Rong Viet Securities - Investment Strategy Report September 2017

- 1. Most of the time in August, VNIndex experienced a strong correction as H1 2017 business results season came to the end, couple with quite high relative valuation of the stock market. The increase in large-cap stocks, including SAB, VIC, and banking stocks, has helped VNIndex quickly bounce back to 780 points by the end of the month. The solid growth of the macro indicators is still the key factor that leads to positive market sentiment. Moreover, in the short term, low inflation rate will help SBV to actively control the FX variation as well as allow credit growth at 21–22% based on the Government’s direction. Besides, SBV’s Draft on Circular 36 amendment also proposes to keep the ratio of short-term capital to finance mid- and long-term loans at 45% in 2018 and reduce to 40% from 2019 (Circular 06: 40% from 2018). If the proposal is approved, credit institutes may have less pressure on raising mid- and long-term deposits. Thanks to those solutions, interestratecould bekeptatthecurrentlow ratefortheremainingmonthsof2017. Hence, thelinkamong investment channels will cause cash flow to stay within the stock market. The average liquidity in the remaining months of 2017 will be above the past eight months average of VND3,200 billion–VND3,300 billion. Even so, we see no likely catalysts for a persistent uptrend at this time. In particular, we find no supportive information from the listed companies in September. Along with that, the participation of foreign investors in Vietnam stock market was reduced to 5-6% in August (while their normal contribution is around 10-11%), in the context that FED can possibly raise interest rates and ECB will narrow down their quantity easingpoliciesinSeptember. Theweakparticipation offoreigninvestors, coupled withtherecent dispute on global geopolitics, may not result to a negative effect in the market, but could have a strong impact on the market sentiment, especially in the “red” sessions. Overall, it is unlikely that the market will break the current sideways trend soon. We think that VNIndex will experience more fluctuation (from 760 to 800 points) in September. Improving liquidity means the daily trading activities will be easier. Despite of that, there will be risk for investors to use margin for trading on speculative stocks, especially in the overexciting sessions. Meanwhile, given the support of macro stability (at least from the Government’s decisiveness), we think that investors can stand a chance to accumulate stocks with sound fundamentals and have a bright outlook in the second half of 2017. Besides, after a strong correction in August, relative valuation of many stocks decreased to a more reasonable value. Therefore, the ones with P/E and P/B lower than its peers may generate higher return to investors. Strategy Board Truc Doan – Head of Research truc.dtt@vdsc.com.vn Ha My Tran my.tth@vdsc.com.vn Lam Nguyen lam.ntp@vdsc.com.vn Thien Bui thien.bv@vdsc.com.vn Hieu Nguyen hieu.nd@vdsc.com.vn Quang Vo quang.vv@vdsc.com.vn Ha Tran ha.ttn@vdsc.com.vn Please see penultimate page for additional important disclosure Viet Dragon Securities Corp. (“VDSC”) is a foreign broker-dealer unregistered in the USA. VDSC research is prepared by research analysts who are not registered in the USA. VDSC research is distributed in the USA pursuant to Rule 15a-6 of the Securities Exchange Act of 1934 solely by Rosenblatt Securities Inc, an SEC registered and FINRA-member broker- dealer. 5 7 9 11 13 15 17 19 21 23 25 PE VNIndex Average PE 06/09/2017 Investment Strategy September 2017 The Confrontation Between Chance and Risk

- 2. Rong Viet Securities Corporation – Investment Strategy Report September2017 2 CONTENTS WORLD ECONOMY ..............................................................................................................................................................................................................................3 US: Growth Momentum Extends in Q3.............................................................................................................................................................3 EU: EUR Heating Up ..................................................................................................................................................................................................3 China: Credit Squeeze Ahead of Leadership Reshuffle...............................................................................................................................4 GLOBAL STOCK MARKETS...............................................................................................................................................................................................................5 VIETNAM MACRO.................................................................................................................................................................................................................................6 Bright Spots in the Economy in Q3 2017..........................................................................................................................................................6 Taxation Changes, Implementation Progress, and Potential Impact....................................................................................................7 VIETNAM STOCK MARKET IN AUGUST: RECOVERY AFTER DEEP CORRECTION.................................................................................................12 SEPTEMBER STOCK MARKET OUTLOOK.................................................................................................................................................................................16 INVESTMENT STRATEGY ................................................................................................................................................................................................................17 Demand on construction comes not only from the residential housing but also from other segments such as hospitality real estate, commercial and office building, workshop and industrial projects, infrastructure, etc. Therefore, although the housing segment is predicted to be saturated in the next few years, it could still bring about increasing construction demand. We expect that constructors who are pioneers in diversifying backlogs towards other market segments will outperform their peers. Among the listed construction companies, we have noticed several signs of CTD reforming its revenue structure as well. Even though residential segment still accounts for around 70% of the company’s total revenue, the larger contribution from commercial and office and industrial sectors will help CTD to diversify its backlog portfolio. By the end of Q2 2017, CTD’s backlog is around VND26,181 billion (+18% YoY) and we expect the backlog could grow even higher following FDI’s trend and the expansion of domestic manufacturers. The acceleration of construction in H2 2017 will push the demand on construction materials, especially in the tile industry. The consumers’ taste is changing; low quality and small size ceramics have been replaced by granite. Given its low penetration ratio at 13%, there is large room for granite to grow in the upcoming years. Among the listed firms, we prefer VIT and CVT due to their large market share (11% and 5%, respectively) and expansion capacity. Given the growth story of granite, it is worth noticing that CVT is investing in a new production line, which is expected to add 25% more to the firm’s total capacity. In eight months of 2017, manufacturing growth was 10.8%, which is higher than the same period of last year growth of 10.4%. Some industries including Steel, Plastic, Paper, Textile and Fertilizer, recorded impressive growth. Although production has been growing, we recognize that some industries such as Plastic, Textile or Fertilizer, have less power to actively control their output price. In this context, steel firms have enjoyed not only the Government’s protection policies but also the uptrend of steel price since mid-Q2 2017. As a result, profit margin of steel players like HPG, HSG, and NKG could extend further in H2 2017. In the the long-term view, we prefer HPG over the others due to its close value chain from upstream to downstream and its growth capacity prospect from Dung Quat Steel Complex. For the banking industry, the story comes not only from the credit growth but also from provision for expenses/reversals. Given the effective of Decision 42, it is expected that the credit institutes can have more authority to foreclose and dispose collateral. It shoud take a long time to see the results, but the expectation has been reflected on the stock price. Therefore, although having sound fundamental from both core business and restructure progress, ACB’s relative valuation is no longer cheap compared to MBB and CTG currently. HIGHLIGHT STOCKS……………………………………………………………………………………………………………………...20 Analysis of 55 stocks of RongViet Research, Discussion with Companies and Specific Evaluation in the “Company Report” or “Analyst Pinboard”.

- 3. Rong Viet Securities Corporation – Investment Strategy Report September 2017 3 WORLD ECONOMY • US: Growth Momentum Extends in Q3 • EU: EUR Heating Up • China: Credit Squeeze Ahead of Leadership Reshuffle US: Growth Momentum Extends in Q3 Revised data showed that US GDP growth expanded faster than the first estimate (3.0% in Q2 2017). An upward revision was mainly thanks to stronger household consumption and non- residential investment. Growth momentum is expected to remain in the third quarter. According to the Institute for Supply Management, manufacturing activity expanded faster in August, climbing to 58.8 from 56.3 in July, the highest level since 2011. In addition, healthy gain in retail sales could also translate into bright outlook for private consumption in Q3. In July, growth in retail sales accelerated to 4.2% from a revised 3.4% in June. Simultaneously, the Conference Board’s consumer confidence index rose from 120 in July to 122.9 in August, marking the second- best reading since December 2000. Despite the Fed officials’ most recent projections of one more rate hike this year and three in 2018, market expectation tells a different story with the Fed funds futures market points to no more rate hikes this year and probably only one in 2018. According to CME Group FedWatch Tool, the probability of a rate hike in September meeting is 0%. Projection for November meeting is 2% (for an increase of 25 bsp). In December meeting, the likelihood of a rate hike of 25 bsp increases to only 31.3% while the probability of the rate remaining unchanged is 67.1%. Given the recent weak development of inflation and inflation expectations, we expect somewhat dovish tones from the September FOMC meeting. However, market still expects that the FOMC will announce the start of balance sheet normalization at this meeting. EU: EUR Heating Up Similar to the US, leading indicators for Q3 point to solid continued momentum. In August 2017, the manufacturing PMI was at 57.4, a robust level suggesting that the strong growth during the first half of 2017 has been sustained into Q3. However, the composite PMI slipped from 55.8 to 55.7, indicating that a strong expansion of the manufacturing sector has been offset by less growth in the service sector. The EU economy is forecasted to grow 0.6% in the third quarter due to improved consumer and business sentiment as well as robust growth in the manufacturing sector. Figure 1: US ISM PMI Figure 2: US Inflation Source: Bloomberg Source: Bloomberg 46 48 50 52 54 56 58 60 01/16 02/16 03/16 04/16 05/16 06/16 07/16 08/16 09/16 10/16 11/16 12/16 01/17 02/17 03/17 04/17 05/17 06/17 07/17 08/17 .00% .500% 1.00% 1.500% 2.00% 2.500% 3.00% 01/16 02/16 03/16 04/16 05/16 06/16 07/16 08/16 09/16 10/16 11/16 12/16 01/17 02/17 03/17 04/17 05/17 06/17 07/17

