Retirement income distribution dashboard v2014a

•

1 like•3,953 views

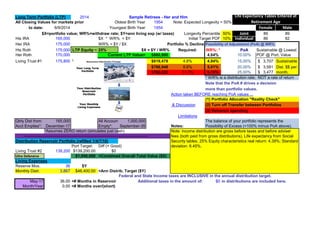

This document summarizes the long term portfolio and retirement plans for a married couple retiring in 2014. It outlines the key details of their retirement accounts and investments totaling $860,800. It calculates a sustainable withdrawal rate of 4.64% based on their projected life expectancies and goals to maintain a 10% probability of portfolio depletion. It also models lower withdrawal rates and the impact on portfolio longevity under different market decline scenarios. The plan is to take $3,867 in monthly distributions from the portfolio to cover living expenses, with taxes already accounted for in the annual distribution target amount.

Report

Share

Report

Share

Download to read offline

Recommended

The Dynamic Implications of Sequence Risk on a Distribution Portfolio Journal...

The Dynamic Implications of Sequence Risk on a Distribution Portfolio Journal...Better Financial Education

More Related Content

Similar to Retirement income distribution dashboard v2014a

Similar to Retirement income distribution dashboard v2014a (20)

Risk Analysis and Project Evaluation/Abshor.Marantika/Alviyanti Nawangsari_Gi...

Risk Analysis and Project Evaluation/Abshor.Marantika/Alviyanti Nawangsari_Gi...

AnF 6 _ Time Value of Money Advanced corporate finance.pptx

AnF 6 _ Time Value of Money Advanced corporate finance.pptx

International Portfolio Investment and Diversification2.pptx

International Portfolio Investment and Diversification2.pptx

ChapterTool KitChapter 7102715Corporate Valuation and Stock Valu.docx

ChapterTool KitChapter 7102715Corporate Valuation and Stock Valu.docx

More from Better Financial Education

The Dynamic Implications of Sequence Risk on a Distribution Portfolio Journal...

The Dynamic Implications of Sequence Risk on a Distribution Portfolio Journal...Better Financial Education

Prototype software example of aging model incorporating both portfolio and lo...

Prototype software example of aging model incorporating both portfolio and lo...Better Financial Education

A question of equilibrium - can there be more buyers than sellers? Or more se...

A question of equilibrium - can there be more buyers than sellers? Or more se...Better Financial Education

More from Better Financial Education (20)

The Dynamic Implications of Sequence Risk on a Distribution Portfolio Journal...

The Dynamic Implications of Sequence Risk on a Distribution Portfolio Journal...

the-rewarding-distribution-of-us-stock-market-returns.pdf

the-rewarding-distribution-of-us-stock-market-returns.pdf

Prototype software example of aging model incorporating both portfolio and lo...

Prototype software example of aging model incorporating both portfolio and lo...

A question of equilibrium - can there be more buyers than sellers? Or more se...

A question of equilibrium - can there be more buyers than sellers? Or more se...

Recently uploaded

Recently uploaded (20)

Black magic specialist in Canada (Kala ilam specialist in UK) Bangali Amil ba...

Black magic specialist in Canada (Kala ilam specialist in UK) Bangali Amil ba...

logistics industry development power point ppt.pdf

logistics industry development power point ppt.pdf

abortion pills in Jeddah Saudi Arabia (+919707899604)cytotec pills in Riyadh

abortion pills in Jeddah Saudi Arabia (+919707899604)cytotec pills in Riyadh

Test bank for advanced assessment interpreting findings and formulating diffe...

Test bank for advanced assessment interpreting findings and formulating diffe...

NO1 Verified Online Love Vashikaran Specialist Kala Jadu Expert Specialist In...

NO1 Verified Online Love Vashikaran Specialist Kala Jadu Expert Specialist In...

Abortion pills in Saudi Arabia (+919707899604)cytotec pills in dammam

Abortion pills in Saudi Arabia (+919707899604)cytotec pills in dammam

+97470301568>>buy weed in qatar,buy thc oil in qatar doha>>buy cannabis oil i...

+97470301568>>buy weed in qatar,buy thc oil in qatar doha>>buy cannabis oil i...

