More Related Content

Similar to DNA Money - when investing keep emotions at bayv- 11 Dec 2008

Similar to DNA Money - when investing keep emotions at bayv- 11 Dec 2008 (20)

DNA Money - when investing keep emotions at bayv- 11 Dec 2008

- 1. Shruti Jain

When it comes to investing, the be-

haviour we exhibit during challeng-

ing market conditions is perhaps the

largest impediment to our long-term

investment success. We often chase re-

turns, buy and sell short-term, and act

on emotions. These easily cloud our

judgment; irrational decisions are

taken in the fear of missing out on the

gains and prejudiced actions are un-

dertaken in the fear of loss.

Behavioural finance explains the

psychology of investing and pairs

emotions with investments to show

how emotions can cause disasters in

our investment decisions. It shows

that investors are, in reality, emotion-

al, biased, overconfident and myopic,

with a distorted concept of their

needs. And this behaviour sometimes

creates bubbles and seasonal swings.

In stock markets, behavioural fi-

nance can help explain situations

such as why we hold on to stocks that

are crashing or are ridiculously over-

valued, why do we jump in late and

buy stocks that have peaked in a rally

just before the price declines, or why

do we take desperate risks and gamble

wildly when our stocks descend.

There is an old saying on Wall

Street that the market is driven by just

two emotions: Fear and greed. Al-

though this is an oversimplification,

it can often be true.

We often succumb to these emo-

tions that lead to a profound and detri-

mental effect on our portfolios and the

stock market.

Behavioural finance has also high-

lighted them as the strongest emo-

tions in the investment fraternity and

how controlling these can help us

make a tremendous difference in our

portfolios’ returns.

Investing behaviour is largely gov-

erned by two dominant emotions:

Greed (in a bull market) and fear (in a

bear market). But it is important to re-

alise that neither of these emotions

form a sound basis for making ration-

al decisions.

Bear markets are distressing and

they make us question all our invest-

ment decisions. The fear that grips us

in such times makes us want to pull

money out of stocks and load up on

cash. Nobody enjoys watching money

vanish, even if it’s only on paper. And

looking at the value plummeting week-

after-week, we begin to believe that the

market will never come back and we’ll

never get our money back.

On the other hand, in a bull market

phase, we all think we are smarter

than the rest and have learned the se-

cret to get rich quick.

Not only do we put our savings and

switch our other investments into

stocks, we even think of borrowing

and investing in stocks, to become the

next Warren Buffett.

We start believing we possess spe-

cial market-beating capabilities. This

was particularly seen in the bull run

India witnessed in 2007. Everyone’s

stock recommendation, including a

naive investor’s recommendation, was

generating exorbitant returns. In

spite of the overvaluations, people

thought that the Sensex will zoom to

over 30,000 levels and their stocks will

keep generating higher returns. But

alas, we all know what happened. Mar-

kets bombed in late January 2008 and

tumbled further in the following

months, and have corrected over 50%

from its all-time highs.

Just as day follows night and spring

follows winter, so does investor psy-

chology follow the seasons of emo-

tions from greed to fear and fear to

greed and the cycle continues.

Overconfidence in a bull market

and despondency in a bear market

cloud our judgement, they navigate

our investment decisions and ration-

ality loses in the process.

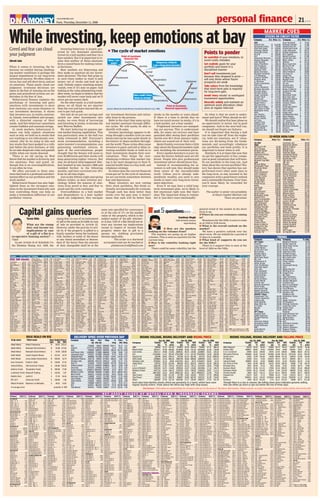

Refer to the chart that sums up typ-

ical market emotions through differ-

ent cycles. We will surely be able to

identify with some.

Investor psychology appears to de-

velop through a market cycle (as seen

below) and can be seen quite clearly in

the history of share markets through-

out the world. These cycles often cause

investors to panic and sell or delay in-

vesting available funds or hold on to

their investments despite their over-

valuations. They forget the over-

whelming evidence that market tim-

ing is far more dangerous to their fi-

nancial health than is a buy, hold, and

rebalance strategy.

So where does the current financial

crisis put us? In the cycle of emotions,

we are currently somewhere between

fear and depression.

Many investors are now cutting

their stock portfolios. But think ra-

tionally, not emotionally, for a minute.

Though cash has done better than

stocks over the past year, it doesn’t

mean that cash will do better than

stocks in the months or years ahead.

If there is a time to decide that we

have too much money in stocks, it’s in

a bull market, not a bear market.

Frightened investors are stamped-

ing out anyway. This is understand-

able, for many are novices and have

panicked after seeing their portfolios

shrink over 60% from January highs;

others are scared out of their wits.

Quite frankly, everyone feels a little

edgy about the financial markets right

now, including the investment gurus.

Every market downturn is scary be-

cause the factors behind each are dif-

ferent. People who give professional

investment advice should know this.

Instead of recommending the in-

vestors to sell now, they should make

them aware of the uncomfortable

truth: Unless you’re already inde-

pendently wealthy, you need to own

stocks to meet your long-term invest-

ment objectives.

Even if we may have a solid long-

term investment plan, we’re likely to

feel emotional right now. But that’s

okay. The important thing to remem-

ber is ‘just don’t react emotionally’.

So what is that we need to under-

stand and learn? What should we do?

We should realise this bear phase as

an opportunity to invest, but in good

companies. And in the next bull run,

we should not forget our failures.

It is important that during a bull

run we take time off from the eupho-

ria, hold our emotions, see if valua-

tions are deviating from the funda-

mentals and accordingly rebalance

our portfolios and book profits. It is

important to know when to sell.

Similarly, it is at times like now that

we get the opportunity to buy compa-

nies at good valuations that will bene-

fit our portfolio in the long run. And

what about the current portfolio? His-

tory has shown that equities has out-

performed every other asset class in

the long term, so stay invested in the

companies with a good future outlook

and a sustainable business. Over time,

you’ll most likely be rewarded for

your courage.

The author is senior vice president,

Arihant Capital Markets Ltd.

Views are personal.

While investing, keep emotions at bayGreed and fear can cloud

your judgment

Tarun Ghia

What are the stamp

duty and income tax

implications in case

of a gift of a flat in a

co-operative housing society? —

Vipul

As per Article 34 of Schedule I to

the Bombay Stamp Act, 1958, the

stamp duty in case of an instrument

of gift is the same as leviable in case

of sale as provided in Article 25.

However, under the proviso to arti-

cle 34, if the property is gifted to a

family member being the husband,

wife, brother or sister of the donor

or any lineal ascendant or descen-

dant of the donor then the amount

of duty chargeable shall be at the

same rate specified for conveyance

or at the rate of 2% on the market

value of the property, which is the

subject matter of the gift, whichev-

er is less. Gift of a flat should not at-

tract any income tax implications

except in respect of income from

property where due to gift to a

spouse, etc, clubbing provisions

become applicable.

The writer is a chartered

accountant and can be reached at

ghiatarun@rediffmail.com

Capital gains queries

Points to ponder

Be watchful of your emotions, to

avoid costly mistakes

Set realistic goals for your

portfolio and invest in a

disciplined manner

Don’t sell investments just

because they dropped in price —

sell only those whose future

prospects are weak

Take solace from the knowledge

that short-term pain is required

for long-term gain.

Avoid ‘story stocks’ or overhyped

investment opportunities

Diversify widely and maintain an

optimum asset allocation; rebal-

ance at regular intervals

Sandeep Wagle

Chief technical analyst,

Angel Broking

■ How are the markets

looking on the volumes front?

The markets are going up on higher

volumes. This is seen as a positive for the

current time.

■ How is the volatility looking right

now?

There could be some volatility, but the

general trend of the market in the short

term is up.

■ Where do you see resistance coming

in?

Resistance for the Nifty is seen to come

in at 3100 to 3150 levels.

■ What is the overall outlook on the

market?

We have a positive outlook over the

short term. We are bullish for a period of

15 days to a month.

■ What kind of supports do you see

for the Nifty?

There is a support that is seen at the

level of 2830 on the Nifty.

just 5questions...

