ERM-Understand Factors Impacting Exchange Rates

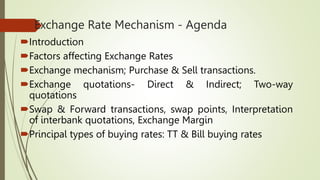

- 1. Exchange Rate Mechanism - Agenda Introduction Factors affecting Exchange Rates Exchange mechanism; Purchase & Sell transactions. Exchange quotations- Direct & Indirect; Two-way quotations Swap & Forward transactions, swap points, Interpretation of interbank quotations, Exchange Margin Principal types of buying rates: TT & Bill buying rates

- 2. Exchange Rate Mechanism - Introduction An exchange rate mechanism (ERM) is a set of procedures used to manage a country's currency exchange rate relative to other currencies. It is part of an economy's monetary policy and is put to use by central banks and in case of our country by RBI. Therefore, an exchange rate mechanism (ERM) is a device used by countries to manage the strength of their currency. The ERM is an important pillar in any economy’s monetary policy and is frequently managed by the central banks either directly or indirectly The exchange rate mechanism is critical to keeping exchange rates stable and controlling currency rate volatility in the market. Reducing foreign currency fluctuation is important, as it allows the market to become more predictable for exporters and importers as well as for outside investors, who want to invest in our country in the form FDIs or FPIs.

- 3. Exchange Rate Mechanism - Introduction What is the Foreign Exchange Market? The foreign exchange market refers to a global marketplace where foreign currencies are exchanged. The market determines the price of all currencies on the market and carries out buying and selling transactions of currencies at the spot price (T+2 in our country) or a predetermined future price, that is beyond T+2 dates. The foreign exchange market’s unique characteristics include: • Unlike commodity markets, it is a two sided market (both buying and selling of foreign currency take place) • Huge trading volume • Market is open 24 hours except on Saturdays, Sundays and declared holidays. • Since it is an efficient market, profitability margin is low when compared to other asset classes.

- 4. Factors affecting Exchange Rates Factors that influence currency exchange rates are important for various reasons. For countries, these factors can affect how one country trades with another. For individuals, these factors affect how much money one can get when exchanging one currency for another. Although it is intricate for anyone to understand the exchange rate movements, at the same time, it is advisable for the traders to understand and anticipate these factors, if one is involved in foreign currency exposures. It is worth noting that these factors affect currency exchange rates at both macro (country as a whole) and micro (individual or entity specific) levels. So, let us analyze the factors that are affecting the exchange rates in the next slide.

- 6. Factors affecting Exchange Rates 1. Inflation Rates: Changes in market inflation cause changes in currency exchange rates. A country with a lower inflation rate than another's will see an appreciation in the value of its currency. The prices of goods and services increase at a slower rate where the inflation is low. Therefore, the inflation differential between two countries mainly fixes the value of the exchange rate in the following two ways: 1. A country with a consistently lower inflation rate exhibits a rising currency value. 2. A country with higher inflation typically sees depreciation in its currency and is usually accompanied by higher interest rates. Our country fall in the No.2 category. India’s exchange rate policy has evolved over time in line with the gradual opening up of the economy as part of the broader strategy of macroeconomic reforms and liberalization since the year, 1991.

- 7. Factors affecting Exchange Rates 1. Inflation Rates (continued): From March, 1993, the market determined exchange rate regime was introduced by Government of India in our country. All foreign exchange transactions are converted at market determined exchange rates from March, 1993. RBI has adopted, US $ as the main intervention currency from March, 1993 on wards. A look at the entire period since 1993 when our country moved towards market determined exchange rates reveals that the Indian Rupee has generally depreciated against the dollar during the last 31 years, since our inflation rate used to be higher than US. The following graphs would show the position of rupee’s value against US $.

- 9. Factors affecting Exchange Rates 1. Inflation Rates (continued): The Indian Rupee has for the first time hit an all-time low of 77.47 against the US Dollar on 9th May, 2022. India imports major requirements of its energy needs, and crude oil prices have crossed $100 per barrel. Foreign Portfolio Investors (FPIs) are exiting Indian stock markets because of the following reasons: High retail inflation levels in India. The US Federal Reserve has raised interest rates in the US by 50 basis points (bps) in May, 2022 to control the four-decade high inflation because of surging energy and food prices. RBI, too raised the repo rate by 40 bps in May, 2022 and more interest rate hikes will follow. Russia-Ukraine war and apprehension about when this war would conclude. Investors worldwide rush to the safety of the US Dollar. The above reasons have led to the strengthening of the US Dollar and massive depreciation of the Indian Rupee.