- 4. Rong Viet Securities Corporation – Investment Strategy Report September 2017 4 The strong depreciation of US dollar coupled with strong economic momentum in the EU led the euro to appreciate to its highest value against the dollar in over two years at the end of August. The euro was up 13.5% year-to-date. Ahead of September meeting was the message coming from the central bank which suggested some discomfort with the EUR’s recent strength because the strong appreciation could put downward pressure on inflation. Regarding the upcoming monetary policy decision, despite net changes in ECB balance sheet which slowed down in recent months, expectations that the ECB might announce a policy shift have been largely delayed to Oct 2017 as the policy makers will not be ready to reduce asset purchase until 2018. Figure 3: EUR-USD Trends Near Seasonal Peak Figure 4: EU Inflation Rate (%) Source: Scotiabank Source: Bloomberg China: Credit Squeeze Ahead of Leadership Reshuffle Chinese banks extended USD122.8 billion in new loans in July, falling sharply from June and recording an eight-month low level. Meanwhile, broad M2 money supply grew 9.2% YoY – the slowest since 1996. According to PoBC, the slowing M2 growth could be a “new normal” due to the efforts to solve risky shadow lending activities. The overwhelming consensus is that the PoBC will hold off on further monetary policy tightening ahead of a leadership reshuffle. The 19th Chinese Communist Party Congress is the most important political event to watch heading to the final quarter of this year. In this event, Xi’s power is put to the test and the trajectory of the country in the next five years will be revealed. In addition, there is a market consensus that the Chinese authorities would not create any interruption in GDP growth until after the leadership transition in the 19th Congress. Despite good growth momentum in H1 2017, the downside risks to short-term economic growth prospects remain high amid concerns over China’s banking system. Figure 5: China New Yuan Loans (USD billion) Figure 6: China Money Supply M2 Growth (%) Source: Bloomberg Source: Bloomberg 00 01 01 02 02 03 08/16 09/16 10/16 11/16 12/16 01/17 02/17 03/17 04/17 05/17 06/17 07/17 08/17 8 58 108 158 208 258 308 358 408 01/16 02/16 03/16 04/16 05/16 06/16 07/16 08/16 09/16 10/16 11/16 12/16 01/17 02/17 03/17 04/17 05/17 06/17 07/17 8 10 12 14 16 18 01/11 05/11 09/11 01/12 05/12 09/12 01/13 05/13 09/13 01/14 05/14 09/14 01/15 05/15 09/15 01/16 05/16 09/16 01/17 05/17

- 5. Rong Viet Securities Corporation – Investment Strategy Report September 2017 5 GLOBAL STOCK MARKETS Figure 7: Performances of Some Global Markets in August Source: Bloomberg, RongViet Research Markets entered August without much business earnings news. However, the markets were still affected by an upsurge of political risk, which was led by the tension between North Korea and the US and terrorist attacks in Spain. However, macro data was quite positive, showing that the global economy remains solid. The markets in August relied on these data. In the US, the economy still showed signs of solid growth. The second quarter GDP was revised up to 3% while unemployment rate fell to 4.3%. Besides, retail sales were up 4.2% YoY. Many forecasts show that growth will reach 2% for H2 2017, even without the fiscal stimulus and public spending that Trump is struggling to implement. However, the inflation rate still stayed below 2% at 1.7%. Such movement lowered the possibility that FED will hike up the rate in December to 34%. Last but not least, markets are heading to the September meeting where market players are looking forward to obtaining more details at the balance sheet cutoff. Dow Jones (+0.26%), S&P 500 (0.05%) and Nasdaq (+1.84%) gained in August. Core inflation remained at 1.3% in the EU, lower than the ECB’s target of 2%. The result has been anticipated in the minutes of July meeting where many members agreed that besides pursuing inflation target, other growth and labor markets were also very important. As a result, the ECB stated that it might not end the QE in the near term. Investors will need more time to have more clues on this decision. CAC 40 and DAX did not react strongly to macro data as they decreased 0.16% and 0.52%, respectively. The negotiations between the UK and EU still proceeded. In spite of the persisting potential uncertainty over this process, the FTSE 100 was one of the few indexes in Europe with positive returns in August. Asian stocks saw North Korea shaking the market. Aside from this political risk, the macro conditions in big countries such as Japan and China were quite positive. In Japan, the second quarter GDP growth was 4%, which was higher than expected. The PMI rose to 52.8. However, the subdued inflation at 0.4% showed an uncertain economic outlook. Moreover, the rising political risk encouraged investors to choose JPY, which is strengthened, leaving the Nikkie 225 down. China has also received positive macro reports despite some investors still showing some concern about shadow banking. However, SSE Index and Hang Seng Index still went up 2.9% and 2.4% in August. Oil prices (WTI) dropped 5.86%. Despite Hurricane Harvey, traders were not positive about oil prices after EIA had reported an increase in US production. On the other hand, gold price surged 4% due to increasing geopolitical threats. .260% .055% 1.841% .795% -.161% -.515% -1.400% 2.900% 2.365% 1.520% -1.645% .396% .309% -.101% 2.669% 4.093% -5.860% -20% -10% 0% 10% 20% 30% 40% DowJones S&P500 Nasdaq FTSE100 CAC40 DAX Nikkei225 SSE(Shanghai) HangSeng(Hongkong) TSEC(Taiwan) Kospi(Korean) JKSE(Indonesia) KLSE(Malaysia) VNIndex(Vietnam) HNX-Index(Vietnam) Gold Oil From 31/07/2017 to 31/08/2017 From 31/12/2016 to 31/08/2017

- 6. Rong Viet Securities Corporation – Investment Strategy Report September 2017 6 VIETNAM MACRO • Bright Spots in the Economy in Q3 2017 • Taxation Changes, Implementation Progress, and Potential Impact Bright Spots in the Economy in Q3 2017 GDP could grow 6.8-7% in Q3 Growth momentum accelerated in Q3 2017. On the supply side, according to GSO, industrial production index in August increased 3.9% MoM. We observed that this gain was in a relatively high level in the middle of the year after considering seasonal effects. In addition, the same growth usually happens in the last quarter of the year. In eight months, industrial production index increased 6.7%, which was lower than the increase of 7.2% in the same period of 2016. However, the most notable change is that manufacturing growth was 10.8%, which is higher than the same period growth of 10.4%. The deceleration of mining industry has been slowed down (- 6.7% YoY in eight months compared to -8.2% YoY in H1 2017). Positive signs appeared not only in terms of manufacturing growth but also in terms of demand, as consumption index showed a very encouraging gain in the first month of Q3. In seven months of 2017, consumption index increased 9.5% YoY, which was higher compared to the gain of 8.4% in H1 2017 and 8.1% in the same period of last year. Positive demand also helps inventory decline; inventory index as of 8 January 2017 increased 9.8% YoY. Based on production growth of some industries, we expect positive business growth for companies in the Steel, Plastic, Paper, Textile and Fertilizer industries. Figure 8: Industrial Production Movement Figure 9: Production Growth of Some Industries Source: GSO Source: GSO On the demand side, consumption showed resilience in the third quarter. To be specific, total retail sales improved to 11.7% YoY in August, faster than a growth of 10.3% in July. In particular, revenue from the retail segment increased significantly (+12% YoY). In eight months of 2017, total retail sales increased 8.9%YoY (excluding inflation), higher than the same period of 2016 (+8.5% YoY). From a microeconomic view, we think this trend will support consumer goods manufacturers in terms of business performance. Based on the above data, we expect the manufacturing and consumption sectors could accelerate in the third quarter and contribute significantly to GDP growth. At the moment, we are optimistic about the GDP growth in Q3 2017. We expect GDP could grow 6.8-7% in Q3, lower than the -2.0 .0 2.0 4.0 6.0 08/2016 09/2016 10/2016 11/2016 12/2016 01/2017 02/2017 03/2017 04/2017 05/2017 06/2017 07/2017 08/2017 50 51 52 53 54 55 IP (3m Moving Average) PMI 34% 27% 24% 18% 17% 10% 10% 10% 9% 9% 9% TV Billet RolledSteel Garment Urea NPK Water Milk Fishery Textile RebarSteel