www.dnaindia.com

2211...Pune, Thursday, December 11, 2008 personal finance

On BSE

High

Bin.Tex.Pr-PP 61.05

Veer Energy 45.25

Mukesh Strips 39.35

Sanket Int’l 36.55

Himachal Fibres 34.90

KZ Leasing 33.50

Supertex Inds 27.39

Munoth Cap Mkt 5.61

Low

Bharat Bijlee 550.00

Dynamatic Tech 483.00

Bhushan Steel 320.55

Ipca Lab 286.70

Solar Explosive 277.00

Jain Irrigation 229.00

Satyam Comp 218.05

Jolly Boards 187.75

Corpn Bank 155.00

JK Agri Gen 142.75

Prime Focus 135.05

Rolta 127.00

AIA Engg 118.05

KEC Intl 108.65

Int.Conveyor 105.65

Murli Indus 100.05

Redington India 99.00

Gayatri Proj 83.75

Rain Commoditie 82.40

Sundaram Clayt 82.10

ABG Shipyard 80.05

Marathon Nex 75.20

Hinduja Foundri 71.80

Tilaknagar Ind 71.00

Champ Indage 68.70

Thirumalai Chem 67.50

Blue Coast Hot 61.80

Kirloskar Elect 61.10

Shri Dinesh 56.75

Indus Fila 55.75

Cosmo Films 55.00

Brady & Morris 52.80

Central Prv Rly 51.45

Pratibha Inds 47.40

Ganesh Hsg Fin 47.00

Fortune Fin 46.00

Greenply Ind 44.00

Ratnamni Metal 43.00

Delton Cables 42.25

Morgan Cru 41.00

Kiduja India 40.90

Panchm Steel 39.65

Himachal Fibres 34.90

Simplex Project 33.85

Brushman Ind 30.45

GEI Ind Sys 30.00

JBF Ind 29.80

Mazda 28.25

Inox Leisure 27.30

Whirlpool 26.50

IOL NetCom 26.00

Bemco Hydraulic 26.00

Shree Pacetron 25.70

Guj St Petronet 25.25

Inani Marble 24.75

PVP Ventures 24.50

Axis Capital 23.75

Aroni Comm 23.10

Vishal Malle 22.65

Vadilal Enter 22.00

Autom Stamping 21.15

Clutch Auto 21.00

Bharat Gears 20.10

Elnet Techno 20.05

Vishnu Chem 19.80

Chartered Logis 19.15

Lancor Holds 18.65

Belapur Ind 18.50

Chartered Cap 18.10

Amtek India 17.90

Damodar Threads 17.35

Basil Infra 15.75

Pioneer Inv 15.40

Surana Corpora 14.65

Ritesh Pro&Ind 14.05

Kanishk Steel 14.00

Alfavision Over 14.00

Dham Sp Sugar 13.80

Ashok Leyland 12.93

Igarshi Motors 12.90

CCAP 12.10

KCP Sugar 11.80

Sri Ramkr Mill 11.75

BSE

Grasim Ind H 1133.95

Saraswati Indus H 720.00

Hind Nat Glass H 518.55

Allcargo Global L 448.10

Greycells Enter L 283.15

M & M H 306.00

DLF H 272.50

Glenmark Pharma L 253.60

Sandur Mangan H 220.00

Jolly Boards L 187.75

Glory Polyfilms L 188.15

Flat Products H 203.20

Shaw Wallace H 187.30

Glodyne Tech H 185.95

Bang Overseas L 174.20

Panyam Cements L 166.80

G E Shipping H 168.85

Century Textile H 166.45

Khaitan Wvg H 164.85

JL Morison L 156.20

Oscar Investmen L 155.85

ECE Inds H 147.05

Lanco Infratech H 147.00

Bombay Burmah H 140.00

Ess Dee Alum L 113.80

Sinclair Hotels L 113.45

Sagar Cements H 123.30

Accent Tech H 114.65

Minda Ind L 112.40

Amani Trading L 110.25

Bajaj Finserv H 109.90

Int.Conveyor L 105.65

VBC Ferro Alloy H 104.05

IOL Chem & Phar L 101.20

Redington India L 99.00

HDIL H 103.80

Zen Techno H 100.90

Vishal Retail H 94.80

Best E Hotels L 85.55

Jai Corp H 94.20

Gayatri Proj H 90.80

Arshyia Intl H 99.10

Zenith Exports L 81.30

Jindal World H 81.15

Marathon Nex H 81.10

SAIL H 80.30

Jhun Vanspati H 79.45

Hinduja Foundri L 71.80

Sahara Hsg Fin H 73.75

United Brw Hold H 72.90

Logix Microsys H 69.70

Kushal Software H 69.45

KLG Capital L 64.10

Mount Everest L 67.80

Zicom Elec Sec H 65.75

Bihar Tubes L 65.10

Atlanta H 64.35

Blue Coast Hot L 61.80

Bin.Tex.Pr-PP H 61.05

Orisa Sp Irs H 60.40

Astral Poly Tec H 59.85

Intra Infotech L 58.80

Fin Eyes (I) L 57.05

Indus Fila L 55.75

Vindhya Tele H 55.35

Ranklin Solu H 55.25

LKP Finance H 55.05

Ist Ltd. L 54.45

Surana Inds H 53.75

Anil Product H 53.05

Brady & Morris L 52.80

Central Prv Rly L 51.45

AP Paper H 49.50

McDowell Hold H 49.20

Blue Star Info H 54.35

Ratnamni Metal H 47.30

Kwality Dairy H 46.50

Gwalior Chem H 46.40

Jaisal Sec H 45.90

Srinivasa Hatch L 45.65

Super Sales H 45.30

Veer Energy H 45.25

Gogia Isec L 45.20

Sambandam Spg L 41.05

Span Diagno H 44.25

Delton Cables L 42.25

JPT Securities L 39.05

Sir Shadi Lal H 42.00

Madras Alum H 42.85

Bheema Cements L 41.80

Escorts H 41.65

Kiduja India L 40.90

Premier H 40.55

52-WEEK HIGH/LOW

Company Price (Rs) Company Price (Rs)

STOCKS ON CIRCUIT FILTER

Company H/L Price (Rs) Company H/L Price (Rs)

