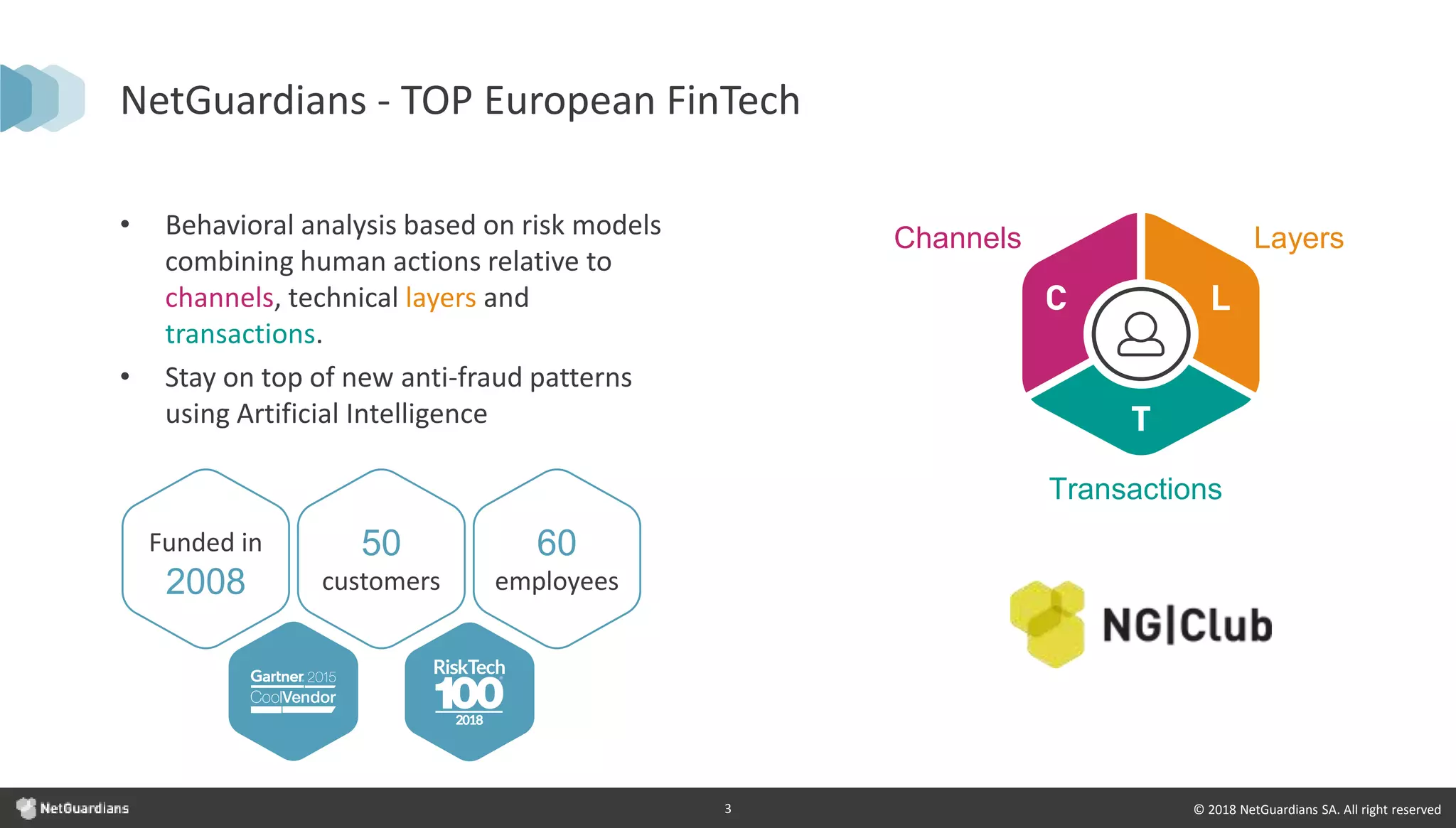

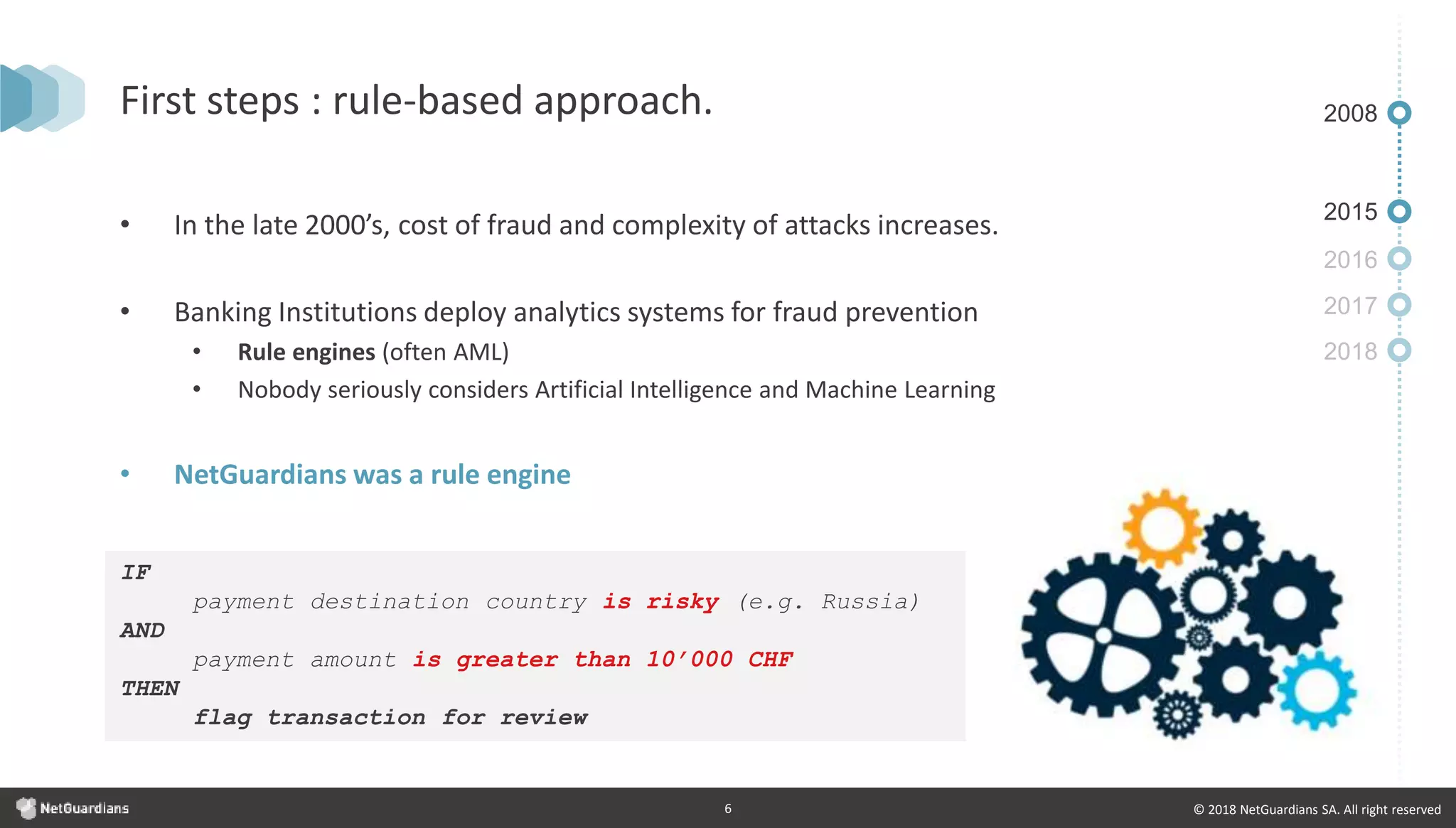

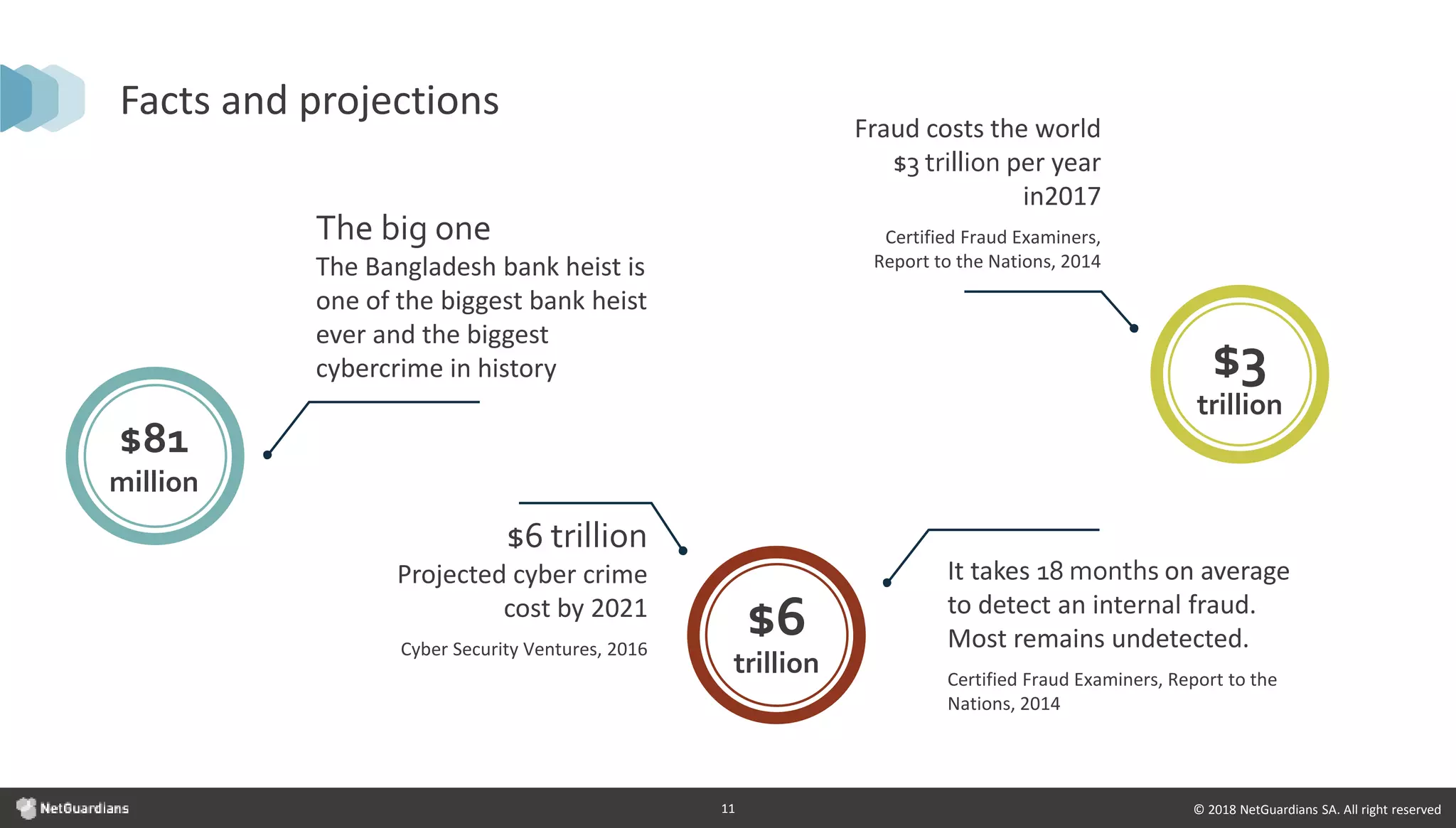

