Ch 5 final seas factors

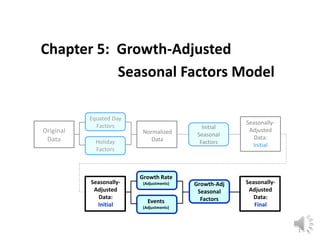

- 1. Chapter 5: Growth-Adjusted 1 Seasonal Factors Model Original Data Equated Day Factors Holiday Factors Normalized Data Initial Seasonal Factors Seasonally- Adjusted Data: Initial Seasonally- Adjusted Data: Initial Growth Rate (Adjustments) Events (Adjustments) Seasonally- Adjusted Data: Final Growth-Adj Seasonal Factors

- 2. Growth-Adjusted Seasonal Factors Model 2 This chapter will walk through the model structure that will be used to arrive at the growth-adjusted seasonal factors. 1. Introduction 2. Inputs 3. Calc 4. Trend 1. Introduction – why growth-adjust? 2. Model Structure: Inputs 3. Model Structure: Calc 4. Model Structure: Trend Introduction

- 3. Growth-Adjusted Seasonal Factors Model Jan Jan Dec Jan Dec Dec Dec is much higher than Jan each year due to GROWTH, not to seasonality. XYZ Sales – with Growth WITH Growth Year 1 Year 2 Year 3 3 Growth is removed so the seasonality measure only captures seasonality, nothing else. 1. Introduction 2. Inputs 3. Calc 4. Trend

- 4. Growth-Adjusted Seasonal Factors Model Jan Dec Dec is much higher than Jan each year due to GROWTH, not to seasonality. XYZ Sales – with & without Growth WITH Growth WITHOUT Growth Without Growth, the “true” seasonal pattern is more obvious. Year 1 Year 2 Year 3 Jan Dec 4 Removing growth reveals the “true” relationship between January and December (& all other months). 1. Introduction 2. Inputs 3. Calc 4. Trend

- 5. Growth-Adjusted Seasonal Factors Model Sep Year 1 Year 2 Year 3 Seasonal pattern can be further skewed if Events are included. XYZ Sales – with & without Growth & Events WITH Growth & Event WITHOUT Growth & Event Adjusting for Events as well as Growth reveals seasonal pattern. New product lifts sales in Sep by 15% WITH Growth only 5 Adjustments need to be made for events as well. 1. Introduction 2. Inputs 3. Calc 4. Trend

- 6. Growth-Adjusted Seasonal Factors Model 6 After adjusting for growth & events, the “true” underlying seasonal pattern emerges. 1. Introduction 2. Inputs 3. Calc 4. Trend Seasonality: Without Growth Adjustment Seasonality: With Growth Adjustment

- 7. Growth-Adjusted Seasonal Factors Model 7 The Excel model for developing the growth-adjusted seasonal factors, and for estimating trend, has three parts. 1. Data Inputs (“Inputs” tab) 2. Calculations (“Calc” tab) 3. Trend Estimate (“Trend” tab) 1. Introduction 2. Inputs 3. Calc 4. Trend

- 8. Growth-Adjusted Seasonal Factors Model 8 The “Inputs” tab contains all the key information drawn from other files that will be used to estimate trend. 1 2 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 197 198 199 200 201 202 203 204 249 250 251 279 A B C D E F Key Inputs Linked to diff file Actuals No. of Days Norm Factor Normalized Data Jan-01 27.844 21.7 1.05 26.510 Feb-01 21.631 19.1 0.92 23.459 Mar-01 27.970 22.0 1.07 26.229 Apr-01 25.529 19.7 0.95 26.799 May-01 24.568 21.9 1.06 23.175 Jun-01 24.674 21.0 1.02 24.284 Jul-01 23.878 19.8 0.96 24.883 Aug-01 23.591 22.8 1.10 21.354 Sep-01 25.417 15.0 0.72 35.098 Oct-01 30.229 22.6 1.09 27.692 Nov-01 26.672 20.4 0.99 27.054 Dec-01 25.506 17.8 0.86 29.529 Jan-02 29.943 21.3 1.03 29.056 Feb-02 26.255 19.1 0.92 28.474Jan-16 29.393 19.5 0.94 31.219Feb-16 29.857 20.0 0.97 30.918Mar-16 29.947 21.8 1.06 28.373Apr-16 26.183 21.0 1.02 25.739May-16 25.757 20.8 1.01 25.606Jun-16 30.123 22.0 1.06 28.334 Jul-16 22.328 19.9 0.96 23.217 Aug-16 23.490 23.0 1.11 21.141 Sep-16 25.282 20.8 1.01 25.100 Oct-16 22.795 20.5 0.99 22.964 Nov-16 22.000 20.4 0.99 22.307 Dec-16 22.000 19.0 0.92 23.878 Jan-17 0.000 20.4 0.99 0.000 Feb-17 0.000 19.0 0.92 0.000Jan-20 0.000 21.4 1.03 0.000Feb-20 0.000 19.0 0.92 0.000Mar-20 0.000 21.9 1.06 0.000Apr-20 0.000 20.8 1.01 0.000May-20 0.000 19.8 0.96 0.000Jun-20 0.000 21.9 1.06 0.000Jul-20 0.000 22.0 1.07 0.000Aug-20 0.000 20.9 1.01 0.000Sep-20 0.000 20.8 1.01 0.000Oct-20 0.000 21.6 1.05 0.000 Nov-20 0.000 19.3 0.93 0.000 Dec-20 0.000 19.3 0.94 0.000 Jan-21 0.000 0.0 0.00 0.000 TrendModel: Inputs Update with data thru Dec 2016 1. Introduction 2. Inputs 3. Calc 4. Trend Model Structure: Inputs

- 9. Growth-Adjusted Seasonal Factors Model 9 The “Inputs” tab also brings in the seasonal factors – the initial factors already developed, and the growth-adjusted factors to be developed in the model. 1 2 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 197 198 199 200 201 202 203 204 249 250 251 279 A B C D E F G H I J Key Inputs Linked to diff file Actuals No. of Days Norm Factor Normalized Data None Initial Growth- Adjusted Jan-01 27.844 21.7 1.05 26.510 1.00 1.00 1.03 Feb-01 21.631 19.1 0.92 23.459 1.00 0.96 0.98 Mar-01 27.970 22.0 1.07 26.229 1.00 1.00 1.01 Apr-01 25.529 19.7 0.95 26.799 1.00 0.99 1.01 May-01 24.568 21.9 1.06 23.175 1.00 0.99 1.00 Jun-01 24.674 21.0 1.02 24.284 1.00 1.02 1.03 Jul-01 23.878 19.8 0.96 24.883 1.00 0.98 0.97 Aug-01 23.591 22.8 1.10 21.354 1.00 0.93 0.89 Sep-01 25.417 15.0 0.72 35.098 1.00 1.00 1.01 Oct-01 30.229 22.6 1.09 27.692 1.00 1.02 1.02 Nov-01 26.672 20.4 0.99 27.054 1.00 1.03 1.00 Dec-01 25.506 17.8 0.86 29.529 1.00 1.07 1.06 Jan-02 29.943 21.3 1.03 29.056 Feb-02 26.255 19.1 0.92 28.474Jan-16 29.393 19.5 0.94 31.219Feb-16 29.857 20.0 0.97 30.918Mar-16 29.947 21.8 1.06 28.373Apr-16 26.183 21.0 1.02 25.739May-16 25.757 20.8 1.01 25.606Jun-16 30.123 22.0 1.06 28.334 Jul-16 22.328 19.9 0.96 23.217 Aug-16 23.490 23.0 1.11 21.141 Sep-16 25.282 20.8 1.01 25.100 Oct-16 22.795 20.5 0.99 22.964 Nov-16 22.000 20.4 0.99 22.307 Dec-16 22.000 19.0 0.92 23.878 Jan-17 0.000 20.4 0.99 0.000 Feb-17 0.000 19.0 0.92 0.000Jan-20 0.000 21.4 1.03 0.000Feb-20 0.000 19.0 0.92 0.000Mar-20 0.000 21.9 1.06 0.000Apr-20 0.000 20.8 1.01 0.000May-20 0.000 19.8 0.96 0.000Jun-20 0.000 21.9 1.06 0.000Jul-20 0.000 22.0 1.07 0.000Aug-20 0.000 20.9 1.01 0.000Sep-20 0.000 20.8 1.01 0.000Oct-20 0.000 21.6 1.05 0.000 Nov-20 0.000 19.3 0.93 0.000 Dec-20 0.000 19.3 0.94 0.000 Jan-21 0.000 0.0 0.00 0.000 Seasonal Factors TrendModel: Inputs Update with data thru Dec 2016 1. Introduction 2. Inputs 3. Calc 4. Trend

- 10. Growth-Adjusted Seasonal Factors Model 10 The “Calc” tab is where all the calculations are performed. Except for updating monthly data, this tab need never be touched. TrendModel: Calc 1 2 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 197 198 199 200 201 202 203 204 205 A B C D E F G H I J K L M N O P Q R S T U Calculations Unit: 1 In Use (1 = None; 2 = Initial; 3 = Final) : 2 Start: 25.000 Actuals Adjust- ments Adjusted Actuals Normalization Factors Normalized Data None Initial Revised In Use Seasonally- Adjusted: Monthly Seasonally- Adjusted: 3- Mo Avg Growth Rate 1-Time Events Estimated Trend Estimated Trend Values Extrapolated Trend Extrapolated Trend Values (= Forecast) Estimated (& Forecast) Trend Actual (& Forecast) Values Estimate vs Actual: Diff Jan-01 27.844 27.844 1.05 26.510 1.00 1.00 1.03 1.00 26.406 25.412 2.0% 0.0% 25.000 26.362 25.000 27.844 (2.844) Feb-01 21.631 21.631 0.92 23.459 1.00 0.96 0.97 0.96 24.418 25.666 2.0% 0.0% 25.042 22.184 25.042 21.631 3.411 Mar-01 27.970 27.970 1.07 26.229 1.00 1.00 1.01 1.00 26.174 25.849 2.0% 0.0% 25.083 26.805 25.083 27.970 (2.887) Apr-01 25.529 25.529 0.95 26.799 1.00 0.99 1.01 0.99 26.954 25.517 2.0% 0.0% 25.125 23.797 25.125 25.529 (0.404) May-01 24.568 24.568 1.06 23.175 1.00 0.99 1.00 0.99 23.424 24.712 2.0% 0.0% 25.167 26.397 25.167 24.568 0.599 Jun-01 24.674 24.674 1.02 24.284 1.00 1.02 1.02 1.02 23.756 24.153 2.0% 0.0% 25.209 26.183 25.209 24.674 0.535 Jul-01 23.878 23.878 0.96 24.883 1.00 0.98 0.97 0.98 25.279 24.015 2.0% 0.0% 25.251 23.852 25.251 23.878 1.373 Aug-01 23.591 23.591 1.10 21.354 1.00 0.93 0.89 0.93 23.011 27.767 2.0% 0.0% 25.293 25.930 25.293 23.591 1.702 Sep-01 25.417 25.417 0.72 35.098 1.00 1.00 1.01 1.00 35.011 28.406 2.0% 30.0% 32.936 23.911 32.936 25.417 7.519 Oct-01 30.229 30.229 1.09 27.692 1.00 1.02 1.02 1.02 27.195 29.510 2.0% -20.0% 26.393 29.337 26.393 30.229 (3.836) Nov-01 26.672 26.672 0.99 27.054 1.00 1.03 1.00 1.03 26.326 27.069 2.0% 0.0% 26.437 26.784 26.437 26.672 (0.235) Dec-01 25.506 25.506 0.86 29.529 1.00 1.07 1.07 1.07 27.685 27.651 2.0% 0.0% 26.481 24.396 26.481 25.506 0.975 Jan-02 29.943 29.943 1.03 29.056 1.00 1.00 1.03 1.00 28.941 28.754 2.0% 0.0% 26.525 27.443 26.525 29.943 (3.418)Feb-02 26.255 26.255 0.92 28.474 1.00 0.96 0.97 0.96 29.637 28.775 2.0% 0.0% 26.569 23.537 26.569 26.255 0.314Mar-02 26.743 26.743 0.96 27.806 1.00 1.00 1.01 1.00 27.747 28.260 2.0% 0.0% 26.613 25.650 26.613 26.743 (0.130)Apr-02 28.761 28.761 1.06 27.239 1.00 0.99 1.01 0.99 27.397 27.017 2.0% 0.0% 26.658 27.985 26.658 28.761 (2.103)May-02 27.152 27.152 1.06 25.632 1.00 0.99 1.00 0.99 25.908 28.461 2.0% 0.0% 26.702 27.984 26.702 27.152 (0.450)Jun-02 31.740 31.740 0.97 32.791 1.00 1.02 1.02 1.02 32.079 33.049 2.0% 0.0% 26.747 26.464 26.747 31.740 (4.993)Jul-02 41.499 41.499 1.02 40.516 1.00 0.98 0.97 0.98 41.160 34.472 1.0% 0.0% 26.769 26.989 26.769 41.499 (14.730)Aug-02 29.511 29.511 1.05 28.003 1.00 0.93 0.89 0.93 30.177 33.477 1.0% 0.0% 26.791 26.200 26.791 29.511 (2.719)Sep-02 28.180 28.180 0.97 29.168 1.00 1.00 1.01 1.00 29.095 31.102 1.0% 0.0% 26.813 25.971 26.813 28.180 (1.367)Oct-02 38.061 38.061 1.10 34.657 1.00 1.02 1.02 1.02 34.034 31.178 1.0% 0.0% 26.836 30.011 26.836 38.061 (11.225)Nov-02 29.087 29.087 0.93 31.245 1.00 1.03 1.00 1.03 30.404 30.700 1.0% 0.0% 26.858 25.695 26.858 29.087 (2.229)Dec-02 26.205 26.205 0.89 29.503 1.00 1.07 1.07 1.07 27.660 29.293 1.0% 0.0% 26.881 25.466 26.881 26.205 0.676 Jul-16 22.328 22.328 0.96 23.217 1.00 0.98 0.97 0.98 23.585 24.695 1.0% 0.0% 30.790 29.149 30.790 22.328 6.821 Aug-16 23.490 23.490 1.11 21.141 1.00 0.93 0.89 0.93 22.782 23.801 1.0% 0.0% 30.815 31.773 30.815 23.490 8.283 Sep-16 25.282 25.282 1.01 25.100 1.00 1.00 1.01 1.00 25.037 23.457 1.0% 0.0% 30.841 31.143 30.841 25.282 5.861 Oct-16 22.795 22.795 0.99 22.964 1.00 1.02 1.02 1.02 22.552 24.850 1.0% 0.0% 30.867 31.200 30.867 22.795 8.405 Nov-16 27.327 27.327 0.99 27.708 1.00 1.03 1.00 1.03 26.963 24.306 1.0% 0.0% 30.892 31.310 30.892 27.327 3.983 Dec-16 23.000 23.000 0.92 24.963 1.00 1.07 1.07 1.07 23.404 25.183 1.0% 0.0% 30.918 30.385 30.918 23.000 7.385 Jan-17 0 0 0.99 0 1.00 1.00 1.03 1.00 1.0% 0.0% 30.944 30.666 30.944 30.666 0 Feb-17 0 0 0.92 0 1.00 0.96 0.97 0.96 1.0% 0.0% 30.970 27.396 30.970 27.396 0 Mar-17 0 0 1.12 0 1.00 1.00 1.01 1.00 1.0% 0.0% 30.996 34.673 30.996 34.673 0 E. Estimate & Actual Seasonal Factors A. Actual & Normalized Data B. Seasonally-Adjusted Data C. Estimated Trend D. Forecasts 1. Introduction 2. Inputs 3. Calc 4. Trend Model Structure: Calc

