IBISWorld on 14 September 2016 in accordance with their license agreement with IBISWorld WWW.IBISWORLD.COM Cigarette & Tobacco Manufacturing in the US August 2016 2 Operators in this industry manufacture cigarettes, cigars, loose pipe tobacco, smokeless (i.e. chewing) tobacco and e-cigarettes. Tobacco manufacturers acquire raw materials from tobacco growers, paper and fiber manufacturers, tobacco stemmers and tobacco redryers and process these into ready-to-use products sold to wholesalers and retailers. The primary activities of this industry are Manufacturing cigarettes Manufacturing cigars Manufacturing smokeless tobacco Manufacturing electronic cigarettes and vaporizers for tobacco use Reconstituting tobacco

- 9. 11191 Tobacco Growing in the US This industry farms and sells tobacco to wholesalers to be used in tobacco product manufacturing. 32211 Wood Pulp Mills in the US This industry produce wood pulp which is used to manufacture filters for cigarettes and tobacco products. 32229b Paper Product Manufacturing in the US This industry manufactures paper used to wrap tobacco for cigarette production. 42494 Cigarette & Tobacco Products Wholesaling in the US This industry wholesales tobacco products such as cigarettes, snuff, cigars and pipe tobacco. Industry Definition Main Activities Similar Industries About this Industry The major products and services in this industry are Cigars E-vapor products Menthol cigarettes Regular cigarettes Smokeless tobacco

- 10. Other Provided to: Ohio State University - Columbus Campus (OhioNet) (211852729) | 14 September 2016 WWW.IBISWORLD.COM Cigarette & Tobacco Manufacturing in the US August 2016 3 About this Industry For additional information on this industry www.ttb.gov Alcohol and Tobacco Tax and Trade Bureau www.cdc.gov Centers for Disease Control and Prevention www.cigarassociation.org Cigar Association of America www.truthinitiative.org Truth Initiative www.industrydocumentslibrary.ucsf.edu/tobacco/ Truth Tobacco Industry Documents www.census.gov US Census Bureau Additional Resources IBISWorld writes over 700 US industry reports, which are updated

- 11. up to four times a year. To see all reports, go to www.ibisworld.com Provided to: Ohio State University - Columbus Campus (OhioNet) (211852729) | 14 September 2016 WWW.IBISWORLD.COM Cigarette & Tobacco Manufacturing in the US August 2016 4 % 21 15 16 17 18 19 20 2006 08 10 12 14 16 18Year Percentage of smokers SOURCE: WWW.IBISWORLD.COM % c

- 12. ha ng e 10 -20 -15 -10 -5 0 5 2208 10 12 14 16 18 20Year Revenue Employment Revenue vs. employment growth Products and services segmentation (2016) 51.2% Regular cigarettes 2.5% Cigars 26.3% Menthol cigarettes

- 13. 11.2% Smokeless tobacco 4.5% Other 4.3% E-vapor products SOURCE: WWW.IBISWORLD.COM Key Statistics Snapshot Industry at a Glance Cigarette & Tobacco Manufacturing in 2016 Industry Structure Life Cycle Stage Decline Revenue Volatility Medium Capital Intensity High Industry Assistance Medium Concentration Level High Regulation Level Heavy Technology Change Medium Barriers to Entry High Industry Globalization Low Competition Level High Revenue

- 14. $37.6bn Profit $12.1bn Exports $422.7m Businesses 144 Annual Growth 16-21 -2.4% Annual Growth 11-16 -2.3% Key External Drivers Percentage of smokers Excise tax on tobacco products Regulation for the Cigarette and Tobacco Production industry Consumer spending World price of tobacco Market Share Altria Group Inc. 49.1% Reynolds American Inc. 32.9%

- 15. Imperial Brands plc 7.0% p. 33 p. 5 FOR ADDITIONAL STATISTICS AND TIME SERIES SEE THE APPENDIX ON PAGE 45 SOURCE: WWW.IBISWORLD.COM Provided to: Ohio State University - Columbus Campus (OhioNet) (211852729) | 14 September 2016 WWW.IBISWORLD.COM Cigarette & Tobacco Manufacturing in the US August 2016 5 Key External Drivers Percentage of smokers Cigarette consumption has declined steadily since the early 1980s because of increasingly unfavorable public attitudes toward smoking. Information disseminated by health authorities on the health consequences of smoking damaged industry performance as people purchased fewer cigarettes. Furthermore, rising excise taxes on tobacco products at the federal, state and municipal levels have raised tobacco prices, further reducing per capita consumption. As the percentage of smokers declines, demand

- 16. for cigarettes and tobacco products deteriorates, hampering industry revenue growth. The percentage of smokers is expected to continue decreasing through 2016, presenting a potential threat to the industry. Executive Summary Over the past five years, the Cigarette and Tobacco Manufacturing industry has persevered despite facing increasingly challenging operating conditions and intense scrutiny from both the government and the public. Federal excise taxes on cigarettes were raised to historic highs in 2009, and individual states increased their own excise taxes on tobacco several times in the following six years. Meanwhile, cigarette consumption continued to decline steadily, further reducing demand for the industry’s largest and most profitable product segment. Nonetheless, sustained demand for noncigarette industry products, such as smokeless tobacco, minicigars and electronic cigarettes (e-cigarettes), helped mitigate declining sales of traditional cigarettes. Furthermore, industry operators raised prices on cigarettes several times in the past five years, which has partially offset declining consumption. Overall, industry revenue is expected to decline

- 17. an annualized 2.3% to $37.6 billion over the five years to 2016, including a projected decline of 1.2% in 2016. Despite rising operating costs, increased consolidation has helped boost average profit during the past five years. In addition, the industry’s two largest operators, which currently account for a combined 81.9% of the market, have successfully raised prices on tobacco products in line with rising compliance costs. Overall, average industry profit is expected to rise to an estimated 32.7% in 2016. Over the next five years, fewer Americans will consume tobacco because of rising excise taxes, greater social stigma associated with smoking and a better understanding of the health risks associated with tobacco use. Rising public scrutiny and an increasingly stringent regulatory environment, as well as ongoing class action suits against major tobacco manufacturers, will continue to tarnish the image of tobacco, accelerating the decline of this industry. As cigarette consumption continues to dwindle, operators will increasingly focus on developing and marketing products perceived to have lower health risks, such as e-cigarettes, which are currently subject to a lower tax burden than cigarettes. In addition, operators

- 18. will continue to raise prices on conventional tobacco products, which will help partly offset declining unit sales. Overall, industry revenue is forecast to decline an annualized 2.4% to $33.3 billion in the five years to 2021. Industry Performance Executive Summary | Key External Drivers | Current Performance Industry Outlook | Life Cycle Stage Demand for industry products such as smokeless tobacco helped mitigate declining sales of cigarettes Provided to: Ohio State University - Columbus Campus (OhioNet) (211852729) | 14 September 2016 WWW.IBISWORLD.COM Cigarette & Tobacco Manufacturing in the US August 2016 6 Industry Performance Key External Drivers continued Excise tax on tobacco products Cigarettes and other tobacco products are heavily taxed, forcing manufacturers to raise their product prices in order to offset declining sales volume and maintain profitability. As federal and state governments raise excise taxes, price-

