More Related Content

Similar to RRM Real Money Performance Metrics

Similar to RRM Real Money Performance Metrics (20)

RRM Real Money Performance Metrics

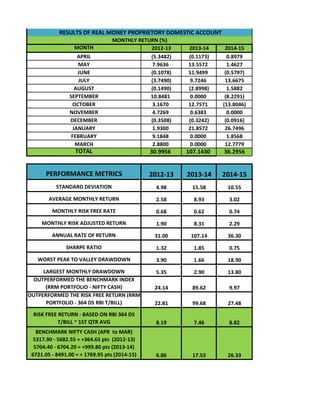

- 1. MONTH 2012-13 2013-14 2014-15

APRIL (5.3482) (0.1173) 0.8979

MAY 7.9636 13.5572 1.4627

JUNE (0.1078) 51.9499 (0.5797)

JULY (3.7490) 9.7246 13.6675

AUGUST (0.1490) (2.8998) 1.5882

SEPTEMBER 10.8481 0.0000 (8.2291)

OCTOBER 3.1670 12.7571 (13.8046)

NOVEMBER 4.7269 0.6383 0.0000

DECEMBER (0.3508) (0.3242) (0.0916)

JANUARY 1.9300 21.8572 26.7496

FEBRUARY 9.1848 0.0000 1.8568

MARCH 2.8800 0.0000 12.7779

TOTAL 30.9956 107.1430 36.2956

PERFORMANCE METRICS 2012-13 2013-14 2014-15

STANDARD DEVIATION 4.98 15.58 10.55

AVERAGE MONTHLY RETURN 2.58 8.93 3.02

MONTHLY RISK FREE RATE 0.68 0.62 0.74

MONTHLY RISK ADJUSTED RETURN 1.90 8.31 2.29

RESULTS OF REAL MONEY PROPRIETORY DOMESTIC ACCOUNT

MONTHLY RETURN (%)

MONTHLY RISK ADJUSTED RETURN 1.90 8.31 2.29

ANNUAL RATE OF RETURN 31.00 107.14 36.30

SHARPE RATIO 1.32 1.85 0.75

WORST PEAK TO VALLEY DRAWDOWN 3.90 1.66 18.90

LARGEST MONTHLY DRAWDOWN 5.35 2.90 13.80

OUTPERFORMED THE BENCHMARK INDEX

(RRM PORTFOLIO - NIFTY CASH) 24.14 89.62 9.97

OUTPERFORMED THE RISK FREE RETURN (RRM

PORTFOLIO - 364 DS RBI T/BILL) 22.81 99.68 27.48

RISK FREE RETURN - BASED ON RBI 364 DS

T/BILL ~ 1ST QTR AVG 8.19 7.46 8.82

BENCHMARK NIFTY CASH (APR to MAR)

5317.90 - 5682.55 = +364.65 pts (2012-13)

5704.40 - 6704.20 = +999.80 pts (2013-14)

6721.05 - 8491.00 = + 1769.95 pts (2014-15) 6.86 17.53 26.33