UP 7 Days

Unitech 51.52

Logix Microsys 48.30

Vishal Retail 40.44

Zicom Elec Sec 40.19

Real Strips 39.69

Kwality Dairy 39.43

Chandni Text 38.66

Well Pack Paper 37.32

RFL Intl 35.90

Millennium B 34.83

Ishita Drugs 34.45

Tutis Technolog 34.38

Hind Nat Glass 34.38

Intec Sec 34.20

Jhun Vanspati 32.64

Agk Computer 32.58

Sarda Energy 32.11

Jindal Steel 26.91

Shiva Fertilzie 26.80

Jindal World 24.65

Grasim Ind 23.53

Sarang Chemical 22.41

Stone India 21.89

Interworld Digi 20.38

Rajesh Exports 18.38

HB Stockholding 17.55

DOWN 7 Days

Vijayeswari Tex -40.00

Classic Diamond -34.18

Jaipan Inds -29.70

Inani Marble -29.69

Dhan Roto Sp -28.89

STI India -26.77

Mazda -24.68

Rolta -23.41

UP 3 Days

Sumeet Inds 73.79

IQMS Software 59.18

Venkat Pharma 58.37

NDTV 55.99

Almondz Global 49.40

Saregama India 46.35

Svam Software 38.13

NRC 37.09

Usha Martin 35.07

Bartronics 34.72

Magma Fincorp 34.46

Dewan Hsg Fin 33.75

Shree Digv Ceme 31.43

Orbit Corp 30.09

Suzlon Energy 30.05

Gammon Infra 29.27

Arihant Found 27.66

Kaushalya Infra 27.07

Rico Auto Inds 26.54

Ent Network 25.87

Triton Valves 25.40

Yes Bank 24.59

Parsvnath Devlp 23.62

HCC 23.04

Majoj Hsg Fin 22.85

Shrenuj & Co 22.55

Jhagad Cop 22.09

Rei Agro 22.08

Take Solutions 21.79

Reliance Comm 21.64

Sandur Mangan 21.51

Creative Eye 21.36

Best & Crompton 21.34

Energy Develop 21.25

First Winner 21.23

Samtex Fashions 21.19

Spentex Ind 21.18

Sankhya Info 21.17

Goldstone Techn 21.03

Marg 21.00

Sagar Cements 20.88

SS Organics 20.77

Ambuja Cements 20.75

Lotus Eye Care 20.52

Tantia Cons 20.32

Kolte Patil 20.27

Premier 19.47

DCM Shriram Ind 18.99

VBC Ferro Alloy 18.91

Bajaj Finserv 18.80

Rel Indl Infra 18.79

ACC 18.60

UltraTech Cemen 18.58

Hatsun Agro 18.42

Sabero Organics 18.16

Nagpur Power 18.09

Haryana Capfin 17.96

TRENDS

Company % chng Company % chng

MARKET CUES

BSE 500 stocks

3I Infotech................34.10 1.34

3M India ................904.05 -0.16

Aban Offshore.......702.70 9.00

ABB .........................468.40 1.47

Abbott India ..........380.00 -0.26

ABG Shipyard..........81.65 -4.34

ACC .........................476.40 9.92

Adani Enter............288.75 5.11

Adhunik Met............26.15 3.36

Adi Bir Nuvo...........568.55 6.70

Adlabs Films..........171.70 2.32

Advanta..................485.00 -5.11

Aftek ........................12.56 0.00

Ahluwalia Co...........28.30 2.54

AIA Engg ................127.60 5.15

Akruti City..............651.15 0.97

Alembic....................32.15 3.71

Alfa Laval...............932.00 1.24

Allahabad Bank.......46.95 1.29

Allcargo Global .....450.00 -4.59

Allied Digit.............250.60 -4.42

Alok Inds..................16.13 3.07

Alstom Projects ....249.95 2.56

Amara Raja..............42.75 5.43

Ambuja Cements....64.00 10.34

Amtek Auto ............52.00 -2.26

Amtek India.............18.30 -3.17

Anant Raj Inds.........57.90 3.39

Andhra Bank............56.10 -0.36

Ansal Infras .............27.95 5.67

Apollo Hosp...........410.00 4.25

Apollo Tyre...............20.25 -0.98

Aptech .....................66.30 3.35

Areva ......................141.30 1.25

Arshiya Intl ..............85.00 2.91

Arvind.......................15.45 2.59

Asahi India...............38.70 -0.90

Asha Minechem......24.95 2.46

Ashok Leyland.........13.00 -1.96

Asian Elect...............23.80 3.03

Asian Hotels..........234.90 0.82

Asian Paints...........870.00 -1.62

Assam Co...................8.63 4.61

Astra Micro..............51.00 -1.83

Atlas Copco ...........437.00 -3.49

Aurobindo Pha......130.70 11.47

Aventis Pharma ....880.00 2.89

Axis Bank...............462.75 2.49

Bajaj Hold Inv........242.10 1.40

Bajaj Auto ..............347.10 5.20

Bajaj Auto Fin..........68.00 -2.30

Bajaj Finserv..........109.30 4.39

Bajaj Hind.................43.60 4.56

Balaji Tele.................71.30 8.44

Ballarpur Inds..........18.90 1.34

Balrampur Cem.......33.95 3.19

Bank of Maha..........22.00 0.46

Bank of Baroda.....249.25 -1.42

Bank of India.........250.25 1.15

Bartronics ................75.85 8.67

BASF India..............227.00 1.77

Bata India.................90.55 7.54

Bayer Crop.............205.00 6.25

BEML.......................308.55 5.76

Berger Paint.............33.00 5.94

BF Utilities..............609.00 -1.11

BGR Energy............135.60 4.31

Bharat Bijli.............552.70 -1.24

Bharat Elect...........717.50 -1.81

Bharat Forge............87.10 -1.25

BPCL .......................335.60 2.90

Bharati Ship.............63.15 1.04

Bharti Airtel...........735.75 4.99

Bhel.......................1412.95 3.75

Bhushan Steel.......337.35 3.58

Bilcare.....................439.90 2.30

Binani Cem ..............30.50 4.45

Biocon ......................97.90 1.66

Birla Corp...............110.10 4.76

BL Kashyap............218.00 5.49

Blue Star ................131.00 0.34

BOC India...............132.00 1.97

Bombay Dyeing.....171.85 7.11

Bombay Rayon......118.25 10.05

Bongaigaon Ref ......37.40 0.67

Bosch ...................3099.00 4.55

Brigade.....................40.70 2.52

Britania Inds........1200.10 1.30

BSEL Infra ................13.43 1.28

Cadila Healt...........255.55 0.59

Cairn India.............150.10 5.26

Cals Ref .....................1.34 -4.29

Canara Bank..........164.65 0.55

Carbo Univer ...........92.10 1.82

Castrol India..........300.30 -0.13

Central Bank............34.05 0.44

Century Textiles....163.45 15.15

CESC .......................241.05 4.87

Chambal Fert...........37.15 2.20

Champagn Inds.......75.90 4.98

Chennai Petro .......105.10 2.99

Cipla........................188.65 1.45

City Union Bk...........13.47 -0.30

CMC ........................331.60 0.32

Colgate Palm.........399.45 0.29

Consol Const.........240.00 5.26

Container Corp .....607.00 1.14

Core Project.............45.30 2.95

Coromandel Fert.....89.45 2.93

Corporation Bank.177.55 -0.48

Country Club...........17.85 -0.83

Cranes Soft..............76.80 1.32

Crisil .....................1954.00 2.30

Crompt Greaves....131.05 10.97

Cummins India......198.00 -2.44

Dabur India..............79.15 -1.06

Dabur Pharma.........36.35 6.91

Dalmia Cem B..........70.90 -3.73

DCM Shr Cons.........28.75 1.95

Deccan Chron..........46.00 1.55

Deepak Fert .............51.75 1.47

Dena Bank................27.95 0.54

Devlp Credit Bk.......20.45 3.02

Dish TV.....................19.00 16.21

Dishman Pharma..125.90 2.44

Divi's Lab..............1240.80 1.05

DLF..........................262.65 18.93

Dr.Reddy's Lab......484.45 0.68

Dredging Corp.......204.30 3.73

Edelweiss Cap.......249.75 1.94

Educomp Soln.....2167.60 2.59

Eicher Motors........210.00 2.24

EID Parry................156.45 5.53

EIH...........................117.80 4.25

Elder Pharma ........235.00 -0.47

Elecon Engg.............32.85 4.78

Electrost Castings..13.40 1.98

Emco ........................30.00 2.74

Engineers India.....423.60 0.62

Ent Network...........130.90 0.15

Era Infra....................70.80 -0.14

Escorts......................41.25 15.87

Ess Dee Alum ........126.75 0.28

Essar Oil...................77.40 6.54

Essar Ship................30.00 4.90

Everest Kanto........153.10 -3.47

Everonn Sys...........249.05 1.49

Exide Inds ................40.90 3.68

Federal Bank..........136.05 1.91

Financial Techn.....523.25 0.39

Finolex Cable...........20.10 0.25

Finolex Inds .............29.30 1.38

Fortis Healt..............62.70 -0.40

Firstsource Soln......12.27 5.96

Future Cap .............137.50 0.88

GAIL India ..............219.70 7.33

Gammon India ........58.10 6.90

Gammon Infra.........53.00 4.43

Ganesh Hsg .............49.35 -0.80

Gateway Dist...........77.85 7.01

Gati............................40.00 1.91

Genus Power...........79.90 1.78

Geodesic ..................58.05 -0.17

Geojit Fin..................23.55 3.74

Gillette India..........719.00 1.11

Gitanjali Gems.........71.80 3.53

GSK Consumer......507.00 -4.02

GSK Pharma........1132.45 -1.50

Glenmark Pha .......262.05 -6.99

GMR Infras...............63.00 4.48

Godrej Consumer .120.25 -0.99

Godrej Inds ..............58.70 6.82

Golden Tobbaco......47.60 1.38

Graphit India ...........34.00 0.15

Grasim Inds .........1098.50 13.66

GE Shipping...........166.45 14.05

Great Offshore......218.60 -2.10

Greaves Cotton.......69.95 5.11

GSS America .........138.25 1.39

GTL Infrast...............36.40 -1.36

GTL..........................203.60 1.80

Guj Alkali..................62.65 -0.63

Guj Min Devl............31.15 0.65

Guj Narmada...........52.35 2.05

Guj Petronet ............26.20 -0.19

Guj Inds Power........40.25 2.16

Guj NRE Coke ..........22.05 2.32

Guj Flurochem.........60.00 0.08

Guj Gas...................201.95 0.72

GSFC .........................68.20 1.41

Gulf Oil Corn............31.00 7.08

GVK Power...............19.85 7.59

Havells India..........116.60 0.13

HCL Infosys..............73.25 4.94

HCL Techno............118.90 1.89

HDFC Bank.............924.85 2.99

HEG .........................114.55 0.00

Hero Honda ..........795.70 0.55

Hexaware ................19.90 -1.00

Himchal Futr..............7.16 -0.42

Himadri Chem.......117.10 -2.17

Hind Motors ...........13.45 -2.18

Hind Unilever.........244.75 1.62

Hind Copper ............85.00 3.85

Hind Oil Exp.............62.40 4.00

Hind Zinc................320.60 1.89

Hindalco Inds ..........53.65 5.82

Hinduja Vent..........124.00 1.43

Hindus Const...........43.25 8.81

HCPL.......................228.75 2.37

Hotel Leela...............19.05 1.33

HDIL ........................101.35 13.43

HDFC.....................1624.05 7.47

HT Media..................70.00 0.00

ITC ..........................170.45 0.26

ICSA Inds................140.75 -2.80

IB Sec........................19.45 2.64

IBN 18........................87.50 -0.28

ICI India..................406.00 1.32

ICICI Bank..............399.95 8.15

IDBI Bank .................61.15 3.56

Idea Cellular............52.90 4.03

IFCI............................18.10 2.26

IL&FS Invtsm...........71.10 3.72

India Infoline ...........39.10 4.27

Indiabull Real ........116.10 10.62

India Cement...........93.85 10.28

India Glycol..............55.60 3.25