- 19. conscious smokers will naturally demand fewer industry goods. However, due to the addictive nature of tobacco products, demand tends to fall slowly. Furthermore, rising excise taxes on cigarettes usually causes heightened demand for other tobacco products, which partially offsets the effects on industry revenue of higher taxes. Excise taxes are expected to increase in 2016. Regulation for the Cigarette and Tobacco Production industry Cigarette and tobacco manufacturing is one of the most highly regulated industries in the United States. During the past five years, the industry has faced increasing scrutiny from both public and private institutions, rising compliance costs associated with the 2009 Family Smoking Prevention and Tobacco Control Act and ongoing costs associated with the 1998 Master Settlement Agreement (see Regulation section). The industry has also faced greater regulatory scrutiny from state governments, growing social stigma and increasing litigation from private parties. The regulatory environment is expected to remain unfavorable to industry operators through 2016. Consumer spending Consumer spending on new goods, including cigarettes and tobacco products, expands as disposable incomes rise and as the economic outlook improves. Higher consumer

- 20. spending allows smokers to purchase cigarettes more frequently or trade up to premium brands, which boosts industry revenue. Consumer spending is anticipated to increase in 2016, which presents a potential opportunity to the industry. World price of tobacco Industry operators source tobacco leaves, the industry’s main raw material input, primarily from domestic and some international farmers to produce cigarettes and other tobacco products. When the price of raw tobacco increases, manufacturers either absorb the higher cost at the expense of profit or raise their product prices at the expense of sales. The world price of tobacco is expected to increase in 2016. $ 5 1 2 3 4 2006 08 10 12 14 16 18Year Excise tax on tobacco products

- 21. SOURCE: WWW.IBISWORLD.COM % 21 15 16 17 18 19 20 2006 08 10 12 14 16 18Year Percentage of smokers Provided to: Ohio State University - Columbus Campus (OhioNet) (211852729) | 14 September 2016 WWW.IBISWORLD.COM Cigarette & Tobacco Manufacturing in the US August 2016 7 Industry Performance Current Performance

- 22. Despite steadily declining smoking rates since the early 1980s, the Cigarette and Tobacco Manufacturing industry continues to adapt to increasingly challenging operating conditions. Overall, industry revenue is anticipated to decline an annualized 2.3% to $37.6 billion over the five years to 2016. In 2016, industry sales are expected to decline 1.2% as continued declines in cigarette consumption are partly offset by stronger demand for smokeless tobacco products. In addition, operators will continue to pass on higher excise taxes and compliance costs to consumers in the form of higher prices. In turn, price markups will help offset declining unit sales of cigarettes, which are expected to generate 77.5% of industry revenue in 2016. Profit expansion and industry consolidation Compared with other nondurable goods manufacturing industries, tobacco manufacturers have experienced strong profit growth over the past few years. Profitability in this industry is a function of exceptional brand loyalty for most of its products, as well as the addictive nature of tobacco products, which naturally contain nicotine, harmaline and

- 23. other addictive chemicals. These factors have allowed operators to mark up their products without significantly hindering demand for tobacco products. Indeed, raising prices has been a key driver of this industry’s resilience, despite steadily declining demand, rising compliance costs and increasingly challenging operating conditions. Despite rising input prices, hikes in excise taxes and several pending lawsuits against industry operators, industry profit has expanded over the past five years. For instance, the world price of tobacco, the primary input for producing cigarettes, rose at an average annual rate of 2.2% in the five years to 2016. Yet industry profitability expanded as operators raised their product prices aggressively, successfully passing on the cost increases to their customers. While profit margins vary widely across manufacturers, average profit is estimated to account for 32.7% of revenue in 2016. The boost in profit margins was driven by the industry’s two largest players, Altria Group and Reynolds American Inc. (RAI). Altria’s profit margin expanded significantly through its acquisitions of cigar manufacturer John Middleton and US Smokeless Tobacco Company prior to this five-year period. Moreover, Altria

- 24. consolidated its production facilities in the United States at the end of 2009 to focus on growing markets abroad. By reducing the number of workers employed in the United States and consolidating its production to one factory, Altria was able to boost its operating income significantly. Likewise, RAI’s margin expanded from a low of 15.3% in 2012 to 20.9% in 2013, driven by price markups for cigarettes and increased demand for its iconic and % c ha ng e 15 -45 -30 -15 0 2208 10 12 14 16 18 20Year Revenue Exports Revenue vs. exports

- 25. SOURCE: WWW.IBISWORLD.COM Provided to: Ohio State University - Columbus Campus (OhioNet) (211852729) | 14 September 2016 WWW.IBISWORLD.COM Cigarette & Tobacco Manufacturing in the US August 2016 8 Industry Performance Profit expansion and industry consolidation continued highly profitable smokeless tobacco brands, Grizzly and Kodiak. More recently, the company’s high-profile merger with Lorillard Inc., which was previously the third-largest operator in this industry, further consolidated RAI’s operations and boosted profit margins through 2016. In an effort to sustain previous profit margins in spite of greater compliance and input costs, the industry has consolidated aggressively while trimming employment. Consequently, industry employment is expected to decline an annualized 1.7% to 13,827 workers over the five years to 2016. At the same time, Altria’s decision to move its production

- 26. for European markets from Cabarrus, NC, to Europe caused exports to continue declining. Overall, industry exports are anticipated to decline an annualized 4.3% to $422.7 million during the five years to 2016. In contrast, greater domestic demand for premium, handmade cigars made in the Caribbean has boosted imports for tobacco products. Consequently, IBISWorld estimates imports to have grown an annualized 8.7% to $1.2 billion during the five- year period. Regulatory challenges and rising public scrutiny The tobacco industry as a whole has been characterized by steadily declining demand for cigarettes, the industry’s largest and historically most profitable product segment. According to data from the Federal Trade Commission, total carton sales fell an annualized 3.3% over the 10-year period from 2003 to 2013 (latest data available), while the average excise tax collected per pack rose significantly over the same period. According to retail sales data from Management Science Associates Inc. and IRI, cigarette shipments declined a further annualized 1.4% from 2013 to 2015. In 2009, Congress enacted the Family

- 27. Smoking Prevention and Tobacco Control Act (Tobacco Control Act), placing more stringent marketing restrictions on tobacco products, banning the sale of flavored cigarettes and prohibiting the use of terms such as “light” or “mild” on tobacco packaging. The law also tightened restrictions on advertising and marketing. The strict regulations on advertising have led to lower brand visibility, placing downward pressure on industry revenue growth. This law was followed by the unprecedented April 2009 federal excise tax hike, which raised the federal tax on cigarettes from $0.39 to $1.01 per pack. During the six years following the Tobacco Control Act, state-level excise taxes on tobacco products were raised more than a hundred times by almost every state. In mid-2016, state and local taxes ranged from just $0.17 per pack in Missouri to $6.16 per pack in Chicago, according to the Federation of Tax Administrators. The large discrepancy between excise taxes of neighboring states caused tobacco smuggling and tax evasion to rise at alarming rates, undermining the efforts of regulators and tobacco manufacturers alike. Nonetheless, declining sales of cigarettes have been partially offset by increasing per-pack prices, as well as unexpectedly strong demand for

- 28. noncigarette products such as smokeless tobacco, machine-made cigars and, especially, electronic cigarettes during The growing use of e-cigarettes has prompted several new companies to enter the industry Provided to: Ohio State University - Columbus Campus (OhioNet) (211852729) | 14 September 2016 WWW.IBISWORLD.COM Cigarette & Tobacco Manufacturing in the US August 2016 9 Industry Performance Regulatory challenges and rising public scrutiny continued the first half of the five-year period. In response to broadening regulation of cigarettes and declining consumption levels, industry operators have increasingly focused on marketing and distributing these noncigarette tobacco products, which are currently taxed at lower rates and subject to less regulatory scrutiny than cigarettes. Consequently, demand for these alternative products rose considerably over the five years to 2016, somewhat offsetting the decline in

