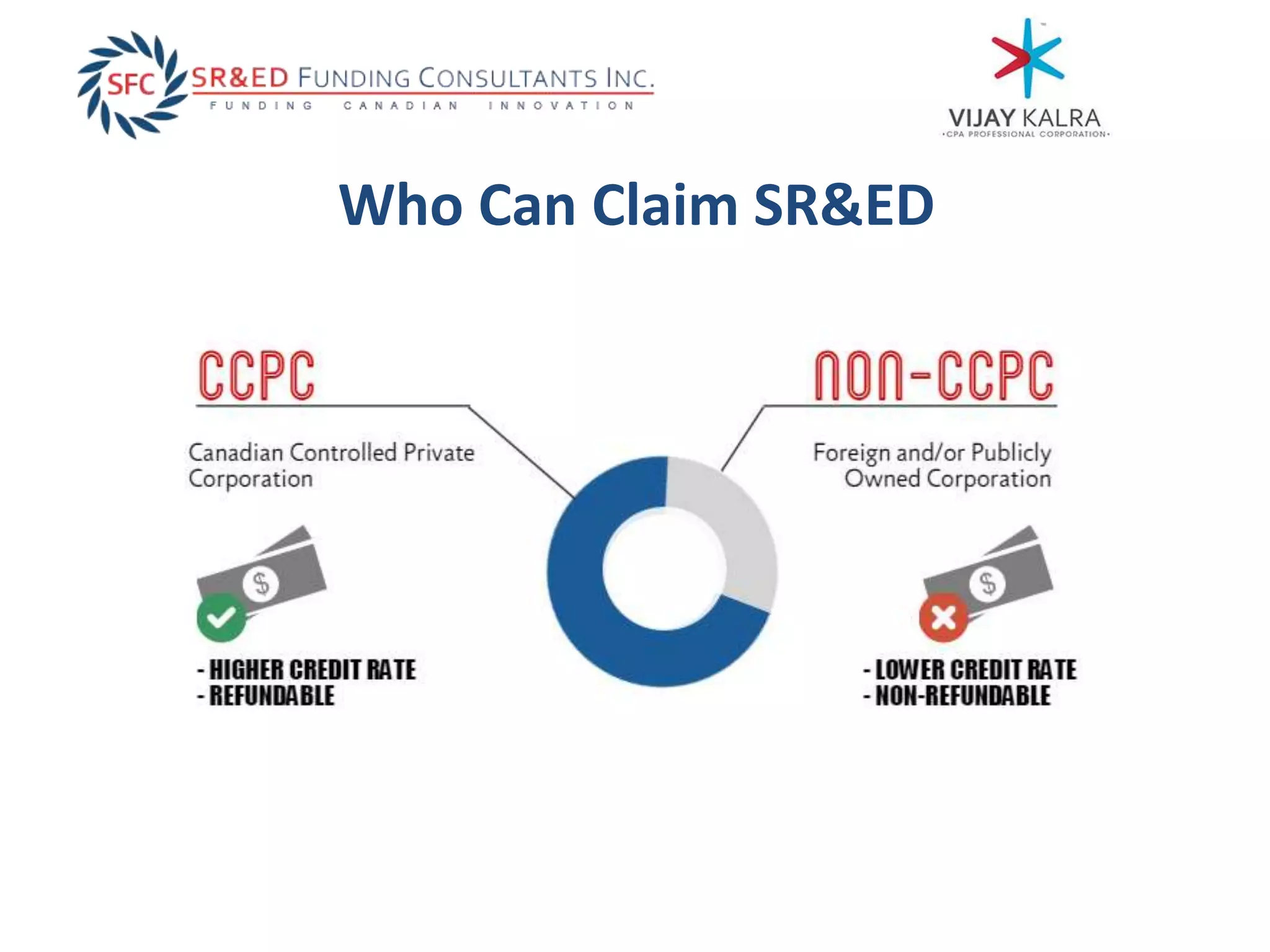

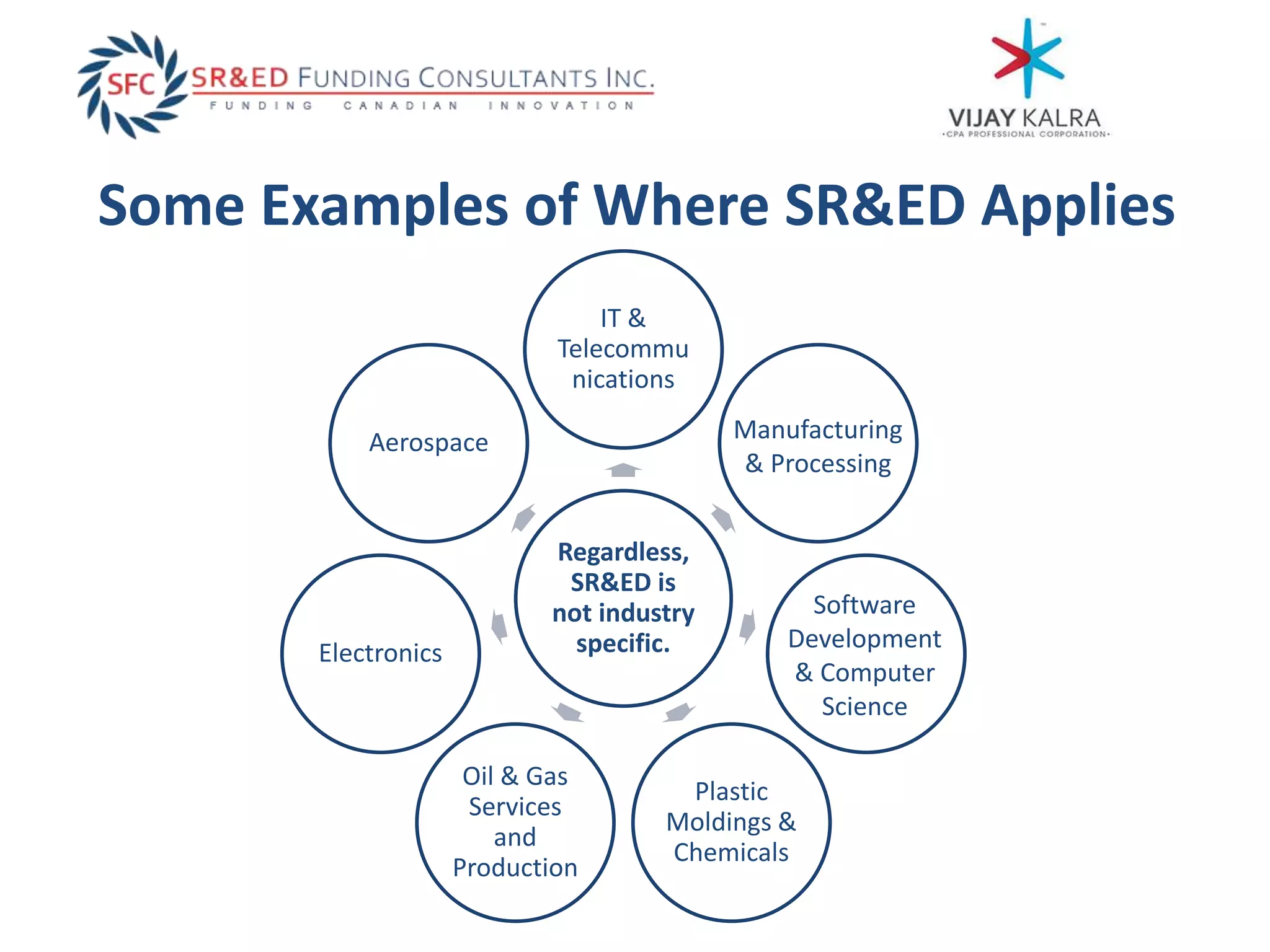

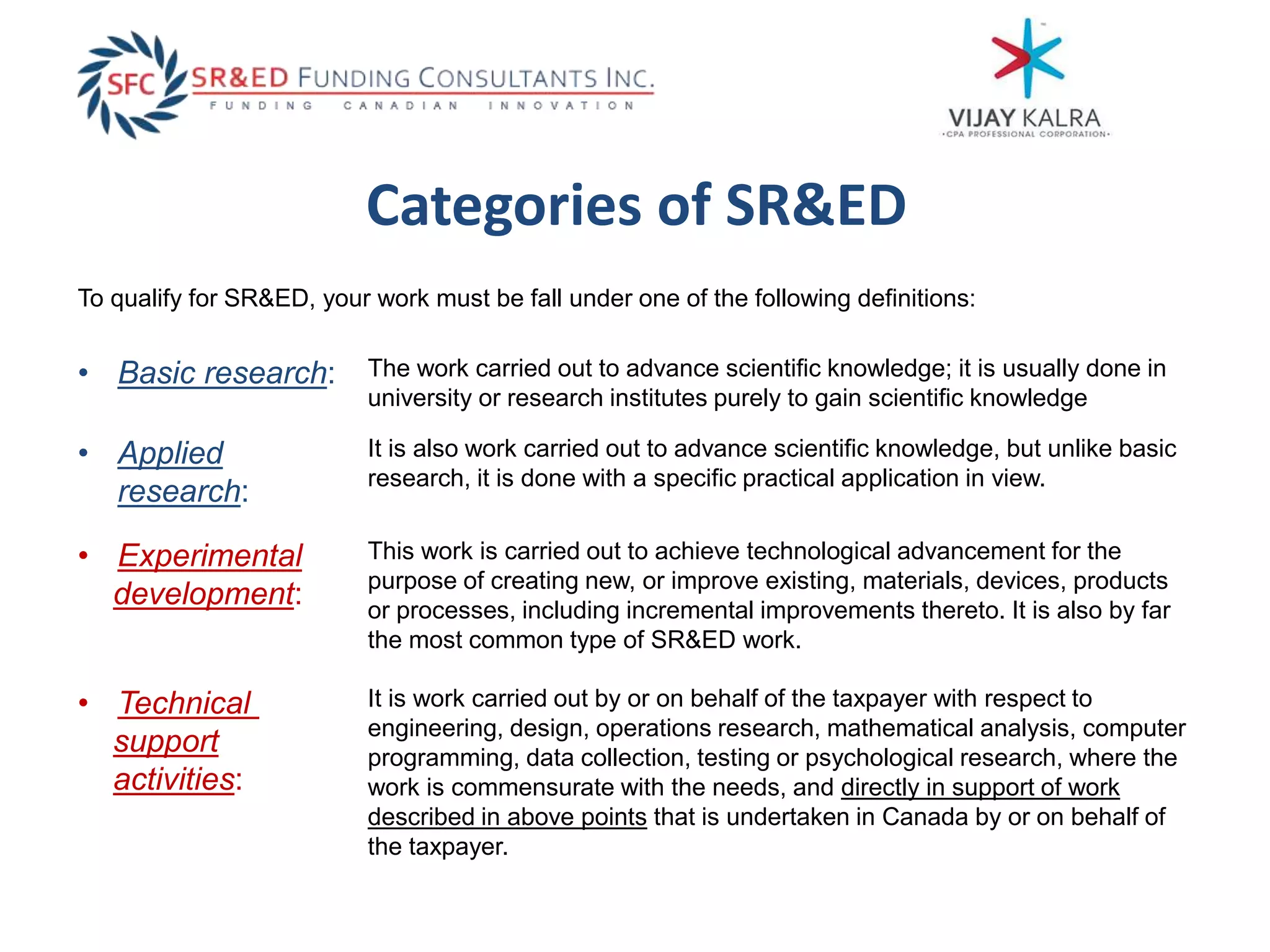

