Ikon Daily Markets Analysis and Economic Development Insights

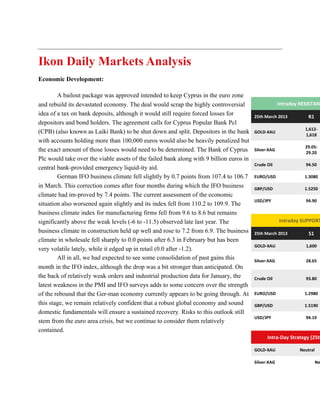

- 1. Ikon Daily Markets Analysis Economic Development: A bailout package was approved intended to keep Cyprus in the euro zone and rebuild its devastated economy. The deal would scrap the highly controversial Intraday RESISTANC idea of a tax on bank deposits, although it would still require forced losses for 25th March 2013 R1 depositors and bond holders. The agreement calls for Cyprus Popular Bank Pcl 1,612- (CPB) (also known as Laiki Bank) to be shut down and split. Depositors in the bank GOLD-XAU 1,618 with accounts holding more than 100,000 euros would also be heavily penalized but 29.05- the exact amount of those losses would need to be determined. The Bank of Cyprus Silver-XAG 29.20 Plc would take over the viable assets of the failed bank along with 9 billion euros in Crude Oil 94.50 central bank-provided emergency liquid-ity aid. German IFO business climate fell slightly by 0.7 points from 107.4 to 106.7 EURO/USD 1.3080 in March. This correction comes after four months during which the IFO business GBP/USD 1.5250 climate had im-proved by 7.4 points. The current assessment of the economic USD/JPY 94.90 situation also worsened again slightly and its index fell from 110.2 to 109.9. The business climate index for manufacturing firms fell from 9.6 to 8.6 but remains significantly above the weak levels (-6 to -11.5) observed late last year. The Intraday SUPPORT business climate in construction held up well and rose to 7.2 from 6.9. The business 25th March 2013 S1 climate in wholesale fell sharply to 0.0 points after 6.3 in February but has been GOLD-XAU 1,600 very volatile lately, while it edged up in retail (0.0 after -1.2). All in all, we had expected to see some consolidation of past gains this Silver-XAG 28.65 month in the IFO index, although the drop was a bit stronger than anticipated. On the back of relatively weak orders and industrial production data for January, the Crude Oil 93.80 latest weakness in the PMI and IFO surveys adds to some concern over the strength of the rebound that the Ger-man economy currently appears to be going through. At EURO/USD 1.2980 this stage, we remain relatively confident that a robust global economy and sound GBP/USD 1.5190 domestic fundamentals will ensure a sustained recovery. Risks to this outlook still USD/JPY 94.10 stem from the euro area crisis, but we continue to consider them relatively contained. Intra-Day Strategy (25th GOLD-XAU Neutral Silver-XAG Ne

- 2. Crude Oil Ne EURO/USD Ne GBP/USD Ne USD/JPY Neutral t Gold – XAU Intraday Support S1 Gold (spot) closed down on Friday made its intraday high of US$1,616.00/ounce after setting intraday low of US$1,603.70/ounce. Gold went down by 0.365% at S2 US$1,603.70/ounce. S3 Intraday Resistanc R1 R2 R3 Closing Snaps Close High Low Chg(%) Technical Indic Name V 14DRSI 5 20-DMA 15 50-DMA 16

- 3. 100-DMA 16 Technicals in Focus: 200-DMA 16 In daily charts, prices are sustaining below 100DMA and 200DMA (1665) level STOCH(5,3) 8 become major resistance level for gold on daily chart; whereas, minor support level is at 20DMA (1589). MACD is now below zero line but histogram are increasing MACD(12,26,9) - will bring more bullish stance in the upcoming sessions. RSI is in neutral region and indicating to buy. The Stochastic Oscillator has entered in overbought territory but giving positive crossover to confirm bullish stance. Cushioned by an immediate support in 1605 – 1601, XAU can keep struggling for 1612 and 1620 – 1626. On the downside, a relapse through 1601 would call for weakness towards 1595 -- 1593 and 1586. Trade accordingly. Generally speaking, a convincing closing above 1620 is needed to confirm a small double-bottom for deeper upwards correction towards the 38.2% retracement (1647) of 1796 to 1555 descend. On the downside, slippage below 1577 would terminate the upwards correction for a meltdown towards 1559 and 1532. Trading Strategy: Neutral Sell at strength at 1612-1620; targeting 1588-1584 and 1574-1566, upside breakage of 1622 will lead to 1626-1631 and 1641-1648. Buyers can buy in 1600-1605 with risk below 1594 hourly closing; targeting 1615-1620 and 1626-1634. Silver - XAG Intraday Suppor S1 Silver (spot) closed down on Friday made its intraday high of US$29.18/ ounce after setting intraday low of US$28.53/ounce. Silver settled 1.498% down at S2 US$28.78/ounce. S3 Intraday Resistan R1 R2 R3 Closing Snaps Close High Low

