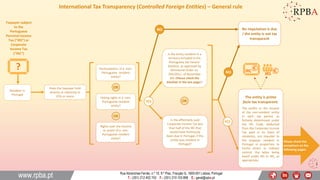

RPBA Infographic: International Tax Transparency (Controlled Foreign Entities) - Updated 14.01.2021

- 1. International Tax Transparency (Controlled Foreign Entities) – General rule Rua Abranches Ferrão, n.º 10, 9.º Piso, Fracção G, 1600-001 Lisboa, Portugal T.: (351) 212 402 743 F.: (351) 210 103 898 E.: geral@rpba.pt No imputation is due / the entity is not tax transparent Is the entity resident in a territory included in the Portuguese tax havens’ blacklist, as approved by Ministerial Order no. 292/2011, of November 8th (Please check the blacklist in the last page)? Participations in a non- Portuguese resident entity? Taxpayer subject to the Portuguese Personal Income Tax (“IRS”) or Corporate Income Tax (“IRC”) NO Is the effectively paid Corporate Income Tax less than half of the IRC that would have fictitiously been due in Portugal, if the entity was resident in Portugal? OR YES NO Voting rights in a non- Portuguese resident entity? Rights over the income or assets of a non- Portuguese resident entity? OR ORDoes the taxpayer hold directly or indirectly in 25% or more: Please check the exceptions on the following pages: Resident in Portugal YES 1 The entity is prima facie tax transparent: The profits or the income of the non-resident entity in each tax period, as fictively determined under the IRC Code, deducted from the Corporate Income Tax paid in its State of residence, are imputed to the taxpayer resident in Portugal in proportion to his/its direct or indirect control, the latter being taxed under IRS or IRC, as appropriate.

- 2. Rua Abranches Ferrão, n.º 10, 9.º Piso, Fracção G, 1600-001 Lisboa, Portugal T.: (351) 212 402 743 F.: (351) 210 103 898 E.: geral@rpba.pt Are the incorporation and holding of the non-resident entity based on valid economic reasons? YES Is the entity resident or established in another Member State of the European Union or of the European Economic Area? NO Does the non-resident entity develop an agricultural, commercial, industrial or service rendering activity? YES NO NO The entity is secunda facie tax transparent: The profits or the income of the non-resident entity in each tax period, as fictively determined under the IRC Code, deducted from the Corporate Income Tax paid in its State of residence, are imputed to the taxpayer resident in Portugal in proportion to his/its direct or indirect control, the latter being taxed under IRS or IRC, as appropriate. The entity is not tax transparent Please check the remaining exceptions on the next page: International Tax Transparency (Controlled Foreign Entities) – Exception according to residence 2 YES NO YES Is this activity supported by staff, equipment, assets and premises?

- 3. Rua Abranches Ferrão, n.º 10, 9.º Piso, Fracção G, 1600-001 Lisboa, Portugal T.: (351) 212 402 743 F.: (351) 210 103 898 E.: geral@rpba.pt The entity is not tax transparent The entity is tax transparent: The profits or the income of the non-resident entity in each tax period, as fictively determined under the IRC Code, deducted from the Corporate Income Tax paid in its State of residence, are imputed to the taxpayer resident in Portugal in proportion to his/its direct or indirect control, the latter being taxed under IRS or IRC, as appropriate. YES NO DISCLAIMER: This infographic is updated until January 14th, 2021. Although great care has been taken when drafting this infographic, Ricardo da Palma Borges & Associados (RPBA) - Sociedade de Advogados, S.P., R.L. does not accept any responsibility whatsoever for any consequences arising from the use of the information contained herein. The information is provided solely for general purposes, cannot be regarded as legal or other advice. It is strongly recommended to take professional legal advice appropriate for your case before making any decisions. Is the income of the non-resident entity derived in more than 25% from one or more of the following categories of income ? Interest or any other capital income? Royalties or any other income derived from intellectual property, image rights or rights of similar nature? Dividends and income derived from the disposal of shares of capital? Income derived from financial leasing? Income derived from transactions proper of the banking business even if not carried on by credit institutions, relating to insurance, business or from other financial activities entered into with entities in special relations for the purposes of the Portuguese transfer pricing provision? Income from invoicing companies that earn commercial and services income derived from goods and services purchased from and sold to related entities, for the purposes of the Portuguese transfer pricing provision and that add no or little economic value? International Tax Transparency (Controlled Foreign Entities) – Exception according to activities 3 OrAnd OrAnd OrAnd OrAnd OrAnd

- 4. Rua Abranches Ferrão, n.º 10, 9.º Piso, Fracção G, 1600-001 Lisboa, Portugal T.: (351) 212 402 743 F.: (351) 210 103 898 E.: geral@rpba.pt Portuguese Tax Havens’ Blacklist, as approved by Ministerial Order no. 292/2011, of November 8th Anguilla Guyana Puerto Rico Antigua and Barbuda Honduras Qatar The Netherlands Antilles Hong Kong The Solomon Islands Aruba Jamaica American Samoa Ascension Jordan Samoa The Bahamas The Queshm Island St. Helena Bahrain Kiribati St. Lucia Barbados Kuwait St. Kitts-Nevis Belize Labuan San Marino Bermuda Lebanon St. Pierre and Miguelon Bolivia Liberia St. Vincent and the Grenadines Brunei Liechtenstein The Seychelles The Channel Islands (Alderney, Guernsey, Jersey, Great Sark, Herm, Little Sark, Brechou, Jethou and Lihou) The Maldives Swaziland The Isle of Man Svalbard Islands (Spitsbergen archipelago and the Bjornoya island)The Northern Marianas Islands The Cayman Islands The Marshall Islands Tokelau The Cocos o Keeling Islands Mauritius Tonga The Cook Islands Monaco Trinidad and Tobago Costa Rica Montserrat Tristão da Cunha Island Djibouti Nauru Turks and Caicos Islands Dominica Natal Tuvalu United Arab Emirates Niue Uruguay The Falkland Islands Norfolk Island Vanuatu Fiji Oman The British Virgin Islands Gambia Palau The U.S. Virgin Islands Grenada Panama Yemen Gibraltar Pitcairn Island “Other Pacific Islands not specifically mentioned” Guam French Polynesia 4