How pocket-friendly will GST be for you and us?

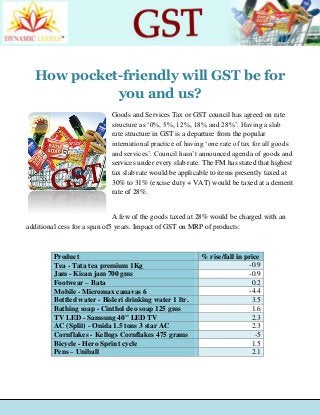

- 1. How pocket-friendly will GST be for you and us? Goods and Services Tax or GST council has agreed on rate structure as ‘0%, 5%, 12%, 18% and 28%’. Having a slab rate structure in GST is a departure from the popular international practice of having ‘one rate of tax for all goods and services’. Council hasn’t announced agenda of goods and services under every slab rate. The FM has stated that highest tax slab rate would be applicable to items presently taxed at 30% to 31% (excise duty + VAT) would be taxed at a demerit rate of 28%. A few of the goods taxed at 28% would be charged with an additional cess for a span of5 years. Impact of GST on MRP of products: Product % rise/fall in price Tea - Tata tea premium 1Kg -0.9 Jam - Kisan jam 700 gms -0.9 Footwear – Bata 0.2 Mobile - Micromax canavas 6 -4.4 Bottled water - Bisleri drinking water 1 ltr. 3.5 Bathing soap - Cinthol deo soap 125 gms 1.6 TV LED - Samsung 40" LED TV 2.3 AC (Split) - Onida 1.5 tons 3 star AC 2.3 Cornflakes - Kellogs Cornflakes 475 grams -5 Bicycle - Hero Sprint cycle 1.5 Pens – Uniball 2.1

- 2. Impact of GST on manufactured/imported consumer goods: Today, excise duty, CVD and CST aren’t available as set off against CST or VAT on sale of goods. This cascading effect of tax isn’t likely to carry on in GST. Most of the goods would be taxed at nearest tax slab, after GST. Entry tax and duty levied on goods won’t be levied in GST. For goods which are categorized under ‘5%, 12% and 18%’ slab rates, effective tax cost might be lesser against current tax regime. Goods where combined rate of excise duty and VAT is 30-31%, the effective rate under the current regime is lesser than 28%. Therefore, subjecting these goods in GST would increase the prices of goods. Impact of GST on services: Cascading effect of VAT, CST, entry tax, duty and additional customs duty won’t exist in GST. Most services are likely to be costlier because of increase in tax rate. But, impact may not be as high as 3% (from current service tax of 15%) if the service providers pass on savings on account of higher tax credits. All services will be taxed at a standard rate of 18%. Industry welcomes new GST rates; Aam aadmi's grocery bill may not rise: AAM AADMI KA BOJH: The aam aadmi’s grocery bill may not rise as the GST Council decided to exempt food items or keep majority at the lowest rate of 5 per cent. More than 50 per cent of the items in the CPI - Consumer Price Index basket would be exempted

- 3. under the GST and the remaining placed in the lowest bracket. The exempted items will not have the advantage of input tax credit. Oil, soaps, shaving kits, small cars and other goods consumed by the middle-class, which faces higher tax incidence of 30-31 per cent encompassing state and central taxes, could become cheaper since they are to be placed in the lower tax slab of 18 per cent and not the equivalent tax slab of 28 per cent. Sports utility vehicles, pan masala and tobacco products, aerated drinks, are to witness any change in their overall tax burden with a novel cess proposed on them. Tobacco currently draws a total tax of about 65 per cent while for aerated drinks, the current rate is about 40 per cent. These goods will be taxed at the highest rate of 28 per cent and topped up with a levy to raise the effective tax. Related Articles: GST Tax Structure- on screen and off screen impacts ITC Relieved From the Hang-Over of GST Tax Structure

- 4. Disclaimer The investment advice or guidance provided by way of recommendations, reports or other ways are solely the personal views of the research team. Users are advised to use the data for the purpose of information and rely on their own judgment while making investment decision. Dynamic Equities Pvt. Ltd - SEBI Investment Advisory Reg. No.: INA300002022 Disclosure Dynamic Equities Pvt. Ltd. is a member of NSE, BSE, MCX SX and a DP with NSDL & CDSL. It is also engaged in Investment Advisory Services and Portfolio Management Services. Dynamic Commodities Pvt. Ltd., associate company, is a member of MCX & NCDEX. We declare that our activities were neither suspended nor we have defaulted with any stock exchange authority with whom we are registered. SEBI, Exchanges and Depositories have conducted the routine inspection and based on their observations have issued advise letters or levied minor penalty on for certain operational deviations. Answers to the Best of our knowledge and belief of Dynamic/ its Associates/ Research Analyst: DYNAMIC/its Associates/ Research Analyst/ his Relative: Do not have any financial interest / any actual/beneficial ownership in the subject company. Do not have any other material conflict of interest at the time of publication of the research report Have not received any compensation from the subject company in the past twelve months Have not managed or co-managed public offering of securities for the subject company. Have not received any compensation for brokerage services or any products / services or any compensation or other benefits from the subject company, nor engaged in market making activity for the subject company Have not served as an officer, director or employee of the subject company Article Written by Salman Hashmi