Pcr may-june-2019

- 1. 1May-June 2019 PINE CHEMICALS REVIEW MAY–JUNE 2019 TRUE G RIT IN CHIN A KO M O

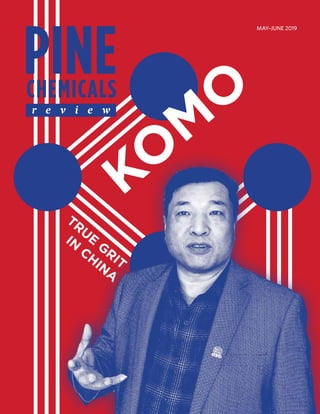

- 3. 3May-June 2019 PINE CHEMICALS REVIEW May- June 2019 Volume 129, Number 3 PUBLISHER Pine Chemicals Review, LLC EDITOR Will Conroy EDITORIAL ADVISORY BOARD Alex Cunningham—Brazil Alan Hodges—United States Francis Pound—United Kingdom Don Neighbors—United States Mariana Ferreira—Portugal/Spain Alessandro Visconti—Switzerland Zhang Ruifen—China PANEL OF REFEREES Dr. John Heitmann Dr. James Russell PRODUCTION MANAGER Laura J. Sanders ACCOUNTS MANAGER Carol Helmstetter CIRCULATION MANAGER Debbie Helmstetter PINE CHEMICALS REVIEW (ISSN 1520-0191) is published bi-monthly by Pine Chemicals Review LLC, Editorial & Ex- ecutive Office at 3803 Cleveland Ave., New Orleans, Louisiana 70119, U.S.A. Telephone (504) 482-3914, FAX (504) 482-4205, e-mail: info@pinechemicalsreview.com web: www.pinechemicalsreview.com POSTMASTER send change of address to PINE CHEMICALS REVIEW, 3803 Cleveland Ave., New Orleans, LA 70119. Subscription rates for six issues of PINE CHEMICALS REVIEW $110 domestic and $145 for interna- tional. Copyright 2019 Covering The Pine Chemicals Industry Since 1890 r e v i e w FEATURE: KOMO, China’s No. 1 4 6 8 22 PINE CHEMICALS REVIEW is editorially directed to producers and proces- sors of pine gum and wood naval stores; producers and processors of pulp chemicals such as black liquor, soap skimmings, tall oil and turpentine; and producers and processors of pine derivative chemicals for the adhe- sives, coatings, printing ink, paper chemicals, flavor and fragrance, solvent and household products industries. Industry News | Environment Industry News | Pine Chemicals Industry News | Adhesives This Industry in 2007 TABLE OF CONTENTS 10 PHOTO ABOVE: Mengqi Ding interviewed KOMO chairman Guangjian Zeng. The going’s not been easy for the company during its first 25 years of existence, but, Guangjian, with his “Never say die” spirit, believes the enterprise is yet to hit new heights. COVER: Design by Laura J. Sanders

- 4. 4 www.pinechemicalsreview.com INDUSTRY NEWS A massive bark beetle out- break in the Czech Re- public, driven by climate change, last year reached unprec- edented proportions. The area of spruce monocultures destroyed in the Central European country was equivalent to around 100,000 soccer fields, according to think tank Czech Forest. The hot, dry summer and drought meant a beetle infestation across 18mn cubic meters of spruce, more than 10 times amounts seen in previous years, according to the Czech Agriculture Ministry. Czech Forest noted that last year saw three generations of bark beetle across the country, instead of the usu- al two as the lack of rainfall weakened trees’ defenses. For this year, much will depend on what levels of rainfall even- tuate, but forecasts for an infestation of from 20mn to 30mn cubic meters (the country has 480mn cubic meters of ENVIRONMENT BARK BEETLE OUTBREAK DESTROYS “100,000 SOCCER FIELDS” OF SPRUCE IN CZECH REPUBLIC

- 5. 5May-June 2019 PINE CHEMICALS REVIEW OPPOSITE TOP: A manually debarked spruce trunk positioned as a defense against bark beetles. Image: Neptuul, Wiki Commons. OPPOSITE BOTTOM:The European spruce bark beetle (Ips typographus) is a species in the weevil subfamily Scolytinae. Image: Wiki Commons. spruce timber in total) are circulating among the expert agencies. “Eighty percent of Czech spruce forests are at high risk of dying,” Ja- romir Blaha, a forest expert at Hnuti Duha (Rainbow Movement), a Czech environmental NGO, told Reuters in late April. “Most of our spruce mono- cultures in lower and mid-laying areas will probably disappear, in years or in a few decades.” In excess of half of Czech for- ests are made up of Norwegian spruce, host to the European spruce bark beetle. In Central Europe, the bark beetle disaster is not confined to the Czech Republic. Slovakia, northern Austria and Bavaria all have significant prob- lems, forcing landowners to fell broad swathes of forests in efforts at con- taining the spread of the insects. When it comes to Austria and Ba- varia, however, experts acknowledge there have been smarter, faster efforts at adapting to climate change. That can meanplantingfewerspruces,addingin various broad-leaved tree species and planting in stages to develop a multi- aged, diverse forest. But even for the Austrians and Bavarians, the efforts may not be enough to get on top of the crisis. Rain, dammit, rain! ABOVE: Galleries in wood made by European spruce bark beetles. Image: Tõnu Pani, Wiki Commons.