- 10. Factors affecting Exchange Rates 2. Interest Rates: How do interest rates affect exchange rates? Changes in interest rate affect currency value and dollar exchange rate. Inflation, Interest rates and Forex rates are all correlated. Inflation is the function of Interest rate in a country, that is, higher the inflation, the interest rate would also be higher. So, when inflation increases, the interest rates would have to increase. Presently, Central banks in many countries are raising rates to counter the effects of inflation. India's retail inflation, as measured by the consumer price index (CPI), rose 16-month high to 6.95% in the month of March, 2022 breaching the upper limit of the Reserve Bank of India's target range of 6% for the third consecutive time. To counter this, RBI has increased the Repo rate by 35 basis points to 6.25 this is the 5th hieke since may 2022. Increase in interest rate may make the domestic currency to appreciate in the short time, but on the long term trend, the domestic currency would depreciate, thus factoring the interest rate differentials. This can be proved by taking an example (given in the next slide).

- 11. Factors affecting Exchange Rates 2. Interest Rates (continued): Let us assume that Today’s parity is 1 $ = Rs. 76/- One year (364 days) T. bill of Government of India 4% One year T. bill of US is 2%. If an Indian invest Rs. 76/- for 1 year, he will get an interest of Rs. 3.04 If an US citizen invest 1 $ for 1 year, he will get after one year an interest rate of 0.02 cents. Today, it is Rs. 1 $ = Rs. 76 After One year it becomes: $ 1.02 = Rs. 79.04 What is 1$ =? (1 $ x 79.04)/ 1.02 = Rs. 77 49. So, to buy 1 $ after one year, we have to pay Rs. 1.49 more (Rs. 77.49 minus Rs. 76). This is also called as forward swap points. Based on the above interest rate structure, we can construct a forward swap points or rates also for buying and selling of 1 $ at a future dates.

- 12. Forward Rates or Swap Points

- 13. Factors affecting Exchange Rates 3. Country's Current Account, which is part of Balance of Payments: A country's current account reflects balance of trade and earnings on foreign investment. It consists of total number of transactions including its exports, imports, debt, etc. A deficit in current account due to spending more of its currency on importing products and services than it is earning through sale of exports or services causes depreciation. Balance of payment position fluctuates exchange rate of its domestic currency. If the balance of payment position is adverse, then the domestic currency would depreciate against the foreign currency. If the balance of payment position is favorable, then the domestic currency would appreciate against the foreign currency.

- 14. Factors affecting Exchange Rates 3. Country's Current Account (continued): India faced the Balance of Payment crisis in the year 1991, which is also one of the factors that had driven our country to embrace the path of liberalization. To counter this adverse BOP position as well as to stabilize the foreign exchange market, Government of India in July, 1991 made a two step downward exchange rate adjustment (depreciation of our currency) of 9% and 11%, that is total 20%. By definition, the current account is a country's trade balance plus net income and direct payments arising out invisibles or services (service exports minus service imports). The balance of trade or visible is the balance of country's imports over exports of goods. So, the current account includes the balance of trade + balance in invisibles or services.

- 15. Factors affecting Exchange Rates 4. Government Debt: Government debt is public debt or national debt owned by the central government. Most countries, including ours, finance their budgets using large-scale deficit financing. In other words, they borrow to finance economic growth. If this government debt outpaces economic growth, it can drive up inflation by deterring foreign investment from entering the country. In majority of emerging economies including ours, the government might print money to finance debt, which can also drive up inflation. The effect of inflation on exchange rate we have already discussed.

