QNBFS Daily Market Report July 16, 2017

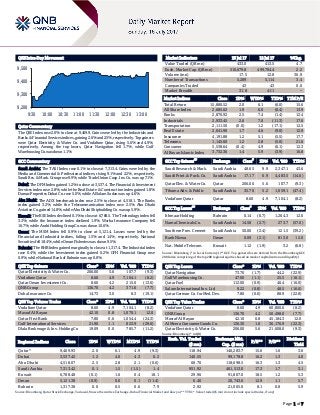

- 1. Page 1 of 7 QSE Intra-Day Movement Qatar Commentary The QSE Index rose 2.0% to close at 9,469.9. Gains were led by the Industrials and Banks & Financial Services indices, gaining 2.6% and 2.5%, respectively. Top gainers were Qatar Electricity & Water Co. and Vodafone Qatar, rising 5.6% and 4.9%, respectively. Among the top losers, Qatar Navigation fell 1.7%, while Gulf Warehousing Co. was down 1.1%. GCC Commentary Saudi Arabia: The TASI Index rose 0.1% to close at 7,313.4. Gains were led by the Media and Commercial & Professional indices, rising 9.1% and 2.2%, respectively. Saudi Res. & Mark. Group rose 9.9%, while Trade Union Coop. Ins. Co. was up 7.1%. Dubai: The DFM Index gained 1.2% to close at 3,537.4. The Financial & Investment Services index rose 2.8%, while the Real Estate & Construction index gained 1.8%. Damac Properties Dubai Co. rose 5.0%, while Al Salam Sudan was up 4.6%. Abu Dhabi: The ADX benchmark index rose 2.5% to close at 4,518.1. The Banks index gained 3.2%, while the Telecommunication index rose 2.5%. Abu Dhabi Aviation Co. gained 14.8%, while Abu Dhabi Shipbuilding Co. was up 5.9%. Kuwait: The KSE Index declined 0.1% to close at 6,788.5. The Technology index fell 3.3%, while the Insurance index declined 1.9%. Warba Insurance Company fell 16.7%, while Arabi Holding Group Co. was down 10.6%. Oman: The MSM Index fell 0.9% to close at 5,121.4. Losses were led by the Financial and Industrial indices, falling 1.5% and 1.4%, respectively. National Securities fell 18.4%, while Oman Fisheries was down 9.5%. Bahrain: The BHB Index gained marginally to close at 1,317.4. The Industrial index rose 0.4%, while the Investment index gained 0.2%. GFH Financial Group rose 0.9%, while National Bank of Bahrain was up 0.8%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Qatar Electricity & Water Co. 206.00 5.6 107.7 (9.3) Vodafone Qatar 8.60 4.9 7,104.1 (8.2) Qatar Oman Investment Co. 8.60 4.2 215.0 (13.6) QNB Group 136.70 4.2 371.6 (7.7) Doha Insurance Co. 14.73 3.0 8.3 (19.1) QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Vodafone Qatar 8.60 4.9 7,104.1 (8.2) Masraf Al Rayan 42.10 0.8 1,070.1 12.0 Qatar First Bank 7.80 0.6 1,054.4 (24.3) Gulf International Services 21.90 1.1 823.9 (29.6) Dlala Brokerage & Inv. Holding Co 19.09 0.0 785.7 (11.2) Market Indicators 13 Jul 17 12 Jul 17 %Chg. Value Traded (QR mn) 433.0 413.5 4.7 Exch. Market Cap. (QR mn) 510,679.8 499,704.4 2.2 Volume (mn) 17.5 12.8 36.9 Number of Transactions 5,289 5,114 3.4 Companies Traded 43 43 0.0 Market Breadth 31:8 41:1 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 15,880.52 2.0 6.1 (6.0) 15.6 All Share Index 2,685.62 1.9 6.0 (6.4) 13.9 Banks 2,870.92 2.5 7.4 (1.4) 12.4 Industrials 2,933.45 2.6 7.0 (11.3) 17.6 Transportation 2,111.50 (0.0) 1.2 (17.1) 12.5 Real Estate 2,041.90 1.7 4.6 (9.0) 12.9 Insurance 4,191.88 1.2 5.1 (5.5) 17.7 Telecoms 1,145.60 1.2 2.8 (5.0) 21.6 Consumer 5,538.64 (0.4) 4.9 (6.1) 12.3 Al Rayan Islamic Index 3,732.36 1.4 5.9 (3.9) 16.8 GCC Top Gainers ## Exchange Close # 1D% Vol. ‘000 YTD% Saudi Research & Mark. Saudi Arabia 48.65 9.9 2,347.1 43.6 Saudi Print. & Pack. Co. Saudi Arabia 17.17 6.9 4,483.5 (14.6) Qatar Elec. & Water Co. Qatar 206.00 5.6 107.7 (9.3) Tihama Adv. & Public Saudi Arabia 35.70 5.2 1,059.1 (47.4) Vodafone Qatar Qatar 8.60 4.9 7,104.1 (8.2) GCC Top Losers ## Exchange Close # 1D% Vol. ‘000 YTD% Ithmaar Holding Bahrain 0.14 (6.7) 1,264.3 12.0 Nama Chemicals Co. Saudi Arabia 14.58 (2.7) 273.7 (57.0) Southern Prov. Cement Saudi Arabia 50.00 (2.4) 121.5 (39.2) Bank Nizwa Oman 0.09 (2.1) 813.0 12.0 Nat. Mobile Telecom. Kuwait 1.12 (1.9) 3.2 (6.8) Source: Bloomberg ( # in Local Currency) ( ## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Qatar Navigation 73.70 (1.7) 44.2 (22.9) Gulf Warehousing Co. 47.00 (1.1) 25.5 (16.1) Qatar Fuel 112.00 (0.9) 46.4 (16.0) Salam International Inv. Ltd 9.22 (0.8) 48.5 (16.6) Qatar German Co. for Med. Dev. 7.80 (0.6) 88.9 (22.8) QSE Top Value Trades Close* 1D% Val. ‘000 YTD% Vodafone Qatar 8.60 4.9 60,800.6 (8.2) QNB Group 136.70 4.2 50,498.0 (7.7) Masraf Al Rayan 42.10 0.8 45,184.3 12.0 Al Meera Consumer Goods Co. 136.30 1.0 36,176.9 (22.3) Qatar Electricity & Water Co. 206.00 5.6 21,608.0 (9.3) Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 9,469.93 2.0 6.1 4.9 (9.3) 118.94 140,283.7 15.6 1.6 3.6 Dubai 3,537.42 1.2 4.0 4.3 0.2 140.55 99,178.8 16.2 1.3 4.0 Abu Dhabi 4,518.07 2.5 2.8 2.1 (0.6) 68.70 118,698.5 16.3 1.3 4.5 Saudi Arabia 7,313.42 0.1 1.5 (1.5) 1.4 951.92 461,513.0 17.3 1.7 3.1 Kuwait 6,788.48 (0.1) 1.6 0.4 18.1 29.96 91,807.0 18.5 1.2 5.3 Oman 5,121.38 (0.9) 0.0 0.1 (11.4) 6.46 20,743.6 12.9 1.1 5.7 Bahrain 1,317.38 0.0 0.5 0.6 7.9 2.92 21,005.0 8.1 0.8 5.9 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) 9,200 9,300 9,400 9,500 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 7 Qatar Market Commentary The QSE Index rose 2.0% to close at 9,469.9. The Industrials and Banks & Financial Services indices led the gains. The index rose on the back of buying support from non-Qatari shareholders despite selling pressure from Qatari and GCC shareholders. Qatar Electricity & Water Co. and Vodafone Qatar were the top gainers, rising 5.6% and 4.9%, respectively. Among the top losers, Qatar Navigation fell 1.7%, while Gulf Warehousing Co. was down 1.1%. Volume of shares traded on Thursday rose by 36.9% to 17.5mn from 12.8mn on Wednesday. Further, as compared to the 30-day moving average of 13.6mn, volume for the day was 28.9% higher. Vodafone Qatar and Masraf Al Rayan were the most active stocks, contributing 40.6% and 6.1% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Ratings, Earnings Releases, Global Economic Data and Earnings Calendar Ratings Updates Company Agency Market Type* Old Rating New Rating Rating Change Outlook Outlook Change Doha Bank Moody’s Qatar DR/BCA A2/baa3 A2/baa3 – – – Mashreqbank Fitch Dubai LT-IDR/ST- IDR/SR/SRF/VR A/F1/1/A/bb+ A/F1/1/A/bbb– – Stable – Dubai Islamic Bank Fitch Dubai LT-IDR/ST- IDR/SR/SRF/VR A/F1/1/A/bb A/F1/1/A/bb+ – Stable – Abu Dhabi Islamic Bank Fitch Abu Dhabi LT-IDR/ST- IDR/SR/SRF/VR A+/F1/1/A+/bb A+/F1/1/A+/bb – Stable – Source: News reports (* LT – Long Term, ST – Short Term, FSR- Financial Strength Rating, FCR – Foreign Currency Rating, LCR – Local Currency Rating, IDR – Issuer Default Rating, SR – Support Rating, LC – Local Currency, DR- Deposit Rating, BCA - baseline credit assessment , SRF- Support Rating Floor, VR- Viability Rating) Earnings Releases Company Market Currency Revenue (mn) 2Q2017 % Change YoY Operating Profit (mn) 2Q2017 % Change YoY Net Profit (mn) 2Q2017 % Change YoY Jarir Marketing Co. Saudi Arabia SR – – 133.2 14.6% 147.8 16.8% Oman Ceramic Company* Oman OMR 1.8 -7.2% – – 0.1 -8.4% Gulf Stones* Oman OMR 1.8 -29.7% – – 0.0 -77.3% Sembcorp Salalah* Oman OMR 40.8 3.7% – – 5.4 -31.5% Oman Refreshment* Oman OMR 34.8 -3.4% – – 3.8 -8.1% Majan Glass Oman OMR 3.8 -8.2% – – -0.5 N/A United Power* Oman OMR 4.1 -21.3% – – 1.0 186.9% Oman Hotels and Tourism* Oman OMR 1.7 -13.5% – – 0.5 -91.1% Muscat Thread Mills# * Oman OMR 1,369.0 13.2% – – 46.9 76.5% Sohar Power* Oman OMR 31.4 -3.4% – – -1.4 N/A Phoenix Power* Oman OMR 62.1 22.4% 17.1 -9.7% 4.0 -10.1% Muscat National Holding* Oman OMR 11.2 26.8% – – 0.8 19.1% Al Batinah Dev. Inv. Holding# * Oman OMR 138.5 0.0% – – 19.2 -93.0% Sharqiyah Desalination# * Oman OMR 6,489.7 36.7% – – -43.4 N/A Salalah Port Services* Oman OMR 25.8 -7.8% – – 0.3 -88.7% Oman Fisheries Oman OMR 3.7 -29.5% – – -0.2 N/A Oman Cement* Oman OMR 30.4 -3.5% – – 5.0 -26.2% Financial Services# * Oman OMR 293.5 -18.7% – – 5.8 -86.8% Al Omaniya Financial Ser. Oman OMR 9.8 0.3% – – 2.7 -14.6% Shell Oman Marketing* Oman OMR 225.8 23.1% – – 6.6 -25.6% Oman Packaging* Oman OMR 6.2 -8.9% – – 555.5 -22.3% Raysut Cement* Oman OMR 37.4 -25.1% 6.2 -55.1% 4.6 -64.2% Ooredoo Oman OMR 67.2 0.7% – – 6.8 -44.7% Muscat Gases* Oman OMR 5.0 7.3% – – 0.3 -40.6% Salalah Mills* Oman OMR 31.1 20.2% – – 2.4 19.2% Gulf Mushroom Products* Oman OMR 3.2 4.6% – – 0.1 -24.1% Asaffa Foods* Oman OMR 14.4 -9.4% – – 1.6 -44.3% Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 44.02% 57.29% (57,503,719.17) Qatari Institutions 18.60% 17.93% 2,881,781.02 Qatari 62.62% 75.22% (54,621,938.15) GCC Individuals 0.78% 1.39% (2,622,241.81) GCC Institutions 0.84% 1.05% (929,822.07) GCC 1.62% 2.44% (3,552,063.88) Non-Qatari Individuals 10.30% 12.30% (8,677,997.80) Non-Qatari Institutions 25.47% 10.03% 66,851,999.83 Non-Qatari 35.77% 22.33% 58,174,002.03

