QNBFS Daily Market Report January 9, 2019

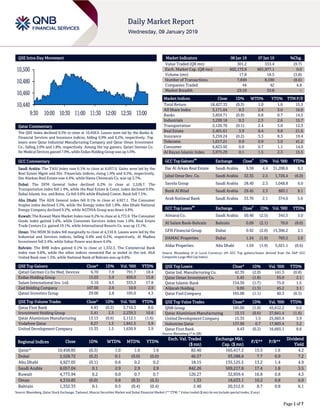

- 1. Page 1 of 7 QSE Intra-Day Movement Qatar Commentary The QSE Index declined 0.3% to close at 10,458.9. Losses were led by the Banks & Financial Services and Insurance indices, falling 0.9% and 0.2%, respectively. Top losers were Qatar Industrial Manufacturing Company and Qatar Oman Investment Co., falling 2.0% and 1.8%, respectively. Among the top gainers, Qatari German Co. for Medical Devices gained 7.9%, while Ezdan Holding Group was up 5.9%. GCC Commentary Saudi Arabia: The TASI Index rose 0.1% to close at 8,057.0. Gains were led by the Real Estate Mgmt and Div. Financials indices, rising 1.9% and 0.5%, respectively. Dar Alarkan Real Estate rose 4.4%, while Nama Chemicals Co. was up 3.7%. Dubai: The DFM General Index declined 0.2% to close at 2,528.7. The Transportation index fell 1.4%, while the Real Estate & Const. index declined 0.9%. Dubai Islamic Ins. and Reins. Co fell 9.8% while Khaleeji Comm. Bank fell 7.5%. Abu Dhabi: The ADX General index fell 0.1% to close at 4,927.1. The Consumer Staples index declined 3.3%, while the Energy index fell 1.8%. Abu Dhabi National Energy Company declined 9.2%, while AGTHIA Group was down 4.8%. Kuwait: The Kuwait Main Market Index rose 0.2% to close at 4,773.9. The Consumer Goods index gained 5.6%, while Consumer Services index rose 1.0%. Real Estate Trade Centers Co. gained 19.1%, while International Resorts Co. was up 13.1%. Oman: The MSM 30 Index fell marginally to close at 4,310.9. Losses were led by the Industrial and Services indices, falling 0.4% and 0.2%, respectively. Al Madina Investment fell 5.4%, while Sohar Power was down 4.4%. Bahrain: The BHB Index gained 0.1% to close at 1,332.3. The Commercial Bank index rose 0.8%, while the other indices remained flat or ended in the red. Ahli United Bank rose 1.5%, while National Bank of Bahrain was up 0.8%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Qatari German Co for Med. Devices 6.70 7.9 791.7 18.4 Ezdan Holding Group 15.03 5.9 836.0 15.8 Salam International Inv. Ltd. 5.10 4.5 333.3 17.8 Zad Holding Company 107.00 2.9 10.9 2.9 Qatari Investors Group 29.00 2.8 105.0 4.3 QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Qatar First Bank 4.43 (0.2) 3,716.3 8.6 Investment Holding Group 5.41 2.5 2,239.3 10.6 Qatar Aluminium Manufacturing 13.13 (0.6) 2,112.1 (1.6) Vodafone Qatar 8.27 1.5 1,841.5 5.9 United Development Company 15.33 1.5 1,630.9 3.9 Market Indicators 08 Jan 19 07 Jan 19 %Chg. Value Traded (QR mn) 301.2 333.4 (9.7) Exch. Market Cap. (QR mn) 602,173.9 601,977.1 0.0 Volume (mn) 17.8 18.5 (3.8) Number of Transactions 7,849 8,590 (8.6) Companies Traded 44 42 4.8 Market Breadth 23:19 33:8 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 18,427.33 (0.3) 1.0 1.6 15.5 All Share Index 3,171.04 0.3 2.4 3.0 16.0 Banks 3,859.71 (0.9) 0.8 0.7 14.5 Industrials 3,299.18 0.3 2.3 2.6 15.7 Transportation 2,120.70 (0.1) 2.4 3.0 12.3 Real Estate 2,401.61 3.9 8.4 9.8 21.6 Insurance 3,259.24 (0.2) 3.3 8.3 19.4 Telecoms 1,017.21 0.9 0.9 3.0 41.2 Consumer 6,823.92 0.0 0.7 1.1 14.0 Al Rayan Islamic Index 3,975.29 0.1 1.5 2.3 15.5 GCC Top Gainers ## Exchange Close # 1D% Vol. ‘000 YTD% Dar Al Arkan Real Estate Saudi Arabia 9.58 4.4 31,208.6 6.2 Jabal Omar Dev. Co. Saudi Arabia 32.35 2.5 1,726.4 (6.0) Savola Group Saudi Arabia 28.40 2.3 1,048.8 6.0 Bank Al Bilad Saudi Arabia 29.45 2.3 883.1 8.1 Arab National Bank Saudi Arabia 33.70 2.1 374.6 5.6 GCC Top Losers ## Exchange Close # 1D% Vol. ‘000 YTD% Almarai Co. Saudi Arabia 50.40 (2.5) 345.5 5.0 Al Salam Bank-Bahrain Bahrain 0.09 (2.1) 70.0 (8.0) GFH Financial Group Dubai 0.92 (2.0) 15,306.2 2.1 DAMAC Properties Dubai 1.54 (1.9) 783.5 2.0 Aldar Properties Abu Dhabi 1.59 (1.9) 5,921.1 (0.6) Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the S&P GCC Composite Large Mid Cap Index) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Qatar Ind. Manufacturing Co. 42.35 (2.0) 141.3 (0.8) Qatar Oman Investment Co. 5.45 (1.8) 55.0 2.1 Qatar Islamic Bank 154.30 (1.7) 75.0 1.5 Alijarah Holding 9.06 (1.5) 45.2 3.1 Qatar Fuel Company 165.08 (1.1) 40.3 (0.5) QSE Top Value Trades Close* 1D% Val. ‘000 YTD% QNB Group 195.00 (1.0) 45,612.2 0.0 Qatar Aluminium Manufacturing 13.13 (0.6) 27,841.4 (1.6) United