- 16. Factors affecting Exchange Rates 5. Terms of Trade: A trade deficit also can cause exchange rates to change. Related to current accounts and balance of payments, the terms of trade is the ratio of export prices to import prices. A country's terms of trade improves if its exports prices rise at a greater rate than its imports prices. This results in higher revenue, which causes a higher demand for the country's currency and an increase in its currency's value. This results in an appreciation of exchange rate. But in case of India, this scenario is very much adverse. We do not have crude oil resources in our country. Petrol is also called as Liquid Gold. Diesel and Petrol are used for many industrial purposes and also for transportation. Hence, India has to import its entire requirement from abroad. Because of this reason, our Balance of Trade is always negative, that is, our imports are always more than exports. In the month of February, 2022 crude oil price crossed $ 130 a barrel because of Russia- Ukraine war and it has affected our Current Account position very badly. However, recently, the oil price has been improving and presently at the level of $ 110.

- 17. Factors affecting Exchange Rates 6. Political Stability & Performance: A country's political state and economic performance can affect its currency strength. A country with less risk for political turmoil is more attractive to foreign investors, as a result, drawing investment away from other countries with more political and economic stability. Increase in foreign capital, in turn, leads to an appreciation in the value of its domestic currency. A country with sound financial and trade policy does not give any room for uncertainty in value of its currency. But, a country prone to political confusions may see a depreciation in exchange rates. Presently, Sri Lanka is witnessing this situation. The Sri Lankan economy has been facing a crisis owing to a serious balance of payments (BoP) problem. Its foreign exchange reserves are depleting rapidly. It is becoming increasingly difficult to import essential consumption goods. The country is unable to repay past debts. The World Bank is deeply concerned about the uncertain economic outlook in Sri Lanka and the impact on people.

- 18. Factors affecting Exchange Rates 7. Recession: When a country experiences a recession, its interest rates are likely to fall, decreasing its chances to acquire foreign capital. As a result, its currency weakens in comparison to that of other countries, therefore lowering the exchange rate. Japan is the best example for this factor. Japan has suffered from sluggish economic growth and recession since the 1990s, a phenomenon dubbed “Japan’s Lost Decade.” The yen weakened to more than 130 (20 years low) to the dollar on 28/04/2022 for the first time since April 2002, after the Bank of Japan reinforced its commitment to low interest rates despite rising inflation. “While central banks in the U.S. and Europe are moving toward monetary tightening or rate increases, the Japanese economy is still on the road to recovery from the impact of the Covid-19 pandemic,” BOJ Gov. Haruhiko Kuroda said at a news conference. “It is most important to support economic recovery by patiently continuing monetary easing.”

- 19. Factors affecting Exchange Rates 8. Speculation: If a country's currency value is expected to rise, investors will demand more of that currency in order to make a profit in the near future. As a result, the value of the currency will rise due to the increase in demand. With this increase in currency value comes a rise in the exchange rate as well. As stated above, sometimes, currencies are affected by the confidence (or lack thereof) traders have in a currency. Currency changes from speculation tend to be irrational, abrupt, and short-lived. For example, traders may be bearish on a currency based on an election outcome, especially if the result is perceived as unfavorable for trade or economic growth. In other cases, traders may be bullish on a currency because of economic news, which may buoy the currency, even if the economic news itself did not affect the currency fundamentals.

- 20. Factors affecting Exchange Rates 9. Government Intervention: Governments have a collection of tools at their disposal through which they can manipulate their local exchange rate. Primarily, central banks are known to adjust interest rates, buy foreign currency, influence local lending rates, print money, and use other tools to modulate currency exchange rates. The primary objective of manipulating these factors is to ensure favorable conditions for a stable currency exchange rate, cheaper credit, more jobs, and high economic growth. Since the adoption of liberalization process, our country has been adopting the above policies. If we track the history, Government of India took the following steps: The dual exchange rate system was replaced by a unified exchange rate system in March 1993, whereby all foreign exchange receipts could be converted at market determined exchange rates. On unification of the exchange rates, the nominal exchange rate of the rupee against both the US dollar as also against a basket of currencies got adjusted lower, which almost nullified the impact of the previous inflation differential. The restrictions on a number of other current account transactions were relaxed. The unification of the exchange rate of the Indian rupee was an important step towards current account convertibility, which was finally achieved in August 1994, when India accepted obligations under Article VIII of the Articles of Agreement of the IMF

- 21. Factors affecting Exchange Rates 9. Government Intervention (continued): China is one more example of Government intervention in manipulating its exchange rate. The People’s Bank of China (PBOC) allows the yuan to trade in a 2% range around a mid-point it fixes against the dollar each day. That mid-point is based on the yuan’s movement in the previous session and moves in currencies of China’s main trading partners. China also maintains heavy capital controls, strict foreign investment quotas and a complex system that manages onshore trading and influences offshore yuan activity, leaving the true value of the yuan open to interpretation.