- 3. Page 3 of 7 Dhofar Cattle Feed Oman OMR 19.1 -2.7% 0.5 33.2% 0.2 -72.5% Global Financial Investment Oman OMR 8.2 215.4% – – 0.0 -96.5% Source: Company data, DFM, ADX, MSM, TASI, BHB. ( # Values in ‘000; *for the period 1H2017) Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 07/13 US Department of Labor Initial Jobless Claims 8-July 247k 245k 250k 07/13 US Department of Labor Continuing Claims 1-July 1,945k 1,950k 1,965k 07/14 US Bureau of Labor Statistics CPI MoM June 0.0% 0.1% -0.1% 07/14 US Bureau of Labor Statistics CPI YoY June 1.6% 1.7% 1.9% 07/14 US Federal Reserve Industrial Production MoM June 0.4% 0.3% 0.1% 07/13 Germany German Federal Statistical Office CPI MoM June 0.2% 0.2% 0.2% 07/13 Germany German Federal Statistical Office CPI YoY June 1.6% 1.6% 1.6% 07/13 France INSEE National Statistics Office CPI MoM June 0.0% 0.0% 0.0% 07/13 France INSEE National Statistics Office CPI YoY June 0.7% 0.7% 0.7% 07/14 Japan METI Industrial Production MoM May -3.6% – -3.3% 07/14 Japan METI Industrial Production YoY May 6.5% – 6.8% 07/14 Japan METI Capacity Utilization MoM May -4.1% – 4.3% 07/13 China National Bureau of Statistics Exports YoY June 11.3% 8.9% 8.7% 07/13 China National Bureau of Statistics Imports YoY June 17.2% 14.5% 14.8% Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Earnings Calendar Tickers Company Name Date of reporting 2Q2017 results No. of days remaining Status MARK Masraf Al Rayan 17-Jul-17 1 Due KCBK Al Khalij Commercial Bank 17-Jul-17 1 Due CBQK Commercial Bank of Qatar 18-Jul-17 2 Due WDAM Widam Food Company 18-Jul-17 2 Due QIBK Qatar Islamic Bank 18-Jul-17 2 Due ABQK Ahli Bank 18-Jul-17 2 Due UDCD United Development Company 18-Jul-17 2 Due DHBK Doha Bank 19-Jul-17 3 Due GWCS Gulf Warehousing Company 20-Jul-17 4 Due QNCD Qatar National Cement Company 23-Jul-17 7 Due QIIK Qatar International Islamic Bank 23-Jul-17 7 Due QGTS Qatar Gas Transport Company (Nakilat) 24-Jul-17 8 Due QIGD Qatari Investors Group 25-Jul-17 9 Due BRES Barwa Real Estate Company 25-Jul-17 9 Due QATI Qatar Insurance Company 25-Jul-17 9 Due QIMD Qatar Industrial Manufacturing Company 25-Jul-17 9 Due QEWS Qatar Electricity & Water Company 26-Jul-17 10 Due DBIS Dlala Brokerage & Investment Holding Company 26-Jul-17 10 Due QFBQ Qatar First Bank 26-Jul-17 10 Due ERES Ezdan Real Estate Company 26-Jul-17 10 Due ORDS Ooredoo 26-Jul-17 10 Due VFQS Vodafone Qatar* 27-Jul-17 11 Due NLCS National Leasing (Alijarah) 27-Jul-17 11 Due QOIS Qatar & Oman Investment 30-Jul-17 14 Due AHCS Aamal Company 30-Jul-17 14 Due QNNS Qatar Navigation (Milaha) 1-Aug-17 16 Due QISI Qatar Islamic Insurance 2-Aug-17 17 Due AKHI Al Khaleej Takaful Insurance 3-Aug-17 18 Due SIIS Salam International Investment 6-Aug-17 21 Due Source: QSE (* Results for 1Q2017-18)

- 4. Page 4 of 7 News Qatar QNB Group: Qatar retains its global LNG dominance – A recent data from BP provided a summary of the state of the global liquefied natural gas (LNG) market in 2016. The market remained oversupplied, but the extent of oversupply increased, QNB Group said in its latest report. QNB Group said global LNG supply rose by 6.5% compared to virtually zero growth over 2011-2015. Demand growth increased by 4.2%, its fastest rate in the past five years. Amidst these market shifts, Qatar maintained its position as the world’s largest and most cost- efficient producer, accounting for 30.1% of global supply and capturing part of the new demand growth. The commitment to boosting long-term production will solidify its position as the global LNG leader, QNB Group said. (Gulf-Times.com) Construction sector unaffected by blockade, affirm industry insiders – Qatar will continue to meet its target dates for major infrastructure projects despite the economic blockade, which failed to make a dent on the country’s construction sector, Ismail Bin Ali (IBA) Group’s CEO, Hamad Mohamed Esmael