- 7. Rong Viet Securities Corporation – Investment Strategy Report September 2017 7 Government’s target of 7.23% but higher than GDP growth in Q2. RongViet Research estimates GDP in nine months of 2017 at 6.1-6.2%, higher than the same period of last year. Inflation is under control In August, most of consumer goods’ prices increased, causing an increase of 0.92% MoM in CPI. Food and foodstuff contributed the most to that gain (34 bps) due to the recovery in pork price and a strong increase of vegetable prices. In addition, transportation contributed 20 bps to CPI because of double petroleum price hikes in August. The healthcare services price adjustments also contributed 14 bps to CPI. In eight months of 2017, CPI recovered to 3.35% YoY; average gain was 3.84% YoY, lower than the Government target of 4%. Although headline inflation recovered, core inflation was unchanged in August. Core inflation increased 1.47%YoY in eight months of 2017, lower than the increase of 1.88% at the beginning of the year. Figure 10: Retail Sales Figure 11: Inflation Movement Source: GSO Source: GSO Taxation Changes, Implementation Progress, and Potential Impact The Vietnam Ministry of Finance has recently announced the plan to launch the tax reform program through two drafts on amending and supplementing the Law on Environmental Protection Tax and the current laws on five types of tax namely VAT, Special Sales Tax, Corporate Income Tax, Personal Income Tax and Natural Resources Tax. These types of tax contribute about 62% of the government revenue, while the rest comes from import-export tax, fees and other income. Hence, the two proposals could be seen as an overhaul of the tax system which likely leads to a significant impact on revenue structure. The plan will result in both revenue losses and gains, depending on the segment of change but we suppose budget revenue could improve rapidly in the near term due to high tax base of VAT and Environmental Protection Tax. Meanwhile, the negative impacts of a higher consumption tax (VAT) and environmental protection tax on consumer spending, inflation as well as economic growth are worthy of more adjustments by policy makers in order to ensure this plan is passed through National Assembly in 2018. Table 1 details RongViet Research’s analysis of the many changes the Government has outlined for the tax reforms. We hope long-term investors could follow these taxation changes to see potential impacts on related industries such as: Consumer Goods (mixed between (+) and (-)), Fertilizers (+), Automobiles ((+) for domestic auto manufacturers), Agriculture (+), IT (+), etc. 260,000 280,000 300,000 320,000 340,000 0% 4% 8% 12% 08/2016 09/2016 10/2016 11/2016 12/2016 01/2017 02/2017 03/2017 04/2017 05/2017 06/2017 07/2017 08/2017 Value (bn dong) Growth (ex inflation) 0.0% 0.1% 0.2% 0.3% 0.4% 0.5% 0.6% 08/2016 09/2016 10/2016 11/2016 12/2016 01/2017 02/2017 03/2017 04/2017 05/2017 06/2017 07/2017 08/2017 Headline inflation Core inflation

- 8. Rong Viet Securities Corporation – Investment Strategy Report September2017 8 Table 1: Taxation Changes, Implementation Progress, and Potential Impact Type Key changes Objective Implementation Impact Consumption tax (VAT) Increase the current standard 10% VAT rate to: 12% from 01 Jan 2019; or 12% from 01 Jan 2019 and then 14% from 01 Jan 2021. The draft law removes a number of goods/services entitled to the 5%VAT rate, moving them to the standard tax rate (water, medical and educational equipment used for multiple purposes, sporting and entertaining activities, books). The 5% VAT rate is proposed to increase to 6% from 01/01/2019. Transfer of land use rights is proposed to be changed from VAT exempt to taxable at the standard VAT rate. Transfer of fertilizers, agricultural machines, off- shore fishing boats from VAT exempt to taxable at 5% VAT or the standard VAT rate. Tax refunds to be brought back for enterprises manufacturing goods or providing services subject to the 6% VAT rate. Threshold for payment by bank for both VAT and CIT purposes is proposed to be reduced from VND20 million to VND10 million. Raise Government revenue and to be consistent with existing global legislations. Reduce administrative procedures and the complication of calculating tax. The National Assembly will discuss this in 2018 and it will take effect on 01 Jan 2019. However, there is a fierce debate for “fairness” and household burden, especially the low-income class in the country. The MoF estimates the VAT increase could add 0.06-0.39% to CPI. It is not a significant number and due to lack of transparency in calculation methodology, we still doubt about this impact. Currently, many economists are most concerned about the effects of VAT increase on household demand, the distribution of income and the shadow economy. If higher VAT feeds through into higher prices, it will prompt a fall in real income. According to Euromonitor, despite the country’s strong economic growth, the majority of Vietnamese consumers will still belong to the low-income segment until 2030. Thus, a hike in VAT rate could lead to weaker consumption growth. However, because not all products are subject to VAT (i.e. necessities); rising income continues in Vietnam and a change in VAT will not be introduced in isolation, we think the net negative effects of VAT on aggregate demand and the distribution of income could be softened partly. Last but not least, based on our practical observations, the rise in VAT is expected to boost the size of the shadow economy in Vietnam. According to the most recent research paper*, Vietnam’s shadow economy averaged about 15.1% of GDP between 1991 and 2015. If the shadow economy grows, recorded GDP will suffer too. Based on our estimates, the VAT increase could create medium term benefits of reducing the fiscal deficit. In 2016, VAT contributed 24.5% to budget revenue. If the new tax applies in 2019, budget revenue could be added by VND70,000 billion. This is a huge number compared to the size of budget deficit target during 2016-2018. When analyzing the effect of VAT increase on the macro economy there are plenty of aspects to consider, however, RongViet Research think a rise in VAT could cause higher inflation, reduced aggregate demand and increased income inequality. These deteriorations will happen at the expense of improved government budget. A rise in VAT is considered as part of fiscal tightening policy. We think there is needed for the Government to provide supplementary policies in order to help this change pass through the National Assembly in 2018. Corporate Income Tax Tax on capital/share transfers by non-residents (CAPT): 1% on sales proceeds as opposed to the current 20% on net gain. CAPT on securities transfer unchanged at 0.1% on sales proceeds. To be consistent with actual situation. The National Assembly will discuss this in 2018. SMEs make up 95% of all companies operating in Vietnam, providing more than 50% of the national workforce and contribute 40% of GDP. Facilitating SMEs growth through tax incentives is one of the ways to upgrade growth driver in Vietnam economy.

- 9. Rong Viet Securities Corporation – Investment Strategy Report September 2017 9 Proposal to allow offsetting of gains from real estate transfers against losses from operations. Introduction of thin capitalization rules: no tax deduction for interest where debt to equity ratio exceeds 5:1 for manufacturing companies, 4:1 for other industries and 12:1 for banking. Cut the CIT for SMEs by 3 percentage points to 17%, the CIT for super small companies could be lower at 15%**. CIT Incentives: Limit incentives available in economic zones located in favorable socio-economic areas. Reintroduce incentives for certain software services and digital content. Align with Law on Investment for investments in rural areas having more than 500 employees and investment projects producing goods subject to SST (except auto manufacturing). Strengthen corporate’s financial situation, prevent transfer pricing. Reduce tax burden for SMEs facing impact of fierce competition. Simplify CIT incentives policy, add incentives for preferential sectors to encourage investment. CIT from SMEs contributes less than 1% to total budget revenue. So we think the tax cuts will impact insignificantly to budget revenue. Special Sales Tax Introduce SST on soft drinks at either 10% or 20% from 01 Jan 2019. Increase rates for cigarettes and cigars: Add a fixed SST charge of VND 1,000 per pack of 20 cigarettes and VND 1,500 per cigar, effective 01 January 2020; or Increase the SST rate from 75% to 80% on cigarettes from 01 Jan 2020 and to 85% from 01 Jan 2021. Amend taxable revenue for automobiles with less than 9 seats manufactured in Vietnam to sales price of manufacturer exclusive of the value of spare parts produced domestically. Hike SST on imported pickup trucks: 60% of the rate on sedans with the same engine capacity. Adjust consumer behavior on sugary drinks and cigarettes. Encourage domestic auto manufacturer to increase the localization rate and to develop domestic auto industry. The National Assembly will discuss this in 2018. Effective time depends on type of products. Special Sales Tax contributes to 7-8% of total budget revenue. The increase of SST for soft drinks and cigarettes could boost budget revenue in the medium term. However, we think the effect will be minimal in the long run. Allow domestic car manufacturers to better compete with imported cars. Companies benefited from this change include THACO, Huyndai Thanh Cong, Toyota. In the beginning of September, VIC also announced plans to invest up to USD3.5 billion to set up a car- manufacturing complex. Personal Income Tax Similar to CAPT for non-residents, PIT on both residents and nonresidents for capital transfer is proposed to be 1% on sales proceeds. PIT on transfer of securities is to remain at 0.1% of the sales proceeds. Encourage labors in IT and agriculture sectors. Reduce the complication of calculating tax and to be The National Assembly will discuss this in 2018. PIT contribution on budget revenue is around 6%. Backed by rising income, contribution of PIT to budget revenue has gradually increased. We think the base of this tax has potential to grow and these changes have minor impacts on PIT’s revenue.

- 10. Rong Viet Securities Corporation – Investment Strategy Report September 2017 10 There is 50% reduction of PIT on employment income of individuals working in IT industry, agriculture, and agricultural product processing projects. Reduce the number of tax brackets from 7 to 5 for employment income for tax residents and broaden the tax base for middle income earners (Table 2). Amend the tax rate for income from prizes from flat rate of 10% to progressive rates up to 30%. Exemption on first VND10 million is proposed to be removed. Increase the withholding threshold for payments to non-employees from VND 2 million to VND 5 million. The withholding rate remains 10%. consistent with actual situation. Simplify administration procedures. Natural Resource Tax Amend some articles of the NRT law to provide clearer guidance on taxable price, types of natural water and taxable objects. Align with Law on Mineral Resources and actual situation. The National Assembly will discuss this in 2018. Price is taxable on natural water producing hydro power. Environmental Protection Tax (EPT) Raise environmental tax rates on petroleum, oil, mazut, plastic bags, etanol petroleum (Table 3). Encourage the use of environment-friendly products. Offset the negative impacts on budget revenue due to the cut import tariffs on petroleum products. The National Assembly will discuss this in Oct 2017 and to be finalized in the next meeting in 2018. We think doubling environmental protection tax on petroleum will not happen immediately and the Government will adjust gradually based on inflation movement. Despite of this, the proposal to raise EPT on petroleum will drive inflation higher. This type of tax contributes 4% of total budget revenue in 2016, because fuel products’ tax base is large. Any changes in EPT on fuel products could create huge revenue for budget. Source: MoF, PWC, RongViet Research complied * http://www.econ.jku.at/members/Schneider/files/publications/2017/JointPaper_LeandroMedina_158countries.pdf | ** SMEs: companies with < 200 labors + revenue per year is from VND3 billion–VND50 billion; Super small companies: revenue per year is lower than VND3 billion.