- 22. Major Players in Forex Market of India Players in the Indian market include: (a) Central Bank of the country, that is RBI in our case. (b) Authorized Dealers (ADs), mostly banks who are authorized to deal in foreign exchange, (c) Foreign exchange brokers who act as intermediaries, and (d)) customers – individuals, corporates, who need foreign exchange for their transactions. Though customers are major players in the foreign exchange market, for all practical purposes they depend upon ADs and brokers. In the spot foreign exchange market, foreign exchange transactions were earlier dominated by brokers. Nevertheless, the situation has changed with the evolving market conditions, as now the transactions are dominated by ADs. Brokers continue to dominate the derivatives market.

- 24. Major Players in Forex Market of India RBI intervenes in the market essentially to ensure orderly market conditions. RBI undertakes sales/purchases of foreign currency in periods of excess demand/supply in the market. Foreign Exchange Dealers’ Association of India (FEDAI) plays a special role in the foreign exchange market for ensuring smooth and speedy growth of the foreign exchange market in all its aspects. All ADs are required to become members of the FEDAI and execute an undertaking to the effect that they would abide by the terms and conditions stipulated by the FEDAI for transacting foreign exchange business. The FEDAI is also the accrediting authority for the foreign exchange brokers in the interbank foreign exchange market.

- 25. Forex Market in India o As stated already, Forex is a two-sided market. Go with $ to banks, we will get rupee. Go with rupee to banks, we will $. In two-sided market, we require a buying rate and a selling rate. By common sense, the buying rate should be less than the selling rate for the marketers. In the wholesale market, the quote will be: 1$ = Rs. 75.80/82 When the customer goes with the $, he will get Rs. 75.80. When the customer goes with rupees, he will get 1 $, provided he pays Rs. 75.82.

- 26. Forex Market in India The wholesale market in forex is called Inter-Bank Market, which resides in the Dealing room of the Treasuries of the Banks. The difference between buying rate and the selling rate is called Spread. In the Inter-bank quote of 1$ = Rs. 75.80/82, 2 paise is the spread of the inter- bank market. Let us take the spread in cross currency quotes: 1 Euro = 1.2060/62 $ Buying Rate is 1.2060 $ for 1 Euro Selling Rate is 1.2062 $ for 1 Euro The spread is 2 pips.

- 27. Forex Market in India Let us take another example: Today’s Inter-bank Rate: 1 $ = 77.26/28 The above quote is called as Direct Quote. In India, we follow direct quote from August, 1993. Previous to August, 1993, we used to follow indirect quote, the example of which is given below: Rs. 100 = 1.2940/43 $. For the customers, the clarity or understanding in direct quote is more when compared to the indirect quote. Let us come back to Direct quote: 1 $ = 77.26/28 The 1 $ portion is called as Base Currency. Rs. 77.26/28 is called as Variable Currency.

- 28. Forex Market in India What is Cross Currency Quote? In a foreign currency quote, where rupee value/parity is not seen, such quotes are called as Cross Currency Quote. For example: 1 $ = 1.3844/46 SGD. 1 Euro = 1.2060/62 $ In cross currency quote, both the legs of the exchange rate will be of currencies other than rupee.

- 29. Types of Forex Contracts based on Settlement/Delivery INDIAN INSTITUTE OF BANKING & FINANCE Date of Contract Date of Settlement or Delivery Type of Contract 01/03/2022 (Tuesday) 01/3/2022 T+0 or Cash Contracts 01/03/2022 02/03/2022 T+1 or TOM Contracts 01/03/2022 03/03/2022 T+2 or Spot Contracts 90% of the forex contracts world over are spot. If the date of settlement or delivery is not told or kept silent, it is by default Spot Contracts. 01/03/2022 Anything beyond T+2 is called as Forward Contracts Forward or OTC (Over the counter) Contracts A spot contract was entered on 03/03/2022 (Thursday) T+2 Funds delivery or settlement for this Spot Contract entered on 3rd March, 2022 would take place on Monday, 7th March, 2022, since intervening Saturday and Sunday are holidays for forex market