al- Emadi said. Further, he added the main materials needed in the construction sector “are available in Qatar.” Al-Emadi said Saudi Arabia and the UAE “are not the only sources for building materials,” as he cited China as a major supplier of wood and tiles. “There are also other countries where we can get a wide range of building materials,” Al-Emadi said, who recently signed a QR550mn housing and recreation project with Manateq. He noted that IBA’s agreement with Manateq, including the company’s other ongoing infrastructure projects with the government “will continue” and were not affected by the Gulf crisis. Aside from steel and concrete, Al-Emadi also said many building materials are already being produced in Qatar. (Gulf-Times.com) QFLS to disclose its semi-annual financials on August 10 – Qatar Fuel Company (QFLS) announced it would disclose its semi-annual financial reports for the period ending June 30, 2017 on August 10, 2017. (QSE) Moody’s affirms Doha Bank rating at ‘A2’ – International credit rating agency Moody’s has affirmed Doha Bank’s ‘A2’ deposit ratings and its ‘baa3’ baseline credit assessment (BCA). Doha Bank said its ‘A2’ deposits rating incorporated the bank’s importance to the local financial system with a market share of around 8% in deposits, the demonstrated willingness and ability of the Qatari government to provide support to local banks, through capital injections and the purchase of real- estate and equity investment portfolios from banks and the government’s 16.7% shareholding in Doha Bank. The bank’s capitalization levels are expected to strengthen as it recently completed a QR1.3bn rights issue, Doha Bank said. As a result, tangible common equity-to-risk weighted assets are expected to increase to 12.4% from 10.8% as of March 2017. (Gulf- Times.com) American Airlines stake still a goal for Qatar Airways, says Al- Baker – Qatar Airways Chief Executive Officer (CEO) Akbar al- Baker said the national carrier is determined to purchase a stake in American Airlines Group as planned, undeterred by its alliance partner’s decision to scrap a marketing deal amid an escalating feud. Qatar Airways refiled its stock purchase to clarify queries from US regulators and will forge ahead with its proposal, Al-Baker said. The US carrier ended the codeshare agreement with Qatar Airways, in a decision communicated through private notification on June 29. “Once we get the OK from the regulator, we will buy the stock that we said we are going to buy,” Al-Baker said. (Gulf-Times.com) Mwani Qatar to buy two ships from Malaysia – Mwani Qatar (Qatar Ports Management Company) signed an agreement to buy two ships for containers and general cargo transport from a group of Malaysian companies. The agreement to this effect was signed in the presence of Qatar's Minister of Transport and Communications HE Jassim Saif Ahmed al-Sulaiti and other senior officials of Mwani Qatar and representatives of some of the Malaysian companies in Kuala Lumpur. The 68 and 64 meters long vessels will be handed over to Qatar over the next few months. (Gulf-Times.com) Qatar-Turkey trade volume reached QR9bn for 2015 and 2016 – The volume of trade exchange between Qatar and Turkey reached QR9bn for the years 2015 and 2016, the official Qatar News Agency said. The two sides recently discussed the means of further developing economic and trade relations between the two countries and also reviewed trade opportunities for Qatari and Turkish companies, besides ways of enhancing cooperation and increasing trade exchange and investment flows. During his visit to Turkey, HE the Minister of Economy and Commerce Sheikh Ahmed bin Jassim bin Mohamed al-Thani said there are great opportunities for companies in both Turkey and Qatar to increase the volume of trade and flow of investments across all sectors, and not just in terms of food and consumer goods. The Qatari economy is strong, solid and diversified, and enjoys an attractive investment climate, he stressed. (Gulf-Times.com) Qatar Chamber and Pakistan plan to set up joint factories – Business leaders from Qatar and Pakistan are mulling the establishment of joint factories in