- 11. Growth-Adjusted Seasonal Factors Model 11 The first part of the “Calc” brings in the original data, allows for adjustments if needed, and calculates the normalized monthly amounts. TrendModel: Calc 1 2 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 197 198 199 200 201 202 203 204 205 A B C D E F Calculations Unit: 1 In Use (1 = None; 2 = Initial; 3 = Final) : Actuals Adjust- ments Adjusted Actuals Normalization Factors Normalized Data Jan-01 27.844 27.844 1.05 26.510 Feb-01 21.631 21.631 0.92 23.459 Mar-01 27.970 27.970 1.07 26.229 Apr-01 25.529 25.529 0.95 26.799 May-01 24.568 24.568 1.06 23.175 Jun-01 24.674 24.674 1.02 24.284 Jul-01 23.878 23.878 0.96 24.883 Aug-01 23.591 23.591 1.10 21.354 Sep-01 25.417 25.417 0.72 35.098 Oct-01 30.229 30.229 1.09 27.692 Nov-01 26.672 26.672 0.99 27.054 Dec-01 25.506 25.506 0.86 29.529 Jan-02 29.943 29.943 1.03 29.056Feb-02 26.255 26.255 0.92 28.474Mar-02 26.743 26.743 0.96 27.806Apr-02 28.761 28.761 1.06 27.239May-02 27.152 27.152 1.06 25.632Jun-02 31.740 31.740 0.97 32.791Jul-02 41.499 41.499 1.02 40.516Aug-02 29.511 29.511 1.05 28.003Sep-02 28.180 28.180 0.97 29.168Oct-02 38.061 38.061 1.10 34.657Nov-02 29.087 29.087 0.93 31.245Dec-02 26.205 26.205 0.89 29.503 Jul-16 22.328 22.328 0.96 23.217 Aug-16 23.490 23.490 1.11 21.141 Sep-16 25.282 25.282 1.01 25.100 Oct-16 22.795 22.795 0.99 22.964 Nov-16 27.327 27.327 0.99 27.708 Dec-16 23.000 23.000 0.92 24.963 Jan-17 0 0 0.99 0 Feb-17 0 0 0.92 0 Mar-17 0 0 1.12 0 A. Actual & Normalized Data 1. Introduction 2. Inputs 3. Calc 4. Trend

- 12. Growth-Adjusted Seasonal Factors Model 12 The next section seasonally-adjusts the data, using one of the 3 sets of seasonal factors. TrendModel: Calc 1 2 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 197 198 199 200 201 202 203 204 205 A B C D E F G H I J K L Calculations Unit: 1 In Use (1 = None; 2 = Initial; 3 = Final) : 2 Actuals Adjust- ments Adjusted Actuals Normalization Factors Normalized Data None Initial Revised In Use Seasonally- Adjusted: Monthly Seasonally- Adjusted: 3- Mo Avg Jan-01 27.844 27.844 1.05 26.510 1.00 1.00 1.03 1.00 26.406 25.412 Feb-01 21.631 21.631 0.92 23.459 1.00 0.96 0.97 0.96 24.418 25.666 Mar-01 27.970 27.970 1.07 26.229 1.00 1.00 1.01 1.00 26.174 25.849 Apr-01 25.529 25.529 0.95 26.799 1.00 0.99 1.01 0.99 26.954 25.517 May-01 24.568 24.568 1.06 23.175 1.00 0.99 1.00 0.99 23.424 24.712 Jun-01 24.674 24.674 1.02 24.284 1.00 1.02 1.02 1.02 23.756 24.153 Jul-01 23.878 23.878 0.96 24.883 1.00 0.98 0.97 0.98 25.279 24.015 Aug-01 23.591 23.591 1.10 21.354 1.00 0.93 0.89 0.93 23.011 27.767 Sep-01 25.417 25.417 0.72 35.098 1.00 1.00 1.01 1.00 35.011 28.406 Oct-01 30.229 30.229 1.09 27.692 1.00 1.02 1.02 1.02 27.195 29.510 Nov-01 26.672 26.672 0.99 27.054 1.00 1.03 1.00 1.03 26.326 27.069 Dec-01 25.506 25.506 0.86 29.529 1.00 1.07 1.07 1.07 27.685 27.651 Jan-02 29.943 29.943 1.03 29.056 1.00 1.00 1.03 1.00 28.941 28.754Feb-02 26.255 26.255 0.92 28.474 1.00 0.96 0.97 0.96 29.637 28.775Mar-02 26.743 26.743 0.96 27.806 1.00 1.00 1.01 1.00 27.747 28.260Apr-02 28.761 28.761 1.06 27.239 1.00 0.99 1.01 0.99 27.397 27.017May-02 27.152 27.152 1.06 25.632 1.00 0.99 1.00 0.99 25.908 28.461Jun-02 31.740 31.740 0.97 32.791 1.00 1.02 1.02 1.02 32.079 33.049Jul-02 41.499 41.499 1.02 40.516 1.00 0.98 0.97 0.98 41.160 34.472Aug-02 29.511 29.511 1.05 28.003 1.00 0.93 0.89 0.93 30.177 33.477Sep-02 28.180 28.180 0.97 29.168 1.00 1.00 1.01 1.00 29.095 31.102Oct-02 38.061 38.061 1.10 34.657 1.00 1.02 1.02 1.02 34.034 31.178Nov-02 29.087 29.087 0.93 31.245 1.00 1.03 1.00 1.03 30.404 30.700Dec-02 26.205 26.205 0.89 29.503 1.00 1.07 1.07 1.07 27.660 29.293 Jul-16 22.328 22.328 0.96 23.217 1.00 0.98 0.97 0.98 23.585 24.695 Aug-16 23.490 23.490 1.11 21.141 1.00 0.93 0.89 0.93 22.782 23.801 Sep-16 25.282 25.282 1.01 25.100 1.00 1.00 1.01 1.00 25.037 23.457 Oct-16 22.795 22.795 0.99 22.964 1.00 1.02 1.02 1.02 22.552 24.850 Nov-16 27.327 27.327 0.99 27.708 1.00 1.03 1.00 1.03 26.963 24.306 Dec-16 23.000 23.000 0.92 24.963 1.00 1.07 1.07 1.07 23.404 25.183 Jan-17 0 0 0.99 0 1.00 1.00 1.03 1.00 Feb-17 0 0 0.92 0 1.00 0.96 0.97 0.96 Mar-17 0 0 1.12 0 1.00 1.00 1.01 1.00 Seasonal Factors A. Actual & Normalized Data B. Seasonally-Adjusted Data 1. Introduction 2. Inputs 3. Calc 4. Trend

- 13. Growth-Adjusted Seasonal Factors Model 13 The 3rd section estimates the data trend, using the Growth Rates and Events that will be estimated in the “Trend” tab. TrendModel: Calc 1 2 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 197 198 199 200 201 202 203 204 205 A E F G H I J K L M N O P Calculations1 In Use (1 = None; 2 = Initial; 3 = Final) : 2 Start: 25.000 Normalization Factors Normalized Data None Initial "Final" In Use Seasonally- Adjusted: Monthly Seasonally- Adjusted: 3- Mo Avg Growth Rate 1-Time Events Estimated Trend Estimated Trend Values Jan-01 1.05 26.510 1.00 1.00 1.03 1.00 26.406 25.412 2.0% 0.0% 25.042 26.406 Feb-01 0.92 23.459 1.00 0.96 0.97 0.96 24.418 25.666 2.0% 0.0% 25.083 22.221 Mar-01 1.07 26.229 1.00 1.00 1.01 1.00 26.174 25.849 2.0% 0.0% 25.125 26.849 Apr-01 0.95 26.799 1.00 0.99 1.01 0.99 26.954 25.517 2.0% 0.0% 25.167 23.836 May-01 1.06 23.175 1.00 0.99 1.00 0.99 23.424 24.712 2.0% 0.0% 25.209 26.441 Jun-01 1.02 24.284 1.00 1.02 1.02 1.02 23.756 24.153 2.0% 0.0% 25.251 26.226 Jul-01 0.96 24.883 1.00 0.98 0.97 0.98 25.279 24.015 2.0% 0.0% 25.293 23.892 Aug-01 1.10 21.354 1.00 0.93 0.89 0.93 23.011 27.767 2.0% 0.0% 25.335 25.973 Sep-01 0.72 35.098 1.00 1.00 1.01 1.00 35.011 28.406 2.0% 30.0% 32.991 23.950 Oct-01 1.09 27.692 1.00 1.02 1.02 1.02 27.195 29.510 2.0% -20.0% 26.437 29.386 Nov-01 0.99 27.054 1.00 1.03 1.00 1.03 26.326 27.069 2.0% 0.0% 26.481 26.829 Dec-01 0.86 29.529 1.00 1.07 1.07 1.07 27.685 27.651 2.0% 0.0% 26.525 24.437 Jan-02 1.03 29.056 1.00 1.00 1.03 1.00 28.941 28.754 2.0% 0.0% 26.569 27.489Feb-02 0.92 28.474 1.00 0.96 0.97 0.96 29.637 28.775 2.0% 0.0% 26.613 23.576Mar-02 0.96 27.806 1.00 1.00 1.01 1.00 27.747 28.260 2.0% 0.0% 26.658 25.693Apr-02 1.06 27.239 1.00 0.99 1.01 0.99 27.397 27.017 2.0% 0.0% 26.702 28.032May-02 1.06 25.632 1.00 0.99 1.00 0.99 25.908 28.461 2.0% 0.0% 26.747 28.031Jun-02 0.97 32.791 1.00 1.02 1.02 1.02 32.079 33.049 2.0% 0.0% 26.791 26.508Jul-02 1.02 40.516 1.00 0.98 0.97 0.98 41.160 34.472 1.0% 0.0% 26.813 27.034Aug-02 1.05 28.003 1.00 0.93 0.89 0.93 30.177 33.477 1.0% 0.0% 26.836 26.244Sep-02 0.97 29.168 1.00 1.00 1.01 1.00 29.095 31.102 1.0% 0.0% 26.858 26.014Oct-02 1.10 34.657 1.00 1.02 1.02 1.02 34.034 31.178 1.0% 0.0% 26.881 30.061Nov-02 0.93 31.245 1.00 1.03 1.00 1.03 30.404 30.700 1.0% 0.0% 26.903 25.738Dec-02 0.89 29.503 1.00 1.07 1.07 1.07 27.660 29.293 1.0% 0.0% 26.925 25.509 Jul-16 0.96 23.217 1.00 0.98 0.97 0.98 23.585 24.695 1.0% 0.0% 30.841 29.197 Aug-16 1.11 21.141 1.00 0.93 0.89 0.93 22.782 23.801 1.0% 0.0% 30.867 31.826 Sep-16 1.01 25.100 1.00 1.00 1.01 1.00 25.037 23.457 1.0% 0.0% 30.892 31.195 Oct-16 0.99 22.964 1.00 1.02 1.02 1.02 22.552 24.850 0.0% 0.0% 30.892 31.226 Nov-16 0.99 27.708 1.00 1.03 1.00 1.03 26.963 24.306 0.0% 0.0% 30.892 31.310 Dec-16 0.92 24.963 1.00 1.07 1.07 1.07 23.404 25.183 0.0% 0.0% 30.892 30.359 Jan-17 0.99 0 1.00 1.00 1.03 1.00 0.0% 0.0% Feb-17 0.92 0 1.00 0.96 0.97 0.96 0.0% 2.0% Mar-17 1.12 0 1.00 1.00 1.01 1.00 0.0% 0.0% Seasonal Factors A. Actual & Normalized Data B. Seasonally-Adjusted Data C. Estimated Trend 1. Introduction 2. Inputs 3. Calc 4. Trend