- 29. cigarette sales. However, the Food and Drug Administration (FDA) drafted new rulings on electronic nicotine delivery products, which extend the FDA’s regulatory control to all products that contain tobacco. Since then, smokeless tobacco has gained wider market acceptance, mirroring the desire for more socially acceptable tobacco products. Dissolvable tobacco, another smokeless tobacco product recently introduced, has become popular among smokers who prefer to use tobacco discretely in public areas where smoking is prohibited. Furthermore, annual retail sales of e-cigarettes, which are electronic devices designed to simulate the act of actual smoking, grew rapidly from less than $30.0 million in 2010 to an estimated $2.0 billion in 2015, according to data from Altria Group and the Society for Research on Nicotine and Tobacco. While claims that e-cigarettes less harmful than regular cigarettes are debatable, the growing use of e-cigarettes among Americans has prompted dozens of new companies to enter the industry, though this growth was partially offset by increased merger and acquisition activity and reduced consumer confidence in e-vapor products since late 2015. Driven primarily by new entrants into the

- 30. e-vapor market, overall industry participation is expected to increase an annualized 8.7% to 144 companies over the five years to 2016. Provided to: Ohio State University - Columbus Campus (OhioNet) (211852729) | 14 September 2016 WWW.IBISWORLD.COM Cigarette & Tobacco Manufacturing in the US August 2016 10 Industry Performance Industry Outlook The Cigarette and Tobacco Manufacturing industry will continue to face major challenges over the next five years, including gradual drops in smoking rates, higher excise taxes and rising compliance and litigation costs. Despite its remarkable resilience during the past several years, the industry is anticipated to continue shrinking during the next five years, especially as demand for all product segments begins to decline in response to broader regulatory pressure by the Food and Drug Administration (FDA), Federal Trade Commission, Alcohol and Tobacco Tax and Trade Bureau and numerous other public and private institutions. In addition to broader

- 31. regulatory scrutiny of tobacco products and diminishing social acceptance of smoking, excise taxes at both the federal and state levels are anticipated to rise significantly through 2021, effectively increasing the price of tobacco products and further discouraging price-conscious smokers. Accordingly, industry revenue is projected to decrease at an annualized rate of 2.4% to $33.3 billion in the five years to 2021. Excise tax at both the federal and state levels are anticipated to rise significantly through 2021 Profit margins squeezed Although profitability will remain high in comparison with other manufacturing industries, rising compliance costs and dwindling demand for industry goods will have a negative effect. These factors will be slightly offset by falling input prices. In particular, the world price of leaf tobacco is forecast to decline an annualized 1.2% in the five years to 2021. Nonetheless, ongoing annual payments through 2025 in accordance with the Master Settlement Agreement, in addition to rising litigation expenses

- 32. associated with the Engle progeny cases (see Regulation section) and other class action suits will increasingly burden the industry’s largest operators, thereby constraining overall profit. Rising compliance costs and dwindling demand will have a negative effect on profit Diminishing social acceptance Despite major efforts to curb smoking and regulate tobacco over the past few decades, smoking remains the leading cause of preventable disease in the United States, according to a landmark 2012 study by the surgeon general. Furthermore, while the percentage of youth who smoke cigarettes has fallen to less than 15.7%, the share of young Americans who still experiment with other tobacco products, especially e-cigarettes, has remained high. Accordingly, antismoking organizations will continue to focus on reducing tobacco use among younger Americans since they are more likely to experiment with tobacco than adults. Negative attitudes toward smoking are a major factor that will affect this industry over the five years to 2021, and continued antismoking campaigns are likely to lower tobacco consumption

- 33. among adults aged 18 to 26. Provided to: Ohio State University - Columbus Campus (OhioNet) (211852729) | 14 September 2016 WWW.IBISWORLD.COM Cigarette & Tobacco Manufacturing in the US August 2016 11 Industry Performance Federal and state excise taxes are expected to continue increasing through 2021, not only for cigarettes (which have traditionally been the focus of price-based regulatory control of tobacco), but also for smokeless tobacco, e-cigarettes and other tobacco products. If the current budget proposal for 2016 is approved, the federal excise tax on cigarettes could rise to $1.95 per pack, while the tax rate on other tobacco products, such as moist snuff and minicigars, would likely rise proportionately. In addition to federal excise taxes, taxes at the state level are expected to rise. Since the beginning of 2016, six states have proposed or already drafted excise tax hikes on tobacco products, and this trend is expected to continue in the coming years. These excise taxes will adversely affect industry performance by raising the final price that consumers pay at retail stores, thereby driving down demand for industry products. While regulations that restrict the use

- 34. of e-cigarettes were recently proposed at the federal level by the FDA, implementing new regulations will remain a top priority for state and local authorities. These new regulations and taxes are anticipated to slow the adoption of e-cigarettes among consumers, as existing regulations pertaining to cigarettes continue to place downward pressure on demand for traditional tobacco products. Lastly, antismoking campaigns are anticipated to further tarnish the industry’s image and hinder revenue growth through 2021. Unfavorable shifts in consumer health trends, antismoking campaigns and increased costs have compelled operators to consolidate in previous years, and this trend is expected to continue in the upcoming years. As demand for the industry’s products continues to fall, smaller operators that are unable to compete will exit the market, providing a window of opportunity for larger operators to obtain greater market share. While the four leading manufacturers already account for almost 92.0% of industry revenue in 2016, they will continue to acquire smaller competitors to further drive up market share concentration. Consequently, the number of operators is projected to fall an annualized 2.5% to 127 companies in the five years to 2021. As companies

- 35. consolidate, employment is forecast to fall at an annualized rate of 3.4% to 11,634 workers during the same period. Due to the popularity of e-cigarettes, leading manufacturers Altria and Reynolds American Inc. (RAI) have launched their own e-cigarette brands in the past two years. In 2014, both of these companies expanded their distribution of these products nationwide, helping drive demand for e-cigarettes. Smokers benefit from being able to use e-cigarettes where the use of traditional cigarettes is banned. Analysts at various investment banks estimate that sales of e-cigarettes could surpass sales of traditional cigarettes in the next decade. Indeed, the retail market for e-cigarettes has already surpassed $2.5 billion, according to estimates from Altria Group, though sales have decelerated markedly since late 2015 because of new regulations and waning consumer confidence in alternative tobacco products. To combat the negative associations encouraged by antismoking campaigns, industry players are looking to develop new products with Operators look to develop new products with potentially fewer health risks or less social stigma

- 36. Product innovation Diminishing social acceptance continued Provided to: Ohio State University - Columbus Campus (OhioNet) (211852729) | 14 September 2016 WWW.IBISWORLD.COM Cigarette & Tobacco Manufacturing in the US August 2016 12 Industry Performance potentially fewer health risks or less accompanying social stigma. For example, Altria Group recently announced plans to jointly develop and market new e-vapor products with its global counterpart, Philip Morris International. Large manufacturers will also focus more on marketing secondary products, such as machine-made cigars and smokeless tobacco, to counterbalance declining demand for cigarettes in the next five years. These products currently face less regulatory pressure than cigarettes, although the regulatory environment is likely to change in coming years. Nonetheless, rapidly growing demand for premium, handmade cigars will boost imports an estimated annualized 2.3% to $1.3 billion during the five years to 2021.