Qatar to provide various commodities to the local market and export the surplus, Qatar Chamber (QC) said. The plan was discussed recently by officials of Qatar Chamber during a series of business meetings with the Federation of Pakistan Chambers of Commerce & Industry in Pakistan’s capital, Islamabad. During the meetings, QC also discussed ways to increase Qatar’s imports of Pakistani goods, Qatar Chamber said. The deliberations, held from July 11 to 14, focused on enhancing cooperation ties between both parties in economic and trade sectors, including construction, building materials, foodstuff, textiles and furniture. (Gulf-Times.com) International US industrial output rises for fifth straight month – US industrial production rose for a fifth straight month in June, helped by gains in mining, while the manufacturing sector rebounded. Overall industrial production rose 0.4% in June after being up a revised 0.1% in May. Mining output increased 1.6%, with advances in oil and gas extraction, in coal mining and in drilling and support activities. Utilities output was unchanged. Economists had expected industrial output to increase 0.3% from the previously reported flat reading in May. Manufacturing rebounded 0.2%, in line with economist expectations, after an unrevised 0.4% fall in May. Activity in the manufacturing sector, which makes up about 12% of the US

- 5. Page 5 of 7 economy, has been slowing amid a moderation in oil prices and declining motor vehicle sales. Capacity utilization, which measures how fully companies are deploying their resources, rose to 76.6% in June from 76.4% in May. Economists had forecasted a 76.7% rate in June. (Reuters) US retail sales fall for second straight month – US retail sales unexpectedly fell in June for a second straight month, which could temper expectations of strong acceleration in economic growth in the second quarter. The Commerce Department said retail sales fell 0.2% last month, weighed down by declines in receipts at service stations, clothing stores and supermarkets. Americans also cut back on spending at restaurants and bars, as well as on hobbies. May's retail sales were revised to show a 0.1% dip instead of the previously reported 0.3% drop. Retail sales rose 2.8% YoY in June. Excluding automobiles, gasoline, building materials and food services, retail sales slipped 0.1% last month after being unchanged in May. These so-called core retail sales correspond most closely with the consumer spending component of gross domestic product. (Reuters) Eurozone’s trade booms in May, EU-Russia commerce rises – Eurozone's trade boomed in May with both exports and imports of goods to the rest of the world growing markedly, in a new sign that global commerce was in good health. The European Union (EU), the world's main trader, also saw its trade increase with all its main partners, with an increase of exchanges with Russia despite economic sanctions on Moscow. The European Union statistics office Eurostat said the 19-country currency area in May exported goods worth 189.6bn Euros to the rest of the world, an increase by 12.9% on the year. Imports also grew yearly by 16.4% for a total volume of 168.1bn Euros, according to data not adjusted for seasonal factors. Both figures were the second highest ever-recorded for the Eurozone after the peak reached in March when exports were above 200bn Euros and imports stood at 176bn Euros. The faster growth of imports compared to exports slightly reduced the bloc's trade surplus which stood at 21.4bn Euros in May, lower than the 23.4bn surplus recorded in May 2016. (Reuters) German economy to grow at accelerated pace in 2Q2017 – The German economy will continue to enjoy solid growth in the second quarter, driven by high private consumption and higher construction activity while net foreign trade is unlikely to add to the expansion, the Economy Ministry said. Europe's biggest economy grew by 0.6% in the first quarter, faster than in the prior quarters and analysts expect gross domestic product (GDP) to grow at least by the same rate in the April-June period. (Reuters) Japan raises FY 2017 forecasts for consumption, capital