- 14. Growth-Adjusted Seasonal Factors Model 14 The 4th section is the forecast, which takes the estimated trend and extrapolates it using the assumptions for future growth rate & events. TrendModel: Calc 1 2 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 197 198 199 200 201 202 203 204 205 A M N O P Q R Calculations Start: 25.000 Growth Rate 1-Time Events Estimated Trend Estimated Trend Values Extrapolated Trend Extrapolated Trend Values (= Forecast) Jan-01 2.0% 0.0% 25.042 26.406 Feb-01 2.0% 0.0% 25.083 22.221 Mar-01 2.0% 0.0% 25.125 26.849 Apr-01 2.0% 0.0% 25.167 23.836 May-01 2.0% 0.0% 25.209 26.441 Jun-01 2.0% 0.0% 25.251 26.226 Jul-01 2.0% 0.0% 25.293 23.892 Aug-01 2.0% 0.0% 25.335 25.973 Sep-01 2.0% 30.0% 32.991 23.950 Oct-01 2.0% -20.0% 26.437 29.386 Nov-01 2.0% 0.0% 26.481 26.829 Dec-01 2.0% 0.0% 26.525 24.437 Jan-02 2.0% 0.0% 26.569 27.489Feb-02 2.0% 0.0% 26.613 23.576Mar-02 2.0% 0.0% 26.658 25.693Apr-02 2.0% 0.0% 26.702 28.032May-02 2.0% 0.0% 26.747 28.031Jun-02 2.0% 0.0% 26.791 26.508Jul-02 1.0% 0.0% 26.813 27.034Aug-02 1.0% 0.0% 26.836 26.244Sep-02 1.0% 0.0% 26.858 26.014Oct-02 1.0% 0.0% 26.881 30.061Nov-02 1.0% 0.0% 26.903 25.738Dec-02 1.0% 0.0% 26.925 25.509 Jul-16 1.0% 0.0% 30.841 29.197 Aug-16 1.0% 0.0% 30.867 31.826 Sep-16 1.0% 0.0% 30.892 31.195 Oct-16 0.0% 0.0% 30.892 31.226 Nov-16 0.0% 0.0% 30.892 31.310 Dec-16 0.0% 0.0% 30.892 30.359 Jan-17 0.0% 0.0% 30.892 30.614 Feb-17 0.0% 2.0% 31.510 27.874 Mar-17 0.0% 0.0% 31.510 35.249 C. Estimated Trend D. Forecasts 1. Introduction 2. Inputs 3. Calc 4. Trend

- 15. Growth-Adjusted Seasonal Factors Model 15 The 5th & final section picks up the past & projected trend, as well as the past actuals and extrapolated trend values. TrendModel: Calc 1 2 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 197 198 199 200 201 202 203 204 205 A B O P Q R S T U Calculations 25.000 Actuals Estimated Trend Estimated Trend Values Extrapolated Trend Extrapolated Trend Values (= Forecast) Estimated (& Extrapolated) Trend Actual (& Extrapolated) Values Estimate vs Actual: Diff Jan-01 27.844 25.042 26.406 25.042 27.844 (2.802) Feb-01 21.631 25.083 22.221 25.083 21.631 3.452 Mar-01 27.970 25.125 26.849 25.125 27.970 (2.845) Apr-01 25.529 25.167 23.836 25.167 25.529 (0.362) May-01 24.568 25.209 26.441 25.209 24.568 0.641 Jun-01 24.674 25.251 26.226 25.251 24.674 0.577 Jul-01 23.878 25.293 23.892 25.293 23.878 1.415 Aug-01 23.591 25.335 25.973 25.335 23.591 1.745 Sep-01 25.417 32.991 23.950 32.991 25.417 7.574 Oct-01 30.229 26.437 29.386 26.437 30.229 (3.792) Nov-01 26.672 26.481 26.829 26.481 26.672 (0.191) Dec-01 25.506 26.525 24.437 26.525 25.506 1.019 Jan-02 29.943 26.569 27.489 26.569 29.943 (3.374)Feb-02 26.255 26.613 23.576 26.613 26.255 0.358Mar-02 26.743 26.658 25.693 26.658 26.743 (0.085)Apr-02 28.761 26.702 28.032 26.702 28.761 (2.059)May-02 27.152 26.747 28.031 26.747 27.152 (0.405)Jun-02 31.740 26.791 26.508 26.791 31.740 (4.948)Jul-02 41.499 26.813 27.034 26.813 41.499 (14.685)Aug-02 29.511 26.836 26.244 26.836 29.511 (2.675)Sep-02 28.180 26.858 26.014 26.858 28.180 (1.322)Oct-02 38.061 26.881 30.061 26.881 38.061 (11.180)Nov-02 29.087 26.903 25.738 26.903 29.087 (2.184)Dec-02 26.205 26.925 25.509 26.925 26.205 0.720 Jul-16 22.328 30.841 29.197 30.841 22.328 6.869 Aug-16 23.490 30.867 31.826 30.867 23.490 8.336 Sep-16 25.282 30.892 31.195 30.892 25.282 5.913 Oct-16 22.795 30.892 31.226 30.892 22.795 8.431 Nov-16 27.327 30.892 31.310 30.892 27.327 3.983 Dec-16 23.000 30.892 30.359 30.892 23.000 7.359 Jan-17 0 30.892 30.614 30.892 30.614 0 Feb-17 0 31.510 27.874 31.510 27.874 0 Mar-17 0 31.510 35.249 31.510 35.249 0 E. Estimate & ActualA. Actual & Normalized DataC. Estimated Trend D. Forecasts 1. Introduction 2. Inputs 3. Calc 4. Trend Revise Col. U & its explanation. Change next page and start page showing this as well

- 16. Growth-Adjusted Seasonal Factors Model 16 The bottom of the “Calc” tab calculates annual totals for all the columns. TrendModel: Calc 1 2 7 8 9 10 299 300 301 302 303 304 305 306 307 308 309 310 311 312 313 314 315 316 317 318 319 320 A B C D E F G H I J K L M N O P Q R S T U Calculations Unit: 1 In Use (1 = None; 2 = Initial; 3 = Final) : 2 Start: 25.000 Actuals Adjust- ments Adjusted Actuals Normalization Factors Normalized Data None Initial "Final" In Use Seasonally- Adjusted: Monthly Seasonally- Adjusted: 3- Mo Avg Growth Rate 1-Time Events Estimated Trend Estimated Trend Values Extrapolated Trend Extrapolated Trend Values (= Forecast) Estimated (& Extrapolated) Trend Actual (& Extrapolated) Values Estimate vs Actual: Diff Annual Totals 2001 308 0 308 0.983 316 1.000 1.000 1.000 1.000 316 316 2.0% 10.0% 314 306 0 0 314 308 6 2002 363 0 363 0.997 364 1.000 1.000 1.000 1.000 364 365 1.5% 0.0% 321 320 0 0 321 363 (42) 2003 352 0 352 1.000 352 1.000 1.000 1.000 1.000 352 353 1.0% 0.0% 325 325 0 0 325 352 (28) 2004 370 0 370 1.003 370 1.000 1.000 1.000 1.000 369 367 1.0% 0.0% 328 329 0 0 328 370 (42) 2005 415 0 415 1.004 414 1.000 1.000 1.000 1.000 414 416 1.0% 0.0% 331 332 0 0 331 415 (84) 2006 458 0 458 0.997 460 1.000 1.000 1.000 1.000 460 459 1.0% 0.0% 335 334 0 0 335 458 (124) 2007 532 0 532 0.999 531 1.000 1.000 1.000 1.000 533 537 1.0% 0.0% 338 338 0 0 338 532 (194) 2008 660 0 660 1.003 656 1.000 1.000 1.000 1.000 656 650 1.0% 0.0% 342 343 0 0 342 660 (319) 2009 549 0 549 0.999 550 1.000 1.000 1.000 1.000 551 551 1.0% 0.0% 345 344 0 0 345 549 (204) 2010 445 0 445 0.999 445 1.000 1.000 1.000 1.000 446 447 1.0% 0.0% 348 348 0 0 348 445 (96) 2011 384 0 384 1.003 381 1.000 1.000 1.000 1.000 382 381 1.0% 0.0% 352 353 0 0 352 384 (32) 2012 287 0 287 0.998 288 1.000 1.000 1.000 1.000 288 288 1.0% 0.0% 355 354 0 0 355 287 69 2013 261 0 261 0.996 262 1.000 1.000 1.000 1.000 262 262 1.0% 0.0% 359 357 0 0 359 261 98 2014 262 0 262 1.000 262 1.000 1.000 1.000 1.000 262 261 1.0% 0.0% 363 362 0 0 363 262 101 2015 299 0 299 0.999 300 1.000 1.000 1.000 1.000 300 301 1.0% 0.0% 366 366 0 0 366 299 67 2016 315 0 315 1.002 315 1.000 1.000 1.000 1.000 315 315 0.8% 0.0% 370 370 0 0 370 315 55 2017 0 0 0 0.997 0 1.000 1.000 1.000 1.000 0 0 0.0% 2.0% 0 0 378 376 378 376 0 2018 0 0 0 0.999 0 1.000 1.000 1.000 1.000 0 0 0.0% 0.0% 0 0 378 377 378 377 0 2019 0 0 0 0.996 0 1.000 1.000 1.000 1.000 0 0 0.0% 0.0% 0 0 378 376 378 376 0 2020 0 0 0 1.004 0 1.000 1.000 1.000 1.000 0 0 0.0% 0.0% 0 0 378 379 378 379 0 E. Estimate & Actual Seasonal Factors A. Actual & Normalized Data B. Seasonally-Adjusted Data C. Estimated Trend D. Forecasts 1. Introduction 2. Inputs 3. Calc 4. Trend

