QSE rises 0.8% led by Real Estate, Telecom indices

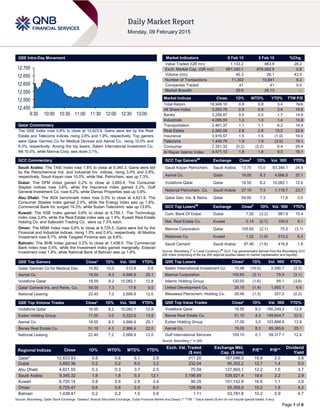

- 1. Page 1 of 6 QSE Intra-Day Movement Qatar Commentary The QSE Index rose 0.8% to close at 12,623.9. Gains were led by the Real Estate and Telecoms indices, rising 2.8% and 1.9%, respectively. Top gainers were Qatar German Co for Medical Devices and Aamal Co., rising 10.0% and 8.3%, respectively. Among the top losers, Salam International Investment Co. fell 10.0%, while Mannai Corp. was down 2.1%. GCC Commentary Saudi Arabia: The TASI Index rose 1.8% to close at 9,345.3. Gains were led by the Petrochemical Ind. and Industrial Inv. indices, rising 3.0% and 2.8%, respectively. Saudi Kayan rose 10.0%, while Nat. Petrochem. was up 7.3%. Dubai: The DFM Index gained 0.2% to close at 3,893.4. The Consumer Staples indices rose 3.6%, while the Insurance index gained 2.2%. Gulf General Investment Co. rose 6.2%, while Damac Properties was up 5.8%. Abu Dhabi: The ADX benchmark index rose 0.3% to close at 4,621.6. The Consumer Staples index gained 2.0%, while the Energy index was up 1.8%. Commercial Bank Int. surged 14.3%, while Sudan Telecomm. was up 13.9%. Kuwait: The KSE Index gained 0.8% to close at 6,755.1. The Technology index rose 2.4%, while the Real Estate index was up 1.4%. Kuwait Real Estate Holding Co. and Salbookh Trading Co. were up 7.3% each. Oman: The MSM Index rose 0.6% to close at 6,725.5. Gains were led by the Financial and Industrial indices, rising 1.5% and 0.4%, respectively. Al Madina Investment rose 8.7%, while Taageer Finance was up 8.6%. Bahrain: The BHB Index gained 0.2% to close at 1,438.5. The Commercial Bank index rose 0.4%, while the Investment index gained marginally. Esterad Investment rose 1.9%, while National Bank of Bahrain was up 1.8%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Qatar German Co for Medical Dev. 10.82 10.0 512.9 6.6 Aamal Co. 19.00 8.3 4,666.9 25.1 Vodafone Qatar 18.55 8.2 10,082.1 12.8 Qatar General Ins. and Reins. Co. 59.00 7.3 17.6 0.0 National Leasing 22.40 7.2 2,668.9 12.0 QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Vodafone Qatar 18.55 8.2 10,082.1 12.8 Ezdan Holding Group 17.00 3.0 6,222.6 13.9 Aamal Co. 19.00 8.3 4,666.9 25.1 Barwa Real Estate Co. 51.10 4.3 2,966.4 22.0 National Leasing 22.40 7.2 2,668.9 12.0 Market Indicators 8 Feb 15 5 Feb 15 %Chg. Value Traded (QR mn) 1,133.2 883.9 28.2 Exch. Market Cap. (QR mn) 681,340.1 676,062.5 0.8 Volume (mn) 40.3 28.1 43.5 Number of Transactions 11,302 10,641 6.2 Companies Traded 41 41 0.0 Market Breadth 29:9 26:13 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 18,948.10 0.8 0.8 3.4 N/A All Share Index 3,263.76 0.9 0.9 3.6 15.6 Banks 3,258.87 0.0 0.0 1.7 14.9 Industrials 4,095.93 1.0 1.0 1.4 13.9 Transportation 2,461.37 1.1 1.1 6.2 14.4 Real Estate 2,582.06 2.8 2.8 15.0 22.6 Insurance 3,919.57 1.5 1.5 (1.0) 16.0 Telecoms 1,440.79 1.9 1.9 (3.0) 19.1 Consumer 7,351.32 (0.2) (0.2) 6.4 29.4 Al Rayan Islamic Index 4,471.13 1.8 1.8 9.0 18.1 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% Saudi Kayan Petrochem. Saudi Arabia 13.70 10.0 83,346.1 24.9 Aamal Co. Qatar 19.00 8.3 4,666.9 25.1 Vodafone Qatar Qatar 18.55 8.2 10,082.1 12.8 National Petrochem. Co. Saudi Arabia 27.10 7.3 1,118.7 23.7 Qatar Gen. Ins. & Reins. Qatar 59.00 7.3 17.6 0.0 GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% Com. Bank Of Dubai Dubai 7.50 (3.2) 987.9 15.4 Nat. Real Estate Co. Kuwait 0.14 (2.7) 100.0 9.1 Mannai Corporation Qatar 105.60 (2.1) 75.5 (3.1) Mabanee Co. Kuwait 1.02 (1.9) 513.2 6.3 Saudi Cement Saudi Arabia 97.46 (1.8) 416.8 1.8 Source: Bloomberg ( # in Local Currency) ( ## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Salam International Investment Co 15.48 (10.0) 2,090.7 (2.3) Mannai Corporation 105.60 (2.1) 75.5 (3.1) Islamic Holding Group 120.00 (1.6) 95.1 (3.6) United Development Co. 25.15 (1.4) 