Report on Stock Market Outlook by Mansukh Investment 17 Aug,2010

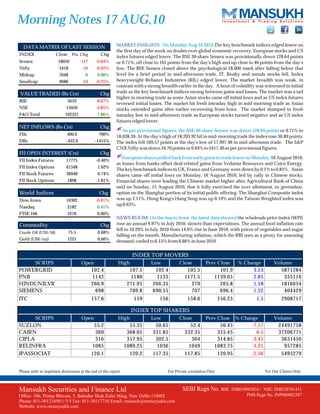

- 1. Morning Notes 17 AUG,10 MARKET INSIGHTS: On Monday Aug 16 2010,The key benchmark indices edged lower on DATA MATRIX OF LAST SESSION the first day of the week on doubts over global economic recovery. European stocks and US INDEX Close Pts. Chg Chg index futures edged lower. The BSE 30-share Sensex was provisionally down 128.64 points Sensex 18050 -117 -0.64% or 0.71%, off close to 165 points from the day's high and up close to 40 points from the day's Nifty 5418 -34 -0.62% low. The BSE Sensex closed above the psychological 18,000 mark after falling below that Midcap 7648 6 0.08% level for a brief period in mid-afternoon trade. IT, Realty and metals stocks fell. Index Smallcap 9686 -24 -0.25% heavyweight Reliance Industries (RIL) edged lower. The market breadth was weak, in contrast with a strong breadth earlier in the day. A bout of volatility was witnessed in initial VALUE TRADED (Rs Crs) Chg trade as the key benchmark indices swung between gains and losses. The market was a tad higher in morning trade as some Asian stocks came off initial lows and as US index futures BSE 5619 -8.07% reversed initial losses. The market hit fresh intraday high in mid-morning trade as Asian NSE 15959 -3.85% stocks extended gains after earlier recovering from lows. The market slumped to fresh F&O Total 102321 7.86% intraday low in mid-afternoon trade as European stocks turned negative and as US index futures edged lower. NET INFLOWS (Rs Crs) Chg As per provisional figures, the BSE 30-share Sensex was down 128.64 points or 0.71% to FIIs 400.0 700% 18,038.39. At the day's high of 18,203.92 hit in mid-morning trade the index rose 36.89 points. DIIs -433.9 -1415% The index fell 169.57 points at the day's low of 17,997.46 in mid-afternoon trade. The S&P CNX Nifty was down 34.70 points or 0.64% to 5417.40 as per provisional figures. FII OPEN INTEREST (Crs) Chg European shares pulled back from early gains to trade lower on Monday, 16 August 2010, FII Index Futures 17775 -0.40% as losses from banks offset deal-related gains from Vedanta Resources and Cairn Energy. FII Index Options 61548 1.62% The key benchmark indices in UK, France and Germany were down by 0.1% to 0.85%. Asian FII Stock Futures 36948 0.74% shares came off initial lows on Monday, 16 August 2010, led by rally in Chinese stocks. FII Stock Options 1898 -1.81% Financial shares were leading the Chinese market higher after Agricultural Bank of China said on Sunday, 15 August 2010, that it fully exercised the over allotment, or greenshoe, World Indices Chg option on the Shanghai portion of its initial public offering. The Shanghai Composite index Dow Jones 10302 -0.01% was up 2.11%. Hong Kong's Hang Seng was up 0.19% and the Taiwan Weighted index was up 0.63%. Nasdaq 2182 0.41% FTSE 100 5276 0.00% NEWS ROOM: On the macro front, the latest data showed the wholesale price index (WPI) Commodity Chg rose an annual 9.97% in July 2010, slower than expectations. The annual food inflation rate fell to 10.29% in July 2010 from 14.6% rise in June 2010, with prices of vegetables and sugar Crude Oil (US$/bl) 75.5 0.68% falling on the month. Manufacturing inflation, which the RBI uses as a proxy for assessing Gold (US$/oz) 1225 0.66% demand, cooled to 6.15% from 6.66% in June 2010. INDEX TOP MOVERS SCRIPS Open High Low Close Prev Close % Change Volume POWERGRID 102.4 107.5 102.4 105.5 101.9 3.53 5871284 PNB 1142 1180 1133 1171.5 1139.05 2.85 355116 HINDUNILVR 266.9 271.95 266.35 270 265.8 1.58 1816654 SIEMENS 698 709.8 690.55 707 696.4 1.52 404429 ITC 157.6 159 156 158.6 156.25 1.5 2908717 INDEX TOP SHAKERS SCRIPS Open High Low Close Prev Close % Change Volume SUZLON 55.2 55.35 50.65 52.4 56.45 -7.17 24491758 CAIRN 360 368.05 331.85 332.35 355.45 -6.5 37206771 CIPLA 316 317.95 302.5 304 314.85 -3.45 3631450 RELINFRA 1085 1089.25 1036 1049 1083.75 -3.21 957285 JPASSOCIAT 120.1 120.2 117.35 117.85 120.95 -2.56 5495279 Please refer to important disclosures at the end of this report For Private circulation Only For Our Clients Only Mansukh Securities and Finance Ltd SEBI Regn No. BSE: INB010985834 / NSE: INB230781431 Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002 PMS Regn No. INP000002387 Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com Website: www.moneysukh.com