- 30. Forex Market in India As stated already Foreign Exchange Market mainly consists of : o Banks or Authorized Dealers o Exporters o Importers o People sending: Outward Remittances Inward Remittances o Capital transactions such as: FDIs (Foreign Direct Investments) FPIs (Foreign Portfolio Investors) ECBs (External Commercial Borrowings)

- 31. Forex Market in India The main wholesale market is called as Inter-Bank market, which resides in the dealing rooms of the banks. The dealing rooms, where foreign currency conversion take place, are part of Treasury of a Bank. Since Mumbai is the financial capital of India, most of the Banks have kept their Treasury in Mumbai. Treasury consist of three departments: o Dealing Room or Front office o Back Office or Accounts Section. o Mid Office or Risk Management Section for the Treasury. So, Forex Deals will be taking place at dealing room. Deals are carried out by the dealers. For every forex transactions concluded, the dealers have to prepare a deal slip. The head of the dealers is called as Chief Dealer. The entire Treasury would be head by a Treasurer.

- 32. Forex Market in India What is the marketable lot in inter-bank market? Normally it is $ 1 mio. It can be $ 500th or called as half a $ or $ 250th or quarter $. Our exports and imports of our customers normally ranges from $ 5,000 to $ 50,000. They fall under retail forex market segment. Dealers working in Treasury of a bank will not keep high forex balances, because of its volatile nature and they keep on squaring their forex positions. Forex market never sleeps and forex market works on week days 24/5. If we take a day, it starts early morning at Tokyo and ends the day with New York market. In forex, the dealing room is called as AD Category I Branch, where the actual currency conversion would take place. AD 2 or B category branches can handle only documents connected exports, imports, inward remittance & outward remittance. C category branches are non-forex dealing branches.

- 33. Forex Market in India What happens in case of exports? o India’s resources are exported to foreign country, that is commodities or services and in turn we get $ or foreign currency. o This $ is to be converted into rupee and exporter’s account is to be credited after deducting Bank’s margin. What happens in case of imports? o Foreign resources are coming to India, it can be goods or services. o In turn, the importer gives rupee to the Bank and Bank converts the rupee into $ (or foreign currency) and $ is sent abroad to the exporter. o It means Importer’s rupee account will be debited with margin of the bank and bank will convert rupee into $ and $ will be sent to the exporter abroad who has supplied the goods or services.

- 34. Exchange Rate Mechanism - Exports Let us assume that an export customer banking with a B Category Branch, Santacruz Branch, Mumbai and delivers an export bill for $ 10,000. o Let us assume that today’s Inter-Bank Market with the dealing room of the bank is: o 1$ = Rs. 75.80/82 o What Santacruz branch is doing? It will sell $ to the Dealing room and in turn: Dealing room would buy $. So, we will have to apply the buying rate of inter-bank. Buying Rate is. . . . . Rs. 75.80 Less Bank’s margin 0.04 Export rate is . . : Rs. 75.76 Exporter would get Rs. 75.76 x $ 10,000 = Rs. 7,57,600/- (or account is credited) and in the process Margin earned by the Bank 0.04 x $ 10,000 = Rs. 400/-.

- 35. Exchange Rate Mechanism - Imports In the similar way, let us assume that an Import customer banking with a B Category Branch, Santacruz Branch wants to clear his import bill for $ 10,000. Let us that today’s Inter-Bank Market with your dealing is: o 1$ = Rs. 75.80/82 o What Santacruz branch is going to do? It has to buy $ for the importer from the dealing room. When Santacruz buys $, the dealing room would be selling the $. Take the selling rate of Dealing Room, that is Rs. 75.82 Margin to be added is 0.06 Import rate will be: Rs. 75.88 Importer’s account will be debited by Rs. 7, 58,800/- (Rs. 75.88 x $ 10,000). Bank will retain: 0.06 x $ 10,000 600/- Balance amount, Rs. 7,58,200, which will be given to Dealing room and dealing room in turn would give $ 10,000 to Santacruz Branch. This $ 10,000 would be used by the importer through the bank for paying his import bill.