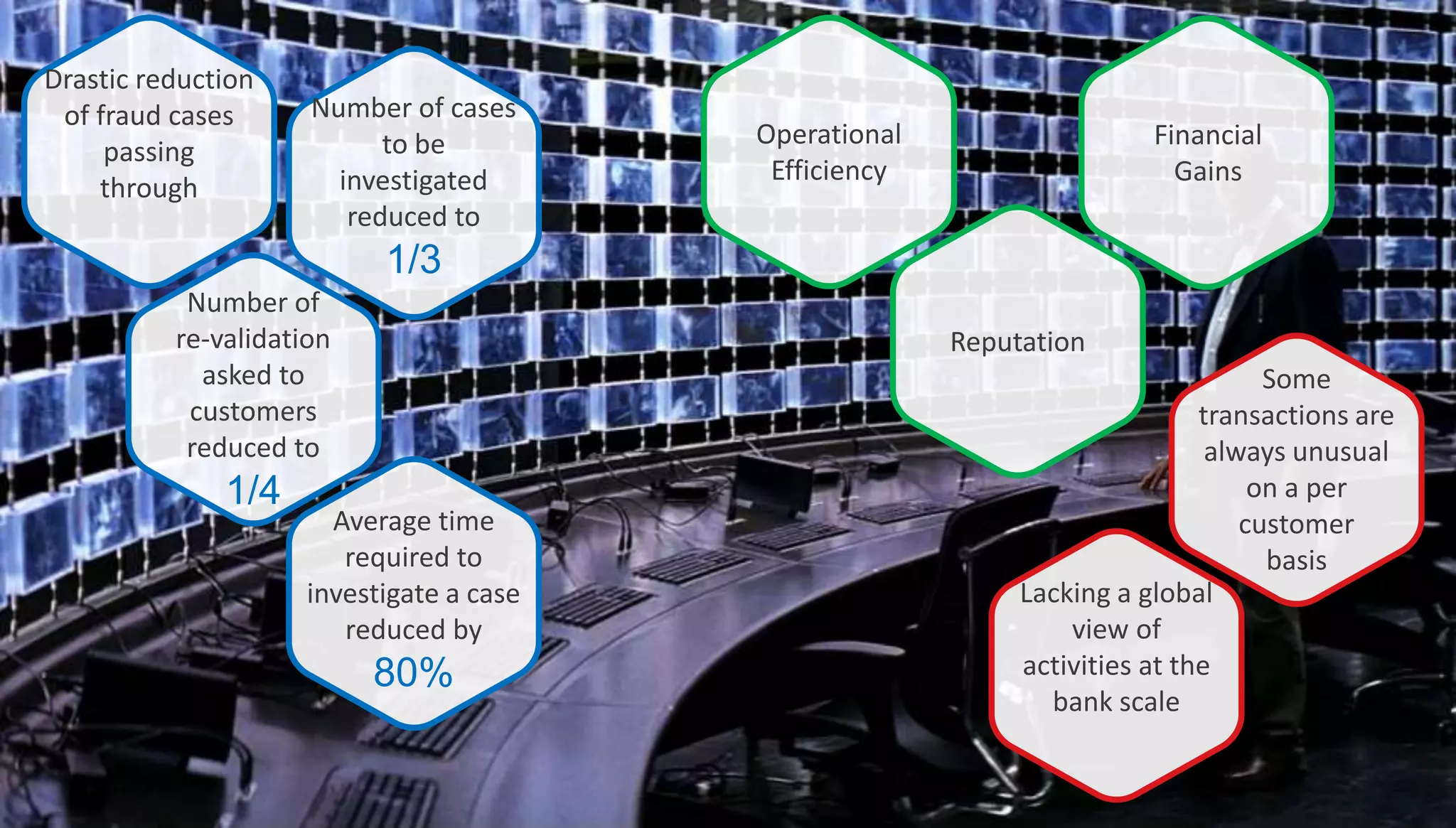

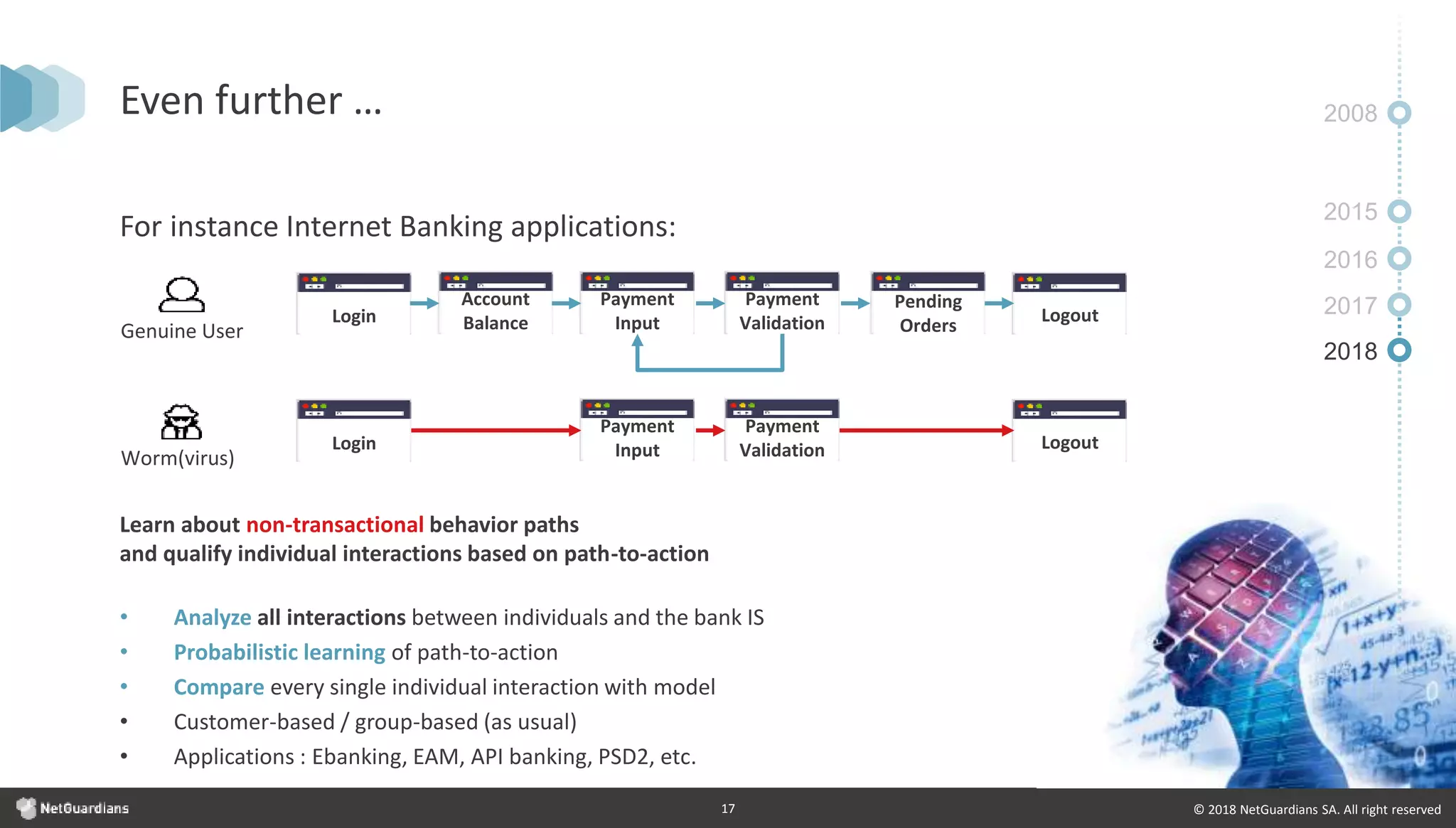

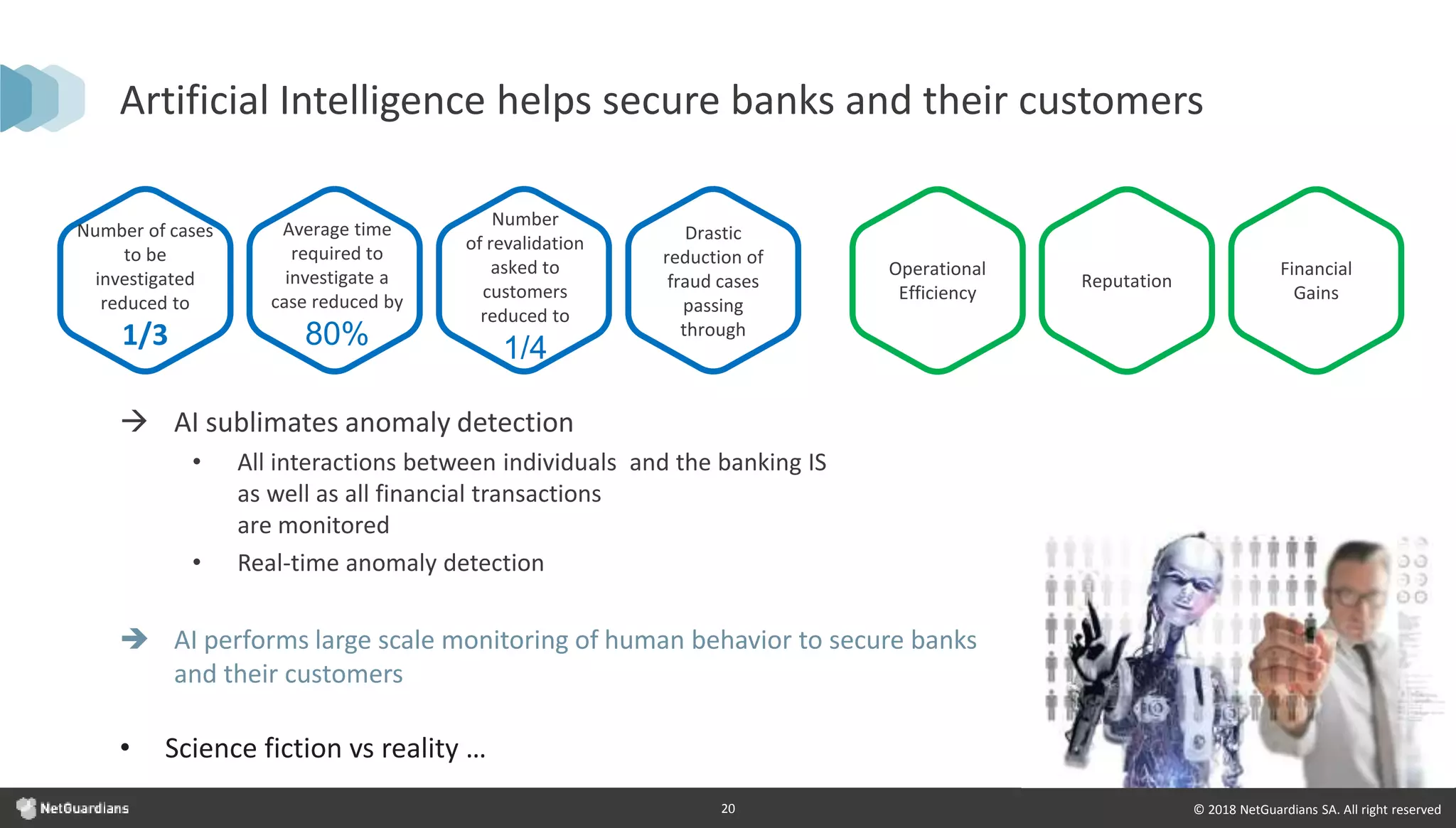