- 17. Growth-Adjusted Seasonal Factors Model 17 The “Trend” tab is divided into three sections. TrendModel: Trend 1 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 49 50 51 52 53 54 55 56 57 58 59 60 61 62 97 98 99 100 101 102 103 104 105 106 107 108 109 110 111 112 113 114 119 120 121 122 123 124 125 126 127 128 129 130 131 132 133 134 139 140 141 142 143 144 145 146 147 148 149 150 151 152 153 154 155 159 160 161 162 163 164 165 166 167 168 169 170 171 172 173 174 175 179 180 181 182 183 184 185 186 187 188 189 190 191 192 193 194 195 196 199 200 201 202 203 204 205 206 207 208 209 210 211 212 213 214 215 219 220 221 222 223 224 225 226 227 228 229 230 231 232 233 234 235 236 A C D E F G H I J K L M N O P Q R S X Y Z AA AB AC AD AE AF AG AH AI AJ Estimating Trend Seasonal Factors In Use: Initial 2 (1 = None; 2 = Initial; 3 = Final) Growth Rate 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Jan 2.0% 2.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 0.0% Feb 2.0% 2.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 0.0% Mar 2.0% 2.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 0.0% Apr 2.0% 2.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 0.0% May 2.0% 2.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 0.0% Jun 2.0% 2.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 0.0% Jul 2.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 0.0% Aug 2.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 0.0% Sep 2.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 0.0% Oct 2.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 0.0% 0.0% Nov 2.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 0.0% 0.0% Dec 2.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 0.0% 0.0% Start 25.0 Events 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Jan Feb 2.0% Mar Apr May Jun Jul Aug Sep 30.0% Oct -20.0% Nov Dec Actuals vs Estimate by Year 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Actual 307.5 363.1 352.4 369.6 415.1 458.5 532.0 660.3 549.3 444.7 383.9 286.8 260.7 261.9 299.1 315.5 0.0 Est 306.4 319.9 324.8 329.0 332.4 333.5 337.5 342.5 344.5 348.1 352.7 354.4 357.3 362.4 365.8 370.4 376.1 Diff -1.1 -43.2 -27.6 -40.6 -82.7 -125.0 -194.5 -317.8 -204.8 -96.6 -31.2 67.6 96.7 100.5 66.7 54.9 % Diff -0.3% -11.9% -7.8% -11.0% -19.9% -27.3% -36.6% -48.1% -37.3% -21.7% -8.1% 23.6% 37.1% 38.4% 22.3% 17.4% Total 2001-16 YTD Actual 6,260 315.5 Est 5,482 370.4 Diff (779) 54.9 % Diff -12.4% 17.4% Seasonal Factors Normalized Data 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Jan 26.5 29.1 29.9 34.2 33.2 39.6 38.3 58.1 46.4 35.6 33.2 24.7 22.0 20.7 24.5 31.2 0.0 Feb 23.5 28.5 27.5 30.6 33.0 37.5 40.0 47.0 54.6 35.5 31.8 24.4 22.2 22.1 23.2 30.9 0.0 Mar 26.2 27.8 29.9 30.7 35.6 35.9 43.9 55.7 61.8 33.2 31.9 24.8 22.4 22.1 24.1 28.4 0.0 Apr 26.8 27.2 29.6 31.9 35.8 37.2 40.2 43.9 53.5 41.0 27.8 24.6 22.2 21.8 22.6 25.7 0.0 May 23.2 25.6 31.0 31.5 32.2 41.5 41.3 42.5 52.6 54.4 28.5 26.4 21.9 19.4 21.8 25.6 0.0 Jun 24.3 32.8 31.5 27.1 32.1 41.4 45.0 50.5 43.7 43.5 30.0 26.4 26.0 21.1 24.6 28.3 0.0 Jul 24.9 40.5 30.2 29.3 31.5 38.7 49.0 60.5 38.4 36.5 27.3 24.5 20.5 19.2 23.0 23.2 0.0 Aug 21.4 28.0 25.1 25.9 30.6 33.3 55.4 44.6 41.2 32.0 43.6 20.2 19.1 17.8 27.5 21.1 0.0 Sep 35.1 29.2 29.7 27.7 36.1 37.3 40.3 70.1 42.8 32.2 35.0 23.9 21.8 21.4 27.8 25.1 0.0 Oct 27.7 34.7 30.0 32.9 40.7 39.1 41.6 75.7 41.4 33.9 34.5 20.2 20.8 26.7 26.4 23.0 0.0 Nov 27.1 31.2 27.8 32.4 36.4 40.4 52.2 57.3 35.2 33.9 29.6 23.1 20.3 22.4 25.2 27.7 0.0 Dec 29.5 29.5 29.6 35.2 36.8 38.2 44.1 50.2 38.1 33.7 27.6 24.7 23.0 27.6 28.9 25.0 0.0 Growth Rate (Monthly Basis) 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Jan 0.2% 0.2% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.0% Feb 0.2% 0.2% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 2.0% Mar 0.2% 0.2% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.0% Apr 0.2% 0.2% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.0% May 0.2% 0.2% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.0% Jun 0.2% 0.2% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.0% Jul 0.2% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.0% Aug 0.2% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.0% Sep 30.2% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.0% Oct -19.9% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.0% 0.0% Nov 0.2% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.0% 0.0% Dec 0.2% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.0% 0.0% Cumulative Growth Rate 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Jan 0.2% 0.2% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.0% Feb 0.3% 0.3% 0.2% 0.2% 0.2% 0.2% 0.2% 0.2% 0.2% 0.2% 0.2% 0.2% 0.2% 0.2% 0.2% 0.2% 2.0% Mar 0.5% 0.5% 0.3% 0.3% 0.3% 0.3% 0.3% 0.3% 0.3% 0.3% 0.3% 0.3% 0.3% 0.3% 0.3% 0.3% 2.0% Apr 0.7% 0.7% 0.3% 0.3% 0.3% 0.3% 0.3% 0.3% 0.3% 0.3% 0.3% 0.3% 0.3% 0.3% 0.3% 0.3% 2.0% May 0.8% 0.8% 0.4% 0.4% 0.4% 0.4% 0.4% 0.4% 0.4% 0.4% 0.4% 0.4% 0.4% 0.4% 0.4% 0.4% 2.0% Jun 1.0% 1.0% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% 2.0% Jul 1.2% 1.1% 0.6% 0.6% 0.6% 0.6% 0.6% 0.6% 0.6% 0.6% 0.6% 0.6% 0.6% 0.6% 0.6% 0.6% 2.0% Aug 1.3% 1.2% 0.7% 0.7% 0.7% 0.7% 0.7% 0.7% 0.7% 0.7% 0.7% 0.7% 0.7% 0.7% 0.7% 0.7% 2.0% Sep 32.0% 1.3% 0.8% 0.8% 0.8% 0.8% 0.8% 0.8% 0.8% 0.8% 0.8% 0.8% 0.8% 0.8% 0.8% 0.8% 2.0% Oct 5.7% 1.3% 0.8% 0.8% 0.8% 0.8% 0.8% 0.8% 0.8% 0.8% 0.8% 0.8% 0.8% 0.8% 0.8% 0.8% 2.0% Nov 5.9% 1.4% 0.9% 0.9% 0.9% 0.9% 0.9% 0.9% 0.9% 0.9% 0.9% 0.9% 0.9% 0.9% 0.9% 0.8% 2.0% Dec 6.1% 1.5% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 0.8% 2.0% Avg 4.6% 0.9% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% 1.8% Indexed Cumulative Growth 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Jan 0.96 0.99 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 0.98 Feb 0.96 0.99 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 Mar 0.96 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 Apr 0.96 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 May 0.96 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 Jun 0.97 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 Jul 0.97 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 Aug 0.97 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 Sep 1.26 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 Oct 1.01 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 Nov 1.01 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 Dec 1.01 1.01 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 Avg 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 Growth-Adjusted Normalized Data 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Jan 27.7 29.3 30.1 34.3 33.3 39.8 38.5 58.3 46.7 35.8 33.3 24.8 22.1 20.8 24.6 31.3 0.0 Feb 24.5 28.6 27.6 30.7 33.1 37.6 40.1 47.2 54.8 35.6 31.9 24.5 22.3 22.2 23.3 31.0 0.0 Mar 27.3 27.9 30.0 30.8 35.7 36.0 44.0 55.9 61.9 33.3 32.0 24.9 22.4 22.1 24.2 28.4 0.0 Apr 27.9 27.3 29.7 32.0 35.9 37.2 40.3 44.0 53.6 41.1 27.9 24.6 22.2 21.8 22.6 25.8 0.0 May 24.1 25.7 31.0 31.5 32.2 41.5 41.4 42.6 52.6 54.5 28.6 26.4 21.9 19.4 21.9 25.6 0.0 Jun 25.2 32.8 31.5 27.2 32.1 41.5 45.1 50.6 43.7 43.6 30.0 26.4 26.0 21.1 24.6 28.3 0.0 Jul 25.7 40.5 30.2 29.3 31.5 38.6 49.0 60.4 38.4 36.5 27.2 24.5 20.5 19.2 23.0 23.2 0.0 Aug 22.1 27.9 25.1 25.9 30.6 33.2 55.4 44.6 41.1 32.0 43.6 20.2 19.0 17.8 27.4 21.1 0.0 Sep 27.8 29.1 29.7 27.6 36.0 37.2 40.2 70.0 42.7 32.1 34.9 23.9 21.7 21.3 27.8 25.0 0.0 Oct 27.4 34.5 29.9 32.8 40.6 39.0 41.5 75.5 41.2 33.8 34.4 20.2 20.7 26.6 26.4 22.9 0.0 Nov 26.7 31.1 27.7 32.3 36.3 40.3 52.0 57.1 35.0 33.7 29.5 23.0 20.3 22.3 25.1 27.6 0.0 Dec 29.1 29.3 29.5 35.0 36.7 38.0 43.9 50.0 37.9 33.6 27.5 24.6 22.9 27.5 28.7 24.9 0.0 Avg 26.3 30.3 29.3 30.8 34.5 38.3 44.3 54.7 45.8 37.1 31.7 24.0 21.8 21.8 25.0 26.3 0.0 0.2% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% Growth-Adjusted Normalized Data: Factored Max Permitted Standard Deviations: 2.0 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Avg Std Dev Low High Wtd Avg Jan 1.05 0.97 1.03 1.11 0.97 1.04 0.87 1.07 1.02 0.96 1.05 1.03 1.01 0.95 0.98 1.19 1.02 0.07 0.87 1.17 1.03 Feb 0.93 0.94 0.94 1.00 0.96 0.98 0.91 0.86 1.20 0.96 1.01 1.02 1.02 1.02 0.93 1.18 0.99 0.09 0.81 1.17 0.97 Mar 1.04 0.92 1.02 1.00 1.03 0.94 0.99 1.02 1.35 0.90 1.01 1.04 1.03 1.01 0.97 1.08 1.02 0.10 0.82 1.22 1.01 Apr 1.06 0.90 1.01 1.04 1.04 0.97 0.91 0.81 1.17 1.11 0.88 1.03 1.02 1.00 0.91 0.98 0.99 0.09 0.80 1.17 1.01 May 0.91 0.85 1.06 1.02 0.93 1.08 0.93 0.78 1.15 1.47 0.90 1.10 1.00 0.89 0.88 0.98 1.00 0.16 0.67 1.32 1.00 Jun 0.96 1.08 1.07 0.88 0.93 1.08 1.02 0.92 0.95 1.17 0.95 1.10 1.19 0.97 0.99 1.08 1.02 0.09 0.84 1.20 1.02 Jul 0.98 1.33 1.03 0.95 0.91 1.01 1.11 1.11 0.84 0.98 0.86 1.02 0.94 0.88 0.92 0.88 0.98 0.12 0.74 1.23 0.97 Aug 0.84 0.92 0.86 0.84 0.89 0.87 1.25 0.82 0.90 0.86 1.37 0.84 0.87 0.81 1.10 0.80 0.93 0.17 0.59 1.26 0.89 Sep 1.06 0.96 1.01 0.90 1.04 0.97 0.91 1.28 0.93 0.87 1.10 0.99 0.99 0.98 1.11 0.95 1.00 0.10 0.80 1.21 1.01 Oct 1.04 1.14 1.02 1.07 1.18 1.02 0.94 1.38 0.90 0.91 1.08 0.84 0.95 1.22 1.06 0.87 1.04 0.14 0.75 1.32 1.02 Nov 1.02 1.03 0.95 1.05 1.05 1.05 1.17 1.04 0.76 0.91 0.93 0.96 0.93 1.02 1.01 1.05 1.00 0.09 0.81 1.18 1.00 Dec 1.11 0.97 1.00 1.14 1.06 0.99 0.99 0.91 0.83 0.90 0.87 1.02 1.05 1.26 1.15 0.95 1.01 0.11 0.79 1.24 1.07 Avg 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 0.11 0.78 1.22 1.00 Data Accepted? 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Total Jan 1 1 1 1 1 1 0 1 1 1 1 1 1 1 1 0 Feb 1 1 1 1 1 1 1 1 0 1 1 1 1 1 1 0 Mar 1 1 1 1 1 1 1 1 0 1 1 1 1 1 1 1 Apr 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 May 1 1 1 1 1 1 1 1 1 0 1 1 1 1 1 1 Jun 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 Jul 1 0 1 1 1 1 1 1 1 1 1 1 1 1 1 1 Aug 1 1 1 1 1 1 1 1 1 1 0 1 1 1 1 1 Sep 1 1 1 1 1 1 1 0 1 1 1 1 1 1 1 1 Oct 1 1 1 1 1 1 1 0 1 1 1 1 1 1 1 1 Nov 1 1 1 1 1 1 1 1 0 1 1 1 1 1 1 1 Dec 1 1 1 1 1 1 1 1 1 1 1 1 1 0 1 1 OK? 1 0 1 1 1 1 0 0 0 0 0 1 1 0 1 0 8 Use Std Dev? 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 Seasonal Factor Weights 1 0 1 1 1 1 0 0 0 0 0 1 1 0 1 0 0 8 Accepted Range 022.0 24.0 26.0 28.0 30.0 32.0 34.0 36.0 38.0 40.0 Jan-01 Jan-02 Jan-03 Jan-04 Sales Volumes (Billions) NYSE Monthly Sales Volumes Seasonally-Adjusted Actual (& Extrapolated) Values Seasonally-Adjusted: Monthly Seasonally-Adjusted: 3-Mo Avg 0.70 0.80 0.90 1.00 1.10 1.20 1.30 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Seasonal Factors Final Initial Low High Trend Estimates Seasonal Factors Calculation Chart 1. Introduction 2. Inputs 3. Calc 4. Trend Model Structure: Trend

- 18. Growth-Adjusted Seasonal Factors Model 1 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 49 50 51 52 53 54 55 56 57 58 59 60 61 62 A C D E F G H I J K L M N O P Q R S X Estimating Trend Growth Rate 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Jan 2.0% 2.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 0.0% Feb 2.0% 2.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 0.0% Mar 2.0% 2.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 0.0% Apr 2.0% 2.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 0.0% May 2.0% 2.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 0.0% Jun 2.0% 2.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 0.0% Jul 2.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 0.0% Aug 2.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 0.0% Sep 2.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 0.0% Oct 2.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 0.0% 0.0% Nov 2.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 0.0% 0.0% Dec 2.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 0.0% 0.0% Start 25.0 Events 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Jan Feb 2.0% Mar Apr May Jun Jul 10.0% Aug Sep 30.0% Oct -20.0% Nov Dec Actuals vs Estimate by Year 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Actual 307.5 363.1 352.4 369.6 415.1 458.5 532.0 660.3 549.3 444.7 383.9 286.8 260.7 261.9 299.1 315.5 0.0 Est 306.4 336.0 357.3 361.9 365.6 366.9 371.3 376.8 378.9 382.9 387.9 389.9 393.1 398.7 402.4 407.4 413.8 Diff -1.1 -27.1 4.9 -7.7 -49.4 -91.6 -160.8 -283.5 -170.4 -61.8 4.1 103.1 132.4 136.8 103.3 91.9 % Diff -0.3% -7.5% 1.4% -2.1% -11.9% -20.0% -30.2% -42.9% -31.0% -13.9% 1.1% 35.9% 50.8% 52.2% 34.5% 29.1% Total 2001-16 YTD Actual 6,260 315.5 Est 5,983 407.4 Diff (277) 91.9 % Diff -4.4% 29.1% 22.0 24.0 26.0 28.0 30.0 32.0 34.0 36.0 38.0 40.0 18 The “Estimating Trend” section is the steering wheel for the model; it’s where you insert your monthly estimates of the growth rate and events. TrendModel: Trend Growth Rates Events Starting Point Actuals vs Estimate Model Structure: Trend Estimates 1. Introduction 2. Inputs 3. Calc 4. Trend

