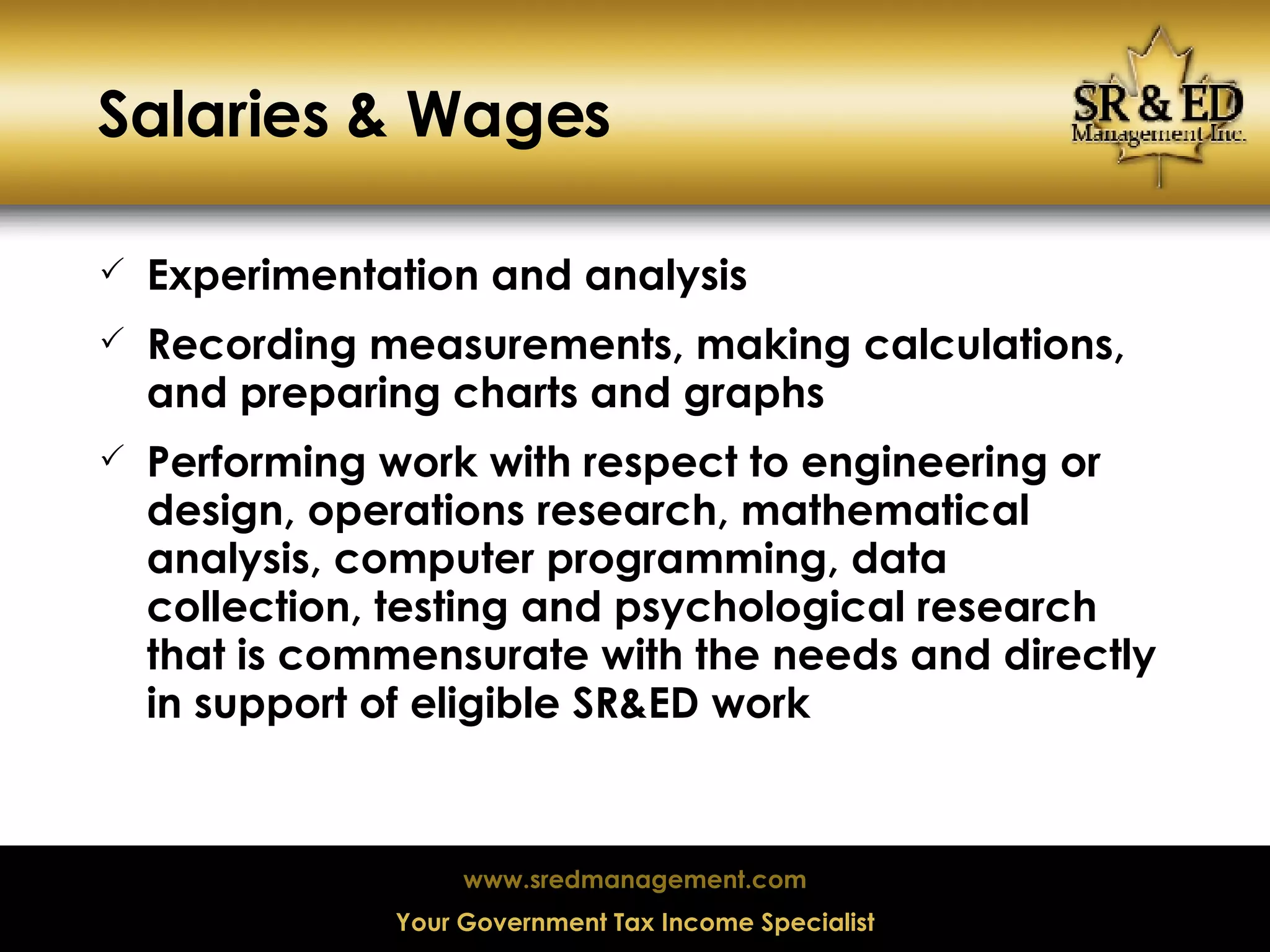

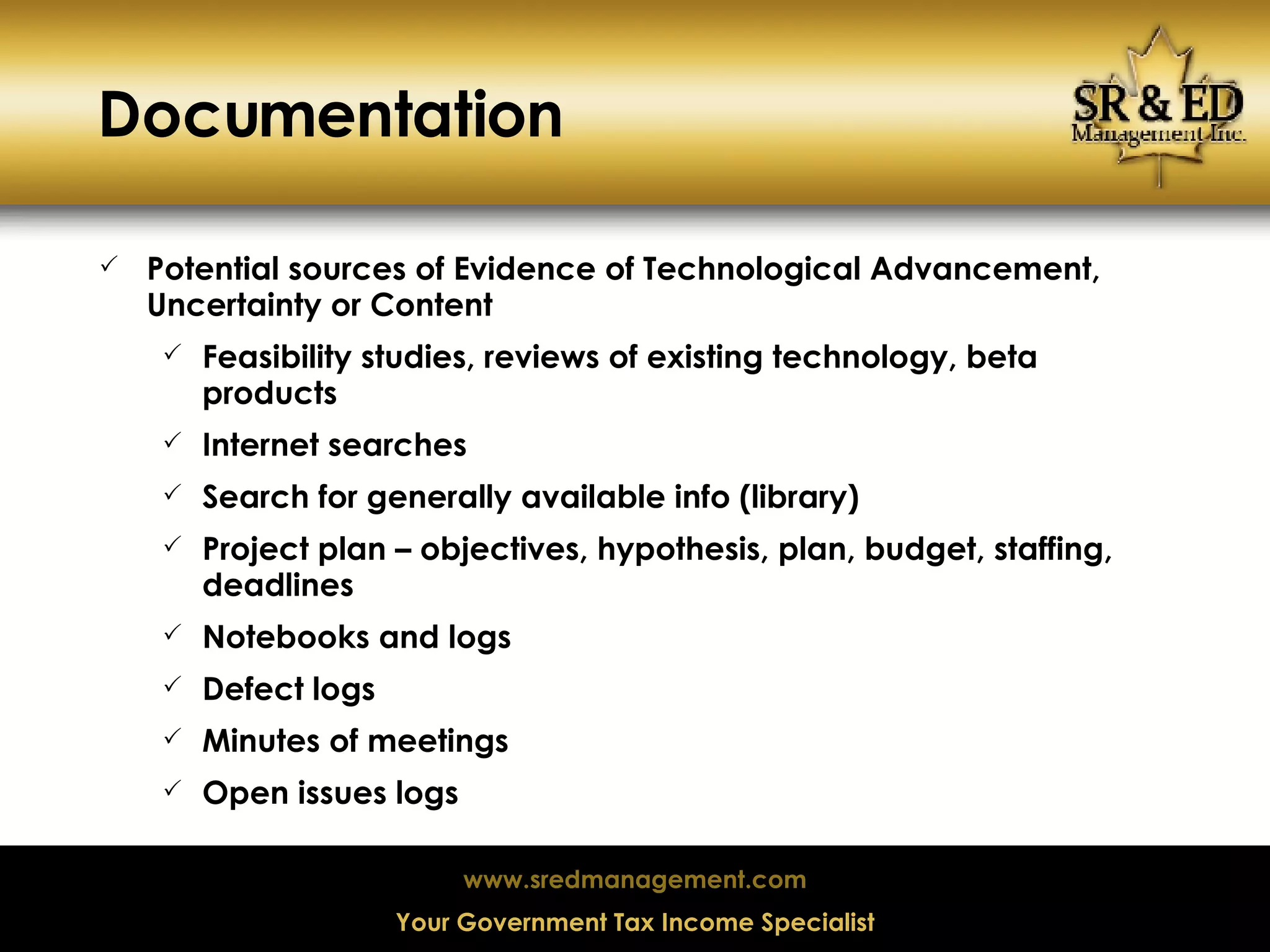

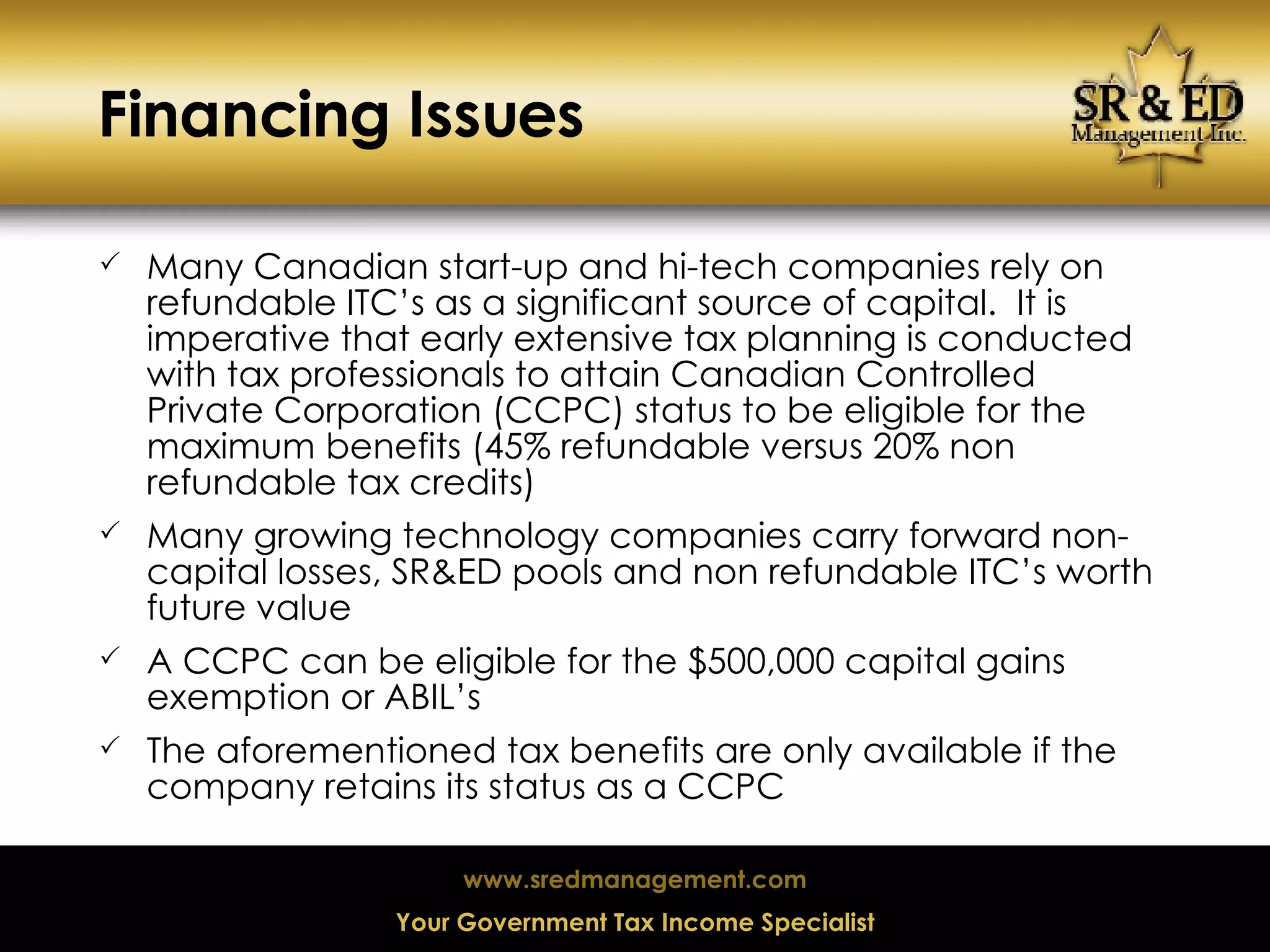

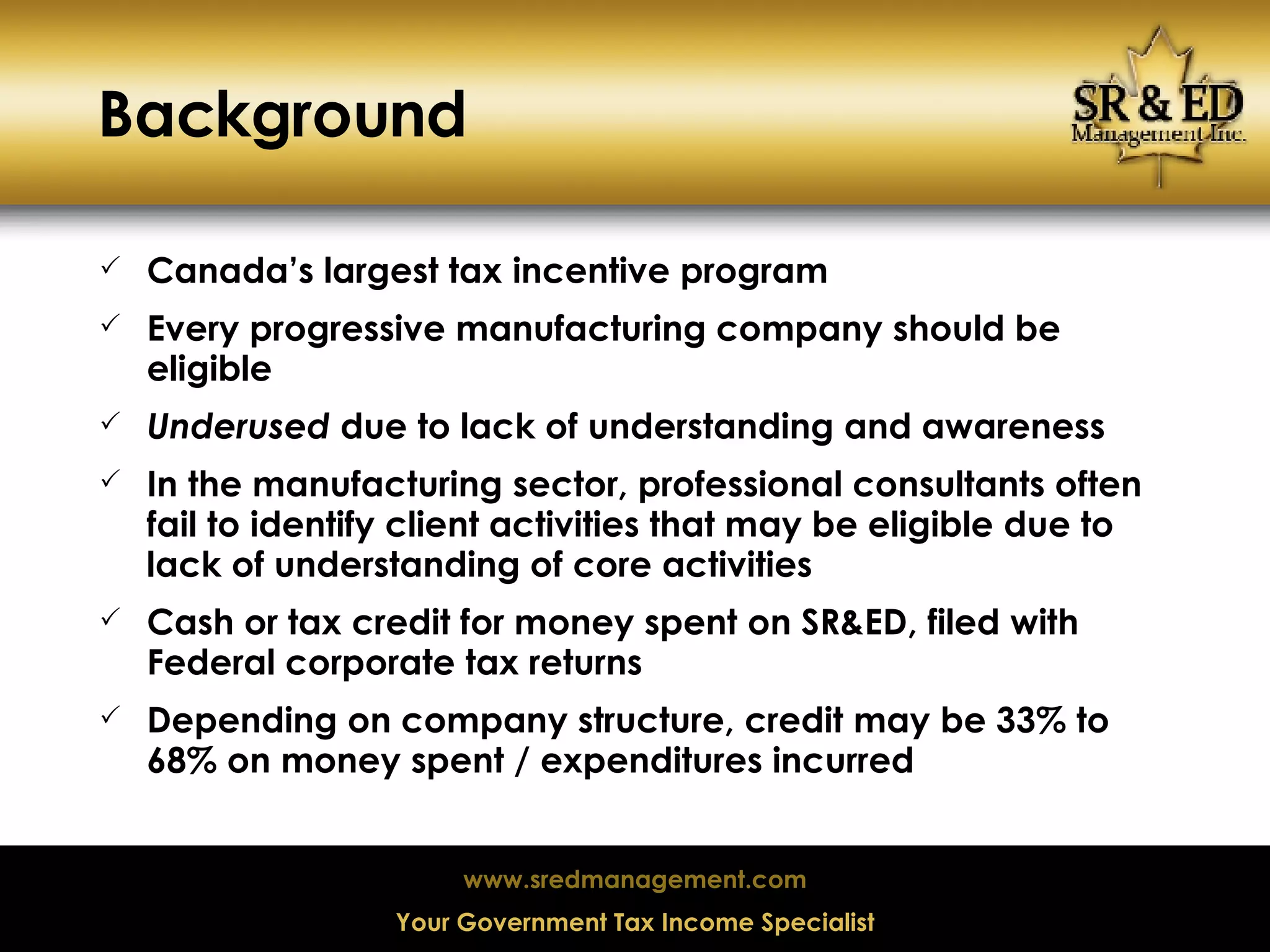

