Report

Share

Download to read offline

Recommended

More Related Content

What's hot

What's hot (15)

Step by Step Guide to File GSTR 9A Annual Composition Form

Step by Step Guide to File GSTR 9A Annual Composition Form

E09 How to complete the incurred cost proposal with success!

E09 How to complete the incurred cost proposal with success!

Analysis of ca ipcc taxation- nov 2014 question paper

Analysis of ca ipcc taxation- nov 2014 question paper

16 part b_vilas mohanrao sanase(5)_auhps0589h_2020-21

16 part b_vilas mohanrao sanase(5)_auhps0589h_2020-21

INSTRUCTION FOR THE COMPLETION OF INCOME TAX RETURN FOR CORPORATE:::::Manual ...

INSTRUCTION FOR THE COMPLETION OF INCOME TAX RETURN FOR CORPORATE:::::Manual ...

Similar to Form 1770-attachment i page 2

Similar to Form 1770-attachment i page 2 (7)

03 2 a special attachment_calculation of fiscal loss carry forward

03 2 a special attachment_calculation of fiscal loss carry forward

#Common Credit for Taxable & Exempted Supplies : Reversal of Credit Rule 42 ...

#Common Credit for Taxable & Exempted Supplies : Reversal of Credit Rule 42 ...

Spt tahunan pph wajib pajak orang pribadi formulir 1770

Spt tahunan pph wajib pajak orang pribadi formulir 1770

TDS compliance reporting in new tax audit report (3CD)

TDS compliance reporting in new tax audit report (3CD)

Bảng chữ cái tiếng Việt theo Bộ GDĐT – Vietnamese alphabet

Bảng chữ cái tiếng Việt theo Bộ GDĐT – Vietnamese alphabet

More from KPP Pratama Kepanjen

More from KPP Pratama Kepanjen (20)

Form 1770-attachment i page 2

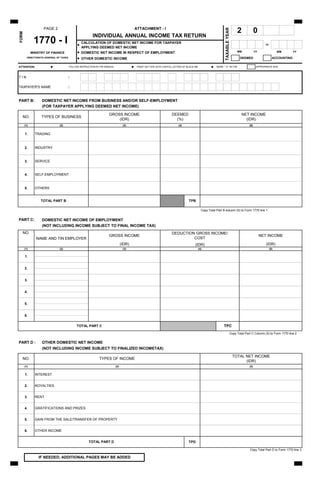

- 1. to DEEMED ACCOUNTING ATTENTION: • • PRINT OR TYPE WITH CAPITAL LETTER OF BLACK INK • T I N : TAXPAYER'S NAME : PART B: Copy Total Part B column (5) to Form 1770 line 1 PART C: DOMESTIC NET INCOME OF EMPLOYMENT (NOT INCLUDING INCOME SUBJECT TO FINAL INCOME TAX) PART D : OTHER DOMESTIC NET INCOME (NOT INCLUDING INCOME SUBJECT TO FINALIZED INCOMETAX) RENT Copy Total Part D to Form 1770 line 3 Copy Total Part C Column (5) to Form 1770 line 2 (IDR) (5)(4)(3) TPD (IDR) GRATIFICATIONS AND PRIZES GAIN FROM THE SALE/TRANSFER OF PROPERTY TOTAL PART D (2) 4. TPC NAME AND TIN EMPLOYER (IDR) 2. GROSS INCOME DEDUCTION GROSS INCOME/ COST NET INCOME (3) TOTAL NET INCOME (IDR) (2) TPB NO. DEEMED (%) 1. INTEREST OTHERS (1) (4) TRADING SELF-EMPLOYMENT (3) 3. 4. 1. 2. NET INCOME (IDR) TYPES OF BUSINESS YY (5) TAXABLEYEAR 2 0 (2) INDIVIDUAL ANNUAL INCOME TAX RETURN 6. NO. 1. 2. 3. 4. 5. TOTAL PART C TYPES OF INCOME PAGE 2 1770 - I FORM DOMESTIC NET INCOME FROM BUSINESS AND/OR SELF-EMPLOYMENT (FOR TAXPAYER APPLYING DEEMED NET INCOME) CALCULATION OF DOMESTIC NET INCOME FOR TAXPAYER APPLYING DEEMED NET INCOME MARK " X " IN THE APPROPRIATE BOX MMMM ATTACHMENT - I YY INDUSTRY SERVICE MINISTRY OF FINANCE DIRECTORATE GENERAL OF TAXES NO. (1) IF NEEDED, ADDITIONAL PAGES MAY BE ADDED ROYALTIES 6. OTHER INCOME 5. 3. (1) FOLLOW INSTRUCTION IN THE MANUAL DOMESTIC NET INCOME IN RESPECT OF EMPLOYMENT OTHER DOMESTIC INCOME TOTAL PART B 5. GROSS INCOME (IDR)