- 11. Rong Viet Securities Corporation – Investment Strategy Report September2017 11 Table 2: Proposed Income Tax Brackets (monthly income – VND million) Current Income Bracket Tax Amount (%) Proposed Income Bracket Tax Amount (%) 1 Less than 5 5 Less than 10 5 2 5-10 10 10-30 10 3 10-18 15 30-50 20 4 18-32 20 50-80 28 5 32-52 25 Greater than 80 35 6 52-80 30 7 Greater than 80 35 Source: MoF Table 3: Proposed Environmental Protection Tax No. Products Unit Tax Rate (VND) Current Proposed 1 Petroleum, except etanol Liter 1,000-4,000 3,000-8,000 2 Air fuel Liter 1,000-3,000 3,000-6,000 3 Diezel Liter 500-2,000 1,500-4,000 4 Paraffin oil Liter 300-2,000 300-2,000 5 Mazut Liter 300-2,000 900-4,000 6 Lubricant Liter 300-2,000 900-4,000 7 E5 petroleum Liter 2,700-7,200 8 E10 petroleum Liter 2,500-6,800 9 Plastic bags Kilogram 30,000-50,000 40,000-80,000 Source: MoF

- 12. Rong Viet Securities Corporation – Investment Strategy Report September2017 12 VIETNAM STOCK MARKET IN AUGUST: RECOVERY AFTER DEEP CORRECTION The market movement seen in August was similar to what we saw in July, but with stronger fluctuation. The only sell-off on August 9th dragged the VNIndex and the HNIndex down by 2.6% and 1.2%, respectively. For the period August 8th–22nd, the VNIndex fell 4.0% (vs. 2.9% over the similar sell-off period in July). But thanks to a robust recovery in the last two weeks, the VNIndex ended only slightly below its beginning prices (-0.1%), and the HNIndex even closed above the flat line by 2.7%. Despite a stronger fluctuation, the market liquidity did not improve much, with total trading value on the HSX increasing 1.5%, while that on the HNX declining by 7.6%, compared to July. Figure 12: VNIndex Movement in August Figure 13: HNXIndex Movement in August Source: RongViet Research Source: RongViet Research The recovery of the VN30 was the main contributor for VNIndex narrowing its losses. During the period August 22nd–31st, we saw 21 stocks in the index, with total market cap accounting for about 55% of the HSX, driving the VNIndex up. VIC and banking stocks including VCB, BID, and MBB were the most notable names. As for VIC, its subsidiary, Vincom Retail, is planning an IPO that could become the country’s biggest ever share sale from the private sector. Along with the upcoming Vincity project, Vingroup’s affordable home brand, the IPO could draw investors’ interest. After being affected by the news and rumors regarding the arrests of big names in the industry, the banking stocks have eventually returned to lead the market, thanks to the following information: First, there is an extension of the timeline applying Circular 06 to adjust the ratio of short-term loans financing medium and long-term loans. Second, the prime minister has decided to boost credit growth further in the remaining months of the year. BID even rose to the ceiling on the last day of the month following rumors of a preliminary contract signing with a Korean bank. Table 4: Contribution of FLC, ROS, HAI to Total Market Liquidity Proportion of Trading Volume Proportion of Trading Value FLC 11.6% 5.2% ROS 1.5% 7.9% HAI 3.5% 2.9% Source: Fiin Pro, RongViet Research FLC, ROS, and HAI saw abnormal transactions in August. On August 24th, FLC’s trading value accounted for 18% of the HSX. HAI, which usually contributes just lower than 2%, affected 720 740 760 780 800 0 50 100 150 200 250 300 350 02/06 16/06 30/06 14/07 28/07 11/08 25/08 Trading Volume (mil. shares) VNINdex (right axis) 85 89 93 97 101 105 0 20 40 60 80 100 120 140 02/06 16/06 30/06 14/07 28/07 11/08 25/08 Trading Volume (mil. shares) HNXIndex (right axis)

- 13. Rong Viet Securities Corporation – Investment Strategy Report September 2017 13 significantly the overall liquidity in some sessions with its trading value accounting for 10.6%. ROS also had a heavy impact on the market with 7% proportion in total trading value in the second half of August. Looking more closely at the transactions, we found that these stocks’ impact was local. Calculating each stock’s average contribution to the VNIndex, we saw that these figures are not significant. Besides, excluding ROS, FLC, and HAI, the performance of the market liquidity would not change much, except for the August 11th and 22nd sessions. Therefore, we believe that the market liquidity has been and will continue to be at normal levels, regardless of the absence of these stocks. Figure 14: The Change of Market Liquidity in Each Session in August Source: Fiin Pro, RongViet Research Derivatives Market Started to Operate The market saw a milestone in August with the appearance of the VN30 futures contracts on August 10th. The newly formed market drew investors’ attention with total trading value jumping by more than ten times from VND36.5 billion to VND400 billion–VND500 billion. The one-month contract played a primary role as it accounted for above 90% of the total trading value. Figure 15: Total Trading Value on the VN30 Futures Market Source: Fiin Pro, RongViet Research In terms of price movement, the shortest-term contracts (one month) followed closely the VN30 Index, while the longest-term contract (VN30F1803) did not fluctuate much, only around 760 points. Our view on this new market is that the gradual increase in liquidity is a good sign, implying that more and more investors are interested in it. In addition, the futures market should be able to attract more capital to match the size of the stock market, whose average liquidity is around -80% -60% -40% -20% 0% 20% 40% 60% 80% 100% 120% 8/1/2017 8/4/2017 8/7/2017 8/10/2017 8/13/2017 8/16/2017 8/19/2017 8/22/2017 8/25/2017 8/28/2017 8/31/2017 HSX HSX (excluding FLC, ROS, HAI) 37 418 0 100 200 300 400 500 600 08/10/2017 08/11/2017 08/14/2017 08/15/2017 08/16/2017 08/17/2017 08/18/2017 08/21/2017 08/22/2017 08/23/2017 08/24/2017 08/25/2017 08/28/2017 08/29/2017 08/30/2017 08/31/2017

- 14. Rong Viet Securities Corporation – Investment Strategy Report September 2017 14 VND4,000 billion/session. Thus, we expect more participants to join the futures market, making it reflect more closely with the movement of the stock market. Figure 16: The VN30 Futures Contract Prices Source: Fiin Pro, RongViet Research Foreign Investors Trading Figure 17: Net Trading Value of Foreign Investors Source: Fiin Pro, RongViet Research In August, foreign investors were net buyers on both the HSX and HNX. Total net buying volume was over 56 million shares, equivalent to VND2,679 billion. Foreigners were net buyers of 50.87 million shares on the HSX with a net value of VND2,652 billion. Banking stocks continued to attract foreign cash flow as their net buying value amounted to more than 50% on the HSX, to which VPB is the main contributor. Recalling August 17th when this stock was officially listed, ATO had 46 million shares traded for nearly VND1,800 billion. Buyers continued to stack up their orders all that day. At the end of the session, VPB set a record for the largest trading day value on the HSX at VND2,255 billion. Ranked second in the net buyers list is the Basic Resources with a net buying value of VND 339 billion. Foreign investors were interested in HPG as they net bought over 238 million of its shares. The sharp increase in construction steel prices in July was a factor supporting HPG in particular and other steel stocks in general. On the HNX, foreigners were net buyers of VND26.58 billion. Banking stocks led the net buyers list. Foreigners net purchased VND77 billion worth of SHB shares. Construction and building materials ranked second with three noticeable stocks: HUT (+VND43 billion), DNP (+VND29 730 740 750 760 770 08/11/2017 08/14/2017 08/15/2017 08/16/2017 08/17/2017 08/18/2017 08/21/2017 08/22/2017 08/23/2017 08/24/2017 08/25/2017 08/28/2017 08/29/2017 08/30/2017 VN30 VN30F1708 VN30F1709 VN30F1710 VN30F1712 VN30F1803 0 2000 4000 6000 8000 10000 12000 14000 -600 -400 -200 0 200 400 600 800 1000 1200 1400 1600 03/01 21/03 02/06 Net bought/sold Accumulated Value