Development Company 15.33 1.5 25,065.4 3.9 Industries Qatar 137.90 0.7 17,803.4 3.2 Qatar First Bank 4.43 (0.2) 16,665.1 8.6 Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 10,458.85 (0.3) 1.0 1.6 1.6 82.40 165,417.2 15.5 1.6 4.2 Dubai 2,528.72 (0.2) 0.1 (0.0) (0.0) 46.57 93,588.6 7.7 0.9 7.2 Abu Dhabi 4,927.05 (0.1) 0.6 0.2 0.2 18.15 135,125.5 13.2 1.4 4.9 Saudi Arabia 8,057.04 0.1 2.9 2.9 2.9 842.26 509,217.8 17.4 1.8 3.5 Kuwait 4,773.94 0.2 0.0 0.7 0.7 120.27 32,959.4 16.8 0.8 4.3 Oman 4,310.85 (0.0) 0.8 (0.3) (0.3) 1.33 18,633.1 10.2 0.8 6.0 Bahrain 1,332.33 0.1 0.5 (0.4) (0.4) 2.40 20,312.9 8.7 0.8 6.1 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Market and Dubai Financial Market (** TTM; * Value traded ($ mn) do not include special trades, if any) 10,440 10,460 10,480 10,500 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 7 Qatar Market Commentary The QSE Index declined 0.3% to close at 10,458.9. The Banks & Financial Services and Insurance indices led the losses. The index fell on the back of selling pressure from Qatari and non-Qatari shareholders despite buying support from GCC shareholders. Qatar Industrial Manufacturing Company and Qatar Oman Investment Company were the top losers, falling 2.0% and 1.8%, respectively. Among the top gainers, Qatari German Company for Medical Devices gained 7.9%, while Ezdan Holding Group was up 5.9%. Volume of shares traded on Tuesday fell by 3.8% to 17.8mn from 18.5mn on Monday. However, as compared to the 30-day moving average of 8.2mn, volume for the day was 116.2% higher. Qatar First Bank and Investment Holding Group were the most active stocks, contributing 20.9% and 12.6% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Global Economic Data and Earnings Calendar Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 1/8 European Commission European Commission Consumer Confidence December F -6.2 -6.2 -6.2 1/8 Germany Deutsche Bundesbank Industrial Production SA MoM November -1.90% 0.30% -0.80% 1/8 Germany Bundesministerium fur Wirtschaft und Industrial Production WDA YoY November -4.70% -0.80% 0.50% 1/8 France Banque De France Current Account Balance November -2.8bn – -0.7bn 1/8 Japan Economic and Social Research Institute Consumer Confidence Index December 42.7 42.8 42.9 Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Earnings Calendar Tickers Company Name Date of reporting 4Q2018 results No. of days remaining Status QNBK QNB Group 15-Jan-19 6 Due GWCS Gulf Warehousing Company 16-Jan-19 7 Due QIBK Qatar Islamic Bank 16-Jan-19 7 Due DHBK Doha Bank 16-Jan-19 7 Due ABQK Ahli Bank 16-Jan-19 7 Due KCBK Al Khalij Commercial Bank 20-Jan-19 11 Due MARK Masraf Al Rayan 21-Jan-19 12 Due IHGS Islamic Holding Group 23-Jan-19 14 Due QNCD Qatar National Cement Company 23-Jan-19 14 Due NLCS Alijarah Holding 24-Jan-19 15 Due QIGD Qatari Investors Group 30-Jan-19 21 Due CBQK The Commercial Bank 4-Feb-19 26 Due Source: QSE Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 37.99% 44.25% (18,846,271.00) Qatari Institutions 17.38% 14.49% 8,692,073.11 Qatari 55.37% 58.74% (10,154,197.89) GCC Individuals 0.96% 0.52% 1,332,207.08 GCC Institutions 8.84% 4.51% 13,047,196.37 GCC 9.80% 5.03% 14,379,403.45 Non-Qatari Individuals 10.49% 11.60% (3,342,652.48) Non-Qatari Institutions 24.34% 24.63% (882,553.08) Non-Qatari 34.83% 36.23% (4,225,205.56)

- 3. Page 3 of 7 News Qatar QNB Group issues supplementary disclosure on issuing revolving financial instruments – Further to the announcement made by QNB Group on December 30, 2018, the following salient features of the Additional Tier 1 (AT1) Perpetual bond were highlighted: i) The Perpetual bond is an Additional Tier 1 Capital Note with no maturity date as this is treated as an item of equity; ii) The Perpetual bond has been issued in accordance with QCB Basel III regulations; iii) The Perpetual bond helps to preserve bank’s total equity position to support organic/inorganic business growth; iv) QNB Group will pay coupon on the Perpetual bond forever until they are called up by the issuing bank (QNB Group); and v) Payment of coupons does not affect QNB Group’s profitability. (QSE) GTA orders traders to file transitional Excise Tax returns by January 31, 2019 – The General Tax Authority (GTA) has directed businesses