Basic accounting unit2

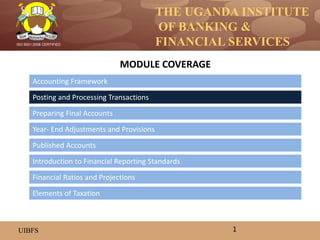

- 1. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED Accounting Framework Posting and Processing Transactions Year- End Adjustments and Provisions Preparing Final Accounts Introduction to Financial Reporting Standards Published Accounts MODULE COVERAGE 1 Financial Ratios and Projections Elements of Taxation

- 2. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED Overview of the accounting cycle The following eight steps of the accounting cycle describe the accounting function for an economic transaction, from the time it occurs until it is ultimately reflected in the financial statements; 1. Identify transaction. i.e. from the source document(s) 2. Classify and analyze the transaction 3. Prepare Journals (journalizing) 4. Post journal to Ledger 5. Make adjusting entries 6. Make closing Entries 7. Prepare Trial Balance 8. Prepare final financial statements Steps 1 and 2: Identifying, classifying and analyzing transactions To do this, every bank has a chart of accounts. A Chart of Accounts is a list of accounts classified according to their nature (that is; assets, liabilities, capital or equity, revenue or income, expenditure) with peculiar account numbers. It provides structure for the recording and reporting of all financial transactions for the institution. 2

- 3. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED Step 3: Journalizing Transactions are entered into the accounting system by means of a journal entry. A general journal, book of original entry, is a daily diary listing all transactions in chronological order. A journal entry is used to enter transactions into the accounting system and records how each transaction affects an asset, liability, equity, revenue and/or expense account. The concept of double entry applies at this point in the accounting cycle. Step 4: Posting to the Ledger Posting is the process of copying journal entry information from the general journal to the ledger. A general ledger is a record of transactions organized by account number and account titles, beginning with the asset accounts and ending with expense accounts. It is a summary of all transactions affecting individual account changes in an asset, liability, equity, revenue and expense accounts. Each ledger is recognized by its account name and number as stated in the chart of accounts. Step 5: Accounting adjusting entries Adjusting entries are made for transactions that have not been recorded through the business operations in the period. Such transactions include loan loss provisions, depreciation, prepaid expenses (e.g. rent, insurance) and accrued expenses. 3

- 4. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED Loan loss provisions and write offs and accrual of interest receivable adjustments shall be discussed in detail in a later module. Depreciation adjustments are usually passed periodically (monthly, quarterly, half yearly or annually) depending on the organizational policy and involve the amortization of capital assets overtime so that the amount equal to its useful life is expensed. Accrued expenses refer to the recognition of expenditure incurred by bank during the accounting period but not yet paid. Step 6: Closing Entries Revenues and expenses are accumulated and reported by period; i.e. monthly, quarterly or yearly. To prevent revenues and expenses of one period being added to or commingled with revenues and expenses of another period, they need to be closed out – that is, given zero balances at the end of each period by transferring balances to the income statement. Their net balance represents the profit or loss for the period. Once revenue and expense accounts are closed, the only accounts that have balances are the asset, liability and owners equity accounts. Their balances are carried forward to the next period. 4

- 5. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED Step 7: Prepare the Trial Balance A Trail Balance is used to verify that the debits and credits are in balance (meaning that the total of all debit entries and the corresponding total of all credit entries add to the same figure). It is a summary of balances of all the accounts after complete posting of all transactions. The trial balance is prepared by: 1. Taking account balances from the ledger 2. Listing all debit balances in one column and credit balances in another column 3. Totaling the debit and credit balances and comparing them. If all the postings were done well and all balances were accurately calculated and taken to the Trial Balance, the totals should be in agreement. The Trial balance tests the completeness and arithmetical accuracy of accounting entries. However certain errors may not be detected through the trail balance. If there should be unequal amounts of debits and credits or if an account appears to be incorrect, the discrepancy or error is investigated and corrected. 5

- 6. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED Step 8: Presentation of final financial statements From the above processes, the final accounts or financial statements (income statement, balance sheet and the cash flow statement) are prepared. Accounting information, in order to be reliable, must be prepared according to generally agreed precepts also referred to as accounting concepts or principles. Accounting principles are the broad basic assumptions or precepts which underlie the periodic financial accounts of business enterprises. 6

