Financial System.pptx

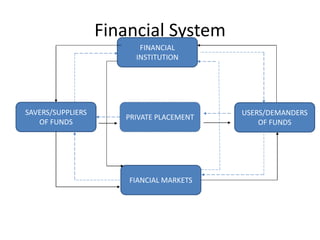

- 1. Financial System FINANCIAL INSTITUTION USERS/DEMANDERS OF FUNDS FIANCIAL MARKETS PRIVATE PLACEMENT SAVERS/SUPPLIERS OF FUNDS

- 2. Composition of Financial System

- 4. 1. Financial Instruments Financial Instruments – is a real or a virtual document representing a legal agreement involving some sort-of monetary value (Source: Investopedia - Sharper Insight. Smarter Investing. | Investopedia. (2016). Investopedia. Retrieved 8 May 2016, from http://investopedia.com). These can be debt securities like corporate bonds or equity like shares of stock. When a financial instrument is issued, it gives rise to a financial asset on one hand and a financial liability or equity instrument on the other.

- 5. 1. Financial Instruments Debt Instruments generally have fixed returns due to fixed interest rates. Examples of debt instruments are as follows: ● Treasury Bonds and Treasury Bills that are issued by the Philippine government. These bonds and bills have usually low interest rates and have very low risk of default since the government assures that these will be paid.

- 6. 1. Financial Instruments . ● Corporate Bonds are issued by publicly listed companies. These bonds usually have higher interest rates than Treasury bonds. However, these bonds are not risk free. If the company which issued the bonds goes bankrupt, the holder of the bonds will no longer receive any return from their investment and even their principal investment can be wiped out.

- 7. 1. Financial Instruments Equity Instruments generally have varied returns based on the performance of the issuing company. Returns from equity instruments come from either dividends or stock price appreciation. The following are types of equity instruments:

- 8. 1. Financial Instruments • Preferred Stock has priority over a common stock in terms of claims over the assets of a company. This means that if a company were to be liquidated and its assets have to be distributed, no asset will be distributed to common stockholders unless all the claims of the preferred stockholders have been given. Moreover, preferred stockholders have also priority over common stockholders in cash dividend declaration. Dividends to preferred stockholders are usually in a fixed rate. No cash dividends will be given to common stockholders unless all the dividends due to preferred stockholders are paid first. (Cayanan, 2015)

- 9. 1. Financial Instruments • Holders of Common Stock on the other hand are the real owners of the company. If the company’s growth is spurring, the common stockholders will benefit on the growth. Moreover, during a profitable period for which a company may decide to declare higher dividends, preferred stock will receive a fixed dividend rate while common stockholders receive all the excess.

- 10. 2. Financial Markets Financial Markets – organized forums in which the suppliers and users of various types of funds can make transactions directly. Primary vs. Secondary Markets ● To raise money, users of funds will go to a primary market to issue new securities (either debt or equity) through a public offering or a private placement

- 11. 2. Financial Markets • The sale of new securities to the general public is referred to as a public offering and the first offering of stock is called an initial public offering. The sale of new securities to one investor or a group of investors (institutional investors) is referred to as a private placement. • However, suppliers of funds or the holders of the securities may decide to sell the securities that have previously been purchased. The sale of previously owned securities takes place in secondary markets. • The Philippine Stock Exchange (PSE) is both a primary and secondary market.

- 12. 2. Financial Markets Money Markets vs. Capital Markets ● Money markets are a venue wherein securities with short-term maturities (1 year or less) are sold. They are created because some individuals, businesses, governments, and financial institutions have temporarily idle funds that they wish to invest in a relatively safe, interest-bearing asset. At the same time, other individuals, businesses, governments, and financial institutions find themselves in need of seasonal or temporary financing. ● On the other hand, securities with longer-term maturities are sold in Capital markets.

- 13. 3. Financial Institutions Financial Institutions – intermediaries that channel the savings of individuals, businesses, and governments into loans or investments. Examples of financial institutions: ● Commercial Banks - Individuals deposit funds at commercial banks, which use the deposited funds to provide commercial loans to firms and personal loans to individuals, and purchase debt securities issued by firms or government agencies.

- 14. 3. Financial Institutions • Insurance Companies- Individuals purchase insurance (life, property and casualty, and health) protection with insurance premiums. The insurance companies pool these payments and invest the proceeds in various securities until the funds are needed to pay off claims by policyholders.

- 15. 3. Financial Institutions • Mutual Funds - Mutual funds are owned by investment companies which enable small investors to enjoy the benefits of investing in a diversified portfolio of securities purchased on their behalf by professional investment managers. When mutual funds use money from investors to invest in newly issued debt or equity securities, they finance new investment by firms. Conversely, when they invest in debt or equity securities already held by investors, they are transferring ownership of the securities among investors.

- 16. 3. Financial Institutions ● Pension Funds - Financial institutions that receive payments from employees and invest the proceeds on their behalf. ● Other financial institutions include pension funds like Government Service Insurance System (GSIS) and Social Security System (SSS), unit investment trust fund (UITF), investment banks, and credit unions, among others