- 37. In contrast, the leading operators are expected to continue divesting their foreign operations and focus exclusively on domestic markets, especially as global regulation of tobacco increases. Consequently, industry exports are anticipated to decline at an annualized rate of 5.1% to $325.5 million over the next five years. Product innovation continued Provided to: Ohio State University - Columbus Campus (OhioNet) (211852729) | 14 September 2016 WWW.IBISWORLD.COM Cigarette & Tobacco Manufacturing in the US August 2016 13 Industry Performance Antismoking campaigns and strict regulation have gradually reduced cigarette consumption since the early 1980s Industry value added and total revenue are expected to decline over the 10 years to 2021 Industry employment is anticipated to fall substantially during this 10-year period Tobacco is one of the most heavily regulated products in the United States and is likely to face even greater scrutiny in the future Life Cycle Stage

- 39. om y % Growth in number of establishments -10 -5 0 5 10 15 20 Decline Shrinking economic importance Quality Growth High growth in economic importance; weaker companies close down; developed technology and markets Maturity Company consolidation; level of economic importance stable Quantity Growth Many new companies; minor growth in economic importance; substantial technology change Key Features of a Decline Industry Revenue grows slower than economy Falling company numbers; large fi rms dominate Little technology & process change Declining per capita consumption of good

- 40. Stable & clearly segmented products & brands Grocery Wholesaling Seasoning, Sauce and Condiment Production Wood Pulp Mills Supermarkets & Grocery Stores Cigarette & Tobacco Manufacturing Provided to: Ohio State University - Columbus Campus (OhioNet) (211852729) | 14 September 2016 WWW.IBISWORLD.COM Cigarette & Tobacco Manufacturing in the US August 2016 14 Industry Performance Industry Life Cycle The Cigarette and Tobacco Product Manufacturing industry is in the declining stage of its life cycle. Over the 10 years to 2021, industry value added (IVA), which measures an industry’s contribution to the economy, is projected to rise an annualized 0.5%. In comparison, GDP is forecast to grow at an annualized rate of 2.1% over the same period. While there was some positive movement in IVA during the first half of the period due to higher profit margins, the industry is expected to continue shrinking during the second half. During the next five years, IVA is

- 41. anticipated to decline as the number of smokers in the United States dwindles. The growing social stigma associated with smoking, rising excise taxes and rising health consciousness among Americans have all contributed to the decline of cigarette consumption in the United States. Although demand for noncigarette tobacco products, such as smokeless tobacco or electronic cigarettes (e-cigarettes), has slightly offset declines in cigarette consumption, this trend is unlikely to generate further industry expansion during the next five-year period. Furthermore, litigation and compliance costs associated with tobacco-related lawsuits and regulation have increasingly burdened industry operators during the five years to 2016, and these costs are likely to increase through 2021. Characteristic of most declining industries, the tobacco industry is also undergoing significant consolidation. The industry’s manufacturing facilities are being restructured to balance supply with falling demand. In particular, Reynolds American Inc. (RAI) merged with Lorillard Inc. in mid-2015, which has significantly boosted its share of the market. This merger has further concentrated the industry into the hands of only a few players, with the two largest companies alone expected to account for 81.9% of industry revenue in 2016.

- 42. Furthermore, IBISWorld anticipates stricter regulation of e-cigarettes and other novel tobacco products during the five years to 2021, which will burden smaller operators and is likely to drive several small e-cigarette manufacturers to leave the industry or merge with larger competitors. For example, Altria Group acquired major e-cigarette company Green Smoke in early 2014, while RAI introduced VUSE, a new line of e-cigarettes that has quickly become the best-selling brand nationally. Smaller e-vapor retailers and mixers are likely to face significantly higher compliance costs associated with the recent FDA ruling on electronic nicotine delivery systems (ENDS), which is also likely to raise barriers to entry for potential new entrants. Consequently, the number of establishments and total employment are expected to decline during the latter half of this 10-year period as operators seeks to sustain profit margins through consolidation. This industry is Declining Provided to: Ohio State University - Columbus Campus (OhioNet) (211852729) | 14 September 2016 WWW.IBISWORLD.COM Cigarette & Tobacco Manufacturing in the US August 2016 15

- 43. Products & Services Cigarettes Cigarettes constitute the single-largest class of tobacco products offered by industry operators, accounting for an estimated 77.5% of revenue in 2016. Within this broader category, industry operators market cigarette brands under two categories: discount and premium. According to retail sales data from MSAI/ IRI, premium cigarettes currently account for 75.2% of total cigarette sales within the United States. The cigarette segment can be further divided into two broad cigarette varieties: regular (non- mentholated) and mentholated: regular cigarettes account for an estimated 51.2% of revenue, while menthol cigarettes account for the remaining 26.3% of industry sales. Almost all cigarettes produced today contain some menthol, although only those with 0.1% or more menthol by weight are typically classified as menthol cigarettes. There were an estimated 20 million menthol cigarette smokers in 2010 (latest data available), according to the American Legacy Foundation. Menthol, which is derived from peppermint, spearmint and other related plants, provides a natural cooling effect when inhaled. Since menthol’s cooling effect helps relieve the throat irritation sometimes caused by cigarette smoke, it

- 44. is particularly appealing to new smokers. Products & Markets Supply Chain | Products & Services | Demand Determinants Major Markets | International Trade | Business Locations KEY BUYING INDUSTRIES 42441 Grocery Wholesaling in the US Grocery wholesalers constitute another significant downstream market for industry operators as they resell cigarettes and other tobacco products to grocery stores, supermarkets and other retailers. 42494 Cigarette & Tobacco Products Wholesaling in the US Cigarette and tobacco product wholesalers are the primary downstream market for manufacturers. 44511 Supermarkets & Grocery Stores in the US Supermarket and grocery store chains with sufficient purchasing power may buy cigarettes directly from the sales and distribution branches of manufacturers to resell at their retail stores. 44512 Convenience Stores in the US Some major convenience store chains with sufficient purchasing power may purchase tobacco products directly from manufacturers, although almost all convenience store chains source tobacco products from intermediary distributors. KEY SELLING INDUSTRIES

- 45. 11191 Tobacco Growing in the US Manufacturers purchase tobacco leaves, the primary ingredient used to produce cigarettes, from tobacco farmers. 31194 Seasoning, Sauce and Condiment Production in the US Cigarette and electronic cigarette manufacturers buy flavoring extracts from producers of seasonings, sauces and condiments to produce menthol cigarettes and flavored electronic cigarettes. 32211 Wood Pulp Mills in the US Cigarette manufacturers purchase wood pulp from mills to create filters for tobacco products. 32212 Paper Mills in the US Manufacturers source rolling paper and packaging material from paper mills. Supply Chain Provided to: Ohio State University - Columbus Campus (OhioNet) (211852729) | 14 September 2016 WWW.IBISWORLD.COM Cigarette & Tobacco Manufacturing in the US August 2016 16 Products & Markets Products & Services continued Accordingly, menthol cigarettes are