importing or producing excise goods to comply with the Excise Tax and file one-time transitional Excise Tax return by January 31, 2019. Businesses having excise goods in their stocks will also need to file transitional Excise Tax returns no later than January 31, 2019, a GTA press release noted. Besides, businesses must pay the Excise Tax no later than 30 days after filing the transitional Excise Tax return, it added. It added further that the GTA reserves the power to conduct assessments on taxable persons and may subsequently impose penalties on defaulters leading to imprisonment for a period not exceeding one year and/or a fine not exceeding three times the tax amount payable as per Act No (25) of 2018 on Excise Tax Law Articles 16 and 18. Businesses that import or produce excise goods or businesses that wish to operate a tax warehouse must register with the General Tax Authority, keep accounting books and records, file tax returns and pay the tax due on a quarterly basis. There are no thresholds for Excise Tax registration. Businesses that only hold a stock of excise goods for business purposes such as hotels, convenience stores, tobacco shops, etc. are not required to register with the General Tax Authority for Excise Tax purposes yet are still liable to pay a one-time transitional Excise Tax returns. (Qatar Tribune) MCI elaborates on law regulating investment of non-Qatari capital in economic activity – The Ministry of Commerce and Industry (MCI) yesterday clarified the new law (Law No. 1 of 2019) regulating the investment of non-Qatari capital in the country’s economic activity. The Ministry highlighted the main provisions of the law, which aims at promoting economic development, attracting foreign investment in all economic and commercial activities, attracting 100% of foreign capital inflows, accomplishing economic diversification in line with the Qatar National Vision 2030, facilitating foreign investors’ access to the market and bolstering the country’s confidence and investment security index. The Ministry said the first Article of the law identifies a non-Qatari investor as a person who invests his money in any of the projects authorized for direct investment in accordance with the provisions of this law. Non-Qatari capital, on the other hand, is defined as money, in- kind investments or rights held by non-Qatari investors. The law also outlines regulations governing the investment of non- Qatari capital, which is permitted in all sectors of the economy across the country. Investments may be undertaken after submitting a request to the competent department which processes the application within 15 days. A non-Qatari investor whose application is rejected may appeal to the Minister within 15 days and the appeal shall be considered within 30 days. A non-Qatari investor is prohibited from investing in the banking industry and insurance companies except for companies excluded based on a decision of the Council of Ministers. Non- Qatari investors are also prohibited from investing in commercial agencies and may be prohibited from investing in any other sector as decided by the Council of Ministers (Peninsula Qatar) Qatar Chamber’s official says QR212bn infrastructure budget to boost Qatar-Kuwait ties – The QR212bn funds allocated in the Qatar 2019 budget for infrastructure projects will play a significant role in enhancing the partnership between Qatar and Kuwait, one of the state’s staunch allies amid the ongoing economic blockade, according to a Qatar Chamber official. The statement was made in a meeting at Qatar Chamber, which hosted a trade and industry delegation from Kuwait. According to Qatar Chamber’s board member, Ali bin Abdullatif Al- Misnad, the country’s budget for 2019 allocated QR212bn for infrastructure projects. He said, “This would pave the way for more partnerships and cooperation between both parties.” He stressed that Qatar has implemented various legislative reforms and laws to increase foreign direct investment (FDI) inflows to the country, including the recently-issued Free Zones Law. Al-Misnad also suggested the setting up of a joint business council to help ease procedures and enhance communication and cooperation between businessmen from both countries. He also proposed for the establishment