expenditure, and housing – Japan's government raised its growth forecasts for private consumption, capital expenditure, and housing investment for the current fiscal year, as domestic demand gathers strength. The government left its overall forecast for gross domestic product growth unchanged in fiscal 2017, which started in April, due to an expected decline in inventories and slightly slower growth in fiscal spending. The government also expects consumer prices to rise 1.1% this fiscal year and 1.3% in fiscal 2018, highlighting a very slow build up in inflationary pressure. Consumer spending is forecasted to rise 0.9% in fiscal 2017, according to forecasts that the government's top advisory panel approved after a meeting. That is more than the previous forecast for 0.8% growth released in January. Housing investment is expected to rise 0.8% this fiscal year, well above the previous estimate of 0.1% growth as the Bank of Japan's quantitative easing sparks a revival in property development. The government expects capital expenditure to rise 3.6% in fiscal 2017, more than its previous estimate for a 3.4% increase. (Reuters) Japan's June exports seen extending solid gains – Japan's exports are expected to have risen for a seventh straight month in June, according to a Reuters poll, indicating that a recent revival in global demand will continue to support a moderate recovery in the world's third-biggest economy. Enjoying a tail wind from a weaker Yen, exports are predicted to have risen 9.5% YoY last month, the same poll showed, after a 14.9% jump in May, the fastest growth rate in more than two years. Imports are forecast for a 14.6% rise from a year ago, up for a sixth straight month, boosted by higher oil prices and solid domestic demand. The poll tipped a resulting surplus at 484.7bn Yen, versus a trade deficit of 203.4bn Yen in May. (Reuters) Fitch affirms China's ‘A+’ rating with ‘Stable’ outlook – Fitch Ratings maintained its ‘A+’ rating on China with a ‘Stable’ outlook, citing the strength of the country's external finances and macroeconomic record. Short-term growth prospects remain favorable, and economic policies have been effective in responding to an array of domestic and external pressures in the past year, Fitch said. In a Reuters poll of 65 economists, China's economic growth is expected to reach 6.6% this year, topping the government's target of around 6.5%. (Reuters) Regional Saudi Arabia curbs oil shipments to the US – Saudi Arabia is trying to support oil prices by reducing its crude shipments to the US in a bid to cut the amount of oil in commercial storage. US crude imports from Saudi Arabia averaged less than 900,000 barrels per day (bpd) in the four weeks ending on July 7, according to the US Energy Information Administration (EIA). (Reuters) Jeddah’s real estate sector stays ‘relatively subdued’ – Jeddah’s retail sector is experiencing some improvements, but overall the city’s real estate sector has remained ‘relatively subdued’ in 2Q2017 with further declines in performance recorded, JLL’s Real Estate Market Overview revealed. Sentiment in the retail sector has been boosted by the reinstatement of benefits to public sector staff, according to JLL’s report. (GulfBase.com) Britain seeks looser IPO rules to lure Saudi Aramco, worries investors – Britain wants to loosen rules on listing state companies in a move that could help London win the lucrative Initial Public Offering (IPO) of Saudi Aramco but which has raised fears for minority investors. The Financial Conduct Authority's proposals would create a new listing category for companies controlled by sovereign states and come as exchanges vie to win the Saudi Aramco’s IPO. (Reuters.com) Government’s fish farming company signed deals with four local companies worth SR800mn – An official of the Ministry of Environment, Water and Agriculture said the recently established government fish farming company has signed deals with four local companies to inject SR800mn into fish farming projects. Ahmad Al-Eyada, the Ministry’s Undersecretary for