- 46. disproportionately popular among younger adults and other inexperienced smokers. While sales across all cigarette categories have fallen in recent years, consumption of menthol cigarettes has decreased at a slower rate than consumption of regular cigarettes. As a result, menthol cigarettes’ share of industry revenue has increased marginally over this five-year period. Furthermore, tobacco-related legislation has yet to specifically target mentholated cigarettes, though efforts were made by the FDA in 2013. Accordingly, the lack of concrete legislation, coupled with an enduring public perception that mentholated cigarettes are less harmful than conventional cigarettes, will likely continue to increase the menthol cigarette segment’s share of revenue in upcoming years. The prevalence and public acceptance of smoking has fallen steadily since the mid-1960s, which has consequently shrunk the overall cigarette product segment’s share of revenue over the past 50 years. More specifically, the percentage of the population that smokes has fallen from 42.4% in 1965 to a low of 16.8% in 2014, according to estimates from the Centers for Disease Control and Prevention (CDC). In order to remain profitable in spite of falling consumption, manufacturers have raised their product

- 47. prices several times over the past five years, thereby passing on higher input and compliance costs to their downstream customers. Furthermore, rising excise taxes at both the federal and state levels have increased the retail price of tobacco products, further driving down demand for cigarettes. Consequently, cigarettes’ share of industry revenue has fallen over the five years to 2016. Smokeless tobacco Smokeless tobacco products, which include chewing and spitting tobacco, snuff and snus, account for an estimated 11.2% of industry revenue. Snuff is a tobacco product made from finely ground tobacco leaves, whereas snus is a moist powdered tobacco consumed by being placed under the lip. The category also includes a variety of novel tobacco products such as dissolvables or lozenges that contain nicotine. Demand for smokeless tobacco products has grown in recent years, because the rising price of regular cigarettes has made alternative products more attractive in terms of price. Secondly, smokeless tobacco products are currently taxed at lower Products and services segmentation (2016) Total $37.6bn 51.2% Regular cigarettes

- 48. 2.5% Cigars 26.3% Menthol cigarettes 11.2% Smokeless tobacco 4.5% Other 4.3% E-vapor products SOURCE: WWW.IBISWORLD.COM Provided to: Ohio State University - Columbus Campus (OhioNet) (211852729) | 14 September 2016 WWW.IBISWORLD.COM Cigarette & Tobacco Manufacturing in the US August 2016 17 Products & Markets Products & Services continued rates than conventional cigarettes. Furthermore, the discreet nature of smokeless products allows consumers to avoid the negative social stigma of smoking while still obtaining their nicotine fix. As the social acceptability of

- 49. smoking erodes and the number of restricted smoking areas increases, more consumers are expected to turn to smokeless tobacco products in the upcoming years. This segment’s share of revenue is expected to continue expanding in upcoming years, as more smokers are expected to switch from cigarettes to smokeless tobacco alternatives. Cigars Domestically produced cigars are expected to account for 2.5% of industry revenue in 2016. The term “cigar” denotes a broad category of smokeable tobacco products that range from machine-made little cigars (cigarillos) to imported, hand-made cigars sold at a premium. The key distinguishing feature between cigarettes and cigars is that the former is wrapped using paper while the latter is typically wrapped with rolled tobacco leaf. The cigar segment has benefited from the Food and Drug Administration (FDA) ban of flavored cigarettes, as younger smokers have turned to chocolate-, candy- and fruit-flavored cigars to satisfy their craving for flavored tobacco products. According to the CDC, little cigars are particularly popular among the youth because aside from the wrapper they are almost identical to cigarettes. Furthermore, cigars are typically taxed

- 50. at lower rates than cigarettes and can be sold individually. Despite the growing awareness of the health risks associated with tobacco products, the use of large cigars has increased 233.0% from 2000 to 2011, according to a study conducted by the CDC (latest data available). Consequently, cigars’ share of industry revenue has increased over the past five years. Other Other products are estimated to account for the remaining 8.8% of revenue. They include pipe tobacco, tobacco substitutes (e.g. clove cigarettes or e-cigarettes), homogenized and reconstituted tobacco, tobacco extracts and essences. While sales of tobacco substitutes are growing in the domestic market, a small percentage of the population currently uses these products. Therefore, it represents a rapidly growing, but small share, of industry sales. This segment’s share is anticipated to have increased in the past five years, primarily driven by the continued market expansion of e-cigarettes in the United States. E-cigarettes and other novel tobacco products were effectively unregulated by the FDA for most of the five-year period, although product-specific regulation passed in early 2016. The e-cigarette product group in particular is expected to continue growing, especially as leading

- 51. cigarette manufacturers develop their own e-cigarette brands or continue to acquire existing brands. According to major player Altria Group, annual retail sales of e-cigarettes and related accessories doubled every year through 2014 to $2.0 billion, though growth has decelerated in more recent years due to new regulations and reduced consumer confidence in e-vapor products. Provided to: Ohio State University - Columbus Campus (OhioNet) (211852729) | 14 September 2016 WWW.IBISWORLD.COM Cigarette & Tobacco Manufacturing in the US August 2016 18 Products & Markets Demand Determinants Demand for cigarettes and other tobacco products is primarily driven by the social acceptability of smoking. The association of smoking with a certain lifestyle became engrained in American culture through popular movies in the 1940s. However, as public awareness of the adverse health risks associated with smoking became widespread, the percentage of adults who smoke began to drop significantly in the late 1970s. While the number of adults who smoke continues to decline, the

- 52. percentage of teen smokers has declined more slowly in recent years, as smoking has come back into fashion among this age group. In particular, the rising use of electronic cigarettes, smokeless tobacco and other novel tobacco products among millennials has once again boosted demand from this consumer group, despite the efforts of anti-tobacco groups to curb teen smoking in recent years. While the addictive quality of nicotine safeguards demand for tobacco products to a certain extent, demand for cigarettes is declining due to growing health concerns and social stigma associated with smoking in public places. Consumption of cigarettes has also declined because of extensive steps taken by the federal and state governments to discourage consumption of tobacco products. These measures include strict restrictions on advertising and sales promotion activities, requirements that health warnings be printed on cigarette packets, bans on smoking in specified locations and public antismoking campaigns funded by annual payments from the largest tobacco manufacturers (see Regulation section). For example, regulations restricting the use of cigarettes in public areas make smoking less convenient and cause people to smoke less frequently when traveling or at work.

- 53. Higher excise taxes enforced by state and federal authorities have significantly raised the retail price of tobacco products over the past several years. In addition, the rising cost of tobacco leaves has caused manufacturers to raise their products, further discouraging smokers from purchasing cigarettes as frequently as before. In order to manage their spending on tobacco products, some smokers have switched to alternative tobacco products that are taxed at lower rates, such as snuff, chewing tobacco or cigarillos (little cigars). Lastly, the introduction and quick adoption of the electronic cigarette (e-cigarette) has helped drive demand for industry products over the five years to 2016. This innovative product is perceived as a less harmful alternative to traditional cigarettes and is produced in a variety of flavors that appeal to younger smokers. Furthermore, e-cigarettes are currently not subject to the same level of excise taxes at the federal or state levels, making this product more affordable than regular cigarettes. However, recent uncertainty over the future regulation of electronic cigarette products has decelerated growth during the latter half of the five-year period. In early 2016, the FDA finalized its ruling on e-vapor products, stating that innovative tobacco alternatives would be subject to the same

- 54. level of regulatory scrutiny as traditional tobacco products. Overall, demand for tobacco products has declined steadily since the early 1980’s, and is expected to continue declining unabated in the coming years. Provided to: Ohio State University - Columbus Campus (OhioNet) (211852729) | 14 September 2016 WWW.IBISWORLD.COM Cigarette & Tobacco Manufacturing in the US August 2016 19 Products & Markets Major Markets Tobacco product manufacturers typically sell their products to intermediary wholesalers who in turn, resell the products to retail establishments such as convenience stores, grocery stores, supermarkets, pharmacies, dollar stores and smaller street vendors. Some large supermarket or grocery store chains, such as Walmart, have the purchasing power to source tobacco products directly from the manufacturers, thereby bypassing the wholesaler. Nonetheless, the majority of industry products are distributed to retail channels via the Cigarette and Tobacco Products Wholesaling industry (See IBISWorld report 42494).