- 15. Rong Viet Securities Corporation – Investment Strategy Report September 2017 15 billion) and VIT (+VND10 billion). In contrast, Oil & Gas was sold the most. Offshore investors net sold nearly VND135 billion worth of PVS shares. A strange ATC trading session took place on August 29th. The highlight of this session was a series of stocks in VN30 basket such as BVH, KDC, VNM and SSI, which unexpectedly sold out strongly ATC, dropped to the floor price and closed in red. Such movement can only be seen in ETFs’ reconstitution sessions. In fact, since the beginning of the month, investors have withdrawn USD7.24 million from VanEck Vectors Vietnam ETF. The fund might have focused on selling shares in one session rather than scattered over several sessions. The FTSE Vietnam Index has released the reconstitution for Q3 2017 related to two ETFs. Accordingly, PLX is the only stock to be added to the index basket and no stock will be excluded for Q3 2017. RongViet Research estimates that 2.6 million PLX shares will be bought. The Db x-trackers FTSE Vietnam UCITS ETF will complete the transaction on September 15th. VanEck Vectors Vietnam ETF will also publish an announcement on September 9th (Vietnam time). RongViet Research forecasts that the fund will neither add nor remove any shares during this reconstitution. The fund will also complete the transaction on September 15th. Sectors HSX HNX Net Volume (million shares) Net Value (VND B) Net Volume (million shares) Net Value (VND B) Oil & gas -1.05 109.25 -7.96 -133.35 Chemicals 0.69 76.32 -0.36 -1.60 Basic resource 10.46 338.75 1.66 6.07 Construction & building materials -7.43 -70.09 3.74 61.11 Industrial goods & services -1.01 28.09 0.27 4.09 Automobiles & parts -1.69 -36.91 0.00 -0.01 Food & beverage 5.84 259.77 0.47 6.50 Personal and household goods -1.18 -18.54 0.06 -0.60 Healthcare 1.17 103.56 0.06 -0.42 Retail 0.10 6.65 0.02 0.21 Communication 0.00 0.00 -0.01 0.34 Travel & leisure -3.68 -81.86 0.21 12.08 Utilities -1.97 -8.17 0.19 2.46 Banks 42.77 1,566.55 9.96 82.28 Insurance 0.02 -1.87 -0.54 -12.25 Real estate 7.87 190.85 -0.28 8.58 Financial services -0.20 186.87 -2.33 -9.44 Technology 0.17 3.37 0.06 0.54 Total 50.87 2,652.58 5.22 26.58 Source: Fiin Pro, RongViet Research

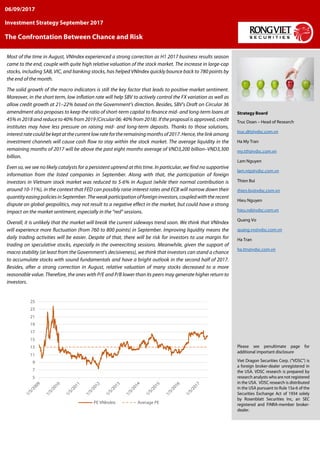

- 16. Rong Viet Securities Corporation – Investment Strategy Report September 2017 16 SEPTEMBER STOCK MARKET OUTLOOK Most of the time in August, VNIndex experienced a strong correction as H1 2017 business results season came to the end, couple with quite high relative valuation of the stock market. The increase in large-cap stocks, including SAB, VIC, and banking stocks, has helped VNIndex quickly bounce back to 780 points by the end of the month. The solid growth of the macro indicators is still the key factor that leads to positive market sentiment. Moreover, in the short term, low inflation rate will help SBV to actively control the FX variation as well as allow credit growth at 21–22% based on the Government’s direction. Besides, SBV’s Draft on Circular 36 amendment also proposes to keep the ratio of short-term capital to finance mid- and long-term loans at 45% in 2018 and reduce to 40% from 2019 (Circular 06: 40% from 2018). If the proposal is approved, credit institutes may have less pressure on raising mid- and long-term deposits. Thanks to those solutions, interest rate could be kept at the current low rate for the remaining months of 2017. Hence, the link among investment channels will cause cash flow to stay within the stock market. The average liquidity in the remaining months of 2017 will be above the past eight months average of VND3,200 billion–VND3,300 billion. Even so, we see no likely catalysts for a persistent uptrend at this time. In particular, we find no supportive information from the listed companies in September. Along with that, the participation of foreign investors in Vietnam stock market was reduced to 5-6% in August (while their normal contribution is around 10-11%), in the context that FED can possibly raise interest rates and ECB will narrow down their quantity easing policies in September. The weak participation of foreign investors, coupled with the recent dispute on global geopolitics, may not result to a negative effect in the market, but could have a strong impact on the market sentiment, especially in the “red” sessions. Overall, it is unlikely that the market will break the current sideways trend soon. We think that VNIndex will experience more fluctuation (from 760 to 800 points) in September. Improving liquidity means the daily trading activities will be easier. Despite of that, there will be risk for investors to use margin for trading on speculative stocks, especially in the overexciting sessions. Meanwhile, given the support of macro stability (at least from the Government’s decisiveness), we think that investors can stand a chance to accumulate stocks with sound fundamentals and have a bright outlook in the second half of 2017. Besides, after a strong correction in August, relative valuation of many stocks decreased to a more reasonable value. Therefore, the ones with P/E and P/B lower than its peers may generate higher return to investors. Table 5 : Key sectors performance No Name % 1M Price Change % 1Y Price Change Market Cap (VND Billion) ROA (%) ROE (%) Basic P/E P/B 1 Retail 7.9 135.4 38,622 8.7 40.0 17.1 6.4 2 Insurance -2.3 8.2 59,020 4.6 10.6 20.9 2.3 3 Real Estate 3.3 25.6 254,030 2.3 6.5 25.0 3.4 4 Technology -1.6 41.5 32,360 8.7 16.1 13.2 2.3 5 Oil & Gas 4.2 20.0 90,781 5.7 16.5 15.9 3.4 6 Financial Services -1.9 37.5 46,374 4.4 14.8 12.5 1.8 7 Utilities -1.9 28.2 167,330 11.2 18.8 14.1 2.7 8 Travel & Leisure 2.0 5.9 51,740 4.9 60.0 14.0 6.7 9 Industrial Goods & Services -1.1 22.2 79,369 0.0 15.7 12.7 1.8 10 Personal & Household Goods -0.1 28.9 32,326 9.9 26.3 15.2 3.7 11 Chemicals -1.3 18.7 46,055 8.5 13.1 10.7 1.4 12 Banks -4.2 17.5 443,759 1.1 14.6 14.6 1.8 13 Automobiles & Parts -3.1 -12.7 15,767 6.6 12.2 12.8 1.4 14 Basic Resources 6.5 55.4 107,167 13.7 18.5 7.0 1.9 15 Food & Beverage 1.4 50.5 525,444 8.6 31.8 23.7 6.5 16 Media -0.7 25.8 12,225 6.5 3.8 16.5 1.9 17 Construction & Material 4.7 95.3 188,810 5.6 19.4 17.5 4.1 18 Health Care -2.7 90.6 34,985 12.8 21.2 18.3 4.0

- 17. Rong Viet Securities Corporation – Investment Strategy Report September 2017 17 Source: FiinPro INVESTMENT STRATEGY Despite our concern on VNIndex’s current rally, we believe that the market can go further in the intermediate- and long-term. Stable macro environment, improving manufacturing, and higher consumer confident index and higher retail sales will push the business activities to grow. Hence, we think construction, building materials (granite tiles and steel), real estate in mid-end segment, banking, and some other consumer-related industries will have positive business results in the H2 2017. Besides, the low rate of deposit has lasted for months and may not recover soon. This would justify higher valuation for companies with a strong history of cash dividend payments or high dividend yields. Table 6: Companies with Expected High Dividend Yields Demand on construction comes not only from the residential housing but also from other segments such as hospitality real estate, commercial and office building, workshop and industrial projects, infrastructure, etc. Therefore, although the housing segment is predicted to be saturated in the next few years, it could still bring about increasing construction demand. We expect that constructors who are pioneers in diversifying backlogs towards other market segments will outperform their peers. Among the listed construction companies, we have noticed several signs of CTD reforming its revenue structure as well. Even though residential segment still accounts for around 70% of the company’s total revenue, the larger contribution from commercial and office and industrial sectors will help CTD to diversify its backlog portfolio. By the end of Q2 2017, CTD’s backlog is around VND26,181 billion (+18% YoY) and we expect the backlog could grow even higher following FDI’s trend and the expansion of domestic manufacturers.

- 18. Rong Viet Securities Corporation – Investment Strategy Report September 2017 18 Figure 19: Growth in Construction Value Source: MOC The acceleration of construction in H2 2017 will push the demand on construction materials, especially in the tile industry. The consumers’ taste is changing; low quality and small size ceramics have been replaced by granite. Given its low penetration ratio at 13%, there is large room for granite to grow in the upcoming years. Among the listed firms, we prefer VIT and CVT due to their large market share (11% and 5%, respectively) and expansion capacity. Given the growth story of granite, it is worth noticing that CVT is investing in a new production line, which is expected to add 25% more to the firm’s total capacity. In eight months of 2017, manufacturing growth was 10.8%, which is higher than the same period of last year growth of 10.4%. Some industries including Steel, Plastic, Paper, Textile and Fertilizer, recorded impressive growth. Although production has been growing, we recognize that some industries such as Plastic, Textile or Fertilizer, have less power to actively control their output price. In this context, steel firms have enjoyed not only the Government’s protection policies but also the uptrend of steel price since mid-Q2 2017. As a result, profit margin of steel players like HPG, HSG, and NKG could extend further in H2 2017. In the the long-term view, we prefer HPG over the others due to its close value chain from upstream to downstream and its growth capacity prospect from Dung Quat Steel Complex. For the banking industry, the story comes not only from the credit growth but also from provision for expenses/reversals. Given the effective of Decision 42, it is expected that the credit institutes can have more authority to foreclose and dispose collateral. It shoud take a long time to see the results, but the expectation has been reflected on the stock price. Therefore, although having sound fundamental from both core business and restructure progress, ACB’s relative valuation is no longer cheap compared to MBB and CTG currently. Table 7: PBR After Adjusted for VAMC’s Special Bonds ACB BID CTG MBB VCB Market Price @Sep 5th (VND) 29,000 20,950 18,900 23,350 38,150 Book value @30/06/2017 (VND bil) 14,884 48,140 60,320 27,309 52,110 Net special bond @30/06/2017 (VND bil) 883 13,789 4,056 1,044 0 BV (excl. special bond) (VND bil) 14,002 34,351 56,264 26,265 52,110 BVPS (VND) 15,097 14,081 16,200 15,945 14,484 BVPS (excl. special bond) (VND) 14,202 10,048 15,111 15,335 14,484 PBR (x) 1.9 1.5 1.2 1.5 2.6 PBR (excl. special bond) (x) 2.0 2.1 1.3 1.5 2.6 In Aug 2017, we also released three company analysis reports, including QNS, PTB, and NLG. Investors who are interested in these stocks can find the full report on our website at Company reports. 5.506% 5.844% 6.286% 6.649% 6.675% 6.597% 6.545% 6.468% 6.390% 5.00% 5.200% 5.400% 5.600% 5.800% 6.00% 6.200% 6.400% 6.600% 6.800% - 50 100 150 200 250 300 350 400 2015 2016 2017F 2018F 2019F 2020F 2021F 2022F 2023F Construction value (thousand billion dong) Growth (%)