1,955.1 6.6 Mesaieed Petrochem. Holding Co. 29.45 (1.3) 327.0 (0.2) QSE Top Value Trades Close* 1D% Val. ‘000 YTD% Vodafone Qatar 18.55 8.2 180,249.2 12.8 Barwa Real Estate Co. 51.10 4.3 149,654.7 22.0 Ezdan Holding Group 17.00 3.0 103,888.8 13.9 Aamal Co. 19.00 8.3 89,385.6 25.1 Gulf International Services 109.10 0.1 59,317.1 12.4 Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 12,623.93 0.8 0.8 6.1 2.8 311.20 187,096.0 15.8 2.0 3.8 Dubai 3,893.36 0.2 0.2 6.0 3.2 232.04 95,352.2 12.7 1.4 5.0 Abu Dhabi 4,621.55 0.3 0.3 3.7 2.0 70.59 127,905.1 12.2 1.5 3.7 Saudi Arabia 9,345.32 1.8 1.8 5.3 12.1 3,196.69 539,921.4 18.6 2.2 2.9 Kuwait 6,755.14 0.8 0.8 2.8 3.4 90.25 101,152.9 16.6 1.1 3.8 Oman 6,725.47 0.6 0.6 2.5 6.0 126.69 25,355.0 10.2 1.5 4.2 Bahrain 1,438.47 0.2 0.2 1.0 0.8 1.11 53,781.8 10.2 0.9 4.7 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) 12,450 12,500 12,550 12,600 12,650 12,700 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 6 Qatar Market Commentary The QSE Index rose 0.8% to close at 12,623.9. The Real Estate and Telecoms indices led the gains. The index rose on the back of buying support from non-Qatari shareholders despite selling pressure from Qatari shareholders. Qatar German Co for Medical Devices and Aamal Co. were the top gainers, rising 10.0% and 8.3%, respectively. Among the top losers, Salam International Investment Co. fell 10.0%, while Mannai Corp. was down 2.1%. Volume of shares traded on Sunday rose by 43.5% to 40.3mn from 28.1mn on Thursday. Further, as compared to the 30-day moving average of 13.8mn, volume for the day was 190.7% higher. Vodafone Qatar and Ezdan Holding Group were the most active stocks, contributing 25.0% and 15.5% to the total volume respectively. Source: Qatar Stock Exchange (* as a % of traded value) Earnings Earnings Releases Company Market Currency Revenue (mn) 4Q2014 % Change YoY Operating Profit (mn) 4Q2014 % Change YoY Net Profit (mn) 4Q2014 % Change YoY Advanced Petrochemical Co. (APC)* Saudi Arabia SR – – 735.1 30.0% 751.0 34.9% Agthia Group* Abu Dhabi AED 1,655.1 9.4% – – 193.3 21.8% Sharjah Cement & Industrial Development Co. (SCIDC)* Abu Dhabi AED 675.0 8.2% 43.0 -17.3% 62.0 26.5% Taageer Finance Co.* Oman OMR – – – – 3.8 -3.6% Salalah Mills Co. (SMC) Oman OMR 67.6 12.8% – – 5.5 10.9% Source: Company data, DFM, ADX, MSM (*FY2014 results) News Qatar QIIK 2014 net income and dividend in-line with our estimates – QIIK (Qatar International Islamic Bank) posted a net profit of QR825.8mn (up 10.1% YoY) in 2014 vs. our estimate of QR819.7mn. EPS amounted to QR5.45 in 2014 vs. QR4.96 in 2013. QIIK’s board of directors proposed cash DPS of QR4.00 (QR3.75 in 2013) in-line with our estimate of QR4.00. Going forward, we maintain a cash DPS of QR4.00 for 2015, implying a dividend yield of 4.7%. Solid balance sheet performance in 2014: Total assets reached QR38.4bn at the end of 2014, up 12.8% YoY. Customer deposits stood at QR26.6bn at the end of 2014 vs. QR24.2bn in 2013. Financing assets posted a strong growth of 14.8% YoY to reach QR21.8bn. Total shareholders’ equity stood at QR5.4bn in 2014 as compared to QR5.1bn in 2013. Tier 1 Sukuk announced. QIIK’s capital adequacy ratio under Basel II stood at 16.27% at the end of 2014 as compared to 18.86% at the end of 2013. The board has proposed to the general assembly to issue additional Tier 1 Sukuk, up to QR3bn, to support the bank’s future capital requirements. Catalyst/Key Events in the pipeline: Going forward, given the appreciation in real estate prices over the last few quarters, we expect QIIK to sell some of its real estate portfolio. This could potentially improve the bottom-line in coming quarters (not incorporated in our estimates) and act as a catalyst for the stock price. The bank is also actively looking at international expansion. Any newsflow in this regard could also act as a