- 2. Morning Notes MARKET OUTLOOK- CAUTIOUSLY OPTIMISTIC TODAY'S MARKET LEVELS Index Support 2 Support 1 Previous Close Resistance 1 Resistance 2 Trend SENSEX 17660 17830 18050 18235 18485 Rangebound NIFTY 5345 5380 5418 5475 5520 Rangebound TECHNICAL VIEW: As expected 5470-5480 once again emerges as a crucial ress zone in the last session as spot index posted marginal losses backed by the weak global cues. At current juncture domestic indices found some strong ress near to 5500 zone. Any successful closing for at least two consecutive days will break this shackle and we might see some more upside near to 5600 though we still intact on our previous view of 5340-5350 as a major support zone on closing basis. Hence traders and investors are advise to maintain cautiously optimistic approach and use ‘Buy on Dip ‘ strategy for the upcoming sessions. HAPPY TRADING.... Index Support 2 Support 1 Previous Close Resistance 1 Resistance 2 Trend BANK NIFTY 10220 10520 10677 10880 10965 Rangebound Please refer to important disclosures at the end of this report For Private circulation Only For Our Clients Only Mansukh Securities and Finance Ltd SEBI RegnRegnBSE: INB010985834 / NSE: INB230781431 SEBI No. No. BSE: INB010985834 / NSE: INB230781431 Mansukh Securities and Finance Ltd Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002 PMS Regn No. INP000002387 PMS Regn No. INP000002387 Phone: 011-30123450/1/3/5 Fax:Bahadur Shah Zafar Marg, New Delhi-110002 Office: 306, Pratap Bhavan, 5, 011-30117710 Email: research@moneysukh.com Website:011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com Phone: www.moneysukh.com Website: www.moneysukh.com

- 3. Morning Notes INTRA DAY TECHNICAL RECOMMENDATIONS Scrip CMP Buy Near Stop Loss Target 1 Target 2 Trend BAJAJ HIND 122.95 120 118 123 125 Rangebound Scrip CMP Buy Near Stop Loss Target 1 Target 2 Trend NRC 10.8 10.5 10 11 11.5 Rangebound Mansukh Securities and Finance Ltd SEBI Regn No. BSE: INB010985834 / NSE: INB230781431 Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002 PMS Regn No. INP000002387 Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com Website: www.moneysukh.com

- 4. Morning Notes INTRA DAY TECHNICAL RECOMMENDATIONS Scrip CMP Buy Near Stop Loss Target 1 Target 2 Trend PRAJ 79.5 78.5 77 80 81 Rangebound Scrip CMP Sell Near Stop Loss Target 1 Target 2 Trend GAMMON I 197.1 200 205 195 193 Rangebound Please refer to important disclosures at the end of this report For Private circulation Only For Our Clients Only Mansukh Securities and Finance Ltd SEBI Regn No. BSE: INB010985834 / NSE: INB230781431 Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002 PMS Regn No. INP000002387 Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com Website: www.moneysukh.com

- 5. Morning Notes Research Desk Phone: 011-30211872/73 Email: research@moneysukh.com NAME DESIGNATION E-MAIL Varun Gupta Head - Research varungupta@moneysukh.com Pashupati Nath Jha Research Analyst pashupatinathjha@moneysukh.com Vikram Singh Research Analyst vikram_research@moneysukh.com For more copies or other information, please send your query at research@moneysukh.com Note: Please refer our Derivative Report for recommendation on OPTION STRATEGIES. Additional Information with respect to the securities referred in our derivative calls is uploaded on our website. Please note that our technical calls are totally independent of our fundamental calls Technical Trends calls are based on momentum, Investors/Traders are requested to observe following discipline to take maximum advantage of the products -Entry/exit will be on the basis of price or time priority -Use strict stop loss at 15% from your average acquisition price This report is prepared for the exclusive use of Mansukh Group clients only and should not be reproduced, recirculated,published in any media, website or otherwise, in any form or manner, in part or as a whole, without the express consent in writing of Mansukh Securities and Finance Ltd. Any unauthorized use, disclosure or public dissemination of information contained herein is prohibited. This data sheet is for private circulation only and the said document does not constitute an offer to buy or sell any securities mentioned herein. While utmost care has been taken in preparing the above, we claim no responsibility for its accuracy. We shall not be liable for any direct or indirect losses arising from the use thereof and the investors are requested to use the information contained herein at their own risk. Please refer to important disclosures at the end of this report For Private circulation Only For Our Clients Only Mansukh Securities and Finance Ltd SEBI Regn No. BSE: INB010985834 / NSE: INB230781431 Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002 PMS Regn No. INP000002387 Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com Website: www.moneysukh.com