- 19. Rong Viet Securities Corporation – Investment Strategy Report September 2017 19 Tickers Target Price (VND) Overall Opinions QNS 87,400 Quang Ngai Sugar (QNS) is a leader in Vietnamese soymilk segment with 85% market share. We believe demand for soymilk, especially branded products, is still viable thanks to the consumer preference for quality and convenient products. Accordingly, we expect a 10% growth in this segment in upcoming years. Regarding sugar segment, QNS owns An Khe plant, the biggest sugar plant in Vietnam with the capacity of 18,000 tonnes sugarcane per day. However, the raw material has not been sufficient for its full capacity. Moreover, domestic market will face many challenges when the government removes the tariff quota for sugar, following the agreement of ATIGA from the beginning of 2018. Thanks to the dominating position in the soymilk market, QNS has been able to grow its revenue and net profit consistently. However, we have seen a rising competition since 2016, which puts the pressure on the selling price and slowdowns the growth. This explains the underperformance of its stock price after being listed. Nevertheless, in our opinion, the company still have “room” for improvement as long as the BOD shows more efforts. Thus, we forecast QNS’s net profit to decrease slightly in 2017, but it should recover in 2018. Forecasted EPS for 2017 and 2018 are VND 6,460 and VND 7,461 respectively. PTB 138,700 Regarding the H1 2017 performance and the three main business segments' outlook, we have slightly revised upward from the latest update. Revenue and PAT in 2017 are estimated at VND4,174 billion (+ 14% YoY) and VND359 billion (+ 35% YoY), respectively. In 2018, we expect that PTB's sales will grow by 15% YoY to VND4,875 billion and PAT will be VND427 billion, equivalent to EPS of VND11,860. Even though stable growth rates and annual dividends attract investors, we would carefully consider PTB's future growth prospects, which are still not commensurate with the investment expansion. Forecasted EPS for 2017 and 2018 are VND 11,716 and VND 11,860 respectively. NLG 30,000 Nam Long Investment Joint Stock Co (NLG - HSX) is among the few real estate developers in the affordable housing segment and has been successful with Ehome brand. After establishing a solid position in the affordable housing segment, NLG's strategy has shifted to mid-end housing with mini-villas and townhouses since 2015. This is considered as a wise movement of NLG’s BOD to meet the rising demand of increasing middle-class consumers in Ho Chi Minh City, to boost NLG’s net profit margin and maximize their land bank’s value. In addition, these projects have been developed under joint ventures, not only to ease NLG’s pressure on required investment capital, but also to take advantage of their partners’ management and development experience. Forecasted EPS for 2017 and 2018 are VND 3,507 and VND 3,472 respectively. Figure 20: RongViet Research’s stock pick Source: RongViet Research; Price @ Sep 5th, 2017 Total return = Expected price appreciation plus expected dividend yield in next twelve months

- 20. Rong Viet Securities Corporation – Investment Strategy Report September 2017 20 Ticker Exchange Total Return Rating 2016 2017F 2018F PER Trailing (x) PER 2017F (x) PBR Cur. (x) Div Yield (%) +/- Price 1y (%) 3-month avg. daily vol. (shares) 3-month avg. daily turnover (USD thousand) Market cap (USD mn) Foreign remaining room (%) Target price (VND) Price @ Aug 3rd (VND) +/- Rev. (%) +/- NPAT (%) +/- Rev. (%) +/- NPAT (%) +/- Rev. (%) +/- NPAT (%) DRC HSX 33,100 23,800 51.7% Buy 1.3 -4.8 7.8 -15.0 1.9 20.8 9.4 9.2 1.9 12.6 -33.9 461,873 613.1 124.2 19.7 VIT HNX 25,308 22,500 23.6% Buy 41.6 53.5 17.8 18.2 33.4 25.7 5.5 6.8 1.4 11.1 9.9 38,445 50.3 19.3 45.5 NT2 HSX 31,900 25,800 33.3% Buy 18.6 -4.9 -10.3 -31.3 4.5 41.7 8.7 10.5 1.5 9.7 -19.1 418,007 519.8 326.3 28.8 DQC HSX 49,400 36,700 42.8% Buy -4.4 -1.7 -1.3 -43.7 16.6 16.7 7.7 12.2 1.1 8.2 -50.8 84,537 163.0 51.5 27.8 PVS HNX 21,900 16,400 40.9% Buy -20.0 -31.5 -0.8 -17.6 17.1 39.6 8.5 8.6 0.7 7.3 -19.7 1,819,342 1,334.1 321.8 27.7 HTI HSX 26,200 18,500 48.1% Buy 33.1 8.7 -16.5 20.8 90.8 -5.8 6.0 7.0 1.1 6.5 7.7 38,913 34.1 20.3 34.1 CHP HSX 31,900 26,300 27.8% Buy -10.9 -21.5 28.6 54.2 -14.2 -19.0 7.3 8.7 2.0 6.5 0.0 96,372 112.7 145.6 45.9 VSH HSX 22,100 18,200 26.9% Buy -4.1 2.6 24.0 12.7 -2.1 -4.6 12.2 13.0 1.3 5.5 16.2 218,496 179.8 164.9 33.6 VFG HSX 69,800 57,400 25.1% Buy 13.4 5.2 9.9 16.2 6.1 7.6 10.6 8.9 1.7 3.5 -16.3 14,742 37.0 59.9 28.0 QNS UPCOM 87,400 73,000 23.2% Buy -10.4 14.6 20.7 -4.0 10.0 18.3 12.7 11.3 4.3 3.4 0.0 130,794 433.6 779.9 41.6 HSG HSX 36,300 29,650 25.8% Buy 16.5 145.3 29.9 18.5 21.4 7.3 6.5 6.3 2.1 3.4 17.7 3,430,663 4,555.9 455.8 20.3 LTG UPCOM 67,000 48,300 41.8% Buy -0.9 9.2 10.4 38.6 13.1 10.6 8.4 7.9 1.6 3.1 0.0 187,314 520.4 142.4 5.5 NKG HSX 39,800 33,200 22.9% Buy 55.4 310.7 62.0 29.0 14.6 10.4 5.5 4.4 1.7 3.0 18.3 452,990 653.9 145.8 19.2 STK HSX 23,700 17,000 42.4% Buy 31.2 -59.9 38.6 272.4 7.8 33.3 24.1 8.5 1.2 2.9 -3.3 5,153 3.6 44.8 37.5 BMP HSX 113,800 73,400 57.8% Buy 18.5 20.9 11.2 7.9 13.1 10.0 11.9 9.9 2.6 2.7 -17.7 243,216 965.2 263.9 2.6 CTD HSX 251,200 209,000 21.6% Buy 52.0 113.5 30.4 25.8 24.7 24.0 9.8 10.2 2.5 1.4 12.3 93,235 858.3 702.6 13.7 KLB UPCOM 12,000 9,200 30.4% Buy 9.0 26.8 24.8 67.7 22.0 30.5 13.3 13.4 0.8 0.0 0.0 87,102 39.3 119.7 11.0 TNG HNX 14,100 11,500 22.6% Buy -1.9 13.9 17.0 16.5 10.5 11.1 5.6 5.8 0.7 0.0 -7.4 198,892 113.0 20.8 27.4 PGI HSX 24,900 20,550 21.2% Buy 0.0 5.2 10.3 55.5 13.2 -13.5 12.3 9.2 1.6 0.0 0.7 31,263 28.6 80.1 28.1 PPC HSX 19,400 20,100 6.5% Neutral -22.0 -2.2 13.9 61.6 1.7 -7.9 4.3 8.5 1.2 10.0 50.7 304,540 279.4 280.9 32.8 BFC HSX 41,000 40,100 11.0% Neutral -1.6 21.0 14.1 16.9 8.9 7.9 7.3 7.7 2.3 8.7 34.1 176,364 319.7 100.7 28.2 DPM HSX 23,900 23,350 10.9% Neutral -18.8 -23.3 4.1 -12.7 14.2 -9.7 11.5 10.8 1.1 8.6 -9.4 1,012,569 1,034.3 401.4 27.9 CTI HSX 31,500 29,250 15.6% Neutral 23.8 58.4 258.8 399.3 -31.3 -14.0 10.3 8.8 1.6 7.9 15.7 462,527 610.7 80.9 17.0 PVT HSX 16,000 15,000 13.3% Neutral 17.8 12.2 -3.5 -1.8 6.9 16.9 11.1 11.0 1.2 6.7 12.8 466,088 292.0 185.4 19.0 SHP HSX 25,400 22,800 18.0% Neutral -13.7 -40.4 23.8 94.6 -3.8 -7.3 12.5 11.2 2.0 6.6 26.2 94,882 92.0 93.9 45.0 VGC HNX 14,600 18,300 -15.0% Neutral 4.1 56.4 8.8 23.6 13.6 9.1 9.1 9.8 1.3 5.2 0.0 209,944 176.0 343.3 14.2 PGS HNX 20,900 20,700 5.8% Neutral -16.5 206.7 36.4 -63.7 6.8 6.5 10.0 8.4 1.1 4.8 41.4 90,318 73.5 45.5 34.4 REE HSX 35,500 35,250 5.2% Neutral 38.4 28.2 23.1 10.1 0.0 11.4 7.1 9.3 1.5 4.5 88.4 1,344,125 2,126.9 480.1 0.0 VCB HSX 41,900 38,150 14.0% Neutral 17.3 28.6 8.0 18.2 19.8 31.6 18.0 21.2 2.6 4.2 4.0 1,299,872 2,181.2 6,029.2 9.1 PAC HSX 40,600 48,400 -12.0% Neutral 8.2 107.5 16.0 -27.0 11.4 20.4 15.2 18.0 3.3 4.1 57.5 128,122 288.9 98.8 17.3 NTC UPCOM 73,800 65,100 17.2% Neutral 17.8 121.4 21.6 -17.7 14.0 12.0 6.1 11.0 3.2 3.8 0.0 52,740 132.7 46.0 48.9 CTG HSX 21,200 18,900 15.9% Neutral 16.3 20.0 8.3 17.4 9.2 17.3 9.6 11.1 1.2 3.7 15.2 2,080,205 1,787.2 3,091.3 0.1 PHR HSX 41,000 41,400 2.7% Neutral -4.0 3.9 21.3 158.9 29.7 15.9 9.2 7.1 1.5 3.6 144.2 515,465 830.6 142.7 40.5 HIGHLIGHT STOCKS