catalyst for the stock. We maintain our estimates and price target of QR85.00; reiterate Market Perform rating. For 2015 and 2016, we expect QIIK to post earnings of QR903mn and QR984mn, respectively. The bank trades on P/E and P/B multiples of 14.3x and 2.2x on our 2015 estimates, respectively. SIIS’ net profit declines 31.2% in FY2014, recommends 6% dividend – Salam International Company (SIIS) has reported 31.2% YoY decline in its net profit to QR78.3mn in FY2014, despite higher operating income (+16.0% YoY to QR2.37bn). The company’s net profit fell primarily due to an increase in both operating costs (QR1.77bn in FY2014 vs. QR1.48bn in FY2013) and general & administrative expenses (QR216.1mn vs. QR192.2mn), along with a 27.2% YoY decline in investment income to QR148.9mn in FY2014. Other income surged by 206.9% YoY to QR28.7mn in FY2014, while finance cost was down 15.2% YoY to QR76.7mn. EPS amounted to QR0.68 in FY2014 as compared to QR1.00 in FY2013. Meanwhile, the company has suggested 6% cash dividend, which needs to be approved by its shareholders at the annual general assembly meeting slated to be held on February 25, 2015. (QSE) MCGS reports QR181.5mn net profit in FY2014 – Medicare Group (MCGS) reported a net profit of QR181.5mn in FY2014 versus QR89.4mn in FY2013. EPS amounted to QR6.45 in FY2014 as compared to QR3.18 in FY2013. Meanwhile, the company’s board decided to put forward to the Ordinary AGM, expected to be held on March 11, 2015, its recommendations for the distribution of cash dividends of 50% of the nominal share value (QR5.0. per share). (QSE) QOIS reports QR26mn net profit in FY2014 – Qatar Oman Investment Company (QOIS) reported a net profit of QR26mn in FY2014 versus QR20mn in FY2013. EPS amounted to QR0.825 in FY2014 as compared to QR0.629 in FY2013. Meanwhile, the company’s board of directors decided to recommend to the General Assembly for the approval of the distribution of 8% cash dividends (80 dirhams per share). (QSE) KCBK seeks shareholder nod for dividend and bond plan – Al Khalij Commercial Bank’s (KCBK) board of directors has invited its shareholders to attend the annual general assembly (AGM) and the extraordinary general assembly (EGM), which Overall Activity Buy %* Sell %* Net (QR) Qatari 67.56% 72.14% (51,973,115.70) Non-Qatari 32.45% 27.86% 51,973,115.70

- 3. Page 3 of 6 will be held on February 25, 2015. KCBK’s shareholders will consider the board’s proposal regarding the distribution of cash dividends of 10% of the share nominal value (QR1 per share) for the year ended December 31, 2014. The shareholders will also consider approving issuance of non-convertible bonds up to a maximum amount outstanding of $1.75bn. In case the required quorum is not met, both meetings shall be deferred to March 2, 2015. (QSE) ERES BoD meeting on February 24 – Ezdan Holding Group’s (ERES) board of directors will meet on February 24, 2015 to discuss and approve the financial results ending December 31, 2014. (QSE) QATI launches new products at Qatar Motor Show – Qatar Insurance Company (QATI), the official insurer for the 2015 Qatar Motor Show, has revealed its new products and services at the event. QATI introduced its recently launched “U-Club”, the nation’s-first loyalty program for policyholders of comprehensive car insurances. QATI’s new launches are aimed at making car travel and home insurance purchasing easier. (Gulf-Times.com) GDF Suez aims to reinforce its position in Qatar – French electric utility company, GDF Suez is looking to reinforce its presence in Qatar by strengthening its foothold and diversifying its portfolio of assets. GDF Suez, which already operates two major power & water plants in Qatar, is a bidder in Qatar’s new power plant. The company is also looking to accelerate its presence in the energy management services in the run up to the FIFA 2022 World