Outlook for Week of December 18, 2017

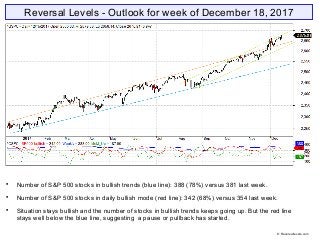

- 1. Reversal Levels - Outlook for week of December 18, 2017 Number of S&P 500 stocks in bullish trends (blue line): 388 (78%) versus 381 last week. Number of S&P 500 stocks in daily bullish mode (red line): 342 (68%) versus 354 last week. Situation stays bullish and the number of stocks in bullish trends keeps going up. But the red line stays well below the blue line, suggesting a pause or pullback has started. © Reversallevels.com

- 2. Ongoing partial profits signal for S&P 500. A 23% gain since our weekly Buy signal 57 weeks ago. Ongoing partial profits signal for Nikkei, a 12% gain in 13 weeks. Weak Buy signal for FTSE 100. Possible fake-out move. Bonds TLT are in bullish trend and seem to gain traction. Gold is in a bearish trend. EURUSD is fully bullish and appears ready for further gains. Oil changes to weak bullish trend because MoM is turning down. Wheat is fully bearish with downward MoM. © Reversallevels.com Major indices

- 3. Bullish divergence for Malaysia KLCI. Weak Buy signal for Chile IPSA. Sell signal for China Shanghai Composite. Most world markets stay in bullish trends, but MoM remains down for a majority countries. This suggests a significant pause or correction has started. World markets © Reversallevels.com

- 4. Buy signal for PG. Partial profits signal for AXP. A 45% gain in 60 weeks. Partial profits signal for BA. A 118% gain in 62 weeks. Partial profits signal for CAT. A 94% gain in 80 weeks. Partial profits signal for MCD. A 45% gain in 56 weeks. Partial profits signal for MMM. A 38% gain in 57 weeks. Partial profits signal for MSFT. A 61% gain in 74 weeks. Partial profits signal for UNH. A 52% gain in 60 weeks. Partial profits signal for V. A 38% gain in 49 weeks. 28 stocks bullish, up from 27 last week. Above 20 = bull market. See article: Keeping an eye on the Dow stocks Bullish participation is good, but partial profits signals for 8 stocks suggests a peak is near. If the number of bullish stocks drops below 15 it would tell us a bear market has started. 30 Dow Jones Industrials stocks © Reversallevels.com

- 5. No major changes this week. Note: Currencies tend to make long trending moves, so we don’t get weekly Buy or Sell signals very often. Keep trading in the direction of the weekly trend and you are likely to do well in the long run. Currencies © Reversallevels.com

- 6. On Twitter: http://twitter.com/lunatictrader1 On Facebook: https://wwww.facebook/Reversallevels/ On Stocktwits: http://stocktwits.com/LunaticTrader Website: Reversallevels.com For daily comments and questions you can find us here: © Reversallevels.com Disclaimer Investing in stocks, forex or commodities is risky. No guarantee can be given that the opinions or predictions given in this presentation will be correct. Reversallevels.com cannot in any way be responsible for eventual losses you may incur if you trade based on the given information. Simulated trading programs in general are subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. Trade at your own risk and responsibility. Subscription service Daily reversal levels for over 2700 stocks and ETF are available by monthly subscription. For just $1 a day you can become a more efficient investor: click here Comes with full instructions and strategies for using the reversal levels and MoM indicator in your own trading. This is an honest method with limited risk, not a get rick quick formula. Give it a try.