- 19. Growth-Adjusted Seasonal Factors Model 1 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 49 50 51 52 53 54 55 56 57 58 59 60 61 62 A C D E F Estimating Trend Growth Rate 2001 2002 2003 2004 Jan 2.0% 2.0% 1.0% 1.0% Feb 2.0% 2.0% 1.0% 1.0% Mar 2.0% 2.0% 1.0% 1.0% Apr 2.0% 2.0% 1.0% 1.0% May 2.0% 2.0% 1.0% 1.0% Jun 2.0% 2.0% 1.0% 1.0% Jul 2.0% 1.0% 1.0% 1.0% Aug 2.0% 1.0% 1.0% 1.0% Sep 2.0% 1.0% 1.0% 1.0% Oct 2.0% 1.0% 1.0% 1.0% Nov 2.0% 1.0% 1.0% 1.0% Dec 2.0% 1.0% 1.0% 1.0% Start 25.0 Events 2001 2002 2003 2004 Jan Feb Mar Apr May Jun Jul 10.0% Aug Sep 30.0% Oct -20.0% Nov Dec Actuals vs Estimate by Year 2001 2002 2003 2004 Actual 307.5 363.1 352.4 369.6 Est 306.4 336.0 357.3 361.9 Diff -1.1 -27.1 4.9 -7.7 % Diff -0.3% -7.5% 1.4% -2.1% 19 The Growth Rates are the estimates of the annual rate at which the data is growing; conditional formatting highlights changes in the rate. TrendModel: Trend Growth Rates 1. Introduction 2. Inputs 3. Calc 4. Trend

- 20. Growth-Adjusted Seasonal Factors Model 1 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 49 50 51 52 53 54 55 56 57 58 59 60 61 62 A C D E F Estimating Trend Growth Rate 2001 2002 2003 2004 Jan 2.0% 2.0% 1.0% 1.0% Feb 2.0% 2.0% 1.0% 1.0% Mar 2.0% 2.0% 1.0% 1.0% Apr 2.0% 2.0% 1.0% 1.0% May 2.0% 2.0% 1.0% 1.0% Jun 2.0% 2.0% 1.0% 1.0% Jul 2.0% 1.0% 1.0% 1.0% Aug 2.0% 1.0% 1.0% 1.0% Sep 2.0% 1.0% 1.0% 1.0% Oct 2.0% 1.0% 1.0% 1.0% Nov 2.0% 1.0% 1.0% 1.0% Dec 2.0% 1.0% 1.0% 1.0% Start 25.0 Events 2001 2002 2003 2004 Jan Feb Mar Apr May Jun Jul 10.0% Aug Sep 30.0% Oct -20.0% Nov Dec Actuals vs Estimate by Year 2001 2002 2003 2004 Actual 307.5 363.1 352.4 369.6 Est 306.4 336.0 357.3 361.9 Diff -1.1 -27.1 4.9 -7.7 % Diff -0.3% -7.5% 1.4% -2.1% 20 The Starting Point is the approximate level at the outset of the period being modeled. TrendModel: Trend Starting Point 1. Introduction 2. Inputs 3. Calc 4. Trend

- 21. Growth-Adjusted Seasonal Factors Model 1 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 49 50 51 52 53 54 55 56 57 58 59 60 61 62 A C D E F Estimating Trend Growth Rate 2001 2002 2003 2004 Jan 2.0% 2.0% 1.0% 1.0% Feb 2.0% 2.0% 1.0% 1.0% Mar 2.0% 2.0% 1.0% 1.0% Apr 2.0% 2.0% 1.0% 1.0% May 2.0% 2.0% 1.0% 1.0% Jun 2.0% 2.0% 1.0% 1.0% Jul 2.0% 1.0% 1.0% 1.0% Aug 2.0% 1.0% 1.0% 1.0% Sep 2.0% 1.0% 1.0% 1.0% Oct 2.0% 1.0% 1.0% 1.0% Nov 2.0% 1.0% 1.0% 1.0% Dec 2.0% 1.0% 1.0% 1.0% Start 25.0 Events 2001 2002 2003 2004 Jan Feb Mar Apr May Jun Jul 10.0% Aug Sep 30.0% Oct -20.0% Nov Dec Actuals vs Estimate by Year 2001 2002 2003 2004 Actual 307.5 363.1 352.4 369.6 Est 306.4 336.0 357.3 361.9 Diff -1.1 -27.1 4.9 -7.7 % Diff -0.3% -7.5% 1.4% -2.1% 21 Events are the estimates of when a step function takes place, when there is a sudden shift in the level of the data. Most months do not have events. TrendModel: Trend Events 1. Introduction 2. Inputs 3. Calc 4. Trend

- 22. Growth-Adjusted Seasonal Factors Model 1 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 49 50 51 52 53 54 55 56 57 58 59 60 61 62 A C D E F Estimating Trend Growth Rate 2001 2002 2003 2004 Jan 2.0% 2.0% 1.0% 1.0% Feb 2.0% 2.0% 1.0% 1.0% Mar 2.0% 2.0% 1.0% 1.0% Apr 2.0% 2.0% 1.0% 1.0% May 2.0% 2.0% 1.0% 1.0% Jun 2.0% 2.0% 1.0% 1.0% Jul 2.0% 1.0% 1.0% 1.0% Aug 2.0% 1.0% 1.0% 1.0% Sep 2.0% 1.0% 1.0% 1.0% Oct 2.0% 1.0% 1.0% 1.0% Nov 2.0% 1.0% 1.0% 1.0% Dec 2.0% 1.0% 1.0% 1.0% Start 25.0 Events 2001 2002 2003 2004 Jan Feb Mar Apr May Jun Jul 10.0% Aug Sep 30.0% Oct -20.0% Nov Dec Actuals vs Estimate by Year 2001 2002 2003 2004 Actual 307.5 363.1 352.4 369.6 Est 306.4 336.0 357.3 361.9 Diff -1.1 -27.1 4.9 -7.7 % Diff -0.3% -7.5% 1.4% -2.1% 22 The Actual vs Estimate section compares each year’s totals and calculates the difference between the estimated trend and actuals. TrendModel: Trend Actuals vs Estimate 1. Introduction 2. Inputs 3. Calc 4. Trend

- 23. Growth-Adjusted Seasonal Factors Model 1 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 49 50 51 52 53 54 55 56 57 58 59 60 61 62 A C D E F G H I J K L M N O P Q R S X Estimating Trend Growth Rate 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Jan 2.0% 2.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 0.0% Feb 2.0% 2.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 0.0% Mar 2.0% 2.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 0.0% Apr 2.0% 2.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 0.0% May 2.0% 2.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 0.0% Jun 2.0% 2.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 0.0% Jul 2.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 0.0% Aug 2.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 0.0% Sep 2.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 0.0% Oct 2.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 0.0% 0.0% Nov 2.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 0.0% 0.0% Dec 2.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 0.0% 0.0% Start 25.0 Events 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Jan Feb 2.0% Mar Apr May Jun Jul 10.0% Aug Sep 30.0% Oct -20.0% Nov Dec Actuals vs Estimate by Year 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Actual 307.5 363.1 352.4 369.6 415.1 458.5 532.0 660.3 549.3 444.7 383.9 286.8 260.7 261.9 299.1 315.5 0.0 Est 306.4 336.0 357.3 361.9 365.6 366.9 371.3 376.8 378.9 382.9 387.9 389.9 393.1 398.7 402.4 407.4 413.8 Diff -1.1 -27.1 4.9 -7.7 -49.4 -91.6 -160.8 -283.5 -170.4 -61.8 4.1 103.1 132.4 136.8 103.3 91.9 % Diff -0.3% -7.5% 1.4% -2.1% -11.9% -20.0% -30.2% -42.9% -31.0% -13.9% 1.1% 35.9% 50.8% 52.2% 34.5% 29.1% Total 2001-16 YTD Actual 6,260 315.5 Est 5,983 407.4 Diff (277) 91.9 % Diff -4.4% 29.1% 22.0 24.0 26.0 28.0 30.0 32.0 34.0 36.0 38.0 40.0 23 The Total Actual vs Estimate table shows how actuals and estimates compare over the entire modeled time period; it also compares current year-to-date. TrendModel: Trend Actuals vs Estimate 1. Introduction 2. Inputs 3. Calc 4. Trend

- 24. Growth-Adjusted Seasonal Factors Model 1 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 49 50 51 52 53 54 55 56 57 58 59 60 61 62 69 70 71 72 73 74 75 76 77 78 79 80 81 82 A C D E F G H I J K L M N O P Q R S Estimating Trend Growth Rate 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Jan 2.0% 2.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 0.0% Feb 2.0% 2.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 0.0% Mar 2.0% 2.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 0.0% Apr 2.0% 2.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 0.0% May 2.0% 2.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 0.0% Jun 2.0% 2.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 0.0% Jul 2.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 0.0% Aug 2.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 0.0% Sep 2.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 0.0% Oct 2.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 0.0% 0.0% Nov 2.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 0.0% 0.0% Dec 2.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 0.0% 0.0% Start 25.0 Events 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Jan Feb 2.0% Mar Apr May Jun Jul 10.0% Aug Sep 30.0% Oct -20.0% Nov Dec Actuals vs Estimate by Year 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Actual 307.5 363.1 352.4 369.6 415.1 458.5 532.0 660.3 549.3 444.7 383.9 286.8 260.7 261.9 299.1 315.5 0.0 Est 306.4 336.0 357.3 361.9 365.6 366.9 371.3 376.8 378.9 382.9 387.9 389.9 393.1 398.7 402.4 407.4 413.8 Diff -1.1 -27.1 4.9 -7.7 -49.4 -91.6 -160.8 -283.5 -170.4 -61.8 4.1 103.1 132.4 136.8 103.3 91.9 % Diff -0.3% -7.5% 1.4% -2.1% -11.9% -20.0% -30.2% -42.9% -31.0% -13.9% 1.1% 35.9% 50.8% 52.2% 34.5% 29.1% Total 2001-16 YTD Actual 6,260 315.5 Est 5,983 407.4 Diff (277) 91.9 % Diff -4.4% 29.1% Other Info (e.g. Price Changes) 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 24 While hidden here because it isn’t applicable, there is a section here for “Other Info” that may provide a useful reference. TrendModel: Trend Other Info 1. Introduction 2. Inputs 3. Calc 4. Trend