Cup. GDF Suez is involved in almost 40% of the total power production in Qatar. (Peninsula Qatar) International Oil price steadies after weak Chinese trade data – Crude oil prices steadied on February 9 as falling oil rig counts in the US and ongoing conflict in Libya were balanced by a slump in Chinese imports, pointing to lower fuel demand in the world’s biggest energy consumer. The global benchmark Brent crude price for March 2015 was up 30 cents at $58.10 a barrel after rising as high as $59.06 earlier in the session. US WTI crude was up 60 cents at $52.29 a barrel, having reached a session high of $53.40. Brent rose more than 9% last week, its biggest weekly rise since February 2011. The North Sea oil futures contract has climbed more than 18% in the past two weeks, its strongest showing since 1998. The move ended a six-month slide, which saw oil prices lose more than half their value. (Reuters) US urges Eurozone leaders to compromise with Athens; Euro will collapse if Greece exits – According to the Financial Times (FT), the Obama administration is pushing Eurozone leaders to compromise more with Greece's new government as fears grow about a protracted budget stand-off damaging the global economy. According to FT’s report citing European Union and US officials, the US lobbying effort comes amid mounting concerns in Brussels and Washington about the hardline stance taken by some members of the Eurozone, particularly Germany to force Greece to press on with its austerity commitments. Meanwhile, the Greek Finance Minister Yanis Varoufakis said if Greece is forced out of the Eurozone, other countries will inevitably follow and the currency bloc will collapse. Greece's new government is trying to re-negotiate its debt repayments and has begun to roll back austerity policies agreed earlier. Meanwhile, British Finance Minister George Osborne said the standoff between Greece and the Eurozone over Greek debt is steadily raising the risks for the British economy. Osborne said Britain was stepping up its contingency planning for any Greece- related instability. (Reuters) Japanese current account surplus shrinks again in 2014 – The current account surplus of Japan shrank for the fourth straight year to its smallest on record, complicating Tokyo's efforts to rein in its massive public debt. Some analysts expect a reduction in the fuel import bill amid a collapse in global oil prices could help narrow the persistent trade gap and boost the surplus on the current account. The Ministry of Finance data showed that Japan's current account surplus fell 18.8% to 2.6tn yen in 2014, reflecting a bulging trade deficit, which is a worrying sign since it will hurt the balance of payments. This was the smallest surplus in comparable data available right from 1985. The narrowing surplus has raised concerns that a persistent trade deficit may tip the current account into the negative territory over the medium term. (Reuters) China's imports slump 19.9%, dismal trade in January – Trade performance in China slumped in January, with exports falling 3.3% YoY, while imports tumbled 19.9%, highlighting the deepening weakness in the Chinese economy. Largely as a result of the sharply lower imports – particularly of coal, oil and commodities – China posted a record monthly trade surplus of $60bn. The data contrasted sharply with a Reuters poll, which showed analysts’ expectation for exports to gain 6.3% and the slowdown in imports to 3%, following a better-than-expected showing in December. The poll had also forecast a trade surplus of $48.9bn. The slide in imports is the sharpest since May 2009, when Chinese factories were still slashing inventories in reaction to the global financial crisis. Exports have not produced a negative annual reading since March 2014. (Reuters) Regional Tadawul announces deposit of TADCO, Al Alamiya’s subscribed