Indiabulls Fin...........98.95 2.91

Indian Bank............120.95 0.37

Indian Hotels...........40.45 2.41

IOCL ........................386.55 1.34

IOB.............................66.35 0.99

Indo Tech Transf ...287.95 1.21

Indraprastha Gas....99.90 -0.15

IndusInd Bank.........31.55 -1.87

Info Edge................404.00 0.54

Infosys Techn......1173.95 1.44

Infotech Enr...........101.00 1.61

IDFC...........................67.60 10.55

ING Vysya Bk.........154.90 8.02

Ingersoll Rand.......240.00 2.45

Inox Leisure.............27.95 -3.45

IOL Net Com............28.20 4.64

Ipca Lab..................356.90 3.36

IRB Infra ...................87.70 2.75

ISMT..........................20.00 -0.25

Ispat Inds.................11.01 3.38

IVR Prime.................34.60 1.47

IVRCL Infra.............147.75 9.16

J&K Bank................321.90 1.82

Jagran Prak..............51.60 3.20

Jai Corp ....................93.60 9.28

Jain Irri Sys............266.25 8.63

Jaiprak Asso ............74.80 8.96

Jet Airways............135.95 1.42

Jindal Saw..............242.15 3.00

Jindal South...........258.80 11.46

Jindal Steel ............905.65 9.14

JK Cement................42.90 0.94

JK Lakshmi...............35.65 6.26

JM Fin........................21.00 1.69

JP Hydropower........28.40 3.46

JSL.............................27.15 1.31

JSW Steel...............241.80 9.09

Jubilant Org...........117.95 -1.38

Jyoti Struct...............54.95 -3.26

K S Oils ....................42.25 1.68

Kalpat Power.........233.85 2.79

Kalyani Steel............56.25 -2.51

Karnataka Bk...........76.70 3.16

Karuturi Global........12.29 4.95

KEC Intl...................110.05 -1.87

KEI Inds ....................11.68 4.66

Kesoram Inds........145.20 5.72

Kingfisher Airlines..28.15 1.26

Kirl Oil Eng...............39.00 -3.94

Kirl Ferrous..............12.38 5.36

Kirl Bros....................74.55 -1.19

KLG Systel................78.30 6.68

Kolte Patil Devp ......26.40 7.32

Kotak Bank ............363.05 3.04

Koutons Retail.......499.50 -1.59

KPIT Cummin ..........27.55 6.99

KSK Energy............157.00 0.32

LMW........................579.50 1.76

Lakshmi Over........185.15 -0.43

Lanco Infra.............145.30 17.56

L&T..........................779.60 5.32

LIC Hsg Fin.............229.50 3.68

Lok Housing.............18.50 4.82

Lupin ......................567.35 1.86

MMTC...................9500.00 -2.83

M&M Fin.................179.90 -0.06

Madhucon Proj........56.35 1.44

Madras Cement......66.80 8.35

MTNL ........................75.20 3.08

Maharash Seam....139.55 0.00

M&M.......................286.65 15.47

Mahindra Life........170.60 1.46

Man Inds..................37.00 -0.67

MRPL.........................34.90 2.50

MARG........................39.75 4.88

Marico .....................49.30 -2.18

Marksans Pharma....5.60 4.87

Maruti Suzuki........515.95 3.36

Mascon Global ..........6.30 -2.48

Mastek....................156.95 -0.10

Matrix Labs..............64.10 9.01

Max India...............102.65 9.43

Maytas Infra..........469.90 -2.73

Mcleod Russel.........40.85 4.08

Mcnally Bharat........33.80 4.00

Megasoft .................19.30 1.58

Mercator Lines........27.40 18.61

Mic Elect ..................34.25 -0.87

MindTree ...............251.00 5.00

Monne Ispat ..........128.80 3.41

Monsanto India...1100.00 0.59

Moser Baer..............58.15 6.50

Moth Sumi Sys........49.95 4.06

Motilal Oswal Fin....66.95 3.40

MphasiS .................159.90 0.03

MRF.......................1772.45 0.94

Mukand ....................23.25 0.87

Mundra Port..........278.75 5.09

Mysore Cem ............12.27 3.02

Nag Cons Co............73.40 7.08

Naga Fert Ch............14.90 1.57

NALCO....................196.55 7.05

Nav Bhar Ven.........119.75 0.38

Navneet Publ...........40.45 2.02

NDTV.......................114.65 3.38

Nesco......................455.25 6.55

Nestle ..................1377.45 -1.18

Neyveli Lignite ........58.05 4.59

NIIT............................24.40 1.46

NIIT Techno..............56.50 0.98

Nirlon .......................19.40 -3.24

Nirma........................95.00 2.76

NMDC......................138.80 1.17

Nocil .........................12.09 1.09

Noida Toll.................18.70 3.89

Novartis Inds.........237.60 1.04

NTPC.......................168.90 1.50

Network18 ...............97.15 -1.17

Omaxe .....................54.10 4.14

ONGC......................676.90 2.65

Onmobile ...............206.95 1.30

Opto Circuit.............72.85 0.83

Oracle Fin...............445.60 1.39

Orbit Corp................51.45 5.86

Orchid Chem ...........86.80 3.21

Orient Paper............19.35 7.50

Oriental Bk.............141.85 -0.80

Panacea Biotech...132.25 1.15

Pantaloon Retail ...205.25 -2.10

Parsvnath Devp ......42.65 4.92

Patel Engg..............119.05 5.40

Patni Comp............134.10 0.07

Penland ...................19.80 3.94

Petronet LNG...........32.50 1.56

Pfizer.......................481.75 -0.10

Phoenix Mills...........63.75 7.78

Pidilite Inds..............88.45 0.11

Piramal Life .............57.15 -5.38

Piramal Healt ........207.60 -0.38

Polaris Lab...............38.40 4.63

Power Fin Corp .....124.00 7.83

Power Grid...............76.70 -1.48

Praj Inds...................57.50 3.05

Prajay Eng................20.05 2.04

Prakash Inds............35.05 -5.01

Prime Focus...........136.90 -8.67

Prism Cement .........17.33 8.86

Prithvi Info...............38.45 -0.13

Proctor Gamble.....750.15 3.32

Provogue Inds .........33.70 -3.02

PSL ............................73.50 -0.14

PTC India..................67.15 -1.61

Punj Lloyd ..............155.25 4.12

PNB .........................451.00 0.24

Punjab Tractor.........89.45 4.99

Puravankara ...........36.80 9.20

Radico Khaitan........57.20 -3.87

Rain Comm..............84.20 -1.23

Rajesh Exports........24.80 0.40

Ranbaxy Lab..........210.75 -1.08

RCF............................29.10 1.93

Ratnama Metals .....47.30 4.99

Raymond .................89.55 0.00

REC............................56.75 2.99

Redington ..............101.60 -15.16

Reliance Com .......228.25 10.24

Reliance Infra........602.05 8.70

Reliance Petro.........77.25 3.69

Reliance Inds.......1227.20 9.57

Reliance Cap .........466.05 2.46

Rel Indl Infra..........368.25 3.02

Religare Ent...........315.00 -0.06

Renuka Sugar..........53.55 5.41

RNRL .........................43.55 3.08

Rolta India..............130.55 -2.50

Reliance Power.....113.00 3.01

Ruchi Soya...............24.35 0.83

S. Kumars Nat.........24.60 5.81

Sadbhav Engg.......230.50 -0.60

Sanghvi Movers......73.80 4.76

Sasken Comm.........56.55 6.60

Satyam Comp .......236.60 5.79

Sesa Goa .................78.80 6.99

Shree Pecoated.......28.00 4.87

Shaw Wallace........187.30 4.99

Shipping Corp .........72.15 6.10

Shivvani Oil............126.85 6.37

Shree Cement .......387.70 7.62

Shriram EPC ..........120.60 3.25

Shriram Tran..........198.05 -1.74

Siemens ................247.60 3.04

Simplx Infra...........128.00 -1.27

Sintex Inds.............172.85 7.16

SKF India................129.00 -1.53

Sobha Devp .............96.70 2.93

South India ..............55.95 1.82

Spice Tele.................32.50 -0.15

SpiceJet ...................12.00 0.76

SREI Infra .................45.00 13.21

SRF............................71.05 1.14

St Trad Corp ..........108.75 2.79

SBI.........................1189.20 1.79

SAIL...........................79.65 15.77

Sterlite Tech ............51.75 2.99

Sterling Biotec ......168.60 0.45

Sterlite Inds...........272.10 8.82

Strides Arcolab.......98.15 1.71

Subex .......................31.15 2.98

Sujana Tower...........16.50 0.61

Sun Pharma.........1095.60 5.74

Sun TV....................170.30 3.31

Sundram Fast..........16.15 -2.71

Sun Pha Adv............41.05 0.74

Suzlon Energy .........48.90 9.15

Syndicate Bk ...........57.65 1.14

TN Newsprint ..........65.00 0.00

Tanla Soln ................66.30 1.22

Tata Chem..............154.75 4.35

Tata Elxsi..................92.40 4.17

Tata Inv Cor...........213.00 -0.26

Tata Motors...........163.10 7.30

Tata Power.............732.20 6.55

Tata Steel...............217.40 10.92

Tata Tea .................530.40 -1.06

Tata Telesrv (M)......20.35 0.49

Tata Comm ............496.25 13.77

TCS..........................541.45 3.65

Tech Mahindra......262.55 4.73

TV 18.........................71.15 9.88

Texmaco ................610.95 -0.28

Thermax.................176.85 5.96

Thomas Cook ..........42.25 1.20

Time Techno............27.70 2.03

Titagarh Wag.........300.00 -0.25

Titan Inds...............874.25 2.59

Torrent Power .........70.75 0.64

Torrent Pharma.....120.55 0.71

Trent........................259.05 0.31

Triveni Engg.............38.90 1.83

Tube Invest ..............35.30 0.71

Tulip Telecom........410.00 3.57

TV Today ..................67.45 3.06

TVS Motor................23.55 2.39

Uco Bank..................26.30 0.19

UltraTech Cem ......326.70 9.47

Union Bank ............143.35 0.14

Unitd Spirits...........957.60 6.42

Unitech ....................35.00 6.54

United Brew.............79.00 1.80

United Brewr (H) ....70.35 1.30

United Phosp...........90.00 -0.06

Unity Infra..............117.35 4.87

Usha Martin.............24.65 16.27

UTV Software........235.45 3.34

Vakran Softw...........29.80 4.93

Varun Shipping .......43.25 1.76

Videocon Inds .........98.65 2.33

Vijaya Bank..............29.70 0.68

Vishal Retail.............94.80 4.98

Voltamp Tran.........321.10 3.70

Voltas .......................50.35 6.79

Walchand Inds ........88.55 2.37

Welsp Guj Sr............85.55 2.27

Wipro......................261.65 9.80

WWIL........................10.80 6.09

Wockhardt ...............99.75 3.31

Wyeth ....................425.10 -0.36

Yes Bank...................71.95 6.12

Zandu Pharma....6998.40 0.79

Zee Enter................128.40 7.76

Zee News .................30.95 1.14

Zuari Inds...............139.60 1.20

Company LTP (Rs) % chg Company LTP (Rs) % chg Company LTP (Rs) % chg Company LTP (Rs) % chg Company LTP (Rs) % chg Company LTP (Rs) % chg Company LTP (Rs) % chg Company LTP (Rs) % chg Company LTP (Rs) % chg Company LTP (Rs) % chg Company LTP (Rs) % chg