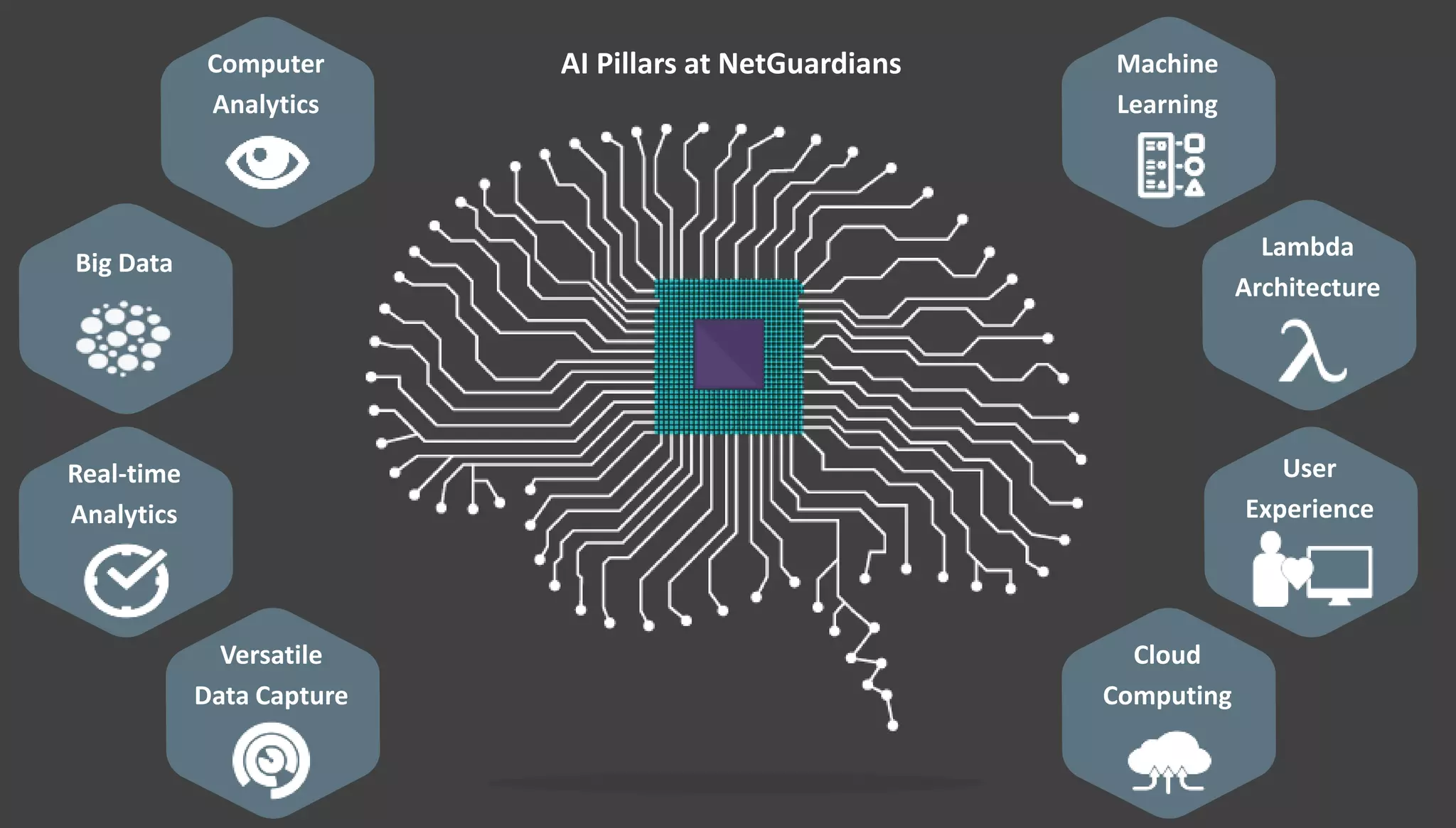

NetGuardians showcases the evolution of artificial intelligence in fraud prevention within banking, transitioning from manual controls to automated rule-based systems, and now to AI-driven behavioral analysis. The use of machine learning allows for real-time detection of suspicious transactions, significantly reducing fraud cases and operational inefficiencies. The integration of AI enables dynamic profiling of customer behavior and enhanced anomaly detection, ultimately improving security for banks and their customers.