shares – The Saudi Stock Exchange (Tadawul) announced that Tabuk Agriculture Development Company (TADCO) and Al Alamiya for Cooperative Insurance Company’s (Al Alamiya) new shares have been deposited in the shareholders’ portfolios on February 8, 2015, based on their allocation. (Tadawul) Saudi ORIX BoD recommends SR27.5mn dividend for 2014 – Saudi ORIX Leasing Company’s board of directors has recommended the distribution of 5% dividend (SR0.5 per share) amounting to SR27.5mn for 2014. Shareholders, who are registered at the end of the general assembly meeting date, are entitled for dividends. This decision will be conveyed to the general assembly meeting for statutory approval. (Tadawul) SCC BoD recommends SR382.5mn dividend for 2H2014 – Saudi Cement Company’s (SCC) board of directors has recommended the distribution of 25% cash dividend (SR2.5 per share) amounting to SR382.5mn for 2H2014. Shareholders registered with the Securities Depository Center (Tadawul) as on the Ordinary Annual General Assembly Meeting date, expected to be held during March 2015, will be eligible for dividends. (Tadawul) NCEP: 60 major firms plan 226 exhibitions across the Kingdom – The National Convention and Exhibition Program (NCEP) in its recent report revealed that there are 60 specialized companies planning to hold 226 trade exhibitions in 2015 across Saudi Arabia, and will cover 18 economic sectors. According to the report, 60% of exhibitions are scheduled to take place in the approved exhibition halls, 31% in hotels, and 9% in licensed halls. (GulfBase.com) SFG: Saudi real GDP expected to grow by 2.6% in 2015 – According to a report released by Samba Financial Group (SFG), Saudi Arabia’s non-oil GDP growth is expected to ease to 4.5% in 2015, from 5.1% in 2014. The non-oil growth is

- 4. Page 4 of 6 expected to further cool to 1.6% in 2016, as the tighter fiscal stance feeds through (and as the calendar reverts to 12 months), before gathering pace again in 2017 and 2018 as rising oil prices restore some private sector confidence. The report stated that the non-oil economy will be expanding at a 5.4% pace by 2018. With the oil sector contributing little growth, the trend in overall real GDP growth is expected to be very similar to that of non-oil GDP, growing by 2.6% in 2015, before dipping down to 1.5% in 2016. There are prospects for a growth of 2% in 2017 before it accelerates to 3.8% in 2018. Exports have suffered from the slowdown in China and the outlook for Chinese demand appears weak over the short-term. However, other Asian countries should continue to absorb Saudi intermediate goods as demand for Asian manufactures in the US and, to a lesser extent the Eurozone, picks up again. Inflationary pressures are expected to remain muted over the next three years. (GulfBase.com) ATMC appoints financial advisor for rights issue – Alinma Tokio Marine Company (ATMC) has appointed Saudi Kuwaiti Finance House as financial advisor to manage the rights issue offering. (Tadawul) APC invites shareholders to approve 7.5% cash dividend for 4Q2014 – Advanced Petrochemical Company (APC) has invited its shareholders to approve the board of directors’ recommendation to distribute 7.5% cash dividend (SR0.75 per share) amounting to SR123mn for 4Q2014. Shareholders registered in the company’s shareholders records in Tadawul at the end of the ordinary general assembly shall be eligible to receive the dividends. This brings the total dividend distribution for 2014 to SR3 per share, totaling SR492mn. (Tadawul) AZIZI reveals AED4.5bn investments in Dubai real estate market – The UAE-based property developer, AZIZI Developments has revealed that it has invested an estimated AED4.5bn into Dubai’s real estate sector till date, driven by robust local demand for affordable luxury and value homes. AZIZI Developments is expected to sustain its