- 6. 6 www.pinechemicalsreview.com PINE CHEMICALS AZELIS STRIKES DISTRIBUTION DEAL WITH DRT G lobal speciality chemicals and ingredients distribu- tor Azelis has announced a distribution agreement with Dérivés Résiniques et Terpéniques (DRT), the French manufacturer of rosin and tur- pentine derivatives. The new partnership, effective 1 October, will secure the direct and exclusive distribution of tall oil fat- ty acids (TOFA) and distilled tall oil (DTO) throughout Europe, with the exception of Spain and Portugal, into the chemicals and lubricants markets. The agreement follows the ter- mination of the partnership between Ingevity and DRT. Javier Miranda, Market Seg- ment Manager Lubricants & MWF at Azelis EMEA, said: “With this part- nership, Azelis can grant continuity in the supply of European sourced TOFA (Resinoline® BD-2) and DTO (Resinoline® BD 25-30) into the mar- ket. Customers will have access to the same products, with no change in product quality, whilst continuing to liaise with the same commercial con- tacts within Azelis.” EricMoussu,DirectorSales&Mar- keting at DRT, added: “Azelis’ extensive market knowledge and application ex- pertise in pine chemicals were key fac- tors in the decision making.” Azelis said the collaboration, based on “hub and spoke” distribu- tion with short lead-times, would strengthen its commitment to sus- tainability by offering products from natural origins in the different mar- kets of application. In combination with the company’s lab capabilities in Europe, this would aid customers in developing sustainable solutions for their current and future needs. Azelis added the pine chemicals market seg- ment to its business in 2014. The Azelis group was established in 2001 through the merger of Italy’s Novochem and France’s Arnaud. The groundwork for the enterprise nowa- days known as Azelis was laid by Dr. Hans Udo Wenzel in 1996 when he acquired Italian distribution compa- ny Organa. In the following years, Dr. Wenzel pursued his ambition to cre- ate a large, international distribution network by acquiring Chemplast in 1998 and Novaria Chemicals and Gul- lio Gross in 1999. PHOTO: Azelis, which added the pine chemicals market segment to its business five years ago, offers customers in Europe lab capabilities in application expertise.

- 7. 7May-June 2019 PINE CHEMICALS REVIEW PHOTO: The top five U.S. pine chemical facility states—Georgia, South Carolina, Louisiana, Florida, and Arkansas—are all located within advantageous proximity of Savannah Port and the transloading facility. ADVANCED RAIL TRANSLOADING FACILITY IN SAVANNAH TO SERVICE EXPANDING PINE CHEMICAL INDUSTRY C argo Logistics Internation- al has opened an advanced rail transloading facility in Savannah, Georgia, designed for bulk liquid transloading with a direct em- phasis on servicing the pine chemical industry market. “The growing need in the south- east [of the U.S.] to handle the in- creased volume of pine chemical im- ports and exports is the main reason we chose Savannah for our transload- ing facility,” said Chad Rundle, CEO of Cargo Logistics International. “Our Savannah facility is equipped to han- dle a vast array of chemicals and bulk liquids with the utmost focus on both service and safety,” he added. Rundle also noted: “Given the top five U.S. pine chemical facility states are Georgia, South Carolina, Louisi- ana, Florida, and Arkansas, all locat- ed in such proximity of the Savannah Port, Cargo Logistics International is proud to have chosen Savannah and the GA Port as its home for our chem- ical transloading facility. “We feel our facility compliments the ongoing rail expansion efforts by the GA Ports Authority, offering ad- ditional rail transloading services for both imports and exports in an area where transloading capacity had previ- ously reached its limits. Business in the southeastern states is growing and we are here to help ensure it continues.” The pine chemical industry di- rectly contributes to the U.S. economy with over $1.92bn in shipments while covering more than 19 states and em- ploying over 1,900 workers, as report- ed by the Bureau of Labor Statistics and American Chemistry Council. The industry supports $11.2bn in downstream economic output and over 18,700 workers in downstream customer industries. Transloading services offered at the facility include Railcar to Flexi- tank/ISO Tanks/Tanker Truck and reverse transloading, with compa- ny-owned dedicated bulk liquid chas- sis and trucks for haulage between transloading and the Savannah port. Setting Records in Growth The Savannah port continues to set records in growth, according to numbers released by the Ports Author- ity at the end of 2018. In a recent press release, Griff Lynch, the Ports Author- ity Executive Director, reported that a strong economy and an expansion of the port’s rail capacity have contribut- ed to the area’s continued growth de- spite the concerns surrounding global trade disputes. Additionally, the Cen- sus Bureau has reported steady growth over the past decade specifically in pine chemical exports. Cargo Logistics International’s transloading facility is located less than one mile from the Port of Savannah. Kerri Kemp, the company’s Chief Op- eratingOfficer,said:“Ourstrategicloca- tion reduces drayage times to and from the port, along with increased efficien- cy in railcar turnaround time, reducing bottom-line costs for our clients.” Kemp added: “The increased shipping challenges that exporters face today, such as driver shortages nationwide and congestion/capacity issues for liquid transloading in Hous- ton and other Gulf ports, have made the Savannah port an ideal alternative for shippers. Due to the competitive pricing of Savannah’s rail and ocean freight services, we now have prod- ucts being railed in for transloading from as far away as Canada and Texas. In addition, we’ve found our prompt transloading service and the varied carrier options out of the Savannah port are granting better options to shippers than previously routed cargo via the Gulf or the North East.” The Cargo Logistics International Savannah transloading facility has an 18-railcar capacity on site with 36 ad- ditional railcars holding capacity with Norfolk Southern coupled with a ded- icated bulk liquid truck fleet and com- pany-owned bulk liquid chassis.