- 25. Growth-Adjusted Seasonal Factors Model 25 The Seasonal Factors Calculation section takes the Normalized data, and adjusts for growth & events. TrendModel: Trend 97 98 99 100 101 102 103 104 105 106 107 108 109 110 111 112 113 114 119 120 121 122 123 124 125 126 127 128 129 130 131 132 133 134 139 140 141 142 143 144 145 146 147 148 149 150 151 152 153 154 155 159 160 161 162 163 164 165 166 167 168 169 170 171 172 173 174 175 179 180 181 182 183 184 185 186 187 188 189 190 191 192 193 194 195 196 199 200 201 202 203 204 205 206 207 208 209 210 211 212 213 214 215 219 220 221 222 223 224 225 226 227 228 229 230 231 232 233 234 235 236 A C D E F G H I J K L M N O P Q R S X Y Z AA AB AC AD AE AF AG AH AI Seasonal Factors Normalized Data 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Jan 26.5 29.1 29.9 34.2 33.2 39.6 38.3 58.1 46.4 35.6 33.2 24.7 22.0 20.7 24.5 31.2 0.0 Feb 23.5 28.5 27.5 30.6 33.0 37.5 40.0 47.0 54.6 35.5 31.8 24.4 22.2 22.1 23.2 30.9 0.0 Mar 26.2 27.8 29.9 30.7 35.6 35.9 43.9 55.7 61.8 33.2 31.9 24.8 22.4 22.1 24.1 28.4 0.0 Apr 26.8 27.2 29.6 31.9 35.8 37.2 40.2 43.9 53.5 41.0 27.8 24.6 22.2 21.8 22.6 25.7 0.0 May 23.2 25.6 31.0 31.5 32.2 41.5 41.3 42.5 52.6 54.4 28.5 26.4 21.9 19.4 21.8 25.6 0.0 Jun 24.3 32.8 31.5 27.1 32.1 41.4 45.0 50.5 43.7 43.5 30.0 26.4 26.0 21.1 24.6 28.3 0.0 Jul 24.9 40.5 30.2 29.3 31.5 38.7 49.0 60.5 38.4 36.5 27.3 24.5 20.5 19.2 23.0 23.2 0.0 Aug 21.4 28.0 25.1 25.9 30.6 33.3 55.4 44.6 41.2 32.0 43.6 20.2 19.1 17.8 27.5 21.1 0.0 Sep 35.1 29.2 29.7 27.7 36.1 37.3 40.3 70.1 42.8 32.2 35.0 23.9 21.8 21.4 27.8 25.1 0.0 Oct 27.7 34.7 30.0 32.9 40.7 39.1 41.6 75.7 41.4 33.9 34.5 20.2 20.8 26.7 26.4 23.0 0.0 Nov 27.1 31.2 27.8 32.4 36.4 40.4 52.2 57.3 35.2 33.9 29.6 23.1 20.3 22.4 25.2 27.7 0.0 Dec 29.5 29.5 29.6 35.2 36.8 38.2 44.1 50.2 38.1 33.7 27.6 24.7 23.0 27.6 28.9 25.0 0.0 Growth Rate (Monthly Basis) 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Jan 0.2% 0.2% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.0% Feb 0.2% 0.2% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 2.0% Mar 0.2% 0.2% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.0% Apr 0.2% 0.2% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.0% May 0.2% 0.2% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.0% Jun 0.2% 0.2% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.0% Jul 0.2% 10.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.0% Aug 0.2% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.0% Sep 30.2% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.0% Oct -19.9% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.0% 0.0% Nov 0.2% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.0% 0.0% Dec 0.2% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.0% 0.0% Cumulative Growth Rate 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Jan 0.2% 0.2% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.0% Feb 0.3% 0.3% 0.2% 0.2% 0.2% 0.2% 0.2% 0.2% 0.2% 0.2% 0.2% 0.2% 0.2% 0.2% 0.2% 0.2% 2.0% Mar 0.5% 0.5% 0.3% 0.3% 0.3% 0.3% 0.3% 0.3% 0.3% 0.3% 0.3% 0.3% 0.3% 0.3% 0.3% 0.3% 2.0% Apr 0.7% 0.7% 0.3% 0.3% 0.3% 0.3% 0.3% 0.3% 0.3% 0.3% 0.3% 0.3% 0.3% 0.3% 0.3% 0.3% 2.0% May 0.8% 0.8% 0.4% 0.4% 0.4% 0.4% 0.4% 0.4% 0.4% 0.4% 0.4% 0.4% 0.4% 0.4% 0.4% 0.4% 2.0% Jun 1.0% 1.0% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% 2.0% Jul 1.2% 11.2% 0.6% 0.6% 0.6% 0.6% 0.6% 0.6% 0.6% 0.6% 0.6% 0.6% 0.6% 0.6% 0.6% 0.6% 2.0% Aug 1.3% 11.3% 0.7% 0.7% 0.7% 0.7% 0.7% 0.7% 0.7% 0.7% 0.7% 0.7% 0.7% 0.7% 0.7% 0.7% 2.0% Sep 32.0% 11.4% 0.8% 0.8% 0.8% 0.8% 0.8% 0.8% 0.8% 0.8% 0.8% 0.8% 0.8% 0.8% 0.8% 0.8% 2.0% Oct 5.7% 11.5% 0.8% 0.8% 0.8% 0.8% 0.8% 0.8% 0.8% 0.8% 0.8% 0.8% 0.8% 0.8% 0.8% 0.8% 2.0% Nov 5.9% 11.6% 0.9% 0.9% 0.9% 0.9% 0.9% 0.9% 0.9% 0.9% 0.9% 0.9% 0.9% 0.9% 0.9% 0.8% 2.0% Dec 6.1% 11.7% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 0.8% 2.0% Avg 4.6% 6.0% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% 1.8% Indexed Cumulative Growth 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Jan 0.96 0.94 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 0.98 Feb 0.96 0.95 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 Mar 0.96 0.95 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 Apr 0.96 0.95 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 May 0.96 0.95 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 Jun 0.97 0.95 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 Jul 0.97 1.05 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 Aug 0.97 1.05 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 Sep 1.26 1.05 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 Oct 1.01 1.05 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 Nov 1.01 1.05 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 Dec 1.01 1.05 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 Avg 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 Growth-Adjusted Normalized Data 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Jan 27.7 30.7 30.1 34.3 33.3 39.8 38.5 58.3 46.7 35.8 33.3 24.8 22.1 20.8 24.6 31.3 0.0 Feb 24.5 30.1 27.6 30.7 33.1 37.6 40.1 47.2 54.8 35.6 31.9 24.5 22.3 22.2 23.3 31.0 0.0 Mar 27.3 29.3 30.0 30.8 35.7 36.0 44.0 55.9 61.9 33.3 32.0 24.9 22.4 22.1 24.2 28.4 0.0 Apr 27.9 28.7 29.7 32.0 35.9 37.2 40.3 44.0 53.6 41.1 27.9 24.6 22.2 21.8 22.6 25.8 0.0 May 24.1 26.9 31.0 31.5 32.2 41.5 41.4 42.6 52.6 54.5 28.6 26.4 21.9 19.4 21.9 25.6 0.0 Jun 25.2 34.4 31.5 27.2 32.1 41.5 45.1 50.6 43.7 43.6 30.0 26.4 26.0 21.1 24.6 28.3 0.0 Jul 25.7 38.6 30.2 29.3 31.5 38.6 49.0 60.4 38.4 36.5 27.2 24.5 20.5 19.2 23.0 23.2 0.0 Aug 22.1 26.7 25.1 25.9 30.6 33.2 55.4 44.6 41.1 32.0 43.6 20.2 19.0 17.8 27.4 21.1 0.0 Sep 27.8 27.8 29.7 27.6 36.0 37.2 40.2 70.0 42.7 32.1 34.9 23.9 21.7 21.3 27.8 25.0 0.0 Oct 27.4 33.0 29.9 32.8 40.6 39.0 41.5 75.5 41.2 33.8 34.4 20.2 20.7 26.6 26.4 22.9 0.0 Nov 26.7 29.7 27.7 32.3 36.3 40.3 52.0 57.1 35.0 33.7 29.5 23.0 20.3 22.3 25.1 27.6 0.0 Dec 29.1 28.0 29.5 35.0 36.7 38.0 43.9 50.0 37.9 33.6 27.5 24.6 22.9 27.5 28.7 24.9 0.0 Avg 26.3 30.3 29.3 30.8 34.5 38.3 44.3 54.7 45.8 37.1 31.7 24.0 21.8 21.8 25.0 26.3 0.0 0.2% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% Growth-Adjusted Normalized Data: Factored Max Permitted Standard Deviations: 2.0 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Avg Std Dev Low High Wtd Avg Jan 1.05 1.01 1.03 1.11 0.97 1.04 0.87 1.07 1.02 0.96 1.05 1.03 1.01 0.95 0.98 1.19 1.02 0.07 0.88 1.17 1.03 Feb 0.93 0.99 0.94 1.00 0.96 0.98 0.91 0.86 1.20 0.96 1.01 1.02 1.02 1.02 0.93 1.18 0.99 0.09 0.82 1.17 0.97 Mar 1.04 0.97 1.02 1.00 1.03 0.94 0.99 1.02 1.35 0.90 1.01 1.04 1.03 1.01 0.97 1.08 1.03 0.10 0.83 1.22 1.01 Apr 1.06 0.95 1.01 1.04 1.04 0.97 0.91 0.81 1.17 1.11 0.88 1.03 1.02 1.00 0.91 0.98 0.99 0.09 0.81 1.17 1.01 May 0.91 0.89 1.06 1.02 0.93 1.08 0.93 0.78 1.15 1.47 0.90 1.10 1.00 0.89 0.88 0.98 1.00 0.16 0.68 1.32 1.00 Jun 0.96 1.13 1.07 0.88 0.93 1.08 1.02 0.92 0.95 1.17 0.95 1.10 1.19 0.97 0.99 1.08 1.02 0.10 0.83 1.21 1.02 Jul 0.98 1.27 1.03 0.95 0.91 1.01 1.11 1.11 0.84 0.98 0.86 1.02 0.94 0.88 0.92 0.88 0.98 0.11 0.76 1.20 0.97 Aug 0.84 0.88 0.86 0.84 0.89 0.87 1.25 0.82 0.90 0.86 1.37 0.84 0.87 0.81 1.10 0.80 0.92 0.17 0.59 1.26 0.89 Sep 1.06 0.92 1.01 0.90 1.04 0.97 0.91 1.28 0.93 0.87 1.10 0.99 0.99 0.98 1.11 0.95 1.00 0.10 0.80 1.21 1.01 Oct 1.04 1.09 1.02 1.07 1.18 1.02 0.94 1.38 0.90 0.91 1.08 0.84 0.95 1.22 1.06 0.87 1.03 0.14 0.75 1.32 1.02 Nov 1.02 0.98 0.95 1.05 1.05 1.05 1.17 1.04 0.76 0.91 0.93 0.96 0.93 1.02 1.01 1.05 0.99 0.09 0.81 1.17 1.00 Dec 1.11 0.92 1.00 1.14 1.06 0.99 0.99 0.91 0.83 0.90 0.87 1.02 1.05 1.26 1.15 0.95 1.01 0.12 0.78 1.24 1.07 Avg 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 0.11 0.78 1.22 1.00 Data Accepted? 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Total Jan 1 1 1 1 1 1 0 1 1 1 1 1 1 1 1 0 Feb 1 1 1 1 1 1 1 1 0 1 1 1 1 1 1 0 Mar 1 1 1 1 1 1 1 1 0 1 1 1 1 1 1 1 Apr 1 1 1 1 1 1 1 0 1 1 1 1 1 1 1 1 May 1 1 1 1 1 1 1 1 1 0 1 1 1 1 1 1 Jun 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 Jul 1 0 1 1 1 1 1 1 1 1 1 1 1 1 1 1 Aug 1 1 1 1 1 1 1 1 1 1 0 1 1 1 1 1 Sep 1 1 1 1 1 1 1 0 1 1 1 1 1 1 1 1 Oct 1 1 1 1 1 1 1 0 1 1 1 1 1 1 1 1 Nov 1 1 1 1 1 1 0 1 0 1 1 1 1 1 1 1 Dec 1 1 1 1 1 1 1 1 1 1 1 1 1 0 1 1 OK? 1 0 1 1 1 1 0 0 0 0 0 1 1 0 1 0 8 Use Std Dev? 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 Seasonal Factor Weights 1 0 1 1 1 1 0 0 0 0 0 1 1 0 1 0 0 8 Accepted Range 0.60 0.70 0.80 0.90 1.00 1.10 1.20 1.30 1.40 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Seasonal Factors Final Initial Low High 1. Introduction 2. Inputs 3. Calc 4. Trend Model Structure: Seasonal Factors Calculation

- 26. Growth-Adjusted Seasonal Factors Model 97 98 99 100 101 102 103 104 105 106 107 108 109 110 111 112 113 114 A C D E F G H I J K L M N O P Q R S X Seasonal Factors Normalized Data 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Jan 26.5 29.1 29.9 34.2 33.2 39.6 38.3 58.1 46.4 35.6 33.2 24.7 22.0 20.7 24.5 31.2 0.0 Feb 23.5 28.5 27.5 30.6 33.0 37.5 40.0 47.0 54.6 35.5 31.8 24.4 22.2 22.1 23.2 30.9 0.0 Mar 26.2 27.8 29.9 30.7 35.6 35.9 43.9 55.7 61.8 33.2 31.9 24.8 22.4 22.1 24.1 28.4 0.0 Apr 26.8 27.2 29.6 31.9 35.8 37.2 40.2 43.9 53.5 41.0 27.8 24.6 22.2 21.8 22.6 25.7 0.0 May 23.2 25.6 31.0 31.5 32.2 41.5 41.3 42.5 52.6 54.4 28.5 26.4 21.9 19.4 21.8 25.6 0.0 Jun 24.3 32.8 31.5 27.1 32.1 41.4 45.0 50.5 43.7 43.5 30.0 26.4 26.0 21.1 24.6 28.3 0.0 Jul 24.9 40.5 30.2 29.3 31.5 38.7 49.0 60.5 38.4 36.5 27.3 24.5 20.5 19.2 23.0 23.2 0.0 Aug 21.4 28.0 25.1 25.9 30.6 33.3 55.4 44.6 41.2 32.0 43.6 20.2 19.1 17.8 27.5 21.1 0.0 Sep 35.1 29.2 29.7 27.7 36.1 37.3 40.3 70.1 42.8 32.2 35.0 23.9 21.8 21.4 27.8 25.1 0.0 Oct 27.7 34.7 30.0 32.9 40.7 39.1 41.6 75.7 41.4 33.9 34.5 20.2 20.8 26.7 26.4 23.0 0.0 Nov 27.1 31.2 27.8 32.4 36.4 40.4 52.2 57.3 35.2 33.9 29.6 23.1 20.3 22.4 25.2 27.7 0.0 Dec 29.5 29.5 29.6 35.2 36.8 38.2 44.1 50.2 38.1 33.7 27.6 24.7 23.0 27.6 28.9 25.0 0.0 26 We start the seasonal factor calculation procedure by bringing in the normalized data. TrendModel: Trend 1. Introduction 2. Inputs 3. Calc 4. Trend

- 27. Growth-Adjusted Seasonal Factors Model 119 120 121 122 123 124 125 126 127 128 129 130 131 132 133 134 A C D E F G H I J K L M N O P Q R S X Growth Rate (Monthly Basis) 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Jan 0.2% 0.2% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.0% Feb 0.2% 0.2% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 2.0% Mar 0.2% 0.2% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.0% Apr 0.2% 0.2% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.0% May 0.2% 0.2% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.0% Jun 0.2% 0.2% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.0% Jul 0.2% 10.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.0% Aug 0.2% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.0% Sep 30.2% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.0% Oct -19.9% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.0% 0.0% Nov 0.2% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.0% 0.0% Dec 0.2% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.0% 0.0% 27 To adjust the data for growth, we bring in the estimates for both the growth rate & events. TrendModel: Trend 1. Introduction 2. Inputs 3. Calc 4. Trend

