Fdc economic bulletin - November 9, 2015

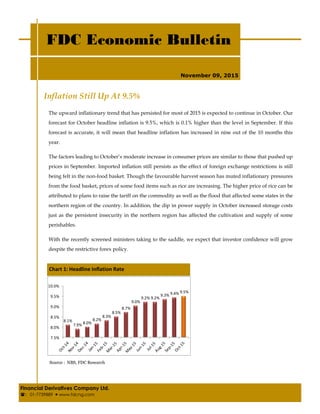

- 1. Inflation Still Up At 9.5% FDC Economic Bulletin Financial Derivatives Company Ltd. : 01-7739889 www.fdcng.com November 09, 2015 The upward inflationary trend that has persisted for most of 2015 is expected to continue in October. Our forecast for October headline inflation is 9.5%, which is 0.1% higher than the level in September. If this forecast is accurate, it will mean that headline inflation has increased in nine out of the 10 months this year. The factors leading to October’s moderate increase in consumer prices are similar to those that pushed up prices in September. Imported inflation still persists as the effect of foreign exchange restrictions is still being felt in the non-food basket. Though the favourable harvest season has muted inflationary pressures from the food basket, prices of some food items such as rice are increasing. The higher price of rice can be attributed to plans to raise the tariff on the commodity as well as the flood that affected some states in the northern region of the country. In addition, the dip in power supply in October increased storage costs just as the persistent insecurity in the northern region has affected the cultivation and supply of some perishables. With the recently screened ministers taking to the saddle, we expect that investor confidence will grow despite the restrictive forex policy. Source : NBS, FDC Research Chart 1: Headline Inflation Rate 8.1% 7.9% 8.0% 8.2% 8.3% 8.5% 8.7% 9.0% 9.2% 9.2% 9.3% 9.4% 9.5% 7.5% 8.0% 8.5% 9.0% 9.5% 10.0%

- 3. Urban prices accelerated in October The FDC Lagos urban inflation index increased to 12.38% in October, up 0.83% from 11.56% in September. This is in line with the rising trend in headline inflation. The y-o-y food index increased to 14.23% from 13.62%, while the y-o-y non-food index also increased to 11.44%, from 10.51% in August. The increase in the urban inflation was driven by the increase in food prices for rice, tomatoes and onions, even though the harvest period muted increases in food prices in general. We expect a further price increases in November as preparations for year end celebrations increase. Inflationary pressures across Sub-Saharan Africa (SSA) Inflation is generally increasing across SSA. Angola’s inflation spiked further to a 3-year high of 11.66% in September from 11.01% in August. The country’s rising inflationary trend has been driven by expensive imports and dwindling oil revenue. Furthermore, Kenya’s inflation rose sharply from 5.97% in September to 6.72% in October, due to inflationary pressures from housing rent, food and clothing. South Africa’s inflation rate was flat at 4.6% in September same as in August. The higher housing rentals in South Africa was offset by a fall in petrol prices. African central banks are utilizing various monetary policy tools to contain inflation. For example, the Central Bank of Angola maintained its interest rate at 10.5% during its policy meeting on 27 October. Angola’s apex bank was compelled to maintain the basic interest rate due to the high level of inflation as FDC Economic Bulletin Page 3 Financial Derivatives Company Ltd. : 01-7739889 www.fdcng.com Source : FDC Research Chart 2: FDC Urban Index -30% -20% -10% 0% 10% 20% 30% 40% 50% 60% Fruits PalmOil Rice Yam Onion MellonSeeds Beans Tomato Vegetables Pepper Paints Toiletries Detergent Cement Rent Kerosene CookingGas TransportationCost Selected Non-Food BasketComponents Selected Food Basket Components

- 5. well as the declining state of its oil industry. The Central Bank of Kenya and the South African Reserve Bank also maintained their interest rates at 11.5% and 6% respectively. Inflation outlook in November We expect headline inflation to increase further in November as preparations for year-end festivities will increase demand for both food and non-food items. This trend is expected to continue until the end of the year due to higher spending during Christmas celebrations. Next MPC meeting The November 23rd/24th MPC meeting is the last MPC meeting of the year, baring any emergency meeting. The Central Bank of Nigeria will have to make critical decisions to steer the country towards growth in 2016. The monetary policy rate will be a key issue since it has been regarded by many as a barrier to achieving economic prosperity. Likely Market Response Interest Rates Given the importance of interest rates to fostering growth, we believe that it will be a key topic of discussion at the MPC meeting; interest rates are more likely to be sensitive to the outcome of the MPC meeting. Additionally, the recent decrease in interest rates due to the suppression of OMO may suggest the CBN’s indirect adoption of an accommodative policy. Exchange Rates The CBN and Federal Government have maintained their positions on defending the naira from any further devaluation despite less favourable terms of trade. We believe that the forex markets will be influenced by any directives from the CBN, the current administration, as well as the position of Nigeria’s external reserves, and is therefore unlikely to react to the inflationary trends. FDC Economic Bulletin Page 5 Financial Derivatives Company Ltd. : 01-7739889 www.fdcng.com

- 6. Stock Market The stock market has reacted negatively to the Q3 2015 results that have been released. We expect the stock market’s plunge to continue just as international investors await new price bottoms. There will more bargain hunting but the market will recover in January. Should the MPC make a decision on interest rates during its meeting, the market will react given the inverse relationship between interest rates and stock prices. FDC Economic Bulletin Page 6 Financial Derivatives Company Ltd. : 01-7739889 www.fdcng.com Important Notice This document is issued by Financial Derivatives Company. It is for information purposes only. It does not constitute any offer, recommendation or solicitation to any person to enter into any transaction or adopt any hedging, trading or investment strategy, nor does it constitute any prediction of likely future movements in rates or prices or any representation that any such future movements will not exceed those shown in any illustration. All rates and figures appearing are for illustrative purposes. You are advised to make your own independent judgment with respect to any matter con- tained herein.