- 8. 8 www.pinechemicalsreview.com Initial Color Traditional Rosin Ester Altatac 1000 Color, Gardner (molten) 3 max Color, Gardner (diluted) 1.8 max Acid number, mg KOH/g 15 max Initial Color Traditional Rosin Ester Altatac 1000 Color, Gardner (molten) 3 max Color, Gardner (diluted) 1.8 max Acid number, mg KOH/g 15 max Traditional Rosin Ester Altatac 1000 Ingevity 5255 Virginia Avenue North Charleston, SC 29406 800 458 4034 ingevity.com Color Stability—Resin Heat Aging at 160 C (Gardner Color, Molten) Request a Sample End-Use Applications Traditional Rosin Ester Altatac 1000 Initial 24 Hours 48 Hours 3.8 2.5 4.2 6.26.2 8.0 Contact us at chemicals@ingevity.com or visit our website to request a sample. Technical assistance is provided for optimization of adhesive formulations utilizing Ingevity’s products. Altatac 1000 is a premium tackifier designed for increased stability in thermoplastic hot melt adhesives. Ideal applications for Altatac 1000 include: ¡ Pressure-sensitive adhesive tapes and labels ¡ Hygiene ¡ Rigid packaging ¡ General industrial September-October 2018 PINE CHEMICALS REVIEW 15 Discarding the metal gutters has environmental and safety pluses and minimizes damage to saw mill blades that are impaired after metal gutter parts remain embedded in the tree at the point of maturity when it is cut down for timber. In terms of resin production, the early months of 2018 brought the breakthrough. Tappers using the natu- ral gutter method have been collect- ing 500 grams of resin from each cup every two months, a volume which is good for a resin project of Montigny’s size according to Diedericks. Once a cup is full, the resin is scooped out into a 20-kilogram buck- et. That bucket is carried to a nearby collecting point within the forest where the resin is put on a filter and is squeezed with metal brooms into a 180-kilogram drum. “We send this crude resin directly to our customers in South Africa and other markets for refining and further processing,” says Diedericks. The use of the natural rather than metal gutter in resin tapping enables Montigny to book savings each two to three months when tappers collect the resin and move up the cup for a repeat of the process. However, there is a downside to the use of the natural gutter. Instead of using one nail to firm the resin cup on the pine tree, the tappers use two nails. A process that replaces the nails with wire is being implemented. “We are of course moving away from the use of nails to wire to mini- mize incidents of nails being left in the tree whenever the tapping process is complete and the pine tree is ready for cutting either at the saw mill or for charcoal making,” notes Diedericks. The shift to wire does not come cheap. Montigny will require several hundreds of kilometers of it to cater for all its 1.2 million pine trees. In pine forest blocks where nails are still in use, a group of rangers armed with metal detectors goes through ev- ery tree earmarked for cutting to be sure Montigny was facing high costs caused by regular damage to metal gutters. It has switched to natural gutters created from pine tree bark using a simple cutting tool. Photo courtesy Montigny. ADHESIVES ABOVE: The superior color stability as indicated by the bar graph is said to not compromise adhesive performance. The product is also sold on the merits of its low color in adhesive applications. Initial 24 Hours Traditional Rosin Ester Altatac 1000 48 Hours COLOR STABILITY—RESIN HEAT AGING AT 160 C (Gardner Color, Molten) INITIAL COLOR INGEVITY’S BIO-BASED TACKIFIER “STAYS LIGHT AND ADHERES TIGHT” I ngevity has introduced a premium bio-based tackifier that “stays light and adheres tight”. Altatac 1000 is de- signed for increased stability in thermoplastic hot melt adhesives and demonstrates “outstanding initial color and color stability compared to traditional rosin esters,” accord- ing to the company. Ingevity exhibited Altatac 1000 resin at the Adhesive and Sealant Convention and Expo held in April in Phila- delphia, Pennsylvania. Based on tall oil rosin chemistry, the new adhesive is said to provide a superior bond on surfaces that are difficult to adhere to. It is promoted as maintaining its adhesive quality after extended heating. “We understand the importance of low color in adhe- sive applications,” said Kim Meidl, Ingevity’s Global Busi- ness Manager, Adhesives. “Altatac 1000 provides custom- ers with an environmentally friendly, low-color alternative that won’t compromise adhesive performance. This prod- uct is ideal for applications where color stability and bond strength matter most, such as hygiene and rigid packaging.” In its press release on Altatac 1000, Ingevity also not- ed how rosin-based tackifiers provide superior adhesion to difficult-to-bond-to surfaces such as recycled corrugated. The product is a “bio-renewable resource that allows adhesive companies to differentiate their product lines, and promote sustainability to end users,” Ingevity added.

- 9. 9May-June 2019 PINE CHEMICALS REVIEW ADVERTISE WITH PINECHEMICALSREVIEW.COM

- 10. 10 www.pinechemicalsreview.com The company has six factories in five provinces of China, namely in Guangdong, Jiangxi (two factories), Hunan, Guangxi, and Yunnan. Each facility owns different kinds of forest- ed lands and plays various roles in the operation of the business. Since 1994, KOMO’s products have been exported to more than 30 countries. Back in 1994, Guangjian Zeng, the chairman of KOMO, left his po- sition as a research technician at the Institute of Chemistry of the Chi- nese Academy of Sciences in Guang- zhou, southern China. Not long after in the city, he established the first KOMO Group pine chemicals com- pany. Three years later, De Fan, who was also a research technician at the Academy, joined him and the pair de- cided to develop the new company together. “We just wanted to make some difference with our technical skills,” Guangjian told PCR. One of the first products of the KOMO company was hot melt adhe- sive based on research conducted by Guangjian and De. Guangjian recalls: “During those years, the Chinese hot melt adhesive companies were main- ly founded by people who’d left their jobs at transnational corporations, one of which was [H.B.] Fuller. Since KOMO sold its products to Fuller at that time, those people knew from dif- ferent channels that our hot melt ad- “No.1 manufacturer of gum rosin in China”, “Leading manufacturer of rosin resin in China”, “No.1 manufacturer of turpentine oil in China”, “Biggest importer of gum rosin in China” … KOMO, the flagship of the Chinese pine chemicals industry, is not short of flattering tag lines. But as far as KOMO’s management team is concerned, the company still has new peaks to aim for. It does not want to end up flattering to deceive. KOMO’S CLIMB TO THE TOP HAS BEEN PRECARIOUS AT TIMES BUT THE CHINESE PINE CHEMICALS COMPANY IS STILL FOLLOWING IN THE FOOTSTEPS OF GIANTS, AMBITIOUS TO BECOME AN … Mengqi Ding caught up with company chairman Guangjian Zeng, heard the history and took a look behind the scenes. INDUSTRIAL LEGEND