LTP: Last traded price on BSE

% change over previous close

AIG India MF

Equity - IP - D . . . . . . . . . . . 5.67

Equity - IP - G . . . . . . . . . . . 5.67

Equity - Reg - D. . . . . . . . . . 5.62

Equity - Reg - G. . . . . . . . . . 5.62

Infra & Eco-IP-G . . . . . . . . . 4.39

Infra & Eco-Reg-D. . . . . . . . 4.37

Infra & Eco-Reg-G. . . . . . . . 4.37

Baroda Pioneer MF

Baroda Global - D . . . . . . . . 7.48

Baroda Global - G. . . . . . . . 7.50

Children-Gift . . . . . . . . . . . 10.75

Children-Study . . . . . . . . . . 9.74

Diversified. . . . . . . . . . . . . 20.11

Elss 96 . . . . . . . . . . . . . . . . 12.38

Growth-D. . . . . . . . . . . . . . 15.44

Growth-G. . . . . . . . . . . . . . 24.49

Benchmark MF

Derivative-D . . . . . . . . . 1,054.83

Derivative-G . . . . . . . . . 1,322.33

Equity Deri Opprt-D . . . . . 10.58

Equity Deri Opprt-G . . . . . 10.88

PSU Bank Bees . . . . . . . . 175.91

Bharti AXA MF

Equity-Eco-B . . . . . . . . . . . . 9.91

Equity-Eco-G . . . . . . . . . . . . 9.91

Equity-Eco-QD. . . . . . . . . . . 9.91

Equity-Eco-Reg-D . . . . . . . . 9.91

Equity-Reg-B . . . . . . . . . . . . 9.90

Equity-Reg-D. . . . . . . . . . . . 9.90

Equity-Reg-G. . . . . . . . . . . . 9.90

Equity-Reg-QD . . . . . . . . . . 9.90

DBS Chola MF

Contra-D . . . . . . . . . . . . . . . 5.43

Contra-G . . . . . . . . . . . . . . . 5.43

Global Adv-D. . . . . . . . . . . . 4.64

Global Adv-G. . . . . . . . . . . . 6.69

Growth-G. . . . . . . . . . . . . . 18.47

Growth-QD . . . . . . . . . . . . . 8.73

Hedged Euity - D. . . . . . . . . 5.12

Hedged Euity - G . . . . . . . . 7.21

Mid Cap-D . . . . . . . . . . . . . . 8.80

Mid Cap-G . . . . . . . . . . . . . 15.26

Multi-Cap-D. . . . . . . . . . . . . 7.45

Multi-Cap-G. . . . . . . . . . . . . 9.35

Oppr-G . . . . . . . . . . . . . . . . 18.68

Oppr-Reg-QD. . . . . . . . . . . . 8.09

Tax Saver-D . . . . . . . . . . . . . 6.58

Tax Saver-G. . . . . . . . . . . . . 7.08

Triple Ace-Reg-Bns. . . . . . 13.96

Triple Ace-Reg-G. . . . . . . . 25.11

Triple Ace-Reg-QD . . . . . . 11.83

Triple Ace-Semi AD . . . . . 10.65

DSP BlackRock MF

Equity - Reg - D. . . . . . . . . 27.65

Equity - Reg - G. . . . . . . . . . 7.23

Equity-IP-D . . . . . . . . . . . . . 7.24

Oppr - Reg - D. . . . . . . . . . 14.81

Oppr - Reg - G. . . . . . . . . . 37.99

Oppr-IP-D. . . . . . . . . . . . . . . 4.59

Oppr-IP-G. . . . . . . . . . . . . . . 4.59

Small-Mid-Reg-D . . . . . . . . 6.16

Small-Mid-Reg-G . . . . . . . . 6.16

Tax Saver-D . . . . . . . . . . . . . 5.68

Tax Saver-G. . . . . . . . . . . . . 7.63

Technology.com-Reg-D . . 10.52

Technology.com-Reg-G . . 14.40

TIGER - IP - G. . . . . . . . . . . . 6.59

TIGER - Reg - D . . . . . . . . . 10.77

TIGER - Reg - G . . . . . . . . . 23.32

TIGER-IP-D. . . . . . . . . . . . . . 4.71

Top 100 Eq - IP - G . . . . . . . 6.61

Top 100 Eq- Reg - D . . . . . 12.21

Top 100 Eq- Reg - G . . . . . 48.72

Top 100 EQ-IP-D . . . . . . . . . 6.61

Fortis MF

China India-Reg-D . . . . . . . 5.10

China India-Reg-G . . . . . . . 5.10

Divdend Yield-D . . . . . . . . . 7.25

Divdend Yield-G . . . . . . . . . 7.94

Equity-D. . . . . . . . . . . . . . . . 7.71

Equity-G. . . . . . . . . . . . . . . 19.03

Future Leaders-D . . . . . . . . 4.09

Future Leaders-G . . . . . . . . 4.09

Opportunities-D . . . . . . . . . 5.76

Opportunities-G . . . . . . . . 11.07

Sustainable Devel-D. . . . . . 6.91

Sustainable Devel-G. . . . . . 6.91

Tax Advantage-ELSS-D . . . 5.71

Tax Advantage-ELSS-G . . . 7.17

Franklin Templeton MF

Asain EQ-D . . . . . . . . . . . . . 6.56

Asain EQ-G . . . . . . . . . . . . . 6.56

Bluechip-D. . . . . . . . . . . . . 24.10

Bluechip-G. . . . . . . . . . . . . 95.65

Child Ast-Edu.-G . . . . . . . . 24.52

Child Ast-Edu.-G . . . . . . . . 26.18

Child Ast-Gift-D. . . . . . . . . 24.52

Eq Inc - D. . . . . . . . . . . . . . . 6.97

Eq Inc - G. . . . . . . . . . . . . . . 8.09

FI Opportunities-D . . . . . . . 8.12

FI Smaller Cos-D. . . . . . . . . 5.30

FI Smaller Cos-G. . . . . . . . . 5.72

Flexi Cap-D . . . . . . . . . . . . . 9.11

Flexi Cap-G . . . . . . . . . . . . 14.32

FMCG-D . . . . . . . . . . . . . . . 18.78

FMCG-G . . . . . . . . . . . . . . . 29.93

Index - BSE - D . . . . . . . . . 25.90

Index - BSE - G . . . . . . . . . 25.90

Index - Nifty - D . . . . . . . . 21.91

Index - Nifty - G . . . . . . . . 21.91

Index Tax. . . . . . . . . . . . . . 21.69

Infotech-D . . . . . . . . . . . . . . 8.49

Infotech-G . . . . . . . . . . . . . 24.49

Opportunities-G . . . . . . . . 16.26

Pension-D . . . . . . . . . . . . . 13.48

Pension-G . . . . . . . . . . . . . 40.76

Pharma-D . . . . . . . . . . . . . 10.99

Pharma-G . . . . . . . . . . . . . 20.77

Prima Plus-D . . . . . . . . . . . 19.96

Prima Plus-G. . . . . . . . . . 104.37

Prima-D . . . . . . . . . . . . . . . 24.09

Prima-G . . . . . . . . . . . . . . 109.37

Taxshield 99. . . . . . . . . . . . 46.08

Taxshield-D . . . . . . . . . . . . 19.94

Taxshield-G . . . . . . . . . . . . 94.88

TI Growth-D. . . . . . . . . . . . 27.13

TI Growth-G. . . . . . . . . . . . 49.51

ICICI Prudential MF

Banking & Fin Serv-RT-D . . 7.48

Banking & Fin Serv-RT-G . . 7.48

Blended B-D . . . . . . . . . . . 11.64

Blended B-G . . . . . . . . . . . 12.96

Child Care-Gift . . . . . . . . . 24.96

Child Care-Study . . . . . . . 20.75

Discovery-D. . . . . . . . . . . . . 8.42

Discovery-G. . . . . . . . . . . . 15.58

Discovery-IP-I-G . . . . . . . . . 6.77

Dyn Plan-D. . . . . . . . . . . . . 10.71

Dyn Plan-G . . . . . . . . . . . . 46.57

Dynamic - IP - I. . . . . . . . . . 7.16

EDF-IOP-ID. . . . . . . . . . . . . 10.42

EDF-IOP-IG. . . . . . . . . . . . . 11.94

EDF-IOP-RD . . . . . . . . . . . . 10.36

EDF-IOP-RG . . . . . . . . . . . . 11.87

EDF-WOP-RD . . . . . . . . . . . . 7.41

EDF-WOP-RG . . . . . . . . . . . . 7.81

Emerging Star-D. . . . . . . . . 7.34

Emerging Star-G. . . . . . . . 13.43

Emrg Star-IP-I . . . . . . . . . . . 5.35

FMCG-D . . . . . . . . . . . . . . . 19.94

FMCG-G . . . . . . . . . . . . . . . 30.18

Focused EQ-IP-I-G. . . . . . . . 6.83

Focused EQ-RT-D . . . . . . . . 6.79

Focused EQ-RT-G . . . . . . . . 6.79

Fusion-D. . . . . . . . . . . . . . . . 6.05

Fusion-G. . . . . . . . . . . . . . . . 6.42

Fusion-III-IP-D . . . . . . . . . . . 5.97

Fusion-III-IP-G . . . . . . . . . . . 5.97

Fusion-III-RT-D. . . . . . . . . . . 5.93

Fusion-III-RT-G. . . . . . . . . . . 5.93

Fusion-IP-I-G . . . . . . . . . . . . 6.63

Growth-D. . . . . . . . . . . . . . 12.59

Growth-G. . . . . . . . . . . . . . 66.96

Growth-IP-I-G . . . . . . . . . . . 9.18

Index . . . . . . . . . . . . . . . . . 25.66

Indo Asia Eq-IP-G . . . . . . . . 4.94

Indo Asia Eq-RT-D. . . . . . . . 4.94

Indo Asia Eq-RT-G. . . . . . . . 4.94

Infra - IP - I - G . . . . . . . . . . 8.41

Infrastructure-D . . . . . . . . . 7.22

Infrastructure-G . . . . . . . . 15.78

Power-D. . . . . . . . . . . . . . . . 9.25

Power-G. . . . . . . . . . . . . . . 51.63

Power-IP-I . . . . . . . . . . . . . 14.04

Service Ind-D . . . . . . . . . . . 6.31

Service Ind-G . . . . . . . . . . . 8.39

Taxplan-D . . . . . . . . . . . . . . 9.66

Taxplan-G . . . . . . . . . . . . . 52.71

Technology . . . . . . . . . . . . . 6.16

ING MF

Balanced-D . . . . . . . . . . . . . 9.83

Balanced-G . . . . . . . . . . . . 14.05

Contra-Bonus . . . . . . . . . . . 7.34

Contra-D . . . . . . . . . . . . . . . 7.34

Contra-G . . . . . . . . . . . . . . . 7.34

Core Eq-D . . . . . . . . . . . . . . 9.58

Core Eq-G . . . . . . . . . . . . . 18.14

CUB-Bonus . . . . . . . . . . . . . 6.50

CUB-D. . . . . . . . . . . . . . . . . . 6.50

CUB-G. . . . . . . . . . . . . . . . . . 6.50

DAAF-Bonus . . . . . . . . . . . . 9.90

DAAF-D. . . . . . . . . . . . . . . . . 9.90

DAAF-G. . . . . . . . . . . . . . . . . 9.90

Div Yield - Bns. . . . . . . . . . . 8.62

Div Yield - D. . . . . . . . . . . . . 7.83

Div Yield - G. . . . . . . . . . . . . 8.62

Domestic Oppr-Bns . . . . . 17.88

Domestic Oppr-D . . . . . . . . 6.74

Domestic Oppr-G . . . . . . . 17.88

Dynamic Dur-AD. . . . . . . . 10.85

Dynamic Dur-Bonus. . . . . 12.78

Dynamic Dur-G . . . . . . . . . 12.78

Dynamic Dur-HD. . . . . . . . 10.43

Dynamic Dur-MD . . . . . . . 10.34

Dynamic Dur-QD. . . . . . . . 10.45

Midcap-Bonus. . . . . . . . . . . 8.81

Midcap-D. . . . . . . . . . . . . . . 8.06

Midcap-G. . . . . . . . . . . . . . . 8.81

Nifty Plus-Bns. . . . . . . . . . 14.17

Nifty Plus-D. . . . . . . . . . . . . 9.43

Nifty Plus-G. . . . . . . . . . . . 14.17

STI-D. . . . . . . . . . . . . . . . . . 11.71

STI-G . . . . . . . . . . . . . . . . . 15.49

Tax Sav-Bns. . . . . . . . . . . . 12.11

Tax Sav-D. . . . . . . . . . . . . . . 5.96

Tax Sav-G. . . . . . . . . . . . . . 12.09