- 55. Wholesalers Wholesalers constitute the largest downstream market for tobacco product manufacturers, accounting for a combined 84.0% of industry revenue in 2016. This market segment consists of two broad types of wholesalers: consumer packaged foods (e.g. candy and tobacco) distributors and broadline grocery distributors. The first group, which accounts for a 71.4% share of the industry, consists of national and regional wholesalers that primarily distribute tobacco products, snacks and confectioneries to convenience stores, dollar stores, pharmacies and other related retail channels. The two largest operators within this market are McLane Company, a subsidiary of Berkshire Hathaway, and Core-Mark International. McLane Company is the largest tobacco wholesaler to major retail chains Walmart, 7-Eleven and Family Dollar. Core-Mark International is a major distributor to convenience store and gas station chains such as Alimentation Couche-Tard and Turkey Hill. This segment’s share of industry revenue is expected to rise over the next five years as demand from convenience stores picks up. The second group, broadline grocery

- 56. distributors, is estimated to account for a 12.6% share of the industry in 2014. Wholesalers within this product segment distribute a variety of groceries, foodservice products and other nondurable goods to supermarkets, grocery stores and restaurants. Consequently, tobacco products represent only a small and incidental share of these companies’ broad product portfolios. This segment’s share of total industry revenue has shrunk over the past five years and is expected to continue shrinking as major broadline Major market segmentation (2016) Total $37.6bn 71.4% Candy and tobacco wholesalers 1.1% Exports 12.6% Broadline grocery distributors 8.8% Supermarkets 3.1% Other major retail chains (pharmacies, grocery stores)

- 57. 3.0% Other SOURCE: WWW.IBISWORLD.COM Provided to: Ohio State University - Columbus Campus (OhioNet) (211852729) | 14 September 2016 WWW.IBISWORLD.COM Cigarette & Tobacco Manufacturing in the US August 2016 20 Products & Markets Major Markets continued distributors, such as C&S Wholesale Grocers, increasingly divest from tobacco in response to growing public scrutiny of tobacco use. The rising prevalence of wholesale bypass, which has negatively affected almost all other nondurable product wholesaling industries, is not a significant issue for tobacco wholesalers because of tobacco’s unique regulatory environment. Although manufacturers are responsible for paying federal excise taxes, downstream wholesalers and retailers are responsible for excise taxes at the state level. Since these taxes can vary greatly across state lines and product groups, only specialized wholesalers that have a well-established

- 58. presence in the tobacco industry typically have the knowledge and resources to collect and remit the appropriate taxes. Consequently, IBISWorld expects wholesalers to remain the industry’s largest market segment in the near future. Retailers Direct sales to retailers, which include large supermarkets, grocery store and pharmacy chains and dollar stores, account for an 11.9% share of revenue in 2016. Typically, only large supermarket chains with sufficient purchasing power, such as Walmart or Kroger, are able to purchase tobacco products in bulk directly from manufacturers. In practice, however, even major supermarket chains typically source tobacco products through intermediary wholesalers. For example, Walmart, which is presently the largest supermarket chain in the United States, sources the bulk of its regular tobacco purchases from McLane Company. This market segment’s share is expected to shrink slightly in upcoming years as demand for cigarettes and other tobacco products from convenience stores (and ultimately, demand for convenience store wholesalers) outstrips demand for tobacco products from traditional grocery stores, supermarkets and pharmacies. Exports Exports have historically accounted for a small share of industry revenue because

- 59. manufacturing is localized due to extensive domestic and international regulations. Consequently, exports are estimated to account for only 1.1% of industry revenue in 2016, representing a decline from 1.2% in 2011. Due to an appreciating dollar, industry exports became less affordable to consumers in foreign markets, causing exports to decline overall during this five-year period. Additionally, industry leader Philip Morris moved its production for the European market from North Carolina to Europe, further lowering industry exports. The Master Settlement Agreement signed in 1998 between the attorneys general of 46 states and four largest tobacco companies (see Regulation section), has also kept exports of tobacco products low during the past five years. The vast majority of US-made tobacco products are exported to US military bases overseas or duty-free shops located in international airport terminals. Sales to all other foreign retail outlets account for an insignificant portion of export volume. Other Other markets for tobacco products account for the remaining 3.0% of revenue in 2016. These include specialty outlets such as cigar shops, hookah bars, duty-free shops at US-based international airports and other travel hubs, army

- 60. bases, online tobacco retailers and other niche stores. While many hospitality industries, including hotels, bars and casinos, buy tobacco products from wholesalers, some major chains that operate nationally can purchase directly from manufacturers. Many niche shops that offer premium, handmade cigars and premium pipe tobacco also purchase these products directly from manufacturers. Provided to: Ohio State University - Columbus Campus (OhioNet) (211852729) | 14 September 2016 WWW.IBISWORLD.COM Cigarette & Tobacco Manufacturing in the US August 2016 21 Products & Markets International Trade The Cigarette and Tobacco Manufacturing industry has a low level of international trade, primarily due to a rapidly developing regulatory environment at the global level that has discouraged domestic producers from exporting tobacco products to international markets. Imports Imported cigarettes and tobacco products are anticipated to account for 3.0% of domestic demand for industry goods in 2016, representing a significant increase from 1.8% in 2011. Imports of industry

- 61. products have historically been low, as domestic producers have satisfied demand for tobacco products among American smokers. However, imports have grown over the past five years, as regulation and the growing price of domestic products have driven smokers to purchase imported handmade cigars from the Caribbean region or imported snus from European countries such as Sweden or Denmark. In terms of product categories, large cigars accounted for 75.1% of total import volume in 2015, while cigarettes and tobacco extracts (e.g. used in e-vapor devices) accounted for 17.6% and 2.1% of volume, respectively. Imports of cigarettes and tobacco products mainly come from premium handmade cigar producing countries in Latin America. Specifically, industry goods from the Dominican Republic are anticipated to account for 52.0% of total imports in 2016. Cigars from this country, which are ranked as one of the best in the world, have helped boost demand for imports. Nicaragua and Honduras represent the second and third largest sources of industry imports, respectively. Cigar imports from Nicaragua have grown in recent years as several leading premium cigar producers, such as Rocky Patel Premium Cigars Inc., have established factories in this country. The majority of premium cigars produced

- 62. in Latin America are imported and distributed domestically by S&K Imports Inc., the largest cigar and cigarillo importer in the United States. Exports Global tobacco producers have shifted their focus on growing markets like the Middle East and Asia, where per capita smoking rates are rising, by establishing production facilities in strategic locations. For instance, industry leader, Philip Morris, consolidated its domestic production to one factory and transferred its production for the European market to Europe. Likewise, Reynolds American Inc. (RAI) is effectively a spinoff of global company British American Tobacco, which produces iconic cigarette brands Kent and Pall Mall for distribution in non-American markets. More recently, RAI sold the international rights to the American Spirit brand name to Japan Tobacco Inc. As a result, the top two largest tobacco manufacturers, Phillip Major Markets continued Online retailing has grown slightly due to the convenience of shopping at home through the internet, although expansion has been offset by the constantly changing and unpredictable regulatory framework surrounding online tobacco sales. This uncertainty is