- 11. 11May-June 2019 PINE CHEMICALS REVIEW hesive and some other products were the main materials in Fuller’s formula. Therefore, after they left Fuller, they contacted KOMO and used our prod- ucts for their own companies.” As a result, KOMO did not face an arduous challenge to expand its market share. Moreover, it became the first company in China to pro- duce rosin for hot melt adhesive. And with the high profits generated by the booming hot melt adhesive industry, the company thrived rapidly. On the overseas market, it was sty- rene-isoprene-styrene (SIS), that drew the attention of foreign companies to the newborn company. Self-stick pres- sure-sensitive adhesives (PSA) are an important element in making nonwo- ven fabrics and hygiene product ma- terials. To manufacture PSA, plants need to utilize both SIS and hydrocar- bon resin. According to Guangjian, the hydocarbon resin mainly came from Exxon, Eastman Chemical, Idemitsu Kosan and Zeon. However, SIS was a rarity all around the world. To solve this, Sinopec introduced polysty- rene-block-butadiene-block-styrene (usually abbreviated as SBS) as a sub- stitute. It was Chinese yuan renminbi (CNY) 20,000 ($2,400) per ton cheap- er than SIS. SBS, however, had a deficien- cy. PSA could be produced from it with the input of super-expensive gum-rosin derivatives. On the other hand, if SBS is used with cheaper hy- drocarbon resin, the PSA loses its ad- hesiveness very quickly. Given this re- alisation, the SIS producers filled the production gap and won out. KOMO’s SIS, meanwhile, also defeated a few rival products from Arizona Chemical (now part of Kraton) on its aroma. As time went by, KOMO’s renown spread across many countries through transnational corporations that had branches in China. “Fuller has been collaborating with us since 1995, and Henkel built a partnership with us as early as 1996. Then, we brought the SIS to the domestic market,” Guangji- an relates, with some pride. Nowadays, KOMO boasts a di- verse range of pine chemicals prod- ucts that it has developed, such as the KS water-white rosin ester, KA and KF tackifier resin, KB cost-effective resin, KH hydrogenated rosin resin, KL liquid resin, KX printing ink resin, KP phenolic resin, KT terpene resin, KZ coating resin and disproportionat- ed rosin. It has become a global sup- plier of adhesives, inks, and paints. Under the guidance of Guangjian, KOMO Group’s 10 subsidiaries, six factories and five production bases have grown to collectively own 73.3 square kilometers of pine forests and are devoted to research, production and sales activities. KOMO products go to the U.S., South America, Aus- tralia, Europe, and the Middle East, among other destinations. But KOMO feels it has only reached a plateau. It wants to take bigger strides to secure a new era. OPPOSITE: KOMO’s factory in Yunnan Guangjian in a KOMO-owned forest.

- 12. THE TOUGH ROAD AHEAD The development of KOMO was neither inevitable nor smooth. Several stumbling blocks have hindered KOMO, one of which, says Guangjian, is hydrocarbon resin, which in fact remains a big challenge for the entire gum ros- in industry in China. As the price of gum rosin relentlessly rose, hit- ting CNY23,000 ($3,660) per ton in 2011, the hydrocarbon resin indus- try took in big profits thanks to its much cheaper product and relative- ly low production costs. These prof- its were plowed into the industry’s technologies, prompting an expan- sion that was especially pronounced after 2010. Previously, China was only exporting 3,000 tons of hydro- carbon resin per month. By now the figure is 10 times that. At the same time, Chinese gum rosin production has fallen by half, from 800,000 tons per year to 400,000 tons per year, and its price continues to drop. In Yunnan, one of the most well-known provinces for sourcing pine chemicals in Chi- na, the number of gum rosin fac- tories has plummeted from more than 70 to less than 20. Yunnan gum rosin output has, meanwhile, dwindled from 210,000 tons per year to 70,000 tons. In 2014, KOMO made a net loss of around CNY2mn ($322,000) because of the impact of hydrocarbon resin on the market. The challenge is real. And Guang- jian concedes that the public per- ception of KOMO is more generous than the reality. The market battle is far from over. For one thing, gum rosin’s reputation as a natural, renewable product is a winning attribute. Guangjian explains how it endows gum rosin with a better aroma and scores higher marks for safety in usage. Consequently, some hygiene products must be made with gum rosin. Hydrocarbon resin is not re- Data from Rosineb (www.rosineb.com) 250,000 200,000 150,000 100,000 50,000 0 2007 2008 2011 TONS 2012 20152009 2013 20162010 2014 2017 ROSIN PRODUCTION OF YUNNAN PROVINCE Rosin samples displayed at a KOMO office 12 www.pinechemicalsreview.com