- 36. Types of Forex Rates All purchase/sale transactions are not alike and hence attract different rates. Although both, payment of an import bill and issuance of a TT in foreign currency are sale transactions, the rate for the former would be costlier or worse as compared to the latter. The issuance of a DD is comparatively simple and while the Rupee equivalent is recovered immediately, the payment made overseas is at a later date, giving the Bank some float funds. In the case of an import bill, there is considerably higher work like scrutiny of documents, follow up, folder maintenance etc. The additional work involved is sought to be compensated by levying a bill collection commission and selling the foreign currency at a costlier rate as compared to the issuance of TT.

- 37. Types of Forex Rates Thus, other things being equal, there would be two rates, one for the import bill - “Bill Selling Rate” (BC Selling) and the other for the outward remittances – the “ TT Selling Rate.” Similarly, in case of purchase transaction, the exchange rate quoted for an export bill would be worse than the quote for an inward remittance. Thus, other things being equal, there would be two rates, one for the export bill – “Bill Buying Rate” (OD Buying) and the other for the inward remittances – the “TT Buying Rate”. Additionally, the quotes would vary because of differences in period of payment for bills of exchange drawn for exports. The forex rates would be different for issuance and buying of Foreign Currencies and Travelers Cheques.

- 38. Exchange Margin EXCHANGE MARGIN: The Base Rates, which are derived from the ongoing interbank spot rates, are applied for arriving at rates for merchant purchase and sale transactions. Banks have been given freedom by FEDAI to fix the quantum of exchange margin to be loaded to the base rate for quoting rates for different types of merchant transactions e.g. TT Buying/Selling, Bill Buying/Selling etc.

- 39. Types of Forex Rates The different types of rates can be summarized as below: Purchase Sale TT Buying Rate (applied for simple inward remittances) TT Selling Rate (applied for services like donation, hospitalization, education fees etc.) OD (On demand) Bill Buying Rate (applied for export bills) BC Selling Rate (applied for import bills) Travelers Cheques (TCs) Buying Rate Travelers Cheques (TCs) Selling Rate Currency Note buying rate (Cash buying Rate) Currency Note selling rate (Cash selling Rate)

- 40. Exchange Margin Let us assume today’s Inter-Bank rate is: 1 $ = Rs. 77.73/75 Let us assume the following exchange margins and based on these exchange margin, the different rates are worked out as follows: Purchase Sale TT Buying Rate – 2 paise per $, Rs. 77.71 (Rs. 77.73 – 0.02) TT Selling Rate – 3 paise per $ - Rs. 77.78 (Rs. 77.75 + 0.03) OD (On demand export bills) – 4 paise per $, Rs. 77.69 (Rs. 77.73 – 0.04) BC Selling Rate – 5 paise per $- Rs. 77.80 (Rs. 77.75 + 0.05) Travelers Cheques (TCs) Buying Rate – 8 paise per $ - Rs. 77.65 (Rs. 77.73 – 0.08) Travelers Cheques – 10 paise per $ (TCs) Selling Rate - Rs. 77.85 (Rs. 77.75 + 0.10) Currency Note buying rate – 12 paise per $ - Rs. 77.61 (Rs. 77.73 – 0.12) Currency Note selling rate – 15 paise per $ - Rs. 77.90 (Rs. 77.75 + 0.15)

- 41. International Monetary Fund (IMF) We have already discussed about Bretton Wood Agreement in the last class. To give you all a small recap, the Bretton Wood Agreement was negotiated in July 1944 by delegates from 44 countries at the United Nations Monetary and Financial Conference held in Bretton Woods, New Hampshire. Thus, the name came “Bretton Woods Agreement. In this agreement, one of the important decisions took place was that this agreement paved the way creation of the following organizations: International Monetary Fund (IMF) World Bank (International Bank for Reconstruction and Development), and International Trade Organization (ITO).

- 42. Brief on IMF History of the IMF: As stated already, the IMF was originally created in 1945 as part of the Bretton Woods Agreement, which attempted to encourage international financial cooperation by introducing a system of convertible currencies at fixed exchange rates. The dollar was redeemable for gold at $35 per ounce at the time. The IMF oversaw the system: for example, a country was free to readjust its exchange rate by up to 10% in either direction, but larger changes required the IMF's permission.