Certified Kala Jadu, Black magic specialist in Rawalpindi and Bangali Amil ba...

Certified Kala Jadu, Black magic specialist in Rawalpindi and Bangali Amil ba...

Business Principles, Tools, and Techniques in Participating in Various Types...

Business Principles, Tools, and Techniques in Participating in Various Types...

Famous Kala Jadu, Kala ilam specialist in USA and Bangali Amil baba in Saudi ...

Famous Kala Jadu, Kala ilam specialist in USA and Bangali Amil baba in Saudi ...

QATAR Pills for Abortion -+971*55*85*39*980-in Dubai. Abu Dhabi.

QATAR Pills for Abortion -+971*55*85*39*980-in Dubai. Abu Dhabi.

Famous Kala Jadu, Black magic expert in Faisalabad and Kala ilam specialist i...

Famous Kala Jadu, Black magic expert in Faisalabad and Kala ilam specialist i...

Bhubaneswar🌹Ravi Tailkes ❤CALL GIRLS 9777949614 💟 CALL GIRLS IN bhubaneswar ...

Bhubaneswar🌹Ravi Tailkes ❤CALL GIRLS 9777949614 💟 CALL GIRLS IN bhubaneswar ...

abortion pills in Riyadh Saudi Arabia (+919707899604)cytotec pills in dammam

abortion pills in Riyadh Saudi Arabia (+919707899604)cytotec pills in dammam

Female Escorts Service in Hyderabad Starting with 5000/- for Savita Escorts S...

Female Escorts Service in Hyderabad Starting with 5000/- for Savita Escorts S...

Retirement income distribution dashboard v2014a

- 1. Long Term Portfolio (LTP) 2014 Sample Retirees - Her and Him All Closing Values for markets prior Oldest Birth Year 1954 Note: Expected Longevity = 50% to date: 6/9/2014 Youngest Birth Year 1954 Female Male $X=portfolio value; WR%=withdraw rate; $Y=ann living exp (w/ taxes) Longevity Percentile 50% Joint 89 89 His IRA 165,000 $X * WR% = $Y Initial Target POF 10% Individual 86 82 Her IRA 175,000 WR% = $Y / $X Portfolio % Decline Possibility of Adjustment (PoA) @ WR%: His Roth 175,000 LTP Equity ~ 25% $X = $Y / WR% Required: WR%: * PoA Sustainable @ Lowest Her Roth 170,000 Current LTP Value= $860,800 4.64% 10.00% POF @ Port. Value Living Trust #1 175,800 $819,478 4.8% 4.84% 15.00% 3,707$ Sustainable $786,948 8.6% 5.01% 20.00% 3,581$ Dist. $$ per $760,025 11.7% 5.16% 25.00% 3,477$ month. * WR% is a distribution rate; NOT a rate of return Note that the PoA # drives a decision more than portfolio values. Action taken BEFORE reaching PoA values ... (1) Portfolio Allocation "Reality Check" & Discussion (2) Turn off Transfer between Portfolios (3) Retrench spending Limitations Qtrly Dist from: 165,000 All Account 1,000,000 The balance of your portfolio represents the Acct Empties*: December-17 Empty*: September-35 Notes: Possibility of Excess (=100% minus PoA above). *Assumes ZERO return (simulates just cash) -------------------------------------------------------------------------------------------- Distribution Reservoir Portfolio (refilled 1/4/7/10) Port Target: Diff (+ Good) Living Trust #2 139,200 $139,200.00 $0 Ultra Defensive $1,000,000 <Combined Overall Total Value ($X) Living Expenses Reserve Mos. 36 $Y Monthly Distr. 3,867 $46,400.00 <Ann Distrib. Target ($Y) Federal and State Income taxes are INCLUSIVE in the annual distribution target. May-17 36.00 <# Months in Reservoir Additional taxes in the amount of: $0 in distributions are included here. Month/Year 0.00 <# Months over/(short) Life Expectancy Tables Entered at Retirement Age Note: income distribution are gross before taxes and before adviser fees (both paid from gross distributions). Life expectancy from Social Security tables. 25% Equity characteristics real return: 4.39%; Standard deviation: 6.45%.