- 13. 13May-June 2019 PINE CHEMICALS REVIEW Guangjian is also optimistic about gum rosin’s prospects on export mar- kets. Hydrocarbon resin is a side prod- uct drawn from the process of making ethylene from petrochemical feed- stock naphtha. Vast quantities of hy- drocarbon resin are manufactured in China by Sinopec, a company with the Chinese government standing behind it. That results in the extremely cheap prices. Moreover, as a norm Chinese fuel oil prices fluctuate according to international crude oil prices. There- fore, companies do not necessarily give too much thought to the money they make from side products such as hydrocarbon resin. On the contrary, observes Guang- jian, when you look at markets abroad you see a lack of naphtha, meaning hydrocarbon resin production lines are relatively scarce and prices of the product are higher. His analysis takes in countries like Brazil, where the hydrocarbon resin industry is not specially sup- ported by a strong state-owned firm like Sinopec. Fuel oil prices in these countries are also kept much more stable, with a good deal less linkage to world crude oil prices. The govern- ments know that any major price in- flation might trigger unrest among the public. Faced with this situation, pri- vate and state-owned enterprises on many foreign markets have to gener- ate what revenues they can from side products such as hydrocarbon resin, leading to increasingly high prices. And in these cases, the rosin resin ex- ported by KOMO proves competitive. Guangjian appreciates the busi- ness spirit seen in certain overseas markets. He provides the example of tall oil rosin resins used in producing road markings. In China, he says, the pressure is always on to cut the cost of paved roads to a minimum. One way garded as an option when it comes to nonwoven fabrics, diapers and sanitary pads. As Guangjian says, “gum rosin can replace hydrocar- bon resin in all areas, but hydrocar- bon resin cannot act as the perfect alternative to gum rosin”. In these markets where gum rosin is irreplaceable, the gum rosin industry sees a good future. In addi- tion, “gum rosin is natural. As long as we have the sun, we have endless supplies of gum rosin. However, crude oil is a one-time thing. After you mine it, you need to find anoth- er resource, which come with in- creasingly high mining costs now- adays,” Guangjian points out. Lots of hydrocarbon-based products are thus losing their past glories, los- ing their allure. Clean energies and renewable resources are gradually moving center-stage. “Gum rosin can replace hydrocarbon resin in all areas, but hydrocarbon resin cannot act as the perfect alternative to gum rosin”. is to add less rosin product in paints. The Chinese industry average is 14kg of gum rosin per 100kg of coating res- in. “It surprised me when I first knew that there were strict standards on coating resin in [some] foreign coun- tries. For example, you need to add at least 16% gum rosin into the paints and they have a specific percentage for glass beads used in road marking products too”. Ashydrocarbonresinhaslowheat resistance and is easily contaminat- ed by tailpipe fumes, road markings made with more hydrocarbon resin often need to be repainted within one year. That compares with the two- year lifetime of gum rosin product alternatives. “The rules for the game are different,” Guangjian reflects. “In China and Southeast Asia, people cel- ebrate the fact that they can use cheap materials and sell more markings and paints because the roads need to be redone frequently. However, in North America and Europe, people are proud of their roads and markings, which can last longer and be used by generation after generation.” SuchanoutlookpersuadesKOMO to give plenty of focus to the Europe- an and North American markets. It collaborates, for example, with the biggest international resin coatings company in the U.S. With the Trump administration planning to spend a huge amount of infrastructure money on the construction of new roads and bridges, KOMO has also started nego- tiations with an American company to supply 10,000 tons of rosin resins. With such market diversification and the prioritizing of infrastructure by the U.S. and other governments, KOMO’s chances of surviving, or even averting, the fierce market impact of hydrocarbon resin suddenly look that much more substantial.

- 14. TRAVAILS OF GOING PUBLIC When more than a decade ago KOMO set out to obtain a listing on the stock market, it can’t have imagined what a terrible headache it was in for. Nevertheless, KOMO still has more than a fighting chance of eventually securing its longed-for initial public offering (IPO), In fact its efforts in this area have become something of a barometer for all those Chinese pine chemicals companies who have flotation dreams of their own. KOMO’s IPO efforts started as far back as 2008. After investing CNY3mn ($440,000), the company was poised to submit its application the following year. The plan was to present one pine forestland proj- ect and a food resins project. But, as Guangjian recollects, the effort at achieving a stock market listing amounted to “one long, tough road”. Right before KOMO was ready to submit its application documents in 2009, the China Securities Regulato- ry Commission (CSRC) issued a new policy. It outlined how all trans-pro- vincial chemical enterprises applying for listing must undergo a strict envi- ronmental investigation to be carried out by the Chinese Ministry of Envi- ronmental Protection. Project testing, an environmental evaluation and ver- ifications conducted by a third-party organization were all demanded. A listing bid without the requisite envi- ronmental checks would now go no- where with the CSRC. Consequently, KOMO again found itself reaching into its pocket, investing a not incon- siderable amount of money over 18 months to meet the requirements and gain the certificate. Armed with the certificate, KOMO was back on the road towards the desired IPO, but then a small di- saster struck. The world market price of gum rosin suddenly skyrocketed. KOMO’s resin was now unaffordable to many buyers, KOMO’s production rate slumped and the CSRC post- poned consideration of the company’s IPO application. The gum rosin price hit as high as CNY23,000 ($3,660) in 2011, and 2012 turned out to be an even less fertile year for progress with the IPO ambi- tion as the CSRC suddenly announced it would be approving no IPO appli- cations at all that year. Moreover, just when KOMO could ill afford any more burdens, the company went through an arduous financial audit in 2013 and that very same year the envi- ronmental certificate, so determined- ly worked for three years previously, expired. As Guangjian went through the gateway of the Ministry of Envi- ronmental Protection, staff greeted him with, “Oh, you’re here again!” Fortunately for KOMO, its per- sistent efforts at fighting adversity to stay afloat were buoyed by a favorable turn in sales across 2012 and 2013. The company was able to present some very attractive numbers for its second IPO application, submitted in 2014. Sensing a change in the air and bet- ter pricing prospects ahead, Guang- jian decided to stockpile as much as CNY200mn ($32.2mn) of gum rosin. Alas, KOMO then found itself back on the rollercoaster. The sheer impact of hydrocarbon resin as a ri- val product was now being felt, and, just after KOMO filed its new IPO request, the gum rosin market again experienced a steep decline. KOMO reported its net loss of CNY2mn and there were frowns all around. While the threshold for a successful IPO was rising, business was sinking. China, contending with choppi- er economic waters in recent years, has exercised tighter control over fi- nancial risks in its economy, meaning A production plant at KOMO 14 www.pinechemicalsreview.com

