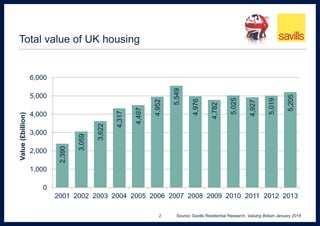

The document analyzes the total value of UK housing stock as of January 2014 according to Savills Residential Research. Some key points:

- The total value of UK housing stock is £5.205 trillion as of 2013, an increase of £186 billion from 2012. London and the Southeast account for 42% of the total value.

- The private rented sector saw the largest growth in value in 2013 at £76 billion and has increased its share of the total housing stock value from 12% in 2003 to 19% in 2013.

- London property values rose dramatically, with the 10 most expensive boroughs increasing £55 billion in value over the past year alone and now worth over £600 billion total.