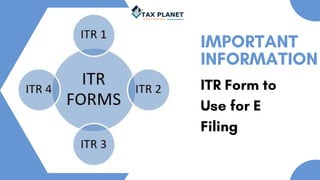

Important Information for Individuals to help you decide which ITR Form to Use for E Filing

•

0 likes•2 views

Income Tax Portal being revamped we all are pretty excited to see the new features on E filing portal which are user friendly and further eases out the ITR E filing experience. Just after you push the Login button a new range of list of forms take over and now you wonder which form is apt or applicable for you. If you want to know more about the importance information for individuals to decide which ITR form to use for E Filling. Checkout the entire blog to know more!

Report

Share

Report

Share

Download to read offline

Recommended

More Related Content

Similar to Important Information for Individuals to help you decide which ITR Form to Use for E Filing

Similar to Important Information for Individuals to help you decide which ITR Form to Use for E Filing (20)

How to save Income tax for FY 2018-19 for Salaried?

How to save Income tax for FY 2018-19 for Salaried?

Whether Income from Share Trading is Taxable ?.pdf

Whether Income from Share Trading is Taxable ?.pdf

How to save Tax : 2013-14. Nice presentation from ApnaPlan.com

How to save Tax : 2013-14. Nice presentation from ApnaPlan.com

Compliance Errors - The expensive poison pill to avoid.pptx

Compliance Errors - The expensive poison pill to avoid.pptx

Starting a business in Singapore (with commentary on implications for US pers...

Starting a business in Singapore (with commentary on implications for US pers...

What is Income Tax Return, Consequences of Filing & Non Filing

What is Income Tax Return, Consequences of Filing & Non Filing

Recently uploaded

Recently uploaded (20)

NO1 WorldWide Black Magic Specialist Expert Amil baba in Uk England Northern ...

NO1 WorldWide Black Magic Specialist Expert Amil baba in Uk England Northern ...

Colby Hobson Exemplifies the True Essence of Generosity, Collaboration, and S...

Colby Hobson Exemplifies the True Essence of Generosity, Collaboration, and S...

Lauch Your Texas Business With Help Of The Best Digital Marketing Agency.pdf

Lauch Your Texas Business With Help Of The Best Digital Marketing Agency.pdf

Bolpur HiFi ℂall Girls Phone No 9748763073 Elite ℂall Serviℂe Available 24/7...

Bolpur HiFi ℂall Girls Phone No 9748763073 Elite ℂall Serviℂe Available 24/7...

Amil baba in Islamabad amil baba Faisalabad 111best expert Online kala jadu+9...

Amil baba in Islamabad amil baba Faisalabad 111best expert Online kala jadu+9...

Top & Best bengali Astrologer In New York Black Magic Removal Specialist in N...

Top & Best bengali Astrologer In New York Black Magic Removal Specialist in N...

LLP Registration in India Requirements and Process

LLP Registration in India Requirements and Process

Strengthening Financial Flexibility with Same Day Pay Jobs.pptx

Strengthening Financial Flexibility with Same Day Pay Jobs.pptx

Black Magic Specialist in United States Black Magic Expert in United kingdom

Black Magic Specialist in United States Black Magic Expert in United kingdom

1h 1500 2h 2500 3h 3000 Full night 5000 Full day 5000 low price call me

1h 1500 2h 2500 3h 3000 Full night 5000 Full day 5000 low price call me

Digital Marketing Lab - Your Partner for Innovative Marketing Solutions

Digital Marketing Lab - Your Partner for Innovative Marketing Solutions

Introduction to MEAN Stack What it is and How it Works.pptx

Introduction to MEAN Stack What it is and How it Works.pptx

Important Information for Individuals to help you decide which ITR Form to Use for E Filing

- 1. IMPORTANT INFORMATION ITR Form to Use for E Filing

- 2. Total Income < Rs 50 lacs . The income may consist of various forms like Salaries, Interest Income etc. Property owners deriving income from one property can also us ITR 1 form. Be careful if you are earning Rental income from more than 1 property this form can’t be used. ITR 1 This simple ITR form is applicable for Resident Individuals only in cases where

- 3. Where Total Income > Rs 50 lacs . The income may consist of various forms like Salaries, Interest Income etc. Property owners deriving income from one or multiple properties can use ITR 2 form. ITR 2 This ITR utility is applicable for Individuals and HUF’s not having income from Business and Profession. Likewise this form can be used

- 4. Individuals and HUF’s having income from Business or Profession. By both Residents and Non Resident Indians. This form being extensive has the functionality to capture all sources of income in it. ITR 3 This comparatively complex ITR utility is applicable for Individuals and HUF’s having income from Business and Profession. Likewise this form can be used

- 5. Please be aware that if you are Director in the company then you can’t use ITR 4 for your ITR Filing. But if you want to take advantage of Presumptive sections you can do the same by using ITR 3 form ITR 4 This is one of the most important and simple forms introduced by the IT department . It is applicable to

- 6. Address: 10 ,Basement, Vinoba Puri, Lajpat Nagar II New Delhi, 110024 Phone: +919811094733 Email: kanika@thetaxplanet.com CONTACT US