- 63. exacerbated by concerns of minors illegally purchasing tobacco online without providing adequate proof of age, as well as the possibility of tax evasion if tobacco products are sold across state lines without collecting the appropriate state-level excise tax. Accordingly, online sales of domestically-produced tobacco products are expected to account for less than 1.0% of industry revenue in 2016. Level & Trend Exports in the industry are Low and Decreasing Imports in the industry are Low and Increasing Provided to: Ohio State University - Columbus Campus (OhioNet) (211852729) | 14 September 2016 WWW.IBISWORLD.COM Cigarette & Tobacco Manufacturing in the US August 2016 22 Products & Markets International Trade continued Morris and Reynolds American, are now

- 64. almost entirely focused on domestic operations. Consequently, exports’ share of industry revenue has declined from 1.2% in 2011 to an estimated 1.1% in 2016. Exports are expected to continue declining in the coming years, accounting for an estimated 1.0% share of revenue by 2021. Exports of US-made tobacco products are primarily made to US military bases and duty-free shops overseas. Accordingly, Japan represents the largest export market by a significant margin, due to the large number of US military personnel positioned in that country. However, exports to Japan have declined moderately in recent years, due to a strengthening dollar that makes American cigarettes more expensive and the declining demand for tobacco products in Japan. According to Japan Tobacco Inc.’s annual survey, the percentage of Japanese adult smokers hit an all-time low of 20.0% in 2014, and is expected to continue dropping through 2016. Exports to Canada, another important market, have also decreased over the past five years. However, exports to the Dominican Republic and Russia have grown significantly during this period, helping offset some of the losses from Japan and Canada.

- 65. Imports From... Total $1.2bn 6.3% Honduras 8.7% South Korea 13.0% Nicaragua 20.0% Other Countries 52.0% Dominican Republic Exports To... Total $422.7m 62.7% Japan 15.4% Dominican Republic 13.8% Other Countries

- 66. 5.6% Canada 2.5% Russia Year: 2016 SIZE OF CHARTS DOES NOT REPRESENT ACTUAL DATA SOURCE: USITC $ m ill io n 1000 -1500 -1000 -500 0 500 2208 10 12 14 16 18 20Year Exports Imports Balance Industry trade balance

- 67. SOURCE: WWW.IBISWORLD.COM Provided to: Ohio State University - Columbus Campus (OhioNet) (211852729) | 14 September 2016 WWW.IBISWORLD.COM Cigarette & Tobacco Manufacturing in the US August 2016 23 Products & Markets Business Locations 2016 MO 2.0 West West West Rocky Mountains Plains Southwest Southeast New England Great Lakes

- 69. 6 4 8 9 Additional States (as marked on map) AZ 2.0 CA 3.0 NV 2.0 OR 0.0 WA 0.0 MT 0.0 NE 0.0 MN 0.0 IA 0.0

- 73. Mid- Atlantic Establishments (%) Less than 3% 3% to less than 10% 10% to less than 20% 20% or more Provided to: Ohio State University - Columbus Campus (OhioNet) (211852729) | 14 September 2016 WWW.IBISWORLD.COM Cigarette & Tobacco Manufacturing in the US August 2016 24 Products & Markets Business Locations The Southeast region of the country, which accounts for 60.2% of establishments, dominates the Cigarette and Tobacco Manufacturing industry. The region’s share of establishments is more than double the percentage of the population that resides in this region. A majority of manufacturers are established in this region due to the abundance of tobacco farms in the area, giving producers easy access to the key ingredient for their products. In addition, industry operators benefit from being located near sources of key inputs, as the cost of transporting materials is relatively low. North Carolina, in particular,

- 74. accounts for 18.8% of establishments. Major players Reynolds American and Lorillard Inc. are also headquartered in North Carolina. Finally, Florida is another major contributor, accounting for 15.8% of total establishments, with the majority of these establishments involved in the e-vapor category. The Mid-Atlantic is another major region in this industry with 18.8% of establishments. New York, New Jersey and Pennsylvania together hold nearly the entire share of establishments for the region, as many tobacco farms are located in these states. Therefore, easy access to inputs and low transportation costs make the region attractive to industry operators. The Southwest and West account for 8.0% and 5.0% of industry establishments, respectively. However, their share of total establishments has declined due to greater investment in plants in other regions. In addition, the Rocky Mountains (1.0%), New England (2.0%) and Plains (2.0%) regions do not represent significant operating areas for this industry. These regions are not suitable for tobacco farmers so establishments are less likely to operate in these areas. % 75

- 77. he as t Establishments Population Establishments vs. population SOURCE: WWW.IBISWORLD.COM Provided to: Ohio State University - Columbus Campus (OhioNet) (211852729) | 14 September 2016 WWW.IBISWORLD.COM Cigarette & Tobacco Manufacturing in the US August 2016 25 Key Success Factors Economies of scale Successful companies benefit from the large scale of operations, which allows them to spread production costs over a large volume of output, reducing per-unit costs. Ability to effectively change community behavior The leading producers have introduced new products, such as electronic cigarettes, that are viewed as less harmful alternatives to traditional tobacco products to maintain demand for industry goods. Marketing of differentiated products

- 78. Tobacco companies are effectively banned from using conventional marketing methods (i.e. commercials, billboards), so manufacturers must market their products aggressively through other means to maintain market share in a highly competitive market. Ability to pass on cost increases Due to rising excise taxes and falling demand for industry products, the leading producers have increased their product prices to maintain earnings. Effective quality control It has become imperative for operators to produce high-quality cigarettes due to extensive media coverage of the negative health consequences of smoking. Also, faulty products can lead to product recalls and taint a brand’s reputation. Market Share Concentration The Cigarette and Tobacco Manufacturing industry is highly concentrated. Based on data from IRI Group and Management Science Associates Inc., made publicly available by Altria Group and Reynolds American Inc. (RAI), Altria’s Marlboro brand alone accounted for a 44.0% share of the cigarette market, while RAI’s respective cigarette brands (which now include

- 79. Camel and Newport) accounted for 32.0% of the US retail market in 2015. These two companies alone are expected to generate a combined 81.9% of industry revenue in 2016. Despite the dominant position that these producers have held for decades, market share concentration has further intensified over the past five years as these manufacturers engaged in several acquisitions. For example, Altria Group acquired US Smokeless Tobacco Co. in 2009 to expand its product portfolio and grow its market share. In 2012, Lorillard acquired Blu eCigs, a manufacturer of electronic cigarettes, for the same reasons. More recently, RAI completed its acquisition of Lorillard for an estimated $27.4 billion. Lorillard was previously the third-largest operator in the industry, accounting for an 18.4% share of the market in 2014. This acquisition boosted RAI’s share of the market from 22.3% in 2014 to an estimated 32.9% in 2016. As a part of this merger, RAI and Lorillard also agreed to divest several assets, including certain brands, a manufacturing facility and over 2,700 employees, to ITG Brands (a subsidiary of Imperial Brands plc). Due to this restructuring, ITG Brands’ share of the tobacco industry also increased from less than 3.8% in 2014 to an estimated 7.0% in 2016. Overall, the

