Embed presentation

Download to read offline

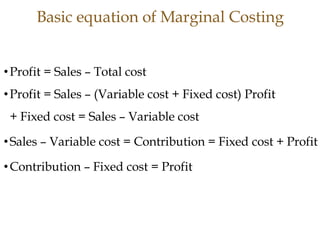

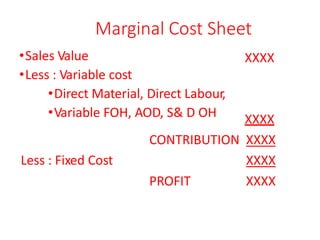

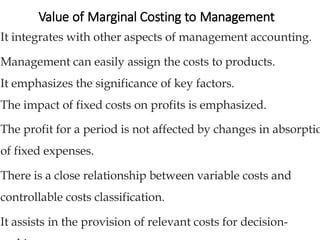

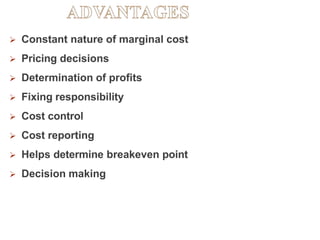

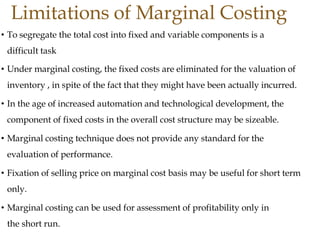

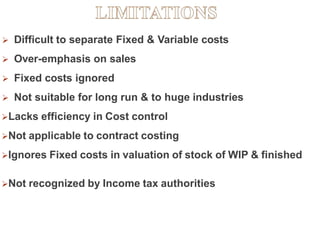

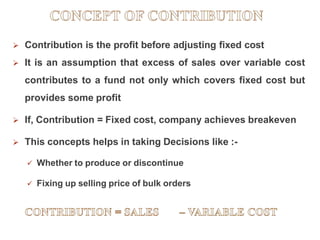

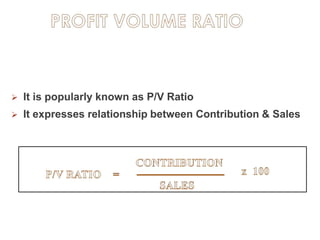

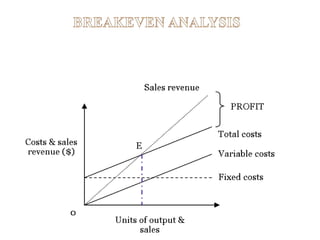

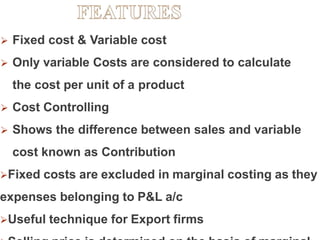

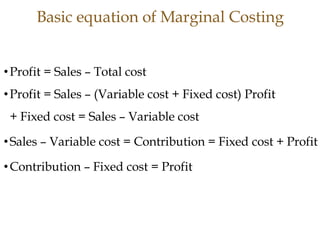

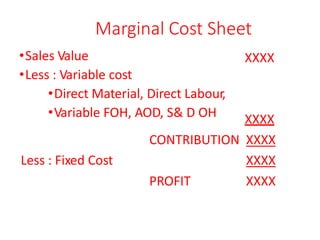

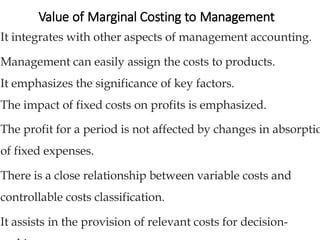

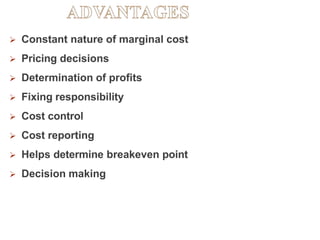

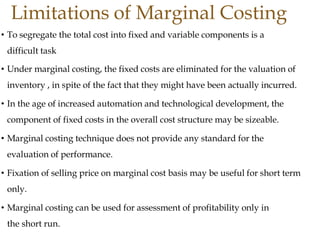

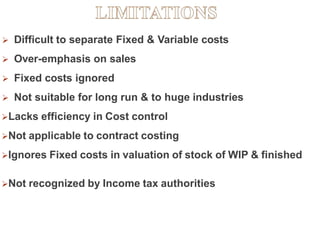

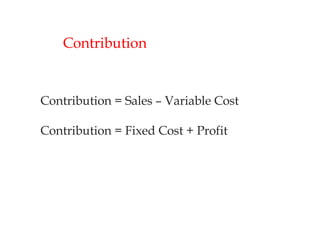

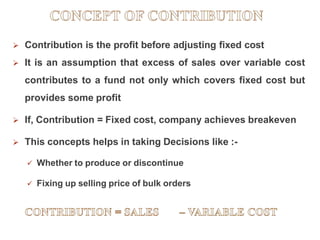

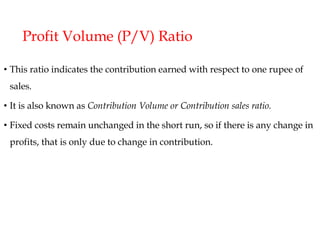

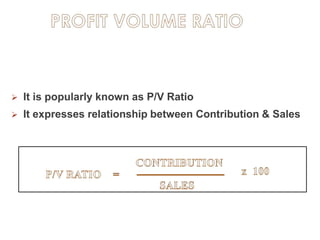

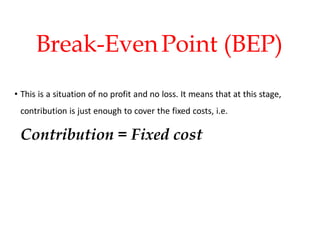

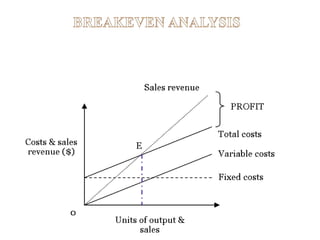

This document provides an overview of marginal costing and key concepts in strategic cost management. It defines marginal costing and differentiates between fixed and variable costs. The basic equations of marginal costing relating contribution, fixed costs, and profit are explained. Advantages and limitations of marginal costing for management decision making are summarized. Key terms like contribution, profit-volume ratio, break-even point, and margin of safety are defined.