- 43. Brief on IMF The IMF also acted as a gatekeeper: Countries were not eligible for membership in the International Bank for Reconstruction and Development (IBRD)— a World Bank forerunner that the Bre tton Woods agreement created in order to fund the reconstructio n of Europe after World War II—unless they were members of the I MF. Since the Bretton Woods system collapsed in the 1970s, the IMF has promoted the system of floating exchange rates, meaning that market forces determine the value of currencies relative to one another. This system continues to be in place even today.

- 44. Brief on IMF The IMF's primary methods for achieving these goals are monitoring, capacity building and lending. The IMF makes loans to countries that are experiencing economic distress to prevent or mitigate financial crises. Surveillance: The IMF collects massive amounts of data on national economies, international trade, and the global economy in aggregate. The organization also provides regularly updated economic forecasts at the national and international levels. These forecasts, published in the World Economic Outlook, are accompanied by lengthy discussions on the effect of fiscal, monetary, and trade policies on growth prospects and financial stability.

- 45. Brief on IMF Capacity Building: The IMF provides technical assistance, training, and policy advice to member countries through its capacity building programs. These programs include training in data collection and analysis, which feed into the IMF's project of monitoring national and global economies. Lending : The IMF makes loans to countries that are experiencing economic distress to prevent or mitigate financial crises. Members contribute the funds for this lending to a pool based on a quota system. In 2019, loan resources in the amount of SDR 11.4 billion (SDR 0.4 billion above target) were secured to support the IMF’s concessional lending activities into the next decade.

- 46. Brief on IMF IMF funds are often conditional on recipients making reforms to increase their growth potential and financial stability. In fact one of the reasons for India adopting liberalization policies in 1991 were due to the conditions imposed by IMF to open its economic border. In 1991, to overcome the foreign exchange problem, India went for IMF loan and in turn IMF put terms and conditions for taking the loan from it. The IMF's website describes its mission as "to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world."

- 47. IMF’s Quota System An important factor that helps the IMF’s functioning is the quota. This quota is basically money that a member country has to give to the IMF. As per the norms, each member has to subscribe a quota of the IMF. It is out of this quota which is basically money, that the IMF gives loans to its members. How the size of quota for each member country is determined? The quota of a country depends on its economic importance. When a country joins the IMF, it is assigned an initial quota in the same range as the quotas of existing members that are broadly comparable in economic size and characteristics. The IMF uses a quota formula to guide the assessment of a member’s relative position. The International Monetary Fund (IMF) is an organization of 190 countries, working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world. The International Monetary Fund (IMF) is an organization of 190 countries, working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world

- 48. IMF’s Quota System The current quota formula (applied for 14th quota review) is a weighted average of GDP (weight of 50%), openness (30%), economic variability (15%), and international reserves (5%). For this purpose, GDP is measured through a blend of GDP—based on market exchange rates (weight of 60%)—and on PPP (Purchasing Power Parity) exchange rates (40%). The formula also includes a “compression factor” that reduces the dispersion in calculated quota shares across members. Quota formula is also subjected to review. The formula also includes a “compression factor” that reduces the dispersion in calculated quota shares across members. Quotas are denominated in SDRs, the IMF’s unit of account. The International Monetary Fund (IMF) is an organization of 190 countries, working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world. The International Monetary Fund (IMF) is an organization of 190 countries, working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world

- 49. IMF’s Quota System After the 14th quota review (enforced on January 26, 2016), the United States, continues to be the largest quota holder (as of September 12, 2016) with quota holding of SDR 82.99 billion (about US$116 billion). The smallest quota holder is Tuvalu, with a quota of SDR 2.5 million (about US$3.5 million). India’s quota holding is SDR 13.11 bn. Quotas of each of the IMF’s 190 members increased to a combined SDR 477 billion (about US$668 billion) from about SDR 238.5 billion (about US$334 billion) after the 14th quota review which was came into effect on January 26, 2016. For any member country, out of the quota, 25% should be paid in the form of foreign currency or gold (called as reserve tranche or gold tranche) to the Fund, and the remaining 75% in the form of domestic currency (called as credit tranche). The International Monetary Fund (IMF) is an organization of 190 countries, working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around

- 50. IMF’s Quota System Multiple purposes of Quotas: Quota with the Fund serves many purposes. 1. Firstly, quota subscribed by the members indicates funds provided by the members to the IMF, and hence it constitute to the resource base of the IMF. 2. Second; a member country’s loan availability depends upon size of its quota. The amount of financing a member can obtain from the IMF (called as access limit) thus depends upon its quota. For example, under Stand-By and Extended Arrangements, a member can borrow up to 200% of its quota annually and 600% cumulatively. However, access may be higher in exceptional circumstances. 3. Thirdly, the size of quota basically determines voting power of a member. The peculiarity of the decision making process of the IMF is that the voting power of a member country depends on the size of the quota.