- 21. Rong Viet Securities Corporation – Investment Strategy Report September 2017 21 Ticker Exchange Total Return Rating 2016 2017F 2018F PER Trailing (x) PER 2017F (x) PBR Cur. (x) Div Yield (%) +/- Price 1y (%) 3-month avg. daily vol. (shares) 3-month avg. daily turnover (USD thousand) Market cap (USD mn) Foreign remaining room (%) Target price (VND) Price @ Aug 3rd (VND) +/- Rev. (%) +/- NPAT (%) +/- Rev. (%) +/- NPAT (%) +/- Rev. (%) +/- NPAT (%) MBB HSX 21,000 23,350 -7.5% Neutral 12.4 16.7 16.5 16.7 7.4 18.4 12.1 12.9 1.5 2.6 73.9 3,221,821 3,132.7 1,756.8 0.0 ACV UPCOM 67,000 59,800 14.5% Neutral 11.2 -70.1 19.2 -18.1 32.4 76.0 26.6 25.7 4.9 2.5 0.0 182,530 413.4 5,646.1 45.5 SVC HSX 54,500 49,000 13.7% Neutral 38.0 18.4 8.2 20.4 -5.0 4.5 10.4 4.7 1.4 2.4 9.4 53,694 124.3 53.8 8.6 FPT HSX 53,200 48,500 11.8% Neutral 4.1 3.1 21.7 21.0 13.2 46.7 12.5 8.5 2.6 2.1 30.6 1,183,118 2,491.9 1,131.0 0.0 VNM HSX 149,800 152,600 0.1% Neutral 16.8 20.3 19.9 12.0 13.4 10.9 21.6 23.5 9.0 2.0 1.8 726,823 4,869.9 9,728.6 44.7 NLG HSX 30,000 27,350 11.5% Neutral 101.3 67.4 37.6 64.7 -13.2 -1.0 8.1 7.8 1.4 1.8 39.4 912,696 1,183.2 188.9 5.5 TCM HSX 24,095 28,750 -14.5% Neutral 10.0 -25.6 6.2 55.6 1.9 7.4 8.1 9.4 1.5 1.7 48.8 721,522 948.5 65.1 0.0 PNJ HSX 114,000 107,600 6.9% Neutral 11.1 496.3 33.1 63.3 21.8 28.6 18.4 15.8 6.1 0.9 57.7 381,448 1,676.7 510.9 0.0 PTB HSX 128,800 128,900 0.7% Neutral 20.2 52.8 14.0 35.4 16.8 -4.0 11.2 11.0 4.0 0.8 34.5 92,356 501.5 146.8 34.3 MIG UPCOM 15,600 13,600 14.7% Neutral 23.1 83.5 0.0 19.6 N/a N/a 15.4 12.9 1.3 0.0 0.0 48,102 28.2 47.5 48.9 HPG HSX 40,000 35,400 13.0% Neutral 21.2 89.4 20.8 9.3 26.6 9.4 6.5 7.2 2.0 0.0 35.0 4,517,181 6,418.8 2,358.9 9.6 PC1 HSX 37,000 34,950 5.9% Neutral -3.0 24.1 13.6 5.8 46.1 76.2 15.1 11.8 1.7 0.0 0.0 95,629 145.6 150.2 17.9 VNR HNX 27,300 26,900 1.5% Neutral -2.8 -1.2 18.2 9.6 4.3 6.8 13.8 13.4 1.3 0.0 32.1 3,960 4.2 154.9 19.2 VJC HSX 121,000 130,600 -7.4% Neutral 38.6 113.3 41.5 42.5 22.0 25.2 15.7 13.5 8.3 0.0 0.0 371,493 2,053.1 1,849.5 5.8 ACB HNX 24,500 29,000 -15.5% Neutral 21.6 28.9 12.8 24.1 27.8 45.8 17.4 19.4 2.0 0.0 79.2 1,874,529 2,170.3 1,255.9 0.0 DHG HSX 83,500 108,200 -20.1% Sell 4.9 20.6 12.4 10.0 9.7 9.2 18.5 13.8 5.0 2.8 67.2 254,766 1,333.4 621.4 0.0 IMP HSX 50,000 68,400 -24.3% Sell 4.8 8.9 24.6 33.5 18.4 17.8 20.6 22.2 2.2 2.6 24.0 27,410 78.6 129.1 0.0 SAB HSX 158,400 255,000 -36.5% Sell 12.6 31.3 11.2 4.2 12.9 4.2 35.6 37.3 11.8 1.4 0.0 57,951 582.8 7,183.3 39.1 MWG HSX 67,250 108,000 -37.7% Sell 76.7 47.2 63.2 41.4 35.9 16.5 18.1 8.9 7.1 0.0 50.2 382,738 1,731.4 1,459.4 0.0 NNC HSX 67,570 55,200 31.5% Under Review 14.9 49.8 23.5 25.7 8.1 3.4 6.5 7.1 2.0 9.1 -13.2 24,342 74.7 53.2 27.6 VSC HSX 73,700 54,600 37.7% Under Review 16.6 -10.0 18.2 18.7 6.0 9.6 10.6 8.9 1.8 2.7 -23.6 119,961 316.1 109.3 0.0 DNP HNX 20,400 25,900 -21.2% Under Review 60.9 91.6 34.7 50.6 17.6 10.8 9.5 6.0 1.6 0.0 46.8 69,079 82.1 56.3 42.5 (*) Total Return = Stocks’ Upside plus dividend yield

- 22. Rong Viet Securities Corporation – Investment Strategy Report September 2017 22 MACRO WATCH IN AUGUST Inflation Increased in August Continuous Improving in Retail Sales Source: GSO, RongViet Research Source: GSO, RongViet Research PMI Slightly Increased in August Trade Growth Started to Decline Source: GSO, RongViet Research Source: GSO, RongViet Research Stable Foreign Capital Winning Volume Decreased Sharply in August Source: FII, RongViet Research Source: VBMA, RongViet Research 0.0% 0.1% 0.2% 0.3% 0.4% 0.5% 0.6% 08/2016 09/2016 10/2016 11/2016 12/2016 01/2017 02/2017 03/2017 04/2017 05/2017 06/2017 07/2017 08/2017 Headline inflation Core inflation 260,000 280,000 300,000 320,000 340,000 0% 4% 8% 12% 08/2016 09/2016 10/2016 11/2016 12/2016 01/2017 02/2017 03/2017 04/2017 05/2017 06/2017 07/2017 08/2017 Value (bn dong) Growth (ex inflation) -2.0 .0 2.0 4.0 6.0 08/2016 09/2016 10/2016 11/2016 12/2016 01/2017 02/2017 03/2017 04/2017 05/2017 06/2017 07/2017 08/2017 50 51 52 53 54 55 IP (3m Moving Average) PMI 0% 5% 10% 15% 20% 25% 30% 35% 08/2016 09/2016 10/2016 11/2016 12/2016 01/2017 02/2017 03/2017 04/2017 05/2017 06/2017 07/2017 08/2017 Export Import 0 1000 2000 3000 4000 5000 6000 7000 08/2016 09/2016 10/2016 11/2016 12/2016 01/2017 02/2017 03/2017 04/2017 05/2017 06/2017 07/2017 08/2017 Implemented capital Registered capital 0% 20% 40% 60% 80% 100% 0 5000 10000 15000 20000 25000 30000 35000 40000 08/2016 09/2016 10/2016 11/2016 12/2016 01/2017 02/2017 03/2017 04/2007 05/2007 06/2017 07/2017 08/2017 Winning volume Offering volume Winning/Offering Ratio