- 7. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED Double entry book keeping The principle used to post transactions into the ledger is called double entry book keeping. The double entry principle is based on the fact that each transaction has two effects which are equal but opposite. This is the dual effect of transactions. Usually, this will affect two different accounts. Double entry rules It is necessary to always observe one important rule: every financial transaction gives rise to two accounting entries, one a debit and the other a credit. An account is a record of transactions (affecting a particular aspect or line item of assets, liabilities, equity, revenue or expenses) between the institution/ organisation and the third party. The total value of debit entries for all transactions must always equal to the total value of the credit entries at any given time. The arithmetic check of this is usually done by way of constructing a trial balance (systematic list of all debit and credit balances) periodically. • Each account has two sides, the left-hand side of which is called the debit side (DR) and the right hand side of which is called the credit side (CR). • When we talk of debiting an account we mean that the transactions details should be recorded on the left hand side and crediting means recording on the right hand side. 7

- 8. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED 8 Date Narrative Amount Date Narrative Amount Stating where the double entry is posted Debit side Credit side The date of the transaction is recorded here Title of Account Table 1. Above is an example and format of a ‘T’ Account

- 9. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED Which account receives the credit entry and which receives the debit depends on the nature of the transaction. Before we consider the dual effect on the main categories of accounts, let us first define an asset, a liability and equity. Assets: are all valuable possessions of the bank and represent what is owned by the bank or owed to it by other entities. Liabilities: represent what the bank owes other entities. Equity: represents the capital or net worth of the Bank. A more detailed discussion of assets, liabilities and equity is presented in unit 3. Table 2 below shows the dual effect on the main categories of accounts 9

- 10. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED 10 Account Type Debit Credit Incomes, Gains, Liabilities, Capital Reduces in value Increases in value Expenses, Losses, Assets Increase in value Reduces in value An increase in revenue (income), e.g. loan interest received is a credit and a decrease is a debit. The normal balance for revenue (income) is a credit. An increase in an expense e.g. purchase of stationery is a debit and the decrease is a credit. The normal balance of an expense account is a debit. An increase in assets e.g. purchase of computers or furniture is a debit and a decrease is a credit. The normal balance of an asset is a debit. An increase in a liability e.g. obtaining a loan from another bank is a credit and a decrease is a debit. The normal balance for a liability is a credit. An increase in capital e.g. cash injections for additional share capital is a credit and a decrease is a debit. The normal capital account balance is a credit.

- 11. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED 11 Main Account Category A debit to an account will: A credit to an account will: Normal Balance will be: Revenue (Income) - Decrease + Increase Credit Expenses + Increase - Decrease Debit Assets + Increase - Decrease Debit Liabilities - Decrease + Increase Credit Capital - Decrease + Increase Credit Table 3: A summary of debit and credit impact on different account types

- 12. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED Below are the accounting entries for typical bank transactions; • When a customer deposits cash DEBIT: Cash/Treasury account (with amount deposited) CREDIT: Customer’s account (with amount deposited) • When a customer withdraws cash DEBIT: Customer’s account (with amount withdrawn) CREDIT: Cash (With the amount withdrawn) • When a loan is disbursed to a Customer DEBIT: Customer Loan Account CREDIT: Customers’ Account or Cash depending on the method of disbursement • Other Current Assets The accounting treatment for other assets is as follows; DEBIT: Other Current assets (Balance Sheet item) CREDIT: Cash & Bank or the individual accounts • Purchase of a Fixed Asset e.g. Bank car DEBIT: Fixed Assets - Motor Vehicle Account CREDIT: Bank/Cash account with the cost of the fixed asset 12

- 13. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED Fixed assets depreciation Different methods of charging depreciation are used by different banking institutions. The following methods are normally used when calculating depreciation; • Straight line method – this is where a uniform annual depreciation charge is made on the asset until the whole purchase value is reduced to zero. In some cases, a residual value remains on the asset. • Declining balance / reducing balance method– Under this method, the depreciation rate is applied to an asset’s book/written down value of the previous year. Example: X Banking Ltd acquired a motor vehicle on 1st January 2011 at a cost of UGX 15 million. Depreciation charge per annum is 25%. What is the depreciation charge under the straight line and reducing balance methods? Straight line method; The depreciation charge as at 31 December 2011 will be 25% × 15 million = 3,750,000. This will be the annual depreciation for 4 years. 13