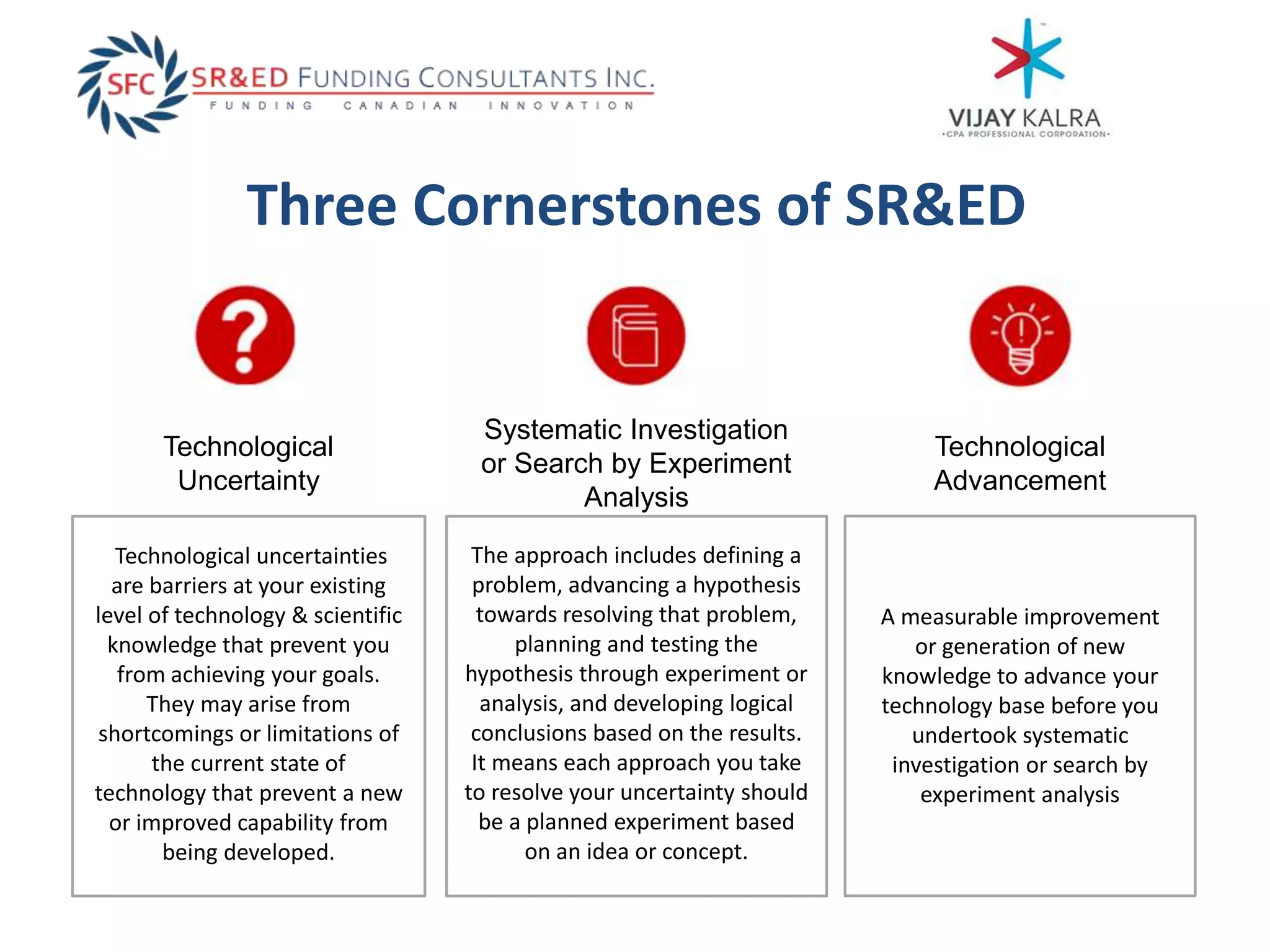

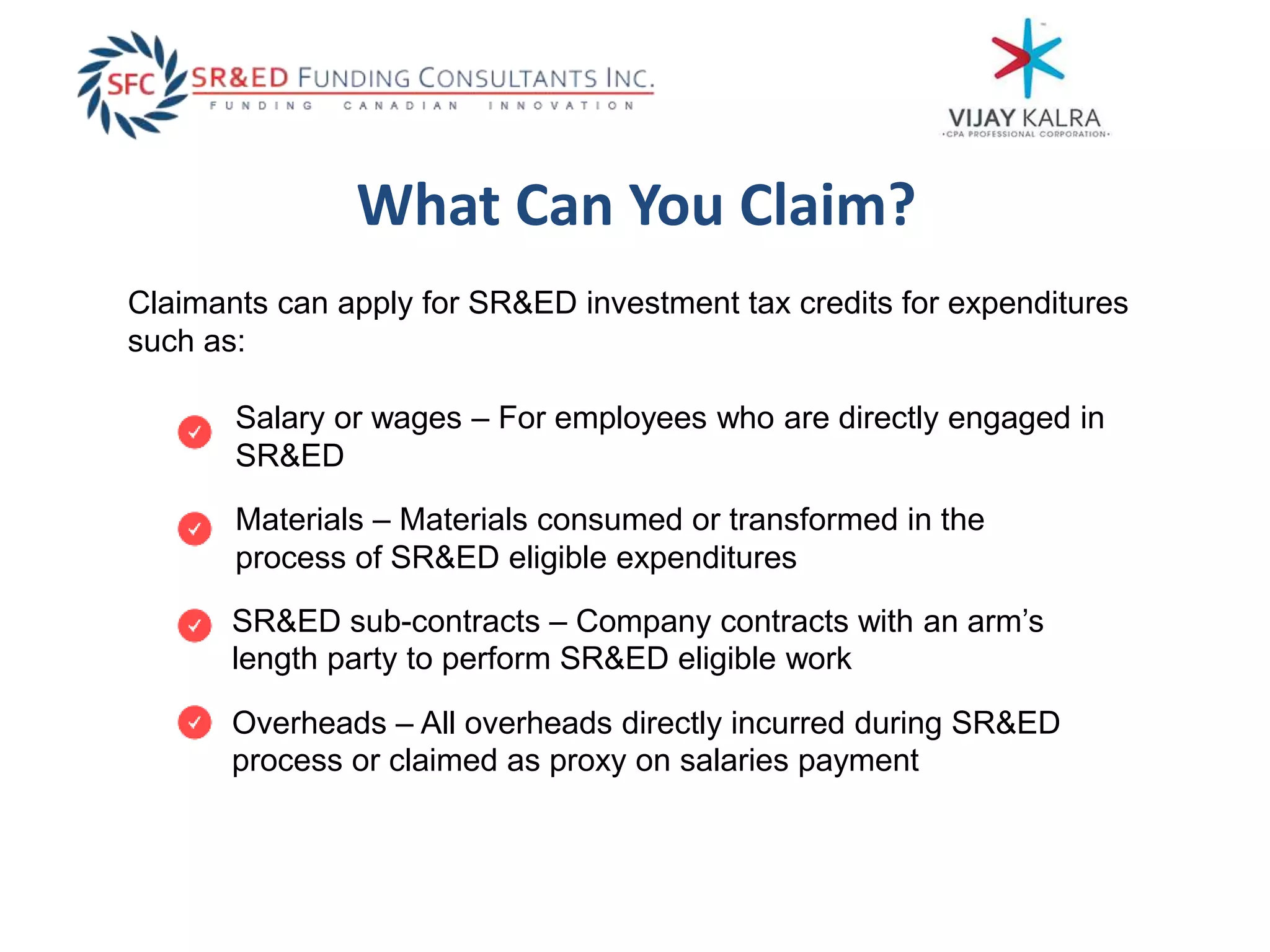

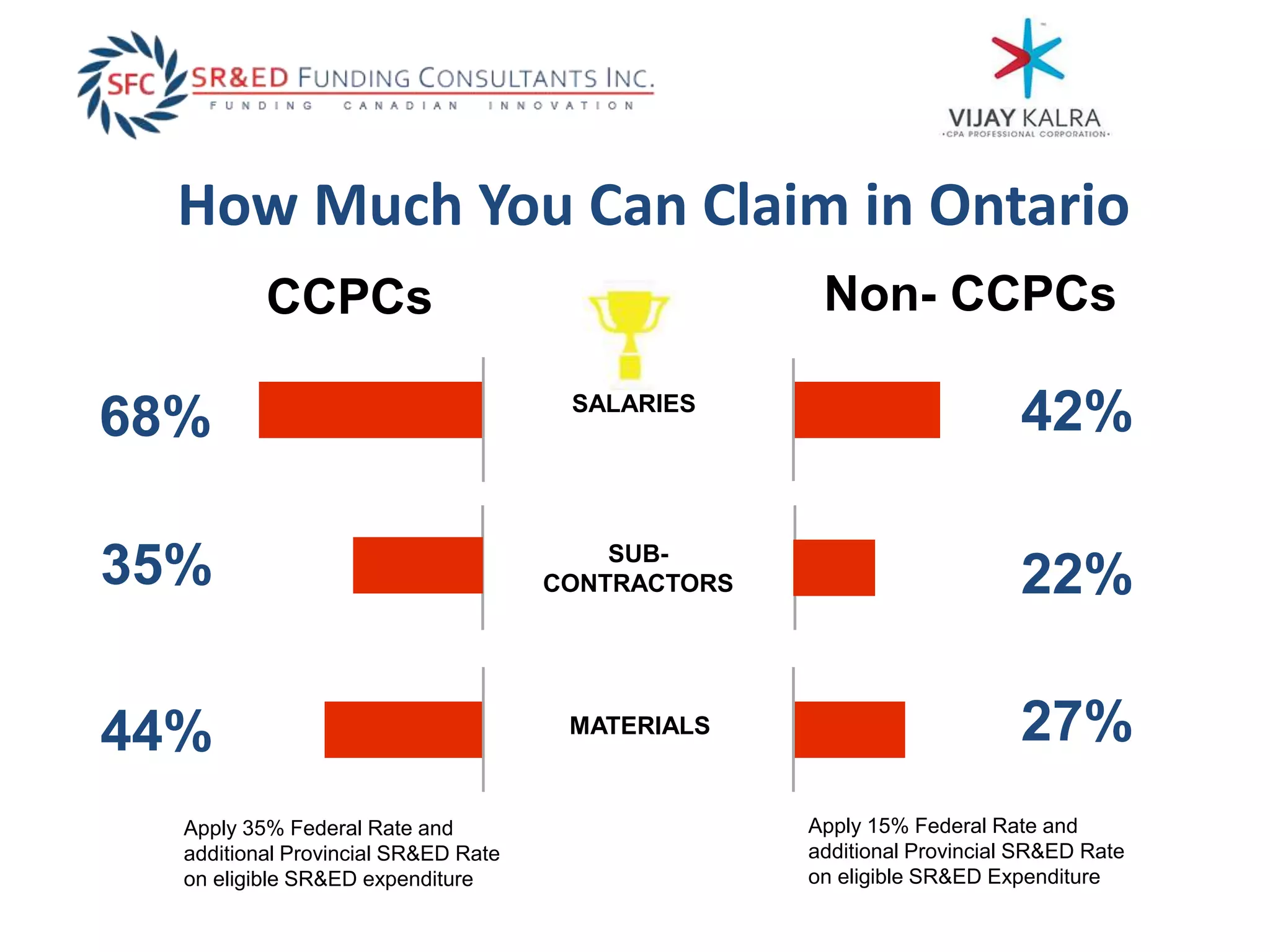