- 15. 15May-June 2019 PINE CHEMICALS REVIEW fewer loans for private enterprise. The number of financing channels available to KOMO has diminished. The company, says Guangjian, previ- ously used a line of credit and added capital of CNY72mn ($10.5mn at June 2019 exch. rate) to its books by mort- gaging its six factories. However, the now stricter government policy on funding meant lines of credit were no longer available to private companies. KOMO was forced to seek other ways to raise finance. Back to that elusive IPO. If KOMO successfully applies for an IPO, it will be a different ball game. “Listed com- panies can still get the lines of credit. Plus, bankers chase after you actively and give you long-term loans to solve money problems. I could also draw on national appetite through corpo- rate bonds equity to raise lots of funds from the market. At, for instance, 20 yuan ($2.91) per share, from 20 mil- lion shares KOMO would obtain four hundred million yuan (more than $58mn) from the bonds. With that money, mergers and acquisitions be- come possible,” Guangjian enthusias- tically explains. As things stand, “the huge ris- es and falls in Chinese gum rosin prices are indeed hindering us and blocking the growth of the whole in- dustry,” says Guangjian, somewhat less enthusiastically. He goes on: “China ranks first among all coun- tries that produce gum rosin. At the peak, from 2007 to 2010, China con- tributed 800,000 tons of gum rosin to the 1,400,000 tons of gum rosin produced worldwide. However, af- ter the price of gum rosin crossed 20,000 yuan per ton, China in recent years found itself only able to manu- facture 400,000 tons per year, even though it is still one of the top gum rosin producing countries”. When it comes to IPOs, “KOMO could be the most unfortunate com- pany on the Chinese market”, says Guangjian. “We’ve adhered to the application process for 10 years, but failed. You cannot find another case like us in China.” In 2017, the CSRC thoroughly assessed the 35 Chinese companies applying for a flotation. KOMO was informed it would have to go through a second inspection. In the meantime, KOMO’s capital chain came under threat. Guangjian had to negotiate with the bankers to persuade them to grant additional loans. The road to that IPO still seems to stretch out a long way ahead. Finding the strength to persevere in company philosophy, despite those slings and arrows of outrageous for- tune, Guangjian talks of how “what others see as ways to earn quick mon- ey, KOMO sees as just one opportuni- ty. No matter whether KOMO is listed or not, we must operate the company morally and effectively. We will not make up numbers or provide fraudu- lent information just to get listed.” By the time of the period just after the stressful examinations performed by the CSRC, Komo’s could still boast 2017 profits exceeding CNY30mn ($4.6mn), passing the latest IPO min- imum, and its capital chain remained intact. Besides, KOMO’s bumpy ride has not been entirely disadvantageous. For one thing, KOMO is significantly advanced in terms of getting listed in the future. CSRC committee members are seen as responsible for the compa- nies they endorse for a lifetime. That makes them very cautious when re- viewing IPO materials, and in recent years the pass rate for companies in China wanting an approval for a list- ing has been extremely low. Among the few companies that have passed the CSRC examinations is KOMO. It waits and persists. And the committee KOMO’s warehouse

- 16. 16 www.pinechemicalsreview.com members tend to be quite confident about its prospects. It has successfully under- gone two rounds of examinations, it is the Chinese leader in the pine chemicals in- dustry, it is building factories and it is pay- ing taxes in many under-developed rural localities where pine forest resources are abundant. It has to be very likely that the CSRC will eventually affirm its high score and sign through an approval for an IPO. KOMO’s demanding IPO experience might also help the company in complying with rigorous policies brought in for chem- ical industry enterprises in China. In re- cent years, officials have closed down many small factories seen as not meeting the new environmental, operational safety and haz- ardous-product standards. But for KOMO, Guangjian sees the more stringent regula- tion as “an opportunity”. When KOMO ini- tiated its application for a listing, it invested substantial sums in upgrading production according to higher environmental and op- erational safety demands. The tougher reg- ulations that have proved fatal for so many Chinese chemical companies have actually helped KOMO by ridding the market of lots of its competitors. KOMO is far from giving up on its long-term strategy. “We will continue on this road to the IPO and the capital mar- kets,” Guangjian states without hesitation. KOMO’S PRICELESS FORESTS As gum rosin prices continue to drop in China, enthusiasm for production abates. A recently introduced policy to ban the exploita- tion of state-owned forested lands to preserve natural resources has not helped. Many Chinese pine chemicals companies now face re- source shortages. Here, however, KOMO is also ahead. The company has always looked to itself to maintain upstream natural resources. “When we first started, I worked on a plan of starting with the resources, while then completing the production chain with resource gathering, manu- facturing, deep processing, and expanding,” Guangjian says. “Our mis- sion has always been the same—develop a good pine chemical product series from natural resources such as gum rosin and turpentine.” Of the three kinds of chemical materials—biological, mineral and hydrocarbon—only the biological materials are renewable, notes Guangjian. Artificial synthesis is expensive, so natural resources offer KOMO a profit with the lowest costs, according to Guangjian’s thinking. In 24 years of existence, KOMO has built up an exclusive natural resources portfolio of pine forests covering a combined area of more than one hundred thousand mu (66.7mn square meters). Especially in regard to the essential and irreplaceable pine species Pinus masso- niana and Pinus kesiya, KOMO enjoys an abundant supply within its own forest lands. Assessing how it is that KOMO survived nosediving gum rosin prices, Guangjian gives credit to the mass production of high-quality resources. In 2007, global hygiene products player Procter & Gamble, both- ered by regular crude oil price hikes, advocated replacing petroleum materials with natural materials. The multinational collected samples of natural resin from its main suppliers, including Bostick, H.B. Full- er, Henkel, National Starch, Eastman Chemical and KOMO. The first- round evaluation determined that only three submitted samples out of 12 met the requirements. One was from Eastman Chemical, while the Guangjian (Middle) and his KOMO team