- 14. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED • Reducing-balance method; Value of Motor vehicle as at 1 January 2011 15,000,000 Less: Depreciation charge for first year (25%) 3,750,000 Book value as at 31 December 2011 11,250,000 Depreciation charge as at 31 December 2012 2,812,500 [25% x11,250,000] To record depreciation expenses, the following entries are made; DEBIT: Depreciation expense CREDIT: Accumulated depreciation • Disposal of fixed assets To record the sale or disposal of a fixed asset, the cost and accumulated depreciation of the fixed asset are transferred to a Fixed Assets Disposal Account as follows: DEBIT: Accumulated Depreciation with the balance on the Accumulated Depreciation Account CREDIT: Fixed asset disposal with the balance on the Accumulated Depreciation Account 14

- 15. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED Then, DEBIT: Fixed Asset Disposal Account with fixed asset cost CREDIT: Fixed Asset Account with fixed asset cost The proceeds received on disposal are recorded as follows; DEBIT: Bank or Cash with the selling price of the asset CREDIT Fixed Asset Disposal A/C with the selling price of the asset The balance on the fixed asset disposal account after passing the above entries is transferred to the Profit/Loss on disposal of fixed assets in the profit and loss account. A debit balance represents a loss on disposal, whilst a credit balance represents a profit on disposal 15

- 16. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED Permanent diminution in value of fixed assets If, in the opinion of BANK management, a fixed asset suffers permanent diminution, the asset is written off the books against the profit and loss account in the year that the permanent diminution is first identified. The permanent diminution in value may involve a partial or absolute loss in value. To record the permanent diminution, the cost and accumulated depreciation of the fixed asset are transferred to a fixed assets disposal account as follows; DEBIT: Accumulated Depreciation A/C with the balance of the assets accumulated depreciation CREDIT: Fixed Assets Disposal A/C with the balance of the Asset’s accumulated depreciation DEBIT: Fixed Asset Disposal A/C with the cost of the Fixed Asset CREDIT: Fixed Assets Cost A/C With the cost of the Fixed Asset The net balance in the fixed assets disposal account after passing the above entries is charged to the profit and loss account as follows: DEBIT: Profit and Loss Account CREDIT: Fixed Asset Disposal A/C 16

- 17. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED Revaluation of Fixed Assets • Revaluation of fixed assets should only be booked in BANKs books if the revaluation is performed by professional valuers. • The following entries are passed to record the revaluation: DEBIT: Fixed Asset A/C (With the revaluation surplus) CREDIT: Revaluation Reserve Account (with revaluation surplus) • For a revaluation deficit, make the opposite of the above entries. • The revaluation surplus or deficit is the difference between the value of the fixed asset as determined by the valuer and its net book value. • The net book value of an asset is its cost minus its accumulated depreciation. • The revaluation surplus is a non-distributable reserve, meaning it cannot be paid out a profits/surplus. • The balance in the revaluation reserve is transferred to the profit and loss account when the asset is disposed of. • In addition, the excess depreciation arising on revaluation is debited to the revaluation reserve and credited to the profit and loss account. 17

- 18. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED Example: Suppose a bank acquires a vehicle on 1/1/2007 for UGX 15 million and depreciates it over 4 years on a straight-line basis, with nil salvage value. On 1 January 2010 a firm of professional valuers appointed by the bank re-values the asset at UGX 8 million. Bank management decides to recognize the revaluation in the accounting records. At the time of the revaluation (1/1/2010), the net book value of the vehicle was as follows; UGX Cost: (1.1.2007) 15,000,000 Less: Accumulated depreciation 11,250,000 [3* 25%*UGX 15 million] Net book value (31.12.2009) 3,750,000 The new valuation of the vehicle is UGX 8 million; therefore the revaluation surplus is UGX 4,250,000 (8,000,000 – 3,750,000). The revaluation surplus would be credited to the Revaluation Reserve Account and debited to the Motor Vehicle Account. The vehicle would still be depreciated over 4 years (until 31/12/2010). Any additional depreciation (based on the revalued amount), would be reduced by an equivalent transfer from the revaluation surplus account. 18