- 4. Chg(%) TECHNICAL INDIC Name V 14DRSI 4 20-DMA 2 50-DMA 3 100-DMA 3 200-DMA 3 STOCH(5,3) 6 MACD(12,26,9) - Technical in Focus: In daily charts, silver is sustaining above 20DMA (28.90), breakage below 28.90 will lead to 28.50-27.90 and immediate resistance level at 50DMA (30.18). MACD is below the zero line and histogram are increasing will bring bullish stance in the upcoming sessions. RSI is entering in neutral region and is indicating bullish stance. The Stochastic Oscillator entered into neutral territory and giving negative crossover to confirm bearish stance for today. The bearish forces again wrested control through an extremely weak line on Friday. With nearby resistance levels around 29.01 and 29.36, XAG can weaken through 28.62 for 28.44 and 28.22. While a break past 29.36 can call for 29.62 – 29.95. Trading Strategy: Neutral SHORT positions at 29.15-29.35 with stop above 29.55; targeting 29.05-28.80 and

- 5. 28.50-28.20, upside breakout of 29.55 will open the way to 29.50-29.65 and 29.75- 29.90. Buyers can buy in 28.50-28.65 with risk below 28.35, targeting 29.35-29.55 and 29.75-30.05. Oil - WTI Intraday Support S1 S2 Crude futures (March 2013) on Friday made an intra‐day high of US$93.93/bbl and S3 made an intraday low of US$92.31/bbl and settled up by 1.656% at US$93.87/bbl Intraday Resistanc on session close. R1 R2 R3 Closing Snaps Close High Low Chg(%) TECHNICAL INDIC Name V 14DRSI 3 20-DMA 9 50-DMA 9 100-DMA 9 200-DMA 9 STOCH(5,3) 8 MACD(12,26,9)

- 6. Technical in Focus: In daily charts, oil is sustaining above its 200DMA i.e 90.40, which is a very strong support and breakage above will lead to 90.70-89.00. MACD is below zero line and histograms are in decreasing mode will bring bearish stance in the upcoming sessions. The Stochastic Oscillator is now in overbought region and signaling to buy as it gave positive crossover for confirmation of bullish stance; while the RSI is in oversold region and indicating to buy. We continue to sight possibility for strength towards 94.55 and 95.64. Nearby supports reside around 93.23 – 93.06 and 92.31 (risk). Stay long with revised risk below 92.31. Trading Strategy: Neutral Today, buy on Weakness to 92.00-92.50 with risk below 91.90 (4-hourly Closing); targeting 91.50-92.50 and 93.05-93.50. Sell below 93.30-93.90, using a stop loss of 94.20, targeting 92.05-91.50 and 90.80. EUR/USD Intraday Support S1 S2 EUR/USD on Friday made an intra‐day low of US$ 1.2888/EUR and made an S3 intraday high of US$1.3009/EUR and settled the day 0.736% up at Intraday Resistan US$1.2991/EUR on session close. R1 R2 R3 Closing Snaps Close High Low Chg(%)

- 7. TECHNICAL INDIC Name V 14DRSI 4 20-DMA 1 50-DMA 1 100-DMA 1 200-DMA 1 STOCH(5,3) 5 MACD(12,26,9) -0 Technical in Focus: In daily charts, prices are sustaining bellow 20DMA (1.3060), which become immediate resistance level, break above will target 1.3125-1.3265. MACD has broken zero line and giving a sell signal. Stochastic has been entered in the oversold territory and still giving negative crossovers to signal for bearish outlook for intraday. RSI is also in oversold region but signaling to buy. The pair managed to stable below 1.3000 levels which is negative and could push the pair to the downside towards the extended targets of the AB=CD bearish harmonic Pattern. The descending channel shown on the graph also supports extending negativity to test 1.2905 levels and perhaps towards 1.2805 levels. Stability below 1.3080 levels is an initial catalyst to maintain these expectations. Trading Strategy: Neutral

- 8. Based on the charts and explanations above, buy in 1.2905-1.2980 with stop below 1.2850; targeting 1.3080-1.3130. Sellers can short around 1.3080-1.3130 with risk above 1.3200 4-hourly closing; targeting 1.2980-1.2905 and 1.2845-1.2805. GBP/USD Intraday Support S1 S2 GBP/USD on Friday made an intra‐day low of US$1.5165/GBP and made an S3 intraday high of US$1.5247/GBP and settled the day up by 0.395% at Intraday Resistanc US$1.5229/GBP on session close. R1 R2 R3 Closing Snaps Close High Low Chg(%) TECHNICAL INDIC Name V 14DRSI 5 20-DMA 1 50-DMA 1 100-DMA 1 200-DMA 1 STOCH(5,3) 8 MACD(12,26,9) -0