JM Financial MF

Agri Infra-D . . . . . . . . . . . . . 2.24

Agri Infra-G . . . . . . . . . . . . . 2.24

Auto Sector-D . . . . . . . . . . . 7.64

Auto Sector-G . . . . . . . . . . . 9.99

Balanced-D . . . . . . . . . . . . 10.26

Balanced-G . . . . . . . . . . . . 13.49

Basic-D. . . . . . . . . . . . . . . . . 6.43

Basic-G. . . . . . . . . . . . . . . . . 8.54

Contra-D . . . . . . . . . . . . . . . 3.46

Contra-G . . . . . . . . . . . . . . . 3.46

Emerging Leaders-D . . . . . 3.59

Emerging Leaders-G . . . . . 3.58

Eq & Derv-Bonus . . . . . . . 12.00

Eq & Derv-D. . . . . . . . . . . . 10.24

Eq & Derv-G. . . . . . . . . . . . 12.95

Equity-D. . . . . . . . . . . . . . . . 9.17

Equity-G. . . . . . . . . . . . . . . 20.38

ETS - I - D. . . . . . . . . . . . . . . 4.19

ETS - I - G. . . . . . . . . . . . . . . 4.19

FSS -D. . . . . . . . . . . . . . . . . . 7.23

FSS -G. . . . . . . . . . . . . . . . . . 7.23

Healthcare Sec-D . . . . . . . . 9.11

Healthcare Sec-G . . . . . . . 11.50

HiFi - D . . . . . . . . . . . . . . . . . 4.75

HiFi - G. . . . . . . . . . . . . . . . . 4.75

Inc G-Bns. . . . . . . . . . . . . . 11.86

Inc-D. . . . . . . . . . . . . . . . . . 10.26

Inc-G-G. . . . . . . . . . . . . . . . 29.00

Arbitrage Adv - D . . . . . . . 10.32

Arbitrage Adv - G . . . . . . . 12.20

Multi Strategy-D. . . . . . . . . 7.09

Multi Strategy-G. . . . . . . . . 7.09

Small Mid-cap - Reg - D. . . 3.17

Small Mid-cap - Reg - G. . . 3.17

Tax gain-D . . . . . . . . . . . . . . 3.96

Tax gain-G . . . . . . . . . . . . . . 3.96

JPMorgan MF

India Alpha-D . . . . . . . . . . 10.20

India Alpha-G . . . . . . . . . . 10.20

India Equity - D. . . . . . . . . . 5.80

India Equity - G. . . . . . . . . . 6.25

LIC MF

Children. . . . . . . . . . . . . . . . 6.48

Equity-D. . . . . . . . . . . . . . . . 5.39

Equity-G. . . . . . . . . . . . . . . 13.68

Growth-D. . . . . . . . . . . . . . . 5.55

Growth-G. . . . . . . . . . . . . . . 6.26

Index-Nifty-D. . . . . . . . . . . . 6.00

Index-Nifty-G. . . . . . . . . . . 16.25

Index-Sensex Adv-D. . . . . . 6.94

Index-Sensex Adv-G. . . . . 16.76

Index-Sensex-D. . . . . . . . . . 6.03

Index-Sensex-G. . . . . . . . . 17.60

Infrastructure-D . . . . . . . . . 5.39

Infrastructure-G . . . . . . . . . 5.39

Oppr-D . . . . . . . . . . . . . . . . . 5.94

Oppr-G . . . . . . . . . . . . . . . . 10.44

Systematic Asset Alloc-D . 8.54

Systematic Asset Alloc-G . 8.54

Tax-D . . . . . . . . . . . . . . . . . . 5.76

Tax-G . . . . . . . . . . . . . . . . . 16.10

Top 100-D. . . . . . . . . . . . . . . 4.87

Top 100-G. . . . . . . . . . . . . . . 4.87

ULIS . . . . . . . . . . . . . . . . . . . 6.72

Vision - D. . . . . . . . . . . . . . . 5.57

Vision - G. . . . . . . . . . . . . . . 5.57

Mirae Asset MF

Global Commod Stk-D . . . . 5.71

Global Commod Stk-G . . . . 5.71

India Oppr-D . . . . . . . . . . . . 6.13

India Oppr-G . . . . . . . . . . . . 6.13

India Oppr-IP-D. . . . . . . . . . 6.16

Morgan Stanley MF

ACE-D. . . . . . . . . . . . . . . . . . 5.97

ACE-G. . . . . . . . . . . . . . . . . . 5.97

Growth. . . . . . . . . . . . . . . . 29.75

Quantum MF

LT Equity - D . . . . . . . . . . . . 8.62

LT Equity - G . . . . . . . . . . . . 8.55

Sahara MF

Banking Fin Ser-D. . . . . . . 10.45

Banking Fin Ser-G. . . . . . . 10.46

Classic - D . . . . . . . . . . . . . 11.15

Classic - G . . . . . . . . . . . . . 11.15

Growth-D. . . . . . . . . . . . . . 16.36

Growth-G. . . . . . . . . . . . . . 43.60

Infra-FP-D . . . . . . . . . . . . . . 6.20

Infra-FP-G . . . . . . . . . . . . . . 8.47

Infra-VP-D . . . . . . . . . . . . . . 6.34

Infra-VP-G . . . . . . . . . . . . . . 8.63

Midcap-Autopayout . . . . . 11.86

Midcap-Bonus. . . . . . . . . . 11.86

Midcap-D. . . . . . . . . . . . . . . 8.05

Midcap-G. . . . . . . . . . . . . . 11.86

Power Nat Res-D. . . . . . . . . 6.06

Power Nat Res-G . . . . . . . . 6.06

Tax Gain-D. . . . . . . . . . . . . . 9.33

Tax Gain-G. . . . . . . . . . . . . 16.38

Wealth Plus-FP-D . . . . . . . 10.66

Wealth Plus-FP-G . . . . . . . 10.66

Wealth Plus-VP-D . . . . . . . 10.90

Wealth Plus-VP-G . . . . . . . 10.90

SBI MF

Arbitrage Opp-D. . . . . . . . 11.31

Arbitrage Opp-G. . . . . . . . 11.94

Balanced-D . . . . . . . . . . . . 17.61

Balanced-G . . . . . . . . . . . . 27.23

Blue Chip - D . . . . . . . . . . . . 6.22

Blue Chip - G. . . . . . . . . . . . 7.13

Child Benefit-<=1Yr. . . . . 17.65

Comma-D . . . . . . . . . . . . . . 9.01

Comma-G . . . . . . . . . . . . . 11.23

Inc Plus-Inv-D . . . . . . . . . . . 9.68

Index-D . . . . . . . . . . . . . . . 12.21

Index-G . . . . . . . . . . . . . . . 23.91

Infra-I-060707-D . . . . . . . . . 5.51

Infra-I-060707-G . . . . . . . . . 5.51

Infra-I-060707-RD . . . . . . . . 5.22

Infra-I-060707-RG . . . . . . . . 5.22

Magnum Equity-D . . . . . . 17.17

Magnum Equity-G . . . . . . 19.52

MGLF 94-D. . . . . . . . . . . . . 13.57

MGLF 94-G. . . . . . . . . . . . . 20.54

MIDCAP-D . . . . . . . . . . . . . . 7.28

MIDCAP-G . . . . . . . . . . . . . . 9.49

MSFU Contra-D. . . . . . . . . 15.39

MSFU Contra-G. . . . . . . . . 27.03

MSFU Emerg.Busi-D. . . . . . 7.48

MSFU Emerg.Busi-G. . . . . 13.84

MSFU FMCG . . . . . . . . . . . 11.77

MSFU IT . . . . . . . . . . . . . . . . 8.58

MSFU Pharma-D. . . . . . . . 14.72

MSFU Pharma-G. . . . . . . . 17.87

MTGS 1993 - G. . . . . . . . . . 29.05

MTGS 93 - D. . . . . . . . . . . . 23.61

Multicap-D. . . . . . . . . . . . . . 7.06

Multicap-G. . . . . . . . . . . . . . 9.30

Multiplier Plus93-D. . . . . . 30.04

Multiplier Plus93-G. . . . . . 37.04

One India - D. . . . . . . . . . . . 5.35

One India - G. . . . . . . . . . . . 5.35

One India - Repur-D . . . . . . 5.17

One India - Repur-G . . . . . . 5.17

UTI MF

Auto Sector-D . . . . . . . . . . . 7.49

Auto Sector-G . . . . . . . . . . . 9.35

Balanced-D . . . . . . . . . . . . 13.63

Balanced-G . . . . . . . . . . . . 42.79

Banking Sec-D. . . . . . . . . . 11.58

Banking Sec-G . . . . . . . . . 16.91

Contra-D . . . . . . . . . . . . . . . 7.35

Contra-G . . . . . . . . . . . . . . . 7.35

CRTS 81-D . . . . . . . . . . . . . 96.24

CRTS 81-G . . . . . . . . . . . . 116.07

Div Yield-D. . . . . . . . . . . . . . 8.06

Div Yield-G. . . . . . . . . . . . . 14.04

Energy-Growth . . . . . . . . . . 6.02

Energy-Income . . . . . . . . . . 6.79

Equity-D. . . . . . . . . . . . . . . 22.85

Equity-G. . . . . . . . . . . . . . . 24.87

ETSP-D. . . . . . . . . . . . . . . . . 9.53

ETSP-G. . . . . . . . . . . . . . . . 20.40

ILF-D. . . . . . . . . . . . . . . . . . . 5.88

ILF-G. . . . . . . . . . . . . . . . . . . 5.88

Index Select-D. . . . . . . . . . 11.00

Index Select-G . . . . . . . . . 25.10

Infra-D . . . . . . . . . . . . . . . . 12.45

Infra-G . . . . . . . . . . . . . . . . 20.22

Infras Adv-D . . . . . . . . . . . . 5.51

Infras Adv-G . . . . . . . . . . . . 5.51

Leadership Eq - D. . . . . . . . 8.22

Leadership Eq - G. . . . . . . . 8.22

Long Term Adv-II-D . . . . . . 7.19

Long Term Adv-II-G . . . . . . 7.19

LTA - D . . . . . . . . . . . . . . . . . 6.17

LTA - G . . . . . . . . . . . . . . . . . 6.17

Mahila Unit Sch . . . . . . . . 29.98

Master Eq Unit Sch . . . . . 27.89

Master Gr 93-D . . . . . . . . . 25.76

Master Gr 93-G . . . . . . . . . 29.86

Master Index-D. . . . . . . . . 28.42

Master Index-G. . . . . . . . . 28.42

Master Plus-D. . . . . . . . . . 33.29

Master Plus-G. . . . . . . . . . 43.42

Master Share-D . . . . . . . . 17.39

Master Share-G . . . . . . . . 26.62

Master Value-D. . . . . . . . . 10.76

Master Value-G. . . . . . . . . 18.76

Mid Cap-D . . . . . . . . . . . . . 10.41

Mid Cap-G . . . . . . . . . . . . . 12.32

MNC UGS 10000-D . . . . . . 16.85

MNC UGS 10000-G . . . . . . 25.08

Nifty Index-D. . . . . . . . . . . . 8.95

Nifty Index-G. . . . . . . . . . . 17.57

Oppr-D . . . . . . . . . . . . . . . . . 7.60

Oppr-G . . . . . . . . . . . . . . . . 11.63

Pharma Health-G . . . . . . . 17.62

Pharma Health-Income. . 14.40

Ret Benefit Pension . . . . . 17.74

Services Inds-G. . . . . . . . . 27.95

Services Inds-Income . . . 13.08

Spread - D . . . . . . . . . . . . . 11.49

Spread - G . . . . . . . . . . . . . 12.35

STI-D. . . . . . . . . . . . . . . . . . 10.92

STI-G . . . . . . . . . . . . . . . . . 14.13

Unit Linked Insurance . . . 13.27

Variable Inv Sch-D . . . . . . . 8.46

Variable Inv Sch-G . . . . . . 11.24

Wealth Builder-D . . . . . . . . 7.55

Wealth Builder-G . . . . . . . . 7.55

NAVs as on 08/12/2008

Source: www.amfiindia.com

Insurance Schemes

Bajaj Allianz Life

Accel Midcap Pens. . . . . . . 8.21

Accelerator Midcap . . . . . . 8.25

Asset Allocation . . . . . . . . . 8.54

Asset Allocation Pension. . 8.27

Bond . . . . . . . . . . . . . . . . . 12.33

