Recommended

More Related Content

What's hot

What's hot (7)

Case alert Investment Trust Companies - Supreme Court

Case alert Investment Trust Companies - Supreme Court

Do I Pay North Dakota Taxes When Someone Leaves Me Money?

Do I Pay North Dakota Taxes When Someone Leaves Me Money?

Similar to FS Flier

Similar to FS Flier (20)

IRS Enforced Collection Actions and Alternatives to Enforced Collection.

IRS Enforced Collection Actions and Alternatives to Enforced Collection.

Overdue Tax Return – ATO Tax Lodgement Advice.pptx

Overdue Tax Return – ATO Tax Lodgement Advice.pptx

IRS-Tax Resolution Options for Individuals and Businesses

IRS-Tax Resolution Options for Individuals and Businesses

What Is Life After Coronavirus? State and Local Tax: First Wave Response & Se...

What Is Life After Coronavirus? State and Local Tax: First Wave Response & Se...

Tax Language: Must Know Definitions and Explanations

Tax Language: Must Know Definitions and Explanations

FS Flier

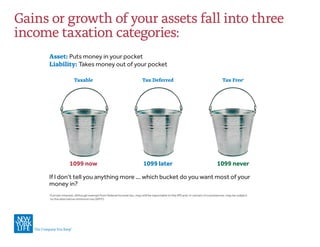

- 1. If I don’t tell you anything more ... which bucket do you want most of your money in? 1 Certain interest, although exempt from federal income tax, may still be reportable to the IRS and, in certain circumstances, may be subject to the alternative minimum tax (AMT). Asset: Puts money in your pocket Liability: Takes money out of your pocket Gains or growth of your assets fall into three income taxation categories: 1099 later 1099 never1099 now Tax Deferred Tax Free1 Taxable

- 2. •Are you happy with the percentages? •Would you like to discuss redistributing some of it? Taxable, tax deferred and tax free refers to the tax treatment of any earnings/growth/gain from these assets. _______% _______% Where is it now? What percentage? _______% New York Life Insurance Company New York Life Insurance and Annuity Corporation (A Delaware Corporation) 51 Madison Avenue, New York, NY 10010 www.newyorklife.com AR05050.RB.042015 SMRU481076 (Exp.04.20.2017) Tax Deferred Tax FreeTaxable