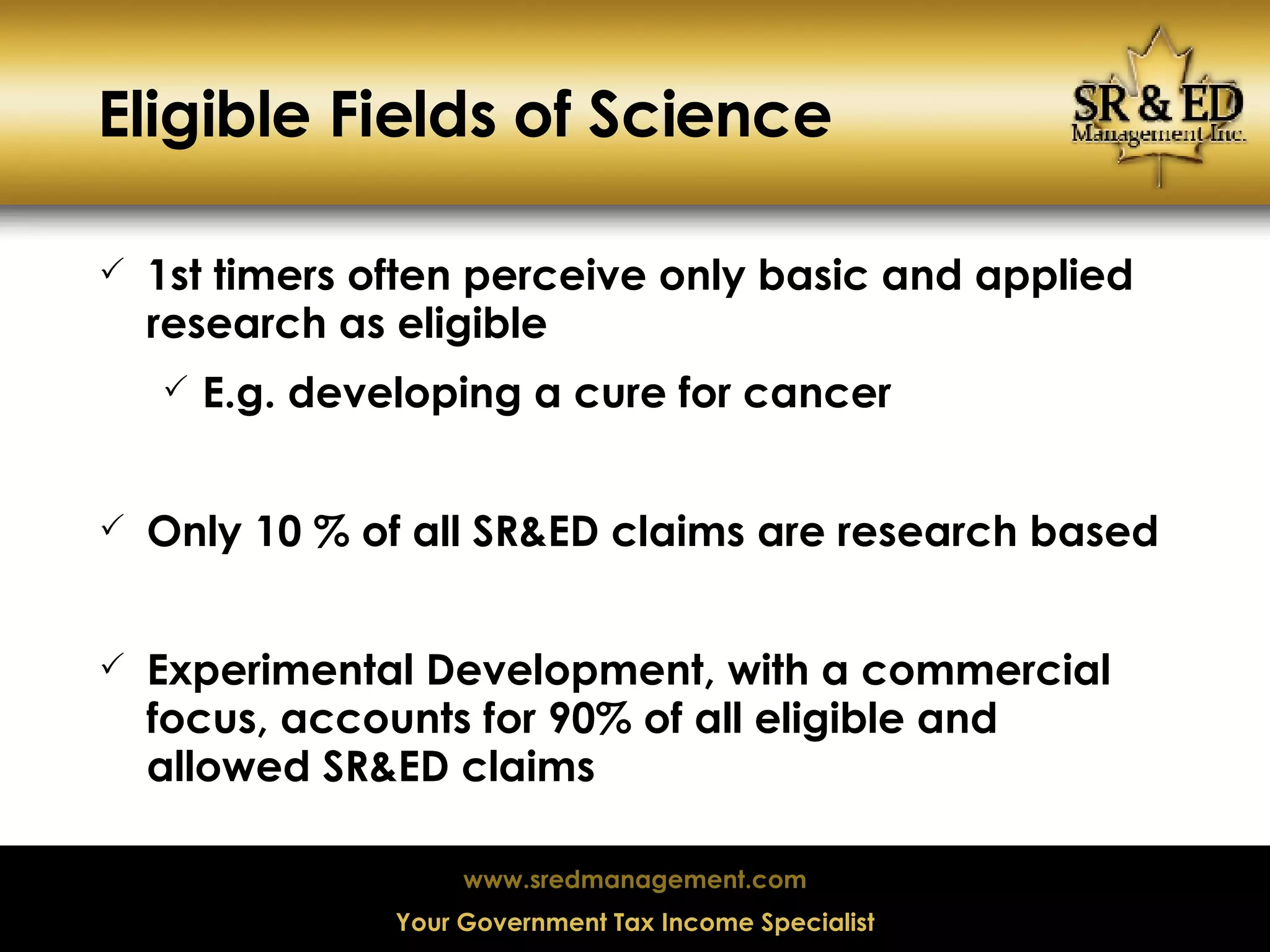

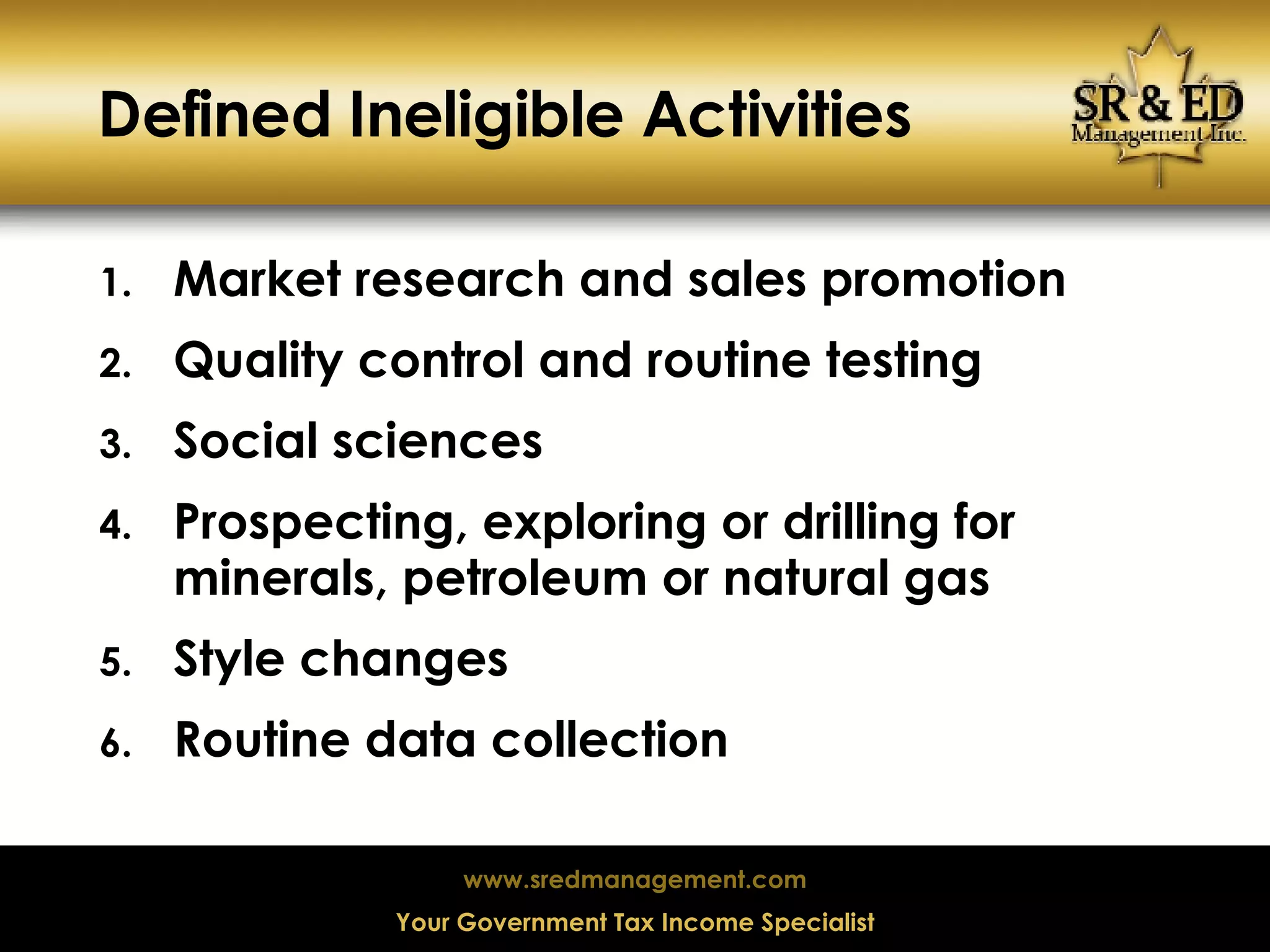

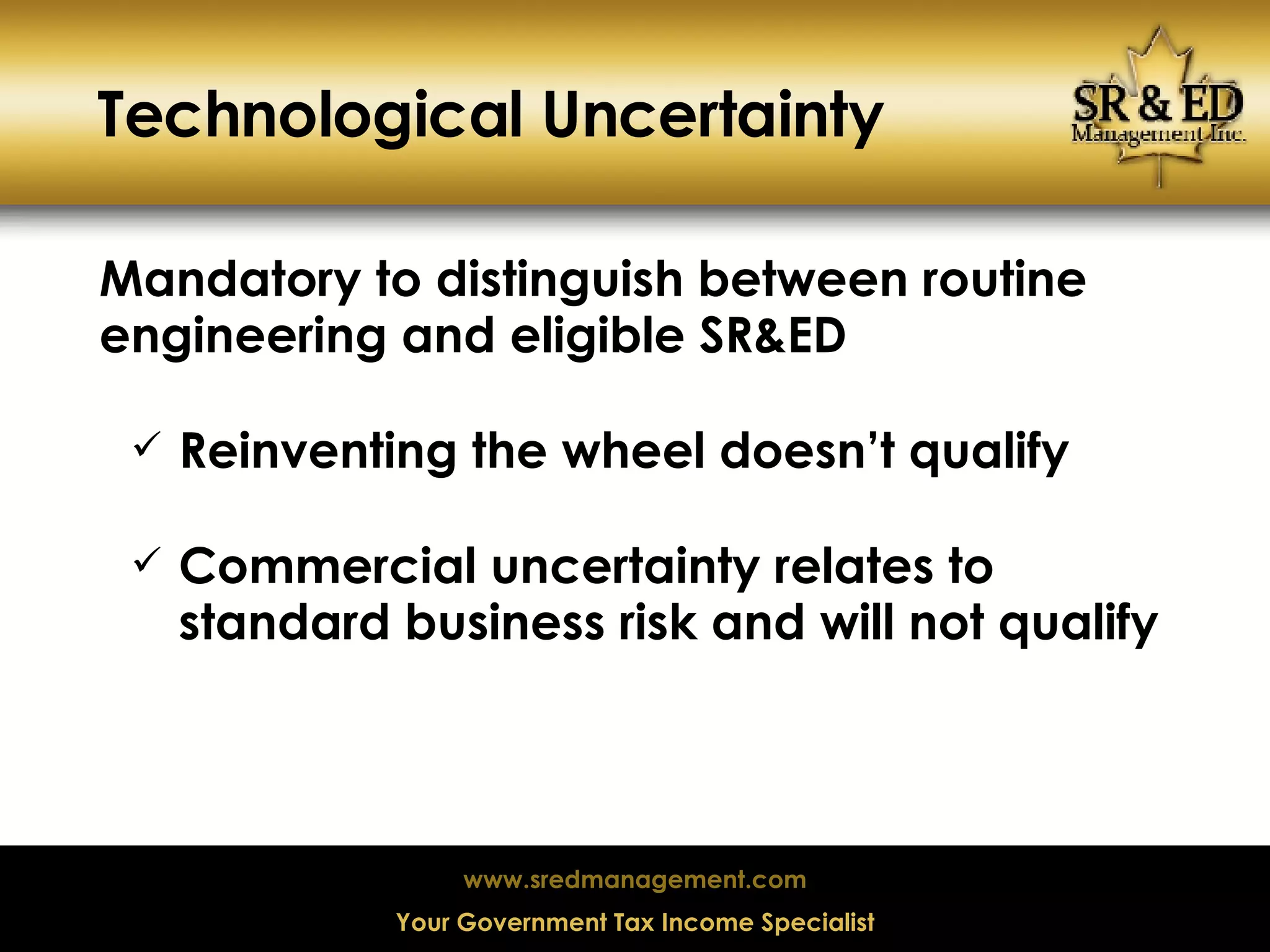

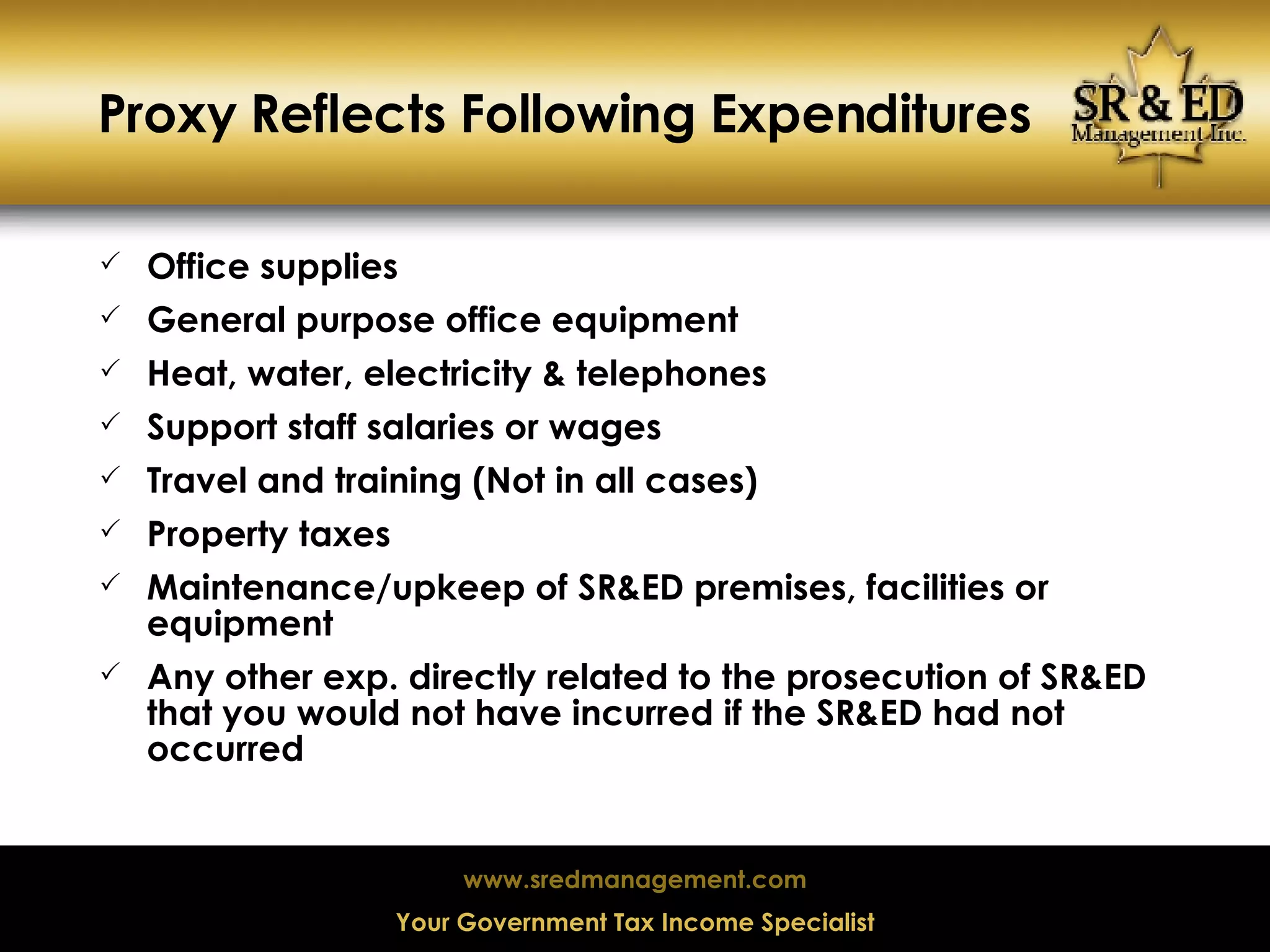

The document provides an overview of Canada's Scientific Research and Experimental Development (SR&ED) program, which offers tax incentives for eligible research and development activities. It describes the program's benefits, eligibility requirements, and how to properly manage and document projects to qualify for the tax credits. Key eligible activities include experimental development work focused on new or improved technologies within established fields of science.

![Understanding the SR & ED Program Prepared By SR & ED Management Inc. Kevin William Angell, CMA [email_address] (519) 254-8661 August 2008](https://image.slidesharecdn.com/sred-program-overview-090408-1220549402690070-8/75/SRED-Program-Overview-1-2048.jpg)

![Proxy Allowable Expenditures Salaries & wages of employees directly engaged in SR&ED, for the incremental time engaged Cost of materials consumed in SR&ED Cost of materials transformed in SR&ED Contract payments (restricted) Lease costs 3rd Party Payments Capital expenditures [“ASA”]](https://image.slidesharecdn.com/sred-program-overview-090408-1220549402690070-8/75/SRED-Program-Overview-26-2048.jpg)