Bond Pension . . . . . . . . . . 12.54

Cap Guar2012 . . . . . . . . . . 10.27

Cap Guar2014 . . . . . . . . . . 10.04

Cap Guar2017 . . . . . . . . . . . 9.63

Capital Shield-I. . . . . . . . . 10.12

Capital Shield-II . . . . . . . . . 9.99

Eq Growth Pension. . . . . . . 8.15

Eq Index II . . . . . . . . . . . . . 9.03

Eq Index Pension II . . . . . . 8.85

Equity Growth . . . . . . . . . . 8.28

Family Gain Pure Eq. . . . . 10.54

Life Long Gain . . . . . . . . . 11.40

Liquid . . . . . . . . . . . . . . . . 12.32

Liquid Pension . . . . . . . . . 12.30

Premier Bond . . . . . . . . . . 11.73

Premier Eq Index . . . . . . . . 8.63

Premier Equity Gr. . . . . . . . 7.77

Pure Stock . . . . . . . . . . . . 10.13

Pure Stock Pension . . . . . . 7.08

UG Bal+ . . . . . . . . . . . . . . . 14.64

UG Bal+ Pension. . . . . . . . 13.98

UG Balanced . . . . . . . . . . . 12.70

UG Cash . . . . . . . . . . . . . . 12.87

UG Debt . . . . . . . . . . . . . . 12.31

UG Eq Midcap. . . . . . . . . . 13.68

UG Equity . . . . . . . . . . . . . 13.06

UG Equity Gain . . . . . . . . . 17.60

UG Premier Bal . . . . . . . . . 11.05

UG Premier Debt . . . . . . . 12.30

UG Premier Eq Gain . . . . . . 9.48

UG Premier Equity . . . . . . . 9.57

UGP Cash+ . . . . . . . . . . . . 13.68

UGP Cash+ Pens. . . . . . . . 13.63

UGP Debt+ . . . . . . . . . . . . 13.07

UGP Debt+ Pens. . . . . . . . 13.39

UGP Eq Index . . . . . . . . . . 16.73

UGP Eq Index Pens. . . . . . 14.70

UGP Eq Midcap+ . . . . . . . 14.45

UGP Eq Midcap+ Pens. . . 15.64

UGP Eq+ Pension . . . . . . . 16.34

UGP Equity+ . . . . . . . . . . . 18.26

HDFC Standard Life

Bond Opportunities . . . . . 11.10

Group - Balanced . . . . . . . 42.12

Group - Defensive. . . . . . . 34.68

Group - Growth. . . . . . . . . 59.84

Group - Liquid. . . . . . . . . . 28.11

Group - Secure . . . . . . . . . 26.94

Group-Sovereign. . . . . . . . 25.19

Group-Stable. . . . . . . . . . . 27.66

Large-Cap . . . . . . . . . . . . . . 6.64

Life - Bal. . . . . . . . . . . . . . . 32.02

Life - Defensive. . . . . . . . . 29.90

Life - Equity. . . . . . . . . . . . 33.48

Life - Growth. . . . . . . . . . . 37.29

Life - Liquid . . . . . . . . . . . . 27.71

Life - Secure . . . . . . . . . . . 26.31

Life-Balanced-II . . . . . . . . . 6.74

Life-Defensive-II . . . . . . . . . 9.05

Life-Equity-II . . . . . . . . . . . . 5.42

Life-Growth-II . . . . . . . . . . . 4.48

Life-Liquid-II . . . . . . . . . . . 10.75

Life-Secure-II. . . . . . . . . . . 10.78

Life-Sovereign. . . . . . . . . . 25.05

Life-Stable. . . . . . . . . . . . . 27.91

Life-Stable-II . . . . . . . . . . . 10.69

Manager’s Fund . . . . . . . . . 8.28

Mid-Cap. . . . . . . . . . . . . . . . 6.58

Money Plus . . . . . . . . . . . . 10.58

Pension - Bal. . . . . . . . . . . 30.69

Pension - Defensive . . . . . 27.19

Pension - Equity . . . . . . . . 31.13

Pension - Growth . . . . . . . 35.65

Pension - Liquid . . . . . . . . 27.78

Pension - Secure. . . . . . . . 25.92

Pension-Balanced-II. . . . . . 9.23

Pension-Defensive-II . . . . . 9.75

Pension-Equity-II . . . . . . . . 7.80

Pension-Growth-II . . . . . . . 8.29

Pension-Liquid-II . . . . . . . 10.17

Pension-Secure-II. . . . . . . 10.60

Pension-Sovereign . . . . . . 25.12

Pension-Stable . . . . . . . . . 27.89

Pension-Stable-II . . . . . . . 10.19

ICICI Prudential Life

Balancer IV . . . . . . . . . . . . . 9.52

Cap Guar Balanced - II. . . 11.16

Cap Guar Debt - II. . . . . . . 12.22

Cap Guar Growth-II . . . . . . 9.43

Cash Plus. . . . . . . . . . . . . . 13.74

CGST Debt - II . . . . . . . . . . 11.67

Flexi Balanced IV . . . . . . . . 8.33

Flexi Growth IV. . . . . . . . . . 6.65

Group Leave Encash-Bal . 10.01

Group Leave Encash-Inc . 10.75

Group Leave Encash-ST. . 10.62

Grp Growth. . . . . . . . . . . . 19.17

Grp Balanced . . . . . . . . . . 17.34

Grp Cap Guar ST Debt . . . 13.59

Grp Debt . . . . . . . . . . . . . . 14.41

Grp ST Debt . . . . . . . . . . . 14.07

Grp Cap Guar Bal. . . . . . . 12.49

Grp Cap Guar Debt . . . . . 13.13

L.InvestShield Cash . . . . 13.13

L.InvestShield Gold . . . . 13.98

L.InvestShield Life . . . . . 13.98

L.InvestShield Pens . . . . . 13.97

L.Link Balancer . . . . . . . . 23.99

L.Link Balancer II . . . . . . . 15.81

L.Link Maximir-Gr II . . . . . 19.05

L.Link Maximr-Gr . . . . . . . 34.83

L.Link Pe Balancer . . . . . . 22.77

L.Link Pe Balancer II. . . . . 16.39

L.Link Pe Maximr-Gr II. . . 19.63

L.Link Pe Preserver-ST. . . 13.76

L.Link Pe Protecr-Inc . . . . 15.65

L.Link Pe Protecr-Inc II. . . 13.15

L.Link Pes Maximr-Gr. . . . 34.48

L.Link Preserver-ST . . . . . 13.81

L.Link Protector-Inc . . . . . 17.39

L.Link Protector-Inc II . . . 13.12

L.Link Sup Balancer III. . . . 8.81

L.Link Sup Maximr-Gr III . 10.27

L.Link Sup Pens Rich-II . . . 6.99

L.Link Sup Preserver III . . 12.28

L.Link Sup Protecr-Inc III. 11.09

L.Link Sup Rich-III. . . . . . . . 7.11

L.Stage Pension Rich . . . . . 6.96

L.Stage Rich-IV . . . . . . . . . . 7.13

L.Stg Pension Balancer . . 22.77

L.Stg Pension Flexi Bal. . . . 9.62

L.Stg Pension Flexi G . . . . . 7.40

L.Stg Pension Maximiser. 34.48

L.Stg Pension Preserver . 13.76

L.Stg Pension Protector. . 15.65

L.Time Balancer . . . . . . . . 23.99

L.Time Balancer II. . . . . . . 15.81

L.Time Maximiser-Gr . . . . 34.83

L.Time Maximiser-Gr II . . 19.05

L.Time Pe Balancer. . . . . . 22.77

L.Time Pe Balancer II . . . . 16.39

L.Time Pe Maximr-Gr . . . . 34.48

L.Time Pe Maximr-Gr II . . 19.63

L.Time Pe Preserver-ST . . 13.76

L.Time Pe Protecr-Inc. . . . 15.65

L.Time Pe Protecr-Inc II . . 13.15

L.Time Preserver-ST. . . . . 13.81

L.Time Protector-Inc. . . . . 17.39

L.Time Protector-Inc II . . . 13.12

Link Flexi - G . . . . . . . . . . . . 7.71

Link Flexi - G II . . . . . . . . . . 7.80

Link Flexi Balance. . . . . . . . 9.11

Link Flexi Balance - II. . . . . 9.39

Link Pension Flexi Bal . . . . 9.62

Link Pension FlexI Gr . . . . . 7.40

Link Pension FlexI Gr II . . . 7.50

Link Sup.Pen.Flexi Bal -II. . 9.63

Link Super Flexi - G III . . . . 7.68

Link Super Flexi Bal - III. . . 9.05

LT Gold Balancer . . . . . . . 23.99

LT Gold Balancer-II. . . . . . 15.81

LT Gold Balancer-III . . . . . 11.09

LT Gold Balancer-IV . . . . . . 9.52

LT Gold Flexi Bal. . . . . . . . . 9.11

LT Gold Flexi Bal-II . . . . . . . 9.39

LT Gold Flexi Bal-III. . . . . . . 9.05

LT Gold Flexi Bal-IV . . . . . . 8.33

LT Gold Flexi Growth . . . . . 7.71

LT Gold Flexi Growth-II . . . 7.80

LT Gold Flexi Growth-III. . . 7.68

LT Gold Flexi Growth-IV. . . 6.65

LT Gold Multiplier. . . . . . . . 5.28

LT Gold Pens-Multi II . . . . . 5.90

LT Gold Pens-Multi IV . . . . 5.87

LT Gold Preserver(ST) . . . 13.81

LT Gold Preserver-III . . . . 12.49

LT Gold Preserver-IV . . . . 11.17

LT Gold Protec IV . . . . . . . 11.30

LT Gold Protec(Income). . 17.39

LT Gold Protec(Income)II 13.12

LT Gold Protec(Income)III12.28

LT Gold Rich . . . . . . . . . . . . 7.09

LT Gold-Multiplier II . . . . . . 5.86

LT Gold-Multiplier III . . . . . 5.81

LT Gold-Multiplier IV . . . . . 5.83

LT Plus Rich II . . . . . . . . . . . 7.14

LT Sup Pens Rich-II. . . . . . . 6.99

Maximiser IV. . . . . . . . . . . . 6.78

New Inv-Balance. . . . . . . . 11.26

New InvestShield Bal. . . . 12.49

Premier L.Gold Rich-II . . . . 7.14

Premier Life Pens Rich-II. . 6.99

Preserver IV . . . . . . . . . . . 11.17

Protector IV. . . . . . . . . . . . 11.30

Secure Plus . . . . . . . . . . . . 13.60

Secure Plus Pension. . . . . 13.37

Smartkid New RP Rich-II. . 7.14

Smartkid New SP Rich-II. . 7.14

Kotak Life

11M-FMP-(06/10/2009) . . 10.12

36M FMP(02/01/2011) . . . 10.63

36M FMP(28/03/09) . . . . . 10.57

36M-FMP(12/09/11). . . . . 10.40

60M-FMP(27/11/2013). . . 10.35

Advantage Fund . . . . . . . . 11.21

Advantage Multiplier . . . 10.73

Advantage Multiplier-II . . 10.73

Advantage Plus . . . . . . . . 10.83

Advantage Plus-II. . . . . . . 10.90

Aggressive Growth. . . . . . 17.87

Aggressive-G. . . . . . . . . . . 11.27

Dynamic Balanced . . . . . . 20.52

Dynamic Bond. . . . . . . . . . 13.89

Dynamic Floating Rate . . 13.16

Dynamic Floor. . . . . . . . . . 12.71

Dynamic Gilt . . . . . . . . . . . 14.26

Dynamic Growth. . . . . . . . 22.34

Group Balanced . . . . . . . . 20.56

Group Bond. . . . . . . . . . . . 13.97

Group Floating Rate . . . . 13.35

Group Gilt . . . . . . . . . . . . . 14.48

Group Growth . . . . . . . . . . . 8.23

Group Money Market. . . . 15.18

Guar. Floating Rate . . . . . 13.18

Guar. Money Mkt . . . . . . . 15.27

Guaranteed Balanced . . . 20.86

Guaranteed Bond. . . . . . . 13.92

Guaranteed Gilt . . . . . . . . 14.29

Guaranteed Growth . . . . . 23.41

Opportunities . . . . . . . . . . 10.32