of a representative office for the PAI at Qatar Chamber to link manufacturing companies in Qatar and Kuwait. (Gulf-Times.com) Qatar-Kuwait trade volume at QR3.57bn in first 10 months of 2018 – Qatar and Kuwait explored ways to enhance joint cooperation on the commercial and industrial levels as well as bolster bilateral trade. These were discussed threadbare at a meeting of HE Ali bin Ahmed Al-Kuwari, Minister of Commerce and Industry, with a Kuwaiti delegation, led by Abdulkarim Taqi Abdulkarim, General Manager of Kuwait’s Public Authority for Industry. The two nations’ close trade relations are positively reflected on the volume of bilateral trade, which approximated QR3.57bn during January-October 2018, ranking Kuwait as Qatar’s 20th trading partner. Talks also focused on the latest developments in terms of bilateral trade, industrial and investment relations and efforts to further strengthen ties. (Gulf-Times.com) QP’s localization program to add QR8bn of import substitutes to local economy – Qatar Petroleum announced that it will launch the localization program for services and industries in the energy sector “TAWTEEN” - an initiative to enhance localizing the sector’s supply chain and expand the small and medium enterprises base. The program will be launched on February 18, 2019, with large participation of official bodies and entities, energy sector companies, and a wide spectrum of service

- 4. Page 4 of 7 providers and supporting industries. The TAWTEEN program is designed to enhance the resilience of the energy sector’s supply chain. It also aims at creating around 100 new investment opportunities within the energy sector in order to retain economic value within Qatar, which in turn is expected to add QR8bn of import substitutes annually and is also expected create more than 5,000 new white collar jobs. Moreover, it will provide valuable business opportunities for local and international entrepreneurs in Qatar, or those planning to set up business in Qatar, by providing technical support as part of TAWTEEN supplier development programs, and create an environment to participate in the sector’s supply chain and generate high-quality job opportunities. (Peninsula Qatar) New law aims to safeguard local products from harmful global trade practices – The law on supporting the competitiveness of national products and combating harmful practices in international trade is aimed at enhancing the position of Qatari products in local, regional and international markets, the Ministry of Commerce and Industry stated in a report released on Tuesday. Highlighting the main provisions of the law, the ministry stated that it aims to support competitiveness of national products and combat harmful practices in international trade, such as dumping and subsidized trade to protect local products, and enable them to compete in the market. The law has defined dumping as the export of a product to the state at price below than the normal value of a similar product in the exporting country in the normal course of trade. The subsidy has been defined as a financial support to manufacturing of products by the government or by a public body or institution of the origin country that leads to subsidized trade resulting in harmful commercial effects. (Qatar Tribune) EY: Qatar Inc should review their historic findings to ensure adequate support for their WHT filing positions – With Doha increasing attention on withholding tax (WHT), Qatar Inc should review their historic findings to ensure adequate support for their WHT filing positions, according to Ernst and Young (EY), a global consultant. Businesses in Qatar should also review their WHT policies to ensure its compliance with Qatar WHT requirements, stated EY in its comment. “The current focus appears to be on the question of whether the appropriate WHT should be 5% or 7%. However, it is possible the Qatar Tax Department’s (QTD) focus could extend to broader WHT compliance matters in the future,” it stated. Before 2018, there was no apparent evidence that the QTD was reviewing WHT compliance. Recently, the QTD has started issuing assessments, according to the global consultant. In October 2018, the QTD issued Circular No 3 of 2018, reiterating its expectations on WHT compliance in Qatar. There