Report

Share

Download to read offline

Recommended

Recommended

More Related Content

What's hot

What's hot (19)

Predictive data analytics models and their applications

Predictive data analytics models and their applications

Prognosis - An Approach to Predictive Analytics- Impetus White Paper

Prognosis - An Approach to Predictive Analytics- Impetus White Paper

Stock market trend prediction using k nearest neighbor(knn) algorithm

Stock market trend prediction using k nearest neighbor(knn) algorithm

PREDICTION OF CRUDE OIL PRICES USING SVR WITH GRID SEARCH CROSS VALIDATION AL...

PREDICTION OF CRUDE OIL PRICES USING SVR WITH GRID SEARCH CROSS VALIDATION AL...

A model for profit pattern mining based on genetic algorithm

A model for profit pattern mining based on genetic algorithm

Crime Type Prediction - Augmented Analytics Use Case – Smarten

Crime Type Prediction - Augmented Analytics Use Case – Smarten

Prediction of stock market index using genetic algorithm

Prediction of stock market index using genetic algorithm

Viewers also liked

Comprendre le pourquoi dans l'utilisation des Médias Sociaux, permet de soutenir la dynamique et d'éviter de nombreuses erreurs. Cette présentation comprend:

- le passage en revue des facteurs et des trends liés aux médias sociaux

- Pourquoi les managers doivent-ils s'y intéresser

- L’importance et la construction d’un profil en cohérence avec son projet

- L’image et la mise au point d’une stratégie de présence et de mise à jour

- Les erreurs à éviter

Pourquoi utiliser les medias sociaux en periode de transition et de recherche...

Pourquoi utiliser les medias sociaux en periode de transition et de recherche...Jacques Eltabet Formations

Viewers also liked (16)

FITT Toolbox: International Technology Transfer Networks

FITT Toolbox: International Technology Transfer Networks

Jornadas academicas científicas trabajo social 2016

Jornadas academicas científicas trabajo social 2016

Pourquoi utiliser les medias sociaux en periode de transition et de recherche...

Pourquoi utiliser les medias sociaux en periode de transition et de recherche...

IMPORTANCIA DEL TRABAJO SOCIAL EN LAS INSTITUCIONES

IMPORTANCIA DEL TRABAJO SOCIAL EN LAS INSTITUCIONES

Similar to JUN ZHAI_CV

Similar to JUN ZHAI_CV (20)

CREDIT CARD FRAUD DETECTION USING MACHINE LEARNING

CREDIT CARD FRAUD DETECTION USING MACHINE LEARNING

MACHINE LEARNING CLASSIFIERS TO ANALYZE CREDIT RISK

MACHINE LEARNING CLASSIFIERS TO ANALYZE CREDIT RISK

Investment Portfolio Risk Manager using Machine Learning and Deep-Learning.

Investment Portfolio Risk Manager using Machine Learning and Deep-Learning.

COMPARISON OF BANKRUPTCY PREDICTION MODELS WITH PUBLIC RECORDS AND FIRMOGRAPHICS

COMPARISON OF BANKRUPTCY PREDICTION MODELS WITH PUBLIC RECORDS AND FIRMOGRAPHICS

Keys to extract value from the data analytics life cycle

Keys to extract value from the data analytics life cycle

Unfolding the Credit Card Fraud Detection Technique by Implementing SVM Algor...

Unfolding the Credit Card Fraud Detection Technique by Implementing SVM Algor...

A Compendium of Various Applications of Machine Learning

A Compendium of Various Applications of Machine Learning

Recently uploaded

Recently uploaded (11)

Mastering Vendor Selection and Partnership Management

Mastering Vendor Selection and Partnership Management

Arjan Call Girl Service #$# O56521286O $#$ Call Girls In Arjan

Arjan Call Girl Service #$# O56521286O $#$ Call Girls In Arjan

Webinar - How to set pay ranges in the context of pay transparency legislation

Webinar - How to set pay ranges in the context of pay transparency legislation

100%Safe delivery(+971558539980)Abortion pills for sale..dubai sharjah, abu d...

100%Safe delivery(+971558539980)Abortion pills for sale..dubai sharjah, abu d...

How Leading Companies Deliver Value with People Analytics

How Leading Companies Deliver Value with People Analytics

2k Shots ≽ 9205541914 ≼ Call Girls In Vinod Nagar East (Delhi)

2k Shots ≽ 9205541914 ≼ Call Girls In Vinod Nagar East (Delhi)