upward trajectory in 2015 as it plans to launch more new luxury residential and hotel projects and develop elite hotel apartments across Dubai. The company had launched five large-scale residential projects in 2014. (GulfBase.com) GGICO launches free-hold apartment property – GGICO Properties has launched its new Grand Horizon Apartments, a new freehold one-bedroom apartment complex in Dubai Sports City. The new project offers quick access to both Al Khail and Sheikh Mohammed Bin Zayed Road and is situated adjacent to the Victory Heights Primary School. The unit prices start from AED799, 846. (GulfBase.com) Buroj Property to invest AED10bn in Bosnia – Dubai-based Buroj Property Development is on the verge of starting work at the Buroj Ozon project in Bosnia. The project, which will be developed in partnership with the Bosnian government at the cost of around AED10bn, features villas, shopping centers and hotels. It will be constructed in four phases, the first of which begins during 3Q2015. (GulfBase.com) Abu Dhabi's Khalifa Port container volumes grow 26% in 2014 – Abu Dhabi’s Khalifa Port operated by Abu Dhabi Terminals (ADT), handled 1.13mn TEUs (twenty-foot equivalent unit containers) in 2014, representing a YoY growth of 26% in container volumes after it attracted more shipping lines. Four new shipping lines began services to Khalifa Port in 2014, taking the total to 20 lines serving 52 destinations. Khalifa Port's container terminal currently has an annual capacity of 2.5mn TEUs, which can be raised to 5mn TEUs, depending on demand over the next few years. (Reuters) KFH reports 9.1% increase in 2014 net profit – Kuwait Finance House (KFH) reported a net profit of KD126.5mn in 2014, representing a jump of 9.1% YoY. The bank said that its board of directors has proposed a cash dividend of 15% and a 10% stock dividend for 2014. This compares with a 13% payout of both cash and shares in 2013. (Reuters) KFH brand value rises 18.5% to $953mn – According to the valuation of Brand Finance agency, published by “The Banker” magazine for the top 500 Brands in the world for the year 2015, Kuwait Finance House’s (KFH) brand value increased by 18.5% to $953mn from $805mn in 2014, while its global brand ranking improved to 163rd from 173rd in 2014. This confirms KFH’s strong reputation, robust position, outstanding performance, and the leadership in the Islamic finance industry. (GulfBase.com) Kuwaiti committee recommends rejecting bids for KD1.39bn airport expansion – Kuwait's minister for electricity, water & public works, Abdulaziz al-Ibrahim, said that a technical committee in the ministry has recommended rejecting all bids to build a new terminal at the country's international airport, without giving a reason for the same. In November 2014, the tender committee for the project said a consortium of Kuwait's Kharafi National and Turkey's Limak Holding had submitted the lowest bid for the contract, worth KD1.386bn. (Reuters) AAAID sells entire 33.25% stake in Asaffa Foods – Arab Authority for Agricultural Investment & Development (AAAID) has sold all its 39,898,654 shares, representing 33.25% of the share capital in Asaffa Foods, to Zulal Investment Company, a wholly-owned subsidiary of Qatar-based Hassad Food Company. (MSM) CBO to issue GDB worth OMR200mn – The Central Bank of Oman (CBO) said that it will issue Government Development Bonds (GDB) worth OMR200mn with a maturity period of 10 years and a coupon rate of 4.5% per annum. The issue is open for subscription from February 8 to 15, 2015, while the auction will be held on February 17, 2015. Interest on the new bonds will be paid on August 23 and February 23 every year, and the date of maturity is February 23, 2025. The 46th GDB issue is offered to all investors of any nationality residing in Oman only. It is not open for subscription to investors residing