has also been a noticeable increase recently in WHT inquiries and assessments. The penalty for WHT non-compliance is 100% of the WHT due. Businesses should ensure they have retained support for their historic WHT filing positions, and review their current practices to ensure they comply with WHT requirements. Qatar introduced WHT when the current Income Tax Law was enacted in 2009. (Gulf-Times.com) International US job openings drop, but still at lofty levels – US job openings fell in November, pulled down by sharp declines in construction and other services, but did little to change views that the economy is facing a shortage of workers. Job openings, a measure of labor demand, dropped by 243,000 to a seasonally adjusted 6.9mn, the Labor Department stated in its monthly Job Openings and Labor Turnover Survey, or JOLTS. Despite November’s drop, job openings outpaced the number of unemployed people that month by 870,000. Job openings hit a record high of 7.3mn in August. The decline in job openings in November was led by a 66,000 drop in the other services category. Construction vacancies fell 45,000. The decrease in job openings in November was concentrated in the West region. (Reuters) US-China trade talks extended amid some signs of progress – The US and China will continue trade talks in Beijing for an unscheduled third day, US officials said amid signs of progress on issues including purchases of US farm and energy commodities and increased access to China’s markets. People familiar with the talks said the world’s two largest economies were further apart on Chinese structural reforms that the Trump administration is demanding in order to stop alleged theft and forced transfer of US technology and on how to hold Beijing to its promises. Steven Winberg, assistant secretary for Fossil Energy at the US Department of Energy, told reporters in Beijing that the talks, which began on Monday, had gone well. This week’s meetings are the first face-to-face talks since US President Donald Trump and Chinese President Xi Jinping agreed in December to a 90-day truce in a trade war that has roiled global financial markets. Trump is increasingly eager to reach an agreement to help lift the markets, Bloomberg reported, citing people familiar with internal White House deliberations. The S&P 500 Index has fallen about 8% since the truce began. (Reuters) US retail imports level off after China tariff avoidance rush – Imports at major US container ports are leveling off after retailers’ months-long rush to bring in Chinese merchandise before higher tariffs hit, according to a retail trade report issued on Tuesday. US ports covered by the National Retail Federation (NRF) and Hackett Associates’ Global Port Tracker handled 1.81mn twenty-foot equivalent units (TEU) in November 2018, the latest available data. That was up 2.5% YoY, but down 11.4% from the record of 2.04mn TEU set in October 2018. A TEU is one 20-foot-long cargo container. The report landed as the US and China hold talks aimed at ending a bitter trade war that is roiling global financial markets. US President Donald Trump and Chinese President Xi Jinping agreed in December to a 90-day truce on tariffs. Warehouses throughout the US are packed to the rafters with Chinese goods - ranging from air conditioners and microwaves to footwear and furniture. (Reuters) UK’s employers hire staff at slowest pace since April 2017 – British employers hired permanent staff in December at the slowest rate since April 2017, adding to a signs the economy has cooled ahead of Brexit, according to a survey of recruitment consultants. The report from the Recruitment and Employment Confederation (REC) and accountants KPMG report also showed growth in starting salaries for permanent staff slowed for a third month running, although it remained high by historical standards. The terms of Britain’s departure from the