Mercer Global Talent Trends 2024 - Human Resources

Mercer Global Talent Trends 2024 - Human Resources

HRM PPT on placement , induction and socialization

HRM PPT on placement , induction and socialization

VIP Russian Call Girls in Indore Komal 💚😋 9256729539 🚀 Indore Escorts

VIP Russian Call Girls in Indore Komal 💚😋 9256729539 🚀 Indore Escorts

JUN ZHAI_CV

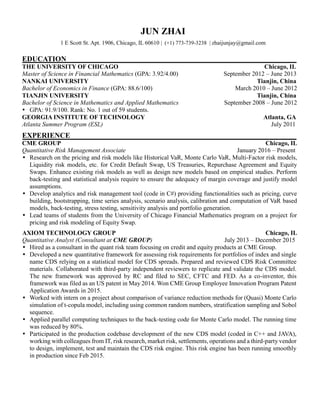

- 1. JUN ZHAI 1 E Scott St. Apt. 1906, Chicago, IL 60610 | (+1) 773-739-3238 | zhaijunjay@gmail.com EDUCATION THE UNIVERSITY OF CHICAGO Chicago, IL Master of Science in Financial Mathematics (GPA: 3.92/4.00) September 2012 – June 2013 NANKAI UNIVERSITY Tianjin, China Bachelor of Economics in Finance (GPA: 88.6/100) March 2010 – June 2012 TIANJIN UNIVERSITY Tianjin, China Bachelor of Science in Mathematics and Applied Mathematics September 2008 – June 2012 GPA: 91.9/100. Rank: No. 1 out of 59 students. GEORGIA INSTITUTE OF TECHNOLOGY Atlanta, GA Atlanta Summer Program (ESL) July 2011 EXPERIENCE CME GROUP Chicago, IL Quantitative Risk Management Associate January 2016 – Present Research on the pricing and risk models like Historical VaR, Monte Carlo VaR, Multi-Factor risk models, Liquidity risk models, etc. for Credit Default Swap, US Treasuries, Repurchase Agreement and Equity Swaps. Enhance existing risk models as well as design new models based on empirical studies. Perform back-testing and statistical analysis require to ensure the adequacy of margin coverage and justify model assumptions. Develop analytics and risk management tool (code in C#) providing functionalities such as pricing, curve building, bootstrapping, time series analysis, scenario analysis, calibration and computation of VaR based models, back-testing, stress testing, sensitivity analysis and portfolio generation. Lead teams of students from the University of Chicago Financial Mathematics program on a project for pricing and risk modeling of Equity Swap. AXIOM TECHNOLOGY GROUP Chicago, IL Quantitative Analyst (Consultant at CME GROUP) July 2013 – December 2015 Hired as a consultant in the quant risk team focusing on credit and equity products at CME Group. Developed a new quantitative framework for assessing risk requirements for portfolios of index and single name CDS relying on a statistical model for CDS spreads. Prepared and reviewed CDS Risk Committee materials. Collaborated with third-party independent reviewers to replicate and validate the CDS model. The new framework was approved by RC and filed to SEC, CFTC and FED. As a co-inventor, this framework was filed as an US patent in May 2014. Won CME Group Employee Innovation Program Patent Application Awards in 2015. Worked with intern on a project about comparison of variance reduction methods for (Quasi) Monte Carlo simulation of t-copula model, including using common random numbers, stratification sampling and Sobol sequence. Applied parallel computing techniques to the back-testing code for Monte Carlo model. The running time was reduced by 80%. Participated in the production codebase development of the new CDS model (coded in C++ and JAVA), working with colleagues from IT, risk research, market risk, settlements, operations and a third-party vendor to design, implement, test and maintain the CDS risk engine. This risk engine has been running smoothly in production since Feb 2015.

- 2. JUN ZHAI 1 E Scott St. Apt. 1906, Chicago, IL 60610 | (+1) 773-739-3238 | zhaijunjay@gmail.com AEGEA CAPITAL MANAGEMENT LLC Chicago, IL Intern January 2013 – June 2013 Used time series tools to analyze the volatility surface of S&P500 index options following different types of market moves, during different implied volatility environments, and over different time periods. Found useful statistics to describe the historical moves in the implied volatility surface and established model to interpret the information for risk management purposes. PUBLICATIONS A matrix-free smoothing algorithm for large-scale support vector machines Information Sciences, Volumes 358–359, September 2016, Pages 29–43. A regularized smoothing Newton-type algorithm for quasi-variational inequalities Computers & Mathematics with Applications, Volume 68, Issue 10, November 2014, Pages 1312–1324. An inexact smoothing-type algorithm for support vector machines Neurocomputing, Volume 129, April 2014, Pages 127–135. Calibration Estimation via a Smoothing Newton Method WSEAS TRANSACTIONS on MATHEMATICS, Issue 3, Volume 12, March 2013, Pages 329-340. PATENTS Margin Requirement Determination and Modeling for Cleared Credit United States Patent Application 14/706, 673. PROJECTS Regression Analysis and Trading Strategy December 2012 – June 2013 This project and paper analyze the pairs trading strategy and propose a new approach to model relative mispricing of paired assets. The innovation includes parameterizing asset returns with a view to incorporate economic and financial risk factors into the strategy as opposed to basing it purely on historical price. We proposes that spread is a stochastic mean-reverting process and discusses the estimation techniques. The back-testing results suggest that the trading strategy outperforms the benchmarks and achieves annual return 22.75%, Sharpe Ratio about 5.39 during the backtesting period 2003-2013. Major model technics include factor model, hidden Markov model (HMM), Kalman filter and Expectation–maximization algorithm. CERTIFICATIONS National Computer Rank Examination Certificate (C++) The Ministry of Education of China License 61311202043115, March 2010. ADDITIONAL INFORMATION Examinations: Certified FRM, Passed Level II of the Chartered Financial Analyst examination in 2013. Languages: English (fluent), Chinese (native). Computer: Proficient: C++, C#, JAVA, MATLAB, R, SQL, BLOOMBERG, IBM SYMPHONY, SWIG.