- 28. Growth-Adjusted Seasonal Factors Model 139 140 141 142 143 144 145 146 147 148 149 150 151 152 153 154 A C D E F G H I J K L M N O P Q R S X Cumulative Growth Rate 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Jan 0.2% 0.2% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.0% Feb 0.3% 0.3% 0.2% 0.2% 0.2% 0.2% 0.2% 0.2% 0.2% 0.2% 0.2% 0.2% 0.2% 0.2% 0.2% 0.2% 2.0% Mar 0.5% 0.5% 0.3% 0.3% 0.3% 0.3% 0.3% 0.3% 0.3% 0.3% 0.3% 0.3% 0.3% 0.3% 0.3% 0.3% 2.0% Apr 0.7% 0.7% 0.3% 0.3% 0.3% 0.3% 0.3% 0.3% 0.3% 0.3% 0.3% 0.3% 0.3% 0.3% 0.3% 0.3% 2.0% May 0.8% 0.8% 0.4% 0.4% 0.4% 0.4% 0.4% 0.4% 0.4% 0.4% 0.4% 0.4% 0.4% 0.4% 0.4% 0.4% 2.0% Jun 1.0% 1.0% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% 2.0% Jul 1.2% 11.2% 0.6% 0.6% 0.6% 0.6% 0.6% 0.6% 0.6% 0.6% 0.6% 0.6% 0.6% 0.6% 0.6% 0.6% 2.0% Aug 1.3% 11.3% 0.7% 0.7% 0.7% 0.7% 0.7% 0.7% 0.7% 0.7% 0.7% 0.7% 0.7% 0.7% 0.7% 0.7% 2.0% Sep 32.0% 11.4% 0.8% 0.8% 0.8% 0.8% 0.8% 0.8% 0.8% 0.8% 0.8% 0.8% 0.8% 0.8% 0.8% 0.8% 2.0% Oct 5.7% 11.5% 0.8% 0.8% 0.8% 0.8% 0.8% 0.8% 0.8% 0.8% 0.8% 0.8% 0.8% 0.8% 0.8% 0.8% 2.0% Nov 5.9% 11.6% 0.9% 0.9% 0.9% 0.9% 0.9% 0.9% 0.9% 0.9% 0.9% 0.9% 0.9% 0.9% 0.9% 0.8% 2.0% Dec 6.1% 11.7% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 0.8% 2.0% Avg 4.6% 6.0% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% 1.8% 28 Next, the growth is accumulated over the year. TrendModel: Trend 1. Introduction 2. Inputs 3. Calc 4. Trend

- 29. Growth-Adjusted Seasonal Factors Model 159 160 161 162 163 164 165 166 167 168 169 170 171 172 173 174 A C D E F G H I J K L M N O P Q R S X Indexed Cumulative Growth 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Jan 0.96 0.94 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 0.98 Feb 0.96 0.95 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 Mar 0.96 0.95 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 Apr 0.96 0.95 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 May 0.96 0.95 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 Jun 0.97 0.95 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 Jul 0.97 1.05 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 Aug 0.97 1.05 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 Sep 1.26 1.05 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 Oct 1.01 1.05 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 Nov 1.01 1.05 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 Dec 1.01 1.05 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 Avg 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 29 The cumulative growth rates are then indexed, giving us the factors we need to adjust the data for growth and events. TrendModel: Trend 1. Introduction 2. Inputs 3. Calc 4. Trend

- 30. Growth-Adjusted Seasonal Factors Model 179 180 181 182 183 184 185 186 187 188 189 190 191 192 193 194 A C D E F G H I J K L M N O P Q R S X Growth-Adjusted Normalized Data 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Jan 27.7 30.7 30.1 34.3 33.3 39.8 38.5 58.3 46.7 35.8 33.3 24.8 22.1 20.8 24.6 31.3 0.0 Feb 24.5 30.1 27.6 30.7 33.1 37.6 40.1 47.2 54.8 35.6 31.9 24.5 22.3 22.2 23.3 31.0 0.0 Mar 27.3 29.3 30.0 30.8 35.7 36.0 44.0 55.9 61.9 33.3 32.0 24.9 22.4 22.1 24.2 28.4 0.0 Apr 27.9 28.7 29.7 32.0 35.9 37.2 40.3 44.0 53.6 41.1 27.9 24.6 22.2 21.8 22.6 25.8 0.0 May 24.1 26.9 31.0 31.5 32.2 41.5 41.4 42.6 52.6 54.5 28.6 26.4 21.9 19.4 21.9 25.6 0.0 Jun 25.2 34.4 31.5 27.2 32.1 41.5 45.1 50.6 43.7 43.6 30.0 26.4 26.0 21.1 24.6 28.3 0.0 Jul 25.7 38.6 30.2 29.3 31.5 38.6 49.0 60.4 38.4 36.5 27.2 24.5 20.5 19.2 23.0 23.2 0.0 Aug 22.1 26.7 25.1 25.9 30.6 33.2 55.4 44.6 41.1 32.0 43.6 20.2 19.0 17.8 27.4 21.1 0.0 Sep 27.8 27.8 29.7 27.6 36.0 37.2 40.2 70.0 42.7 32.1 34.9 23.9 21.7 21.3 27.8 25.0 0.0 Oct 27.4 33.0 29.9 32.8 40.6 39.0 41.5 75.5 41.2 33.8 34.4 20.2 20.7 26.6 26.4 22.9 0.0 Nov 26.7 29.7 27.7 32.3 36.3 40.3 52.0 57.1 35.0 33.7 29.5 23.0 20.3 22.3 25.1 27.6 0.0 Dec 29.1 28.0 29.5 35.0 36.7 38.0 43.9 50.0 37.9 33.6 27.5 24.6 22.9 27.5 28.7 24.9 0.0 Avg 26.3 30.3 29.3 30.8 34.5 38.3 44.3 54.7 45.8 37.1 31.7 24.0 21.8 21.8 25.0 26.3 0.0 30 The normalized data, from above, is adjusted for growth, using the Indexed Cumulative Growth. TrendModel: Trend 1. Introduction 2. Inputs 3. Calc 4. Trend

- 31. Growth-Adjusted Seasonal Factors Model 199 200 201 202 203 204 205 206 207 208 209 210 211 212 213 214 A C D E F G H I J K L M N O P Q R S X Growth-Adjusted Normalized Data: Factored Max Permitted Standard Deviations: 2.0 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Jan 1.05 1.01 1.03 1.11 0.97 1.04 0.87 1.07 1.02 0.96 1.05 1.03 1.01 0.95 0.98 1.19 Feb 0.93 0.99 0.94 1.00 0.96 0.98 0.91 0.86 1.20 0.96 1.01 1.02 1.02 1.02 0.93 1.18 Mar 1.04 0.97 1.02 1.00 1.03 0.94 0.99 1.02 1.35 0.90 1.01 1.04 1.03 1.01 0.97 1.08 Apr 1.06 0.95 1.01 1.04 1.04 0.97 0.91 0.81 1.17 1.11 0.88 1.03 1.02 1.00 0.91 0.98 May 0.91 0.89 1.06 1.02 0.93 1.08 0.93 0.78 1.15 1.47 0.90 1.10 1.00 0.89 0.88 0.98 Jun 0.96 1.13 1.07 0.88 0.93 1.08 1.02 0.92 0.95 1.17 0.95 1.10 1.19 0.97 0.99 1.08 Jul 0.98 1.27 1.03 0.95 0.91 1.01 1.11 1.11 0.84 0.98 0.86 1.02 0.94 0.88 0.92 0.88 Aug 0.84 0.88 0.86 0.84 0.89 0.87 1.25 0.82 0.90 0.86 1.37 0.84 0.87 0.81 1.10 0.80 Sep 1.06 0.92 1.01 0.90 1.04 0.97 0.91 1.28 0.93 0.87 1.10 0.99 0.99 0.98 1.11 0.95 Oct 1.04 1.09 1.02 1.07 1.18 1.02 0.94 1.38 0.90 0.91 1.08 0.84 0.95 1.22 1.06 0.87 Nov 1.02 0.98 0.95 1.05 1.05 1.05 1.17 1.04 0.76 0.91 0.93 0.96 0.93 1.02 1.01 1.05 Dec 1.11 0.92 1.00 1.14 1.06 0.99 0.99 0.91 0.83 0.90 0.87 1.02 1.05 1.26 1.15 0.95 Avg 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 31 The growth-adjusted data is then expressed as an index. TrendModel: Trend 1. Introduction 2. Inputs 3. Calc 4. Trend

- 32. Growth-Adjusted Seasonal Factors Model 199 200 201 202 203 204 205 206 207 208 209 210 211 212 213 214 A C D E F G H I J K L M N O P Q R S X Y Z AA AB AC Growth-Adjusted Normalized Data: Factored Max Permitted Standard Deviations: 2.0 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Avg Std Dev Low High Wtd Avg Jan 1.05 1.01 1.03 1.11 0.97 1.04 0.87 1.07 1.02 0.96 1.05 1.03 1.01 0.95 0.98 1.19 1.02 0.07 0.88 1.17 1.03 Feb 0.93 0.99 0.94 1.00 0.96 0.98 0.91 0.86 1.20 0.96 1.01 1.02 1.02 1.02 0.93 1.18 0.99 0.09 0.82 1.17 0.97 Mar 1.04 0.97 1.02 1.00 1.03 0.94 0.99 1.02 1.35 0.90 1.01 1.04 1.03 1.01 0.97 1.08 1.03 0.10 0.83 1.22 1.01 Apr 1.06 0.95 1.01 1.04 1.04 0.97 0.91 0.81 1.17 1.11 0.88 1.03 1.02 1.00 0.91 0.98 0.99 0.09 0.81 1.17 1.01 May 0.91 0.89 1.06 1.02 0.93 1.08 0.93 0.78 1.15 1.47 0.90 1.10 1.00 0.89 0.88 0.98 1.00 0.16 0.68 1.32 1.00 Jun 0.96 1.13 1.07 0.88 0.93 1.08 1.02 0.92 0.95 1.17 0.95 1.10 1.19 0.97 0.99 1.08 1.02 0.10 0.83 1.21 1.02 Jul 0.98 1.27 1.03 0.95 0.91 1.01 1.11 1.11 0.84 0.98 0.86 1.02 0.94 0.88 0.92 0.88 0.98 0.11 0.76 1.20 0.97 Aug 0.84 0.88 0.86 0.84 0.89 0.87 1.25 0.82 0.90 0.86 1.37 0.84 0.87 0.81 1.10 0.80 0.92 0.17 0.59 1.26 0.89 Sep 1.06 0.92 1.01 0.90 1.04 0.97 0.91 1.28 0.93 0.87 1.10 0.99 0.99 0.98 1.11 0.95 1.00 0.10 0.80 1.21 1.01 Oct 1.04 1.09 1.02 1.07 1.18 1.02 0.94 1.38 0.90 0.91 1.08 0.84 0.95 1.22 1.06 0.87 1.03 0.14 0.75 1.32 1.02 Nov 1.02 0.98 0.95 1.05 1.05 1.05 1.17 1.04 0.76 0.91 0.93 0.96 0.93 1.02 1.01 1.05 0.99 0.09 0.81 1.17 1.00 Dec 1.11 0.92 1.00 1.14 1.06 0.99 0.99 0.91 0.83 0.90 0.87 1.02 1.05 1.26 1.15 0.95 1.01 0.12 0.78 1.24 1.07 Avg 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 0.11 0.78 1.22 1.00 Accepted Range 32 In order to determine what years we wish to exclude, each month’s factors are averaged, and an acceptable low & high range is calculated. TrendModel: Trend 1. Introduction 2. Inputs 3. Calc 4. Trend