- 6. Page 6 of 7 fish farming said that studies are being carried out to determine locations for these projects. He said that the projects will be established between the Makkah region and Jazan. The ministry had issued licenses to six local companies to build fish floating cages in the Red Sea. Foreign companies are also likely to invest in such projects, Al-Eyada added. (GulfBase.com) IMF expects UAE’s growth to recover over the next few years – The International Monetary Fund (IMF) sees the UAE economic activity to strengthen gradually in the coming years with firming oil prices and an easing pace of fiscal consolidation. Non-oil growth is projected to rise to 3.3% in 2017 from 2.7% in 2016. Over medium term, non-oil growth expected to remain above 3%. (Bloomberg) Ajman Bank’s net profit narrows to AED29.3mn in 2Q2017 – Ajman Bank recorded net profit of AED29.3mn in 2Q2017 as compared to AED32.7mn in 2Q2016. Income from Islamic financing and investing assets rose to AED169.7mn in 2Q2017 from AED139.3mn in 2Q2016. Accordingly, net operating income rose to AED129.0mn in 2Q2017 as compared to AED122.0mn in 2Q2016. However, impairment charge on Islamic financing and investing assets rose to AED38.0mn in 2Q2017 from AED28.4mn in 2Q2016. Total assets stood at AED18.35bn at the end of June 30, 2017 as compared to AED16.0bn at the end of December 31, 2016. Islamic financing and investing assets (net) stood at AED14.20bn, while Islamic customers’ deposits stood at AED13.14bn at the end of June 30, 2017. EPS decreased to AED0.017 in 2Q2017 from AED0.023 in 2Q2016. (DFM) Fitch affirms Mashreqbank at ‘A’; upgrades VR to ‘bbb-’ – Fitch Ratings (Fitch) affirmed Mashreqbank’s Long-Term Issuer Default Rating (IDR) at ‘A’, Short-Term IDR at ‘F1’, Support Rating at ‘1’ and Support Rating Floor at ‘A’. Its Viability Rating (VR) has been upgraded to ‘bbb-’ from ‘bb+’. (Reuters) Fitch affirms Dubai Islamic Bank at ‘A’; upgrades VR to ‘bb+’ – Fitch Ratings upgraded Dubai Islamic Bank's (DIB) Viability Rating (VR) to ‘bb+’ from ‘bb’. Its Long-Term Issuer Default Rating (IDR) has been affirmed at ‘A’ with a ‘Stable’ outlook. The upgrade of the VR reflects DIB's improved asset quality metrics, supported by the recovery in the real estate sector, and repayments write-offs of and successful restructuring. DIB has also tightened its underwriting standards for real estate financing and its impaired financing ratio (NPF) has been falling consistently since 2011 to 3.7% at end-2016. The VR upgrade also takes into account the bank's diversification away from the real estate sector. (Reuters) Fitch maintains Commercial Bank International on rating watch Negative – Fitch Ratings maintained UAE-based Commercial Bank International's Long-Term Issuer Default Rating (IDR) of ‘A-’, Short-Term IDR of ‘F1’, and Support Rating (SR) of ‘1’ on Rating Watch Negative (RWN). The Viability Rating (VR) has been affirmed at ‘b+’. (Reuters) UAB’s net profit rises to AED27.3mn in 2Q2017 – United Arab Bank (UAB) recorded net profit of AED27.3mn in 2Q2017 as compared to AED25.7mn in 2Q2016. Net interest income declined to AED126.1mn in 2Q2017 from AED158.6mn in 2Q2016. Operating income fell to AED174.9mn from AED226.7mn in 2Q2016. However, the net impairment loss narrowed sharply to AED60.0mn from AED117.2mn in 2Q2016. Total assets stood at AED21.16bn at the end of June 30, 2017 as compared to AED21.25bn at the end of December 31, 2016. Loans and advances stood at AED13.40bn, while customers’ deposits stood at AED13.88bn at the end of June 30, 2017. EPS came in flat YoY at AED0.02 in 2Q2017. (ADX) Fitch affirms Abu Dhabi Islamic Bank at 'A+'; outlook ‘Stable’ – Fitch Ratings has affirmed Abu Dhabi Islamic Bank's Long- Term Issuer Default Rating (IDR) at ‘A+’, Short-term IDR at ‘F1’, Viability Rating at ‘bb’, Support Rating at ‘1’ and Support Rating Floor at ‘A+’. (Reuters) Kuwait sees oil inventories falling faster – Crude oil inventories will decline at a faster pace worldwide in 2H2017 as demand increases and Organization of Petroleum Exporting Countries (OPEC) members comply better with a global agreement to cut output, Kuwait’s OPEC Governor, Haitham al-Ghais said. (Gulf- Times.com) BKMB’s net profit falls 6.8% YoY to OMR84.3mn in 1H2017 – Bank Muscat (BKMB) recorded 6.8% YoY decline net profit to OMR84.3mn in 1H2017. Net interest income and income from Islamic financing came in at OMR138.0mn in 1H2017 as compared to OMR136.2mn in 1H2016. Operating profit came in at OMR117.2mn as compared to OMR124.7mn in 1H2016. Net loans and advances stood at OMR7.18bn (+4.8% YoY), while customers’ deposits stood at OMR6.57bn (-4.9% YoY) at the end of June 30, 2017. (MSM) HBMO’s net profit rises 3.8% YoY to OMR8.2mn in 1H2017 – HSBC Bank Oman (HBMO) recorded 3.8% YoY rise in net profit to OMR8.2mn in 1H2017. Operating income fell 4.3% YoY to OMR35.8mn in 1H2017. Total assets stood at OMR2.37bn at the end of June 30, 2017 as compared to OMR2.24bn at the end of June 30, 2016. Net loans and advances to customers stood at OMR1.33bn (-4.9% YoY), whereas customers’ deposits stood at OMR1.96bn (+6.8% YoY) at the end of June 30, 2017. (MSM) BKDB’s net profit falls 13.3% YoY to OMR22.7mn in 1H2017 – Bank Dhofar (BKDB) reported 13.3% YoY decline in net profit to OMR22.7mn in 1H2017. Profit from operations fell 17.1% YoY to OMR33.0mn in 1H2017. Total assets stood at OMR3.98bn at the end of June 30, 2017 as compared to OMR3.80bn at the end of June 30, 2016. Net Loans and Advances to customers stood at OMR3.11bn (+9.6% YoY), while deposits from customers stood at OMR2.98bn (+8.5% YoY) at the end of June 30, 2017. (MSM) NBOB’s net profit falls 11.2% YoY to OMR26.1mn in 1H2017 – National Bank of Oman’s (NBOB) net profit decreased 11.2% YoY to OMR26.1mn in 1H2017. Operating Profit fell 9.5% YoY to OMR35.2mn in 1H2017. Total assets stood at OMR3.61bn at the end of June 30, 2017 as compared to OMR3.56bn at the end of June 30, 2016. Loans, advances and financing activities for customers (net) stood at OMR2.78bn (-0.4% YoY), while customers’ deposits and unrestricted investment accounts stood at OMR2.59bn (+6.0% YoY) at the end of June 30, 2017. (MSM) Investcorp sells Spain-based Esmalglass to Lone Star – Bahrain- based asset manager Investcorp agreed to sell Spain-based Esmalglass, a supplier of intermediate products for the ceramic industry, to US buyout firm Lone Star Fund X for an enterprise value of $693mn. (Reuters)

- 7. Contacts Saugata Sarkar Shahan Keushgerian Zaid al-Nafoosi, CMT, CFTe Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6509 Tel: (+974) 4476 6535 saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa zaid.alnafoosi@qnbfs.com.qa Mohamed Abo Daff QNB Financial Services Co. W.L.L. Senior Research Analyst Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6589 PO Box 24025 mohd.abodaff@qnbfs.com.qa Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services Co. W.L.L. (“QNBFS”) a wholly-owned subsidiary of Qatar National Bank (Q.P.S.C.). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange. Qatar National Bank (Q.P.S.C.) is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 7 of 7 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 70.0 90.0 110.0 130.0 150.0 170.0 Jun-13 Jun-14 Jun-15 Jun-16 Jun-17 QSEIndex S&P Pan Arab S&P GCC 0.1% 2.0% (0.1%) 0.0% (0.9%) 2.5% 1.2% (1.0%) 0.0% 1.0% 2.0% 3.0% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,228.70 0.9 1.3 6.6 MSCI World Index 1,948.07 0.6 1.8 11.2 Silver/Ounce 15.99 1.9 2.4 0.5 DJ Industrial 21,637.74 0.4 1.0 9.5 Crude Oil (Brent)/Barrel (FM Future) 48.91 1.0 4.7 (13.9) S&P 500 2,459.27 0.5 1.4 9.8 Crude Oil (WTI)/Barrel (FM Future) 46.54 1.0 5.2 (13.4) NASDAQ 100 6,312.47 0.6 2.6 17.3 Natural Gas (Henry Hub)/MMBtu 2.93 (0.3) 1.4 (20.5) STOXX 600 386.84 0.8 2.2 16.3 LPG Propane (Arab Gulf)/Ton 64.25 0.6 7.5 (10.9) DAX 12,631.72 0.5 2.4 19.5 LPG Butane (Arab Gulf)/Ton 71.38 0.7 4.0 (38.9) FTSE 100 7,378.39 0.7 1.9 9.4 Euro 1.15 0.6 0.6 9.1 CAC 40 5,235.31 0.6 2.2 17.0 Yen 112.53 (0.7) (1.2) (3.8) Nikkei 20,118.86 0.7 2.3 9.0 GBP 1.31 1.2 1.6 6.1 MSCI EM 1,047.05 0.6 4.4 21.4 CHF 1.04 0.4 0.1 5.8 SHANGHAI SE Composite 3,222.42 0.4 0.6 6.5 AUD 0.78 1.3 3.0 8.7 HANG SENG 26,389.23 0.2 4.2 19.1 USD Index 95.15 (0.6) (0.9) (6.9) BSE SENSEX 32,020.75 0.2 2.7 27.2 RUB 59.01 (1.3) (2.3) (4.1) Bovespa 65,436.18 1.1 8.2 10.9 BRL 0.31 1.0 3.1 2.3 RTS 1,044.27 1.4 4.9 (9.4) 102.5 98.2 96.7