- 5. Page 5 of 7 European Union (EU), scheduled for March 29, 2019 remain unclear as legislators are expected next week to vote down the divorce deal that May struck with the EU in November. Business chiefs and investors fear that leaving the EU without a deal would slow trade, spook financial markets and dislocate supply chains for the world’s fifth-largest economy. REC stated a shortage of candidates had hampered growth in permanent job placements last month, with some employers saying Brexit uncertainty was making people reluctant to change jobs and discouraging workers from moving to Britain from elsewhere in Europe. (Reuters) German growth worries mount as industrial output plunges – German industrial output unexpectedly fell in November 2018 for the third consecutive month, adding to signs that companies in Europe’s largest economy are shifting into a lower gear due to mounting risks from abroad. Trade disputes driven by US President Donald Trump’s ‘America First’ policies, the threat that Britain will leave the European Union without a deal in March and weaker growth in emerging markets are putting the brakes on a nine-year expansion in Europe’s economic powerhouse. These external shocks and risks are cushioned by a vibrant domestic economy and strong household spending, however, as German consumers benefit from record-high employment, inflation-busting pay hikes, low borrowing costs and some fiscal stimulus. Industrial output fell by 1.9% on the month in November 2018, data released on Tuesday by the Federal Statistics Office showed, coming in way below the 0.3% increase that had been forecast. The output figure for October was revised down to a fall of 0.8% from a previously reported drop of 0.5%. (Reuters) Japan’s real wages rise most in five months in positive sign for consumption – Japan’s real wages rose the most in five months in November 2018, reversing from a third straight month of drops, government data showed, raising hopes for stronger domestic consumer spending to offset slowing external demand. Labor ministry data showed inflation-adjusted real wages rose 1.1% in November 2018 from a year earlier, following a 0.1% decline in October and posting the first increase in four months. It was the biggest annual gain since June, and was due in part to a slowdown in consumer price growth, the data showed. The wage data should provide some relief for the central bank as sluggish wage growth has kept consumers from boosting spending, hampering its efforts to stoke a virtuous growth cycle led by the private sector and generate inflation. Despite nearly six years of massive monetary stimulus, tame consumer spending has kept core consumer inflation at around the half the Bank of Japan’s 2% price target. (Reuters) Regional Islamic finance volume seen at $2.5tn this year; Takaful stays miniscule – The global volume of the Islamic finance industry will reach about $2.5tn this year, only a small growth from the $2.44tn it reached in 2017 and after it lost some momentum in 2018 for which definite figures are not available yet. The forecast has been made by CEO of the AlHuda Center of Islamic Banking and Economics, Muhammad Zubair Mughal based upon the latest industry figures. According to Mughal, 2018 has “not proved as much beneficial” for the global Islamic banking and finance industry as previously expected owing to continued pressure on oil prices, international trade wars between major powers, as well as the political situation in the Arabian Gulf. This year, the subdued situation in the Gulf will likely persist, while growth in the Islamic finance industry will mainly be supported by new entrants from the West, East and North Africa, as well as Central Asia, regions which are currently introducing and/or enhancing their regulatory frameworks for the industry, while demand in Malaysia, Indonesia, Pakistan and Bangladesh will continue to increase due to economic growth and government support. Interestingly, Islamic insurance, or Takaful, is still idling at its 2% share and not moving due to a variety of reasons. Mughal expects that Islamic microfinance, in its tremendously emerging role for poverty alleviation in many Muslim countries, will take over Takaful in asset volume as early as this year and grow to over 2% in share of the total Islamic finance volume. (Gulf-Times) Saudi Aramco will announce a deal to invest in US LNG – Saudi Aramco has narrowed its focus to a shortlist of at least four US LNG projects and aims to announce a deal in the first half of this year, the Wall Street Journal (WSJ) reported. Companies with projects being considered include Tellurian Inc. and Sempra Energy. It is