Pension Balanced. . . . . . . 21.35

Pension Bond . . . . . . . . . . 13.86

Pension Floating Rate . . . 13.22

Pension Gilt. . . . . . . . . . . . 14.53

Life Insurance Corpn

^Bima + Balanced . . . . . . 25.90

^Bima + Risk. . . . . . . . . . . 30.64

^Bima + Secured . . . . . . . 22.85

^Child Fortune Plus Bal . . 10.06

^Child Fortune Plus Bond 10.06

^Child Fortune Plus Secu. 10.05

^Child Fortune Plus-G . . . 10.05

^Fortune Plus Balanced. . . 8.22

^Fortune Plus Bond . . . . . 11.15

^Fortune Plus Growth . . . . 7.53

^Fortune Plus Secured. . . . 9.17

^Future + Balanced . . . . . 13.51

^Future + Bond. . . . . . . . . 12.60

^Future + Growth . . . . . . . 14.69

^Future + Income. . . . . . . 13.85

^Gratuity Plus Bal. . . . . . . 10.51

^Gratuity Plus Bond. . . . . 11.21

^Gratuity Plus Growth . . . 10.50

^Gratuity Plus Inc. . . . . . . 11.95

^Health Plus . . . . . . . . . . . . 9.24

^Jeevan + Balanced . . . . 11.60

^Jeevan + Bond . . . . . . . . 11.76

^Jeevan + Growth . . . . . . 13.45

^Jeevan + Secured . . . . . 12.28

^Market + Balanced . . . . 10.26

^Market + Bond . . . . . . . . 13.01

^Market + Growth . . . . . . . 9.14

^Market + Secured . . . . . 11.11

^Market Plus-I Bal . . . . . . . 9.13

^Market Plus-I Bond. . . . . 10.45

^Market Plus-I Growth. . . . 9.02

^Market Plus-I Secured. . . 9.62

^Money Plus Balanced . . . 9.76

^Money Plus Bond . . . . . . 11.80

^Money Plus Growth . . . . . 7.50

^Money Plus Secured . . . 10.60

^Money Plus-I Bal. . . . . . . 10.16

^Money Plus-I Bond. . . . . 11.03

^Money Plus-I Growth. . . . 8.68

^Money Plus-I Secured . . 10.40

^Profit Plus Balanced. . . . . 8.14

^Profit Plus Bond . . . . . . . 11.08

^Profit Plus Growth . . . . . . 7.21

^Profit Plus Secured. . . . . . 8.38

Max NY Life

Dynamic Opportunities . . . 8.36

Group Gratuity-Bal. . . . . . 11.45

Group Gratuity-Cons . . . . 11.92

Group Gratuity-Growth . . 10.18

Growth Super . . . . . . . . . . . 7.75

Guaranteed Dynamic. . . . 11.11

Guaranteed Income. . . . . 10.98

High Growth . . . . . . . . . . . . 6.37

Life Maker Inv - Bal . . . . . 15.70

Life Maker Inv - Cons. . . . 14.39

Life Maker Inv - Gr . . . . . . 18.34

Life Maker Inv - Secure . . 13.15

Life Maker Pens - Bal. . . . 11.80

Life Maker Pens - Cons . . 11.95

Life Maker Pens - Gr . . . . 10.93

Life Mkr Pens - Secure. . . 12.12

Pension Growth Super. . . . 5.17

Superannuation Bal . . . . . 11.74

Superannuation Cons . . . 10.00

Superannuation Growth . 10.00

Met Life

Accelerator . . . . . . . . . . . . 14.15

Balancer . . . . . . . . . . . . . . 13.63

Moderator . . . . . . . . . . . . . 13.06

Multiplier. . . . . . . . . . . . . . 13.77

Preserver. . . . . . . . . . . . . . 12.59

Protector . . . . . . . . . . . . . . 12.35

Virtue. . . . . . . . . . . . . . . . . . 6.07

Reliance Life

AIP - A . . . . . . . . . . . . . . . . . 7.06

AIP - B . . . . . . . . . . . . . . . . . 8.55

AIP - C . . . . . . . . . . . . . . . . 10.18

AIP - Corporate Bond. . . . 11.26

AIP - Equity . . . . . . . . . . . . . 6.27

AIP - Gilt. . . . . . . . . . . . . . . 11.06

AIP - Money Market. . . . . 11.30

AIP Energy. . . . . . . . . . . . . . 6.29

AIP Infrastructure. . . . . . . . 6.35

AIP Midcap . . . . . . . . . . . . . 5.62

AIP Pure Equity. . . . . . . . . . 6.29

GG - Balanced. . . . . . . . . . 10.37

GG - Capital Secure . . . . . 11.65

GG - Growth . . . . . . . . . . . . 9.14

GG-Corporate Bond . . . . . 10.35

GG-Money Market . . . . . . 10.20

GG-Pure debt . . . . . . . . . . 10.34

GLE-Corporate Bond . . . . 10.81

GLE-Equity. . . . . . . . . . . . . . 4.74

GLE-Gilt . . . . . . . . . . . . . . . 10.90

GLE-Money Market . . . . . 11.01

GLE-Pure Debt. . . . . . . . . . 10.35

GSA - Balanced. . . . . . . . . 13.13

GSA-Capital Secure . . . . . 10.62

GSA-Growth. . . . . . . . . . . . . 7.72

GSA-Money Market . . . . . 10.15

GSA-Pure Debt . . . . . . . . . 10.31

GYP - Balanced. . . . . . . . . 13.28

GYP - Capital Secure . . . . 12.84

GYP - Equity . . . . . . . . . . . . 7.34

GYP - Growth . . . . . . . . . . 10.73

GYP Energy . . . . . . . . . . . . . 6.29

GYP Infrastructure. . . . . . . 6.35

GYP Midcap. . . . . . . . . . . . . 5.62

GYP Pure Equity . . . . . . . . . 6.29

MGP - D . . . . . . . . . . . . . . . . 9.54

MGP - E . . . . . . . . . . . . . . . . 9.06

MGP - F . . . . . . . . . . . . . . . . 8.74

MGP - Return Shield. . . . . 11.24

MRP - Balanced . . . . . . . . 13.27

MRP - Capital Secure. . . . 12.80

MRP - Equity . . . . . . . . . . . 14.86

MRP - Growth . . . . . . . . . . 13.50

MRP Energy. . . . . . . . . . . . . 6.29

MRP Infrastructure . . . . . . 6.35

MRP Midcap . . . . . . . . . . . . 5.62

MRP Pure Equity. . . . . . . . . 6.29

SAIP-A . . . . . . . . . . . . . . . . . 7.06

SAIP-B . . . . . . . . . . . . . . . . . 8.55

SAIP-C . . . . . . . . . . . . . . . . 10.18

SAIP-Corporate Bond. . . . 11.26

SAIP-Energy . . . . . . . . . . . . 6.29

SAIP-Equity . . . . . . . . . . . . . 6.27

SAIP-Gilt. . . . . . . .

M

M M

M

w

M

M M

M

M M

M

M

M

M

M

M M

M M M

M

M

M M

M

M M

W

W

W M

W

W

W

W

W

W

W M M

m

w

w

M M

M M

N E T A S S E T V A L U E S O F M U T U A L F U N D & N S U R A N C E S C H E M E S

S heme NAV R S heme NAV R S heme NAV R S heme NAV R S heme NAV R S heme NAV R S heme NAV R S heme NAV R S heme NAV R S heme NAV R S heme NAV R S heme NAV R S heme NAV R S heme NAV R S heme NAV R S heme NAV R

Compan De P e Chng % P e %

q de q hng R Chng

REC

Un e h

HD

GVK Powe n a

a p a a h A o

nd abu Rea

Ma an Pha ma

H nda o nd

D h TV

A ho e and

Se a Goa

Su on Ene g

Re an e Comm

Bha A e

Me a o ne

dea Ce u a

nd a n o ne

SA

D

Ta a Mo o

DEL VERY SP KE OVER PREV OUS DAY

Dec 05 2008 Dec 08 2008 Dec 10 2008

Company T aded De NSE T aded De NSE T aded De NSE

q y % p ce q y % p ce q y % p ce

ABB 548528 31 23 441 30 654993 42 26 460 65 704084 47 37 468 10

Bha A e 3491577 25 48 664 80 5139568 34 26 701 25 6670650 51 49 735 80

Ca n nd a 3563117 44 80 133 85 6069181 40 76 142 85 6338897 56 01 150 10

DLF 21424265 11 57 203 45 27812298 17 31 221 55 37625952 16 29 262 90

G a m nd 206780 58 02 949 15 307358 63 14 961 80 543722 45 35 1099 55

HDFC Bank 2498864 23 34 890 30 3004748 49 60 898 00 3690949 53 01 923 75

H nda co nd 8795593 32 33 49 85 12427203 36 51 50 75 17264427 40 44 53 75

nda S ee 878752 35 50 815 60 986338 45 61 826 55 1404210 45 30 905 20

L & T 3683145 17 87 729 10 4312976 24 15 739 15 5147624 30 56 779 80

Lanco n a ech 3445104 18 70 116 85 3559336 22 87 124 85 6203066 17 16 144 70

Re ance Powe 4437132 14 64 106 15 5159794 19 61 109 65 5345016 20 87 113 15

SA L 18871834 18 33 66 20 20607105 30 41 68 75 34065077 22 40 79 55

Ta a Comm 249098 10 85 411 95 327789 13 82 436 65 951927 27 70 496 85

Ta a Powe 654425 12 74 669 70 846697 34 06 687 05 1262331 41 50 734 65

W p o 1465695 27 46 227 30 2062305 27 21 238 40 2085271 37 42 261 30

R S NG VOLUME R S NG DEL VERY AND R S NG PR CE

Dec 05 2008 Dec 08 2008 Dec 10 2008

Company T aded De NSE T aded De NSE T aded De NSE

q y % p ce q y % p ce q y % p ce

ABG Sh pya d 59018 55 92 85 95 64482 62 74 85 35 184257 81 85 81 80

Am ek nd a 208821 58 05 19 45 233692 78 44 18 80 292261 70 67 18 35

C & C Con uc 14408 62 81 109 00 19343 52 93 108 00 28686 88 64 107 55

G enma k Pha ma 455886 45 05 312 60 761068 62 08 281 35 2214138 42 61 262 90

God e Con 17406 75 09 125 60 76290 88 99 121 35 169910 97 99 119 40

HT Med a 15508 70 51 72 50 253675 99 73 69 70 309252 98 71 67 25

ndu nd Bank 308894 43 52 33 00 355804 42 93 32 20 819243 50 34 31 60

OL Chem & Pha 6426 50 58 106 65 36335 60 95 106 50 36999 77 40 102 30

K o ka B o 5067 89 56 75 10 7501 90 84 75 05 43785 99 74 74 80

Kou on Re a 14974 82 46 511 15 17966 92 36 508 95 25852 85 34 498 80

Pan a oon Re a 61999 66 15 210 40 93914 72 06 210 00 186205 91 83 209 55

P ama Hea h 9004 38 07 214 15 22314 82 31 209 45 87995 85 77 208 95

P aka h nd 51015 78 87 37 15 79568 81 35 37 00 224215 66 72 35 15

Ro a 1385661 36 63 144 50 2319944 44 49 133 60 3392550 41 12 130 60

Texmaco 4300 89 19 623 00 7174 92 17 613 35 30568 98 71 611 90

Though he e s a se n vo ume he a ng sha e p ce nd ca es genu ne se ng

One can e he go sho o ge ou be ow he ow o h ee days

A ka Me a Kha En e p e B 60 63 153 31

A ka Me a Man ukh S ock B oke B 54 98 137 83

A ka Me a Man ukh S ock B oke S 54 98 138 68

Ank Me a Anand Yoge h Sha e S 210 25 16 75

Ank Me a Lo u G oba nve men B 500 00 16 74

Eu o Ce am c P a k K Shah B 150 00 37 22

nda D ng Odd And Even T ade S 140 00 236 29

Koh no Food Temp a on Food B 300 00 77 00

Lum na e Techn Robo o T ad ng S 192 00 3 67

Rank n So u yo h G S 27 20 54 36

RFL n Un ve a C ed S 180 00 1 06

R e h P o& nd Bhanwa La Moha a S 46 93 14 65

# ave age p ce quan y n 000

BULK DEALS ON BSE