abroad. (GulfBase.com) BMB reports $4.52mn net profit for FY2014 – Bahrain Middle East Bank (BMB) posted a $4.52mn net profit for FY2014, as against a net loss of $4.66mn in FY2013. The bank’s total operating income for FY2014 amounted to $12.23mn as compared to $11.93mn in FY2013. The bank’s total assets stood at $172.84mn at the end of December 2014 as against $169.5mn at the end of December 2013. EPS stood at 1.87 cents, against losses per share of 1.92 cents in 2013. Meanwhile, BMB’s board of directors has decided not to distribute dividends to its shareholders for the financial year ended December 31, 2014. (Bahrain Bourse) GARMCO signs MoU with MI for technical cooperation – Gulf Aluminium Rolling Mill Company (GARMCO) has signed a MOU for technical and operational cooperation with Dubai- based Metals Industries (MI), the holding company for the Saif Al Ghurair Group's aluminum and metals businesses. Under the terms of the MoU, GARMCO and MI will work together across a number of key areas covering operational, technical and warehousing/service centre functions in order to identify prospects for mutual benefit and the capturing of synergies. (GulfBase.com) Gulf Air, Batelco extend partnership agreement – Gulf Air and Bahrain Telecommunications Company (Batelco) have

- 5. Page 5 of 6 extended their partnership agreement to enhance benefits for Batelco’s Al Dana customers. As per the terms of the agreement, members of Batelco Al Dana Club, who hold Gulf Air Frequent flyer cards as part of their Al Dana Club benefits, will have the opportunity to accrue additional Gulf Air Falconflyer Miles based on their Batelco bill payments. The accrual rates for Batelco’s customers have been raised from 30 to 50 Gulf Air Falconflyer Miles for every BHD100 spent. (Peninsula Qatar)

- 6. Contacts Saugata Sarkar Abdullah Amin, CFA Shahan Keushgerian Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6569 Tel: (+974) 4476 6509 saugata.sarkar@qnbfs.com.qa abdullah.amin@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa Sahbi Kasraoui Ahmed Al-Khoudary QNB Financial Services SPC Manager – HNWI Head of Sales Trading – Institutional Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6544 Tel: (+974) 4476 6548 PO Box 24025 sahbi.alkasraoui@qnbfs.com.qa ahmed.alkhoudary@qnbfs.com.qa Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services SPC (“QNBFS”) a wholly-owned subsidiary of QNB SAQ (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange QNB SAQ is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 6 of 6 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 80.0 100.0 120.0 140.0 160.0 180.0 200.0 220.0 Jan-11 Jan-12 Jan-13 Jan-14 Jan-15 QSE Index S&P Pan Arab S&P GCC 1.8% 0.8% 0.8% 0.2% 0.6% 0.3% 0.2% 0.0% 0.4% 0.8% 1.2% 1.6% 2.0% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,233.92 (2.4) (3.9) 4.1 MSCI World Index 1,720.55 (0.4) 2.6 0.6 Silver/Ounce 16.71 (3.2) (3.1) 6.4 DJ Industrial 17,824.29 (0.3) 3.8 0.0 Crude Oil (Brent)/Barrel (FM Future) 57.80 2.2 9.1 0.8 S&P 500 2,055.47 (0.3) 3.0 (0.2) Crude Oil (WTI)/Barrel (FM Future) 51.69 2.4 7.2 (3.0) NASDAQ 100 4,744.40 (0.4) 2.4 0.2 Natural Gas (Henry Hub)/MMBtu 2.55 (3.0) (4.7) (14.7) STOXX 600 373.31 (0.9) 2.0 2.0 LPG Propane (Arab Gulf)/Ton 54.75 4.0 10.1 11.7 DAX 10,846.39 (1.7) 1.7 3.0 LPG Butane (Arab Gulf)/Ton 69.25 3.6 0.7 5.7 FTSE 100 6,853.44 (0.6) 3.0 2.1 Euro 1.13 (1.4) 0.2 (6.5) CAC 40 4,691.03 (1.4) 2.2 2.7 Yen 119.12 1.4 1.4 (0.6) Nikkei 17,648.50 (0.8) (1.6) 1.4 GBP 1.52 (0.6) 1.2 (2.1) MSCI EM 978.57 (0.4) 1.8 2.3 CHF 1.08 (0.6) (0.7) 7.3 SHANGHAI SE Composite 3,075.91 (1.8) (4.1) (5.5) AUD 0.78 (0.0) 0.4 (4.6) HANG SENG 24,679.39 (0.4) 0.7 4.6 USD Index 94.70 1.2 (0.1) 4.9 BSE SENSEX 28,717.91 (1.0) (1.5) 6.5 RUB 66.86 0.4 (3.8) 10.1 Bovespa 48,792.27 (2.2) 0.7 (6.9) BRL 0.36 (1.3) (3.5) (4.6) RTS 826.40 2.7 12.1 4.5 181.4 141.7 129.6