- 17. 17May-June 2019 PINE CHEMICALS REVIEW KOMO UPS ANCHOR FOR ANOTHER STAB AT ITS IPO DREAM Despite multiple setbacks, KOMO says it remains determined to place an initial public offering (IPO). KOMO, which commenced its efforts to secure a stock market flotation as far back as 2008, in June this year restarted its IPO application. The company, founded in 1994, is eying a listing on the Shenzhen Stock Exchange’s small-cap Growth Enterprise Market (GEM), often known as ChiNext, which debuted in 2009 to such enthusiasm that trading was briefly suspended on its opening day. It is mostly government enterprises that list on the Shanghai and Shenzhen main exchanges in China’s multi-tier capital market structure. To date, KOMO’s business and listing plans have not been caught up in the growing exchange of trade war tariffs between the U.S. and China, says company chairman Guangjian Zeng. He adds that the level of interest there will be in the offering is hard to predict. FACTS AND FIGURES ON KOMO’S PLANNED IPO AND ITS BUSINESS SIZE • Proposed IPO size: Chinese yuan renminbi (CNY) 2bn ($290.7mn) • Proposed initial offer price per share: around CNY 15 ($2.18) • Starting out, KOMO is not likely to be ranked among China’s top 500 listed companies • Brokerage and investment bank hired to conduct IPO: China Galaxy Securities. IN 2018, KOMO, WITH A WORKFORCE OF 486 AND 60+ PRODUCTS, RECORDED • sales revenues of $145mn • coatings and adhesives domestic sales volume of 47,000 tons (category represents company’s main product on Chinese market) • gum rosin derivatives international sales volume of 10,000 tons (category represents company’s main export product) CHINA’S EXPORTED AND IMPORTED GUM ROSIN IN 2017 IMPORTED EXPORTED QUANTITY (MT) 55,256 59,626 QUANTITY (MT) 20.8% -12.1% TOTAL AMOUNT (USD) 73,561,183 105,935,823 AMOUNT (USD) 14% -13.4% AVERAGE PRICE (USD/MT) 1,331.27 1,776.66 AVERAGE PRICE -5.6% -1.4% COMPARISON WITH THE SAME PERIOD IN 2016 (±%) Data from China Customs Administration other two were from KOMO. After the secondary evaluation, only KOMO’s samples were left. KOMO’s emphasis on high-quality natural resources drew the experts from P&G’s U.S. headquarters to the company’s factories in China. KOMO’s efforts in developing unparalleled gum-rosin deriva- tives had paid off. KOMO became a strategic supplier to P&G. In 2018, KOMO’s share of the Chinese coatings and adhesives mar- ket stood at around 30% and the company remains the biggest Chinese exporter of pine chemicals. KOMO exports to more than 30 different countries. It ships around 15% of the gum rosin derivatives exported from China. Thanks to its early recognition of the importance of owning one’s own natural resources, KOMO has gradually taken control of the upstream industry, securing its future. Given the domestic gum rosin deficit, KOMO has also turned to im- porting gum rosin. China has transformed from its status as a leading gum rosin exporter into a big gum rosin consumer. KOMO imports gum rosin from countries including the U.S., Brazil, Argentina, Indonesia, Vietnam, South Africa and Russia. Around 40% of China’s gum rosin imports are brought in by the company. A trend of gum rosin producers moving to countries with low labor costs—including Vietnam, Myanmar, Cambodia, Indonesia, Argentina, and Brazil—is well under way. Guangjian names Brazil as a particularly good example. Companies there only have to pay a pine-resin tapper around $470 per month on average. And Brazil, along with other countries including Mexico and Argentina, have started to use their own gum rosin, instead of importing product from China. To its existing challenges, such as defeating hydrocarbon resin market incursions, KOMO can thus add the difficulty of competingwithcountrieswithlowlaborandrawmaterialcosts.Thisiswhere technologycomestothefore.KOMOsaysitismakingbigstridesinproducing deep-processed pine chemical products. Guangjian sees products for special applications opening up unique markets for KOMO. The opportunities lie in fields such as surfactants, epoxy resins and organosilicon resins, where

- 18. 18 www.pinechemicalsreview.com new materials and applications could be created. Guangjian suggests that “as we now cannot compete with new competitors in the raw material costs, the only solution is technology. Even though the emerging gum rosin production countries trail China in terms of technology now, once they catch up, the challenge will become even more serious. Therefore, the only way is to concentrate on technology, andtheonlywaytoenhancetechnology is to invest both more time and money”. In 2007, KOMO established a re- search center specifically for develop- ing new and outstanding pine chemical products. Its research lab covers 1,500 square meters. The facility is replete with a range of equipment and appli- ances for research, development and piloting of products. Guangjian remains devoted to recruiting experts and talent in the deep processing of rosin and tur- pentinefortheresearchcenter.Arounda thirdofitspersonnelhaveatleastaMas- ter’s degree. The center holds 16 patents for inventions and has many proprietary technologies to its credit. Several nation- al scientific research projects fall under its remit and each year it produces four or more new products for the domestic pine chemicals industry. Thanks to its new technologies and products, KOMO has gradually made its way to market frontiers. For instance, in the production of elec- tronic devices, colophony soldering paste is indispensable in making cir- cuit boards. Previously, the gum ros- in used in colophony soldering paste could only be made by Japanese com- panies. But after painstaking techno- logical research, colophony soldering paste finally emerged from a KOMO research laboratory. KOMO became the second company in the entire world capable of producing this spe- cialty product, making it the pride of the Chinese Welding Society. Guangdong province support- ed KOMO’s research center without reservation. It put in funding and shaped policies to help the company create more unique and irreplace- able deep-processed pine chemical products. Guangjian feels lucky that “among domestic companies, KOMO is one of the few that can afford a large investment in technology. Com- pared with foreign-funded enter- prises, which usually have research centers outside of China, KOMO can draw on a lot of convenience and advantages. Due to its technology, KOMO stands out.” KOMO’s technology teams also study imported foreign materials from companies such as Kraton busi- Members of KOMO’s research team KOMO’s research lab