unclear what the value of the potential investments is, the sources said. (Bloomberg) Nama Chemical’s request for capital increase approved – Nama Chemical’s request for increasing the capital through a rights issue has been approved by the regulators. The company will increase its capital by SR200mn, it stated to the Saudi bourse. (Bloomberg) SHUAA Capital issues and places $135mn Sukuk For Jabal Omar Development Company – SHUAA Capital has announced the issuance and private placement of $135mn US Dollar- denominated five-year Sukuk for Jabal Omar Development Company. SHUAA Capital acted as the sole arranger for the Sukuk, which was originally issued in the second half of 2018. (Reuters) Commercial Bank of Dubai to take control of Abraaj assets secured against loan – Commercial Bank of Dubai (CBD), which lent around $170mn to Abraaj, will take stakes in the troubled private equity firm’s funds which were offered as security against the debt, sources said. Dubai-based Abraaj, worth $13.6bn, was the largest buyout fund in the MENA region until it collapsed last year following turmoil triggered by a row with investors, including the Gates Foundation, over the use of their money in a $1bn healthcare fund. A court in the Cayman Islands is expected to grant approval to swap the debt held by CBD in the coming weeks. The move comes after Noor Bank, which lent Abraaj around $100mn, recently got the go ahead from the same court to take control of parts of funds pledged against its loan, sources said. (Reuters) Abu Dhabi's green energy firm launches region's first all- electric bus – Abu Dhabi Future Energy Company (Masdar) has launched the region’s first fully electric passenger bus as the capital of the UAE pursues clean and energy efficient transport. The UAE has set a clean energy target of 27% by 2021. Green energy company Masdar, wholly-owned by Abu Dhabi’s Mubadala Investment Company, has invested $8.5bn in renewable energy projects in the UAE and abroad. The all-

- 6. Page 6 of 7 electric bus, jointly developed by Masdar, Siemens Middle East and Abu Dhabi-based bus manufacturer Hafilat Industry LLC, can seat 30 passengers with a range of 150 kilometers (93 miles) per battery charge, Masdar stated. (Reuters) Bahrain sells BHD26mn 182-day Islamic Sukuk – Bahrain sold BHD26mn of Islamic Sukuk due on July 11, 2019. The Sukuk will settle on January 10, 2019. (Bloomberg)

- 7. Contacts Saugata Sarkar, CFA, CAIA Shahan Keushgerian Zaid al-Nafoosi, CMT, CFTe Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6509 Tel: (+974) 4476 6535 saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa zaid.alnafoosi@qnbfs.com.qa QNB Financial Services Co. W.L.L. Contact Center: (+974) 4476 6666 PO Box 24025 Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services Co. W.L.L. (“QNBFS”) a wholly-owned subsidiary of Qatar National Bank (Q.P.S.C.). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange. Qatar National Bank (Q.P.S.C.) is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 7 of 7 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 45.0 70.0 95.0 120.0 Dec-14 Dec-15 Dec-16 Dec-17 Dec-18 QSE Index S&P Pan Arab S&P GCC 0.1% (0.3%) 0.2% 0.1% (0.0%) (0.1%) (0.2%) (0.6%) (0.3%) 0.0% 0.3% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,285.21 (0.3) 0.0 0.2 MSCI World Index 1,935.79 0.8 1.7 2.8 Silver/Ounce 15.66 0.0 (0.3) 1.0 DJ Industrial 23,787.45 1.1 1.5 2.0 Crude Oil (Brent)/Barrel (FM Future) 58.72 2.4 2.9 9.1 S&P 500 2,574.41 1.0 1.7 2.7 Crude Oil (WTI)/Barrel (FM Future) 49.78 2.6 3.8 9.6 NASDAQ 100 6,897.00 1.1 2.3 3.9 Natural Gas (Henry Hub)/MMBtu 2.89 5.5 3.2 (11.1) STOXX 600 345.85 0.7 1.1 2.4 LPG Propane (Arab Gulf)/Ton 62.75 0.6 (1.8) (2.0) DAX 10,803.98 0.4 0.8 2.4 LPG Butane (Arab Gulf)/Ton 66.00 (1.5) (2.4) (5.0) FTSE 100 6,861.60 0.4 0.3 1.8 Euro 1.14 (0.3) 0.4 (0.2) CAC 40 4,773.27 1.0 1.2 0.9 Yen 108.75 0.0 0.2 (0.9) Nikkei 20,204.04 0.8 3.1 2.6 GBP 1.27 (0.5) (0.0) (0.3) MSCI EM 975.51 (0.3) 1.1 1.0 CHF 1.02 (0.2) 0.6 0.0 SHANGHAI SE Composite 2,526.46 (0.3) 0.7 1.7 AUD 0.71 (0.1) 0.4 1.3 HANG SENG 25,875.45 0.1 0.9 0.0 USD Index 95.90 0.2 (0.3) (0.3) BSE SENSEX 35,980.93 (0.2) (0.1) (0.9) RUB 66.90 (1.2) (1.2) (4.0) Bovespa 92,031.86 0.7 0.3 9.2 BRL 0.27 0.6 0.0 4.5 RTS 1,122.90 0.4 0.4 5.1 84.7 80.7 77.5