- 80. combined market share of the top four tobacco manufacturers has increased to an estimated 91.6% of industry revenue in 2016. Due to rising barriers to entry and an increasingly stringent regulatory framework that prevents smaller companies from entering the industry or gaining a meaningful share of the market, IBISWorld anticipates this industry’s market share concentration to continue increasing over the next five-year period. Competitive Landscape Market Share Concentration | Key Success Factors | Cost Structure Benchmarks Basis of Competition | Barriers to Entry | Industry Globalization Level Concentration in this industry is High IBISWorld identifies 250 Key Success Factors for a business. The most important for this industry are: Provided to: Ohio State University - Columbus Campus (OhioNet) (211852729) | 14 September 2016

- 81. WWW.IBISWORLD.COM Cigarette & Tobacco Manufacturing in the US August 2016 26 Competitive Landscape Cost Structure Benchmarks Due to its unique regulatory environment, the Cigarette and Tobacco Manufacturing industry’s cost structure differs substantially from that of any other manufacturing industry. Cost structures vary among industry operators, depending on their size and scale of production, proximity to tobacco farms, exposure to litigation claims and levels of technology and capital investments. Large manufacturers typically incur lower per-unit production costs than smaller competitors because these operators are able to spread production costs out over a large volume of output and spend more on brand development. Consequently, the industry’s largest operators benefit from much higher profit margins than niche and small-batch producers. Profit Profit, or earnings before interest and taxes, is estimated to account for 32.7% of industry revenue in 2016. Tobacco companies’ profit margins are relatively high when compared with other manufacturing industries because the naturally addictive nature of tobacco

- 82. products in addition to strong brand loyalty allows manufacturers to charge a premium for their products without a significant drop in demand. Additionally, due to the small package sizes of cigarettes, packaging material accounts for a small share of total purchases. Finally, the price that producers charge their downstream customers is much higher than the cost of inputs. Even though the retail price of tobacco rose steadily over the past five years, companies raised their prices at a slightly faster pace to maintain their profit margins. Additionally, the consolidation of industry operators has allowed the leading producers to reduce costs through economies of scale. Lastly, the five years since the ratification of the Sector vs. Industry Costs n Profi t n Wages n Purchases n Depreciation n Marketing n Rent & Utilities n Other Average Costs of all Industries in sector (2016) Industry Costs

- 84. 56.7 0.41.81.6 5.0 2.2 19.9 2.1 0.62.6 54.2 12.0 Provided to: Ohio State University - Columbus Campus (OhioNet) (211852729) | 14 September 2016 WWW.IBISWORLD.COM Cigarette & Tobacco Manufacturing in the US August 2016 27 Competitive Landscape Cost Structure Benchmarks continued 2009 Tobacco Control Act (see Regulation section) have given manufacturers enough time to adjust their prices appropriately to sustain profit margins. Consequently, the industry’s profitability has risen significantly since 2011.

- 85. Purchases Purchases, which account for an estimated 5.0% of revenue, include a variety of raw materials, such as tobacco leaves, paper, additives, cellulose materials and packaging. However, the most important and substantial input for industry producers is tobacco leaf. According to data sourced from the World Bank, the world price of tobacco leaves is anticipated to rise an annualized 2.2% in the five years to 2016. Additionally, the cost of wood pulp, which is used to create filters in cigarettes, has risen at an average annual rate of 0.4%, further boosting the cost of inputs for manufacturers. Consequently, purchase costs have risen as a share of industry revenue over the past five years. Nonetheless, fluctuating material costs have very little impact on the industry’s overall performance due to the industry’s unique cost structure and high profit margins. Wages Wages are estimated to comprise just 2.2% of industry revenue in 2016, relatively unchanged as a share of revenue since 2011. Producers have increased their reliance on technology and equipment over the years, boosting production efficiencies. Additionally, the leading cigarette producer, Philip Morris USA, consolidated its US manufacturing facilities during the past five years, substantially reducing the number of

- 86. industry employees. Industry operators are likely to keep labor costs low over the next five-year period as other costs, including expenses related to regulatory compliance, excise tax remittance and litigation, continue to rise. Marketing Relevant marketing expenses account for a combined 1.8% of industry revenue in 2016. As part of the Final Tobacco Marketing Rule passed in 2010, tobacco-affiliated businesses are effectively prohibited from engaging in traditional methods of advertising, including outdoor billboards, TV or radio commercials and attractive product packaging. These prohibitions are intended to curb tobacco products’ appeal to youth, who are otherwise susceptible to traditional forms of tobacco marketing. Moreover, the Food and Drug Administration implemented new rules in 2010 that ban tobacco companies from sponsoring sporting and entertainment events, prohibit free cigarette samples and giveaways and restrict the use of self-service displays, among other restrictions. In 2016, the FDA released new rulings that expand such restrictions to electronic cigarettes and other innovative tobacco products. Examples of marketing programs that can still be used by manufacturers

- 87. include exclusive consumer engagement programs, promotional pricing through discounts and retail coupons, advertising in certain magazines and advertising in adult- only venues. According to the Federal Trade Commission’s latest reports on the tobacco industry, operators spent a total of $9.4 billion on advertising and promotional activities in 2013 (latest data available). However, 92.0% of these expenses was spent on non- traditional marketing methods such as price discounts and promotional allowances, neither of which are considered relevant marketing expenses in IBISWorld reports. During the past five years, spending on traditional advertising methods fell, while spending on promotional allowances has increased. Provided to: Ohio State University - Columbus Campus (OhioNet) (211852729) | 14 September 2016 WWW.IBISWORLD.COM Cigarette & Tobacco Manufacturing in the US August 2016 28 Competitive Landscape Cost Structure Benchmarks continued

- 88. Other All other costs are estimated to account for 56.3% of industry revenue in 2016. This segment includes a number of expense categories that are unique to the tobacco industry, including federal excise taxes, tobacco-related litigation costs and ongoing payments to the signatories of the 1998 Master Settlement Agreement (MSA). For example, federal excise tax payments accounted for 25.8% of Altria Group’s industry-relevant revenue in 2015, while MSA and FDA user fees accounted for an additional 18.9% of net sales in that year. Although payments associated with the Fair and Equitable Tobacco Reform Act (FETRA) were concluded in 2014, these costs were significant in previous years (see Regulation section). Litigation costs and settlement payouts are unique costs for operators in the Cigarette and Tobacco Manufacturing industry and are estimated to account for a significant 18.6% share across all industry operators. These costs, which are mostly associated with annual payments in accordance with the MSA, are much higher among the two largest manufacturers (Philip Morris USA and Reynolds) than among smaller operators. For example, Phillip Morris USA (Altria Group) faced over 62

- 89. independent tobacco-related cases at the end of 2015, in addition to several class action suits and ongoing costs unrelated to the MSA. Likewise, Reynolds has paid over $130.0 million in unfavorable tobacco-related judgments unrelated to the MSA in just the past three years. However, as the number of smokers in the United States continues to decline in the near future, the frequency of lawsuits brought against producers is anticipated to fall. In particular, litigation costs unassociated with the MSA are expected to decline as a greater number of cases related to the Engle vs. Liggett decision are settled (see Regulation section). Remittance of federal excise taxes also constitutes another major expense. Federal excise taxes on tobacco products are levied exclusively on the manufacturers, which collect the appropriate per-unit tax on their products and pass down the added expense to wholesalers or retailers in the form of higher selling prices. Since excise taxes are usually adjusted to unit sales volume, declining shipment levels in recent years have lowered this expense’s share of industry costs since 2011. Nonetheless, excise tax’s share of industry costs is likely to increase considerably over the next five-year period because the government may