- 51. IMF’s Quota System For example, if India’s quota arrived at by IMF is 2.76%, her voting weight will be near to that i.e. it is 2.76 % at present (though India’s vote share is 2.64% after the 14th Quota review). As per the IMF rules, for an important resolution to be passed, at least 85% of the votes should be secured. This means that the US, with 16.54 % of voting power, enjoys a veto power. Thus, a member’s quota indicates basic aspects of its financial and organizational relationship with the Fund. The International Monetary Fund (IMF) is an organization of 190 countries, working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world. The International Monetary Fund (IMF) is an organization of 190 countries, working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world

- 52. IMF – China included in the basket of currencies Effective October 1, 2016, the IMF has added the Chinese renminbi (RMB) to the basket of currencies that make up the Special Drawing Right, or SDR. The SDR is an international reserve asset created by the IMF in 1969 to supplement its member countries’ official reserves. The IMF’s Executive Board agreed to change the SDR’s basket currency composition in November 2015, and the decision now enters into force after a period of transition. The RMB joins the SDR basket in addition to the previously included four currencies—the U.S. dollar, the euro, the Japanese yen, and the British pound. , secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world. The International Monetary Fund (IMF) is an organization of 190 countries, working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world

- 53. IMF – China included in the basket of currencies The RMB’s inclusion is an important milestone in the integration of the Chinese economy into the global financial system. The IMF’s determination that the RMB is freely usable reflects China’s expanding role in global trade and the substantial increase in the international use and trading of the renminbi. It also recognizes the progress made in reforms to China’s monetary, foreign exchange, and financial systems and acknowledges the advances made in liberalizing, integrating, and improving the infrastructure of its financial markets. IMF expected that the inclusion of the RMB in the SDR basket will further support the already increasing use and trading of the RMB internationally. financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world.

- 54. Article VIII of IMF Acceptance of Article VIII: There are 31 articles in IMF prescribing the role, rights and obligations of member countries. Article VIII of the IMF imposes certain obligations on member countries of the Fund. In particular Article VIII, Sections 2(a) and 3 prohibit members, except with the approval of the Fund, from imposing restrictions on the making of payments and transfers for current international transactions or from engaging in multiple currency practices or discriminatory currency arrangements. Exchange contracts involving currency of any member of IMF and which are contrary to regulations imposed by the member are not enforceable in the territory of any member. The International Monetary Fund (IMF) is an organization of 190 countries, working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world

- 55. Article VIII of IMF Moreover, Article VIII Section 4 requires Fund members, subject to certain conditions, to purchase balances of their currency from other members which represent the balances that have been recently acquired as a result of current international transactions or that the conversion is necessary for the purpose of making payments for current transactions. The buying member has the option either to pay in SDR or in the currency of the selling member. The members are obliged to furnish information to IMF which is required for effective discharge of Fund’s obligations. Each member will undertake to coordinate with the fund and other members for surveillance of international liquidity and making SDR as principal reserve asset. ic growth, and reduce poverty around the world. The International Monetary Fund (IMF) is an organization of 190 countries, working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world

- 56. India Attain Article VIII of IMF IMF permitted India in the club of Article VIII of its schedule in the year 1993 and thereby India has agreed not to impose any restrictions on the current account transactions from our country, Current Account Transaction means all transactions, which are not capital account transactions. Specifically, it includes: i. Business transactions between residents and non-residents. ii. Short-term banking and credit facilities in the ordinary course of business. iii. Payments towards interest on loans and by way of income from investments. iv. Payment of expenses of parents, spouse or children living abroad or expenses on their foreign travel, medical and education. v. Scholarships/Chairs, etc. Primarily there are no restrictions on current account transactions The International Monetary Fund (IMF) is an organization of 190 countries, working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world