More Related Content

Similar to Kuwait Juice Market Est - LACNOR Market Share Forecast

Similar to Kuwait Juice Market Est - LACNOR Market Share Forecast (20)

More from Mohamed Ibrahim

More from Mohamed Ibrahim (10)

Kuwait Juice Market Est - LACNOR Market Share Forecast

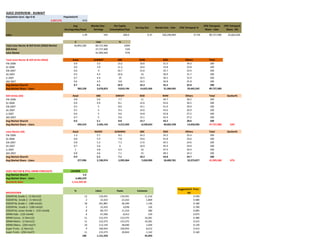

- 1. JUICE OVERVIEW - KUWAIT

Population (excl. Age 0-4) Population%

2,437,572 91%

Avg

Servings/day/Head

Market Size -

Servings

Per Capita

Conumption/Year

Serving Size Market Size - Liter CPG Tetrapack %

CPG Tetrapack

Share - Liter

CPG Tetrapack

Share - KD

Juice 1.49 545 200.0 0.37 326,296,894 27.5% 89,727,400 25,662,036

$ Liter %

Total Juice Nectar & Still Drink (JNSD) Market 34,892,200 89,727,400 100%

Still Drink 47,727,400 53%

Juice Nectar 41,999,500 47%

Total Juice Nectar & Still Drink (JNSD) Awal SUNKIST ABC RANI KDD Others Total

FM 2008 0.9 3.5 13.2 16.6 31.5 34.3 100

DJ 2008 0.6 3.9 11.3 16.6 33.8 33.8 100

ON 2007 0.6 4 10.7 15.6 35.7 33.4 100

AS 2007 0.5 4.3 10.6 16 36.9 31.7 100

JJ 2007 0.7 4.4 10 16.5 36.5 31.9 100

AM 2007 0.6 4.5 9.8 16.5 36.8 31.8 100

Avg Market Share% 0.7 4.1 10.9 16.3 35.2 32.8 100

Avg Market Share - Liters 583,228 3,678,823 9,810,196 14,625,566 31,584,045 29,445,542 89,727,400

Still Drinks (SD) Awal ABC SINKIST KDD RANI Others Total Section%

FM 2008 0.8 5.6 7.7 11 44.7 30.2 100

DJ 2008 0.6 4.9 8.1 12.6 43.6 30.2 100

ON 2007 0.5 5 8.6 14.1 41.9 29.9 100

AS 2007 0.5 5 9.4 14.6 43.6 26.9 100

JJ 2007 0.6 5 9.6 14.8 42.8 27.2 100

AM 2007 0.7 5 9.6 15.1 42.4 27.2 100

Avg Market Share% 0.6 5.1 8.8 13.7 43.2 28.6 100

Avg Market Share - Liters 294,319 2,426,143 4,215,920 6,538,654 20,602,328 13,650,036 47,727,400 53%

Juice Nectar (JN) Awal NADEC ALMARAI ABC KDD Others Total Section%

FM 2008 1.3 5.7 8.2 24.2 35.2 25.4 100

DJ 2008 0.8 5.4 7.8 19.6 41.8 24.6 100

ON 2007 0.8 5.2 7.3 17.6 44.5 24.6 100

AS 2007 0.7 5.6 6 16.9 45.9 24.9 100

JJ 2007 1 4.8 6.4 16 47.4 24.4 100

AM 2007 0.8 4.6 7.1 15 48.2 24.3 100

Avg Market Share% 0.9 5.2 7.1 18.2 43.8 24.7 100

Avg Market Share - Liters 377,996 2,190,974 2,995,964 7,650,909 18,409,781 10,373,877 41,999,500 47%

JUICE NECTAR & STILL DRINK FORECASTS LACNOR

Avg Market Share% 5.0

Avg Market Share - Liters 4,486,370

Quarterly Sales 1,121,592.50

BREAKDOWN

% Liters Packs Cartoons

Suggested R. Price -

KD

ESSENTIAL Grade 1 - (1 literx12) 12 134,591 134,591 11,216 0.430

ESSENTIAL Grade 2 - (1 literx12) 2 22,432 22,432 1,869 0.480

ESSENTIAL Grade 1 - (180 mlx32) 18 201,887 36,340 1,136 0.180

ESSENTIAL Grade 2 - (180 mlx32) 2 22,432 4,038 126 0.190

ESSENTIAL Junior Grade 1 - (125 mlx40) 8 89,727 11,216 280 0.085

DRINK Kido - (125 mlx40) 6 67,296 8,412 210 0.075

DRINK Sunny - (1 literx12) 11 123,375 123,375 10,281 0.380

DRINK Melco - (1 literx12) 11 123,375 123,375 10,281 0.415

DRINK Melco - (250 mlx27) 10 112,159 28,040 1,039 0.130

Super Fruits - (1 literx12) 9 100,943 100,943 8,412 0.415

Super Fruits - (250 mlx27) 11 123,375 30,844 1,142 0.160

100 1,121,593 45,993