- 33. Growth-Adjusted Seasonal Factors Model 199 200 201 202 203 204 205 206 207 208 209 210 211 212 213 214 215 219 220 221 222 223 224 225 226 227 228 229 230 231 232 233 234 235 236 A C D E F G H I J K L M N O P Q R S X Y Z AA AB AC Growth-Adjusted Normalized Data: Factored Max Permitted Standard Deviations: 2.0 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Avg Std Dev Low High Wtd Avg Jan 1.05 1.01 1.03 1.11 0.97 1.04 0.87 1.07 1.02 0.96 1.05 1.03 1.01 0.95 0.98 1.19 1.02 0.07 0.88 1.17 1.03 Feb 0.93 0.99 0.94 1.00 0.96 0.98 0.91 0.86 1.20 0.96 1.01 1.02 1.02 1.02 0.93 1.18 0.99 0.09 0.82 1.17 0.97 Mar 1.04 0.97 1.02 1.00 1.03 0.94 0.99 1.02 1.35 0.90 1.01 1.04 1.03 1.01 0.97 1.08 1.03 0.10 0.83 1.22 1.01 Apr 1.06 0.95 1.01 1.04 1.04 0.97 0.91 0.81 1.17 1.11 0.88 1.03 1.02 1.00 0.91 0.98 0.99 0.09 0.81 1.17 1.01 May 0.91 0.89 1.06 1.02 0.93 1.08 0.93 0.78 1.15 1.47 0.90 1.10 1.00 0.89 0.88 0.98 1.00 0.16 0.68 1.32 1.00 Jun 0.96 1.13 1.07 0.88 0.93 1.08 1.02 0.92 0.95 1.17 0.95 1.10 1.19 0.97 0.99 1.08 1.02 0.10 0.83 1.21 1.02 Jul 0.98 1.27 1.03 0.95 0.91 1.01 1.11 1.11 0.84 0.98 0.86 1.02 0.94 0.88 0.92 0.88 0.98 0.11 0.76 1.20 0.97 Aug 0.84 0.88 0.86 0.84 0.89 0.87 1.25 0.82 0.90 0.86 1.37 0.84 0.87 0.81 1.10 0.80 0.92 0.17 0.59 1.26 0.89 Sep 1.06 0.92 1.01 0.90 1.04 0.97 0.91 1.28 0.93 0.87 1.10 0.99 0.99 0.98 1.11 0.95 1.00 0.10 0.80 1.21 1.01 Oct 1.04 1.09 1.02 1.07 1.18 1.02 0.94 1.38 0.90 0.91 1.08 0.84 0.95 1.22 1.06 0.87 1.03 0.14 0.75 1.32 1.02 Nov 1.02 0.98 0.95 1.05 1.05 1.05 1.17 1.04 0.76 0.91 0.93 0.96 0.93 1.02 1.01 1.05 0.99 0.09 0.81 1.17 1.00 Dec 1.11 0.92 1.00 1.14 1.06 0.99 0.99 0.91 0.83 0.90 0.87 1.02 1.05 1.26 1.15 0.95 1.01 0.12 0.78 1.24 1.07 Avg 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 0.11 0.78 1.22 1.00 Data Accepted? 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Total Jan 1 1 1 1 1 1 0 1 1 1 1 1 1 1 1 0 Feb 1 1 1 1 1 1 1 1 0 1 1 1 1 1 1 0 Mar 1 1 1 1 1 1 1 1 0 1 1 1 1 1 1 1 Apr 1 1 1 1 1 1 1 0 1 1 1 1 1 1 1 1 May 1 1 1 1 1 1 1 1 1 0 1 1 1 1 1 1 Jun 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 Jul 1 0 1 1 1 1 1 1 1 1 1 1 1 1 1 1 Aug 1 1 1 1 1 1 1 1 1 1 0 1 1 1 1 1 Sep 1 1 1 1 1 1 1 0 1 1 1 1 1 1 1 1 Oct 1 1 1 1 1 1 1 0 1 1 1 1 1 1 1 1 Nov 1 1 1 1 1 1 0 1 0 1 1 1 1 1 1 1 Dec 1 1 1 1 1 1 1 1 1 1 1 1 1 0 1 1 OK? 1 0 1 1 1 1 0 0 0 0 0 1 1 0 1 0 8 Use Std Dev? 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 Seasonal Factor Weights 1 0 1 1 1 1 0 0 0 0 0 1 1 0 1 0 0 8 Accepted Range 33 A “Data Accepted?” table is added that flushes out those years where one or more months fall outside the accepted range. TrendModel: Trend 1. Introduction 2. Inputs 3. Calc 4. Trend

- 34. Growth-Adjusted Seasonal Factors Model 199 200 201 202 203 204 205 206 207 208 209 210 211 212 213 214 215 219 220 221 222 223 224 225 226 227 228 229 230 231 232 233 234 235 236 A C D E F G H I J K L M N O P Q R S X Y Z AA AB AC Growth-Adjusted Normalized Data: Factored Max Permitted Standard Deviations: 2.0 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Avg Std Dev Low High Wtd Avg Jan 1.05 1.01 1.03 1.11 0.97 1.04 0.87 1.07 1.02 0.96 1.05 1.03 1.01 0.95 0.98 1.19 1.02 0.07 0.88 1.17 1.03 Feb 0.93 0.99 0.94 1.00 0.96 0.98 0.91 0.86 1.20 0.96 1.01 1.02 1.02 1.02 0.93 1.18 0.99 0.09 0.82 1.17 0.97 Mar 1.04 0.97 1.02 1.00 1.03 0.94 0.99 1.02 1.35 0.90 1.01 1.04 1.03 1.01 0.97 1.08 1.03 0.10 0.83 1.22 1.01 Apr 1.06 0.95 1.01 1.04 1.04 0.97 0.91 0.81 1.17 1.11 0.88 1.03 1.02 1.00 0.91 0.98 0.99 0.09 0.81 1.17 1.01 May 0.91 0.89 1.06 1.02 0.93 1.08 0.93 0.78 1.15 1.47 0.90 1.10 1.00 0.89 0.88 0.98 1.00 0.16 0.68 1.32 1.00 Jun 0.96 1.13 1.07 0.88 0.93 1.08 1.02 0.92 0.95 1.17 0.95 1.10 1.19 0.97 0.99 1.08 1.02 0.10 0.83 1.21 1.02 Jul 0.98 1.27 1.03 0.95 0.91 1.01 1.11 1.11 0.84 0.98 0.86 1.02 0.94 0.88 0.92 0.88 0.98 0.11 0.76 1.20 0.97 Aug 0.84 0.88 0.86 0.84 0.89 0.87 1.25 0.82 0.90 0.86 1.37 0.84 0.87 0.81 1.10 0.80 0.92 0.17 0.59 1.26 0.89 Sep 1.06 0.92 1.01 0.90 1.04 0.97 0.91 1.28 0.93 0.87 1.10 0.99 0.99 0.98 1.11 0.95 1.00 0.10 0.80 1.21 1.01 Oct 1.04 1.09 1.02 1.07 1.18 1.02 0.94 1.38 0.90 0.91 1.08 0.84 0.95 1.22 1.06 0.87 1.03 0.14 0.75 1.32 1.02 Nov 1.02 0.98 0.95 1.05 1.05 1.05 1.17 1.04 0.76 0.91 0.93 0.96 0.93 1.02 1.01 1.05 0.99 0.09 0.81 1.17 1.00 Dec 1.11 0.92 1.00 1.14 1.06 0.99 0.99 0.91 0.83 0.90 0.87 1.02 1.05 1.26 1.15 0.95 1.01 0.12 0.78 1.24 1.07 Avg 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 0.11 0.78 1.22 1.00 Data Accepted? 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Total Jan 1 1 1 1 1 1 0 1 1 1 1 1 1 1 1 0 Feb 1 1 1 1 1 1 1 1 0 1 1 1 1 1 1 0 Mar 1 1 1 1 1 1 1 1 0 1 1 1 1 1 1 1 Apr 1 1 1 1 1 1 1 0 1 1 1 1 1 1 1 1 May 1 1 1 1 1 1 1 1 1 0 1 1 1 1 1 1 Jun 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 Jul 1 0 1 1 1 1 1 1 1 1 1 1 1 1 1 1 Aug 1 1 1 1 1 1 1 1 1 1 0 1 1 1 1 1 Sep 1 1 1 1 1 1 1 0 1 1 1 1 1 1 1 1 Oct 1 1 1 1 1 1 1 0 1 1 1 1 1 1 1 1 Nov 1 1 1 1 1 1 0 1 0 1 1 1 1 1 1 1 Dec 1 1 1 1 1 1 1 1 1 1 1 1 1 0 1 1 OK? 1 0 1 1 1 1 0 0 0 0 0 1 1 0 1 0 8 Use Std Dev? 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 Seasonal Factor Weights 1 0 1 1 1 1 0 0 0 0 0 1 1 0 1 0 0 8 Accepted Range 34 A weighted average is calculated, picking up all the accepted years. This is our goal: the growth-adjusted seasonal factors. TrendModel: Trend 1. Introduction 2. Inputs 3. Calc 4. Trend

- 35. 1 2 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 A F G H I Key Inputs None Initial Growth- Adjusted Jan-01 1.00 1.00 1.03 Feb-01 1.00 0.96 0.97 Mar-01 1.00 1.00 1.01 Apr-01 1.00 0.99 1.01 May-01 1.00 0.99 1.00 Jun-01 1.00 1.02 1.02 Jul-01 1.00 0.98 0.97 Aug-01 1.00 0.93 0.89 Sep-01 1.00 1.00 1.01 Oct-01 1.00 1.02 1.02 Nov-01 1.00 1.03 1.00 Dec-01 1.00 1.07 1.07 Jan-02 Seasonal Factors 1 2 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 A G H I J Calculations B. Seasonally-Adjusted Da In Use (1 = None; 2 = Initial; 3 = Final) : 2 None Initial "Final" In Use Jan-01 1.00 1.00 1.03 1.00 Feb-01 1.00 0.96 0.97 0.96 Mar-01 1.00 1.00 1.01 1.00 Apr-01 1.00 0.99 1.01 0.99 May-01 1.00 0.99 1.00 0.99 Jun-01 1.00 1.02 1.02 1.02 Jul-01 1.00 0.98 0.97 0.98 Aug-01 1.00 0.93 0.89 0.93 Sep-01 1.00 1.00 1.01 1.00 Oct-01 1.00 1.02 1.02 1.02 Nov-01 1.00 1.03 1.00 1.03 Dec-01 1.00 1.07 1.07 1.07 Seasonal Factors 1 195 199 200 201 202 203 204 205 206 207 208 209 210 211 212 213 A X Y Z AA AB AC Estimating Trend Growth-Adjusted Normalized Data: Factored Avg Std Dev Low High Wtd Avg Jan 1.02 0.07 0.88 1.17 1.03 Feb 0.99 0.09 0.82 1.17 0.97 Mar 1.03 0.10 0.83 1.22 1.01 Apr 0.99 0.09 0.81 1.17 1.01 May 1.00 0.16 0.68 1.32 1.00 Jun 1.02 0.10 0.83 1.21 1.02 Jul 0.98 0.11 0.76 1.20 0.97 Aug 0.92 0.17 0.59 1.26 0.89 Sep 1.00 0.10 0.80 1.21 1.01 Oct 1.03 0.14 0.75 1.32 1.02 Nov 0.99 0.09 0.81 1.17 1.00 Dec 1.01 0.12 0.78 1.24 1.07 Avg 1.00 0.11 0.78 1.22 1.00 Growth-Adjusted Seasonal Factors Model 35 Note that these final growth-adjusted seasonal factors are the set that are picked up in both the “Inputs” tab and “Calc” tab. TrendModel: Trend 1. Introduction 2. Inputs 3. Calc 4. Trend TrendModel: Inputs TrendModel: Calc

- 36. Growth-Adjusted Seasonal Factors Model 36 We now turn to the chart that will be used to track our estimation of trend. TrendModel: Trend 1 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 49 50 51 52 53 54 55 56 57 58 59 60 61 62 Y Z AA AB AC AD AE AF AG AH AI AJ Seasonal Factors In Use: Initial 2 (1 = None; 2 = Initial; 3 = Final) 022.0 24.0 26.0 28.0 30.0 32.0 34.0 36.0 38.0 40.0 Jan-01 Jan-02 Jan-03 Jan-04 Jan-05 Sales Volumes (Billions) NYSE Monthly Sales Volumes Seasonally-Adjusted Actual (& Extrapolated) Values Seasonally-Adjusted: Monthly Seasonally-Adjusted: 3-Mo Avg Estimated (& Extrapolated) Trend 1. Introduction 2. Inputs 3. Calc 4. Trend Model Structure: Chart

- 37. Growth-Adjusted Seasonal Factors Model 37 One of the most important aspects for trending the data is the choice of seasonal factors to use. TrendModel: Trend 1 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 49 50 51 52 53 54 55 56 57 58 59 60 61 62 Y Z AA AB AC AD AE AF AG AH AI AJ Seasonal Factors In Use: Initial 2 (1 = None; 2 = Initial; 3 = Final) 22.024.026.028.030.032.034.036.038.040.0S N 1. Introduction 2. Inputs 3. Calc 4. Trend

- 38. Growth-Adjusted Seasonal Factors Model 38 Focusing on the chart, we start by setting the time range to the 1st three-four years of the series. TrendModel: Trend 1. Introduction 2. Inputs 3. Calc 4. Trend

- 39. Growth-Adjusted Seasonal Factors Model 39 Focusing on the chart, we start by setting the time range to the 1st three-four years of the series. TrendModel: Trend 1. Introduction 2. Inputs 3. Calc 4. Trend

- 40. Growth-Adjusted Seasonal Factors Model 40 The Actuals are the first set of data to chart. They are colored light gray to de- emphasize them; they’re here as an FYI. TrendModel: Trend 1. Introduction 2. Inputs 3. Calc 4. Trend

- 41. Growth-Adjusted Seasonal Factors Model 41 A dotted blue line is added, showing the seasonally-adjusted data. TrendModel: Trend 1. Introduction 2. Inputs 3. Calc 4. Trend

- 42. Growth-Adjusted Seasonal Factors Model 42 A thicker and solid blue line is added for the 3-month moving average on the seasonally-adjusted data. TrendModel: Trend 1. Introduction 2. Inputs 3. Calc 4. Trend

- 43. Growth-Adjusted Seasonal Factors Model 43 Finally, the Estimated Trend line is added to the chart, colored in red to emphasize its distinction. TrendModel: Trend 1. Introduction 2. Inputs 3. Calc 4. Trend