- 23. Rong Viet Securities Corporation – Investment Strategy Report September 2017 23 INDUSTRY INDEX Level 1 Industry Movement Level 2 Industry Movement Source: RongViet Research Source: RongViet Research Industry PE Comparison Industry PB Comparison Source: RongViet Research Source: RongViet Research 0% 3% 6% 3% -4% 1% -4% 4% 1% -2% -6% -4% -2% 0% 2% 4% 6% 8% Technology Industrials Oil&Gas ConsumerServices HealthCare ConsumerGoods Banks BasicMaterials Financials Utilities 7% -5% 3% 0% 6% -2% -2% 0% -2% -1% 1% -4% -5% 5% 1% 0% 5% -4% -6%-4%-2% 0% 2% 4% 6% 8% Retail Insurance Real Estate Technology Oil & Gas Financial Services Utilities Travel & Leisure Industrial Goods & Services Personal & Household Goods Chemicals Banks Automobiles & Parts Basic Resources Food & Beverage Media Construction & Materials Health Care 13 14 16 16 18 19 15 08 20 14 17 13 Technology Industrials Oil&Gas ConsumerServices HealthCare ConsumerGoods Banks BasicMaterials Financials Utilities HSX HNX 02 03 03 06 04 06 02 02 03 03 04 02 Technology Industrials Oil&Gas ConsumerServices HealthCare ConsumerGoods Banks BasicMaterials Financials Utilities HSX HNX

- 24. Rong Viet Securities Corporation – Investment Strategy Report September 2017 24 ANALYSIS & INVESTMENT ADVISORY DEPARTMENT Truc Doan Head of Research truc.dtt@vdsc.com.vn + 84 28 62992006 (1308) Ha My Tran Deputy Manager my.tth@vdsc.com.vn + 84 28 62992006 (1309) • Macroeconomics Lam Nguyen Senior Strategist lam.ntp@vdsc.com.vn + 84 28 6299 2006 (1313) • Banking • Conglomerates Thien Bui Senior Analyst thien.bv@vdsc.com.vn + 84 28 6299 2006 (1321) • Market Strategy • Financial Services • Personal Goods Hoang Nguyen Senior Analyst hoang.nh@vdsc.com.vn + 84 28 6299 2006 (1319) • Transportation • Industrial Real Estates Hieu Nguyen Senior Analyst hieu.nd@vdsc.com.vn + 84 28 6299 2006 (1514) • Market Strategy • Pharmaceuticals • Durable Household Goods Duong Lai Senior Analyst duong.ld@vdsc.com.vn + 84 28 6299 2006 (1522) • Real Estates • Building Materials Vu Tran Senior Analyst vu.thx@vdsc.com.vn + 84 28 6299 2006 (1518) • Oil & Gas • Food & Beverage Trinh Nguyen Analyst trinh.nh@vdsc.com.vn + 84 28 6299 2006 (1331) • Steel • Construction • Technology Quang Vo Analyst quang.vv@vdsc.com.vn + 84 28 6299 2006 (1517) • Market Strategy • Basic Materials • Personal Goods Son Phan Analyst son.pnt@vdsc.com.vn + 84 28 6299 2006 (1519) • Utilities • Natural Rubber Thu Le Analyst thu.lta@vdsc.com.vn + 84 28 6299 2006 (1521) • Automobiles and Parts Ha Tran Assistant ha.ttn@vdsc.com.vn + 84 28 6299 2006 (1526) RONG VIET SECURITIES CORPORATION Floor 1-2-3-4, Viet Dragon Tower, 141 Nguyen Du St. - Dist 1 – HCMC Tel: (84 28) 6299 2006 Fax: (84 28) 6291 7986 Email: info@vdsc.com.vn Website: www.vdsc.com.vn Hanoi Branch 2C Thai Phien St., Hai Ba Trung Dist, Hanoi Tel: (84 24) 6288 2006 Fax: (84 24) 6288 2008 Can Tho Branch 95-97-99 Vo Van Tan – Ninh Kieu - Can Tho Tel: (84 292) 381 7578 Fax: (84 292) 381 8387 Nha Trang Branch 50Bis Yersin St, Nha Trang Tel: (84 258) 382 0006 Fax: (84 258) 382 0008

- 25. Rong Viet Securities Corporation – Investment Strategy Report September 2017 25 DISCLAIMERS This report is prepared in order to provide information and analysis to clients of Rong Viet Securities only. It is and should not be construed as an offer to sell or a solicitation of an offer to purchase any securities. No consideration has been given to the investment objectives, financial situation or particular needs of any specific. The readers should be aware that Rong Viet Securities may have a conflict of interest that can compromise the objectivity this research. This research is to be viewed by investors only as a source of reference when making investments. Investors are to take full responsibility of their own decisions. VDSC shall not be liable for any loss, damages, cost or expense incurring or arising from the use or reliance, either full or partial, of the information in this publication. The opinions expressed in this research report reflect only the analyst's personal views of the subject securities or matters; and no part of the research analyst's compensation was, is, or will be, directly or indirectly, related to the specific recommendations or opinions expressed in the report. The information herein is compiled by or arrived at Rong Viet Securities from sources believed to be reliable. We, however, do not guarantee its accuracy or completeness. Opinions, estimations and projections expressed in this report are deemed valid up to the date of publication of this report and can be subject to change without notice. This research report is copyrighted by Rong Viet Securities. All rights reserved. Therefore, copy, reproduction, republish or redistribution by any person or party for any purpose is strictly prohibited without the written permission of VDSC. IMPORTANT DISCLOSURES FOR U.S. PERSONS This research report was prepared by Viet Dragon Securities Corp. (“VDSC”), a company authorized to engage in securities activities in Vietnam. VDSC is not a registered broker-dealer in the United States and, therefore, is not subjectto U.S. rules regarding the preparation of research reports and the independence of research analysts. This research report is provided for distribution to “major U.S. institutional investors” in reliance on the exemption from registration provided by Rule 15a-6 of the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”). Any U.S. recipient of this research report wishing to effect any transaction to buy or sell securities or related financial instruments based on the information provided in this research report should do so only through Rosenblatt Securities Inc., 40 Wall Street 59th Floor, New York, NY 10005, a registered broker dealer in the United States. Under no circumstances should any recipient of this research report effect any transaction to buy or sell securities or related financial instruments through VDSC. Rosenblatt Securities Inc. accepts responsibility for the contents of this research report, subject to the terms set out below, to the extent that it is delivered to a U.S. person other than a major U.S. institutional investor. The analyst whose name appears in this research report is not registered or qualified as a research analyst with the Financial Industry Regulatory Authority (“FINRA”) and may not be an associated person of Rosenblatt Securities Inc. and, therefore, may not be subject to applicable restrictions under FINRA Rules on communications with a subject company, public appearances and trading securities held by a research analyst account. Ownership and Material Conflicts of Interest Rosenblatt Securities Inc. or its affiliates does not ‘beneficially own,’ as determined in accordance with Section 13(d) of the Exchange Act, 1% or more of any of the equity securities mentioned in the report. Rosenblatt Securities Inc, its affiliates and/or their respective officers, directors or employees may have interests, or long or short positions, and may at any time make purchases or sales as a principal or agent of the securities referred to herein. Rosenblatt Securities Inc. is not aware of any material conflict of interest as of the date of this publication. Compensation and Investment Banking Activities Rosenblatt Securities Inc. or any affiliate has not managed or co-managed a public offering of securities for the subject company in the past 12 months, nor received compensation for investment banking services from the subject company in the past 12 months, neither does it or any affiliate expect to receive, or intends to seek compensation for investment banking services from the subject company in the next 3 months. Additional Disclosures This research report is for distribution only under such circumstances as may be permitted by applicable law. This research report has no regard to the specific investment objectives, financial situation or particular needs of any specific recipient, even if sent only to a single recipient. This research report is not guaranteed to be a complete statement or summary of any securities, markets, reports or developments referred to in this research report. Neither VDSC nor any of its directors, officers, employees or agents shall have any liability, however arising, for any error, inaccuracy or incompleteness of fact or opinion in this research report or lack of care in this research report’s preparation or publication, or any losses or damages which may arise from the use of this research report. VDSC may rely on information barriers, such as “Chinese Walls” to control the flow of information within the areas, units, divisions, groups, or affiliates of VDSC. Investing in any non-U.S. securities or related financial instruments (including ADRs) discussed in this research report may present certain risks. The securities of non- U.S. issuers may not be registered with, or be subject to the regulations of, the U.S. Securities and Exchange Commission. Information on such non-U.S. securities or related financial instruments may be limited. Foreign companies may not be subject to audit and reporting standards and regulatory requirements comparable to those in effect within the United States. The value of any investment or income from any securities or related financial instruments discussed in this research report denominated in a currency other than U.S. dollars is subject to exchange rate fluctuations that may have a positive or adverse effect on the value of or income from such securities or related financial instruments. Past performance is not necessarily a guide to future performance and no representation or warranty, express or implied, is made by VDSC with respect to future performance. Income from investments may fluctuate. The price or value of the investments to which this research report relates, either directly or indirectly, may fall or rise against the interest of investors. Any recommendation or opinion contained in this research report may become outdated as a consequence of changes in the environment in which the issuer of the securities under analysis operates, in addition to changes in the estimates and forecasts, assumptions and valuation methodology used herein. No part of the content of this research report may be copied, forwarded or duplicated in any form or by any means without the prior.