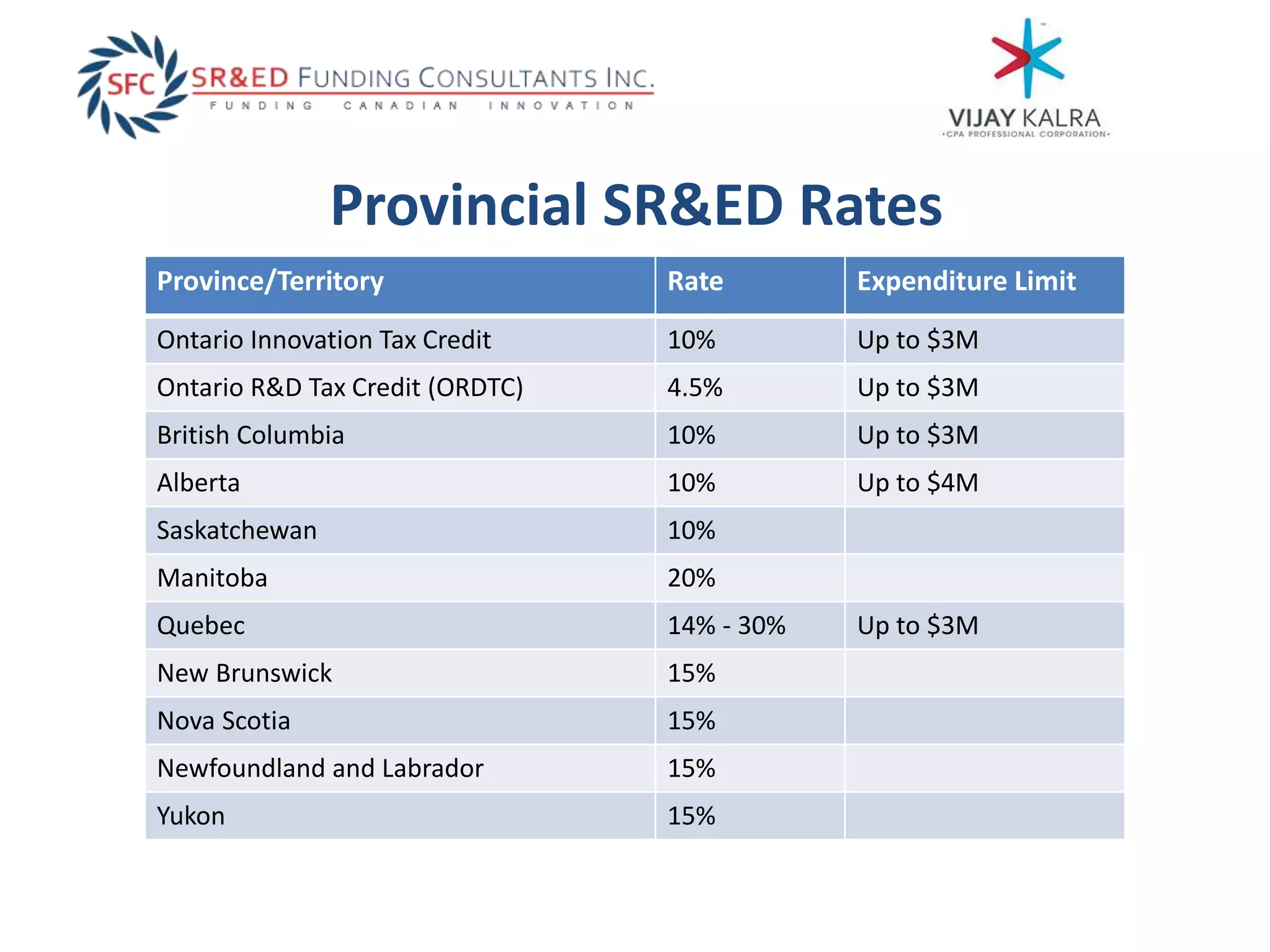

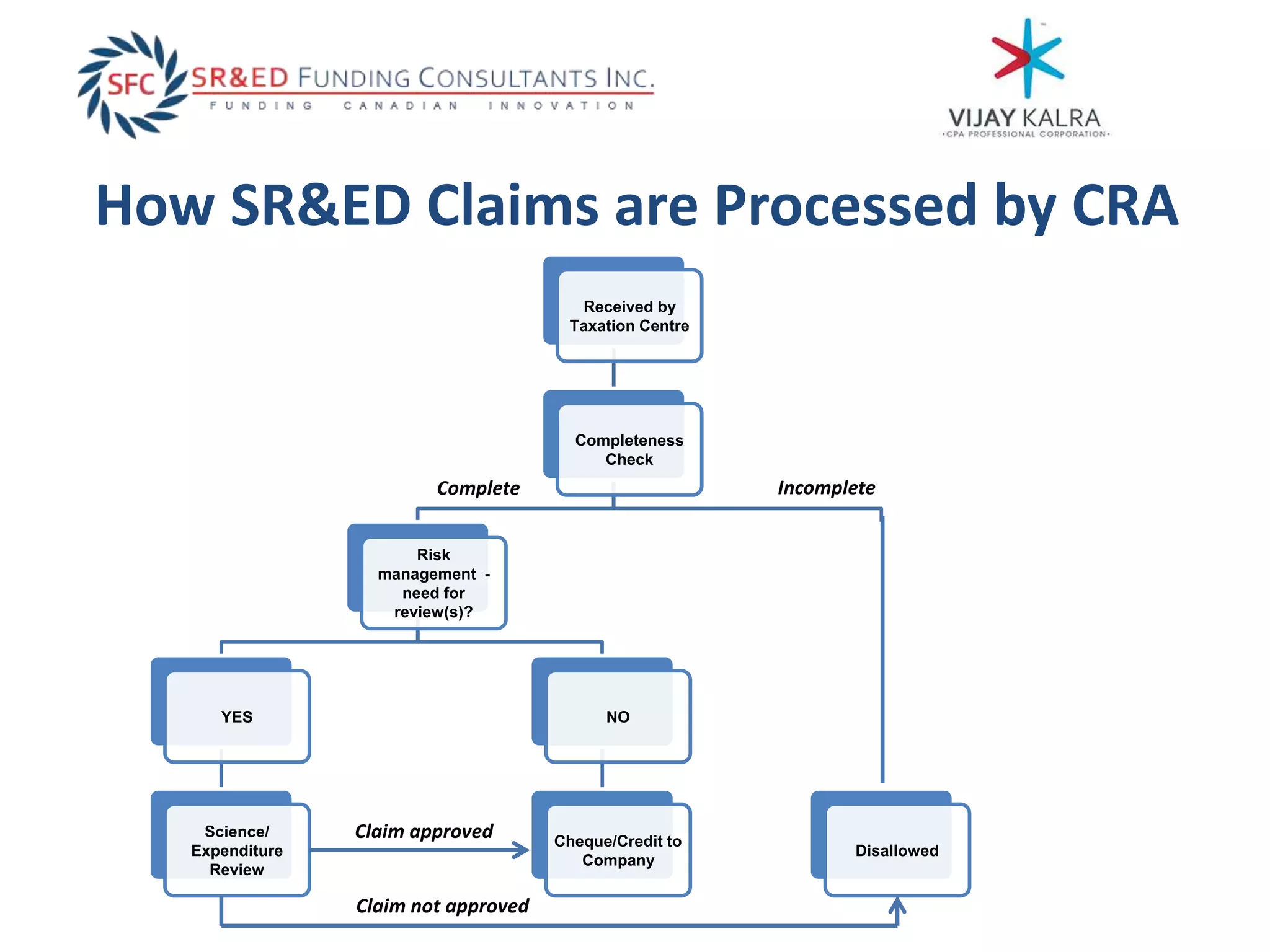