- 19. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED Maintenance of Fixed Asset Register The FAR records the following details on each Fixed Asset: a. Nature of the asset (e.g. motor vehicle, building, computer etc) b. Unique serial number of the asset (e.g. vehicle No 678 UCH) c. Total cost d. Date of acquisition e. Vendor details (name and address) f. Location g. Estimated useful life h. Depreciation rate i. Estimated salvage value on disposal j. Accumulated depreciation (updated k. Physical verification of fixed assets - The physical verification of fixed assets is aimed at: l. Confirming the existence of BANK fixed assets as recorded in the FAR m. Determining whether BANK owns any fixed assets which are not recorded in the FAR n. Determining the condition of the fixed assets (e.g. damages or obsolescence) o. Confirming other details about the fixed assets contained in the FAR. p. Fixed assets unique identification: q. Each asset should bear a unique identification mark, which is also recorded in the FAR. 19

- 20. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED Short Term & Long Term Loans Payable When the bank receives a loan, the following entries are made; DEBIT: Cash or Bank Account with the principal amount CREDIT: The lender institution’s a/c with the principal loan amount Interest expense When interest falls due: DEBIT: Interest payable account CREDIT: Lender institution When the bank pays back, DEBIT: The lender institution with the principal and interest CREDIT: The Cash or Bank Account with the Principal and interest 20

- 21. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED Example W Banking Ltd makes a loan to one of its customers at the following terms; Principal amount UGX2 million Interest rate 3% per month Loan period 6 months (182 days) The interest payable by the customer at the end of the first month will be computed as follows; UGX 2million × 3% = UGX 60,000 The following entries will be passed on W Banking Ltd. accounts to record the above transaction: To record the principal amount of the loan; DEBIT: Customer’s loan account UGX 2,000,000 CREDIT: Customers’ Account UGX 2,000,000 To record the total interest receivable at the end of the first month; DEBIT: Interest receivable UGX 60,000 CREDIT: Interest Income UGX 60,000 21

- 22. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED To record interest payment by the borrower, DEBIT: Cash or Customers Savings A/C - UGX 60,000 CREDIT: Interest Receivable A/C UGX 60,000 To record receipt of principal repayment installment from Customer; DEBIT: Customers’ account or Cash account -UGX 383,197 CREDIT: Customers Loan account If a loan is non–performing (based on Bank of Uganda standard regulations and W Bank Ltd.’s credit policy), interest income is not recognized in the profit and loss account. It is suspended on the balance sheet. As soon as a loan is classified as non–performing, the outstanding interest receivable is reversed (reversal entries in step 2 above) as follows; DEBIT: Interest Income (with outstanding interest receivable) CREDIT: Interest receivable The following entries are then passed to record the interest in suspense; DEBIT; Interest in suspense – asset CREDIT: Interest in suspense – liability (With the outstanding / unearned interest income at the time that the loan is classified non – performing) 22

- 23. THE UGANDA INSTITUTE OF BANKING & FINANCIAL SERVICES UIBFS ISO 9001:2008 CERTIFIED Other Payables, Accruals & Short Term Provisions • Payables, accruals, and short term provisions are liabilities to an institution. Their accounting treatment is as follows; DEBIT: The Expense Account to which they relate CREDIT: Accruals or other payables (liabilities - balance sheet items) • Provisions are estimates debited to the P & L Account during the accounting period. Examples of provisions include bad debts, Audit fees, depreciation and discounts. Accounting treatment is as follows: DEBIT: Profit & Loss Account CREDIT: Provisions for these Accounts (assets - Balance Sheet items) 23

Editor's Notes

- To assist a book keeper or accountant of a typical bank to record transactions in a consistent and easy-to-understand manner, a chart of accounts is important. There is no standard chart of accounts for banking institutions. It varies from institution to institution.

- The unique identification should be bold and easily noticeable by an observer – this acts as a deterrent to would be thieves

- The unique identification should be bold and easily noticeable by an observer – this acts as a deterrent to would be thieves