- 19. 19May-June 2019 PINE CHEMICALS REVIEW ness Arizona Chemicals and Ingevity. “The foreign materials have special strengths such as better purity,” says Guangjian. “By learning from them, we have gained competitive advantages,” he adds. Guangjian remembers when Arizona Chemicals made a big impact on the Chinese market with tall oil rosin sold at super-low prices. KOMO had to respond quickly. It researched the prod- uct’s characteristics and applications. Nowadays, KOMO says it produces tall oil rosin of an even better quality and sells it at even lower prices. “Technology is the key to success,” reiterates Guangjian. “Natural resourc- es can sometimes fluctuate with the market, but technology advantages can last for a long time. For instance, the secret to the 140-year success of [Ja- pan’s] Arakawa Chemical and the per- sistent flourishing of [fellow Japanese companies] Harima Chemicals Group and Toho Chemical Industry is their deep-processing technologies. Even if they’ve needed to import most resourc- es from China due to extremely low do- mestic production, they’ve still become industrial legends”. It’s an open secret that once KOMO’s patents expire, com- panies from all over the world rush to learn their secrets. If KOMO manages to list successful- ly, Guangjian plans to invest CNY 100mn ($14.6mn) in boosting technology re- search. Nature, with a helping hand from science and technology, will soar, he says. THE FUTURE BECKONS Guangjian is optimistic about the Chinese pine chemicals market as a whole. “With its huge consumption base, it is more likely to ma- ture than the foreign market,” he says. Annual gum rosin consumption in China stands at around 500,000 tons. “That does indicate that China has transformed from a global power in gum rosin production and ex- port to a leading country in gum rosin consumption,” Guangjian recaps. The history books will show that the Chinese gum rosin industry gradually took off given abundant resources and cheap labor. A few decades back, Spain, Portugal and the U.S. made up the top three in rosin production. As their labor costs rose, the industry moved over to China. By the 1980s, China was already producing in excess of 300,000 tons of gum rosin annually. Spain, Portugal and the U.S. were more or less only left with tall oil rosin. In gum rosin, China filled the gap. “Till now, there’s hardly been any country that could replace Chi- na in the pine chemicals industry,” Guangjian asserts. His reasoning is that as things stand annual global gum rosin demand is fairly stable at around one million tons. Driven by falling gum rosin prices, Chi- nese gum rosin production has halved from 800,000 tons to 400,000 tons. But the country still holds the lion’s share of the market. No other country can produce as much as 300,000 tons. Take Vietnam as an ex- ample. Its rosin production is outmatched by that of Chinese province Yunnan, even though Yunnan’s gum rosin output has tumbled from 210,000 tons to 70,000 tons. Looked at from this angle, the development of the Chinese pine chemicals industry remains promising. What’s more, notes Guangjian, as gum rosin production diminishes, rosin prices will further increase because of supply and demand dynamics. There is steady consumption of around 500,000 tons of rosin on the Chinese market. There’s no way the fire’s going out in the progress of China’s pine chemicals industry. As for KOMO’s prospects, Guangjian speaks of industrial integra- tion. KOMO has to date taken the approach of integrating management across different factories. The integration took in activities including purchasing, financing and selling. “The only difference between the factories is the variety of their products,” Guangjian explains. “Based on natural conditions, the Jiangxi province factory is the best produc- KOMO product awaiting distribution

- 20. 20 www.pinechemicalsreview.com tion place for Pinus elliottii. Yun- nan acts as the best nationwide resource for Pinus kesiya, while Guangxi is the top domestic origin for Pinus massoniana. Some of our factories are our deep processing bases, whereas some other sites mainly import gum rosin. KOMO can be said to have an excellent production allocation”. The di- verse distribution of production has its clear benefits, but KOMO is wary of heavy management ex- penses. Guangjian is therefore looking into merger potential. There’s good reason, it seems, to bring things under one roof. According to Guangjian, even though KOMO ranks number one among Chinese pine chemical companies, its business turnover does not compare with desired benchmarks. For instance, Arizo- na Chemicals’ annual revenue is around $1.5bn and Arakawa turns over around a billion dollars each year. KOMO’s turnover has only just passed $100mn. To battle with international competitors, KOMO needs to scale up. Mergers, or ac- quisitions, might be the way for- ward. Guangjian says mergers will be KOMO’s top priority across five to 10 years, once its IPO applica- tion is approved. “Most Chinese pine chemical companies want KOMO to be listed and to become a strong leader for the whole indus- try,” he adds. So where to from here? Guang- jian mentions how lots of Chinese entrepreneurs have been scour- ing Africa for pine resin and “they even formed a touring group for Fiji”. Rosin resources from coun- tries such as Fiji, Madagascar and the Democratic Republic of Congo are in fact already being shipped to China for processing. Guang- jian can only see more and more rosin from Africa arriving to meet the needs of the Chinese mar- ket. However, Africa’s rosin out- put does not yet exceed 100,000 tons. KOMO sometimes likes to point out that its name can be tak- en to stand for “Keep Our Mind Open”, and the company is not at all averse to considering forays abroad. Guangjian says a deci- sion on this will be made once the IPO is green-lighted. Big funds and international talent would be needed, he adds. For now, KOMO is marshalling its “breakthrough” talent at home. The company re- mains determined to follow in the footsteps of giants. GUANGJIAN ZENG is Chairman of Guangzhou KOMO Chemicals Co., Ltd. He graduated from Nanjing University of Science and Technology in 1986 with a bachelor’s degree in Chemical Engineering. In 1989, he earned a master’s degree in chemistry from South China University of Technology. Upon graduation, he worked at the Guangzhou Institute of Chemistry, Chinese Academy of Sciences. In 1994, he established KOMO. His pine chemicals- related research has been recognized with many important awards in China, such as the First Prize of Guangdong Academy of Sciences, the Second Prize of Science and Technology Progress in Guangdong and the Outstanding Products Awards in Jiangxi. Currently, Guangjian Zeng is also Vice President of the Jiangxi Rosin Association and Committee Chair of the China Chamber of Commerce of Foodstuffs and Native Produce, specializing in the deep processing of rosin. *All provided exchange rate conversions are based on historical data unless otherwise stated.

- 21. A global association whose members create significant value by taking a natural renewable resource from pine trees and providing a reliable and sustainable supply of environmentally responsible, high quality specialty chemicals and their derivatives to customers worldwide. The PCA brings value to its members and to the pine chemicals industry by providing a focused industry-wide approach to maintain pine chemicals commerce globally and by addressing and reacting to regulatory, legislative or sustainability issues impacting the industry. “Bringing together Industry leaders from around the world, since 1947” PINE CHEMICALS ASSOCIATION WWW.PINECHEMICALS.ORG PINE CHEMICALS ASSOCIATION IS A VIBRANT, GROWING GROUP. SUPPORT YOUR INDUSTRY AND BECOME A MEMBER.

- 22. 22 www.pinechemicalsreview.com 2007THIS INDUSTRY IN 22 www.pinechemicalsreview.com H ow do the ancient origins of the pine chemicals industry re- late to Noah and Moses? And why were North American pine resources such a motivating factor in the English exploration and colonization of the Americas? How are fish related to a big mar- ket setback suffered by turpentine in the early 1980s and why did consumption of pine oil in disinfectants slump? Read on …

- 23. 23May-June 2019 PINE CHEMICALS REVIEW