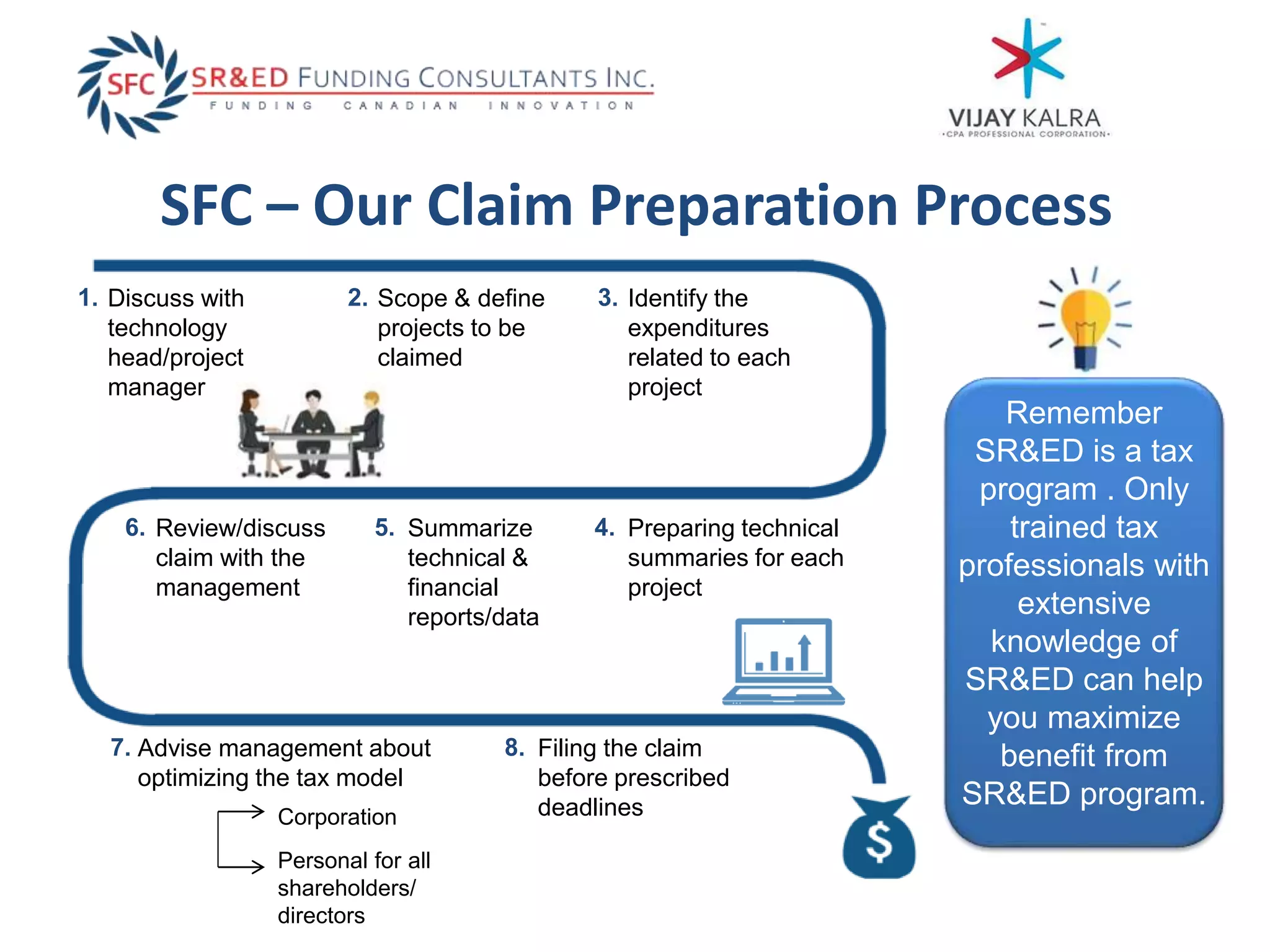

The document presents an overview of the Scientific Research and Experimental Development (SR&ED) tax incentive program in Canada, emphasizing its importance in promoting R&D across various sectors. It outlines eligibility criteria, eligible expenditures, and specific activities that qualify for claims, highlighting that the program is not restricted to any particular industry. Additionally, it provides guidance on documentation, claiming processes, and the potential financial benefits for businesses involved in technological advancements.